HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

MARKET UDPATE

In todays update you only get 2 small portions of the update. You get the seasonal outlook for soybeans & the possible downside risk objective for soybeans.

You miss the entire corn update, entire wheat update, downside risk objective in wheat & more.

Todays video version is subscriber only*

Want Full Access?

30 DAYS FREE: CLICK HERE

UPDATE PREVIEW

Soybean Seasonal Hope

Seasonals are not perfect, but the bean seasonal gives bulls some hope.

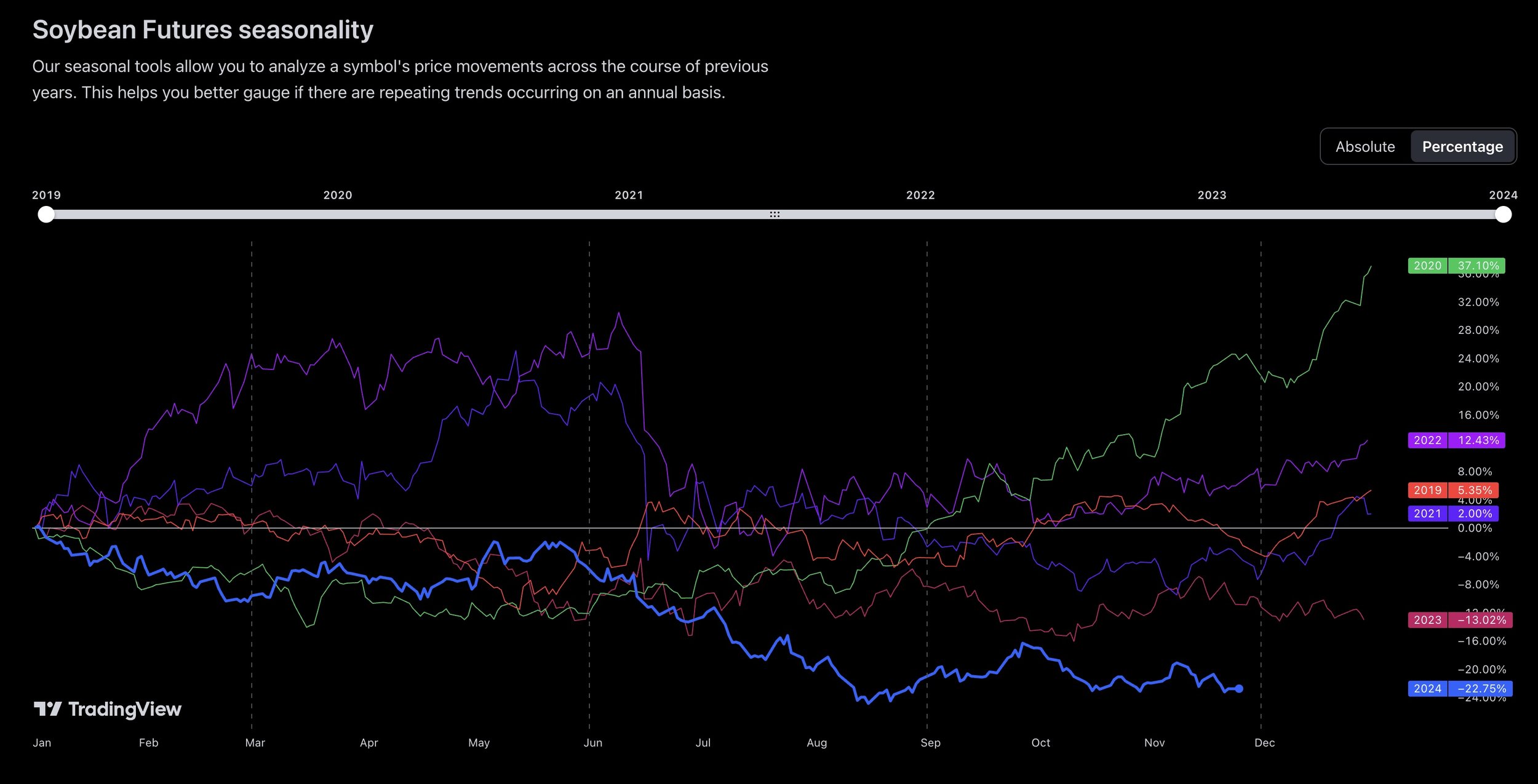

Here is the past 5 years of soybean prices.

From Top to Bottom:

2020: Green

2022: Purple

2019: Red

2021: Violet

2023: Pink

2024: Blue

Every year except 2023, we bottomed around the first of December and rallied throughout the month of December and into January.

