MARKET UPDATE

Futures Prices 12:15am CT

Overview

The outside markets see another reversal to start the week off with the dollar trading lower, crude oil and Dow Jones trading higher. Helping support the grains. Harvest progress pressuring the grains. Wheat was initially higher on Russia and Ukraine news, but has since given back its gains. Soybeans also giving back their early gains.

Today's Main Takeaways

Corn

Last weeks USDA report didn't have a major impact on the landscape of the corn market. With corn trading in a pretty wide range all week, roughly 25 cents or so. We did see us touch our highs we've haven't seen since June, but we weren’t able to see prices stabilize at that level, closing Friday lower. As corn has still struggled to break and hold above the $7 level. As we haven't seen a close above $7 since June. We ended the week +6 1/2 cents higher on the week. Nonetheless, corn has remained fairly strong, and we have to keep in mind that corn is still well over $1 off its lows made in July. Corn is down about -8 cents this morning and at the very bottom of its trading range on the day.

Corn continues to be pressured by U.S. harvest, as weather has been good and the current outlook looks pretty favorable for the majority of the corn belt. U.S. harvest was at 31% complete compared to the average of 30%.As for global weather, Brazil has been getting rainfall, but Argentina on the other hand is still struggling with their drought conditions. There are also talks that China will be looking at buying more corn from Brazil, which puts a question mark on U.S. exports.

The Russia and Ukraine situation still remains a big wild card. As many are questioning whether we will see Putin renew the Black Sea agreement. Russia has suggested that they aren't interested in renewing the agreement unless they are able to get their grain and fertilizer purchased and exported through the Black Sea. Russia is the largest exporter of nitrate fertilizer.

Some other factors outside of demand would of course include the U.S. dollar situation and whether it continues to climb, as the dollar took a big dip this morning down over -1%. As well as the direction we see crude oil go as crude is down around -5% the last 5 days following their massive rally not too long ago. We also have to keep our eye out on the Mississippi River situation as they are still battling historically low levels.

Dec-22 (6 Month)

Soybeans

Soybeans ended Friday sharply lower following a pretty strong week, as the USDA cut their soybean yield to 49.8 bpa causing a rally in prices. Soybeans were +16 3/4 cents higher on the week despite falling 12 cents Friday. Soybeans were up pretty nicely this morning, but have since gave back all their gains trading -10 cents off their highs.

This morning we saw the NOPA Crush Report for September. Which came in at 158.109 million bushels, well below the average trade estimate of 161.627 million. If it would’ve came in at the estimate it would have been a record crush.

Last week we saw the USDA show soybean harvest at 44% complete which was far ahead of the usual pace. There has been some fairly cold weather in the U.S. but the majority thinks producers will continue to get their crop out of the fields in a timely matter. As for global planting, Brazil hasn’t seen many issues and has received rainfall. But Argentina on the other hand is still struggling with their drought conditions.

