ECON 101 APPLIED TO GRAIN SALES

Here are some not so fearless comments for www.dailymarketminute.com

Another violate week that included plenty of disappointing price action yet doing so in a way that left plenty of hope that we have a bottom in for corn and wheat.

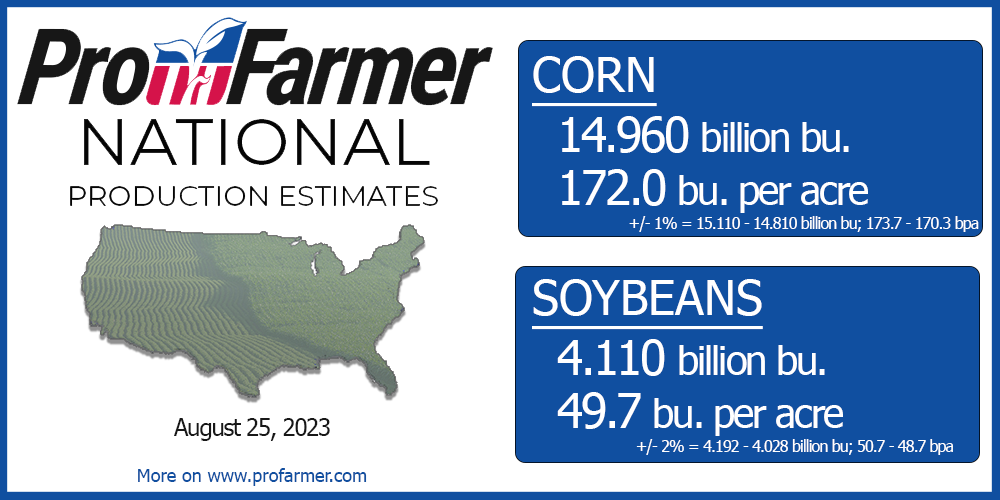

The big headline last week was the Pro Farmer Crop Tour. Which estimated that our production was less than what the August USDA printed. A little over 100 million under what the USDA had for corn. While Pro Farmer estimated the soybean production at 85 million less.

ECON 101 GRAIN MARKETING STYLE

Presently our markets are still in the supply discovery mode. Meaning we are trying to determine acres and yield. In ECON 101 we learn that more supply creates more demand, while higher prices create more supply. High prices cure high prices and low prices cure low prices. Etc

A few months ago we had corn yield ranges over 180 on the top side and under 165 on the low side. For corn that is a supply range of nearly 1.5 billion bushels. It goes without saying that if we have a billion bushels more corn prices will likely go down, if we have a billion bushels less corn production prices will likely go up.

For grains our production is determined by our acres and yield. While our supply includes old crop carryover. Acre ranges pre planting were at one point as wide as 7 million acre range. Every million acres is about 175 million bushels.

For soybeans I would say pre planting estimates had yield ranges of 5 bushels on yields and 7 million on acres. So for yield you have a little over a 400 million bushel production range. Which is 1-2 times what our carryout is.

As time goes by we narrow in the possible ranges for production, as we see how many acres get planted, followed by yield estimates and finally harvest results. Even though corn production isn’t going to be as big as what the USDA first put out in May it is going to be big enough that the job of the market MIGHT be to add demand.

For soybeans we have the exact opposite type of ECON 101 type of supply change versus USDA first estimates. So the job of the soybean market becomes curbing demand.

With the weather this past week the unknown for soybean supply (yield/production) has increased instead of being more dialed in. As estimates for soybean yields have seen the possible range widen out.

Presently USDA has bean yields at 50.9 bushels per acre on 82.7 million acres with an ending carryout of 245 million bushels. So if we end up 3 bushels less we end up with a negative carryout if our demand was the same as what the USDA has printed. Obviously that won’t be the case. As we can’t use what is not there.

The bottom line is that one should ask themselves what ECON 101 stage is the market at. Are we determining supply, determining demand ,needing to find demand, needing to curb demand. It isn't as simple as that but it helps when looking at the big picture.

The bottom line is that if we are needing to curb demand because our supply is lighter then estimated the easiest way to do so is to have prices go up. This is why the soybean market will have plenty of potential over the next several months.

The soybean oil situation and world veg oil situation is one that has demand outpacing supply. This should help prices long term.

HARVEST BASIS - STORAGE - PRICE LATER - DELAYED PRICE

When it comes to should I store, should I sell, or should I pick up the carry? My big picture point is that if you are supplying grain during harvest…….

The rest of this post is subscriber content only. Subscribe to continue reading and get every exclusive update sent via text & email.

Want to Keep Reading? Try Free Trial

Get every single exclusive update sent via text & email. Scroll to check out past updates you missed. Try a 30 day free trial or get 50% OFF yearly or monthly HERE

Scroll to check out updates you would’ve received.

Become a Price Maker. Not a Price Taker.

GET 50% OFF YEARLY OR MONTHLY

INCLUDED IN TODAY’S UPDATE

Harvest basis decisions timing and tactics

Should you be locking in harvest basis now or wait?

Demand factors

Chinese demand. Will they be buying soon?

Can Chinese corn reach new yearly highs?

When supply is unknown, we add weather premium

Will we be weak going into September production report?

And More..

Updates You Might’ve Missed

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio