BEANS CONTINUE BULL RUN

Overview

Soybeans continue their bull run from their recent lows as wheat remains the weak link in the ag complex. As beans are now over $1 off their lows from August 8th.

The demand story for beans continues to grow. We got another sale to China this morning, this time 121k metric tons.

We have updates crop conditions Monday. There is a very good chance we see a significant drop in ratings. Here is what a few people in the industry think we will see Monday.

Mark Gold from TopThird:

2% to 5% drop

Heartland Farm Partners:

3% to 5% drop

Jason Britt, President of Central State Commodities:

7% drop in corn ratings

8% to 10% drop in bean ratings

So I’m expecting these to provide some support to both corn and beans. Keep in mind, a lot of damage that was done this week from the heat was not picked up in the tours.

Overall day 4 of the crop tours were pretty friendly for the markets. Here were the results in case you missed them.

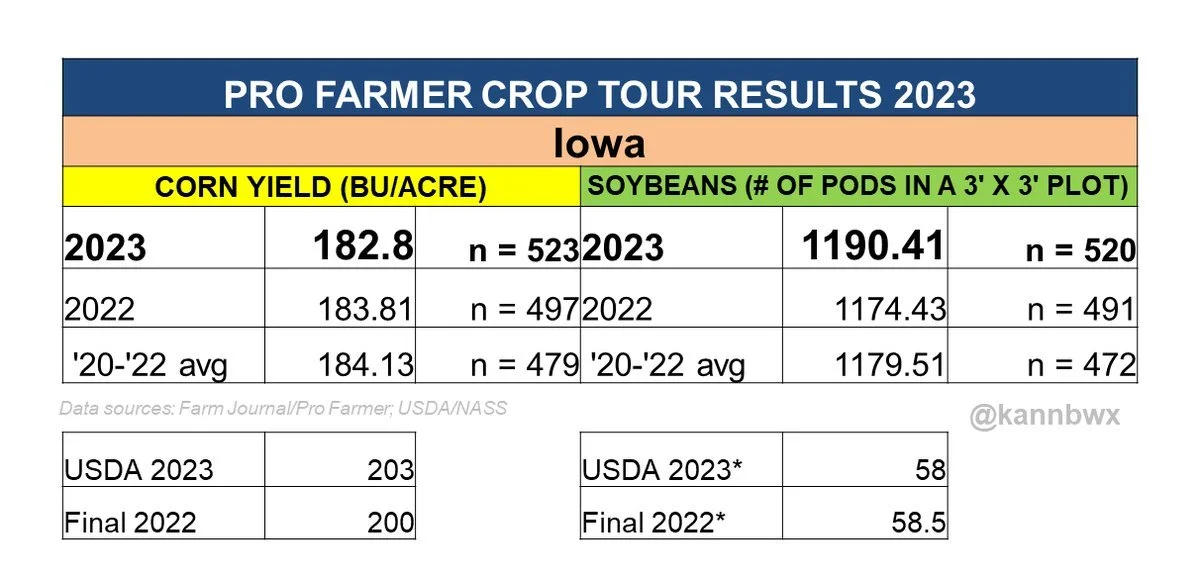

Iowa:

Corn at 182.8, below last year and the 3-year average.

Bean pods slightly higher than last year & the average.

