ALL EYES ON USDA REPORT TOMORROW

MARKET UPDATE

Futures Prices 11:00am CT

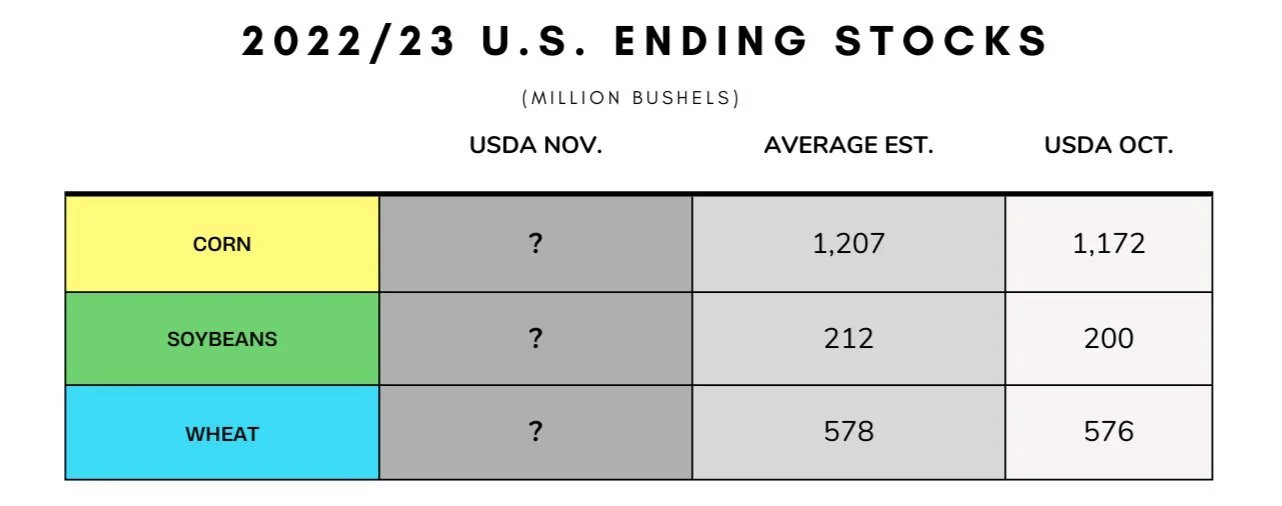

USDA Estimates For Nov. 9th, 2022

Overview

Not a whole lot shaking up the grains right now ahead of tomorrow’s highly anticipated USDA report. Grains mostly lower here. Hopefully tomorrows report will give us a better direction in which the grains will lead.

Today's Main Takeaways

Corn

Corn continues trading in its choppy narrow trading range ahead of tomorrow’s big report. Corn is now back into the bottom portion of its trading range.

Yesterday we saw corn pressured by the pretty weak exports, as yesterday's weekly numbers was a marketing year low. Overall exports for corn remain pretty dismal. With the most recent only totaling 9 million bushels. With season to date being 175 million bushels compared to last years 241 million.

The USDA had U.S. corn at 87% harvested vs a 76% average. With most states being well ahead of pace. Some notable ones being;

Iowa 89% vs 74% average

Nebraska 90% vs 75% average

South Dakota 91% vs 66% average

North Dakota 91% vs 59% average

Minnesota 92% vs 75% average

Obviously tomorrow’s report will likely shake things up. But factors outside of the report to keep your eye on remain relatively the same. South America, Russia/Ukraine news, as well as any China news that moves demand.

We mentioned yield recently such as in yesterday’s update. But final yield is still a large topic that is being debated by everyone. Where last month we saw the USDA lower their estimate from 172.5 bpa to 171.9 bpa. There is plenty of arguments for both sides, as to whether we see it raised or lowered further. There is also a good chance we see that number left unchanged come tomorrow. But we can't ignore the fact that many analysts just recently starting raising their estimates. Such as StoneX and IHS.

Dec-22 (6 Month)

Soybeans

Soybeans slightly higher here again this morning. Being the only one of the grains to still be trading in the green.

Soybean exports have essentially the opposite story of corn. Soybean exports have actually been pretty strong as of late. Over the past three weeks bean exports are close to 100 million bushels, and getting closer to being on par with last year.

