MORNING MARKET UPDATE

Futures Prices 7:30am CT

Today's Main Takeaways

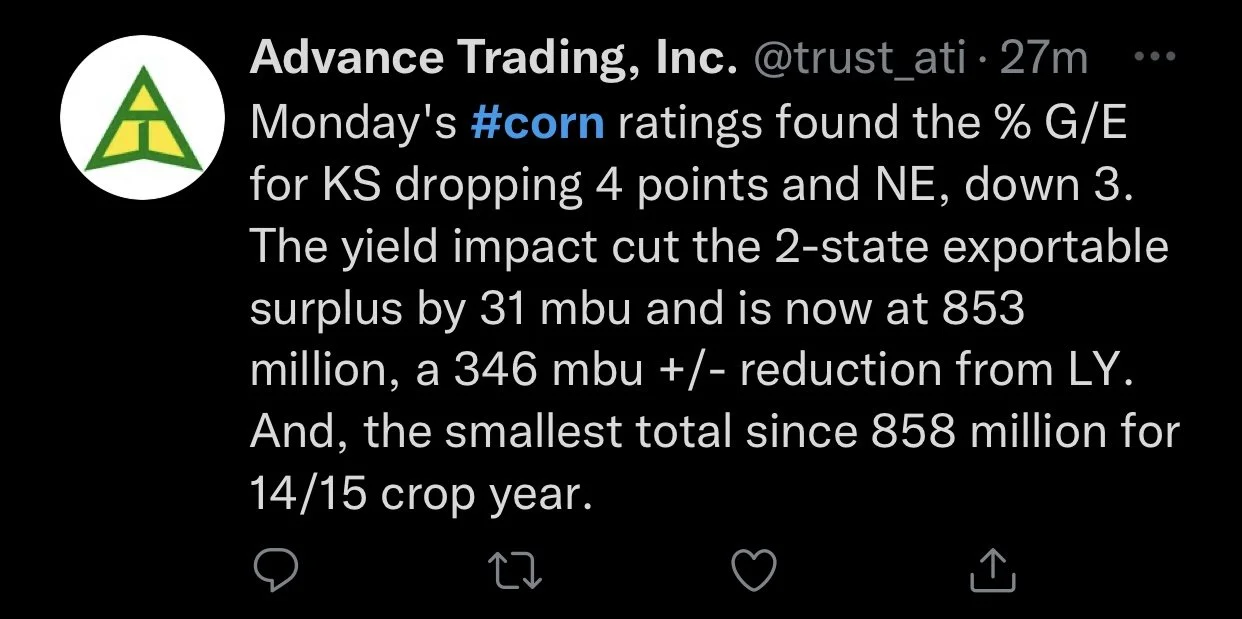

Corn

Corn lower this morning despite the vast majority agreeing that last weeks crop tours was nothing but bullish. As we continue to look at the fact that the USDA is going to need to lower yield and U.S. production estimates, as well as the EU (European Union).

It appears that most believe the EU production will fall to around the 50-55 million metric ton range. While the USDA currently has it at a 60 million metric ton forecast.

The USDA current forecast for U.S. yield is at 175.4 bushels an acre. Down from the previous 177 bushel forecast, this will likely continue to drop. Especiallypecially given the results of the crop tours last week, where they estimated a 168.1 yield. How low do we actually go? It wouldn’t be unreasonable to think we could see at minimum 172 or it could very well be even lower. Private analyst Cordonnier has U.S. corn yield at 170 flat bushels per acre. Which is 3 bpa lower than his previous estimate.

On the other side of things, we have a few things weighing on the markets. We have the extremely strong U.S. dollar, as it continues to keep rising. We also have Ukraine, as they continue to export corn and other grains. As well as how weak crude oil has been, being down over $5 yesterday. To go along with not amazing demand.

Dec-22 (6 Month)

