CORN & BEANS LOWER AHEAD OF REPORT WED.

MARKET UPDATE

Futures Prices 11:45am CT

Overview

Grains mixed to start off the week, with corn and soybeans lower and wheat slightly higher. We haven’t seen any real new updates out of Russia and Ukraine. We might not see a ton of action until the USDA Supply & Demand report releases Wednesday.

Today's Main Takeaways

Corn

Corn slightly lower this morning. Continuing its back-and-forth choppy narrow trade it has for the past few weeks. We really haven't seen prices move hardly at all in the past few weeks. Its very possible that we might just see a chop around in prices until the WASDE report unless we see some serious moves in the dollar or crude or any other big headlines to get prices moving.

Export sales this morning again came in disappointing for corn. Some of the worst we have seen in recent memory. Coming in below the estimate range and totaling almost just half of what we saw last week. With sales coming in at 231,000 tons. If we want to see corn higher, better demand and export sales would definitely help.

For the most part the WASDE report Wednesday is looking like a mixed bag for production. Some suggest we are going to be higher and some think we will be lower. However, most think we see carry out increase with the lack of demand we have seen. The USDA report will likely be the factor that breaks us out of this narrow trade range we have seen, breaking out higher or lower.

We mentioned this in yesterday’s update, but as for yield, we continue to see numbers all over the board as it remains a large debate. In the last report we saw the USDA lower their estimate from 172.5 down to 171.9 bpa. But then we take a look at other analysts and we are actually seeing many of them raise their estimates higher than what the USDA currently has. Analysts such as IHS and StoneX for example both raised their estimates. IHS raising theirs to 172.9 bpa and StoneX raising theirs to a rather large 174.5 bpa.

Bottom line, we can probably expect fairly quiet trading from corn until the report comes out Wednesday. Then the report should hopefully set a tone of where the future for corn lies.

Dec-22 (6 Month)

Soybeans

Soybeans down about a dime today. Which isn't too much of a surprise given the rally we had last week. As profit taking was expected. Yesterday I also mentioned we definitely have the possibility to see soybeans lower this week if certain headlines don’t go our way. Such as if China keeps their lockdowns in play.

Right now prices are at a pretty good level. So it wouldn’t be a bad idea to market some grain at these relatively high levels as there are plenty of factors that could change the markets. Brazil's weather has been looking pretty great. Even Argentina is starting to look a lot better than it has. So overall, most are expecting a pretty large crop out of South America which isn’t good for U.S. exports. With last weeks rally its hard to find reasons for the soybean market to keep pushing higher. To see prices higher we will likely need a lot more bullish headlines.

Taking a look at exports. Soybean exports came in pretty strong once again. Coming in just above estimates, and above last weeks number. Coming in at 2.59 million tons.

Recently the Chinese headlines have been supportive, with the rumors of them possibly ending their zero covid policy. This has helped sale volume. But this morning we did see Bejing officials say they will be sticking with their zero covid policy which has beans under pressure. If they continue to enforce their zero covid policy, this will be hard on the bean market. Outside of this, the other main concern I have with the markets is still South America. Then again we have the possibility for some issues with South American weather but we can’t count on that, especially given how large their crop is expected to be.

Soymeal prices have slid back down around their 20-day moving average. Soyoil on the other hand remains a supportive factor. As it just keeps pushing up and making new highs.

Similar to corn, the WASDE report Wednesday is looking like a mixed bag for production. With some calling for higher, and some saying lower. As for yield, the USDA lowered its estimate from 50.5 to 49.8 bpa last month. Since then many analysts have raised theirs to the 50-51 range.

