WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Another disappointing week for the grain markets. Overall the grain markets didn’t bleed as bad as they have the previous couple of weeks. As our markets stabilized trying to find possible bottoms.

But we had a week filled with disappointment. It started with wheat starting the week on the firm side on the Russian/Ukraine news over the weekend that we had an escalation in the Black Sea. Wheat failed to follow through as the war news continues to be the boy crying wolf type of news.

We followed that up with soybeans having a nice reversal on Tuesday bouncing off of technical support from both the 200 day moving average and fibonacci support. The disappointment for beans was the reversal left on the charts on Friday as we spiked higher from the USDA report initial reaction only to close in the red leaving an outside bearish day on the charts after a 46 cent bounce from Tuesday’s low.

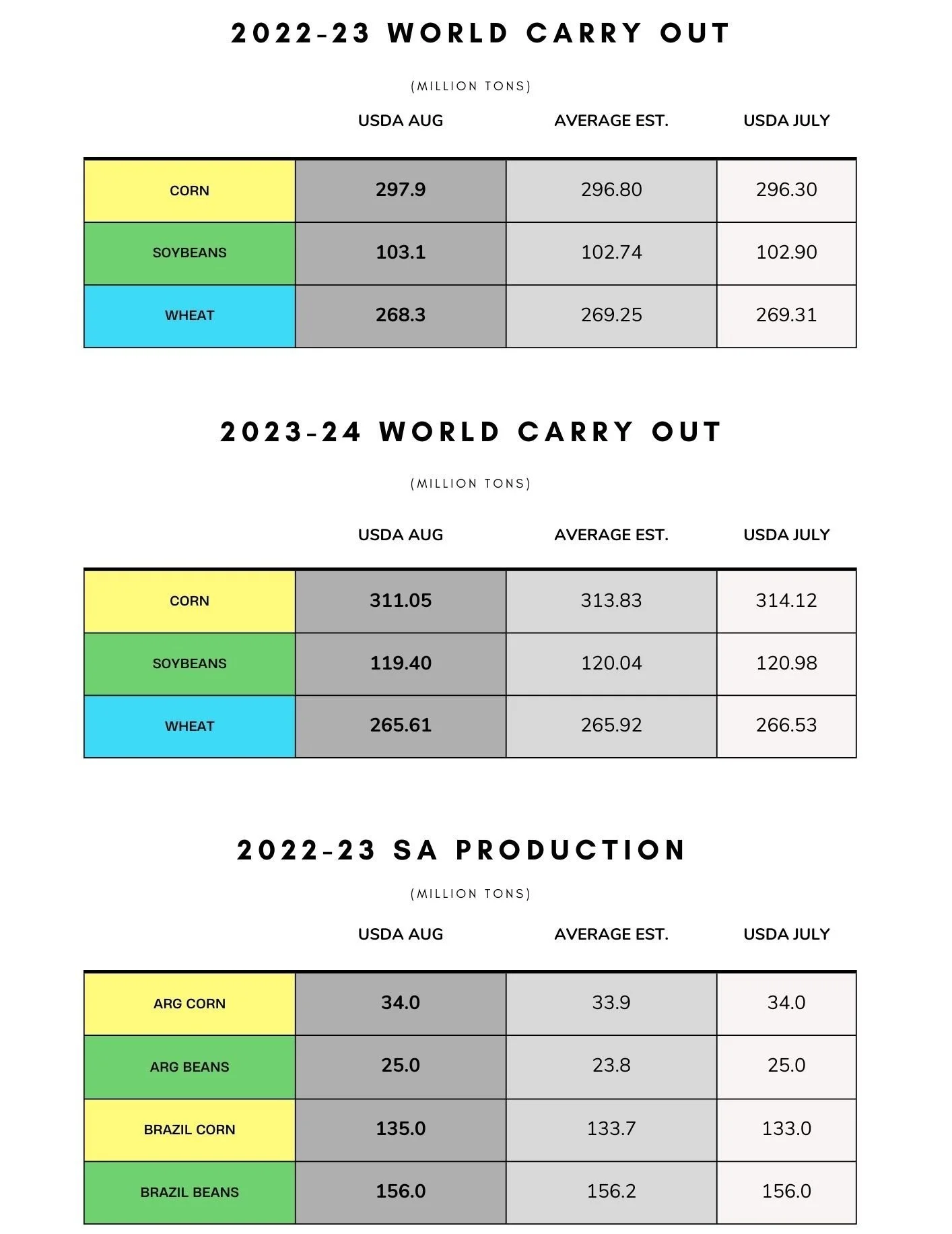

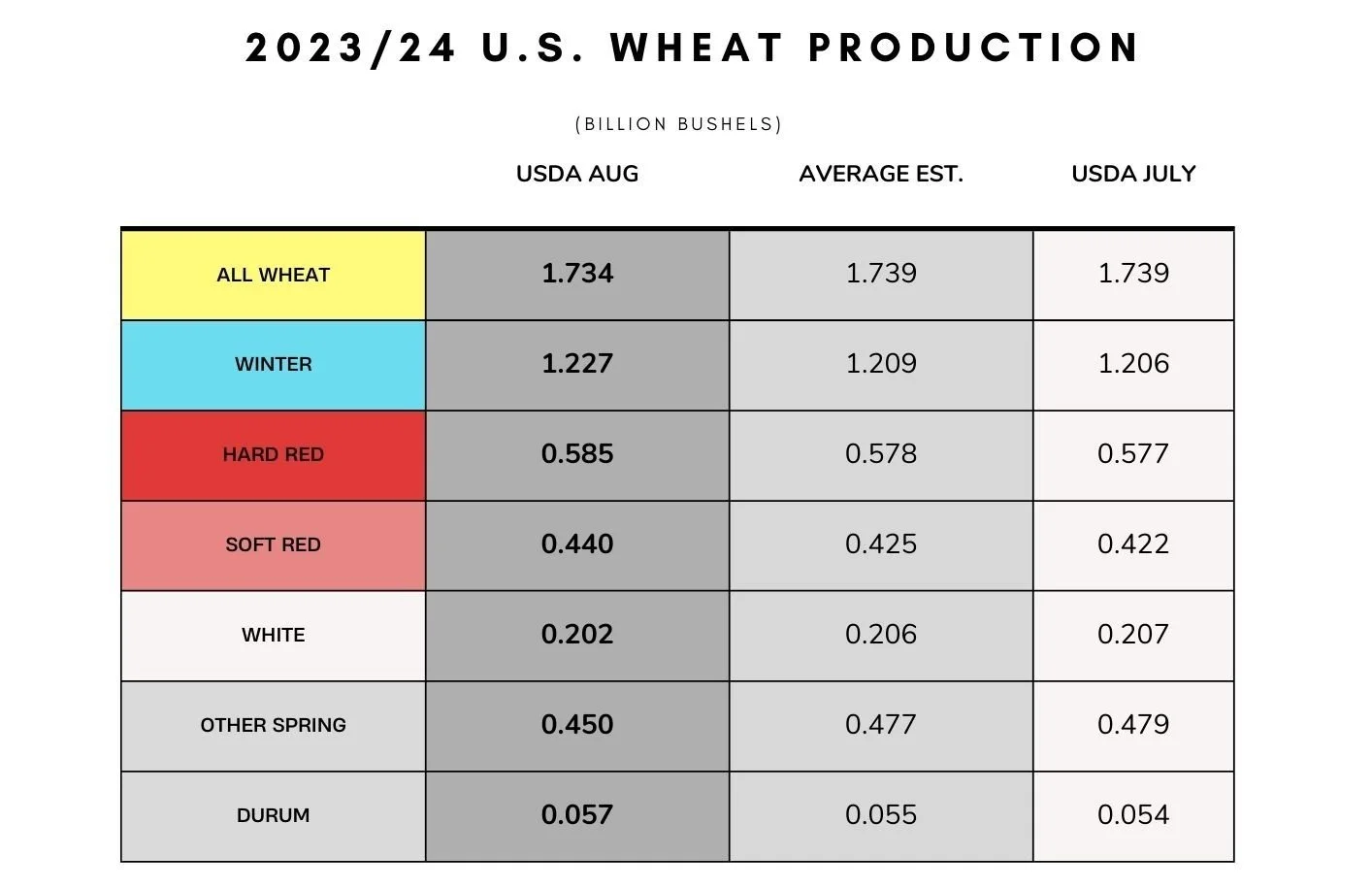

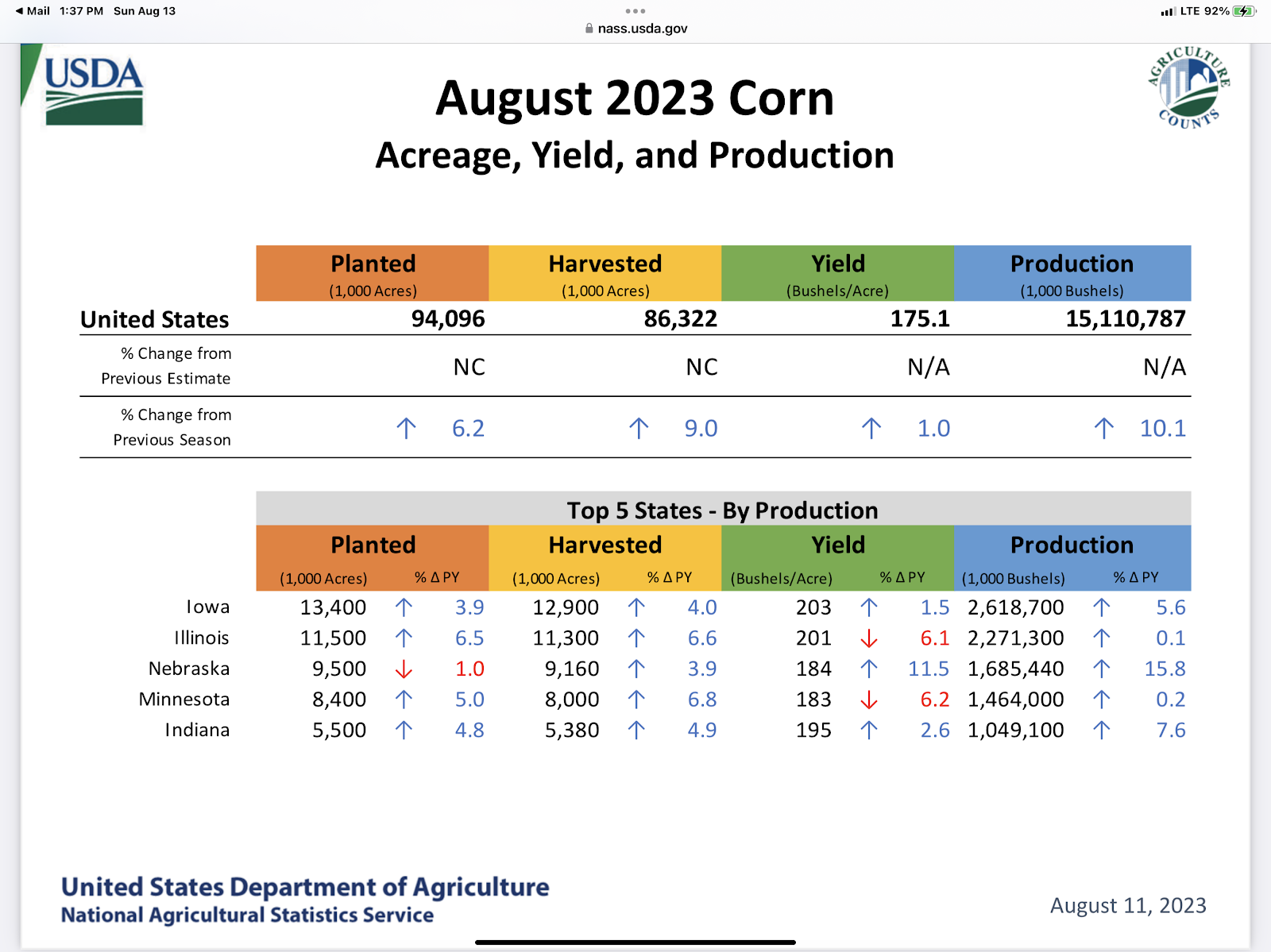

The biggest disappointment of all was the price action we got on Friday after the USDA report came out. Here is a recap of the numbers.

