USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

MARKET UPDATE

Subscribe so you don’t miss our next sell signal or opportunity in the markets

Comes with every daily update along with 1 on 1 tailored market plans.

Stop guessing when to take risk off table.

Try 30 Days Free: CLICK HERE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

USDA Overview: 0:00min

Corn Export Story: 1:30min

The Funds: 4:34min

Corn: 6:42min

Beans: 9:00min

Wheat: 10:35min

Want to talk or put together a market plan?

(605)295-3100

Futures Prices Close

Overview

Grains mixed ahead of tomorrows USDA report. Today's price action was mostly just pre-report positioning.

Tomorrow’s USDA is an old crop report. Which means there will not be any new crop acres, yield, etc.

Changes will only be made on the demand side of the US balance sheet along with actual production changes to South America.

At the end of the month we will get the USDA Ag Forum Outlook. That will give us the projections for the new crop balance sheets.

USDA Estimates

Here is the estimates for tomorrow.

The trade is not looking for huge changes to the US balance sheets.

They are expecting a small cut to both US corn & soybean carryout as well as a small cut to world carryout for both.

South America production is likely going to be the wild card.

They are expecting decent production cuts to Argentina's crops but a bump in Brazil's soybeans.

Is Feb USDA a Market Mover?

How big of a market mover is this report usually?

Well, it usually isn’t considering demand is the only thing changed on the US balance sheet in this report.

Here is the price action from this report since 2014.

Corn has only been green 3 of the past 11 reports, while soybeans have been green 7 years in a row.

Corn has only seen one double digit move, in 2022. While soybeans have only seen 2 double digit moves, in 2022 and 2021. All were to the upside.

Corn 🌽

🔴 2024: -1

🟢 2023: +4 1/2

🟢 2022: +14 1/2

🔴 2021: -7 1/2

🔴 2020: -2

🔴 2019: -2 1/4

🟢 2018: +1/2

🔴 2017: -1 1/4

🔴 2016: -1 1/4

🔴 2015: -3 1/4

🔴 2014: -1 1/4

Beans 🌱

🟢 2024: +4 1/2

🟢 2023: +4 1/2

🟢 2022: +25 3/4

🟢 2021: +14

🟢 2020: +1/2

🟢 2019: +1 1/4

🟢 2018: +4 3/4

🔴 2017: -8 1/4

🟢 2016: +3/4

🔴 2015: -9 1/2

🔴 2014: -6

Wheat 🌾

🔴 2024: -13 1/2

🟢 2023: +15

🟢 2022: +6 1/4

🔴 2021: -6 1/4

🔴 2020: -10

🟢 2019: +4

🔴 2018: -4 1/4

🟢 2017: +11

🔴 2016: -1

🔴 2015: -8

🟢 2014: +7 1/4

Corn Export Story

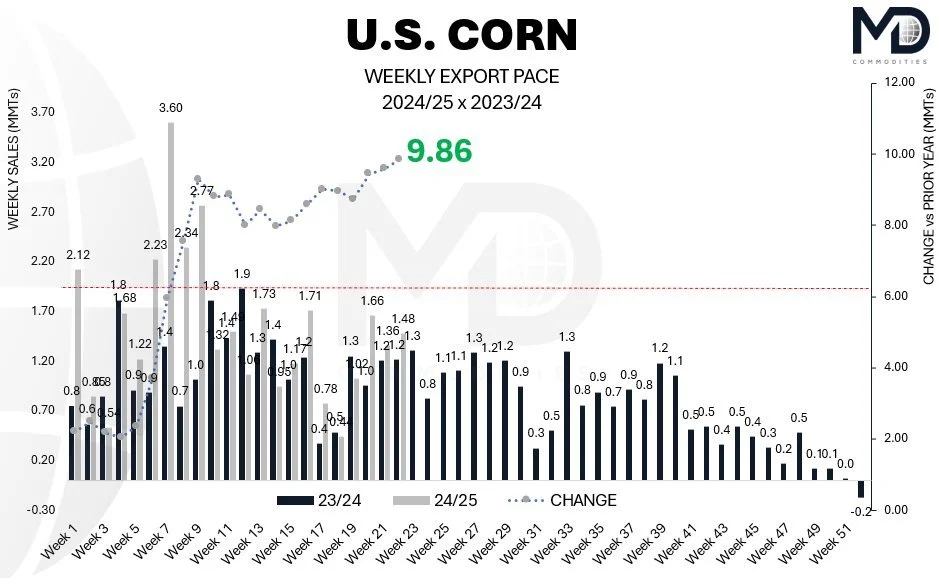

Corn exports have been running ahead of pace for several months now.

Which supports the idea that the USDA should raise their export demand numbers tomorrow. Will they? Who knows. But they probably should, even if it doesn’t happen tomorrow.

Mexico continues to gobble up US corn. As we saw another flash sale of 365k MT this morning and a 330k MT flash sale last Wednesday.

Exports continue to impress, and the delay of that 2nd corn crop in Brazil is going to keep buyers coming to the US for corn longer than usual. As Brazil's corn crop won’t be exported until June or July.

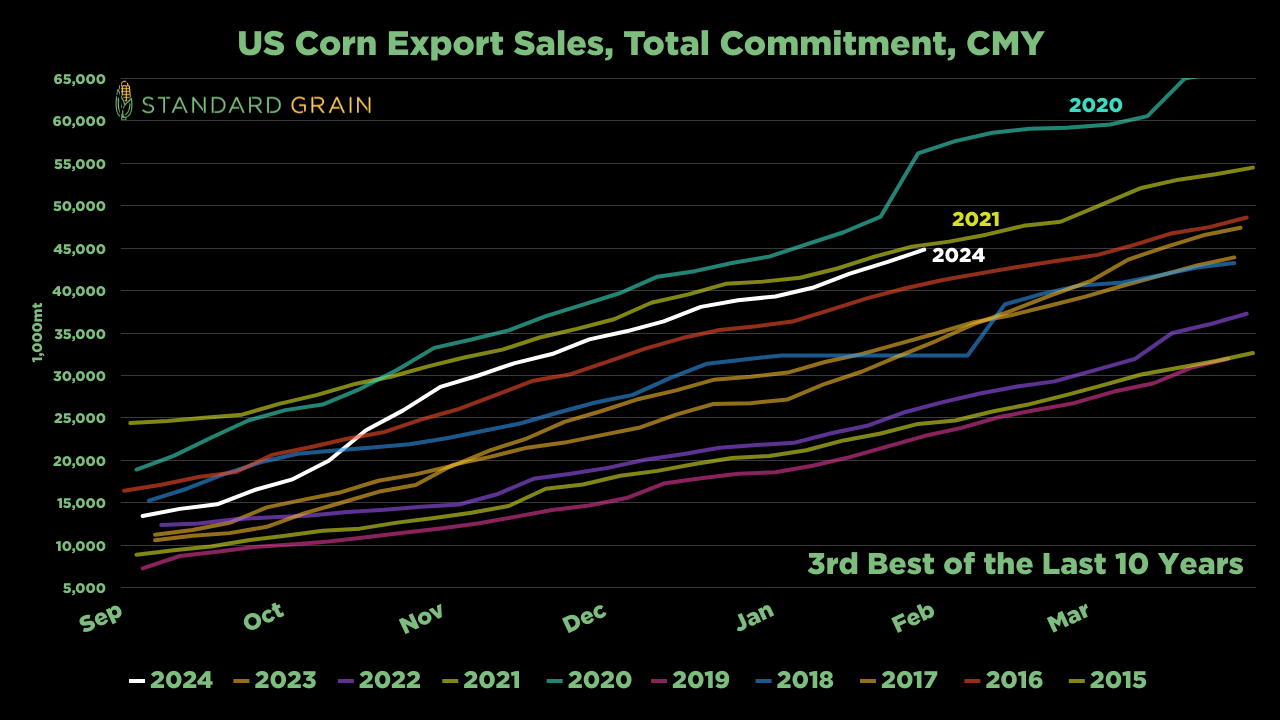

Here is a chart from Standard Grain that shows total US corn export commitments.

