MORNING MARKET UPDATE

Futures Prices 12:00PM CT

Overview

Grains significantly higher today following the slightly lower crop conditions ratings. U.S. harvest is also not moving along quiet as fast as most had expected. Markets higher despite higher dollar and weaker outside markets.

Tomorrow the Federal Reserve will raise interest rates at 1:15pm CT. It’s looking like they are giving an 80% chance for them to raise rates by 75 basis points which is 3/4 of a percent. While on the other hand there is that slim possibility we see a full 1% increase, looks like they are giving a full 100 basis points roughly a 16% chance of possibility.

Read yesterday’s audio below - How much money is Putin making on the wheat market?

Today's Main Takeaways

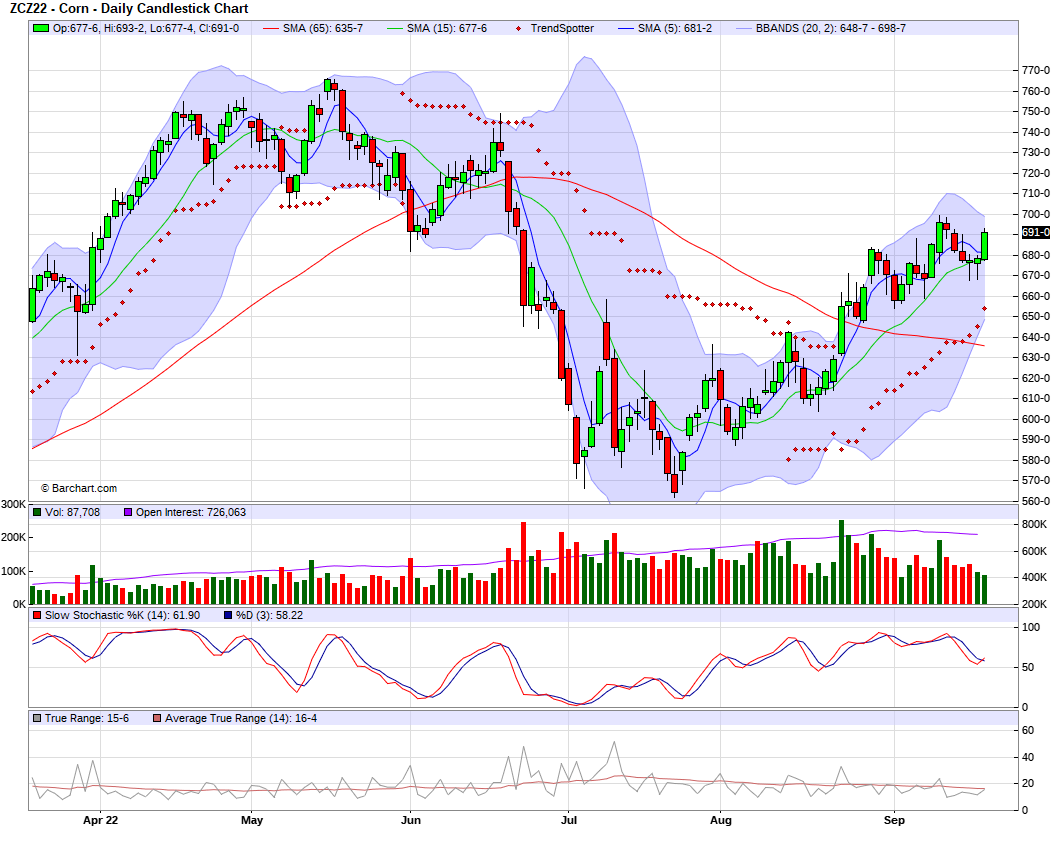

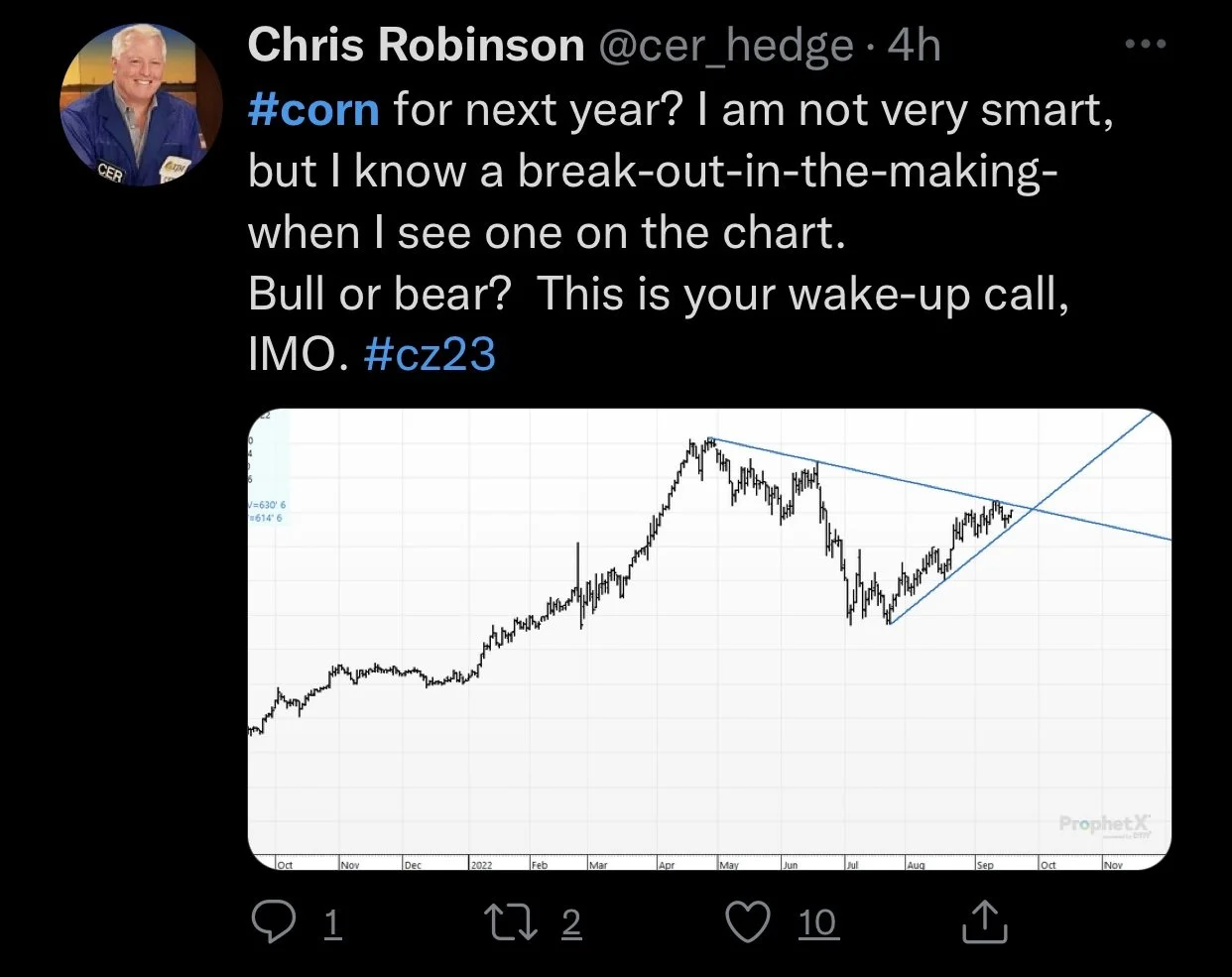

Corn

Corn up pretty nicely this morning, as we found support yesterday at the 20-day and the 100-day moving averages. As we just slightly closed in the green to end the day yesterday.

Today we are seeing some support given the lower than expected crop conditions ratings, where corn ratings were dropped another 1%. The U.S. harvest is also moving along slower than the markets were expecting which is also helping push prices. Many thought we'd maybe see harvest at 10% complete given that we thought we'd had seen pretty good progress in the past week. But that must not have been the case. As harvest came in at 7%, which was lower than expectations and just below the average pace of 8%

There are quite a few states near or just at their average harvest pace. But Kansas is the only state that's far ahead of their typical pacew. As Kansas is sitting at 27% harvested vs their traditional 17%.

Crop conditions report had corn harvest at 7%, just below the 8% average

52% of corn was rated G/E which was 1% lower than last week (53%), last year was 59%. This is also the lowest number we've seen since 2012.

Cron inspections were up 3 million bushels to 21.6 million

Argentina is looking to have cooler temps and could actually see some frost. The dry soil and cool temps have set back corn planting, and could have also potentially damaged some wheat as well.

We also have to talk about the production losses in the European Union. As many areas have experienced some problematic weather.

Nonetheless, if we come across disappointing yields that could definitely cause a spark in the markets. The global weather concerns are also a bullish factor to keep an eye on. But as for the U.S. weather we still don't have all that great of chance for any scare, and demand hasn't been amazing especially given the recent tensions with China.

