BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

AUDIO COMMENTARY

Corn tested July lows but bounced

Wheat remains disappointing despite war news

Is there still a reason for wheat to rally?

Big picture, supply is getting smaller

Forecasts are hot & dry

Beans improve by 5% G/E after close

Continue to sell beans to China. Demand is strong

Will demand increase offset supply increases?

Tomorrow will be great test for beans, but don’t be surprised if they are pressured heavily

(Scroll for crop conditions, charts, & forecasts)

Listen to today’s audio below

Keep Listening With Free Trial

You only got to listen to half of today’s audio.

Continue listening with a 30-day free trial and start receiving all of our daily exclusive updates via text & email.

Scroll to check out past updates you would have received.

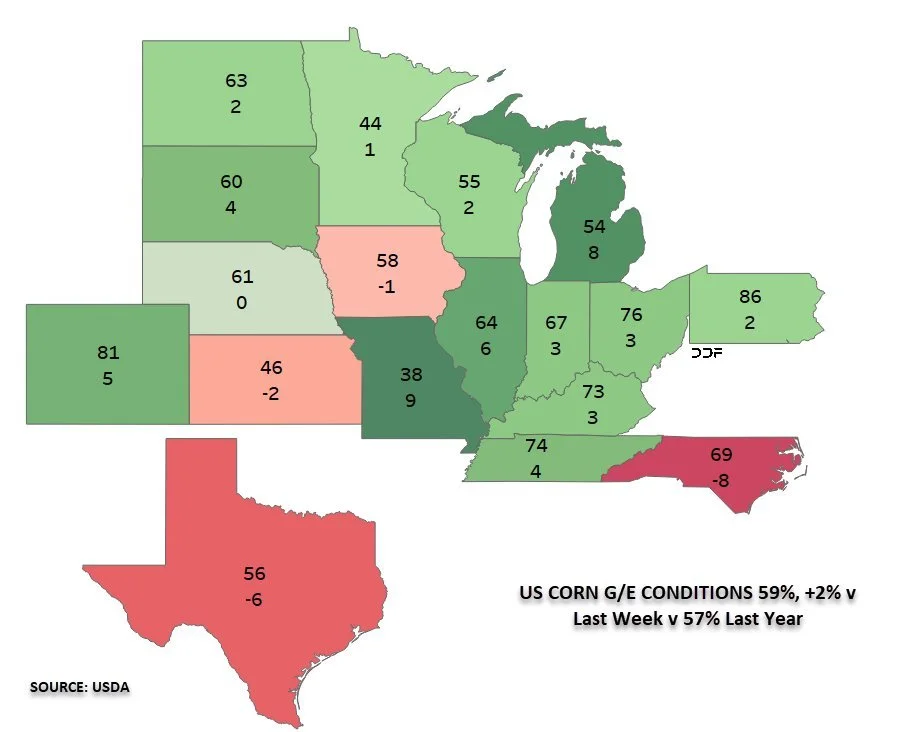

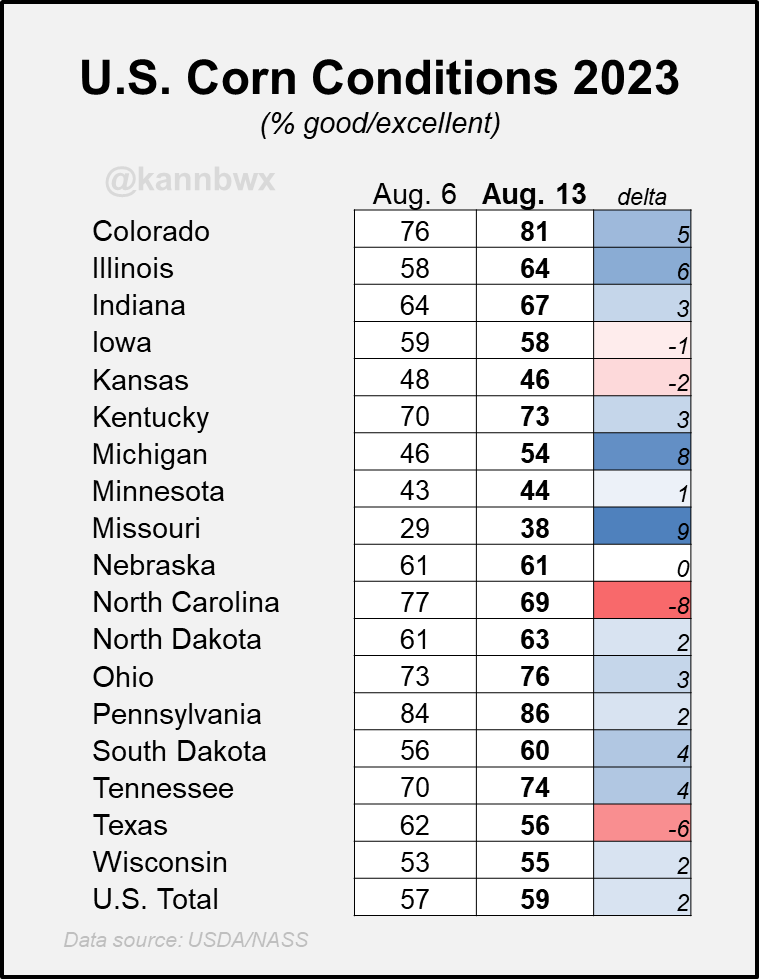

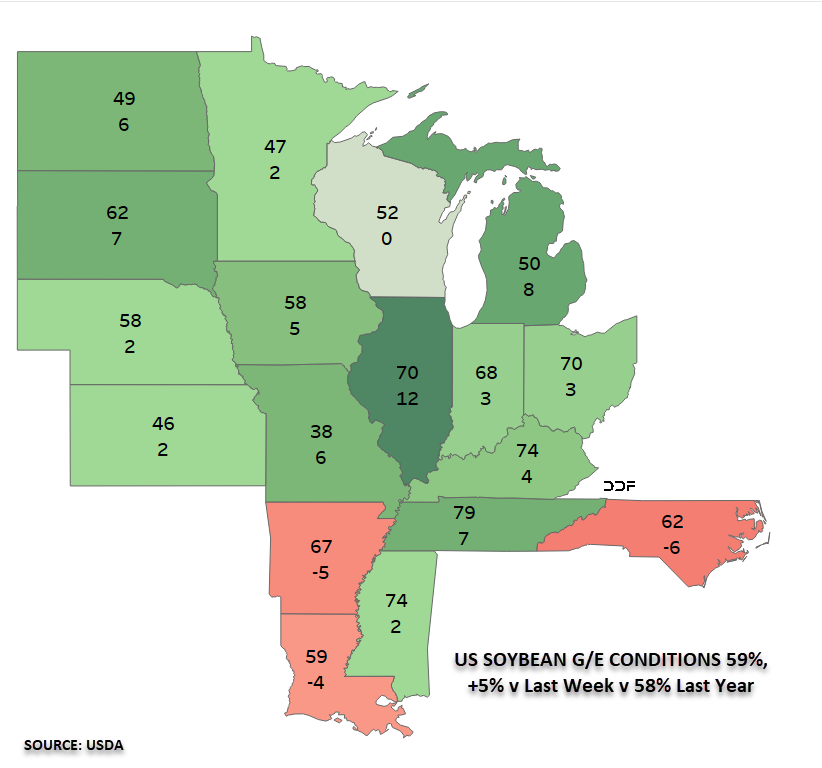

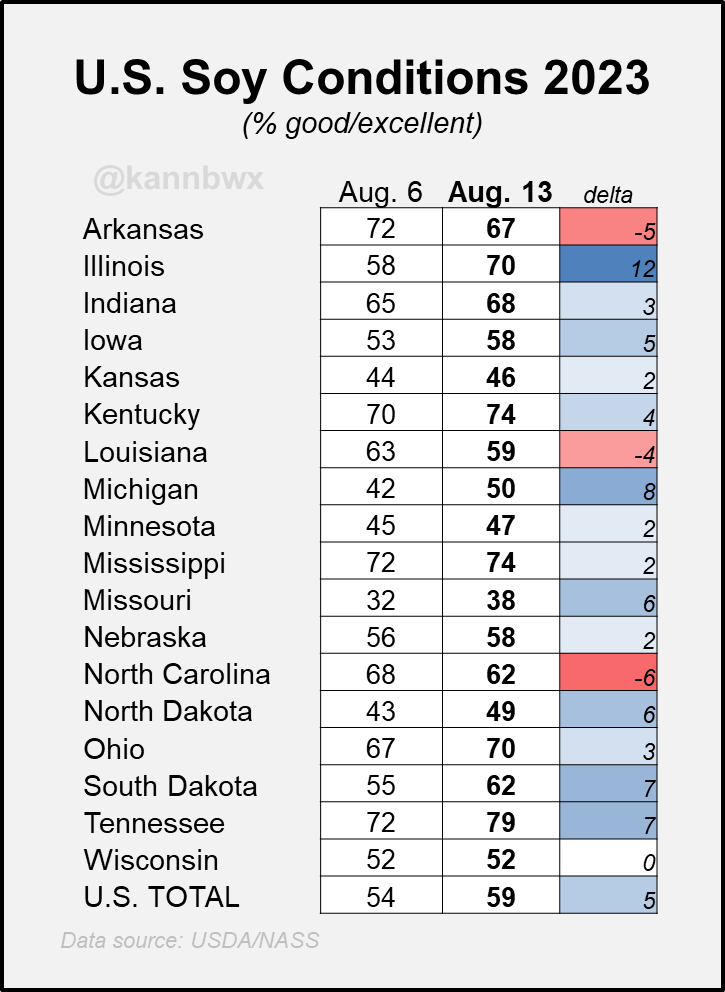