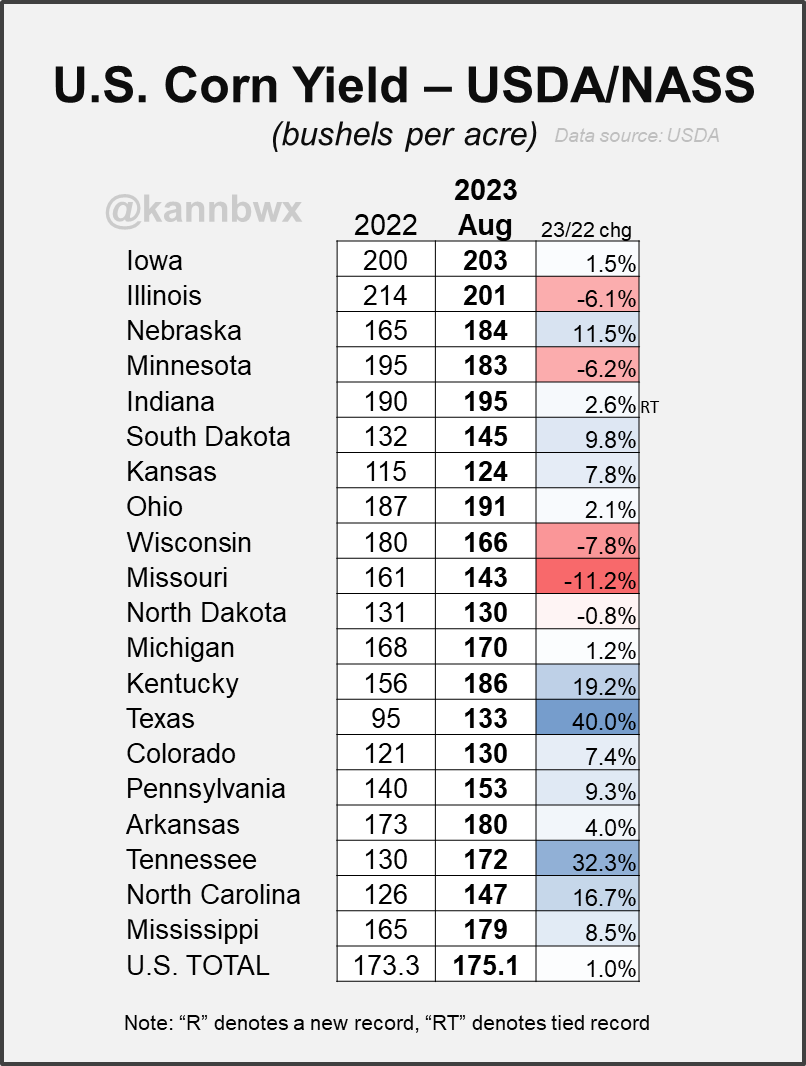

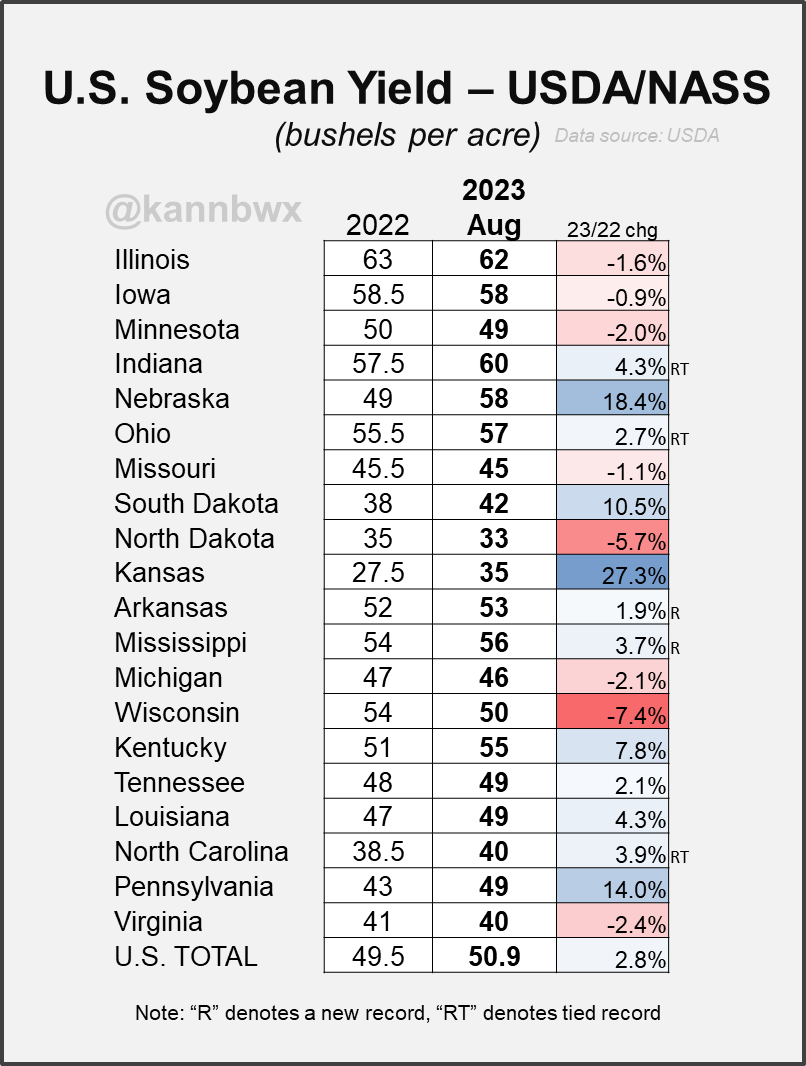

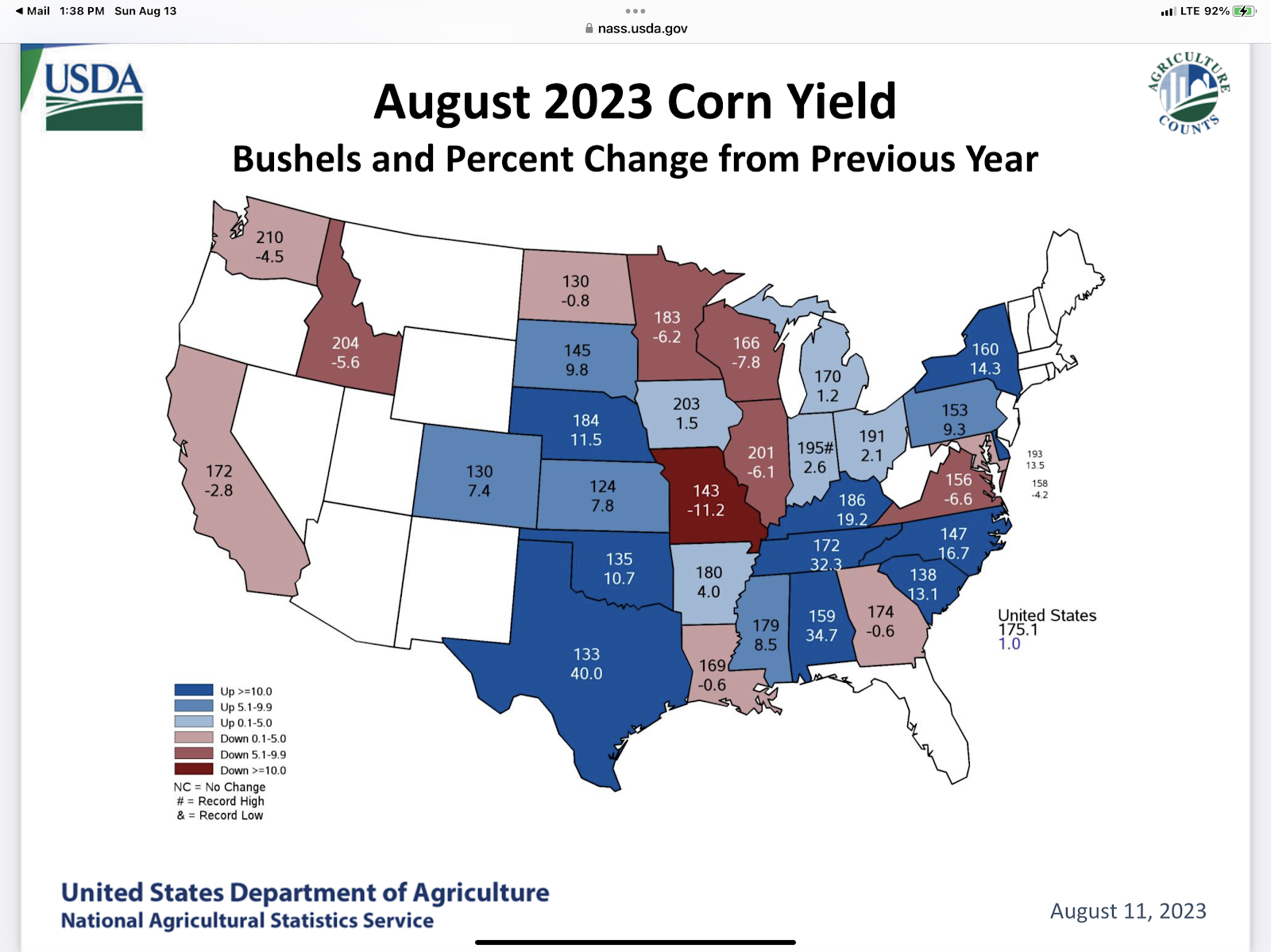

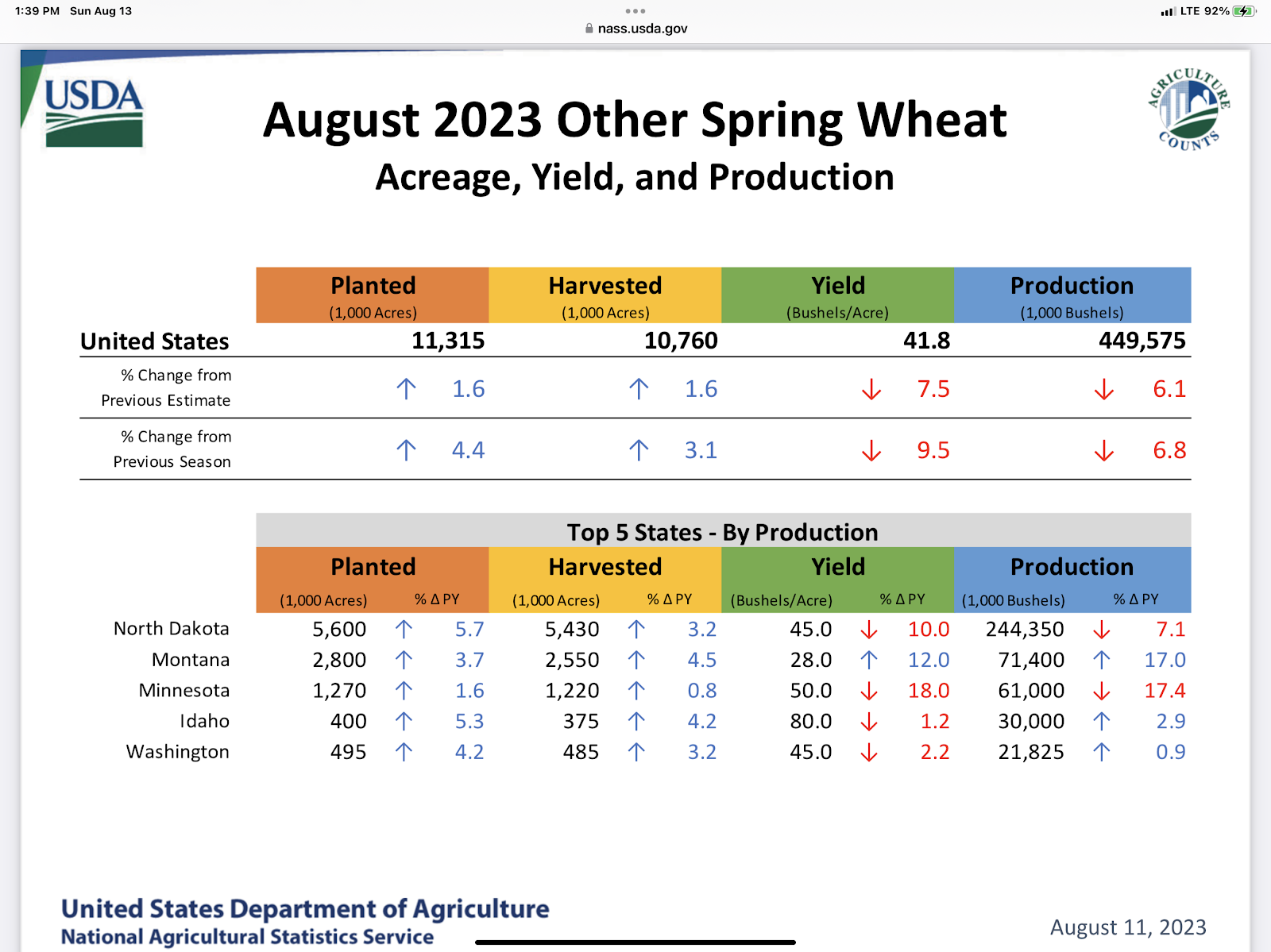

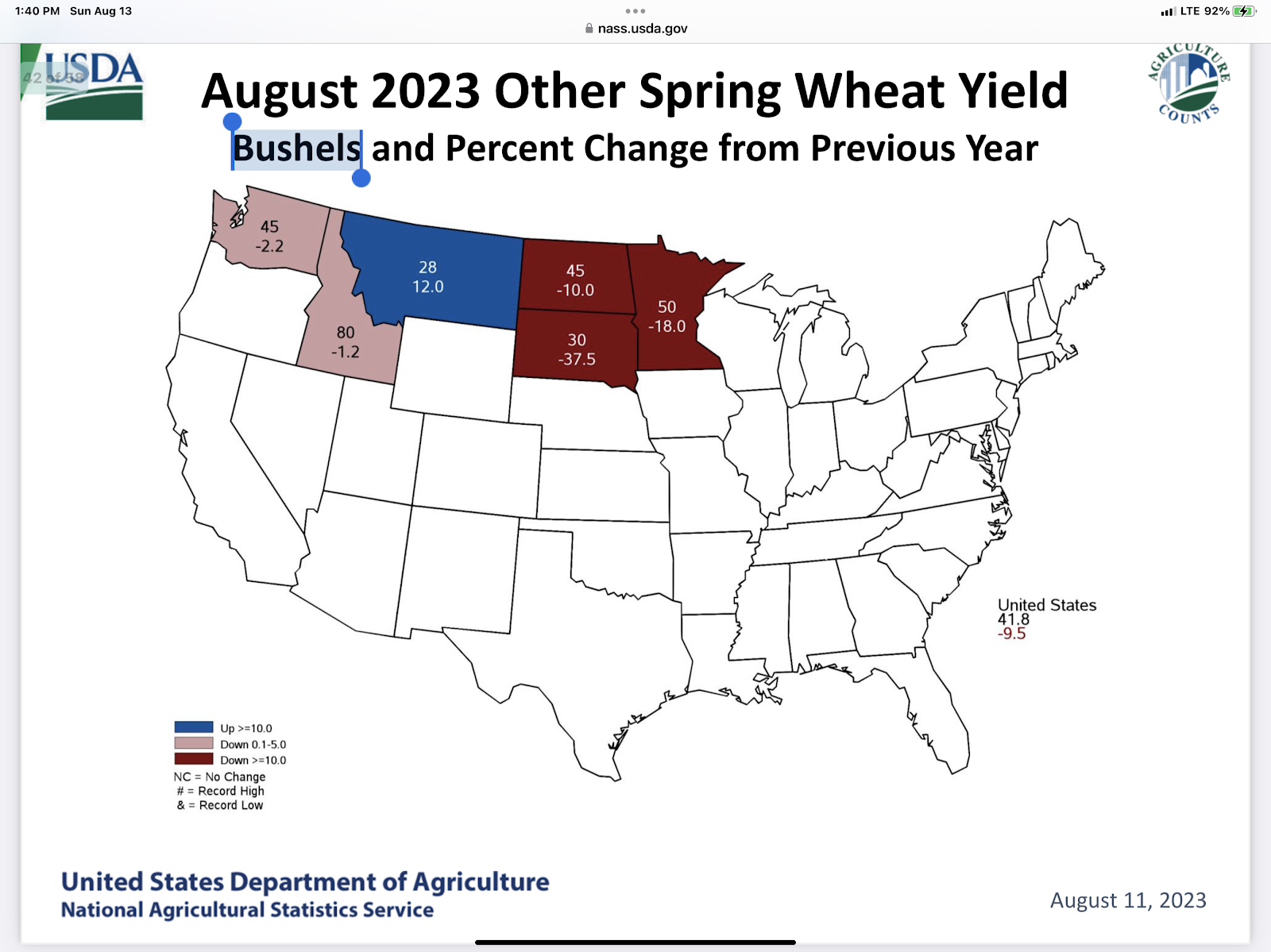

State By State Yield

- From Karen Braun -

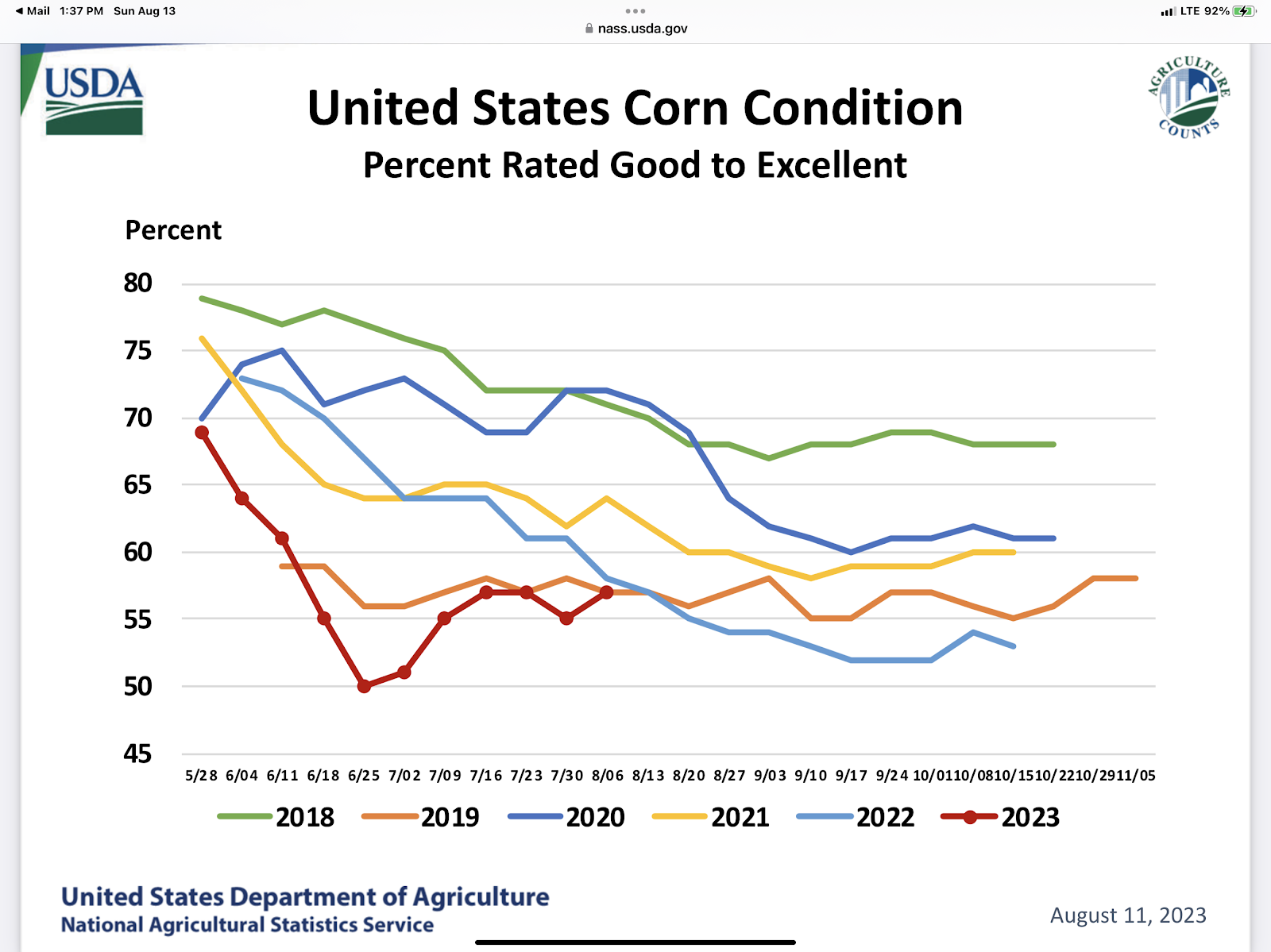

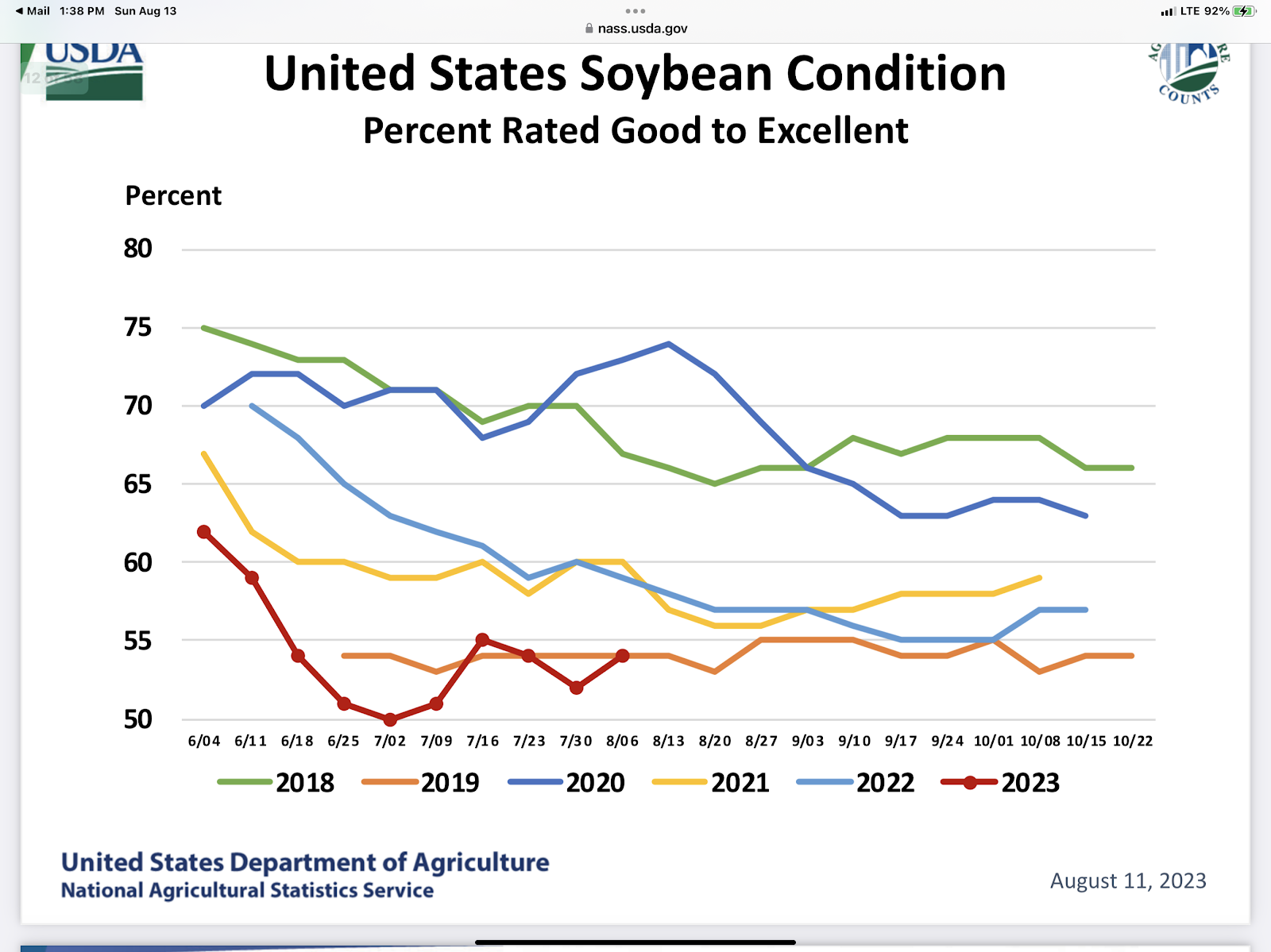

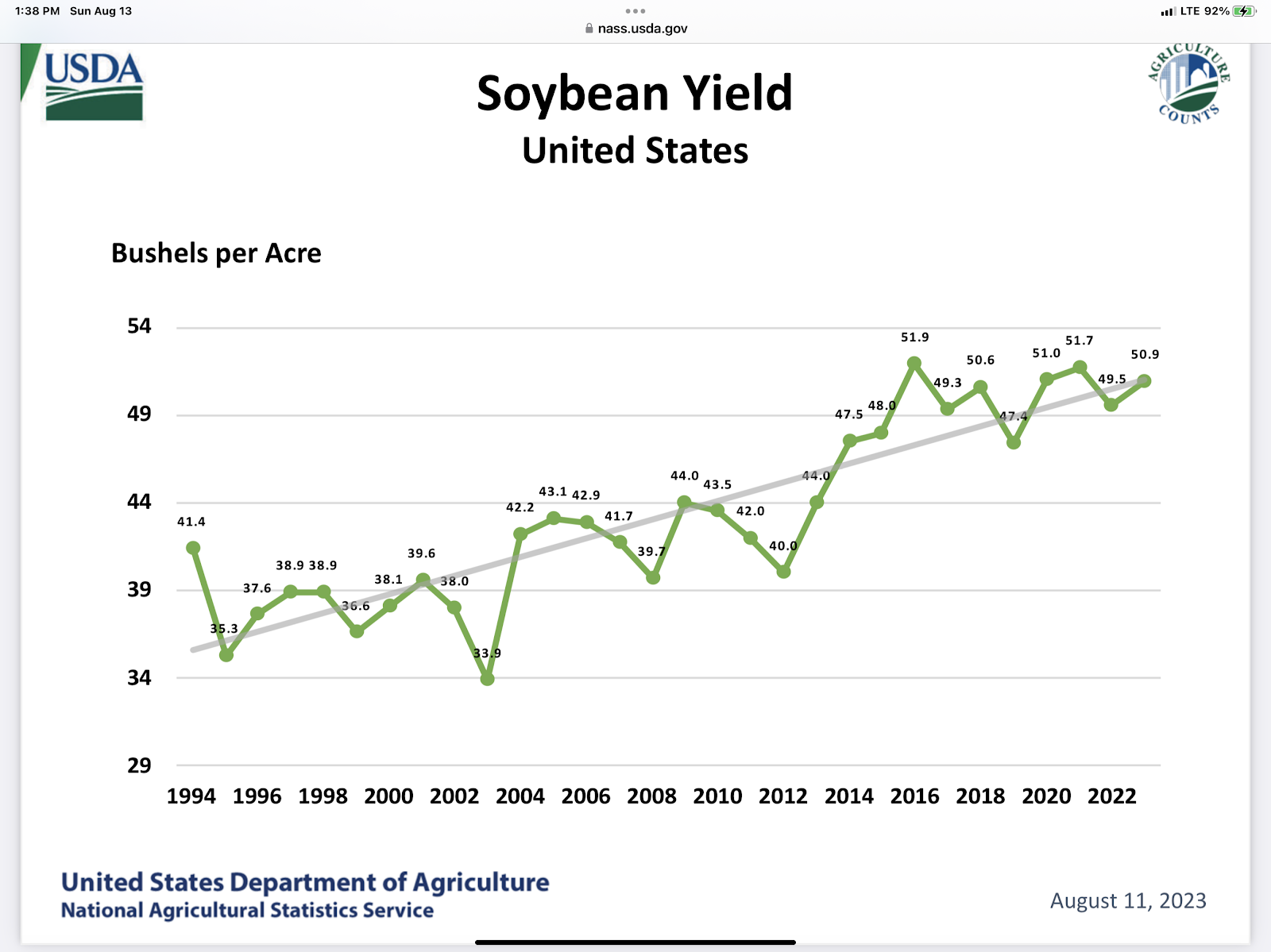

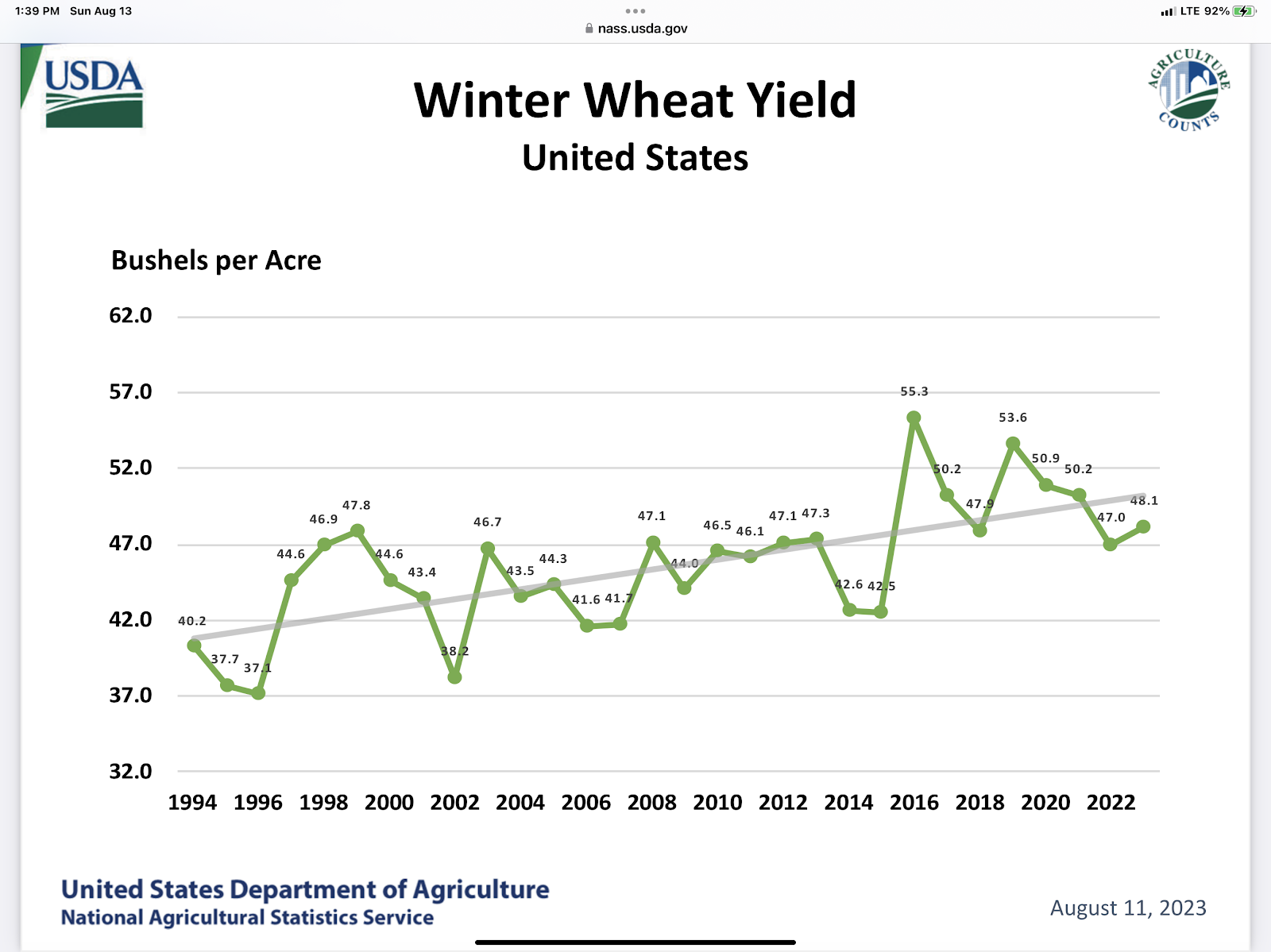

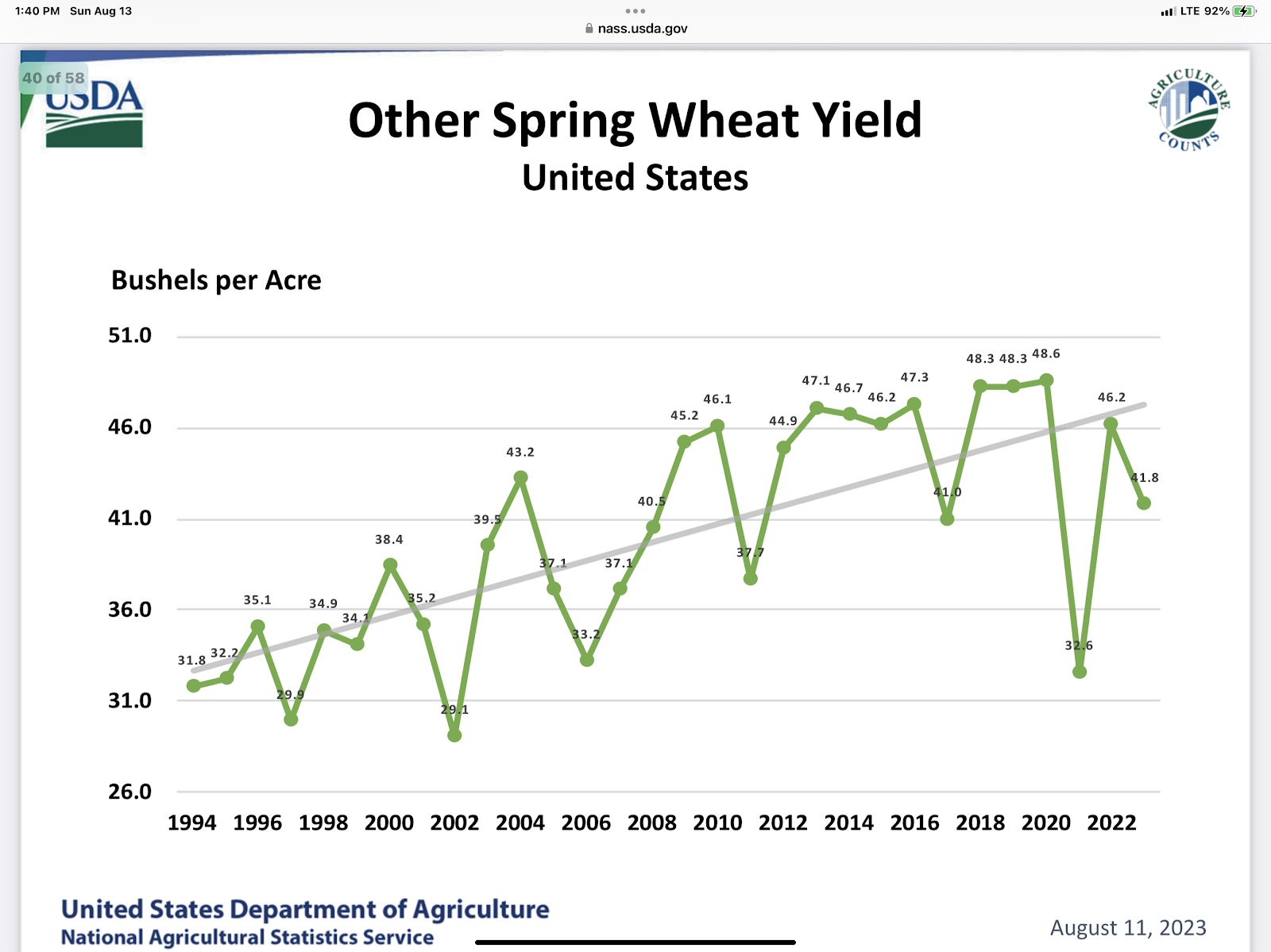

Here are some more screenshots of slides from the USDA.

Notice in particular the sample size. The smaller the sample size the more volatile future reports can be.