Soymeal & Soyoil

Soymeal down -3.9 to 416.5

Soyoil down -0.29 to 76.88

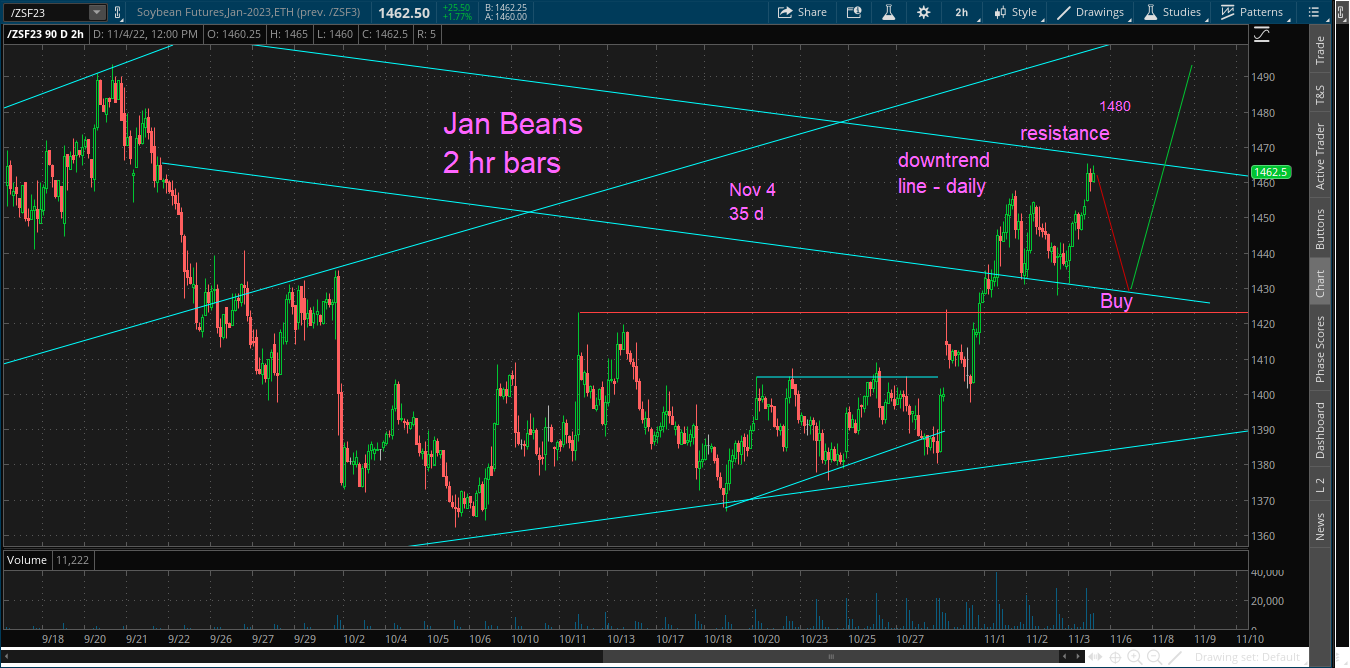

Here is a snippet from Wright on the Markets Tech Guy

"There is a downtrend line in Jan Beans which is currently providing overhead resistance. For that reason and another - namely that the chart has a familiar short term sell signal from Friday, I am expecting a correction lower.

I anticipate a selloff down to the 1428-1423 area in the Mon/Tues timeframe, then a slingshot back up to make new highs for the move, maybe after the report Wednesday. I expect a near-term run up to 1510. You can see the red sell line and green buy line on the updated Jan Bean chart below"

You can read his full analysis on all the grains here

Tech Guy's Chart

Soybeans Nov-22 (6 Month)

Wheat

Wheat leading the grains, trading slightly higher today, adding on to last weeks solid gains. We are nearly +20 cents off our lows we made in the overnight session.

Of course the Black Sea agreement will continue to be a factor. A decision from Russia could be made anytime now. But the date to watch out for is November 19th, which is when the renewal for the agreement expires. Also, that date happens to be the day that railroad workers have the possibility to go on strike, only if their labor agreements arent approved. Not unlikely we see rail volume slightly decrease until then.

Weather will continue to be a factor. Both globally and here in the US. Australia for starters is still battling with their heavy rain and flooding. So this has led to people lowering some estimates. Argentinas crop is also being debated, as they have had issues but currently the weather is starting to look better. The recession concerns will also likely remains a factor.

Export sales for wheat this morning came in on the low end, just below estimates. Coming in at 181,000 tons, with the estimate range being 200-450k. This is still slightly higher than the week prior.

