BEANS BOUNCE AFTER 5 DAYS OF LOSSES

Overview

Grains close mixed with soybeans finally seeing some strength, while corn on the other hand finds weakness following strong price action yesterday.

Looks like traders might be starting to unwind these short wheat long corn spreads. So perhaps we see traders start to buy wheat and sell corn.

We also saw a report that Russians fired missiles at a Turkey ship. Haven’t seen any major updates yet. This didn’t help wheat rally as much as bulls would have liked.

Argentina rain remains one of the main focal points in both the soybean and corn market. While wheat focuses on global competition and U.S. weather.

Today's Main Takeaways

Corn

Quiet day for corn, following yesterday's strong price action. In the overnight, we were able to extend prices to $6.81 before ultimately losing those early gains and closed down just over -2 cents at $6.74 3/4.

Corn planting in Brazil for their second crop is underway but is trailing behind. Currently sitting at 1% planted compared to last year's 5%.

The main concerns for corn going forward is lack in demand and of course the recent rains in Argentina. But bulls could argue most of the damage has already been done in Argentina. We also have Brazil running behind on their harvest, and if they keep getting rain they could definitely continue to face these issues leading to lower second-crop acres.

The USDA has its Argentina crop pegged at 52 MMT. But most think this number will definitely need to work its way down below 50 million. But there is an argument to be made that the trade already has this low number factored in as it's pretty clear that it needs to be lowered.

Here in the U.S. people are beginning to digest and discuss where we see U.S. new crop acres. The most common numbers being discussed are around 90 to 91 million with some saying much higher and some much lower. Last year we planted 88.6 million.

Main Factors

Chinese appetite

Overall demand

South America weather

Argentina rain

Brazil harvest delays

War escalation & headlines

Funds

Corn continues to chop around in its recent range. If you take a look our recent trendline (faded line) looks like we might’ve seen bit of a bull trap from earlier in the day. Will have to see if we can break out to the upside or continue to chop around. I still wouldn’t be surprised to see a test of the upper trend line if the funds allow us to do so, a break above gives us a good chance to see $7.

Corn March-23

Soybeans

Soybeans finally see some strength following their 5th straight day of losses yesterday. Soybeans again breaking that $15 mark, which in the past has been an area of stiff resistance. Rains in Argentina gain pressured beans overnight, but were able to rally well off their lows.

The main topics being discussed around the soybean market are more of the same. South America weather and Chinese demand being two of the larger ones.

We all know Argentina has a poor crop. The USDA has their estimates at 45.5 MMT, which will likely be lower. But we just have to wonder how much of that is already factored into the trade.

Similar to corn, there has been some buzz surrounding planted U.S. acres. There is some talk of nearly 90 million acres this year compared to the 87.5 million we saw last year. However, when its all said and done a number under 88.5 million or so wouldn’t be bad for bulls.

Not much has changed from the past five red days up until today. Majority of the strength we saw today could’ve perhaps just been a relief bounce, or maybe it is a sign of strength and higher prices. We will have to see if beans can again break well over $15 and test our recent highs, but with the Argentina rain and other factors at play it just doesn’t give me a ton of confidence and reason to see us retesting those highs well beyond $15 into the $15.40 or so range, at least here short term until we get some bullish headlines or fundamentals to see a break to the upside. But perhaps, maybe these rains just won't be enough, leading to higher prices.

Main Factors

South American weather

Argentina rain & drought

Is the damage already done?

Chinese appetite for U.S. exports

Soymeal

Is the sell off over?

Funds

From a technical standpoint, soybeans bounced exactly where they needed to. We remain in a clear uptrend. But my main concern is the Argentina rain and massive crop in Brazil. Strictly looking at the charts, if beans were to continue higher and break $15.50 there is a large gap to fill to the upside. But looking short term, I'm just not sure the headlines support that unless we see a change or some other bullish catalyst, as right now it's looking like they want to sell every one of these rallies. However, looking long term is a completely different story and fundamentals are pretty bullish looking long term.

Soybeans March-23

Wheat

Wheat trading higher again here today following yesterday’s double digit rallies across all classes of wheat. As March Chicago is now nearly 30 cents off our 52-week lows made just a few days ago.

One reason for the higher wheat today is strong wheat prices over in India. As India announced they are going to sell 2 MMT of their stockpiles to help cool down the global high prices. Which is beneficial given the fact that wheats biggest problem is still competition globally. We are also seeing an increase in European prices due to warmer temps and drier weather which have the potential to hurt yields.

Another thing being monitored is the U.S. weather. As warmer temps had wheat under some pressure, but there might be some snow and brutally cold temps in a few important growing regions. The recently warm temps opens the door for some possible winter kill.

