WEEKLY NEWSLETTER - USDA Supply & Demand Report Recap - Corn Basis, Ethanol Plant bids

By Jeremey Frost

This is Jeremey Frost with some not so fearless grain market comments for www.dailymarketminute.com

This week’s headline is one simple question.

Why?

Many may have heard the motivational quote “What is your why?” But in this week’s www.dailymarketminute.com newsletter we are going to trim down that question to simply why? In an attempt to analyze grain price action and possible future price action.

Before we get to why, we must go over the headlines from the USDA report we had earlier this week.

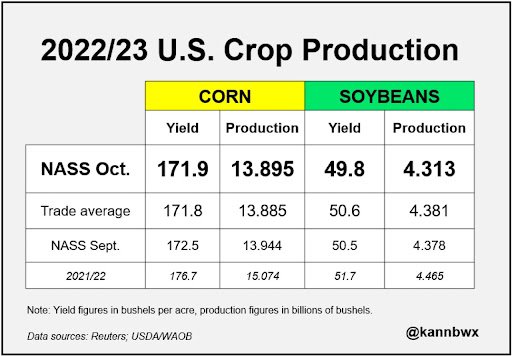

Thanks to twitter and @kannbwx for the below.

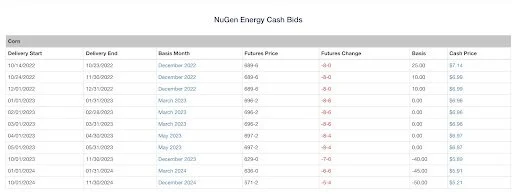

As the above illustrates we had crops get smaller, but we also had forecasted demand slip. In all three of the major grains we saw production lowered but forecasted demand was lowered at the same time.

That brings the first point of these USDA reports.

Why do USDA reports exist?

When we are looking at these reports we need to remember that old crop reports are the best explanation as to what the USDA thinks has happened versus new crop reports being what the USDA is projecting to happen in the future. It’s not easy but it is simple to say our grain stocks on X date are X.

Now some can debate how believable USDA reports are. I can testify that when I was at CHS, I would receive a call from NASS asking me what I had for inventory on a given day. I would run a report on my position and I gave them the numbers that helped that position, not the actual stock numbers.

I never had anyone from CHS tell me to do that but to me the stocks reports were always like who could lie the most. But when I asked other merchandisers what to do, telling the actual stock numbers was never an answer given. When I asked the farmers they tended to also tell some made up tale if they responded at all. When I asked end users they said they would always say they had storage completely full. So whatever the elevator capacity was, that was the inventory they magically had.

So my experience in the stocks reports was farmers said they had none, end users said they were completely full, and the traders in the middle said whatever was in their best interest. So I have always expected the stock reports to be rather volatile. How NASS counts inventory is another reason for the volatility. Not once in the 40 plus calls from NASS that I took did they ask me what I had intransit. If I had just loaded a shuttle, or had I been waiting on rail cars.

The reason we have quarterly stock reports is to simply reconcile the checkbook so to speak. But if everyone is putting in bad information anyways why do we have these quarterly grain stock reports? I would like to think that with technology these reports have gotten better and I know they allow for some bad information, but if it is all bad I do not know how it is going to produce good accurate information.

The easiest answer as to, Why do we have USDA Reports would come from our conspiracy corner and it would be something like to control prices.

So the question of: Why do we have these quarterly grain stock reports? If I throw out my conspiracy corner type of answer then I am left with an answer of I do not know. I know why it is considered a good idea, but the history of the swings shows how inaccurate they are. Basis and spreads show how garbage these reports can be.

Have you ever reconciled your own checkbook? Did it always balance or did you forget to write something down at times? Maybe these quarterly stocks reports are the same, once in a while something slips and via the reconciliation process it gets caught on the quarterly stocks report.

Then why did myself and many others in the industry think that the soybean quarterly stocks numbers was the USDA showing its hand for the October Supply and Demand report?

On to the next why?

Why did the USDA lower demand on corn, soybeans, and wheat? Is it not a little early to do that? My answer is that they have to lower demand because the crop is not there. We can’t use what we do not have.

Basis as well as future spreads will help show where the crop is lacking and when or where it might be abundant at.

Why did grains not go higher with the USDA report showing lower production for corn, wheat, and soybeans?

Because it was inline with the trade estimates, plus money flow is very sensitive to headline news such as the stock market. Our biggest fundamental is not supply and demand, it is money wanting to buy or money wanting to sell.

Why are elevators bidding using such a wide range of basis during harvest?