As for the USDA report this Wednesday. Nobody is really looking for anything major from the wheat. As no big changes are expected. Usually we see these adjustments made in January. Last month we saw yield lowered from 47.5 to 46.5 with acres being lowered down -2 million to 35.5 million, production being lowered by -133 million bushels. With the somewhat larger adjustments we saw last month, we will have to see what the USDA does here. Especially given the global situations with Ukraine and Argentina etc. The average estimate for wheat carryout in the report is 578 mbu, in October the USDA had 576 mbu.

So in conclusion, the main factors driving this wheat market remain relatively the same. Obviously Russia and Ukraine being the largest. Weather is the other major one we will be looking out for. Long term, there is a chance we see prices higher. But we will have to wait and see if Russia renews the deal or not. Weather issues are also a possibility to push prices higher.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil unchanged at $92.61

Dow Jones up +200

Dollar Index down -0.689 to 110.085

Cotton up +0.62 to 87.55

News

Bejing officials say they will stick with their zero covid policy

China's October soybean imports slid to 8 year lows

Ukraine grain exports down over 30% so far in 2022/23

Sales for Brazil's new crop soybeans well below last years

The hot October leaves crops in France vulnerable to frost

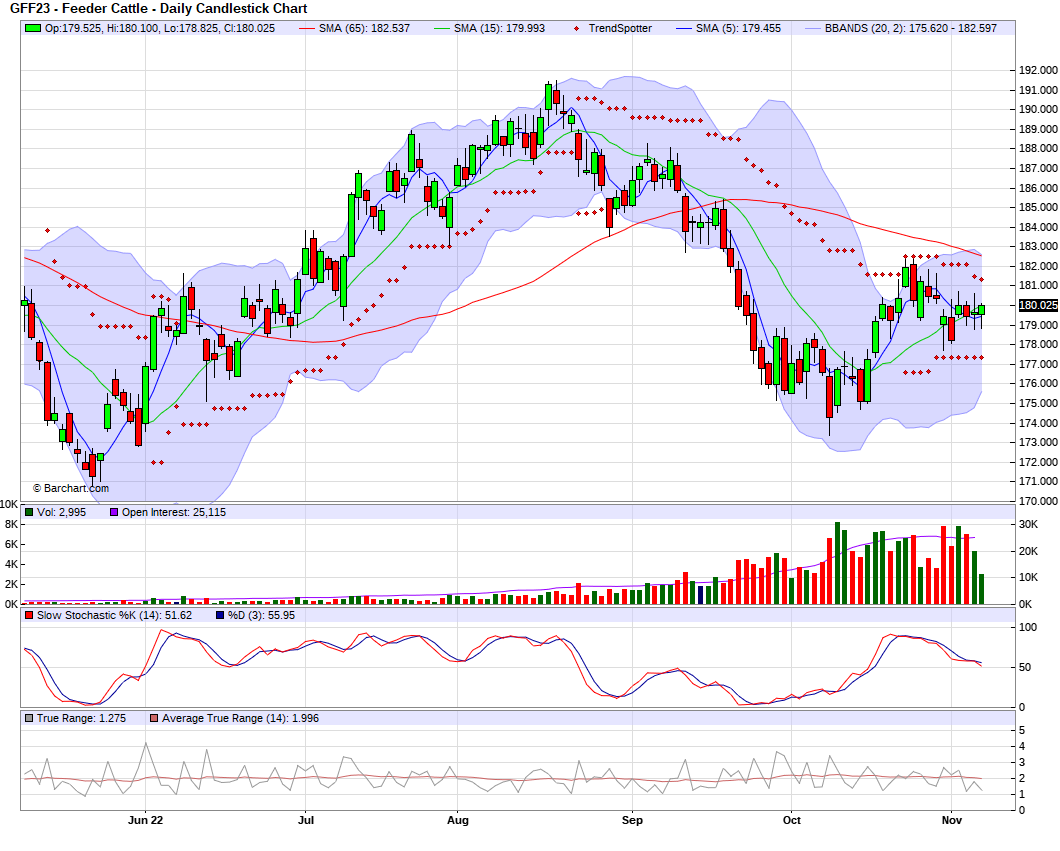

Livestock

Live Cattle up +1.025 to 152.675

Feeder Cattle down -0.025 to 179.600

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Is Corn Still King? - Sunday's weekly newsletter

Nov. 3 Audio - What's Next For The Grains?

