BULLISH USDA FOR CORN & BEANS

AUDIO COMMENTARY & CHART VIDEO

Very bullish USDA report for corn & beans

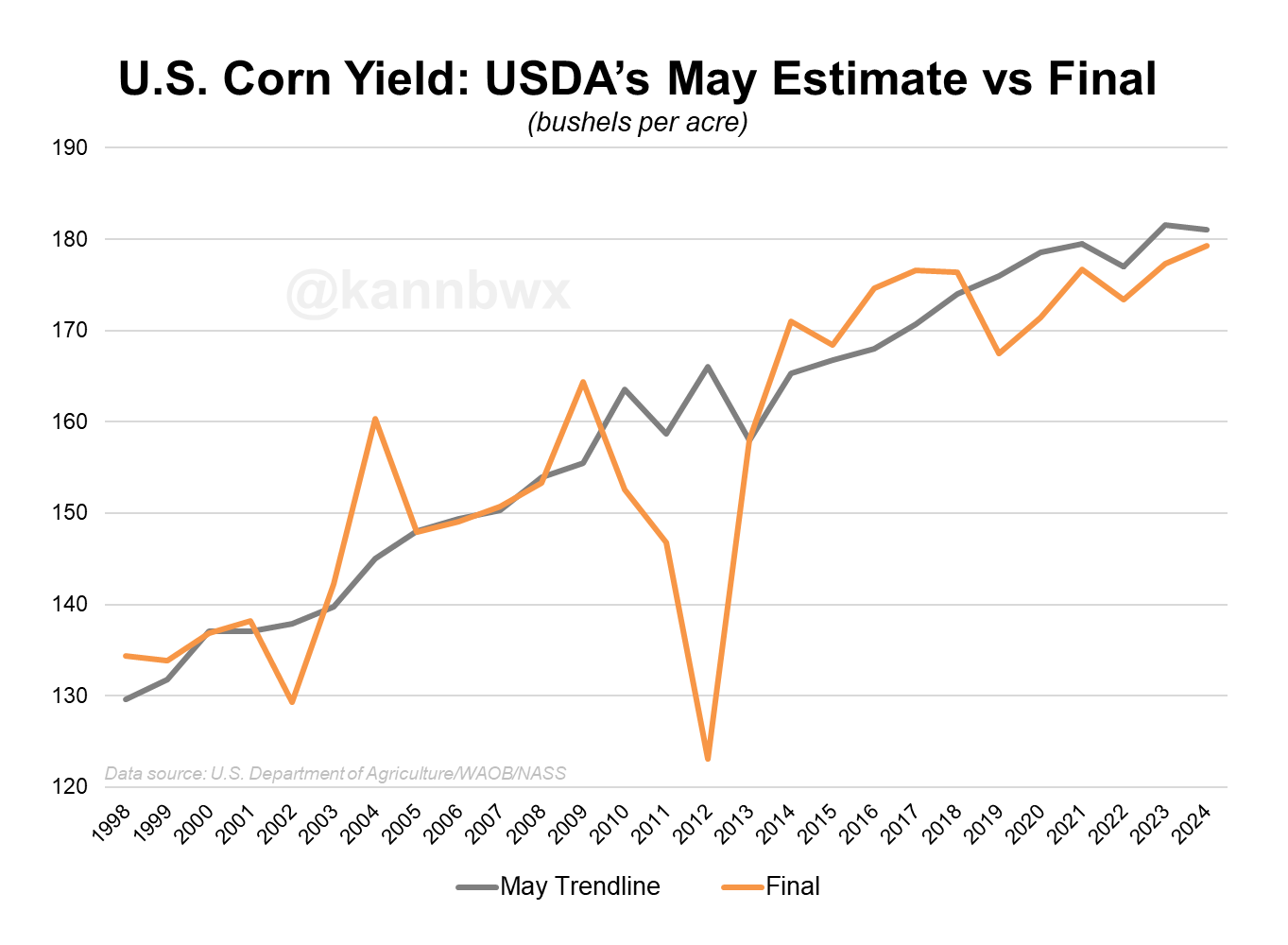

USDA couldn’t get 180 bpa since 2018

Corn & bean yield fell outside trade range 4th time in 6 years

They dropped corn demand numbers

Beans go from near 500 to 380 million carryout

Corn spreads continue to be on fire. Why to hedge old crop vs new

This report sets the opportunity to use corn basis contracts and hedge what is undervalued via the spreads

This could change that acre battle story

Still issues in SA, but this report changed the fundamental story

Definitely real potential for $5 corn

45Z guidance added some fresh news

One of biggest yield drops ever for Nov-Jan

Snooze in wheat. Still see plenty of potential

Who should make sales here?