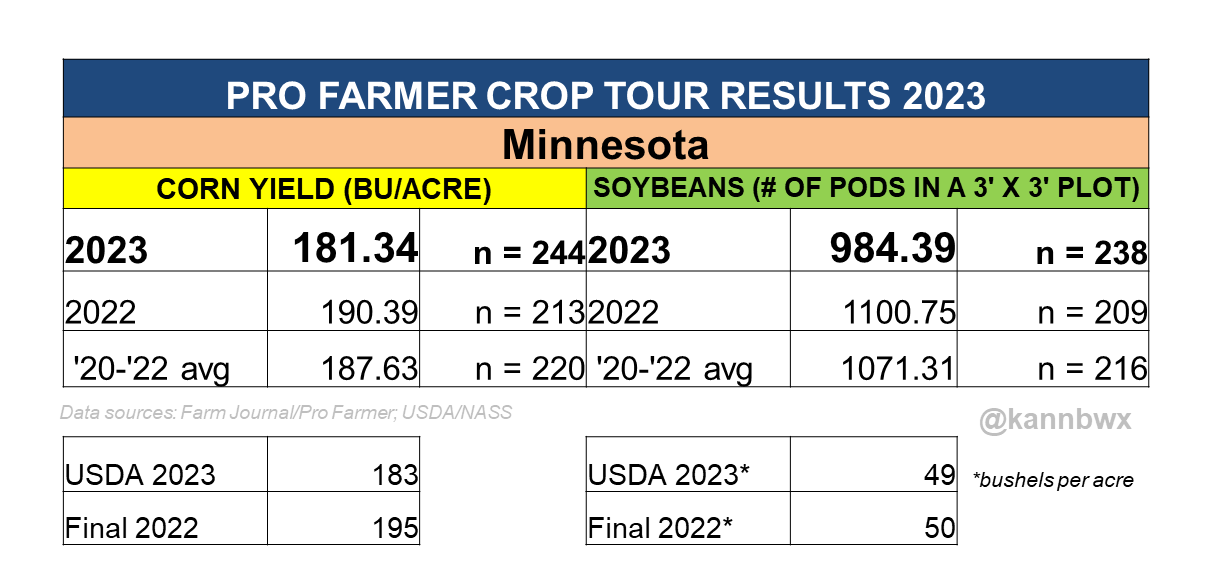

Minnesota:

Corn yield well below last year and the 3-year average.

Bean pods also well below both.

Following the crop tours, Pro Farmer released their yield estimates for the crops right after market close today.

Here were the results (bushels per acre):

Corn 🌽

Pro Farmer - 172.0

USDA - 175.1

Last Year - 173.3

Beans 🌱

Pro Farmer - 49.7

USDA - 50.9

Last Year - 49.5

Here are the production numbers:

Corn: 14.96 billion bushels vs USDA's 15.11 billion

Beans: 4.11 billion bushels vs USDA's 4.205 billion

These are pretty friendly numbers. What would happen if beans did drop below 49.5 bpa? Make sure you read the rest of today's update where we go over this into further detail and why soybeans might just have to go higher..