Dec-22 (6 Month)

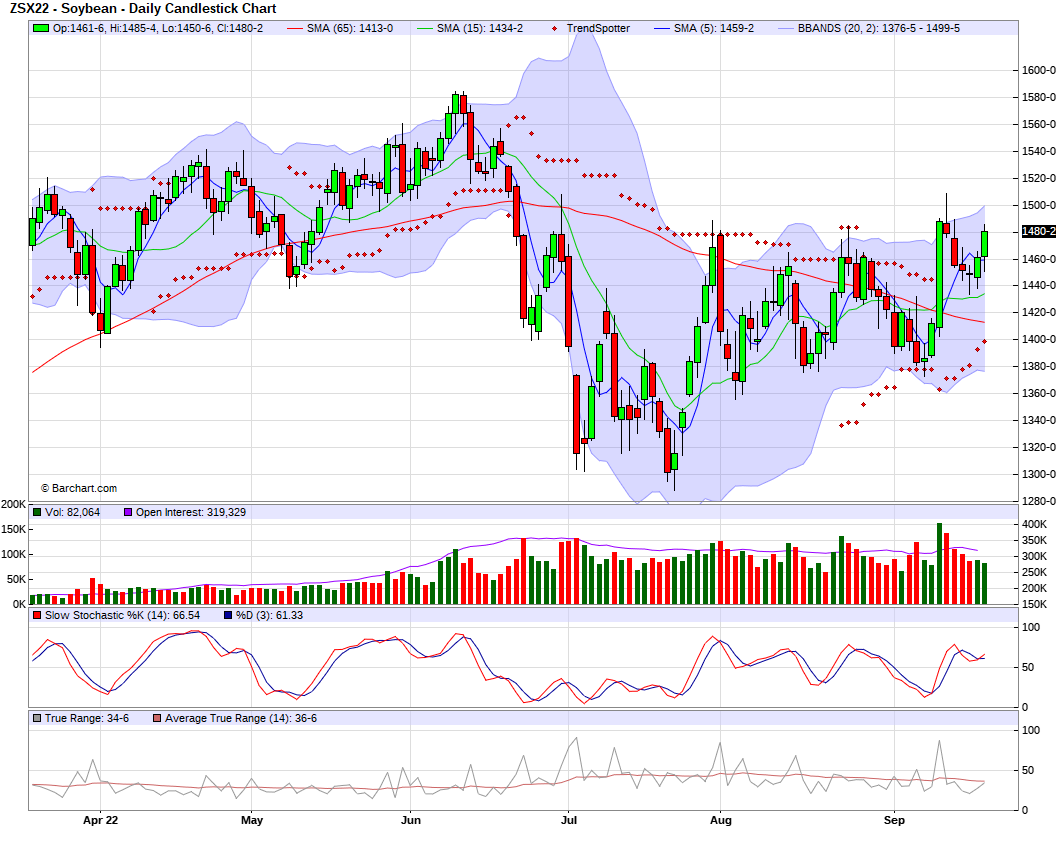

Soybeans

Soybeans are significantly higher this morning, extending their rally from yesterday. We saw the crop conditions ratings similar to corn, drop 1% for soybeans from last week. Adding support to the markets. The purchase from China also has some people optimistic that maybe China will begin to purchase more U.S. soybeans, but I'm just not convinced that that's the case.

U.S. harvest for soybeans is also -2% behind the average 5-year pace. With only two states being ahead of their typical pace. Those being Mississippi and Kansas.

Crop condition highlights had soybean harvest at 3% done vs 5% average

55% of soybeans were rated G/E, which was also down 1% from week (56%), last year was 58%.

Soybean inspections can in up 6 1/2 million bushels to 29 million.

Yesterday we saw a flash sale of soybeans to China for 136k MT. Which was actually somewhat surprising given that they just purchased some besns from Argentina at a much lower prices.

Crop consultant Dr. Michael Cordonnier lowered his U.S. soybean yield estimate by 0.5 bu to 50.0 bpa. Dropping his production estimate to 4.33 billion bu. down from 4.38 billion bu.

As has been for a while now, demand still remains the biggest question mark surrounding the soybean market, and if demand alone can carry the weight of these markets. As a weather scare is looking like its out of the picture for now. But who knows, maybe we do see exports and demand pick up sooner than later.

Soymeal very strong again today. If soymeal can remain strong, it could definitely be a supportive factor in pushing beans higher or keeping them at their relatively high levels.