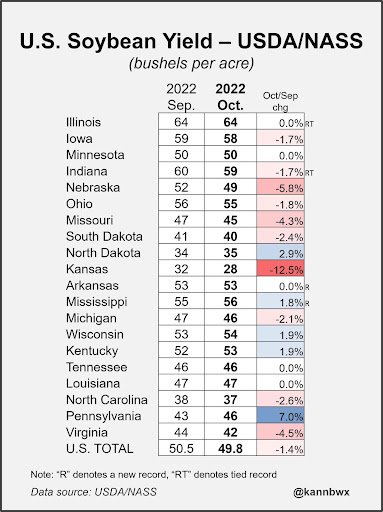

This is happening in many places other than just in South Dakota, but here are some SD corn bid structures.

First one is Poet in Mitchell/Loomis SD. You can see they are bidding a small carry that goes into an inverse for summer corn followed by a bigger inverse for new crop 2023 corn.

Next is Ringneck Energy in my hometown of Onida SD. Notice the huge carry they are bidding in the market. Paying nearly 40 cents a bushel more for May corn then corn off of the combine.

Next is Agtegra Cooperative, I am using the Huron location. You will notice like Ringneck Energy a rather wide basis, but just a small carry of 11 cents for April versus off of the combine.

Next we have Glacial Lakes Energy, with 3 different locations. First off Watertown is paying 11 cents more for March corn then off of the combine, followed by Mina that is paying 27 cents more for corn in March then off of the combine, while Aberdeen is paying 32 cents more for March then off of the combine.

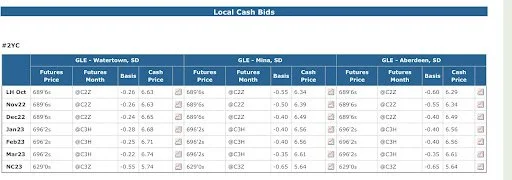

Lastly we have NuGen Energy in Marion SD. They are paying 18 cents more for corn delivered this week versus March delivery.

So why do we have such extremes at these locations? It is simply the market doing its job locally. It is affecting grain flow as well.

Take a look at Ringneck Energy, they are basically telling farmers we don’t want your corn right now, the local crop is too good and farmers are bringing us supply. The reason for the carry is to attempt to get farmers to sell the carry to them versus letting the grain slide southeast to the Poet or Nugen Plants ethanol plants.

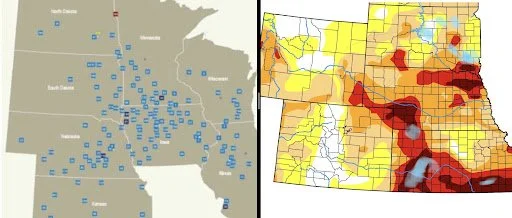

Take a look at the picture below, on the left is from issuu.com and it shows all of the ethanol plants, on the right is a drought monitor picture with some scribblings in blue from me.

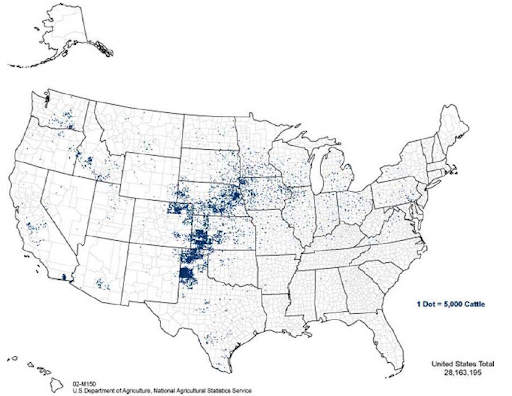

Next is an older map of feedlots, notice the strong possible demand pull at the same areas as the dark red drought monitor above.

What should one be doing in each of these areas? For one do not give your corn away to the end user. I.E. build bins if you are in the areas where they have a big carry. If you are in an area where it is inverted you need to watch for coverage clues. Are you seeing a bunch of corn flow into Nugen coming from some of these other areas.

One thing I do not like doing that many will do is simply trucking corn to the area that is begging for it. Let someone else use the time and money to do that. The more corn as an example that leaves RingNeck Energy the ethanol plant in Sully County. The more they will have to pay up for it later.

Bottom line if you look at the maps and pictures above you should be bullish corn basis. When you see the only counties in SD not in the drought happen to be right where RingNeck Energy is located it makes sense for them to have a huge carry. But when you see all of the demand sources further west and south, it is just a matter of time before RingNeck has to improve their basis. The only way they don't is if they get enough supply via elevators and farmers selling them the big carry that they are posting.

Check out the article on selling off the combine here.

Why are we trading at $7.00 corn futures during harvest?

I think it is because we can not just flip a switch nor write it on paper that demand is down 1.2 billion bushels. I think the market needs to find a way to actually soften demand. The argument on the other side of the demand fence is that we can not sell what we do not have.