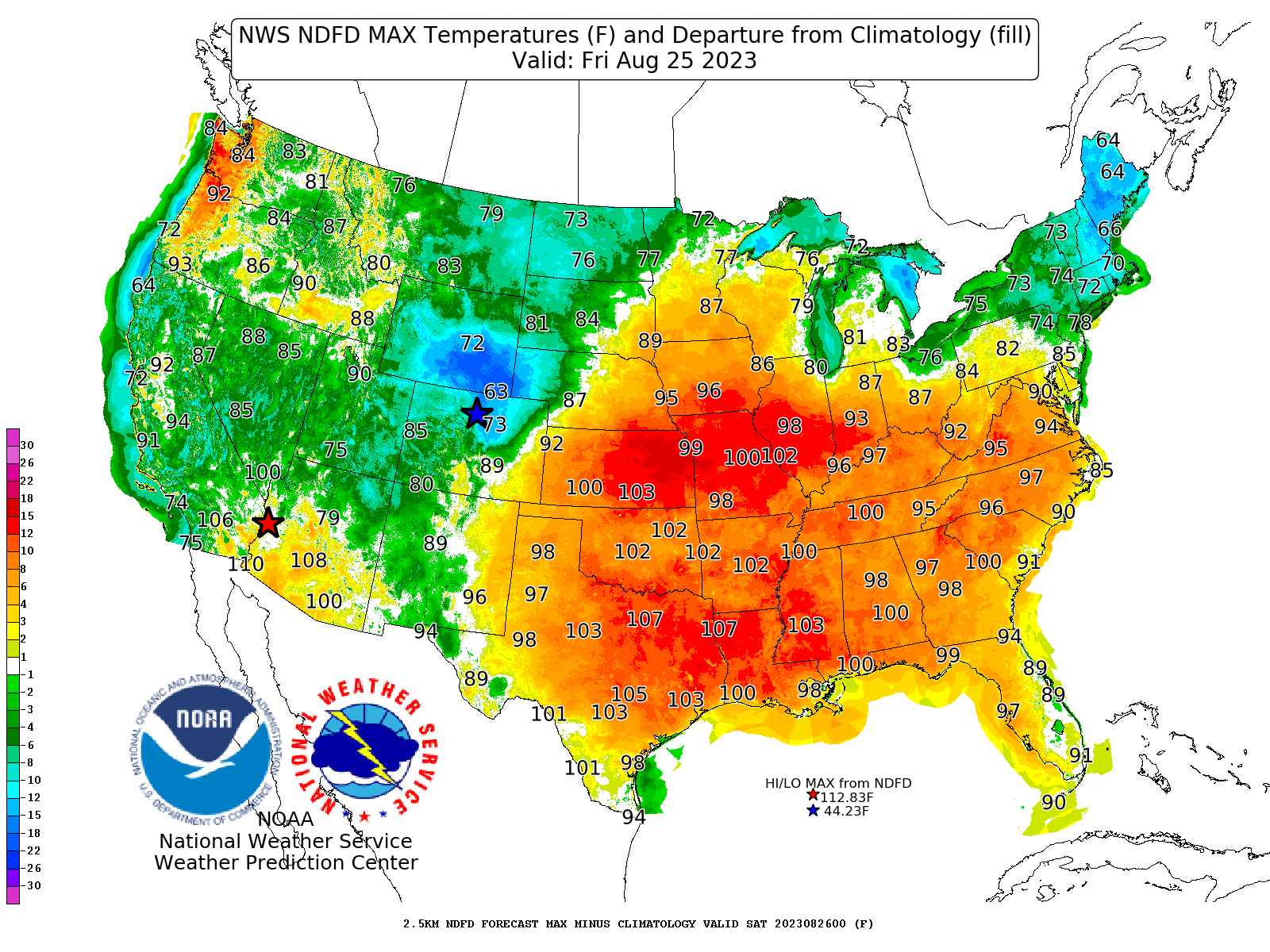

Here is the weather to close out the week. Still brutally hot today. Here was the max temperatures.

