SOYBEANS TRY TO BOUNCE FOLLOWING BEARISH USDA REPORT

Overview

First trading day following the data dump and bearish USDA report on Friday.

As everyone knows in that report they increased final US yields, but both were slightly offset by the decrease in acres. However there was still a net increase in carryout in both. South America production was also higher than bulls would’ve liked, but not unexpected.

After the report Friday, soybeans rallied over +20 cents off their lows. Overnight it looked like soybeans would continue that strength, as they were up double digits.

However, they failed the hold those gains despite the new record crush number this morning for beans. As the NOPA crush came in at 195.328 which was well above the estimates of 193.1, the previous month's 189 and last year's 177.5

Wheat was also higher overnight but sold off pretty hard, dragging the corn market down with it. As corn was holding up well until wheat fell apart.

We didn’t get a ton of fresh bullish news over the holiday weekend which allowed the funds to continue to add to their short positions. The funds now hold the shortest position of corn, beans, and wheat combined since May of 2019.

The funds and lack of fresh news was the biggest reason for the lower action in wheat and corn today.

As for what's going on today, we got a flash sale of corn to Mexico this morning.

The US dollar is rallying, which isn’t helping the grains.

The forecasts in Brazil are looking hot and dry for the next 7 to 10 days, but rains are expected to bring some relief towards the end of January.

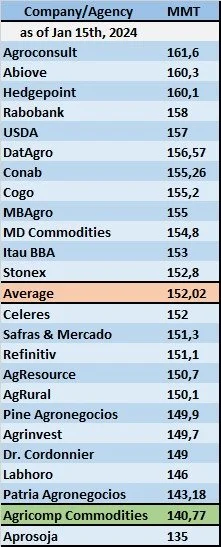

We continue to see downgrades to the Brazil crop estimates.

The big one today was a farmer lobby Aprosoja in Brazil. They are saying that the Brazil soybean estimates are too high by as much as 20 million metric tons.

The association which is represented by thousands of farmers in Brazil projects production at 135 million. This is a very low number and far below the USDA's current 157 and CONAB's 155 numbers from last week.

How much creditability does this report have? Hard to say. On one hand, they are the ones in the fields, so they know better than any of us what their crop looks like. On the other hand, they are typically the most bullish when it comes to their crop. The producers there obviously have a bias, but this is a massive swing in numbers from theirs to the USDA's.

Other changes to estimates we saw include:

Dr. Cordonnier once again lowered his estimates. Dropping his beans by 2 million to 149 and his corn by 2 million to 115.

He did however also raise his Argentina estimates, raising beans by 2 million to 52 and raising corn by 3 million to 56 million.

AgRural dropped their bean number from 159 to 150.

Here is a chart with all of the bean estimates from analysts:

So why does the market continue to trade lower despite the downgrades across the board?

The reason the market isn’t taking into account of these reductions is because……

The rest of this is subscriber only. Please subscribe to continue reading and get every exclusive update.

In today’s update we go over why the market is ignoring the downgrades to Brazil, the biggest risks the corn & bean markets faces, things both bears & bulls are looking at, how to hedge & more.

TRY 30 DAYS FREE

Get all of our daily updates & audio completely free for a month.

Become a price maker & beat Big Ag at their own game.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23