GRAINS TAKE A STEP BACK

MARKET UPDATE

Video Version is Subscriber Only

For Full Access: CLICK HERE

(Chart Breakdowns Start at 7:50 min)

Futures Prices Close

Overview

Grains lower across the board as the funds take a pause.

We've had a phenomenal rally.

Corn is 50 cents off it's lows, and both beans & wheat are nearly $1.00 of theirs.

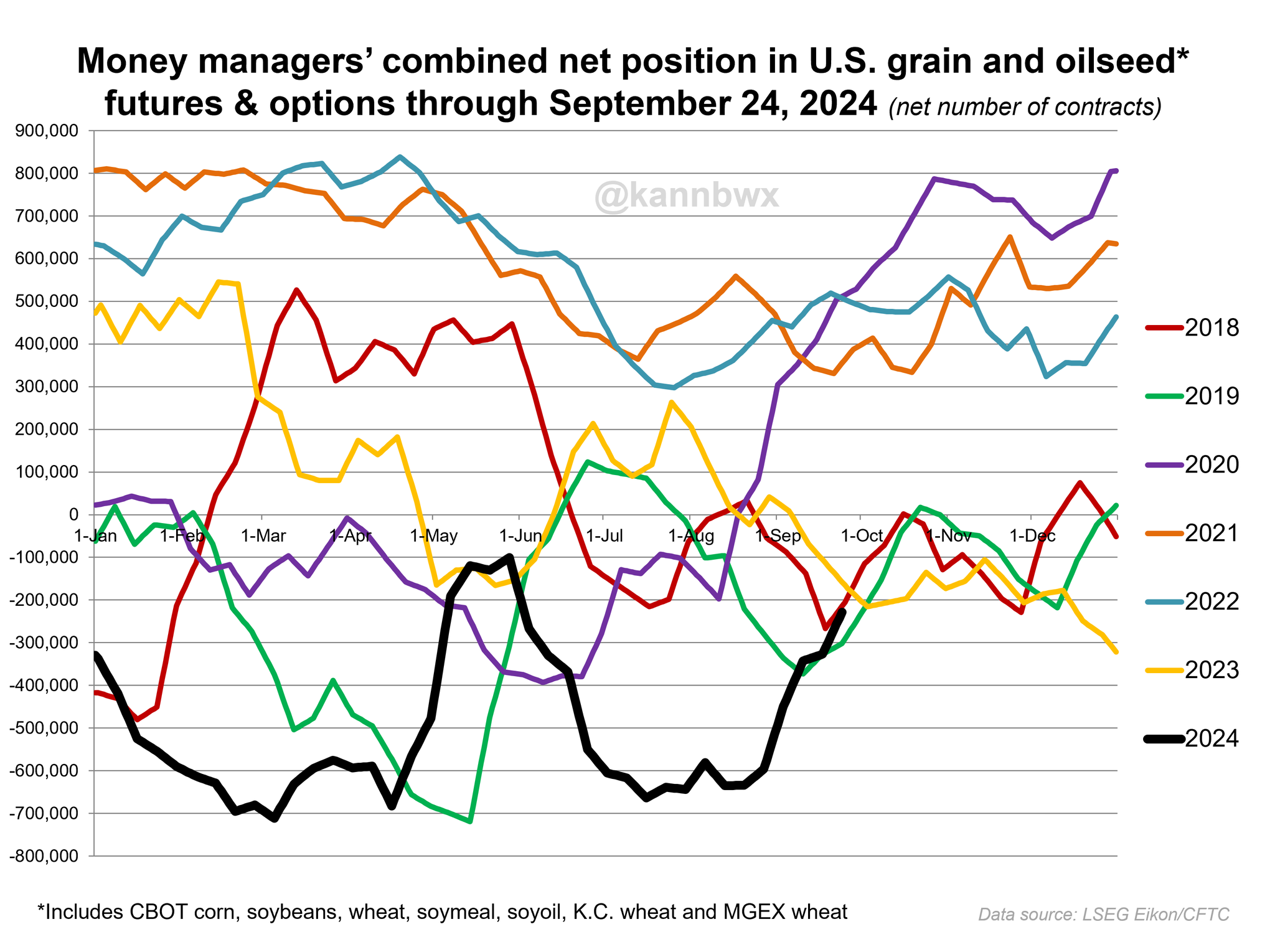

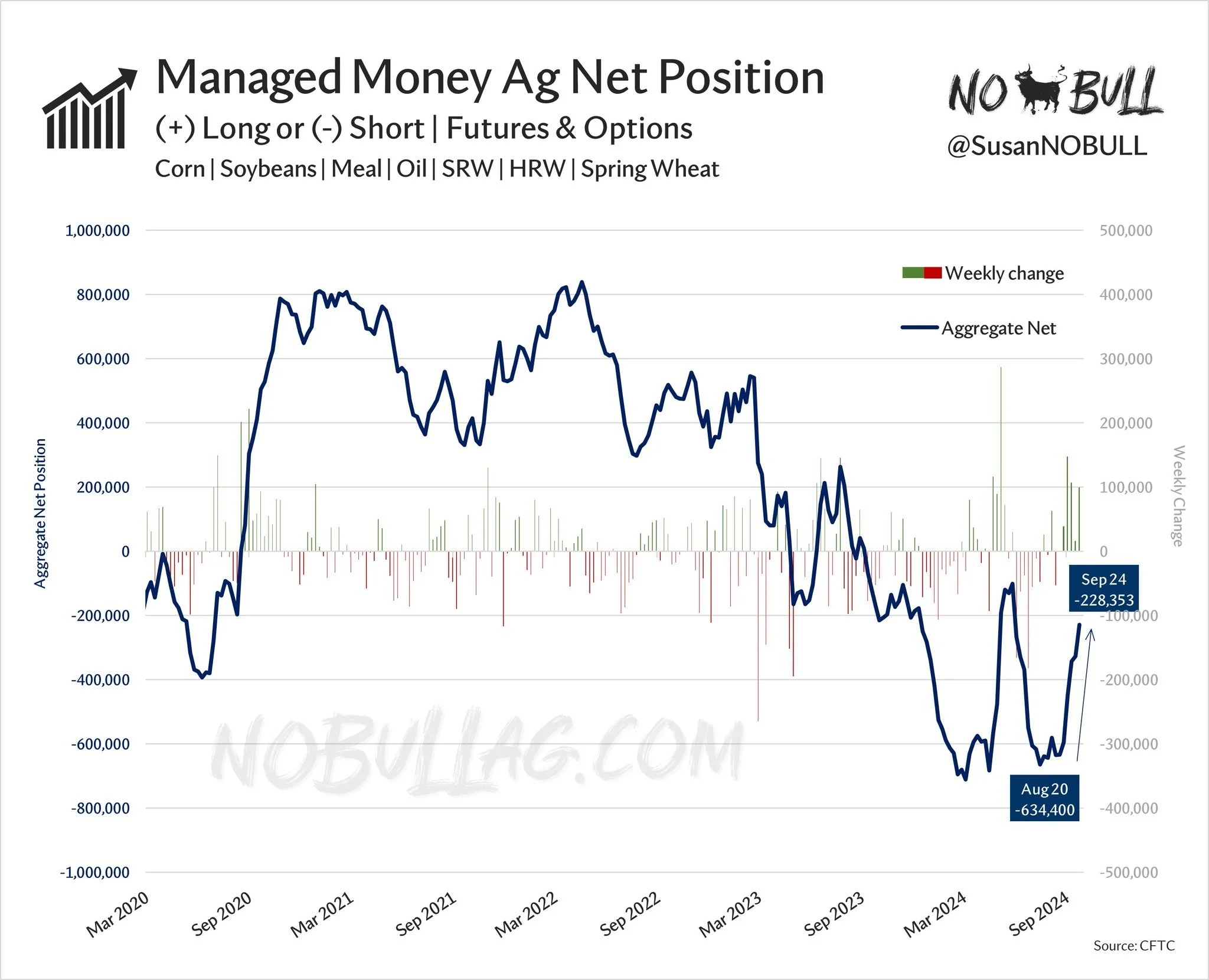

Private analysts suggest the funds are now only short around 50k contracts of corn. They were short a record 356k back in July.

So the funds are nearly back to even, with not many reasons to necessarily get long. Hence they are potentially taking a pause with all of the unknowns out there.

Why have we rallied in harvest?

The number #1 reason we have rallied is the funds.

We are definitely seeing farmer selling on this rally, but the fund short covering has more than offsetting that selling.

The funds held record shorts not too long ago, but ran out of reasons to stay that short.

Now they are nearly even on their positions, looking like they could soon be waiting for a factor to push them one way or the other.

Fun Fact:

The funds have never not got long corn during a year. They have still yet to get long. Will they finally do so?

Chart from Karen Braun

Chart from Susan of NoBull Ag

Could they continue to cover? Absolutely possible. They still have a little room to go until they even.

If they continue to cover, it will probably be more technical driven rather than fundamental driven unless something changes.

We have break outs on the charts. We are at our highest price levels since June, so that means that short position is red since June.

Fundamentally there isn’t any one factor driving us higher.

Yes we have some war news.

Yes the USDA report Monday was friendly corn.

The river levels are back to normal with the hurricane rains. So this helps logistics & exports.

But we still have expectations of record crops.

