TURNAROUND TUESDAY, CORN & WHEAT REBOUND

Overview

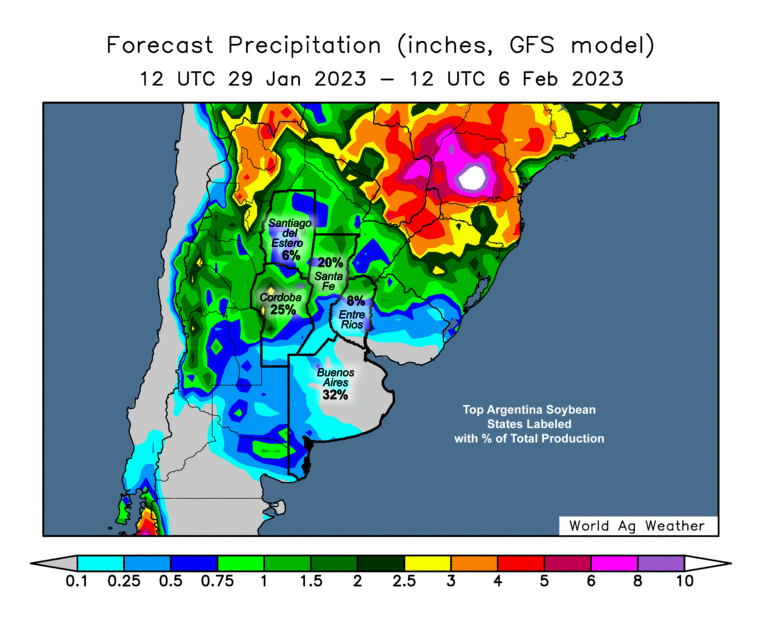

Grains started off the week on a sour note yesterday with losses across the board. Pressured by increased rains and favorable forecasts in South America and here in the US.

Today we are seeing a bit of a turnaround Tuesday, with wheat and corn rallying, capturing back a large portion of those losses from yesterday.

Soybeans on the other hand haven’t been able to overcome the pressure from Argentina rain, trading lower for the fifth session in a row.

In case you missed it, read Sunday's Weekly Grain Newsletter. Should Grains Be Higher or Lower Than Last Year? - Read Here

Today's Main Takeaways

Corn

Corn seeing a turnaround Tuesday following our losses of a dime yesterday. Today's gains entirely wiped out yesterday's losses which is giving bulls some optimism.

Bears continue to look at the improved rain in Argentina, which was what had both corn and beans under pressure yesterday. The Argentina rain more negatively effects soybeans rather than that of corn, but definitely can’t be ignored.

They are also looking at improvements here in the US, as some of the areas that have had the worst drought in parts of the southern and western plains are starting to receive some moisture with forecasts calling for more, which has added pressure to the markets.

China remains pretty quiet as of recent, which was expected this week given the fact that they are celebrating their New Year.

One wild card is Brazil's second corn crop. As there is plenty of time for possible weather woes to cause concern.

With the ongoing war, still relevant problems in Argentina, and plenty of time for some Brazil weather woes, I don’t want to get super bearish here. Demand is one of the larger things keeping a lid on prices, and is the main thing I'm nervous about looking short term as fundamentally there isn't a whole lot there. But if we can get a large demand-driven story I think that opens the door to higher prices.

Corn continues to trade sideways but showed some great strength today following yesterday's losses. I still think we have a good chance to see a test of $7 if we can get a break to the upside.