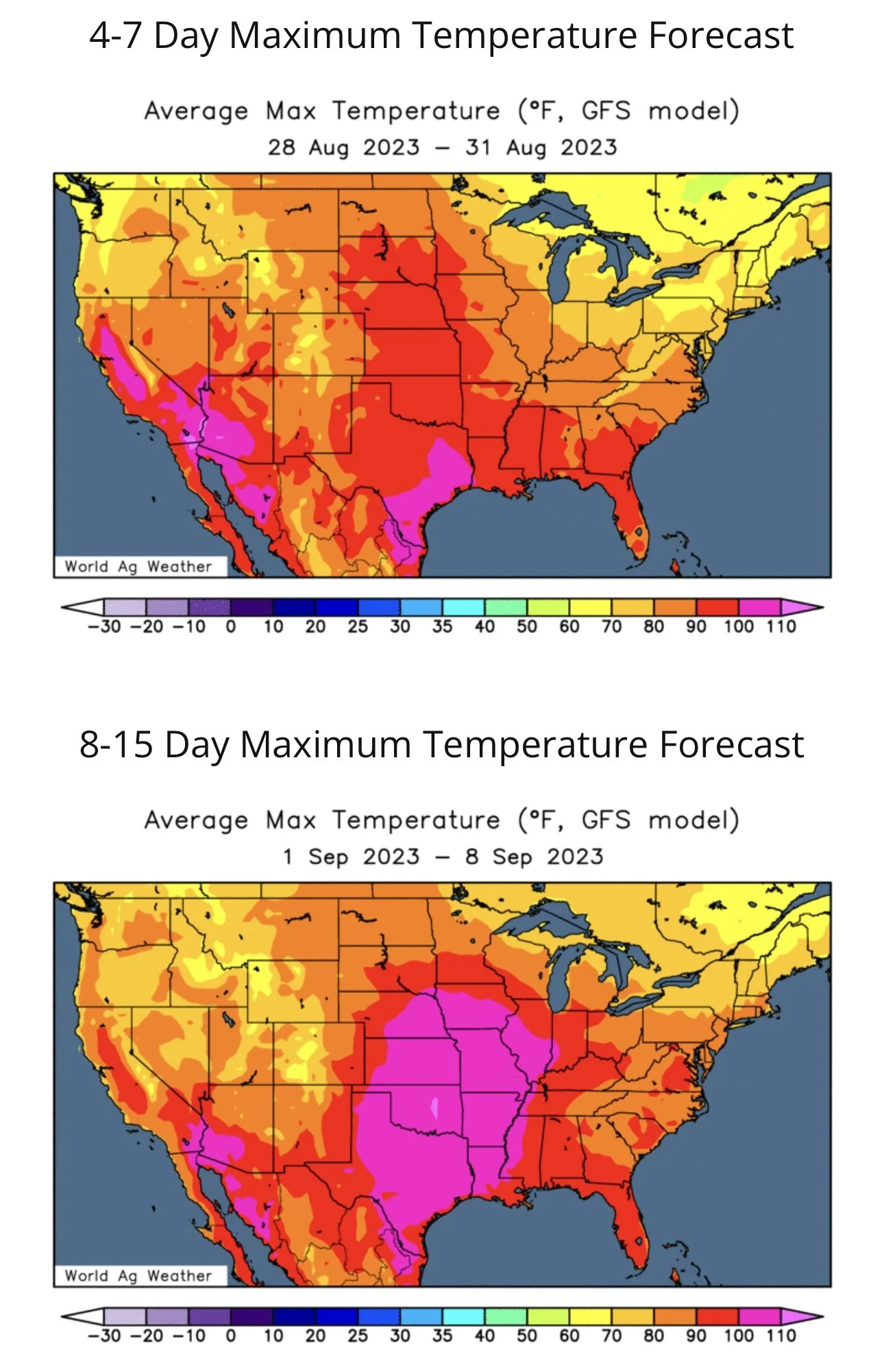

Here is how the heat looks for the next few weeks. As you can see, it cools off a little bit next week, but that heat is expected to make a return right as we head into September.

