AFTERNOON MARKET UPDATE

Futures Prices Close

Overview

A very volatile two sided day ended mixed for the grains, as wheat extends its move upwards. With support coming from the Russia military headlines. While both corn and soybeans finished lower, with some pressure from disappointing ethanol production, and cheaper world soybeans as soybeans fell the lowest of the grains. Lower crude and a very strong U.S. dollar added additional pressure to the markets.

Putin, Russia, & Ukraine

Putin mobilizes 300,000 troops for war in Ukraine and warns he's not bluffing with nuclear threat. This news initially added support to prices overnight, before giving back their gains. This was the first mobilization since World War II. He warned the U.S. amonst other allies that he is prepared to use nuclear weapons to defend Russia.

Bullish or Bearish Survey

We are conducting a survey on whether people are bullish or bearish on the grains. You can submit your answers here

Data will be provided in this week’s weekly newsletter

Interest Rates

Federal Reserve unanimously raised interest rates by 75 basis points (0.75%), as expected. Bringing interest rates to 3.25%, the highest we've seen since 2008. This marks the third consecutive quarter of percentage point hikes. They see inflation at 5.4% by the end of 2022, and 2.8% in 2023. They are expecting more rate hikes throughout 2023. The interest rate decision send Dow Jones tumbling down over 500 points (-1.70%), and the S&P 500 Index down -1.71%.

U.S. dollar rallied to fresh new 20-year highs once again.

The interest rate decision didn't have much of an effect on the grains as this news was released at 1:15pm CT.

Today's Main Takeaways

Corn

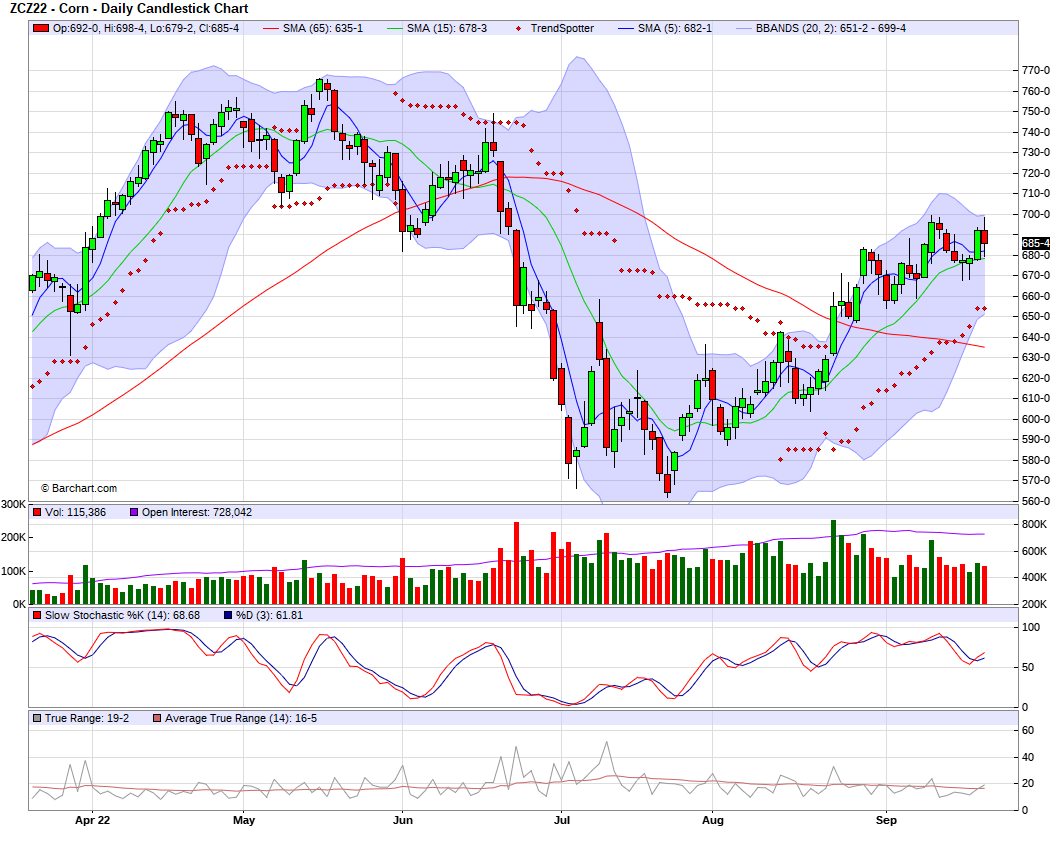

Corn closed down 6 1/2 cents, as we closed 13 cents off our highs of $6.98 1/2. We tried to get over that $7 hurdle with the Russian news but ultimately fell short ending the day lower. We will have to see if we can push back up over that $7 range and open the door to higher prices, or if we will continue to trickle lower.