China lockdown news continues to be a large factor in the soybean market. As one day we see headlines of them easing their lockdowns and "zero covid policy", then the next we see cities like Bejiing come out and say they will be stocking to their guns in implementing the strict policy. If China continues to be locked down this will most likely harm the U.S. exports and demand.

Probably the main factor going forward outside of tomorrow report has to be South American weather. As from the looks of it, there weather isn’t bad at all from what it sounds like. Everyone is also expecting a very massive crop out of South America which doesn’t help the soybean market here in the U.S. Yes Brazil and Argentina are running a little behind pace on their planting but there isn't any real concerns just yet.

Looking forward to tomorrow’s report. Last month we saw the USDA lower its yield estimates from 50.5 bpa to 49.8 bpa. Similar to corn, a lot of analysts have raised their projections to as high as 51 bpa. We also have a fair possibility tomorrow for the USDA to just leave it unchanged.

Last month we also saw the USDA lower its export forecast by 40 million bushels. Which yes exports were off to a pretty slow start, but given the changes they've already made there is a solid chance we don't see any huge changes tomorrow for the demand side of things.

With prices at their current level it wouldn’t be a bad idea to market some soybeans here. As there are plenty of factors that still have a chance to shake up the soybean market. With South America's expected large crop. China lockdowns still being relevant. With the rally we saw last week, we would need that much more bullish headlines to keep up rallying to higher prices. But tomorrows report could definitely change the landscape either way.

Soymeal & Soyoil

Soymeal up +2.3 to 421.3

Soyoil down -0.98 to 75.35

Soybeans Nov-22 (6 Month)

Wheat

Wheat continues to trade back and forth sitting around its 20-day moving average. Wheat initially trading higher early this morning but has gave up its gains now trading near the bottom of its daily range.

No real updates surrounding the Russia/Ukraine Black Sea export deal news. The expiration for the deal to be renewed is still November 19th, so we will have to wait and see if we have any major changes made before the deadline.

Weekly wheat exports continue to be pretty lackluster. With this weeks report only having 6 million bushels. But out of the three major commodities, wheat is the only one ahead of the USDA target pace.

We saw the USDA peg U.S. winter wheat at 92% planted vs the 90% average. With overall conditions for winter wheat coming in at 30% rated good/excellent, which is a slight increase from last weeks 28% rated G/E. But still far below last years 45% rated G/E.

Gloablly we have Argentina starting to move along better than it has, following its recent struggles. Even with the progress being made, we are still seeing estimates lowered for their crop. We also have to keep an eye on Australia as they are still facing issues with flooding with has the potential to harm their crop quality.

Looking forward to tomorrows report. Wheat is the one people are probably least excited to see. As nobody is really expecting any ground shaking changes to be made, but of course we could still see a curve ball. We also saw the USDA make some larger changes last month. Where the USDA lowered production and lowered yield from 47.5 bpa tp 46.5 bpa.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil down -1.00 to 90.79

Dow Jones up +500

Dollar Index down -0.738 to 109.255

Cotton up +1.31 to 88.80

News

China's Oct. soybean imports down almost -20% compared to last year

Ukraine exports down -30% in 2022/23

There is still talks about a potential railstrike

Ukraine corn harvest is only at 27% compared to 61% last year

Former President Trump says he will make a "major" announcement Nov. 15th

Livestock

Live Cattle down -0.300 to 152.750

Feeder Cattle down -0.850 to 179.075

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Is Corn Still King? - Sunday's Weekly Newsletter

Nov. 3 Audio - What's Next For The Grains?

Ag Directory

Here is a few shoutouts from our Ag Directory. View the entire directory here

Maverick Insurance

Kaylee Speck

Phone: 605-598-3025

Email: kaylee.speck@getmaverickinsurance.com

207 9th Ave S

Faulkton, SD 57438

MMJ CARD CLINIC

SOUTH DAKOTA

GET YOUR SOUTH DAKOTA MEDICAL MARIJUANA CARD

To apply call or text (605) 836-3104

or schedule an appointment online

Email- sd.info@mmjcardclinic.com

Website - mmjcardclinic.com

Open in Sioux Falls every Friday 10am - 7pm

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

Weather

Source: National Weather Service