Corn March-23

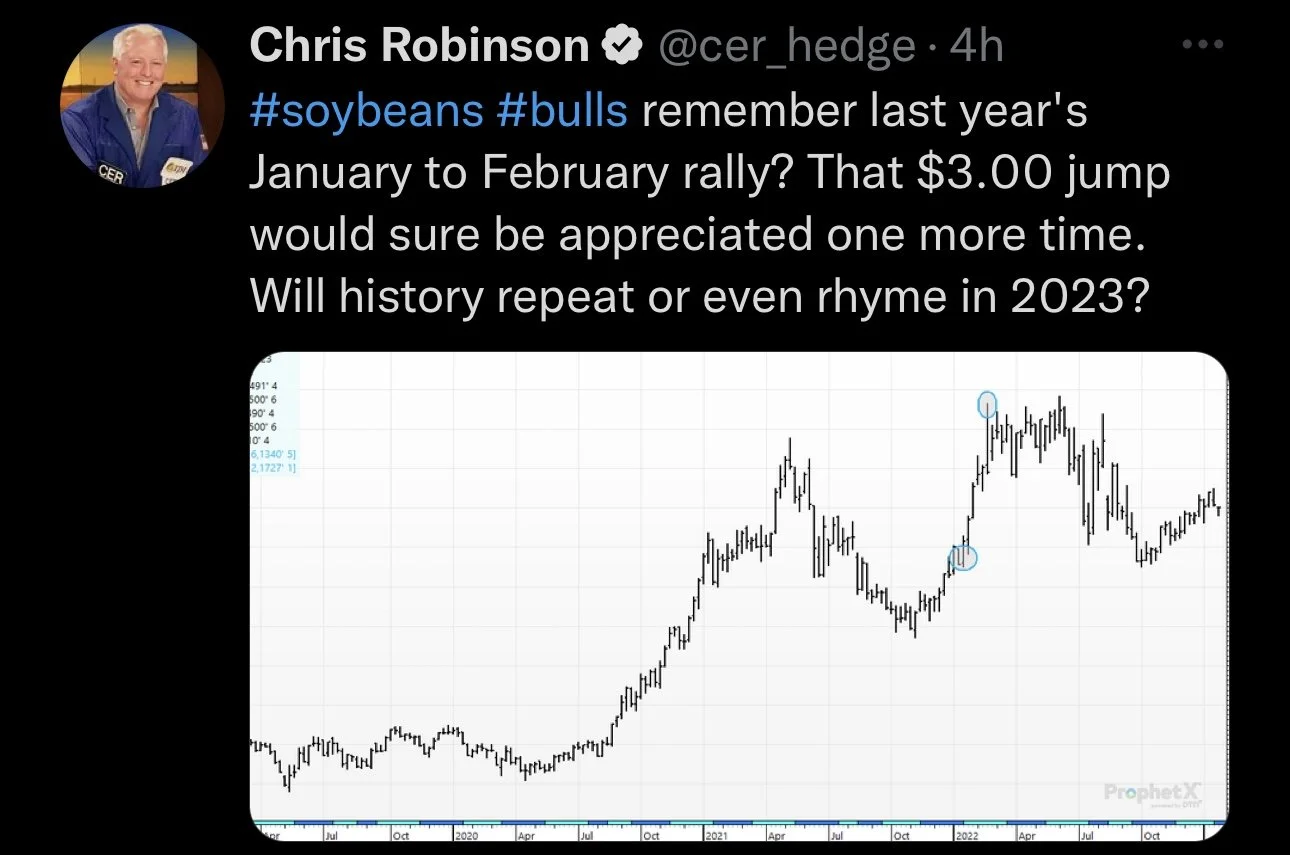

Soybeans

Soybeans tried to rebound here after trading lower four consecutive sessions. We saw a deadcat bounce overnight following the sharp losses yesterday, but with the better rains and forecasts in Argentina, soybeans weren’t able to hold onto any of those gains. Finishing -18 cents off their highs with small losses of just over a penny.

Looks like there was some more unexpected rains over in Argentina, which could be an indicator that the pattern is changing. They are now looking for moderate to heavy rains for the next 10 days or so. There is some talk that this abundant rain might go a long way in helping their extremely poor crop.

In Brazil, they are showing record yields in Mato Grosso.

Demand is starting to shift to Brazil for both corn and soybeans.

With the rains in Argentina increasing the possibility of an improved crop, an expected record crop in Brazil that in some areas has a record yield to throw on top of that, there just isn’t much there for the soybean market to grab on to and go higher here looking short term. The funds are also still heavily both soybeans and soymeal, so if the funds decide to jump ship we could see prices under further pressure.

Brazil is experiencing some slight delays in harvest. Which no at this time isn't a huge concern. But looking long term, definitely has the potential to help push beans higher. Later in today's update there is a great write up from Wright on the Markets that goes further into how this might benefit beans and corn in the long run.

Nonetheless, South American weather will likely continue to dominate the soybean trade. We also have the uncertainty about China's appetite for US beans which will continue to be another factor.

Following our recent highs, soybeans have continued to trade lower. Notching their fifth straight day of losses. Soybeans closed right at our bottom trend line of its channel. We will have to see if we bounce here or get a break to the downside.