We are currently the 3rd best of the last decade only behind 2020 and 2021.

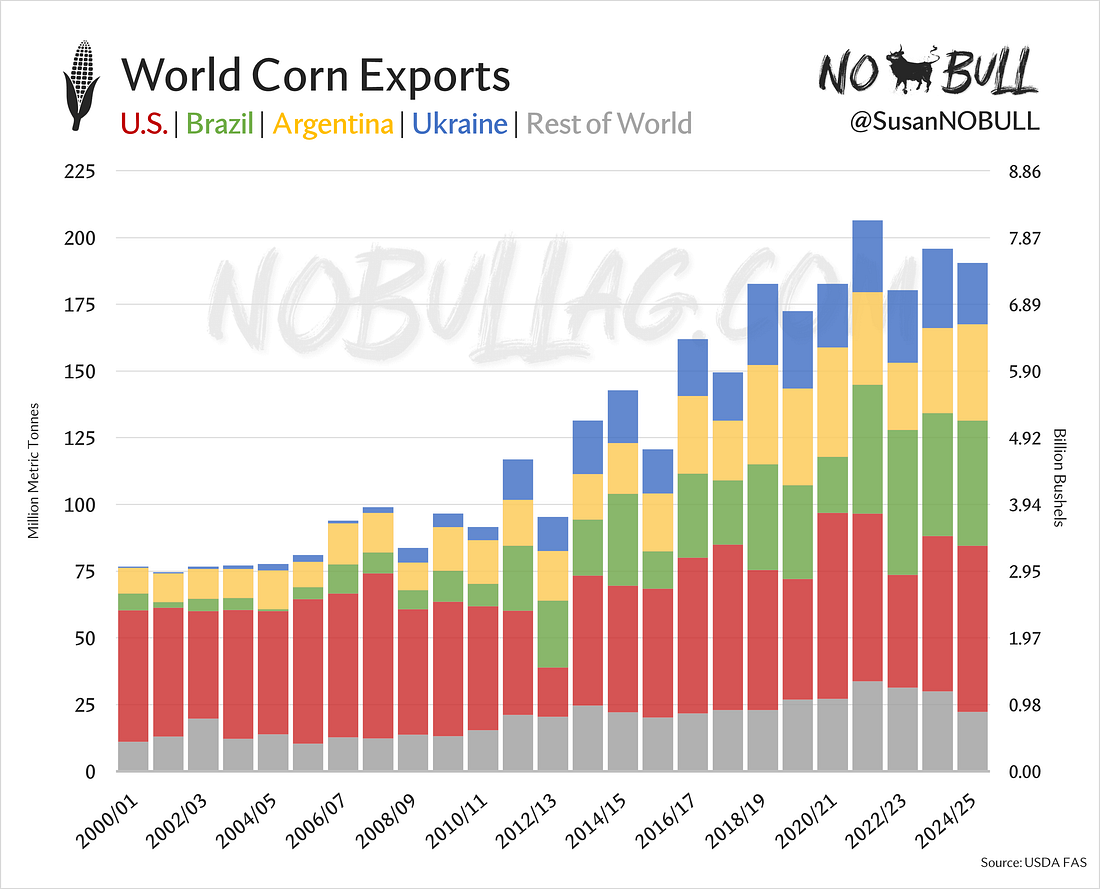

Now here are two amazing charts from Susan of NoBull Ag.

This first one shows world corn exports.

As you can see the US, Brazil, Argentina, and Ukraine dominate the export market.

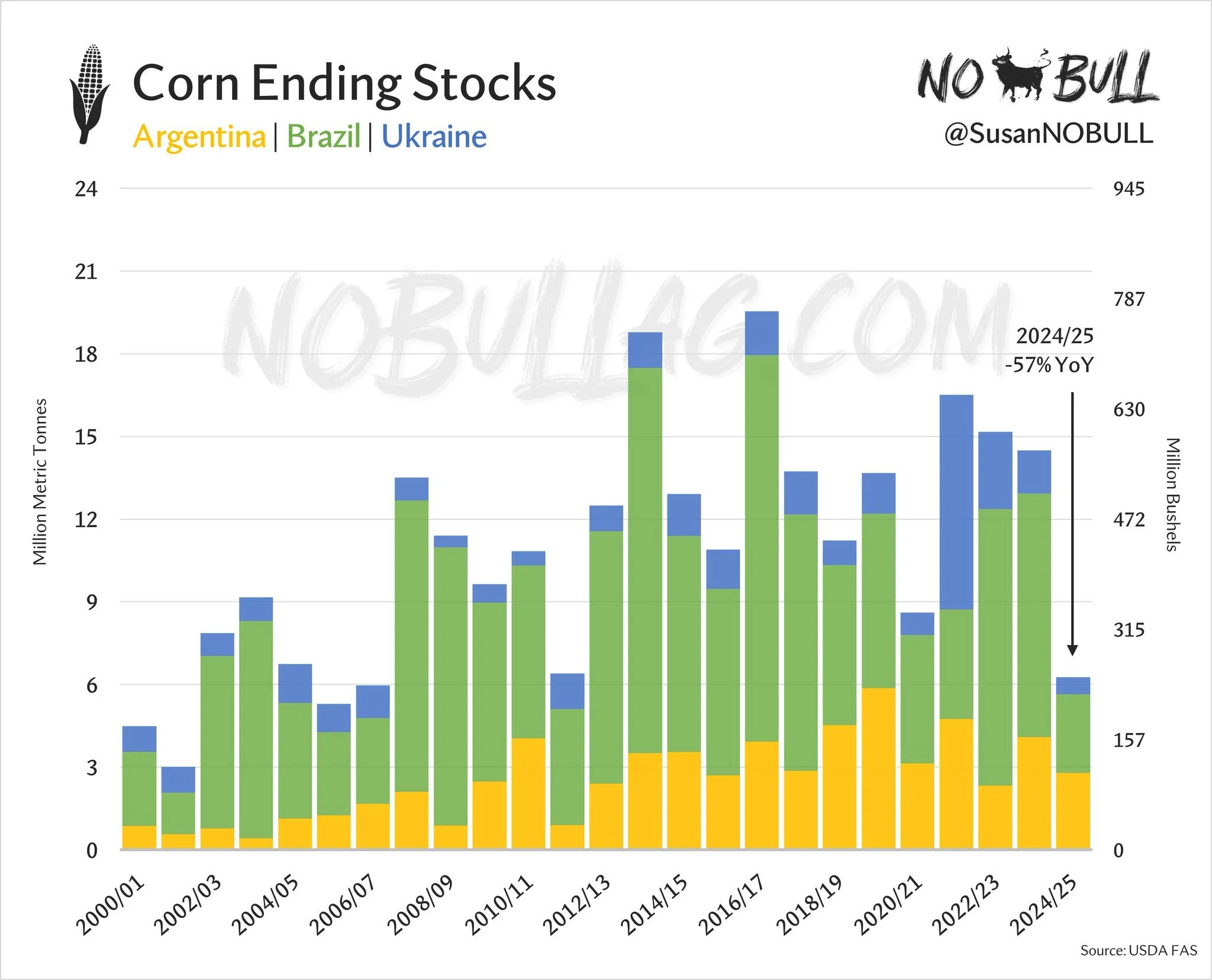

Now here is a chart that shows Brazil, Argentina, and Ukraine's corn ending stocks.

