MORNING MARKET UPDATE

Grains as well as mostly every other market sharply lower despite last weeks crop tours.

Crop Progress Report Highlights

Corn

54% rated G/E - Last week 55% - Last year 60%

86% dough - 88% average

46% dented - 52% average

8% mature - 9% average

Soybeans

57% rated G/E - Last week 57% - Last year 56%

91% setting pods - 92% average

4% dropping leaves - 7% average

Spring Wheat

68% rated G/E - Last week 64% - Last year 11%

50% harvested - Last week 33% - Last year 86% - Avg Pace 71%

Cotton

34% rated G/E - Last week 31% - Last year 70%

Sorghum

21% rated G/E - Last week 25% - Last year 58%

The biggest takeways were the decrease we saw in corn, lowering ratings by 1%. While soybeans remained unchanged. We also saw spring wheat ratings jump 4% which is a pretty big move this late in the year.

Pro Farmer Forecasts

State By State

Corn

South Dakota

Pro Farmer forecast: 122 bushels per acre yield

USDA forecast: 147 bushels per acre yield

Iowa

Pro Farmer forecast: 198 bushels per acre yield

USDA forecast: 205 bushels per acre yield

Illinois

Pro Farmer forecast: 198 bushels per acre yield

USDA forecast: 203 bushels per acre yield

Nebraska

Pro Farmer forecast: 164 bushels per acre yield

USDA forecast: 55 bushels per acre yield

Minnesota

Pro Farmer forecast: 191 bushels per acre yield

USDA forecast: 193 bushels per acre yield

Ohio

Pro Farmer forecast: 175 bushels per acre yield

USDA forecast: 190 bushels per acre yield

Indiana

Pro Farmer forecast: 177 bushels per acre yield

USDA forecast: 189 bushels per acre yield

Soybeans

South Dakota

Pro Farmer forecast: 41 bushels per acre yield

USDA forecast: 43 bushels per acre yield

Iowa

Pro Farmer forecast: 60 bushels per acre yield

USDA forecast: 58 bushels per acre yield

Ohio

Pro Farmer forecast: 57 bushels per acre yield

USDA forecast: 57 bushels per acre yield

Nebraska

Pro Farmer forecast: 53 bushels per acre yield

USDA forecast: 55 bushels per acre yield

Illinois

Pro Farmer forecast: 64 bushels per acre yield

USDA forecast: 66 bushels per acre yield

Minnesota

Pro Farmer forecast: 52 bushels per acre yield

USDA forecast: 50 bushels per acre yield

Today's Main Takeaways

Corn

Corn lower here this morning despite the continuation of crop deterioration and the underwhelming results from the Pro Farmer Crop Tours. The USDA lowering crop conditions for corn by another 1%. Makinng this the lowest we've seen for this time since 2012. We are now far below the average, with the 5-year average standing at 62% and last year being 60% rated good/excellent.

Now everyone is wondering just how big of a cut will the USDA make to their yield estimates. As the Pro Farmer Tour had their average yield at 168.1

I think we should still see corn higher here, but we will have to wait and see just how large of a cut we actually see in yield.

There are a few factors pressuring the markets, with the outside markets and very strong U.S. dollar being two of them. As we still have recession concerns, as these slowdowns in the economy can often make it tough to sustain rallies in the commodities.