As you can see above the USDA report really wouldn't be considered bearish. Neutral to maybe friendly is what most call the numbers. But the price action was not positive.

Sometimes USDA reports will have lagging price action. So that is a little hope that as we analyze the report that more buyers might get interested.

One other possibility is that we can see a technical bounce as the charts are near some support levels and despite Friday’s negative price action we did have markets close above those support levels.

September corn made a new low but right at July 13th low. December corn held the July 13th low but also closed below the 4.91 level which has acted as major support. With the markets oversold giving buy signals on RSI and STOCH we have a possible bear trap set but we will need some sort of catalyst to start the bounce. Perhaps the Black Sea War, perhaps the Pro Farmer Crop Tour next week, or perhaps solid demand, or perhaps other production issues in the world such as the Chinese flooding?

For soybeans the key level to watch will be last week’s lows. If we can hold that level don’t be surprised if we rally going into harvest as the market has priced in a lot of bearish information, the market is still trading a yield higher then what the USDA printed on Friday. Weather forecasts are hot and dry. I don’t expect any more weather rallies to come from US weather unless we get an early freeze. Overall the weather market for the US crop is over or shortly will be as the time runs out on the weather clock.

If demand can continue for soybeans like it has the previous couple of weeks soybeans can and should rally on demand. Demand driven markets are much different then fear of supply shortage rallies. The fear of production rallies typically go straight up and then one of a couple things happen. We go straight back down if the fear isn’t realized, such as the corn drought scare this year. Or we have to get to price levels that curb demand. Sometimes this is done with basis and future spreads.

While a demand driven market tends to be one that just builds momentum that eventually leads to a massive move once the market realizes demand is outpacing supply.