Their combined ending stocks are down -57% from last year.

Why does this matter?

Our top 3 export competitors have less corn to export. Meaning the US gets that much more export business.

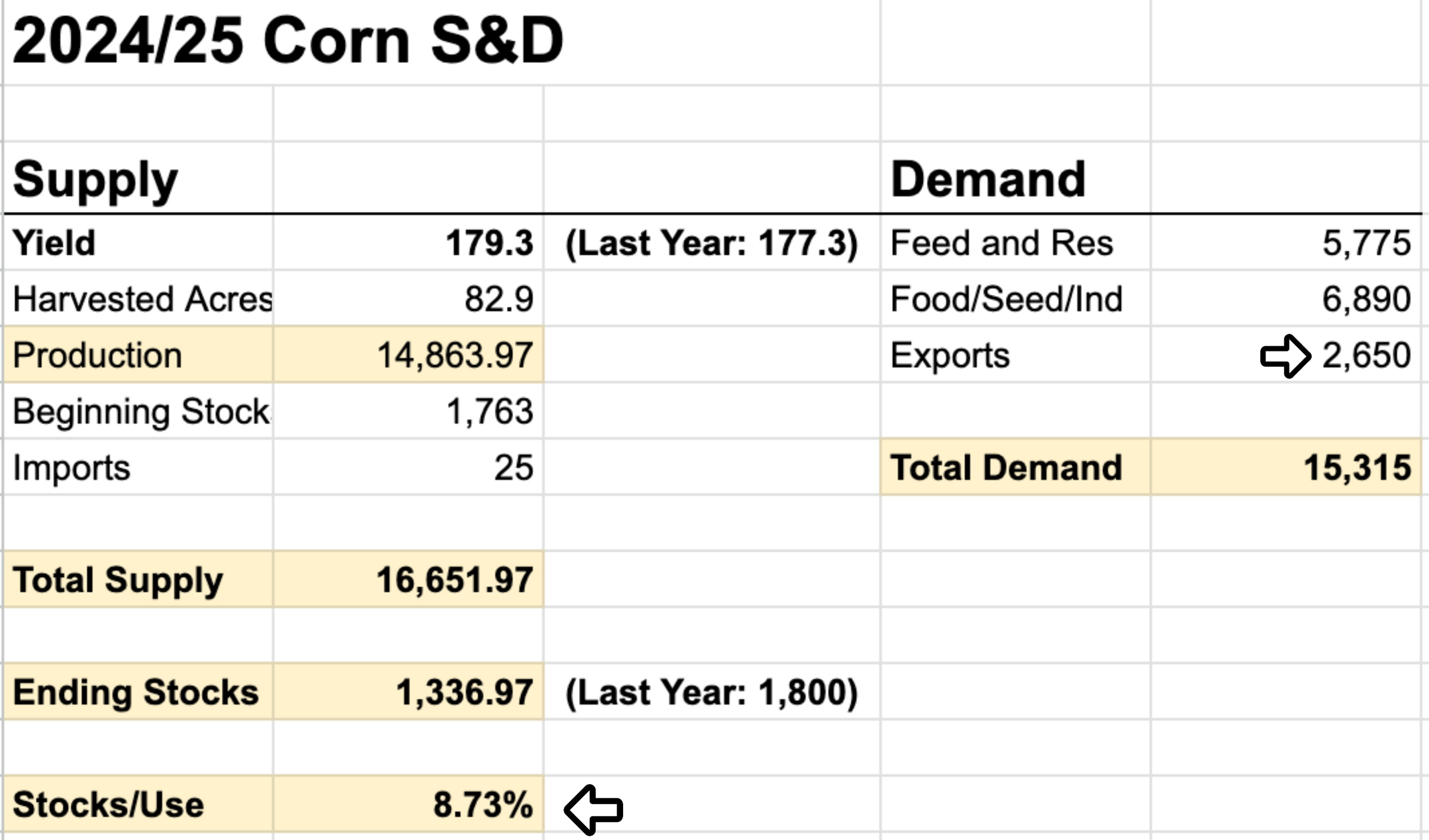

There is talk that corn exports might eventually need to be bumped by 100-200 million bushels.

Last years USDA export number was 2.300 billion.

This year they have exports at 2.450 billion.

Currently exports are on pace for nearly 10 MMT more than last year (equates to around 390 million bushels) (1 MMT = 39 million bushels)

For example, if you were to add 350 million bushels on to last year's export number you get 2.650 billion.

