CORN TARGETS & CHINA CONCERNS

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video. But the video version gives a better understanding of the charts & targets.

Want full future updates?

TRY 30 DAYS FREE

Comes with signals & 1 on 1 plans.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains mixed as we enter holiday mode.

Not a ton of fresh news out there.

Today was December options expiration.

Next week we have first notice day, but with Thanksgiving on Thursday. All basis contracts will have to be priced or rolled by Wednesday. This could add a little pressure to corn.

As we enter into "holiday mode" in the markets. There is less traders, which means thinly traded markets which can create a lot of choppy price action. Especially in an environment that lacks fresh news. So I don’t expect anything major next week.

One thing we did see today was the dollar hitting 2 year highs. As it continues it's dominate run.

This is not friendly for grains or export business, especially in the wheat market.

Overall, soybeans still have a ton of negative tone as we test those old lows. Today we actually bounced right off of them. (Chart breakdown later)

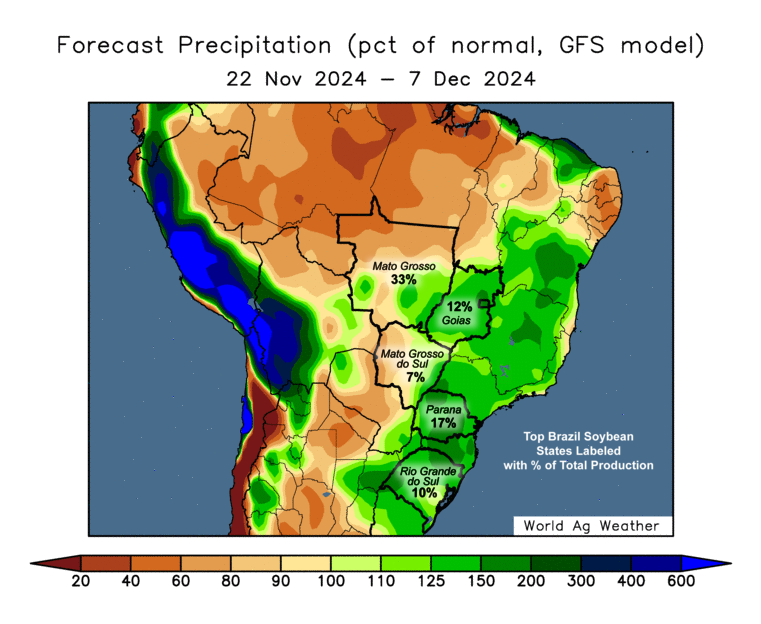

Brazil planting is wrapping up. The forecasts in South America still look ideal. So no signs of any weather scare there.

We have some concerns surrounding Trump's support for bio fuels as soy oil continues to collapse and pressure beans.

Bean oil is down -15.5% since November 11th.

Then of course we have the uncertainty with the trade war news.

Along with that, we have Brazil & China becoming "buddies".

As they signed a trade agreement earlier this week.

We do not know if this includes grains or not, but regardless it's not a friendly headline as it can take away business from the US.

The wheat market gives back some of the recent relief bounce.

The bounce was a combination of technical buying as it was severely oversold, and then we added a little war premium with the Russia & Ukraine headlines.

As always, war headlines are sold.

Let's jump into the good stuff now...

Today's Main Takeaways

Corn

Fundamentally, corn still looks the friendliest of the grains.

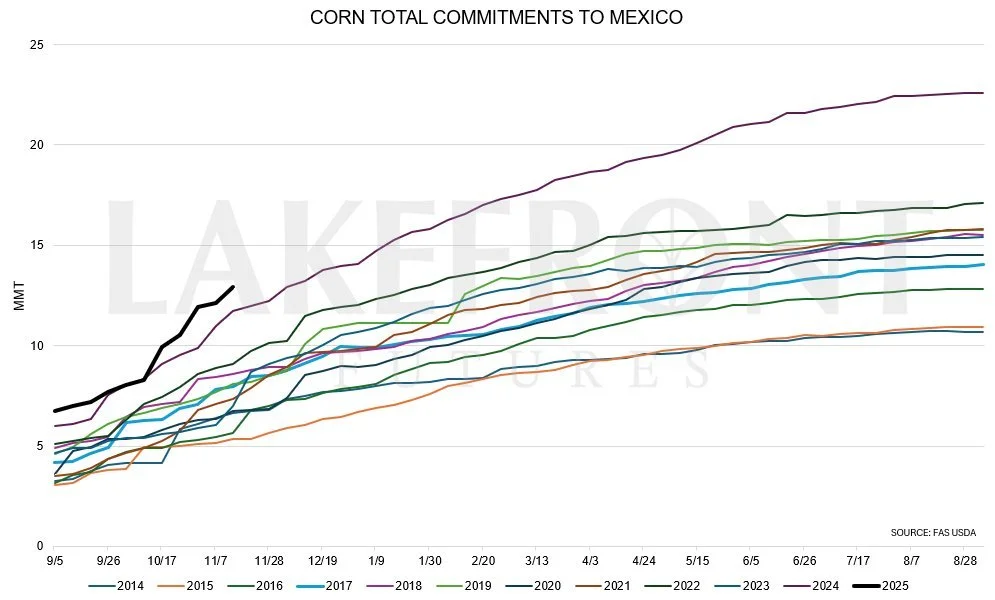

Exports are solid. But we do have to question if that recent demand was entirely front ran, or if it's here to stay.

That is going to be a major wild card. If that demand dries up, it won’t be friendly. But if that demand pace continues, it is a good sign.

Here is a chart from Lake Front Futures that shows our corn sales to Mexico.

They titled it: "Front loaded, sustainable, or both?"

Ethanol production is still one of the friendliest factors to demand. We are well ahead of last year despite the USDA projecting us to be lower. Consensus is that the UDSDA will be forced to raise their ethanol demand numbers.

Orginally, it looked like we would probably be looking at fewer corn acres next year with the high cost of production etc. However, that thought process has somewhat changed.

With soybean prices falling apart, we could easily see some of those acres switch over to corn. So this is one potentially negative factor we have to be aware of.

For now, my bias remains higher longer term. Short term, we could see a little pressure or perhaps some choppy sideways action with the holiday.

*If you have grain you have to move in January, keep puts for protection.

If we look at the chart, my target to re-hedge or make some sales if you need to is still $4.39 to $4.46

If you watch my video I break it down a little further but here is why:

$4.39 is our golden fib extension from the $3.99 to $4.24 rally (161.8%)

$4.41 reclaims 50% of our May highs.

$4.46 is our February lows.

The 200-day MA also sits right up there. In my video I break down the significance of this 200-day MA. But in the past corn prices have rejected right off it several times. It has somewhat acted as a lid. (2nd chart shows this).

200-day MA is the pink line.

Notice, we have rejected off it several times.

IF we were able to continue higher, my 2nd target to look to re-hedge or make sales again would $4.60 to $4.65

Reason 1: We found support here several times in the past. Old support turned new resistance. (That area is circled)

Reason 2: $4.65 us our golden fib extension of the entire $3.85 to $4.34 rally (161.8%)

Reason 3: We have a volume gap (shown on the right)

Reason 4: We have a LONG term trendline that we have heavily respected. That trendline also comes in around this area. (Blue line)

Soybeans

It is still hard to make a bullish argument for soybeans.

Could we get a……………..

The rest of this is subscriber only..

IN TODAYS UPDATE

Possible spot to take off risk in beans

Brazil more bearish than trade war?

China economic collapse

Wheat breakdown

TRY 30 DAYS FREE

Completely free for a month.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24