Crop Conditions & Progress

Corn 🌽

Rated G/E: 59%

Trade: 58%

Last Week: 57%

Last Year: 57%

Soybeans 🌱

Rated G/E: 59%

Trade: 55%

Last Week: 54%

Last Year: 58%

Spring Wheat 🌾

Rated G/E: 42%

Trade: 41%

Last Week: 41%

Last Year: 64%

Winter Wheat 🌾

Harvested: 92%

Trade: 93%

Last Week: 87%

Last Year: 89%

Average: 92%

State By State Map (% Change)

- From Darrin Fessler & Karen Braun -

Corn 🌽

Beans 🌱

Charts

Corn 🌽

Corn held it’s July lows of $4.81 bouncing right off of that support. First upside target is the $5.16 range. Bulls need to hold that $4.81 or we could drop into the $4.50 or so range.

Beans 🌱

Beans have found some nice support in this area. However, given the massive improvement to crop conditions, I wouldn’t be at all surprised to see us pressured heavily and test the $12.96 level. If that level doesn’t hold we might look to the $12.83 level. If neither of those hold, bulls need to hold the $12.45 level which is where we made our March and July lows. On the other hand, upside targets are $13.37 then $13.63.

Chicago 🌾

Chicago broke it’s slight uptrend from late May. We are currently sitting at some good support, so hopefully we hold the $6.06 level here. But if it doesn’t hold we might look to our May 31st lows of $5.87 1/2.

KC 🌾

The KC chart doesn’t look too hot for bulls. But we did find support right at our May lows which is the level bulls need to hold to prevent further bleeding.

Minneapolis 🌾

As is the same for KC, we are sitting at support. If this doesn’t hold we could look to test our May 31st lows.

WEATHER

CHECK OUT PAST UPDATES

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio

PREPARING FOR THE USDA REPORT

8/9/23 - Market Update

TRADE PREPARES FOR USDA REPORT

8/8/23 - Audio

MARKETS PUT BANDAID ON THE BLEEDING

8/7/23 - Market Update

BEANS SELL OFF WHILE WHEAT RALLIES

8/7/23 - Audio

NAVIGATING WEATHER & WAR YOYO

8/6/23 - Weekly Grain Newsletter