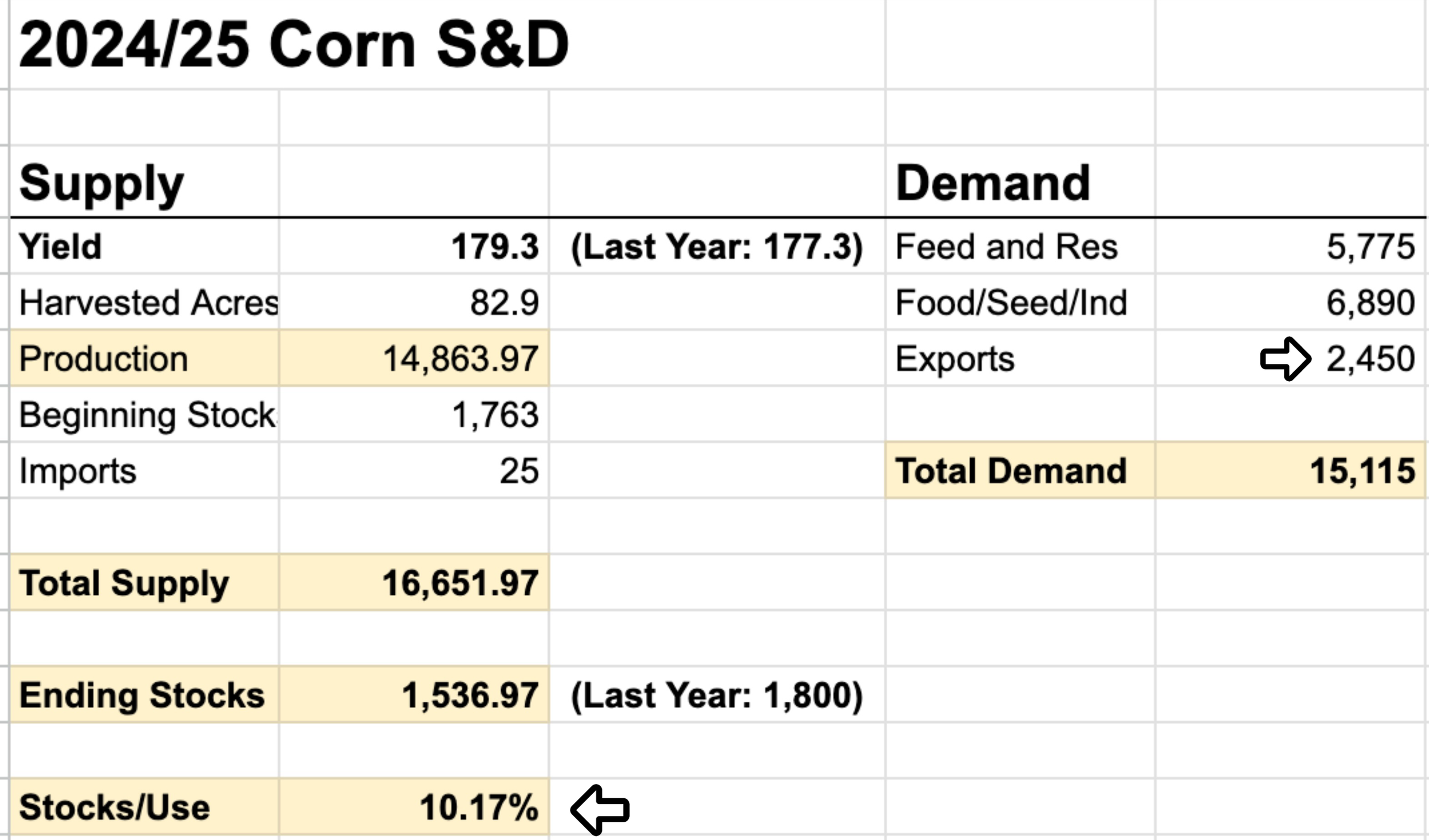

What would that do to the balance sheet?

Here is the current balance vs our balance sheet if exports were bumped another 200 million.

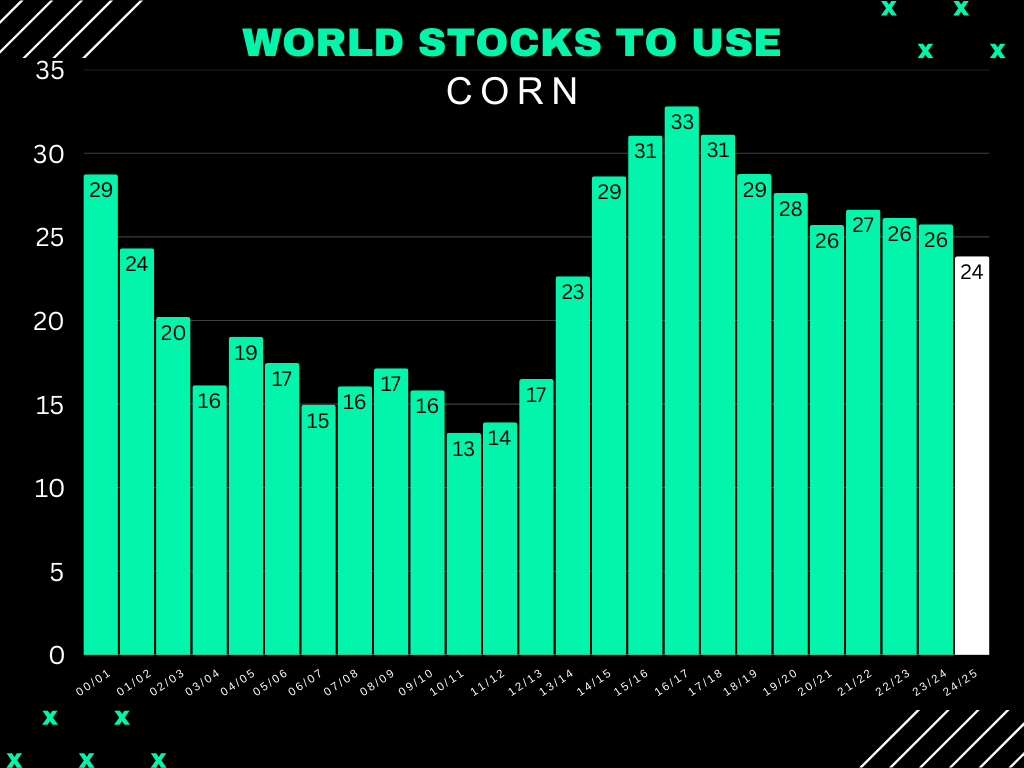

Our carryout would fall to around 1.3 billion and our stocks to use ratio would fall below 9%. Which is full blown bull market territory.

(This is without any other adjustments to the balance sheet. Only exports.)