Why should grain prices go higher?

Here are just a couple of reasons.

Stock market reversal on October 13th, if it holds money should flow into commodities as well as other investments

Supply is lower year over year for all three of the major grains

Russia-Ukraine see below from Wright on the Market

“Russia has submitted its objections to the United Nations about the Black Sea agreement of Ukraine grain exports and is prepared to reject renewing the deal next month unless its demands are addressed according to Russia's U.N. ambassador when speaking to Reuters yesterday.

With corn and wheat in the toilet yesterday, obviously no one believes Russia (or insurance companies) will close the export corridor. The only thing more certain than the grain export corridor being shut down in the coming weeks or months is the sun coming up this morning.

What will corn and wheat prices do when the news breaks there will be no more Ukrainian grain shipments until further notice? A little common sense should kick-in here some place.”

Why could we see lower prices?

Recession and money flow is the greatest risk

Demand has started off on the slow side (but as I talk about we can not sell what we don’t have)

An ease of weather across the world and better SAM production. Right now this is not the case but a risk of bigger crops in the future.

Why I think we will see higher prices and the bulls will win out.

I do not think the supply will be there in upcoming USDA reports. I also think farmers continue to grow and get smarter. They do not give away quite as much grain as they used to give away.

Ever heard the saying united we stand divided we fall? I think more farmers are united in holding grain and doing the right stuff in marketing that it helps us get better prices.

If you look at grain prices versus any other investment vehicle, would you buy or sell grains? Commodities have underperformed most other investment vehicles longer term.

What is something that mankind will always need? Food.

Why should one build bins?

If you are reading this on a consistent basis I really shouldn’t have to answer this question, however I will give you two examples. Last week's newsletter talked about the over $2.00 a bushel carry that ADM in Silver Grove Kentucky had.

Above I talk about the nearly 40 cent a bushel carry that RingNeck Energy in Onida SD is posting.

I have mentioned several times that some of the specialty crops like sunflowers have doubled in value from harvest lows to the highs later in the year.

The only real risk in building bins is becoming complacent in your marketing. Plus if every farmer built bins we wouldn't supply enough “cheap” grain and that would kill demand when we need it. So there are some risks in building bins; but really only if everyone builds them.

Why should one be consistent in their marketing style?

If you change your grain marketing style every year you will constantly be trying to do what worked the previous year. It is a good way to strike out year after year and go broke.

If you can distinguish the reasons for changing and they are valid it is also the best route, but only if you have strong holding power.

I know several farmers that can hold more than one crop year. Are you one of them? If not you really should have some consistent type of grain marketing style versus puking out when the grain bins are still full. That goes without saying, can you hold out until you have to puke with the grain bins still full?

KNOW YOUR STAYING POWER

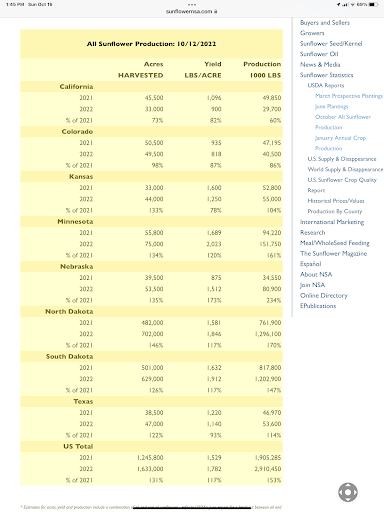

Sunflowers - Yield up but can prices still bounce?

Below is a screen shot from the National Sunflower Association. On the surface this is rather bearish. But from what I am told there was a fair amount of crush business done with the Ukraine - Russia War. This may be a case of demand leading to supply increase. Only time will tell how this shakes out. But so far the crushers have an inverse posted. What does an inverse in the markets tell us? Not enough local supply, at least not yet.

AntiTrust - Class Action Lawsuit

With recent headlines “Regulators Accuse Pesticide Makers of Inflating Prices for Farmers” in the Wall Street Journal I have had a few farmers ask me about some specialty grains with some of the recent acquisitions and mergers that have happened. I have been in contact with an AntiTrust and Class Action Firm that has had a large amount of success in the ag industry. Please send me your contact info if you would like more information or be included in a possible class action lawsuit for AntiTrust and price fixing for some of the speciality grains. (Email me at jfrost@banghartproperties.com)

Free Grain Marketing Plans

We are presently offering free grain marketing plans. Fill out a questionnaire and we will send you back a grain marketing plan. Send me your email address and I will send you over the questionnaire. You can text me at 605-295-3100 or email me at jfrost@banghartproperties.com