Soybeans March-23

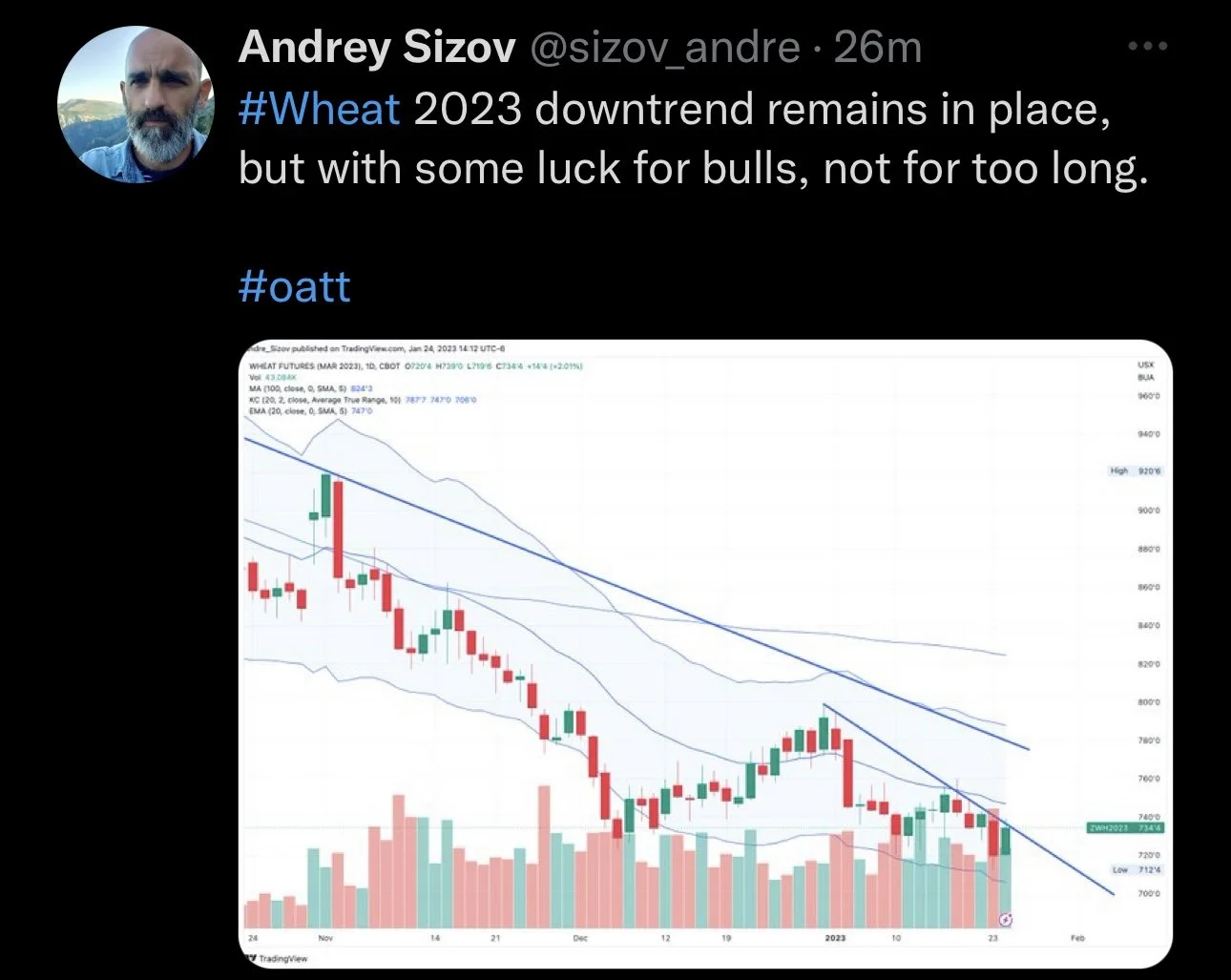

Wheat

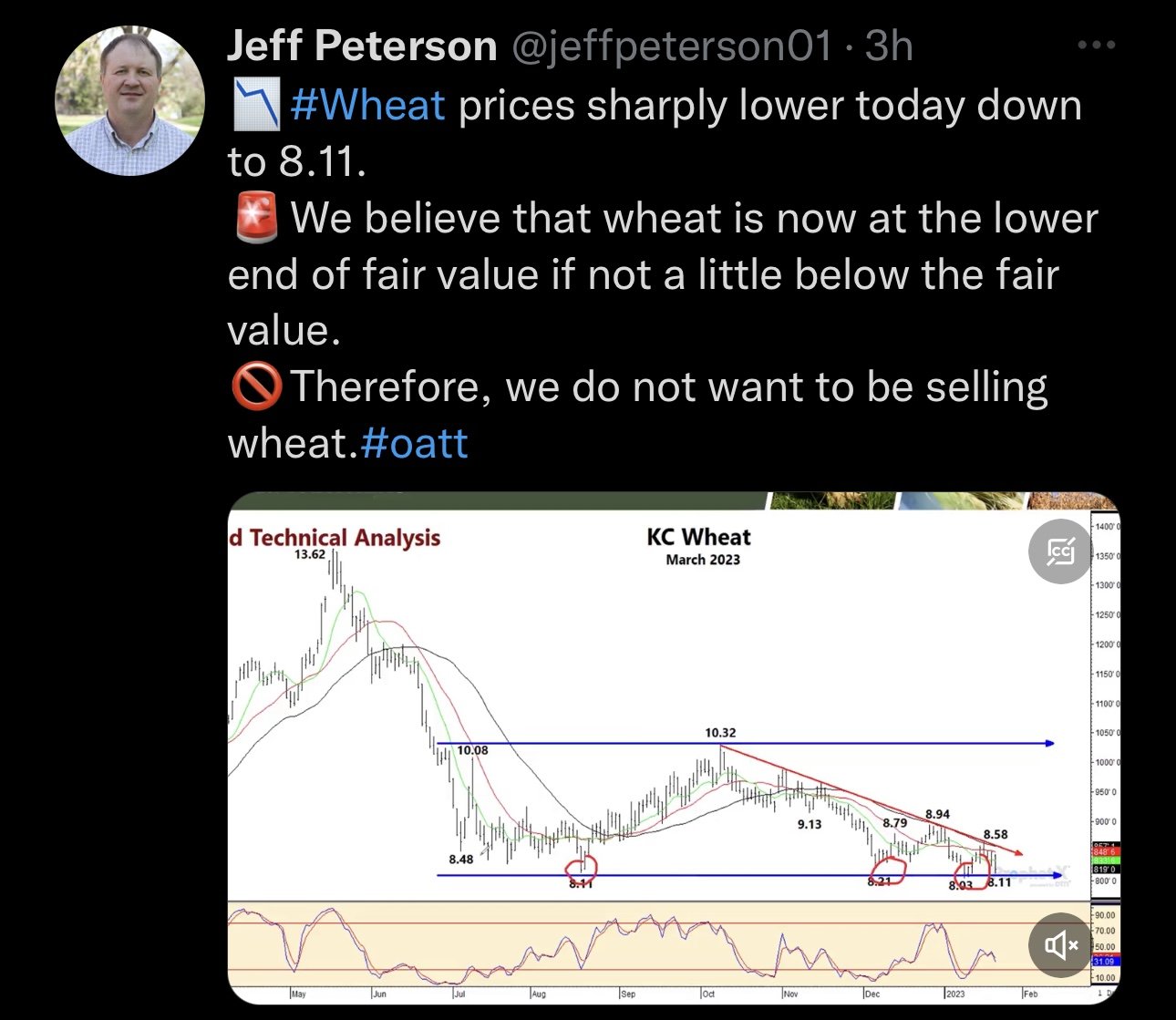

Wheat got hit the hardest of the three grains yesterday, as Chicago hit new 52-week lows, but seeing the most strength on today's rebound, as wheat futures rally +14 to 15 cents.

The main reason for the lower prices yesterday was the favorable forecasts and rain in the southern and western plains that helped areas suffering from drought.

We've mentioned this multiple times, but the biggest concern looking long term and the number one thing keeping a lid on wheat futures is global compared. The world is just cheaper compared to the US. However, domestic wheat prices in India just jumped to record highs.

Looking to the upside, we did see a major drought here in the US which some think may lead to reduced acres in the future. We also have many people thinking that Russia and Ukraines export numbers are still overly optimistic and that we ultimately see a reduction. The trade is mostly ignoring these two factors until there is concrete proof. But its hard to imagine we don’t see these numbers reduced given that our two largest wheat exporters have been going head to head in a war for nearly a year.

We really haven’t seen any major changes in the wheat market. The three W's Wealth (Funds), War, and Weather will continue the be the main factors in dictating where we go.