The Funds

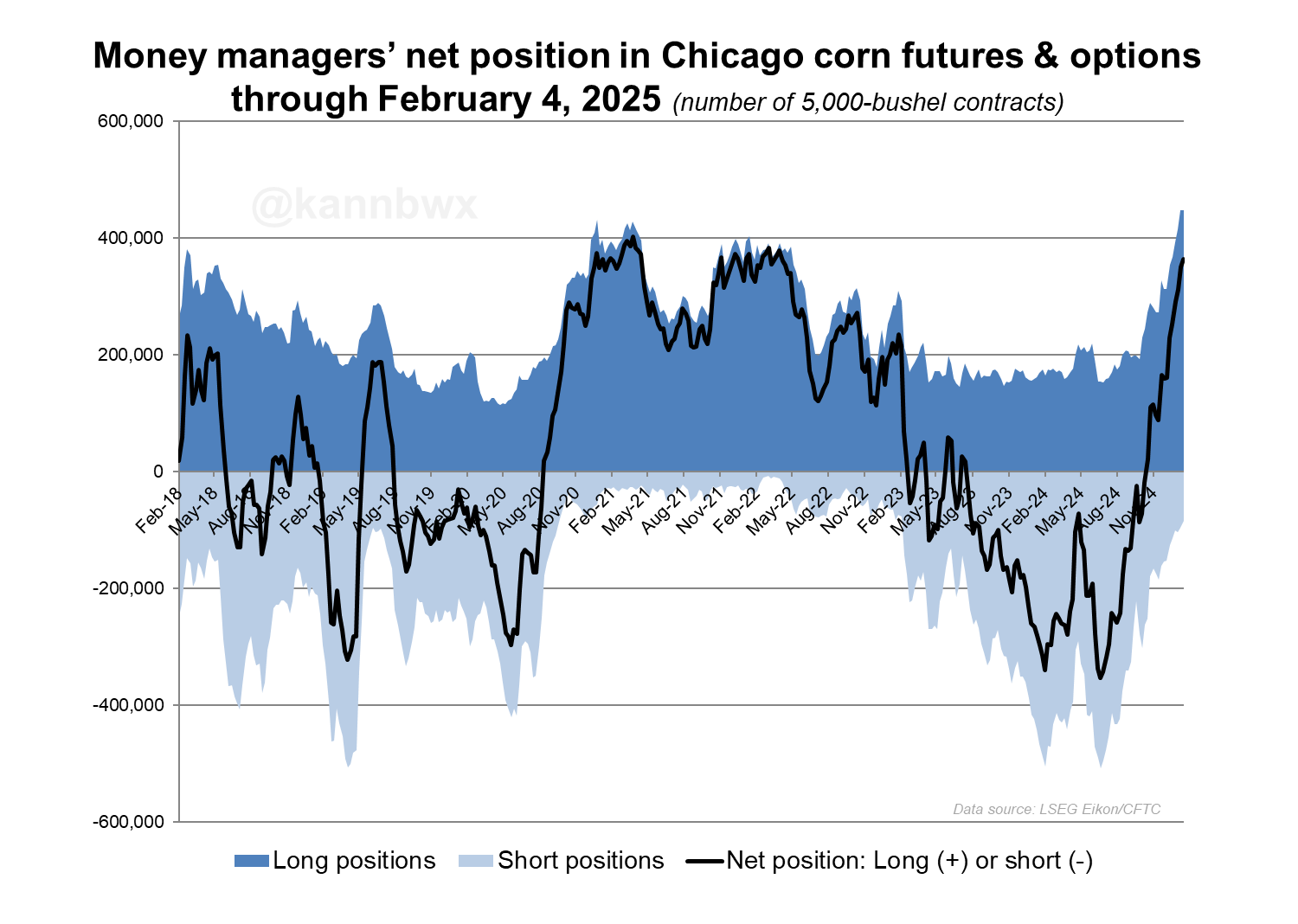

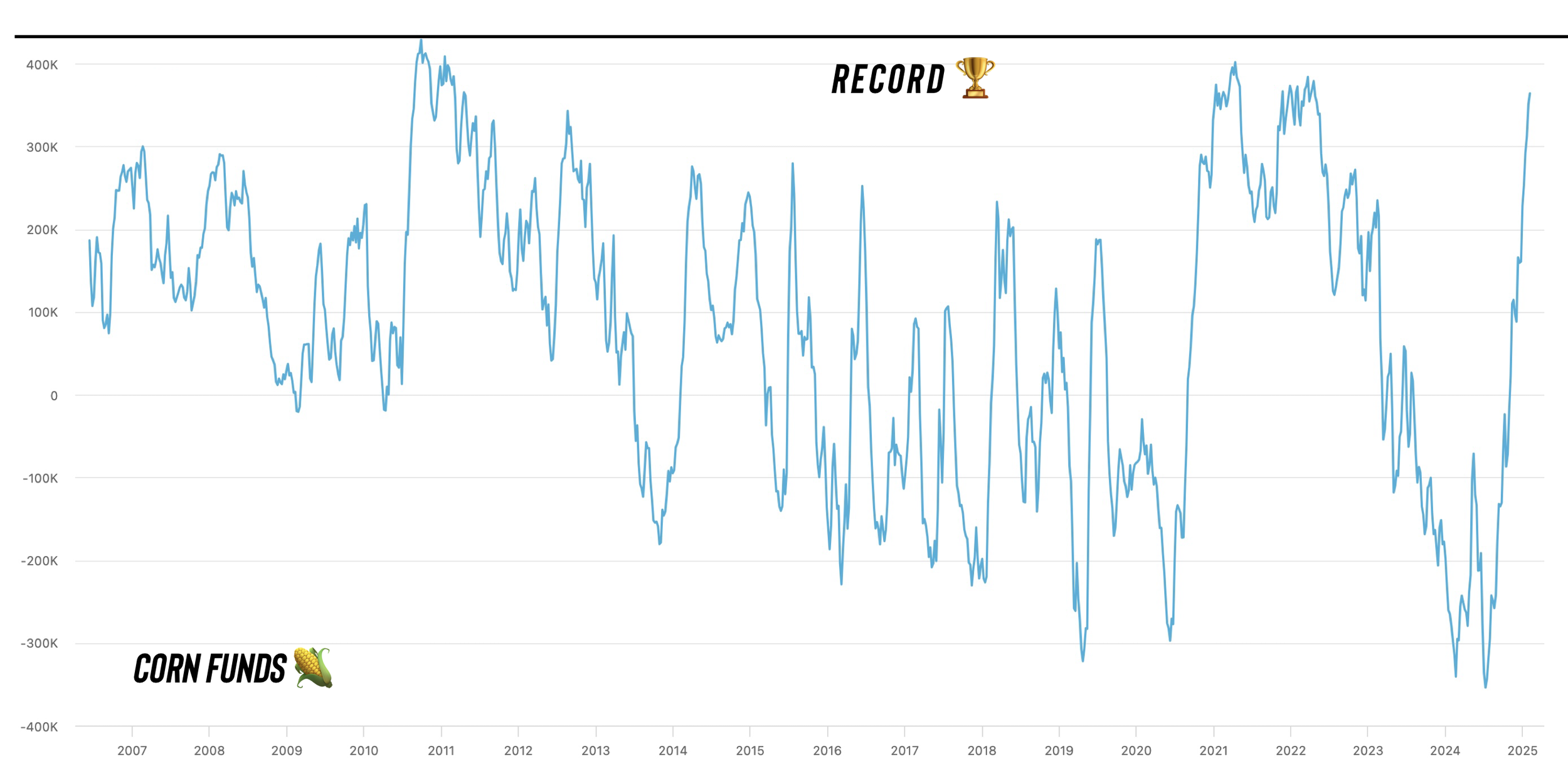

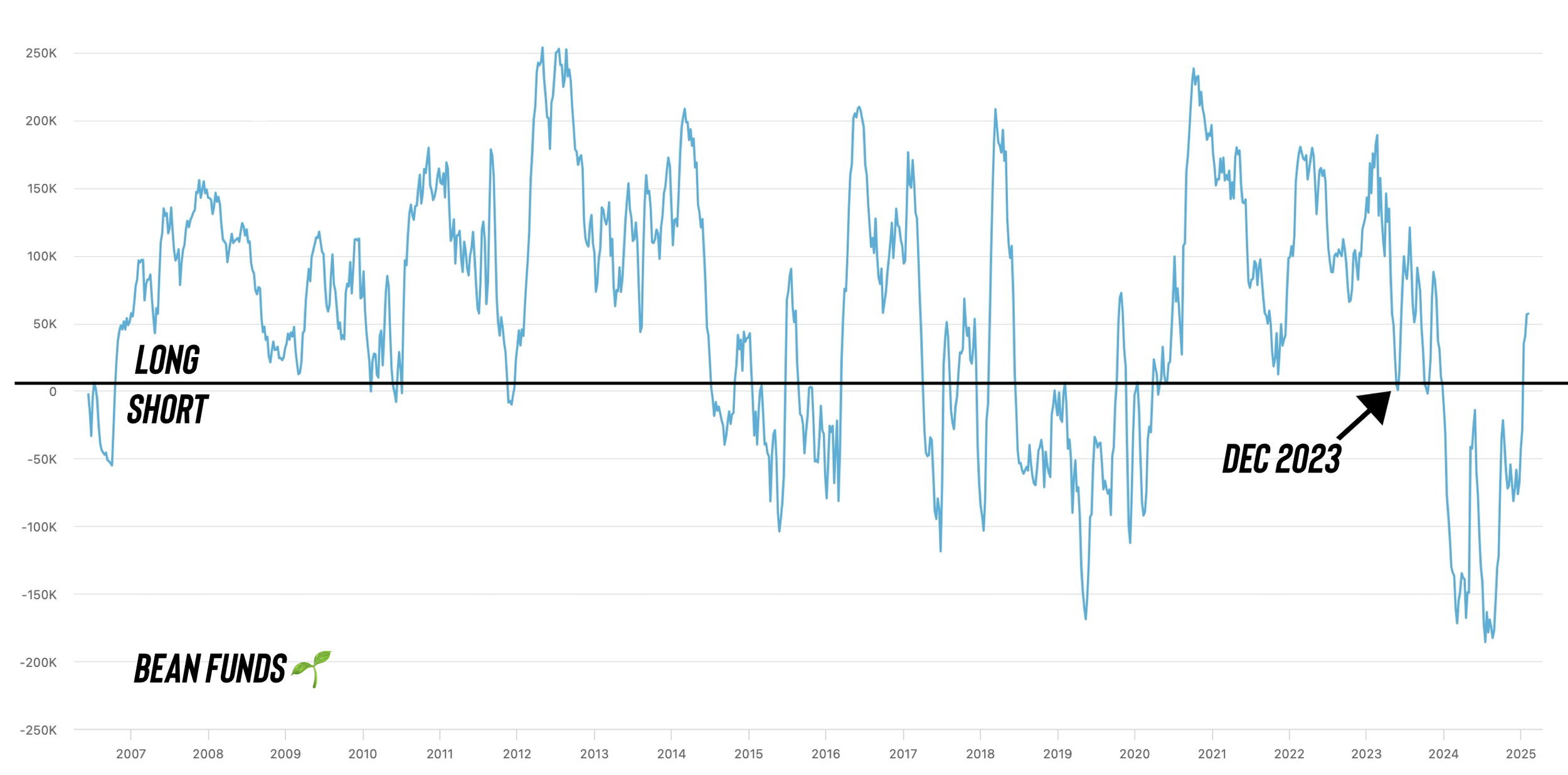

The funds are holding a record long "gross" position in corn.

This means their total long position is the largest ever.

Sitting at +448k contracts.

Chart from Karen Braun

Usually when you refer to the funds, you talk about their "net" position.

Which is their long position minus their short position.

(448k long - 84k short = 364k net long)

Their net position is sitting at 364k contracts.

The last time funds were this long?

April 2022 when corn was trading over $8.00

The funds record net long was 409k contracts back in 2010.

Which means, no the funds won’t be adding a ton of contracts here. As they are almost "maxxed out".

But this does not mean they have to simply puke out of this long position.

They are not dumb, and did not get near record long for no rhyme or reason.

When the funds get this long, they can stay this long for several months.