The Russian headlines added support as a few important areas under Russian control may soon be declared as the war tensions continue to escalate. The headlines and uncertainty alone are enough to justify some buying, as many worry the Ukraine exports may soon be limited.

We would love to think that corn could just continue to push higher, but we still have global demand issues as there isn't going to be any real corn shortage in the next 6 months.

However, from a technical standpoint, the corn chart still looks fairly supportive. There is also the definite possibility that we see South America have a ton of weather problems, causing prices to climb higher.

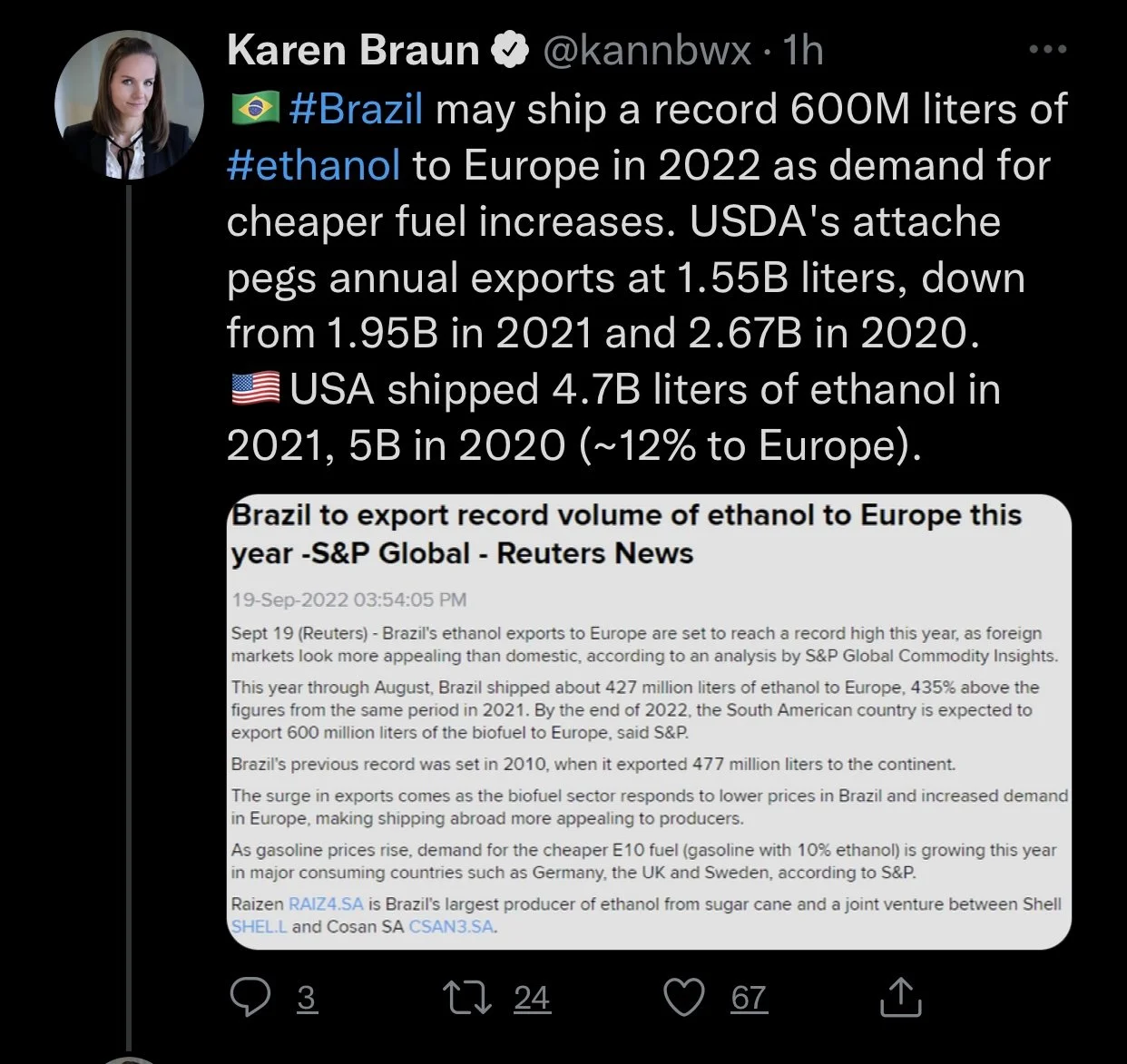

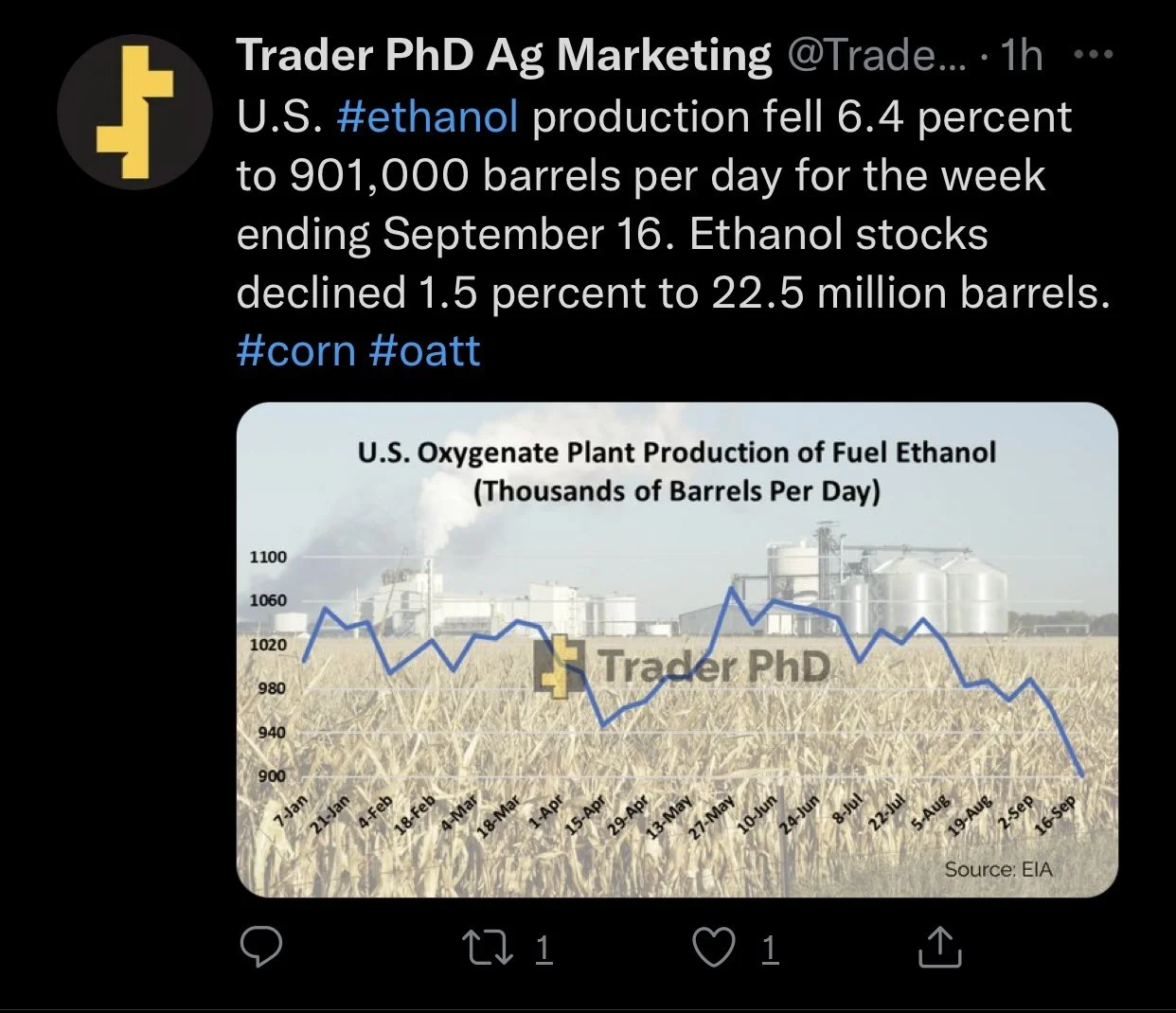

Ethanol production dropped (6.4%) 62,000 barrels per day to 901,000 barrels per day. Stocks were down 300,000 barrels (1.5%) to 22.5 million barrels.