Weather will ultimately remain a wild card, but I think both the funds and war have the potential to push us higher. The war is far from over, and nobody knows what Putin will pull out of his hat next. Funds are short wheat but long corn, beans, and soymeal. I think they start exiting some of these long positions and start moving those over into the wheat market.

Wheat charts might look the worse out of all the grains. We still remain in a clear downtrend. However, I think we start to see the charts turnaround. If we can break out of the downtrend I think we have plenty of upside.

Chicago March-23

KC March-23

MPLS March-23

South America Rain Delays

Here is a great write up from Wright on the Market going over why these heavy rains delaying harvest might be more bullish than one might think.

He said;

Two years ago, Brazil’s record large (139 mil mt) soybean crop harvest faced the same rain problem this year’s crop is facing. Rain everyday makes for a difficult and delayed harvest.

Rain in January delays harvest of the early planted beans, but the January rains do increase the yield of the later planted soybeans, so total production numbers do increase. Two years ago, we applied common sense and said soybeans harvested so wet that water ran (not just dripping) out of the combine hoppers were not usable and, therefore, the number of mts of mashed, wet beans that had no value would more than offset the increased yield of late planted beans.

That was a mistake as the analysts continued to increase the size of the Brazilian bean crop. We will call those unusable bushels for crush and export “phantom beans” counted as usable beans; that is one of the reasons soybean prices have been so strong these past two years.

We expect that to be the case again this year with rain delaying harvest in the north area of Brazil where 85% of the beans are grown. In the short run, the delayed bean harvest keeps the window open for US soybean exports as USDA reported more sales again yesterday.

Longer term, if the current soybean crop in Brazil ends with “phantom beans,” it will support prices into 2024. However, for Brazil’s second crop corn, which is the safrinha crop, will be planted late, just as it was two years ago. That late planted 2021 crop resulted in a much below normal yields and contributed greatly to the rally in corn into 2022, which peaked just before the great 2022 safrinha harvest began in late May. The safrinha crop is a race to maturity before the dry season begins. Late planting greatly handicaps the safrinha crop in that race.

Bottom line: Watch the number of rain days for the first three locations on our daily rain day chart. More rain there means delayed bean harvest, more phantom beans, longer delay to corn planting and long term bullish both beans and corn.

Check out Wright on the Market Here

89-Year Drought Cycle

These are a few snippets from an article from Farms.com talking about how we are in a 89-year drought cycle and what this means for the future of grain prices.

Since we are in the middle of its peak (4th year out of a 6-year cycle expected to peak in 2023 but could be 1-2 years off) and as we have been discussing it extensively since 2020 like a broken record, it is only timely that we revisit the 89-yr drought cycle and a new volcano that has erupted on the island on Tonga in the Pacific Ocean.

When Tonga's Hunga-Tonga-Hunga Ha'apai volcano went off in Jan of 2022, it sent water vapor aerosols into the stratosphere in just 2 days with a total amount of water equivalent to 145,000 mega liters will act like a greenhouse gas what scientist and researchers are calling a 1 in 1,000-year event! As of May 2022, the eruption is the largest volcanic eruption in the 21st century.

Many experts expect that this volcano could impact the worlds weather for the next 5-10 years and the temperature on earth could increase ad additional 1.5 degrees. The timing is bad as we are nearing the end of the peak to the 89-year drought cycle and may are speculating that it could make the extreme weather and temps brough by this cycle will only make it worse in the coming years!

Water vapour can linger in the atmosphere for up to a decade, trapping heat on Earth's surface and leading to more overall warming. More atmospheric water vapour can also help deplete ozone, which shields the planet from harmful UV radiation.

It normally takes around 2-3 years for sulfate aerosols from volcanoes to fall out of the stratosphere. But the water from the Jan. 15 eruption could take 5-10 years to fully dissipate. Given that timeframe and the extraordinary amount of water involved, Hunga Tonga-Hunga Ha'apai may be the first volcanic eruption observed to impact climate not through surface cooling caused by volcanic sulfate aerosols, but rather through surface warming.

We cannot underestimate that farmers need to prepare for this upcoming dry cycle. The best and foremost thing to do its buy crop insurance first, keep moisture in your soils and prevent from selling too much forward as you will leave money on the table and/or to prevent yourself from buying out contracts as bushels fall short of what you expected.