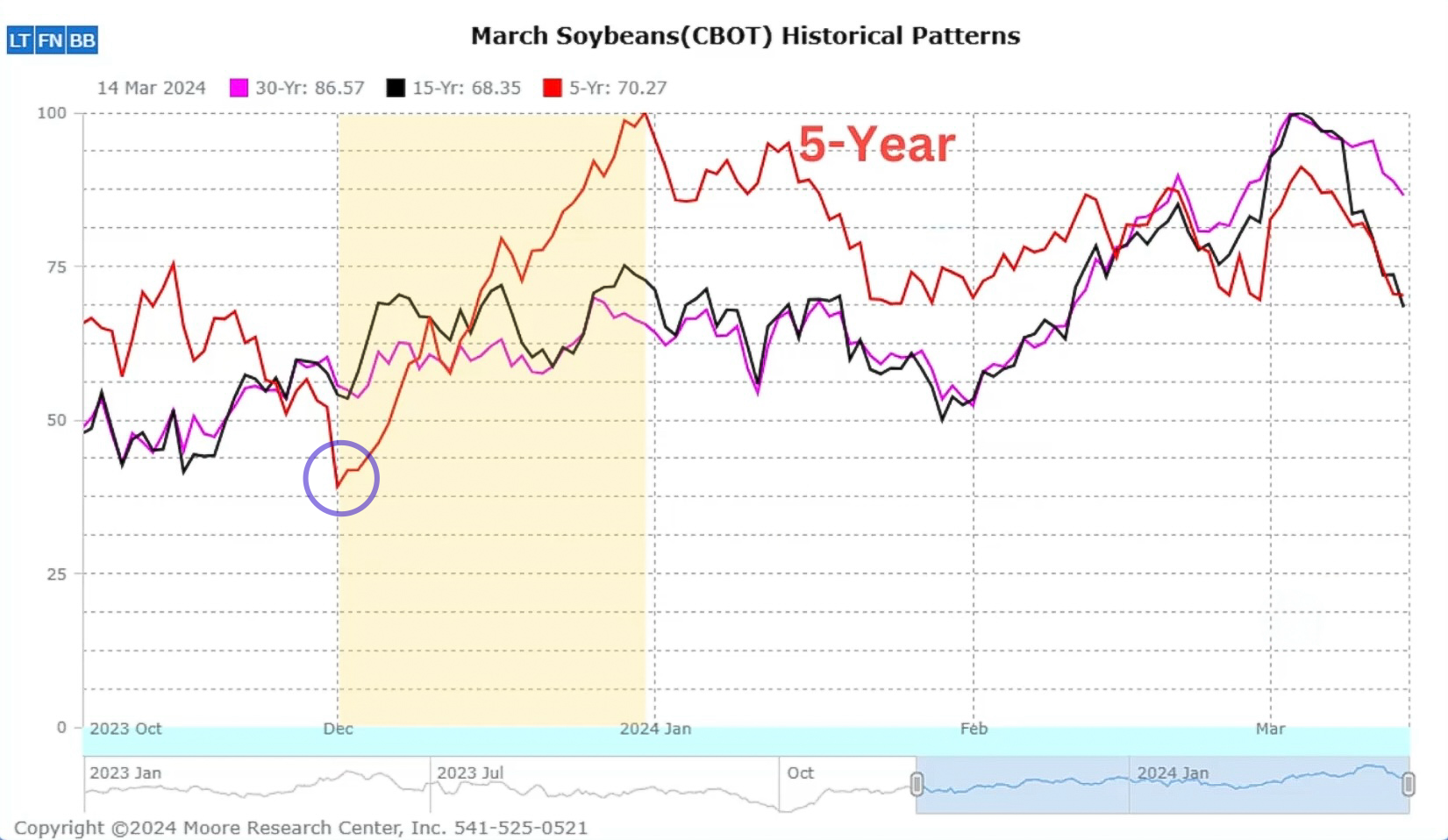

Now here is some data from Moore Research.

The red line is the past 5 years.

The black and pink line are the past 15 and 30 years.

Back a decade ago, Brazil wasn’t this huge player in the bean market. But now they are.

So we have essentially created a Brazil weather month for December, similar to the US and June.

Since Brazil has become a bigger player, the past 5 years we historically bottom on December 1st and rally into January.

In the 15 and 30 year seasonals, we do not see that rally. We went more sideways as Brazil wasn’t this major player.