Soymeal & Soyoil

Soymeal up +11.9

Soyoil up +0.72

Soybeans Nov-22 (6 Month)

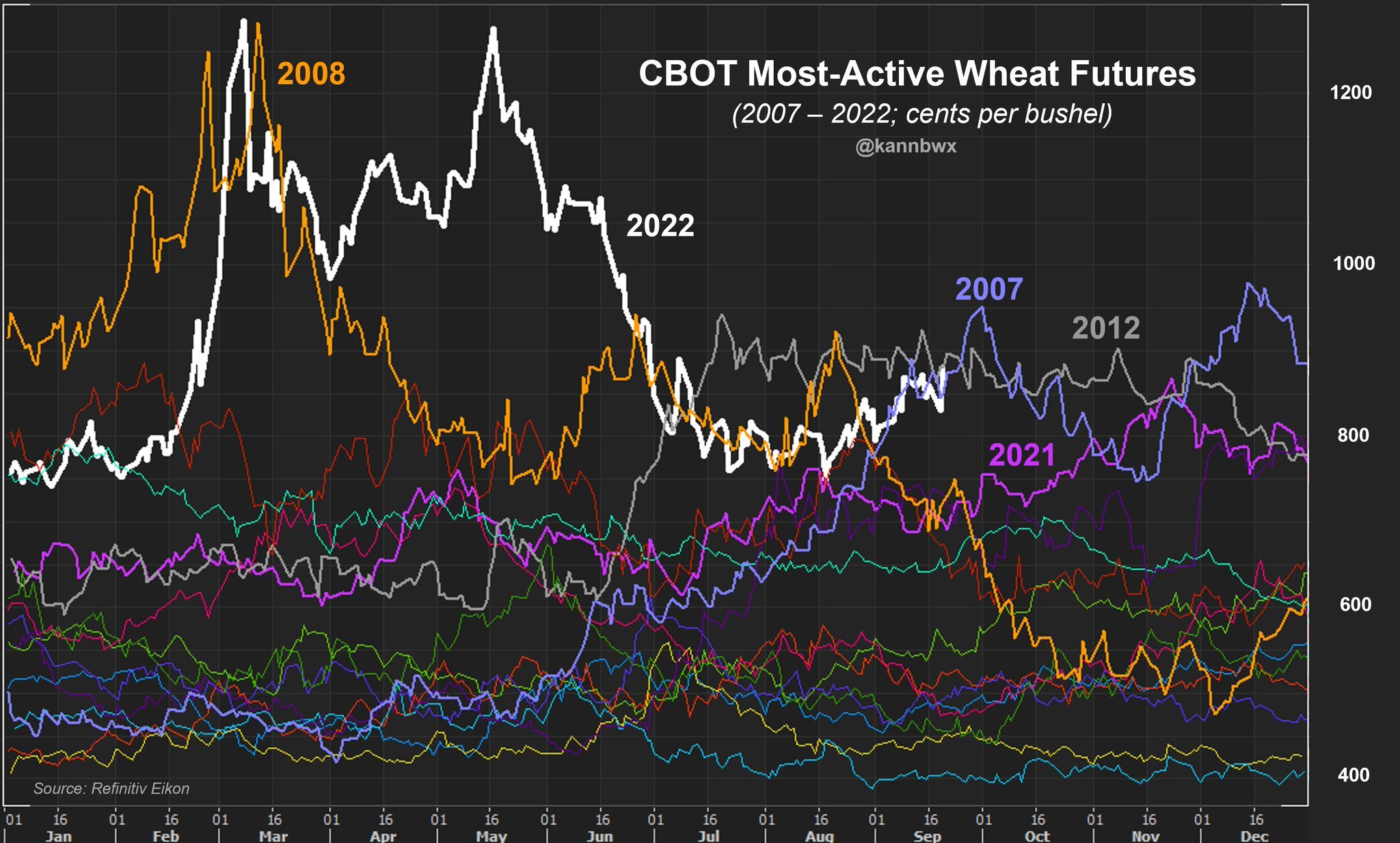

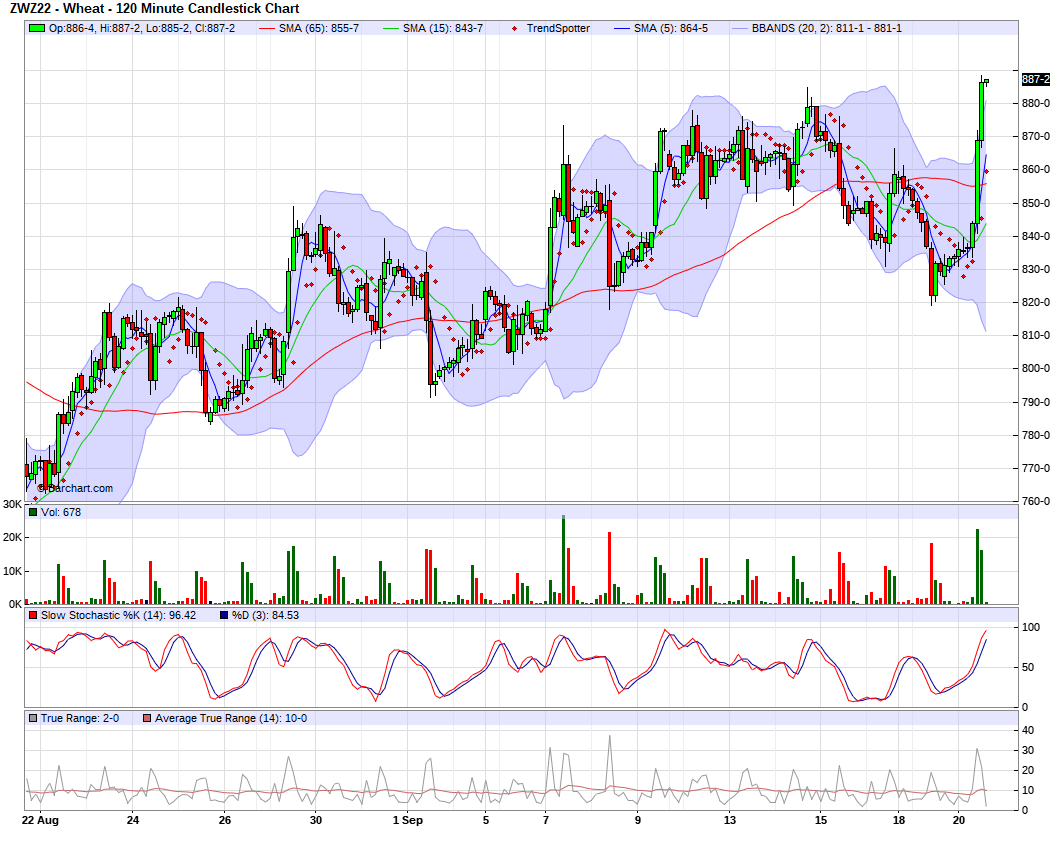

Wheat

As I mentioned yesterday, I thought there was a pretty good chance of a turnaround Tuesday following yesterday’s sharp losses across wheat futures. And that’s exactly what has happened so far today, as wheat futures have rallied and actually surpassed yesterday’s losses.

Well for starters, Monday’s sell off came from virtually no bearish news. So this massive rally we are seeing here today is coming from Russia announcing their annexation of Ukraine territories which control roughly 15% of Ukraine’s wheat. As well as Kremlins decision to hold referendums. Putin is supposed to make a statement shortly. Wheat has now broken out of their bearish trend line yesterday, as we have a bullish reversal today testing the recent highs.

Ukraines Ag Ministry established that their wheat crop is 9% planted, but expects the planted area has the potential to decline 17% from last year.

IKAR added an additional 2 million metric tons to their Russian wheat estimate, bringing them to 99 million. Many analysts think that the Russian crop is actually 100 MMT. USDA has it at 91. This news added some pressure to the markets yesterday. As we continue to see Russia wheat production and exports estimates raised.

Wheat exports were up over 1 million bushels to 29 million

Winter wheat is 21% planted, up from 10% last week, and 4% ahead of pace. This is also the highest percentage we've seen since 2009.

Spring wheat is 94% harvested, vs 92% expected but on pace

Spring wheat harvest progress is ahead of what they had expected, so that could be a slightly bullish factor. Given that the markets have absorbed a bigger percent of the crop than what the markets had originally thought it had.

As I was writing this, most active Chicago wheat futures just reached the highest levels in more than two months. As the Black Sea tensions continue to threaten the global supply.

Listen to yesterday’s audio below - How much money is Putin making in the wheat market?