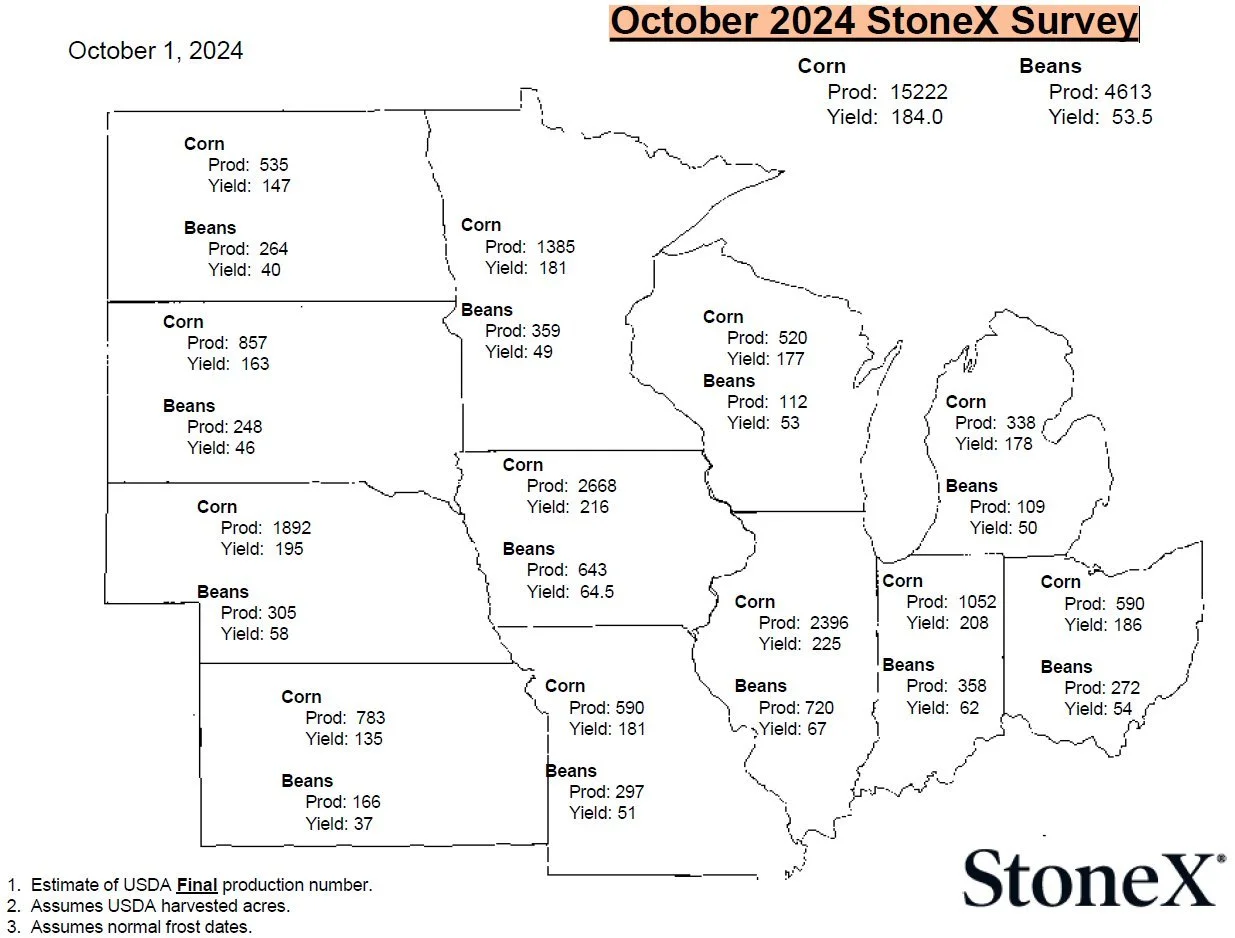

The talk is that soybean yields are more disappointing than expected, while corn yield continues to be great.

StoneX released their newest estimates and they actually have the crop bigger than the USDA does. As they raised their estimates from last month. This is a customer based survey.

StoneX Corn: 184.0 (182.9 last month)

USDA Corn: 183.6

StoneX Beans: 53.5 (53.0 last month)

USDA Beans: 53.2

So perhaps the funds take a wait and see approach here sometime soon.

If they pause, it will likely result in a correction. As that farmer selling & hedge pressure won’t be bought with fund buying.

They still have room to cover their short, but it just seems unlikely that they flip long given all of the unknowns. It is possible, but would likely require a bullish factor such as yield falling, demand increasing, or a Brazil scare.

What could make them flip long?

The first reason they could flip long is…………

The rest of this is SUBSCRIBER-ONLY content.

Subscribe to get full access to all of our updates, signals, & 1 on 1 market plans.

In today’s update we go over..

Why could the funds cover?

Brazil rains

Chinese demand

Most concerning thing about this rally..

Spreads don’t scream bull run

Balance sheet breakdowns

Technical breakdowns

Why $4.60 corn is possible

Russia wheat story

TRY 30 DAYS FREE

Get access to our daily updates, signals & 1 on 1 plans completely free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24

LOWS ARE IN UNLESS SOMETHING FUNDAMENTALLY CHANGES?

9/6/24

GRAINS WEAK. OUTSIDE DOWN DAY ON CHARTS

9/5/24

GRAINS GET HEALTHY CORRECTION. GETTING READY TO PROTECT DOWNSIDE

9/4/24

GRAINS CONTINUE RUN. WAYS TO PLAY THE MARKET. WHAT’S YOUR SITUATION?

9/3/24