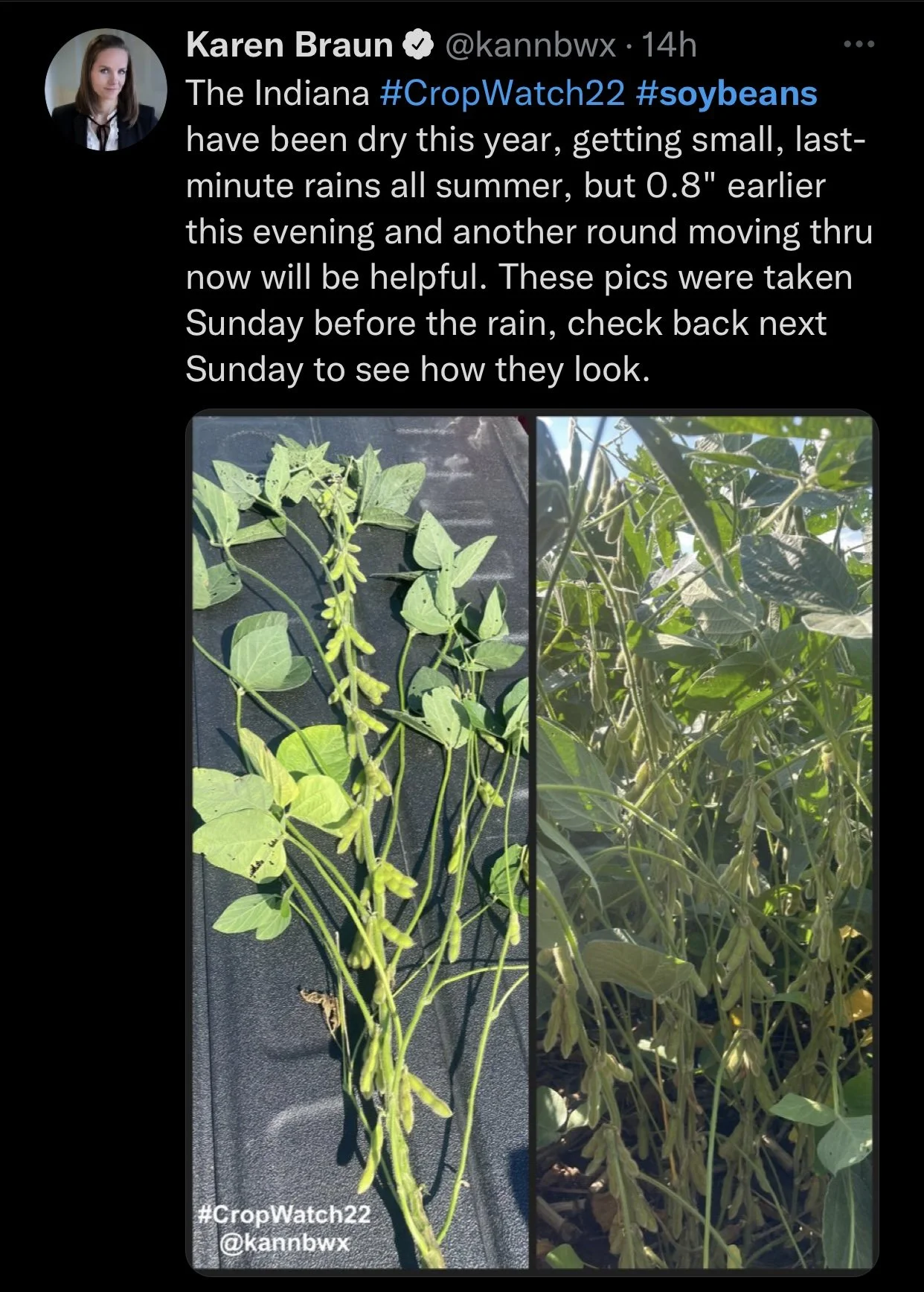

Soybeans

Beans sharply lower again following yesterday’s massive sell-off. Yesterday we saw the Sep-22 closed down -70 cents with Nov-22 dropping 23 1/2 cents.

A lot of the weakness we are seeing in soybeans is due to the fairly neutral crop tours. With soybeans results coming nowhere close to the bullishness of corns. Unlike corn and wheat, we really haven’t had a ton of bullish news in general to support the market outside of a Chinese purchase here and there, as we still haven’t seen that spark in demand we’ve been waiting for.

We also have late rains now that are putting pressure on the markets. As these rains will likely add a lot of help to many regions for U.S. soybeans. U.S. weather isn't looking to help the bulls anytime soon. Not to mention the record crop expected out of Brazil.

We saw the USDA leave condition ratings for soybeans unchanged which wasn't much of a surprise. There is the potential for some late weather scares to make a bullish impact, such as an early freeze etc.

Chinese demand for the U.S. still has a lot of people concerned. Because without demand from them its tough to be super optimistic.

Wheat

Wheat lower today along with the rest of the markets. It appears that Russias record crop is fairing okay, as they are expecting a pretty massive crop. India and Australia also having a decent crop. On the other hand, the EU and Ukraine could very well be short. Many are hoping that corn can continue to help pull wheat higher. And of course we have Ukraine freely moving grain, which adds pressure.

There is still controversy to how much grain we will actually see out of Ukraine. As well as the weather complications in both India and the EU, could both help prices in the future.

Other Markets

Crude down back around $91, currently down -5.75

Dollar Index down -0.130 to 108.660

Dow down -225

Cotton down -4.02 to 113.14

News

Crop consultant Dr. Micheal Cordonnier cut his corn yield by 3 bushels down to 170 bushels an acre

Ukraine’s exports are down over -52% year to year.

German grain crop appears better than was originally feared.

We have millions of tons of grain stuck in Ukraine silos.

China blocks pork shipments from Indiana plant

Weekly Export Data On Halt

It was announced that the USDA would be retracting its weekly export data it released last Thursday. Yesterday they said the weekly sales data would not be available until further notice.

The problem seemed to be a technical mishap, as they tested out a new system last Thursday which ultimately crashed.

Roger Wright made a good point surrounding the news of this:

"This is the same government that wants us to trust them about climate change, electric cars, green energy, managing the money supply, the economy, COVID vaccine and they can't even put a group of numbers together that require a simple arithmetic exercise we used to do in fourth grade."