Chart Source: Karen Braun on Twitter

Chicago Dec-22 (1 month)

Other Markets

Crude oil down -1.63 to 83.73 (-1.80%)

Dow Jones down -380 (-1.23%)

Dollar Index up +0.488 (+0.44%)

Cotton down -1.95

S&P 500 down -1.30%

News

Bread prices in the Eurpean Union have jumped nearly 20%

China digs deep to raise coal output to a record high

2-year U.S. treasury notes rose to a near 15-year high as investors prepare for another interest raise.

Hurricane Fiona hits Turks & Caicos, Puerto Rico among others, as a category 3 storm

Previous Newsletters

Check out a few of our other posts in case you missed them. Would love any feedback or things you would like to see.

This Week's Weekly Newsletter - Read Here

Yesterday's Audio - How much money is Putin making on the wheat markets - Listen Here

Social Media

Credit: All credit to users of posts

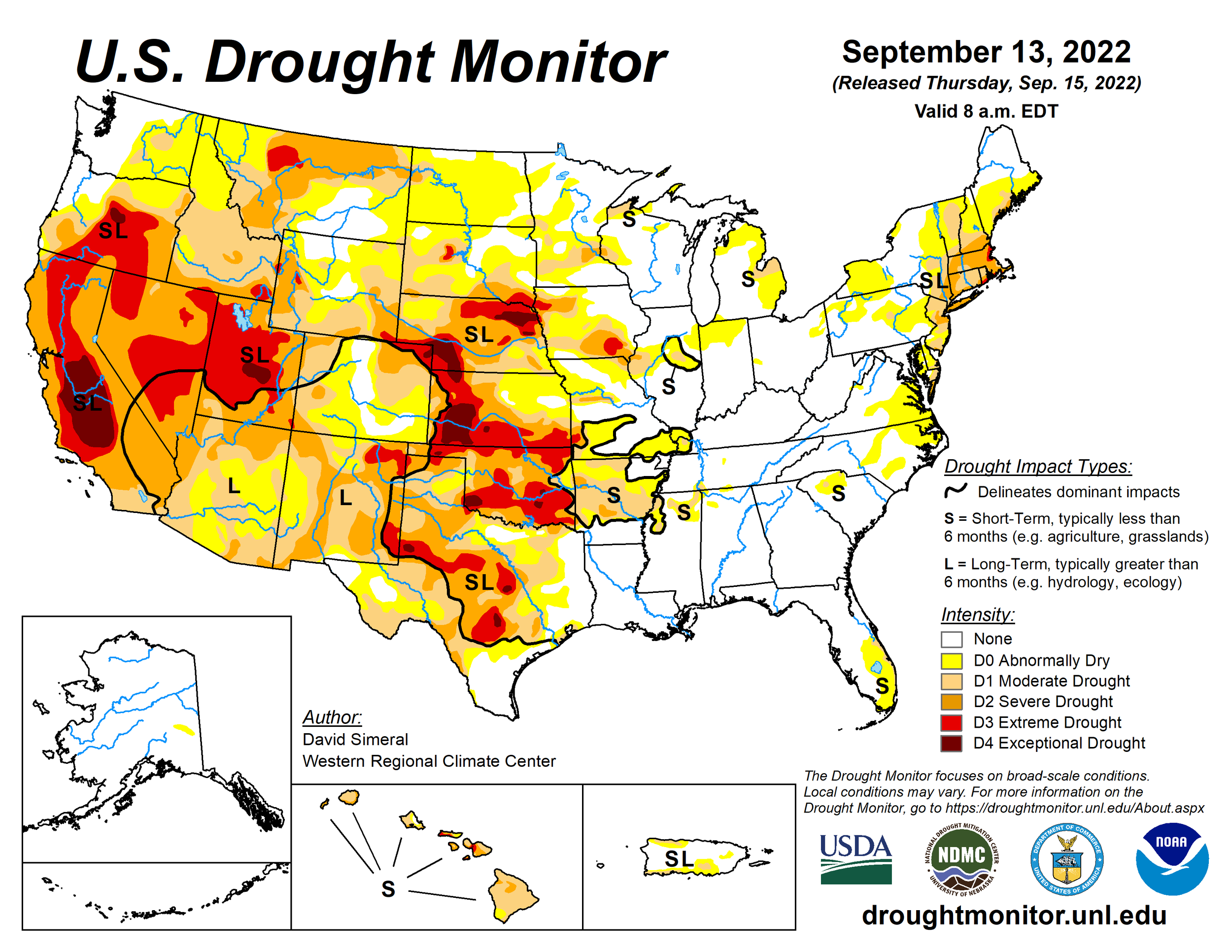

Precipitation Forecast 2-Day

Weather

Source: National Weather Service