If you bought puts, make sure you are making sales to get your money back from the put

Do not re-own here if you made sales lower

Video chart update below audio*

Corn against downtrend from Oct 2023*

Why $4.85 is next target after $4.67*

Visuals from USDA report below*

Listen to today’s audio below

VIDEO CHART UPDATE

Why $4.85 is my next corn target after hitting my $4.67 target. Beans hit short term target. Wheat still looks okay here.

I added pics of the charts below the video in case you prefer to read.

I also added some USDA visuals below the charts that show how corn carryout has decreased, how we have failed to hit 180 bpa etc.

March Corn 🌽

We hit the $4.67 target.

Next target is $4.85. Scroll to see why

Reason #1

It is the 78.6% retracement to our May highs.

We busted above the 50% at $4.56. Now sitting at the 61.8% at $4.68 (another reason why $4.67 was our previous target).

Next fib level is at $4.85

Reason #2

It is the implied upside objective from this ascending triangle we broke out of.

I mentioned this a while back, but the conservative target is $4.85

How you calculate the implied move is you take the range of the first test of the bottom of the triangle to the top of the triangle (35 cents) and add it on top of the point of breakout ($4.50)

$4.50 + $0.35 = $4.85

The more aggressive target would be to take the entire range of the triangle instead which is 48 cents and gives you an implied move of $4.99. But I am sticking with $4.85 for now.

HOWEVER..

Corn has a new challenge to face.

This downward trend from Oct 2023.

If we bust above this, it would be a big win for the bulls.

Today we rejected perfectly off of it.

March Beans 🌱

Beans hit that green box and short term target.

Next possible target would be a test of that black line that we have rejected a few times.

Still need to hold this red line, as there is a gap of air below. Meaning zero support until the lows.

Continuous Wheat 🌾

Nothing to change.

Need to hold this green box or we make a leg lower. Would like to think we hold, as this has been support several times.

Either way, bulls need to bust this downward trend from May to get excited.

March Wheat 🌾

Still think we are in a bullish falling wedge, but we can still post new lows and be in a bullish set up.

Bulls need to break the downtrend then the fun can start.

KC Wheat 🌾

Need to hold the lows.

Need to bust the red downward trendline.

Until one of those happen, simply range bound.

USDA VISUALS

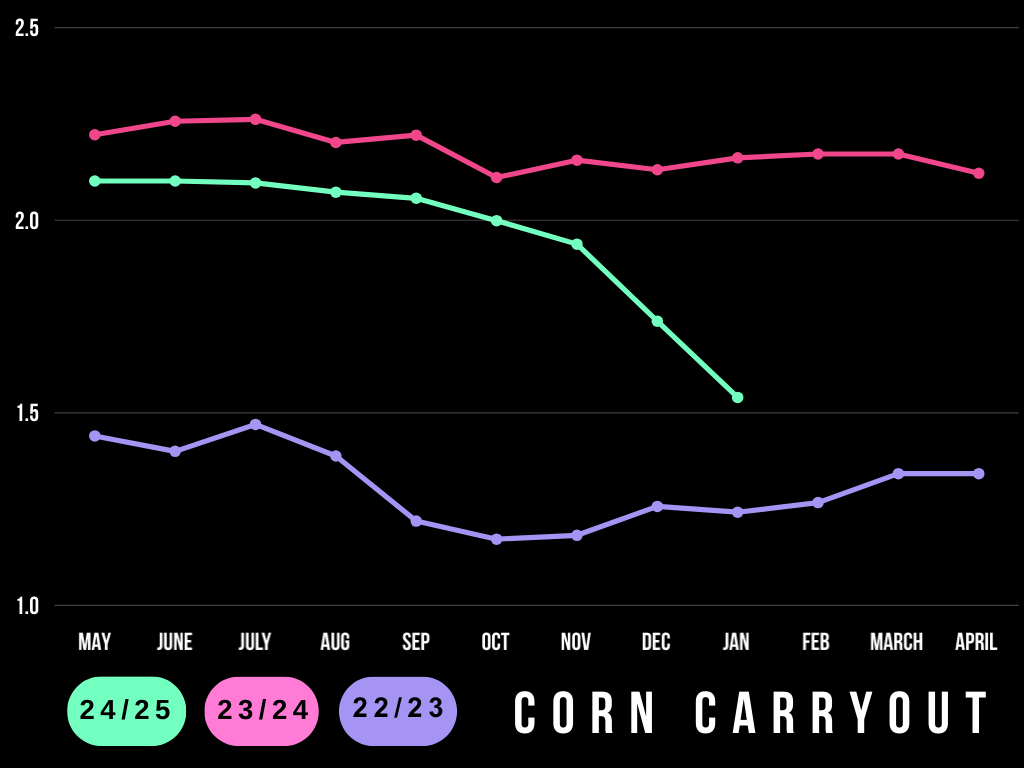

Here is corn carryout by marketing year.