For example the last time they were this long, they were long over +350k contracts from Nov 2021 until May 2022.

The funds would need a reason to bail.

They are probably waiting to see how this Brazil crop turns out and how our US growing season shakes out. Because they realize that if we cut into the world stocks this year the corn story could continue.

Despite the bearish global situation, the funds have opted to stay long soybeans.

They haven't been long in over a year.

Now holding +73k contracts of soybeans.

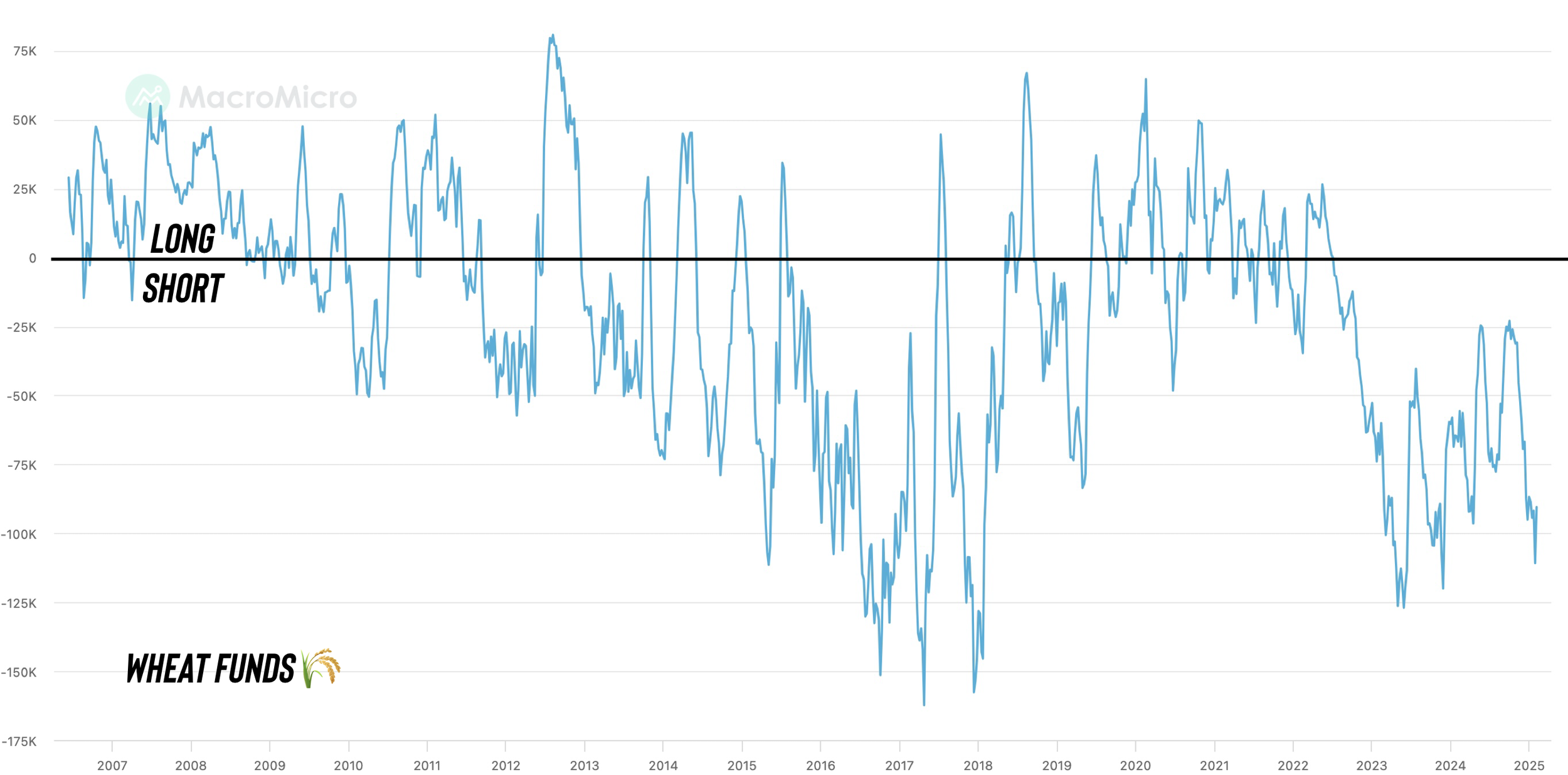

Funds are short -90k wheat.

The fundamental situation for wheat is not bearish at all.

So to me, this looks like a case of the funds simply using wheat as a hedge. Where they go long corn and short the wheat market as their hedge in case the grains fall apart.

The hedge won’t last forever, but the funds are rarely long wheat to begin with.

Today's Main Takeaways

Corn

Moving forward, my bias still remains higher for corn.