Dec-22 (6 Month)

Soybeans

Soybeans closed significantly lower today. Closing roughly 27 cents off its highs of $14.88 3/4 in a very volatile day. The Russian news was able to give it a quick bounce but it was unable to hold on to its gains.

Argentina soybeans are looking a little better which is putting some additional pressure on the soybean market. We also have Argentina selling soybeans under their new currency deal. Which has put a damper on U.S. exports and demand. We also don't much of a weather scare headline to carry the markets.

We are expected to see some rains in growing areas for Brail as they begin planting their crops. Their crop is also supposed to be a record production year if their weather cooperates with them. Argentina is also supposed to get some rain, but the rain looks like it will miss most of the important growing areas as Argentina still faces a historic drought.

Demand still remains uncertain, and it's tough to think that demand alone can sustain these levels through harvest. Especially given the recent Chinese tensions. Yes, the Chinese will eventually have to get beans from the U.S. but it may be some time. As it looks like they are willing to purchase them anywhere but from the U.S. and are trying to buy as much from South America as possible. However the technicals don't look all that bad, and the tight USDA carry-out projections continue to remain supportive. And similar to corn, we do have that potential looking longer term, of problems in South America and their weather which could ultimately support prices.

We have continued to see soybeans be able to hold their support levels facing these sell offs. Hopefully, we can hold the 14.50 range otherwise we could definitely see another leg down.

Soymeal & Soyoil

Soymeal down -0.6 to 438.8

Soyoil down -0.91 to 65.00

Soybeans Nov-22 (6 Month)

Wheat

Wheat pulled back from its early rally but still managed to extend its gains from yesterday into today. The Russian news added a beneficial amount of support to the wheat markets. Trade has remained very volatile as traders try to digest all the news coming in, and attempt to get a better understanding of the situations in Russia/Ukraine.

Dec-22 Chicago closed roughly 16 cents off its highs of $9.19 1/2. The current 200-day moving average is $9.14 1/2, we were able able to trade above the moving average but couldn't manage a close above as we saw gains pullback slightly. A close above the 200-day moving average could set up the possibility for even higher prices. Some are talking about the potential for seeing $10. However, I'm not quiet that optimistic just yet. As longer term, we will need to see better global demand to justify these rallies and hold prices.

Dec-22 KC also traded as high as $9.82 but wound up closing 15 cents off its highs as well at $9.67. We closed just below the 200-day moving average of $9.68 3/4.

Yesterday’s announcement offered a lot of support clearly, as we rallied off the news yesterday, as Russia decided to announce their annexation of Ukraine territories which control roughly 15% of Ukraine’s wheat. As well as Kremlins decision to hold referendums. But then we got more Russian news that caused some buying. As Putin and Russia are adding 300,000 more troops, preparing for war. Which signals that he's not backing down. He also stated that he is not bluffing with nuclear threat. The war headlines could send the markets in either which direction, depending on what Putin decides to do. Either way everyone will have all eyes on the news, as Russia has the largest exportable supply of wheat.

Listen to Monday's audio below - How much money is Putin making in the wheat market?

Chicago Dec-22 (6 month)

Other Markets

Crude oil down -1.24 to 83.02 (-1.47%)

Dow Jones down -522.45 (-1.70%)

Dollar Index up +1.159 (+1.05%)

Cotton up +3.59 to 96.92

S&P 500 Index down -1.71%

News

Feds raised interest rates an additional 75 basis points as expected. Interest rates now highest since 2008

Putin threatens nuclear war

Hurricane Fiona is expected to move into the Gulf next week and could potentially soak the southeast harvest in early October.

Ukraines wheat crop could fall 1 MMT to 3MMT due to less planted acerage

Taiwan signs letters of intend to buy nearly $3 billion worth of Iowa corn and soybeans

Previous Newsletters

Check out a few of our other posts in case you missed them. Would love any feedback or things you would like to see.

This Week's Weekly Newsletter - Read Here

Monday's Audio - How much money is Putin making on the wheat markets - Listen Here

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service