This is the 7th straight month it has been lowered.

The longest streak in +20 years.

Yield is still a record at 179. But the USDA has failed to reach trendline yield for the 6th year in a row.

Even with one of the best growing seasons ever for many, we still failed to reach 180 bpa once again.

The USDA has been calling for 180 since 2018.. it has not yet hit.

Chart from Karen Braun

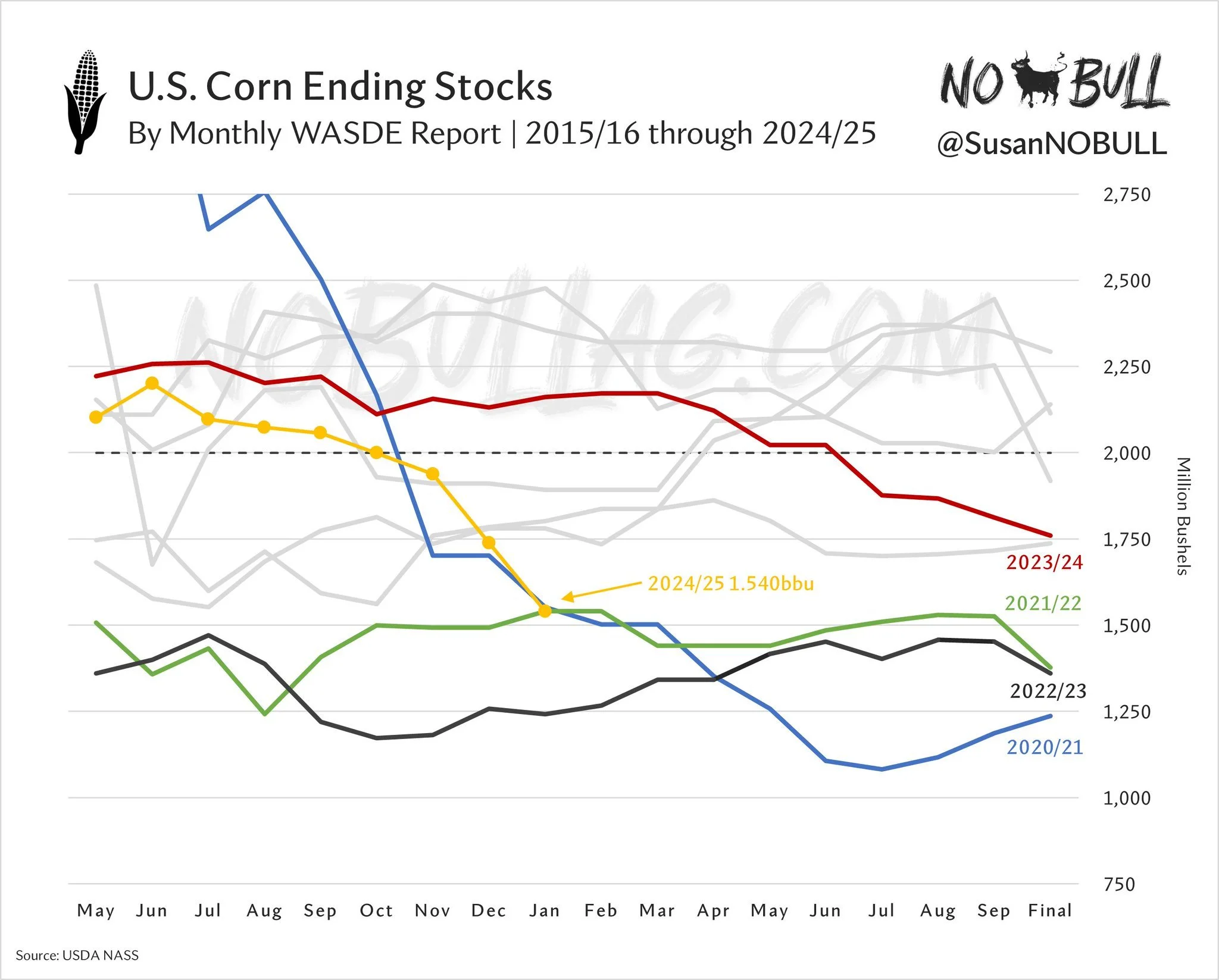

This chart is from NoBull Ag.

Our carryout is the same as it was in 2020/21 and 2021/22 for the month of January. Altought 2020/21 took a nose dive after.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24