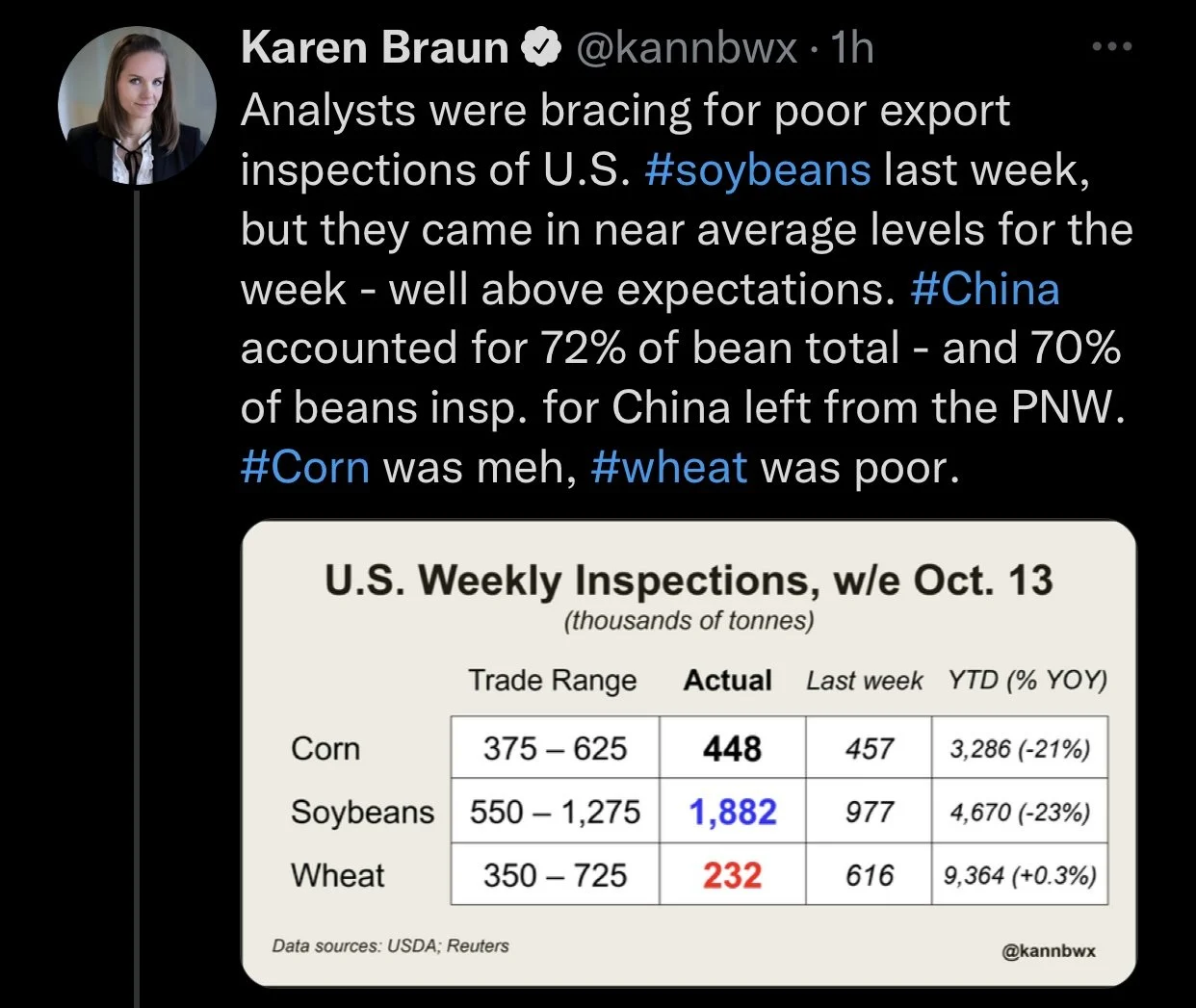

Export sales have really picked up and are now back at their traditional seasonal trend levels. Many were preparing for poor export inspections for U.S. soybeans last week, but they came in well above expectations. Coming in at 1,882 thousand tons. With China accounting for 72%. The dollar still remains a negative factor for demand until we see the strength cool off as demand still remains a fairly large concern.

Soymeal & Soyoil

Soymeal up +0.5 to 411.6

Soyoil up +1.71 to 67.01

Soybeans Nov-22 (6 Month)

Wheat

Wheat for the most part continues its sideways trading. We did prices try to push higher but we ultimately saw wheat sharply lower to end the week Friday and classes of wheat were roughly -13 to -20 cents lower on the week. Wheat was higher this morning following the Russian attacks over the weekend. But have faded off their early morning highs, nearly -20 cents off their highs.

Over the weekend we saw some more Russian attacks. This time on Ukraine's capital, Kyiv. The Russia and Ukraine situation will continue to be a major factor especially in the wheat markets, and will most likely be a wild card going forward. The biggest question mark surrounding this entire situation is whether we will Putin and Russia renew their agreement or not. As they have suggested they are ready to not go ahead and renew the deal especially if they aren't given the ability to export their own grain and fertilizer from the Black Sea.

As mentioned previously, Argentina remains dry in the majority of its key growing regions. However, Australia on the other hand is expecting a lot of rainfall which eases some of their crop quality concerns. In the U.S. we saw winter wheat planting at 55% last week.

Outside of the Russia and Ukraine situation, demand is still a rather large question mark surrounding the wheat markets. As one would think that its tough to see demand really gain some steam with the strength of the dollar being where its at. We also have people continuing to question the size of the Russian crop, as its looking like a record crop.

It's tough to be extremely bullish with wheat falling roughly $1 lower from its highs last week. But there is still a good possibility that this Russia and Ukraine situation provides more support going forward if we continue to see major headlines.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil +0.71 to 86.32

Dow Jones up +532

Dollar Index down -1.26 (-1.11%) to 112.036

Cotton up +0.35 to 83.50

News

Argentina corn planting is the slowest in 6 years due to the drought

It appears that most think the high interest rates won't have a major effect on farmland demand

China is set to start importing Brazilian corn in December

Floridas orange crop is looking to be its smallest since World War II

Livestock

Live Cattle +1.500 to 149.275

Feeder Cattle +2.550 to 177.650

Live Cattle (6 Month)

Feeder Cattle (6 month)

Previous Newsletters

Yesterday's Weekly Newsletter

Thursday's Audio

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Forecasts are showing somewhat dry forecasts for the next few days which will be good for harvest progress, but negative for the already critically low water levels in the Mississippi River.

Source: National Weather Service