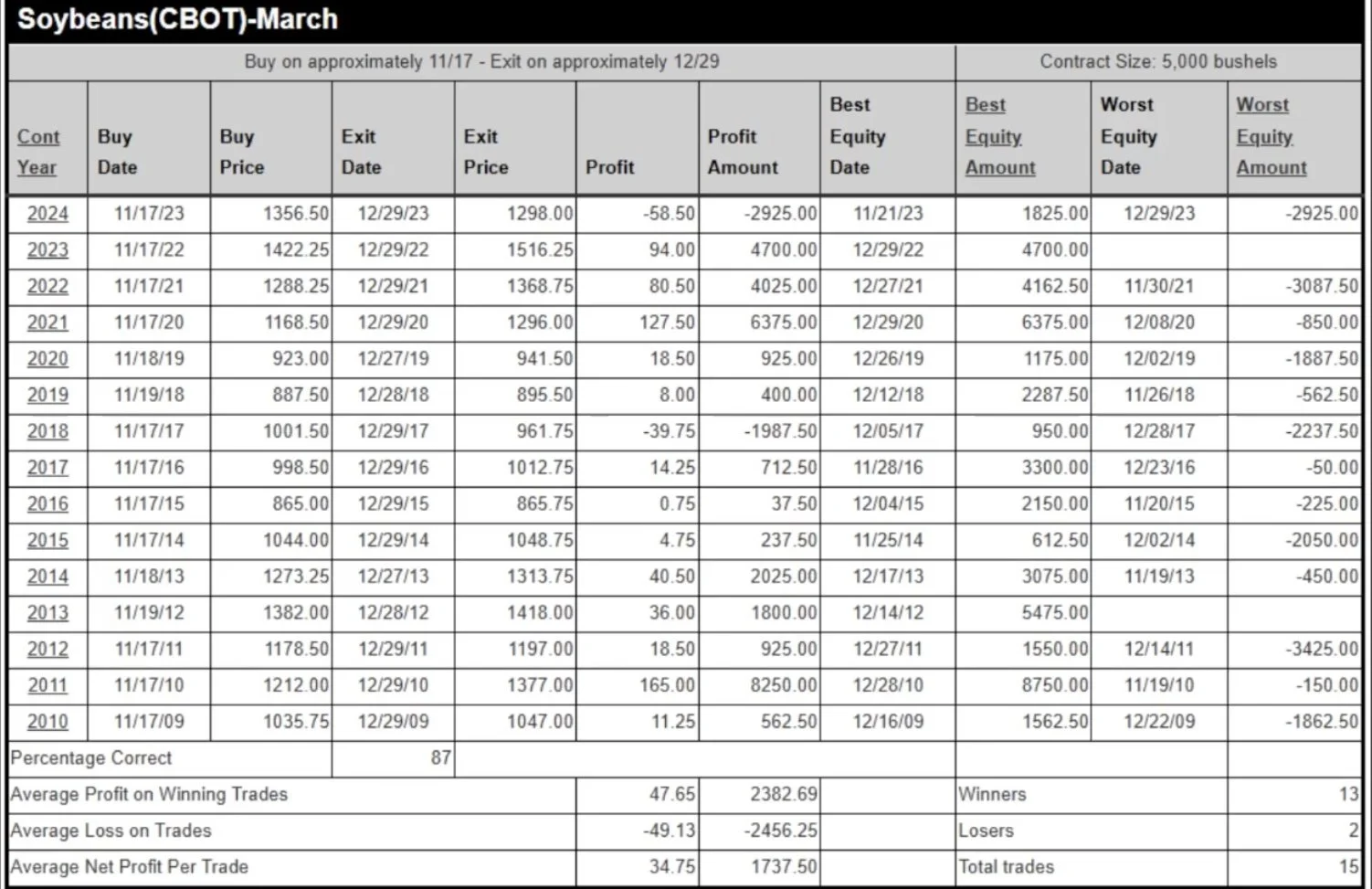

Here is another study done by Moore Research.

They go long soybeans on November 17th, and close the position on December 29th.

This trade has been a winning trade the past 13 of 15 years.

The only years it was a losing trade were 2023 and 2017.

Soybeans do not have to rally from here, but the data says history is on our side.

If this rally occurred, it would likely be……..

…..even without a trade war, if Brazil has this huge crop, that alone could send prices much lower.

I REALLY want to see us hold those contract lows.

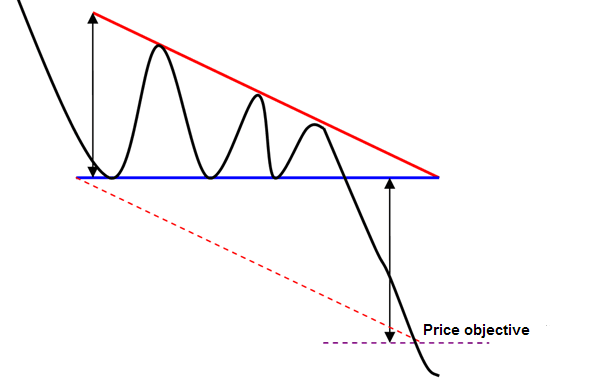

PURELY based on technical patterns, we are sitting in a descending triangle. The implied move if we were to bust below this support is well below $9. Something to be aware of. (Desending triangle pattern below).

To negate this pattern, we need to bust that downward trendline.

My next spot I am looking to re-hedge or make a few sales will be if we can crawl up and test that downward black trendline.

Here is an illustration to show you the potential implied move for beans.

The patterns says the move to the upside usually sees an equal move to the downside.

From the lows of $9.74 to the highs of $10.87 was a $1.12 upside move.

So the downside target would be $9.76 minus $1.12 = $8.64

I really hope this does not happen, but you have to be aware of all possibilities and what the charts say.

If this move did happen, it would take us back to those trade war levels where $8.50 was essentially our floor.

Wheat

Wheat hammered today, as we…………

Want full future updates?

TRY 30 DAYS FREE

Our daily updates, signals & 1 on 1 plans.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24