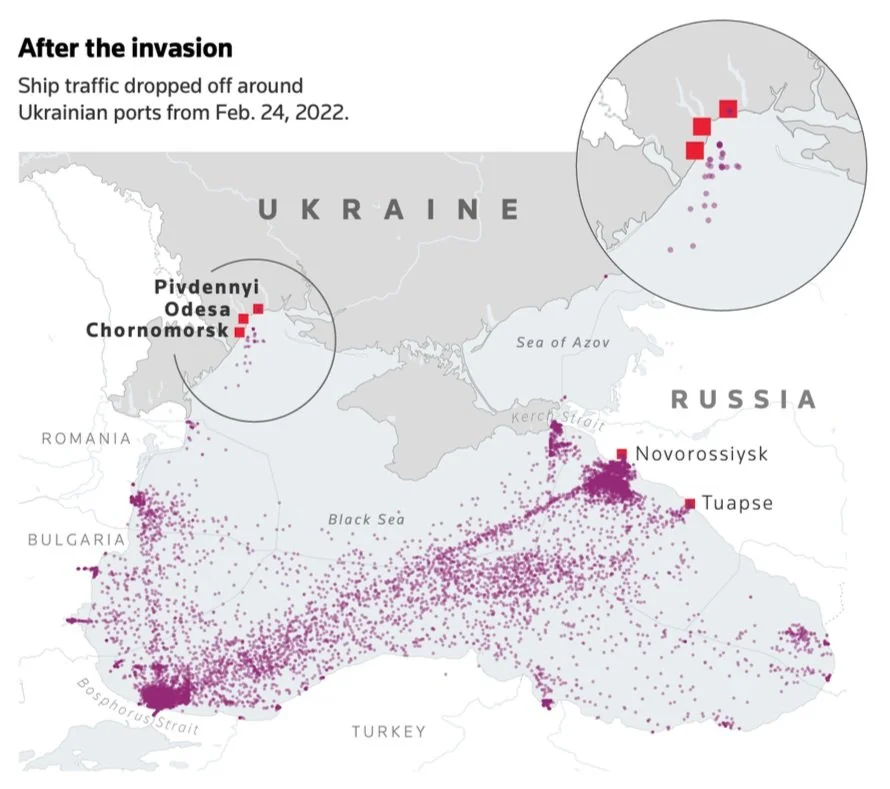

Ukraine Ports

Below is two images that show how much Russia's invasion has effected the Ukraine ports.

Source: Reuters

Below is an image that shows Ukraine reopening their exports. As they continue to freely move more and more grain

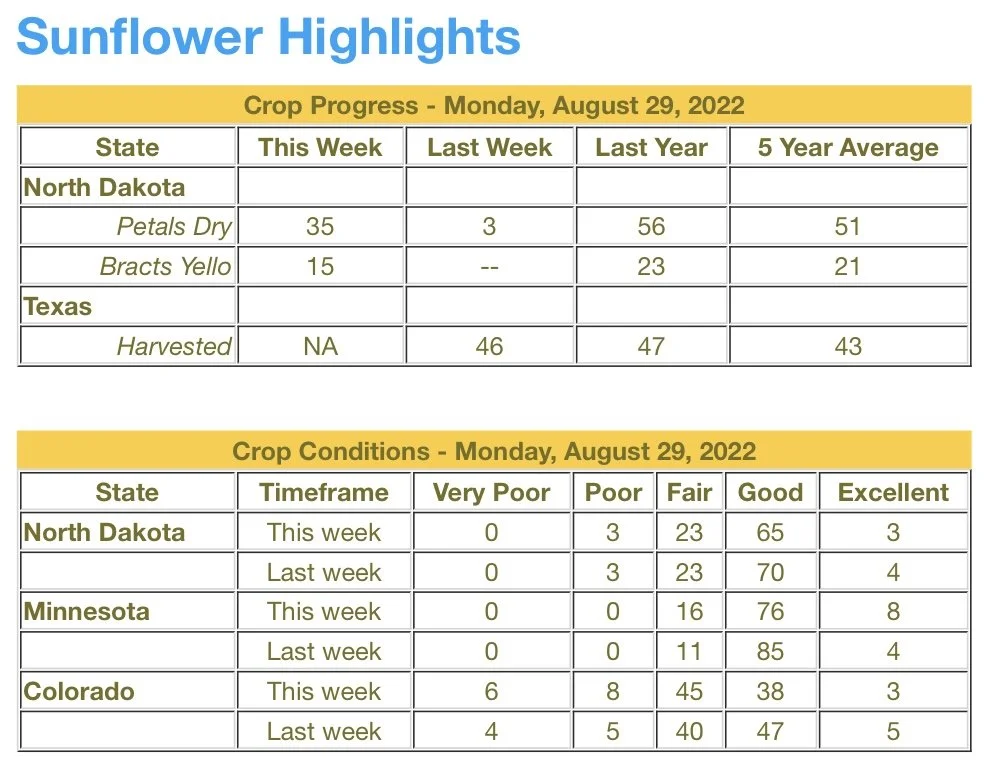

Sunflower Highlights Report

Credit: All credit to users of posts

Weather

Source: National Weather Service