Main Factors

War escalation and headlines

U.S. weather, warm temps & possible winter kill

Global prices & competition

Funds

Wheat again trying to move off its recent bottom and break out the downtrend. If you take a look at the faded line, we actually did manage to break out of our 2023 downtrend. Will will have to see if we break out of this long term down trend next. A break above $8 would be a solid indicator that our bottom is in and would give confidence for higher prices. Nonetheless, wheat is oversold, fundamentals are bullish and I still think we manage to climb out of this downtrend in the coming months and see higher prices.

Chicago March-23

KC March-23

MPLS March-23

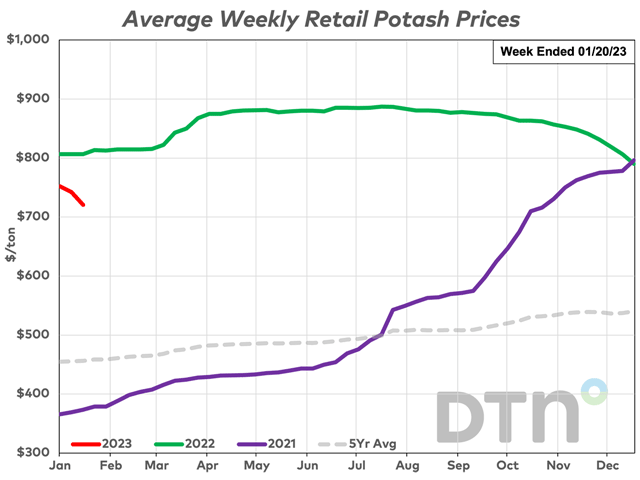

Fertilizer Prices Update

Retail Fertilizer Prices Fall to Lowest Level in 15 Months

This info comes from DTN. You can read the full article here

Most retail fertilizers were lower again for last week. The past few weeks we've seen a considerable decline in prices.

7 of the 8 major fertilizers are now lower compared to last month. Of those seven, six of them were significantly lower (-5% change or more).

Changes vs Last Month

Potash

-9%

$721 per ton

Anhydrous

-9 %

$1,238 per ton

UAN28

-7%

$536 per ton

UAN32

-7%

$634 per ton

Urea

-6%

$712 per ton

MAP

-5%

$865 per ton

DAP

Slightly cheaper

$859 per ton

10-34-0

Only one that was slightly more expensive vs last month

$755 per ton

Prices had been trending lower for months, but they've dropped considerably in recent weeks.

But by how much?

Looking back in DTN's fertilizer data, prices for all eight major fertilizers are essentially at the same level they were in the fall of 2021 -- right before the beginning of the run-up in prices, which lasted for a full year and a half.

DAP is now at $859/ton

Lowest price since the second week of December 2021 when the price was at $858/ton.

MAP is now at $865/ton

Lowest price since the third week of October 2021 when the price was at $863/ton.

Potash is now at $721/ton

Lowest price since the third week of October 2021 when the price was at $716/ton.

Urea is now at $712/ton

Least expensive it has been since the first week of October 2021 when the price was at $653/ton.

10-34-0 is at $755/ton now

Lowest price since the third week of October 2021 when the price was also at $755/ton.

Anhydrous is currently at $1,238/ton

Least-expensive price since -- yes, you guessed it -- the third week of October 2021 when the price was at $1,220/ton.

UAN28 is at $536/ton now

Lowest price since the third week of October 2021 when the average price was at $458/ton.

UAN32 is currently at $634/ton

Lowest price since the second week of October 2021 when the price was at $614/ton.

So, finally, some good news for producers in the retail fertilizer markets, as these are the lowest prices we have seen in roughly 15 months. This is especially true for those farmers who are still in the market for their fertilizer needs for the 2023 growing season.

All fertilizers are now lower compared to one year ago.

DAP is 1% lower

10-34-0 is 6% less expensive

Both MAP and UAN32 are 7% lower

UAN28 is 8% less expensive

Potash is 11% lower

Anhydrous 14% less expensive

Urea is 22% lower compared to a year prior.

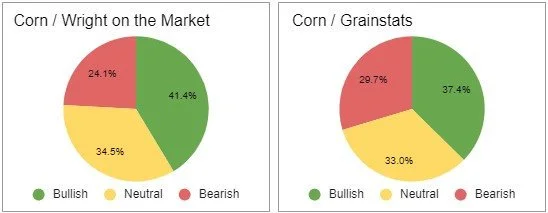

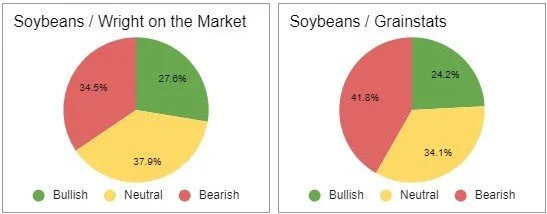

Bullish vs Bearish

The following charts are voted on by Wright on the Market & GrainStats respective audiences, showing their opinions on the markets.

Highlights & News

S&P Global sees US corn seedings at 90.5 million acres.