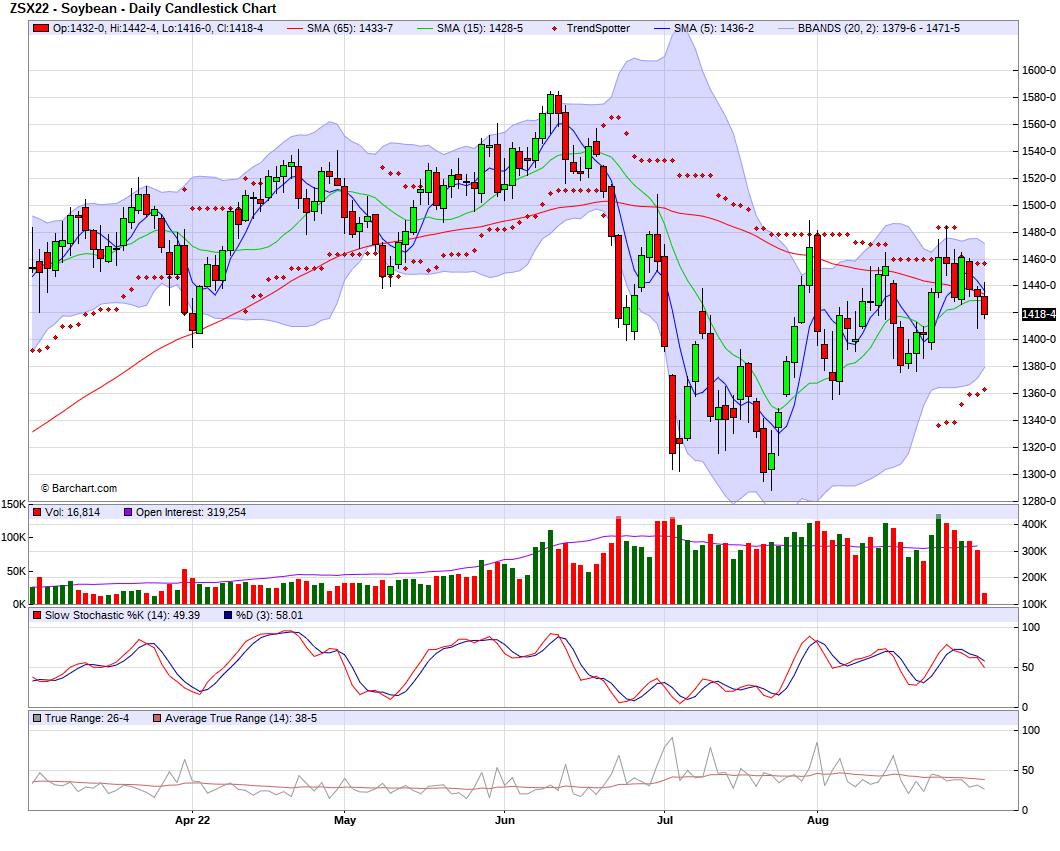

Soybeans

Soybeans lower again this morning, after a brutal start the week. On the bright side, soybeans finished around 25 cents off their lows yesterday, which can be a bullish sign. Hopefully this is a sign of support here. We have also seen a little bit of a pick up in Chinese demand, but will need to see this keep increasing I. we want soybeans higher. Soymeal has also been pretty supportive as of lately, as soymeal has been dominating the soybean market.

On the other hand, similar to corn, the strength of the U.S. dollar is putting a toll on all of the markets including soybeans. Making exports harder. We also have some rumors of a record U.S. crop, with some thinking we see a yield between 51-52 bpa. Private analyst Cordonnier has the 22 U.S. soybean yield at 50.4 bushels per acre. Which is a pretty steady number, but 1.5 lower than the current USDA estimate.

The market will be largely dictated by the direction we see Chinese demand go. As we also better a better understanding of the total U.S. crop production.

It is estimated that the 2022/23 Brazilian soybean production could likely hit a record 151 million metric tons (5.548 billion bushels).

The USDA announced yesterday that 264,000 mts of new crop soybeans we purchased by an unknown destination.

As I was writing this, the USDA confirmed a sale of 167,000 tonnes of U.S. soybeans for delivery to China in 2022/23.

Tomorrow we will see the NASS crush data. Its believed that we will see some slightly higher numbers but nothing too crazy.

Soymeal & Soyoil

Soymeal down -5.8 to 418.7

Soyoil down -0.33 to 66.02

Soybeans Nov-22 (6 Month)

Soymeal Dec-22 (6 Month)

Wheat

Wheat down this morning, but holding up slightly better than corn and soybeans. Wheat continues to be pretty choppy and trading around the lower end of the trade range.

Spring wheat harvest is now 50% or so complete, and U.S. winter wheat harvest is basically complete. So hopefully that harvest pressure will soon no longer be a factor.

If the exports coming out of Ukraine and Russia aren't as great as they seem, that could help push prices higher. As it looks like we are seeing some estimates cut rather than raised. However, this could go both ways, and the numbers could be larger, thus putting extra pressure on the markets.

Another headline that could support prices would be the international weather. As India and China face weather concerns. An increase in Chinese demand would also help the wheat market.

Other Markets

Crude oil was down over $5 yesterday. Main reason for this being that there is a rumor a deal has been made with Iran and its nuclear program. This morning back under $90. Currently at $89.13, down -$2.51

DOW +65

Cotton +0.36 to 112.68

Dollar Index +0.28 to 109.03

News

China will provide farmers $1.45 billion (10 billion yuan) in subsidies to protect them from the rising costs of supplies. Which in turn should help encourage them to continue planting.

There is news that states its unclear whether the USDA will release its export sales Thursday or not.

Euro zone inflation rose and hit a new all time high of 9.1%, up from 8.9% last month

National average U.S. diesel prices back above $5, seeing its first weekly increase in around two months

South Africas 2022 corn harvest forecast is -8% lower than last year

Home prices went down in the month of June, but still remained over 18% higher than last year

Previous Newsletters

Here are our last 3 newsletters. Would love any feedback or things you would like to see.

August 26, Audio Commentary - Listen Here

August 28, Weekly Newsletter - Read Here

August 30, Morning Market Update - Read Here

Social Media

Credit: All credit to users of posts

Precipitation Forecasts

Weather

Source: National Weather Service