Prices could soar beyond your expectations ($20 corn, $40 soys and $30 wheat), but the funds will not care until late into the party. Remember in 2012 they did not hit the panic button until July 1, 2012, creating a "short crop, long tail."

Drought is still the biggest crop concern and threat to production we head in 2023 and beyond! The reality of the Tonga volcano eruption a year ago, that sent greenhouse gas water vapors into the upper atmosphere, will only add fire to an already dry and hot 89-year drought cycle. Farmers need to prepare by buying crop insurance, buying inputs cheaper if they can and preventing themselves from selling too much too low and prevent the buying out of contracts as bushels were far less than expected. Expect the unexpected in prices ($20 corn futures, soybeans $40 and wheat $30) creating a short crop long tail like in 2012! Mother Nature will simply not allow the world to overproduce. Go buy that freezer full of meat as livestock futures will soar beyond everyone's imagination. There will be social unrest, political instability and government intervention worse than COVID-19.

The ongoing drought in the U.S., Canada and Argentina is not looking good, as we head further into 2023. If 1934 is to repeat itself in 2023 the average U.S. corn yield will drop by 20% or low 140's as we get an early_planting season and a dry/hot May, June and July with the U.S. ECB getting the dry/hot weather whereas the WCB will get more storms and moisture. We have a client in Southern Indiana that talks about his grandfather that had bottom creek land with a spring and in 1936 had an 8 bpa corn crop that farmers would come and see for miles!

In fact, Oil World projects the Argentine soybean crop at 34.0 mmt compared to the USDA at 45.5 mmt and they forecast combined production from the 5 South American countries at 201 mmt compared to the USDA at 213.9 mmt but still well above last year's combined production total of 183.6 mt up +17.4 but that largely. will get imported by Argentina to maintain a 45 mm domestic soybean/meal crush market! Grain prices should continue to be supported, on tight balance-sheet projections and anxiety over global weather outlooks.

This latest correction was just that as renewed optimism over Argentina's crops has helped overbought ag markets correct and remove the weather risk premium after a very bullish/friendly USDA Jan. crop report. nd we remain in an upward sloping uptrend in soybean futures with a target of $16.44 by mid-Feb. and range bound in corn ($6.50 - $7.00) but the USDA Feb. 8 crop report will remind everyone how tight

U.S. crops are irregardless of what's going on in South American and we can not afford a production hiccup. (Please see charts below)

South America Update

The main story in South America is obviously the rains Argentina received which has heavily pressured corn and soybeans. The rains have been some of the best they've had this entire growing season. The next 10-days are also expecting some pretty decent rains which could further add pressure.

With this recent rains, Dr. Cordonnier left his production estimates unchanged for South America. But his estimates are still lower than that of the USDA.

His current estimates are;

Brazil Beans

151 vs USDA 153 MMT

Argentina Beans

39 vs USDA 45.5 MMT

Brazil soybeans were at 1.8% harvested last week vs 4.7% last year and an average of 3.4%. So they are running behind but the majority seems to think this isn’t a noteworthy concern just yet.

Mato Grosso is however running pretty well, sitting at 5.9% harvested. There are also reports of record yields in Mato Grosso.

First corn crop in Brazil is at 5.9% harvested vs 10.9% last year, so again there are some slight delay concerns with Brazil's harvest. The talks are that Brazil corn yields for their first corn crop might be disappointing.

Argentina soybeans were 95.5% planted vs 98.6% last year.

Current crop conditions have Argentina soybeans at 60% rated poor to very poor, with just 3% being rated good to excellent.

Argentina corn is 88.6% planted vs 87.9% last year and 92.2% average.

Crop conditions for Argentina corn sit at 47% rated poor to very poor, with just 5% rated good to excellent.

Highlights & News

AgRural lowered its Brazilian soybean estimate to 152.9 MMT.

USDA announced 130k MT of corn to unknown this morning. Looks like it might have been Japan.

IHS Market pegs US 2023 corn planted acres at 90.504 million acres, down 2.5 million from their last estimate. But still 600k more than last year.

Walmart increased minimum wages to $17.50 an hour.

Wheat exports for the EU are up +6% from last year.

Other Markets

Crude oil essentially down -1.50 to 80.15

Dow Jones down up +70

Dollar Index down -200 to 101.71

Cotton down -1.15 to 86.24

Livestock

Live Cattle up +0.750 to 161.300

Feeder Cattle up +0.325 to 183.600

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Brazil 8-15 Precipitation

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service