BRAZIL WEATHER WOES: CORN & SOYBEAN PRODUCTION FORECASTS FOR 2023/24

GRAIN PRICE STRATEGIES FOR US FARMERS TO USE BASED ON BRAZIL PRODUCTION

Authored by Google Bard, with guidance from ChatGPT & Jeremey Frost

Introduction

In the face of climatic challenges reshaping its corn and soybean production landscapes, Brazil remains a global agricultural powerhouse. The world’s top soybean exporter and a major corn producer, Brazil’s output significantly impacts global markets. This year, erratic weather patterns are influencing crop yields and market dynamics. For a deeper understanding of these complexities, I recommend reading a related article on Daily Market Minute HERE.

Brazil, the agricultural titan of the south, stands at a crossroads, its corn and soybean production trembling under the capricious hand of weather aka the nasty old lady called Mother Nature! Uncertainties abound, yet amidst the shifting sands, opportunities shimmer for those who can navigate with insight and agility. This is not a season to get fearful like many buyers will try to tell you, but a time for utilizing various tools by understanding the probable yield scenarios and their market implications.

Corn's Uncertain Path: USDA Garbage, late to the game numbers!

USDA paints a cautious picture, (FULL OF LIES and UNREALISTIC PRODUCTION NUMBERS) forecasting a 125-135 MMT corn harvest for Brazil in 2023/24. Conab, however, offers a starker viewpoint, anticipating a 5% shrinkage in acreage driven by unappealing futures prices and high production costs. This translates to potential losses in both first and second corn crops, casting a shadow over yield expectations. El Niño further complicates the equation, its searing touch parching Mato Grosso, the heartland of corn production. Plus acres are simple going away daily for either late planting of beans or a different more profitable crop.

Soybeans: A Beacon of UnRealistic Hope in the Tempest:

While corn stumbles, soybeans offer a glimmer of optimism. USDA's revised forecast hints at a 155-165 MMT harvest, a potential record surge fueled by enticing prices and increased acreage, despite delayed planting in Mato Grosso. Yet, even this potential bounty dances to the tune of El Niño's unpredictable rains, raising anxieties for both early and late harvests. But the reality is that if it stays dry in early January like it has been this crop is going to get super small in a hurry. We will have to see what the USDA tries to feed us on the 12th.

Shifting Sands and Market Implications:

These climatic complexities are driving a significant transformation. Farmers, lured by attractive soybean prices and wary of unpredictable corn yields, are opting for more soybeans and less corn. As they should, but they still have to grow it. And the fact is Mother Nature can be a bitch!

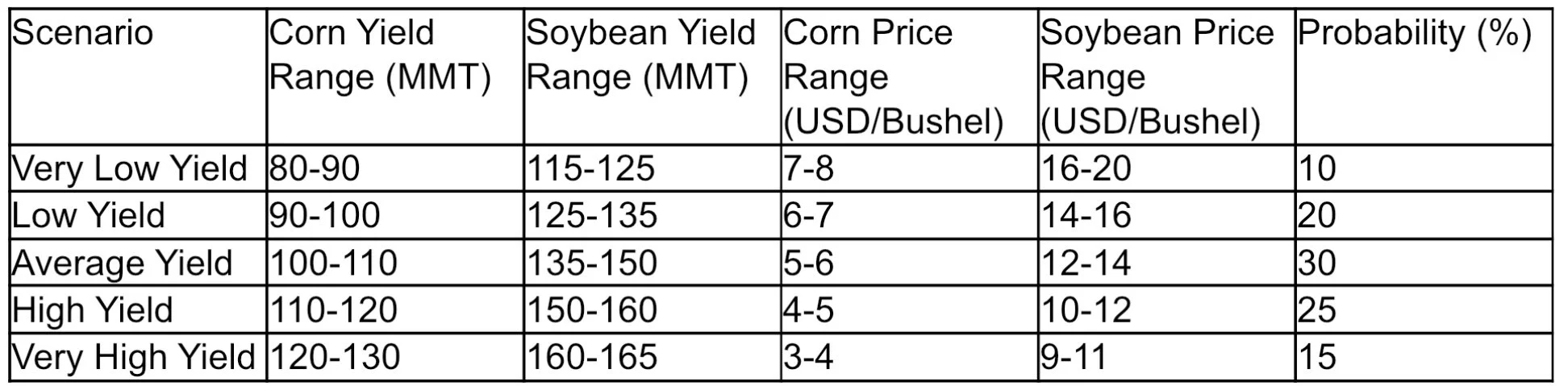

The wide range of possibilities is still open. As is US production in 2024. As the table below outlines, various yield scenarios translate into diverse price ranges for both corn and soybeans, with varying degrees of probability: It should be noted that if the US production ends up extremely high or low the price probability increases on both ends.