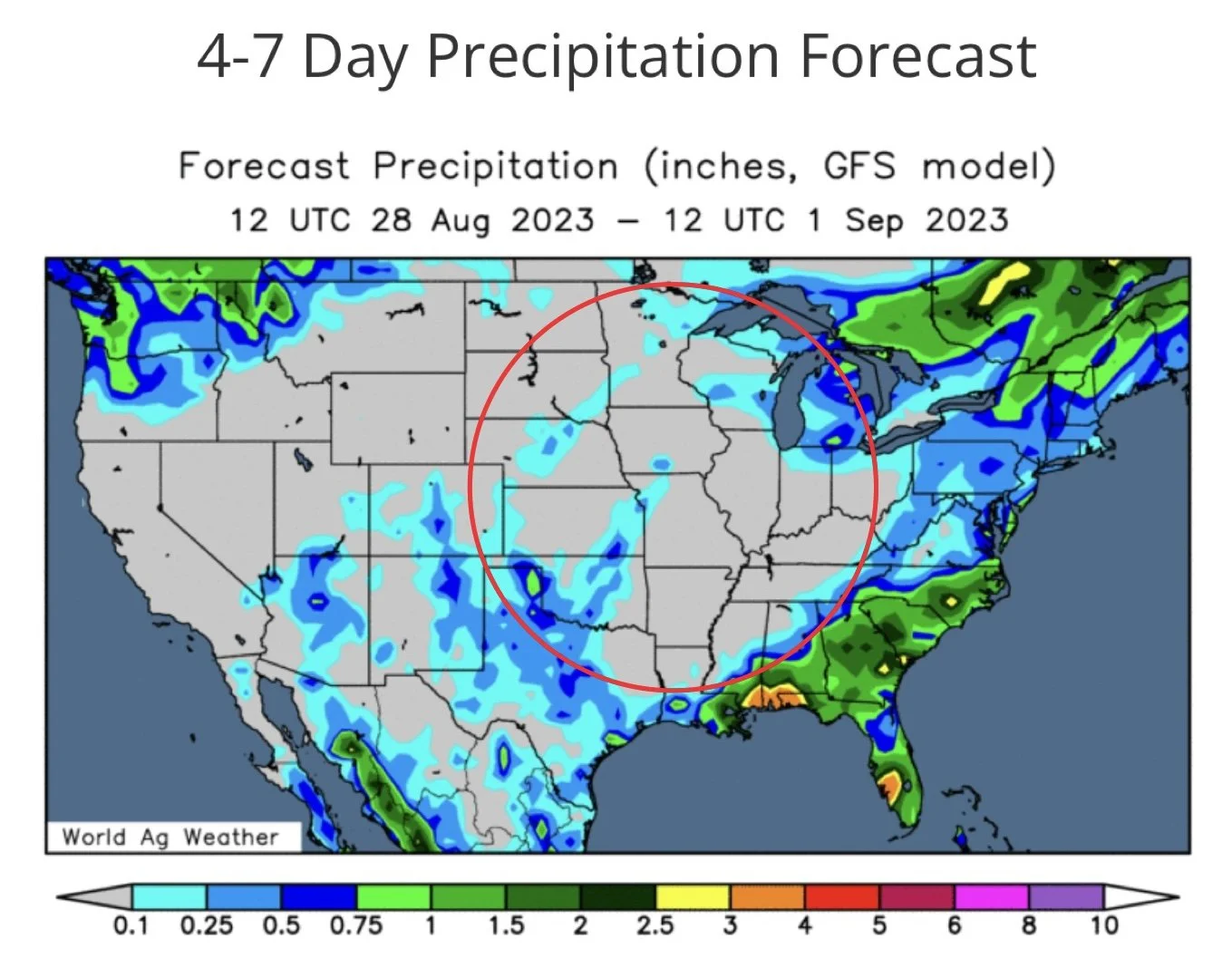

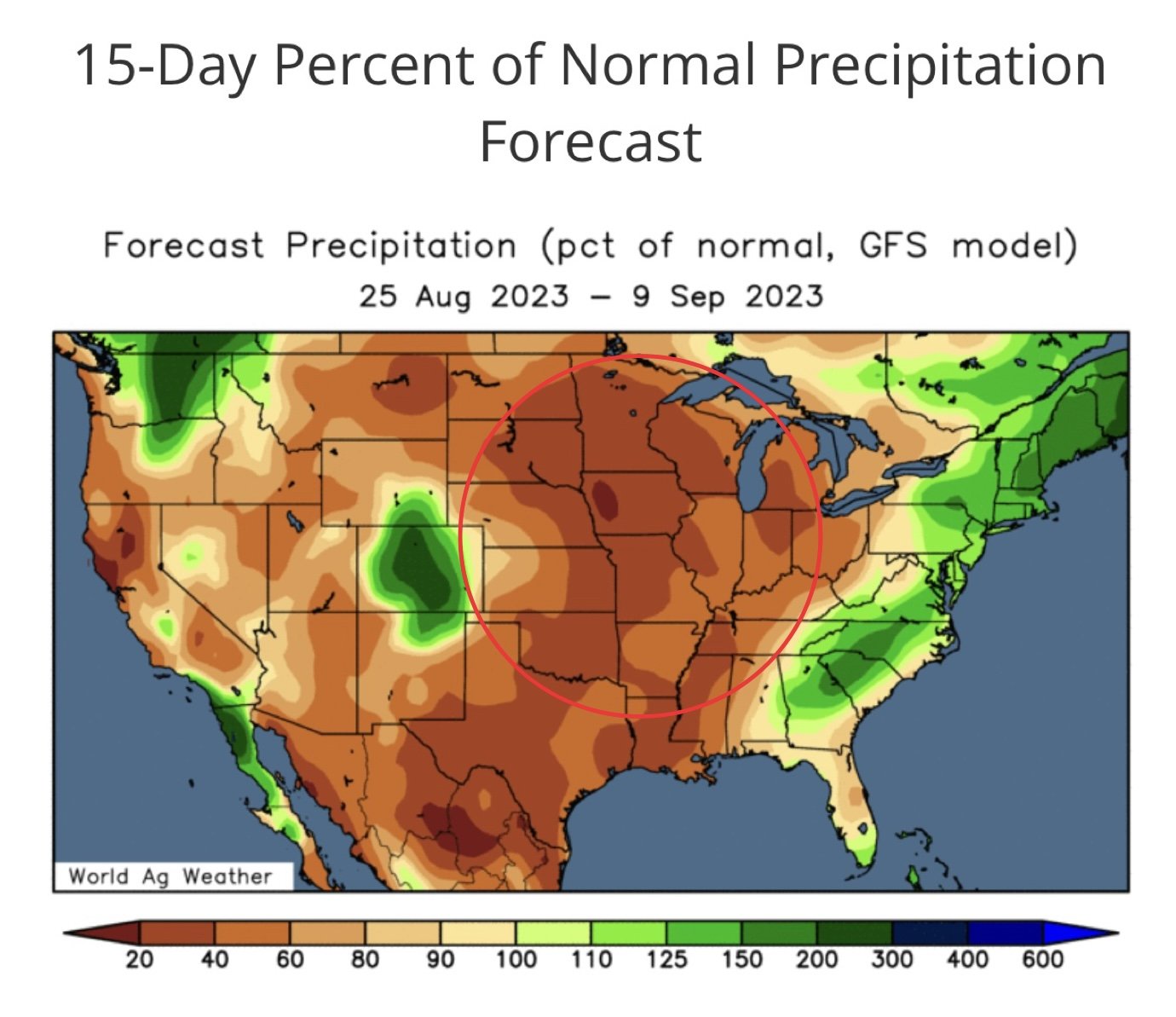

Now these next maps are just as important. As you can see, we aren’t expected to get much if any rain over the course of the next two weeks for a large portion of the corn belt. Notice the big pocket missing rain.

I mentioned this Wednesday, but towards the end of their maturation cycle, moisture is crucial for beans. Without moisture, they can see huge reductions to yield.

So altough it is expected to somewhat cool down for a few days, we are still experiencing some not so great conditions to finish the growing season.

There might not be much to scare the funds and cause a massive rally in corn and wheat quite yet. But if beans start to take off, we would have to imagine corn follows suit and gets some short covering. Especially with crop conditions Monday, which I expect to see bullish numbers.

Overall, the bean situation remains very bullish. Seasonally we are nearing a time where we put in our lows for corn and wheat. We also have a crop that is getting smaller, not larger. All of which could push us higher in the future.

Today’s Main Takeaways

Corn

Not a great day for corn today. We only closed down 1/4 of a cent, but this was a nickel off our highs, as we failed to trade above yesterday's highs. On the week, corn only lost about 4 cents.

The biggest thing holding back corn is still………

The rest of this post is subscriber content only. Subscribe to continue reading and get every exclusive update sent via text & email.

KEEP READING WITH A FREE TRIAL

Get every single exclusive update sent via text & email. Scroll to check out past updates you missed. Try a 30 day free trial or get 50% OFF yearly or monthly HERE

Become a Price Maker. Not a Price Taker.

INCLUDED IN TODAY’S UPDATE

Is corn close to putting in a seasonal low?

Calls or puts for corn? What if you made sales?

Biggest takeaway from the crop tours

Why beans might have to go higher..

What could beans trade if yield falls to 49.5 bpa?

It feels like demand is increasing.. what if yield is decreasing?

Balance sheet continues to tighten

The marathon in the wheat market

Check Out Past Updates

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio