USDA NUMBERS

Full thoughts later this afternoon*

As we mentioned yesterday, this report is usually a non-event and does not move the market a whole lot.

We saw no changes made to the US balance sheets for corn & beans. Meaning we saw no bump in demand/exports etc in corn.

The report was not bearish at all. But it appears like the trade was slightly disappointed we did not get that bump in demand for corn. As corn was trading higher before the report and saw selling after the numbers.

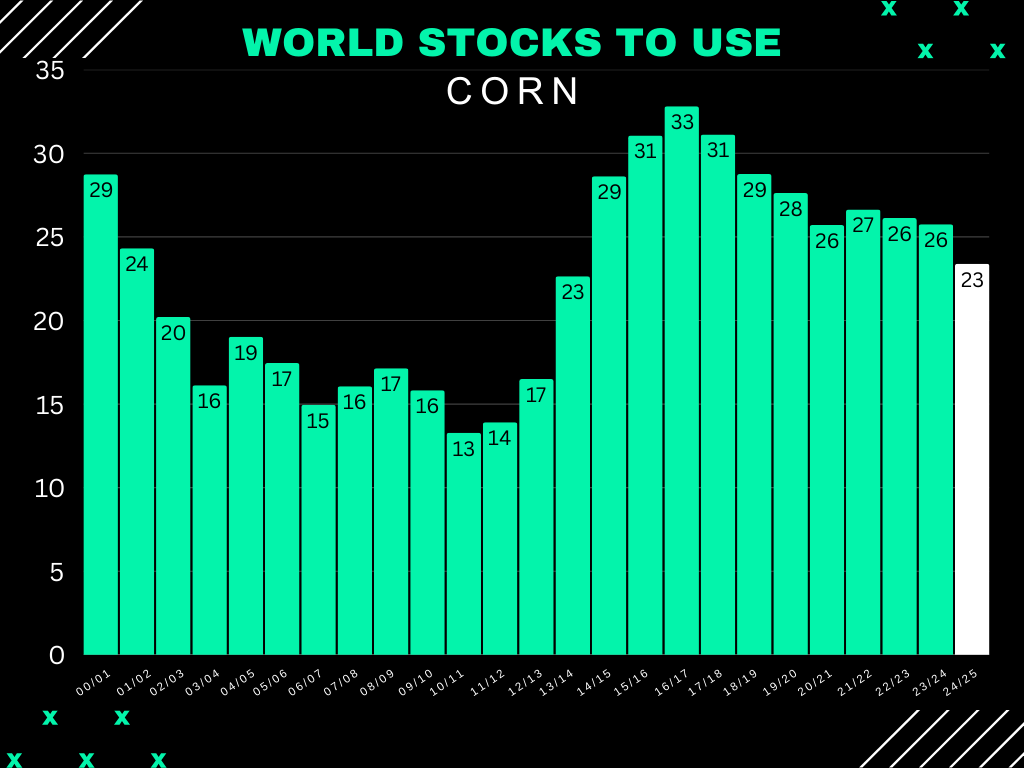

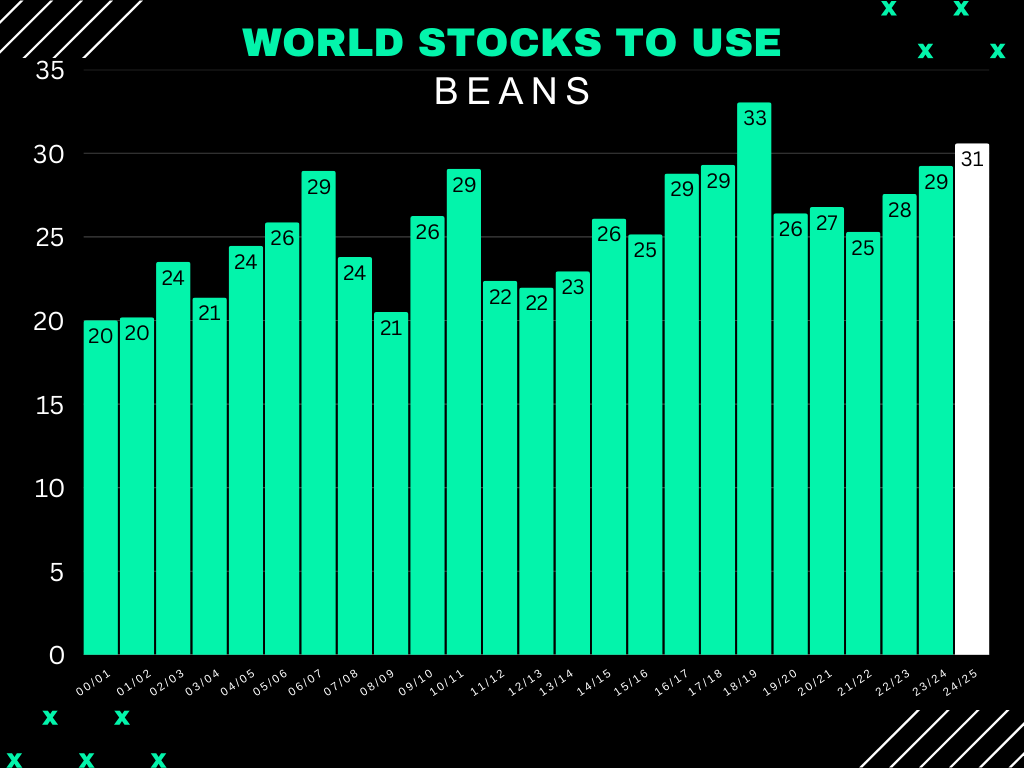

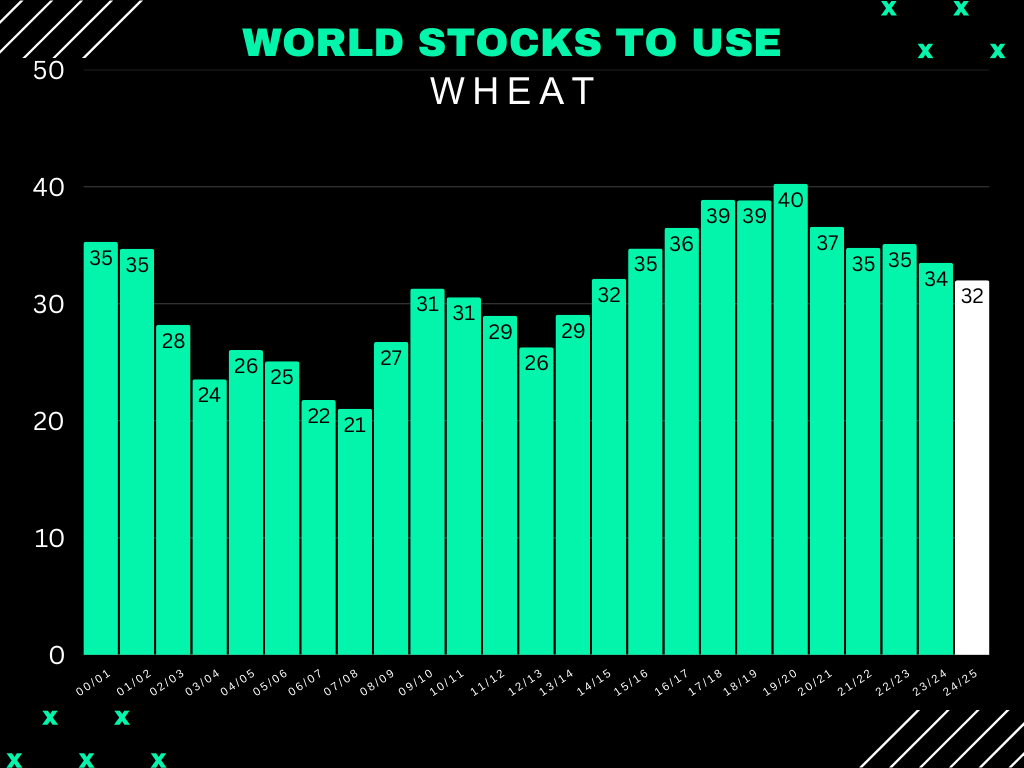

World carryout did come in lower than expectations for all the grains. So that was nice to see.

For South America, we saw cuts to the Argentina crop in both corn & soybeans. The cut in Argentina beans was more than expected while the cut in Argentina corn was less than expected. Friendly we saw cuts.

Both of Brazil’s crops came in lower than expected as they cut the Brazil corn while leaving the Brazil beans unchanged (trade was expecting an increase). Friendly as well.

Overall, it wasn’t a major report and was far from a game changer for bulls or bears. We will have our full thoughts & breakdown later this afternoon.

NUMBERS

WORLD STOCKS TO USE

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.