Ag Directory

Here is a few shoutouts from our Ag Directory. View the entire directory here

King Insurance Agency Inc.

Beverly King

beverly@kinginsurancesd.com

Farm ~ Crop ~ Home ~ Auto ~ Health ~ Long Term Care ~ Business

Mobile: (605) 380-8444

Social Media

All credit to respectful owners

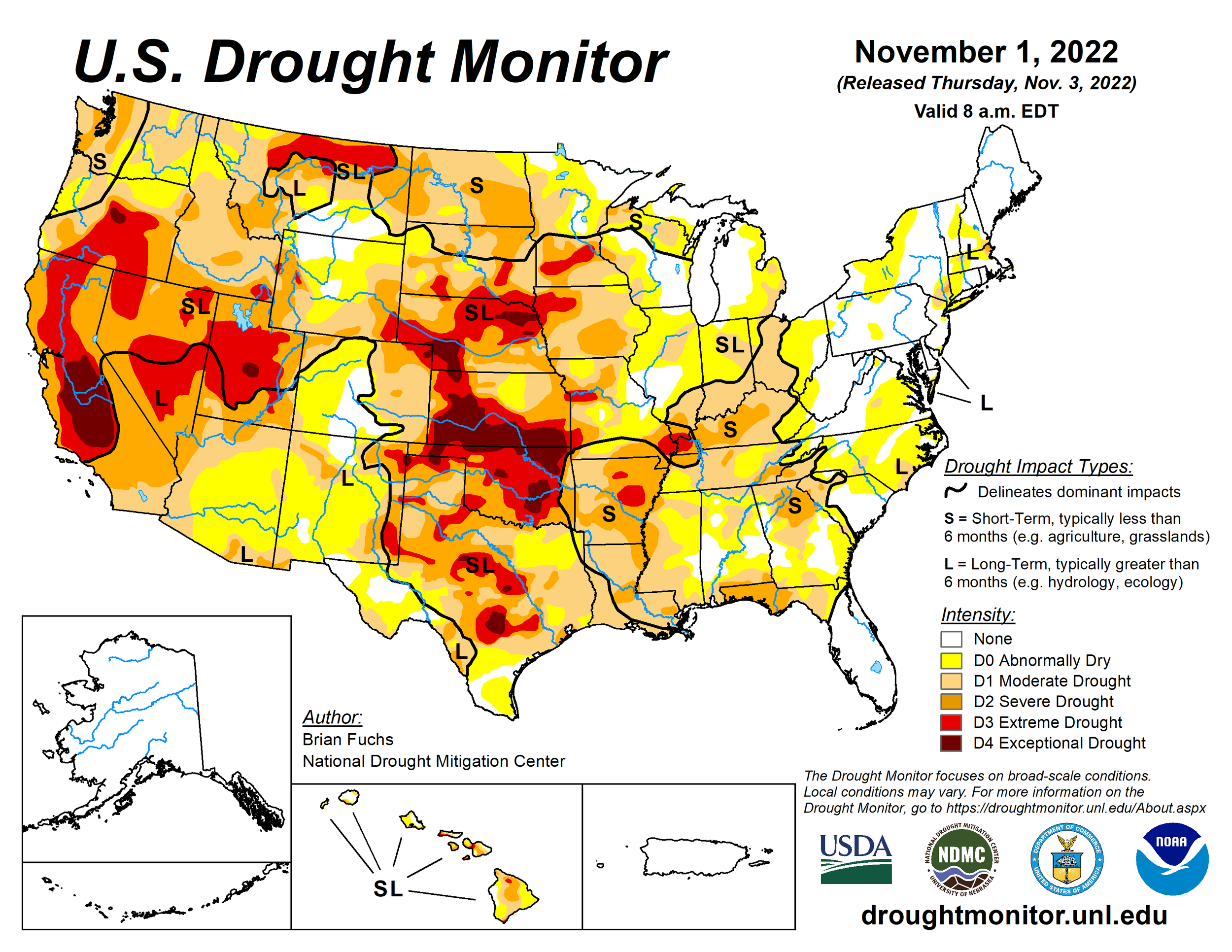

Precipitation Forecast 2-Day

Weather

Source: National Weather Service