Indian wheat prices hit a new high.

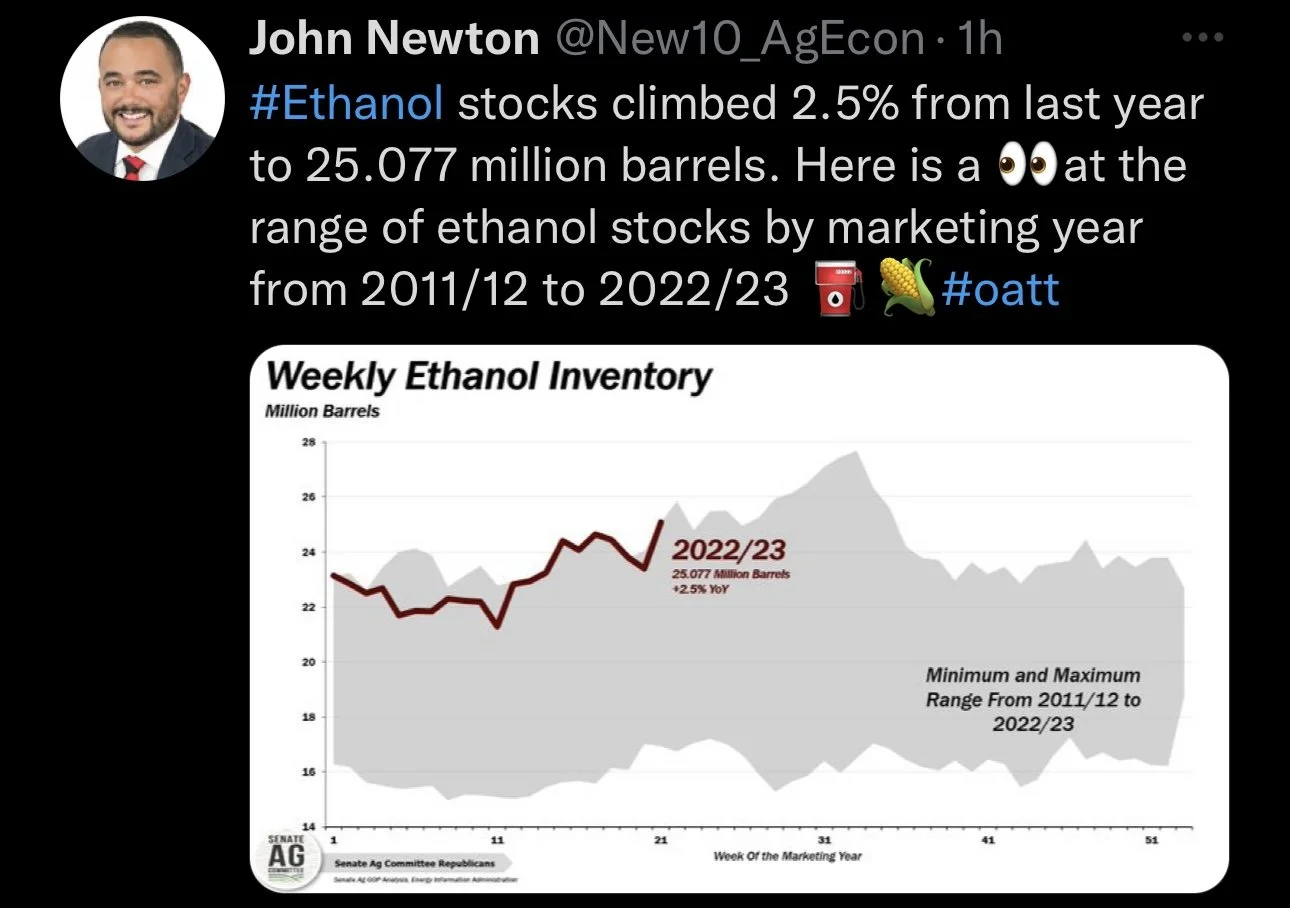

French ethanol fuel sales rose +13% last year.

A dozen Ukrainian government officials were fired yesterday.

February CBOT options expire Friday.

Russian launched a strike on a Turkey ship in port.

Other Markets

Crude oil up +0.35 to 80.46

Dow Jones essentially unchanged

Dollar Index down -0.265 to 101.410

Cotton up +0.42 to 86.66

In Case You Missed It..

Here are a few of our past updates in case you missed them

Yesterday's Audio - $20 Corn?

Listen Here

Yesterday's Market Update

Read Here

Sunday's Weekly Newsletter - Should Grain Be Higher or Lower Than Last Year?

Read Here

Jan. 20th Audio - Why You Shouldn’t Be Making 2023 Sales

Listen Here

Livestock

Live Cattle up +0.250 to 161.550

Feeder Cattle up +0.150 to 183.750

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Brazil 8-15 Precipitation

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service