Looking at March corn, if we take out the recent highs the next point of interest is going to be around $5.08 which is the May 2024 highs.

We still remain in an uptrend (black line).

Really nothing bearish here at all. The longer corn consolidates in this area the friendlier, as it builds a longer term base of support.

If you are undersold on old crop, then that $5.08 area would be a good spot to make another sale or grab some puts.

(on Jan 23rd we alerted a sell signal for old crop. If you did not take advantage of that signal, you still have the green light to do so)

If you are simply just holding gambling bushels (10-20% left to price) then I wouldn’t be opposed to simply seeing how high this thing can go.

Looking at continuous corn, if we break this level the door to higher prices opens wide up.

I still have the $5.37 area as my major long term point of interest.

Again, this doesn’t have to happen on the March contract. It could happen on the May or July if it does.

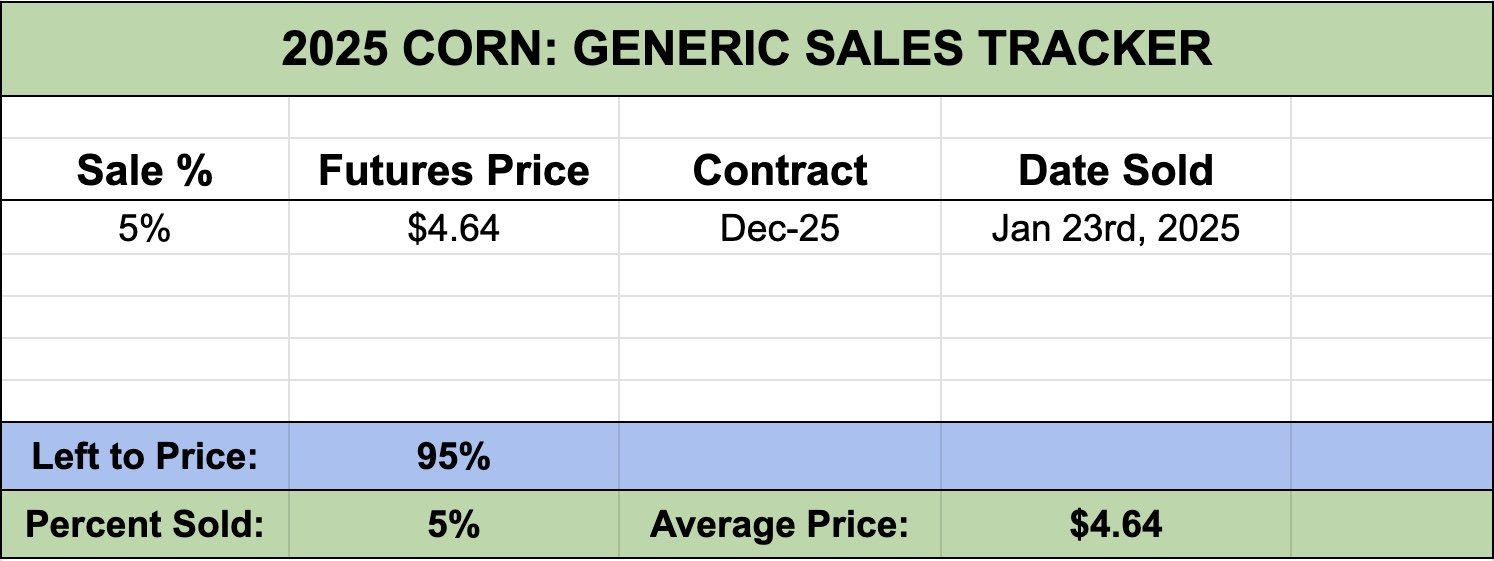

Looking at Dec-25 corn.

We posted a bullish reversal candle (took out Friday's lows but closed above Friday's highs).

This chart looks great and remains in an uptrend.

We are right under my 2nd target of $4.72

I still do not know if we will alert a full blown sell signal, but I will personally be looking to price just a very small 5% to bring my total to 10% sold on the generic sales tracker (located at the bottom of the update).

Then I probably won’t be making much more until we get into the $4.80's or higher.

(Ideally I'd rather utilize old crop puts for my new crop rather than flat out sales as we have talked about several times the past few weeks. If you have questions on it shoot us a text or call: (605)295-3100)

Soybeans

Overall I am still not super bullish on soybeans, as they don’t have nearly the fundamental story that corn does. But I am not really bearish here either.

Soybeans have continued to fight despite the ongoing Brazil harvest as well as the fact that the US is far overpriced on the global export market.

I think Brazil's monster crop will probably somewhat keep a lid on soybean prices. I think beans "potential" ceiling is as high as $12 but I don’t think we could fundamentally justify prices much higher than that unless something drastically changed such as a trade agreement between China and Trump.

Overall still just looking for opportunities when we get them.

If you still have a bunch of old crop you are looking to price, that $10.80 level is still the next point of interest.

Bulls would like to hold this new upward trend we have, otherwise it could spark a leg lower.

If we bust that black downward trend and $10.80 level, the next target would be around the $11.35 area.

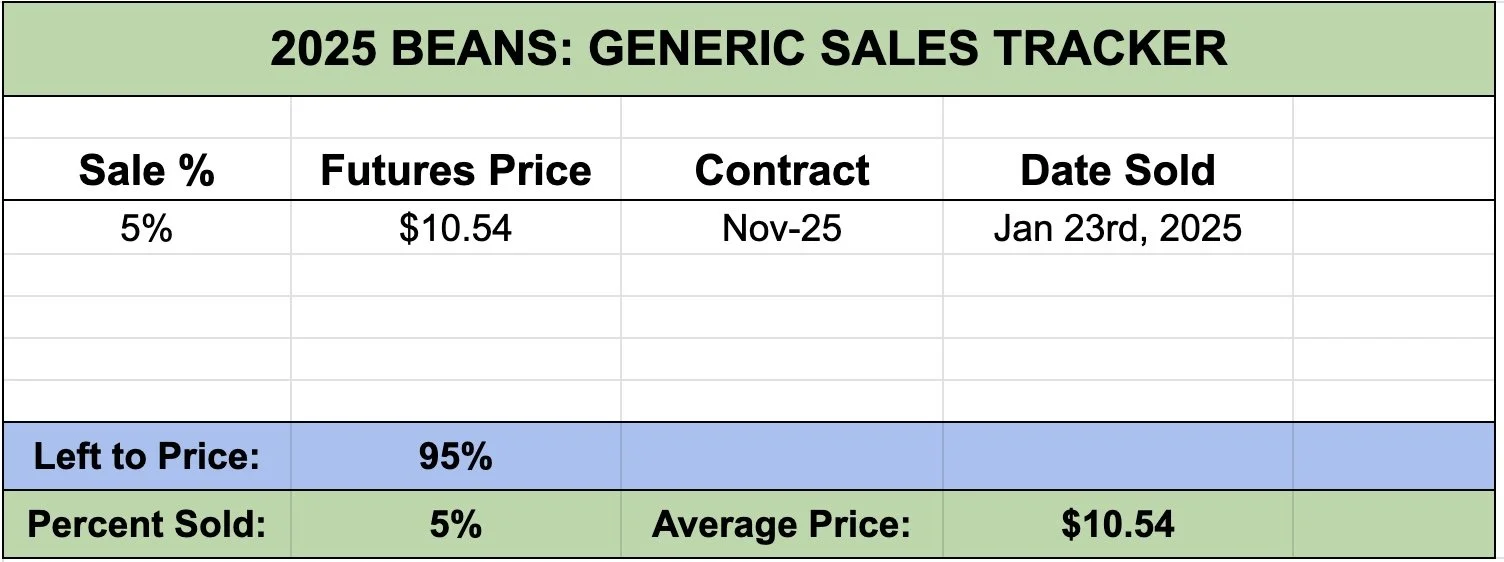

The targets for new crop have not changed.

My next target is still $10.82 (50% of May 2024 highs).

I am personally still looking to price just 5% on my generic sales tracker if we can hit that level. Bringing my total to 10% sold on new crop.

A bigger picture target is still going to be around that $11.50 area.

It is the implied upside move from this inverse head & shoulders.

It is also 78.6% to the May highs.

If that target hits later this year, I will look to be a lot more aggressive than I am at these levels.

Wheat

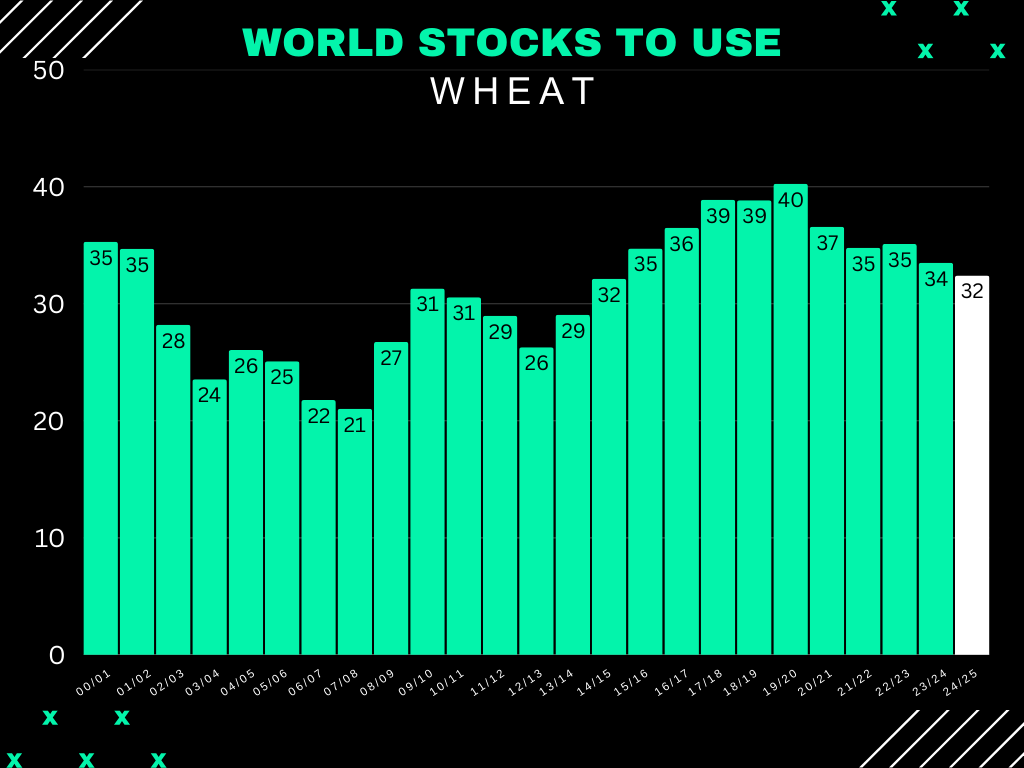

I still see wheat as undervalued here.

The global situation is far from being bearish.

It is the tightest in a decade, and looking at the 2025/26 marketing year. This figure will probably shrink even further given that Russia has their worst winter wheat crop ever.

There are a ton of friendly factors going on right now as well.

We have the cold temps in Russia.

It is very cold here in the US and there is no snow in most of the US.

India the worlds 3rd leading exporter of wheat is severely dry.

We have a global balance sheet that has continued to shrink year over year.

Eventually the US should catch some business and wheat should find a story.

My next target is still $6.30 on Chicago wheat. (38.2% of the May highs).

We will likely be alerting a sell signal if that level hits.

Nasty price action the past 2 days for KC.

Next target is still $6.30 (38.2% of May highs)

MPLS is stting at resistance right now.

If we break this level, the first target is also the 38.2% of the May highs at $6.63

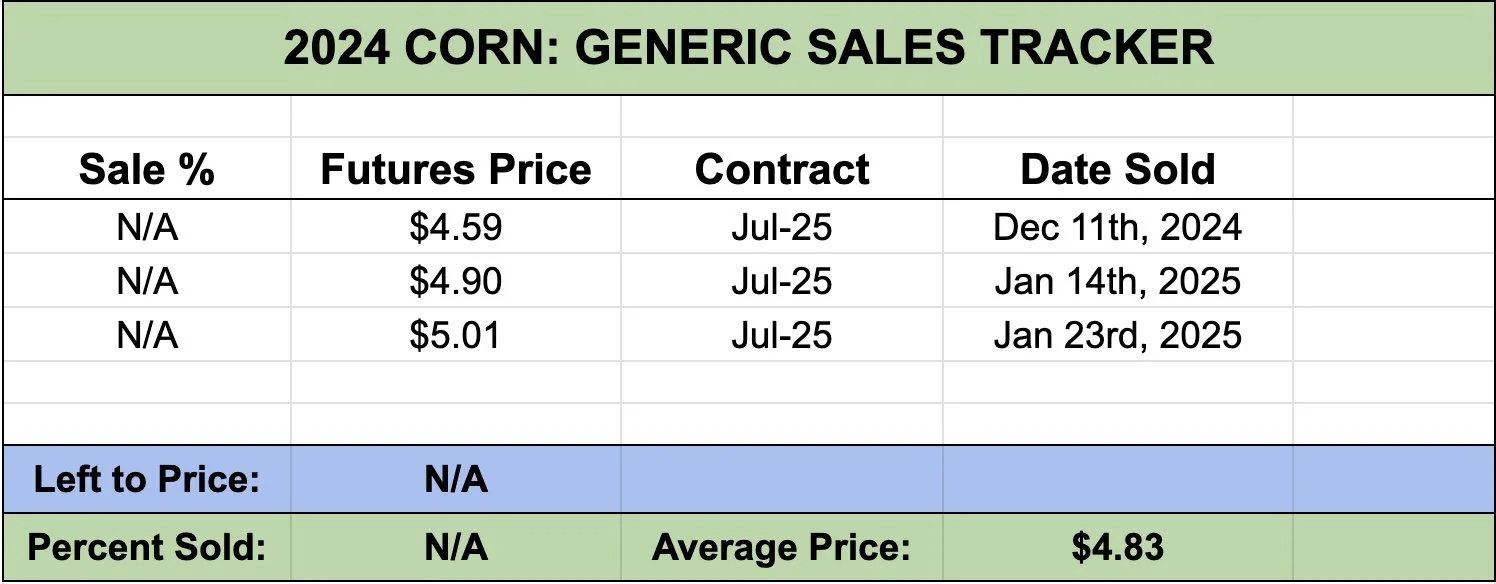

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24