The bean market feels like we have solid demand that wants to grow and grow substantially while at the same time we have the USDA printing lower demand numbers to help offset the lower supply. Don’t be surprised at all if………

The rest of this is subscriber-only content. Please subscribe to continue reading and receive every exclusive daily update via text & email. Scroll to check out past updates you would’ve received.

LAST CHANCE FOR OUR USDA SALE

This is your last chance to lock in this offer and save over $500. Don’t miss all our future updates.

OFFER: $299/yr or $29/mo

WILL BE: $800/yr or $80/mo

Not Sure? Try 30 Days Free HERE

Become a Price Maker. Not a Price Taker.

INCLUDED IN TODAY’S UPDATE

Can the bean market bounce here?

Weather is looking far more bullish now. Will it matter?

Did we get enough rain to make a bean crop? Or will the forecasts lower yield?

What’s going on in the wheat market

Hedging, not chasing these markets

Wheat’s vicious cycle

Will these lower prices create demand?

Black Sea situation

USDA report vs info from the report

Check Out Past Updates

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio

PREPARING FOR THE USDA REPORT

8/9/23 - Market Update

TRADE PREPARES FOR USDA REPORT

8/8/23 - Audio

MARKETS PUT BANDAID ON THE BLEEDING

8/7/23 - Market Update

BEANS SELL OFF WHILE WHEAT RALLIES

8/7/23 - Audio

NAVIGATING WEATHER & WAR YOYO

8/6/23 - Weekly Grain Newsletter