Disclaimer: The above table is for informational purposes only. Actual market prices and yields are influenced by various factors, including climatic conditions, global demand, and geopolitical events.

Hedging Your Bets: Weathering the Market Storm

Producers, faced with a dynamic and precarious landscape, can adopt various hedging strategies to mitigate risks and capitalize on opportunities. Depending on anticipated yields, options include:

Very Low Yield: Buying coverage calls, re-owning previously made sales, selling puts to reown, bull spreading futures, buying futures.

Low Yield: Bull spreading futures, buying futures, selling puts at higher strike prices, moderate sales of physical crop.

Average Yield: Balanced approach with a mix of futures contracts and options, selling some physical crop at market price, using options to manage price risks.

High Yield: Making sales of physical crop, selling futures, selling calls, buying puts as a price floor, aggressive marketing strategies.

Very High Yield: Aggressive sales of physical crop, selling futures on rallies, selling calls at higher strikes, buying puts for downside protection, consider deferred sales contracts.

Watch price action between months to get a better idea of what the commercials believe production will be pegged at. If spreads narrow it is a bullish sign, while widening spreads is bearish. The trend of Money flow or the funds will also dictate prices, just remember funds tend to be the shortest at the bottom and the longest at the top. So the use of a trigger to make a grain marketing strategy can help. Whether the trigger is a time trigger or a function of pricing or something that evolves from price movement i.e. a technical trigger such as RSI, STOCH, Moving average cross over etc.

Strategy Disclaimer: These strategies are suggestions based on market analysis and should be tailored to individual circumstances and risk tolerance. It's recommended to consult with Jeremey at 605-295-3100 for personalized advice.

Beyond the Horizon: Making Grain Marketing Plans with Confidence

Navigating the Brazilian grain market in this era of climatic and market uncertainties demands comprehensive understanding, proactive engagement, and access to reliable information. Stay informed with Daily Market Minute (https://www.dailymarketminute.com/), where expert analysis and actionable insights equip traders and farmers alike to navigate volatile market conditions with confidence. Join us on this journey towards informed decision-making and success in the dynamic world of grain marketing.

Embrace the Challenge, Use Proactive Tools that fit your comfort level with futures and options:

Brazil's agricultural odyssey presents a complex and captivating tale, fraught with uncertainties yet brimming with potential. Those who can navigate the shifting sands, interpret the whispers of the weather, and adapt their strategies with agility stand to claim the rewards. This season demands flexibility, not rigidity; proactive engagement, not passivity; and a thirst for knowledge, not complacency.

www.DailyMarketMinute.com: The grain market advisor working for you the farmer, making price makers, while buying fear and selling greed.

The ever-evolving landscape of the Brazilian grain market necessitates a reliable guide. Daily Market Minute serves as your compass, offering:

In-depth analysis: Our team of experts deciphers complex market trends, providing insights into weather patterns,global demand, and geopolitical influences.

Actionable strategies: We go beyond mere data, translating trends into concrete hedging strategies tailored to specific yield scenarios and risk tolerances.

Real-time updates: Stay ahead of the curve with immediate access to breaking news, market fluctuations, and expert commentary.

One on One personalized marketing plans.

Charting Your Course to a Success in Grain Marketing via making sales that Make sense:

The path forward demands more than just knowledge; it requires action. By equipping yourself with the insights and tools offered by Daily Market Minute, you can:

Make informed decisions: Confidently choose the hedging strategies best suited to your farm's unique situation and risk profile.

Minimize risks: Proactively mitigate potential losses and safeguard your income against volatile market fluctuations.

Maximize opportunities: Seize the moment and capitalize on favorable market conditions, ensuring long-term profitability and prosperity.

Become a Price Maker and navigate the futures market fluctuations: Cultivate the skills and knowledge to confidently navigate the ever-changing dynamics of the Brazilian grain market and the CBOT futures markets.

The story of Brazilian agriculture is a saga of resilience, adaptation, and triumph. In this season of climatic and market uncertainties, it is your story too. Embrace the challenge, equip yourself with knowledge, and embark on your own odyssey towards success. With Daily Market Minute as your guide, you can weather the storm, seize the opportunities,and emerge victorious from the unpredictable depths of the Brazilian grain market.

Join us and write your own chapter in this captivating tale. Together, let's navigate the uncharted waters and chart a course towards a bountiful harvest and a prosperous future. While taking back control from Big Ag to become a Price Maker.