MARKET UPDATE

Futures Prices 11:30am CT

Overview

Grains were mostly higher this morning led by good exports from wheat this morning, where they came in above trade estimates. Corn on the other hand had very terrible sales. The lowest we've seen for a week since 2012. Despite prices higher this morning and the good exports from wheat, similar to yesterday, prices have now gave back their early gains. As the grains are now all trading in the red.

Today's Main Takeaways

Corn

Corn trading a few cents lower followed by their absolutely terrible export sales which came in this morning. Coming in at 0.264 million tonnes after an estimate between 0.35 - 1.0 million. This is the lowest week we've seen for corn sales since 2012. The pace of corn sales is just disappointing right now. As they are -243 million bushels (-11%) below the USDA target pace.

Currently corn is down -4 and a half cents trading near the very bottom of its trading range. Trading roughly -9 cents off its highs.

Corn continues to trade sideways in a very tight range due to lack of really any fresh news to move the markets either which direction. Some think this tight trading range is a good sign of things to come and could ultimately lead to prices seeing a break to the upside. Another argument to be made is that globally we have the possibility to see less corn acres being planted due to how expensive everything is, and perhaps more growers look to plant less expensive crops. Thus leading to less corn supply.

Weather is looking decent for the most part right now. But we do still have the chance for any weather concerns down to the road to boost prices.

We also have the Russia and Ukraine situation as well as recession concerns both being factors in the market. The UN is claiming that Russia is going to go ahead and renew the deal. We will have to see how this situation actually plans out. If the agreement is made we could see prices come under some additional pressure.

Ethanol

Ethanol stocks increased 2% to 22.3 million barrels a day. Which is nearly +12% higher than a year ago.

Estimates for corn used for ethanol was set at 103.8 million bushels. The needed weekly average to meet the USDA forecast is 102.2 million.

Dec-22 (6 Month)

Soybeans

Soybeans are slightly lower here this morning. Unlike corn and wheat where export sales came in well below or above estimates, soybeans came in slightly lower than the average estimate. Coming in at 1.026 million tonnes. Estimates were 0.8 - 1.6 million. But this number was more than half of what it was a week ago. Chinese were the biggest buyers.

Soybeans initially trading higher, but giving up their gains. Sitting roughly -15 cents off its highs of $13.94 1/4. Currently down to $13.79 1/2 as of 11:30am CT.

Similar to corn, soybeans currently trading in a pretty tight range. Yesterday we were able to see prices move above the 20-day moving average. Obviously the bulls would love to see a close above the $14 level which is remained a strong resistance. Yesterday prices got close before giving our gains back. We can't seem to even have the Jan-23 beans move past $14 let alone the Nov-22 contracts.

One thing we should be keeping an eye on is the China covid situation. As they announced they will be revamping their zero covid tolerance policy. Locking down multiple cities, including Guangdong which is one of their largest cities. We will have to wait and see if this puts a ripple in demand out of China.

We also have to keep in mind that a large crop is expected out of South America. As they are looking to be somewhere around 40% complete for planting. We of course have the potential for weather to make some headlines and help support prices. But if not, this large crop could negatively affect demand.

The strength from soyoil remains to be a supportive factor for the soybean market. As soyoil hit another new high yesterday.

Soymeal & Soyoil

Soymeal up +5.4 to 414.1

Soyoil down -1.38 to 72.04

Soybeans Nov-22 (6 Month)

Wheat

Wheat trading lower his morning following the release of the export sales this morning. Where wheats sales came in above trade estimates at 0.533 million tonnes. Estimates were around 0.1 - 0.45 so a pretty good number for wheat. This was actually the third highest we've seen out of wheat this marketing year.

Despite the great export sales, wheat along with the rest of the markets is trading lower following prices higher this morning. Wheat is around -22 cents off its highs. Trading in a pretty wide range.

The UN announced a statement saying that they fully expect the export agreement with Russia and Ukraine will be extended. If the deal is made, prices will likely see a slip. But we also have to keep in mind the long term damages that were made, and just how big of an impact long ter the war has had.

We have to take a look at Argentina cutting wheat production with their recent drought. They've lost about 1.3 million metric tons of wheat just in the last couple of weeks due to their conditions. However, they are still looking at one of their largest crops they've ever had. Supply-wise, Russia still has a good amount as does the U.S.

Wheat is nearly a dollar off its highs we made several weeks ago. Maybe wheat has finally found a bottom after a month long of lower prices. We did issue a wheat buy signal on Monday which is still in effect. So our personal opinion on wheat leans to the bullish side.

Listen to yesterday's audio - Is wheat set up for a rally?

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +1.55 to 89.46

Dow Jones up +335

Dollar Index up +0.698

Cotton down -2.70 to 75.12

News

Chine revamps their lockdowns. Committing to their zero covid policy.

U.S. Q3 GDP rises more than expected.

Jobless claims rise again, just slightly

Grains get halted at Mississippi river elevators

USDA's foreign agriculture service forecasts Argentina 22/23 corn crop -3 MMT below the official estiamte

Livestock

Live Cattle up +0.075 to 153.650

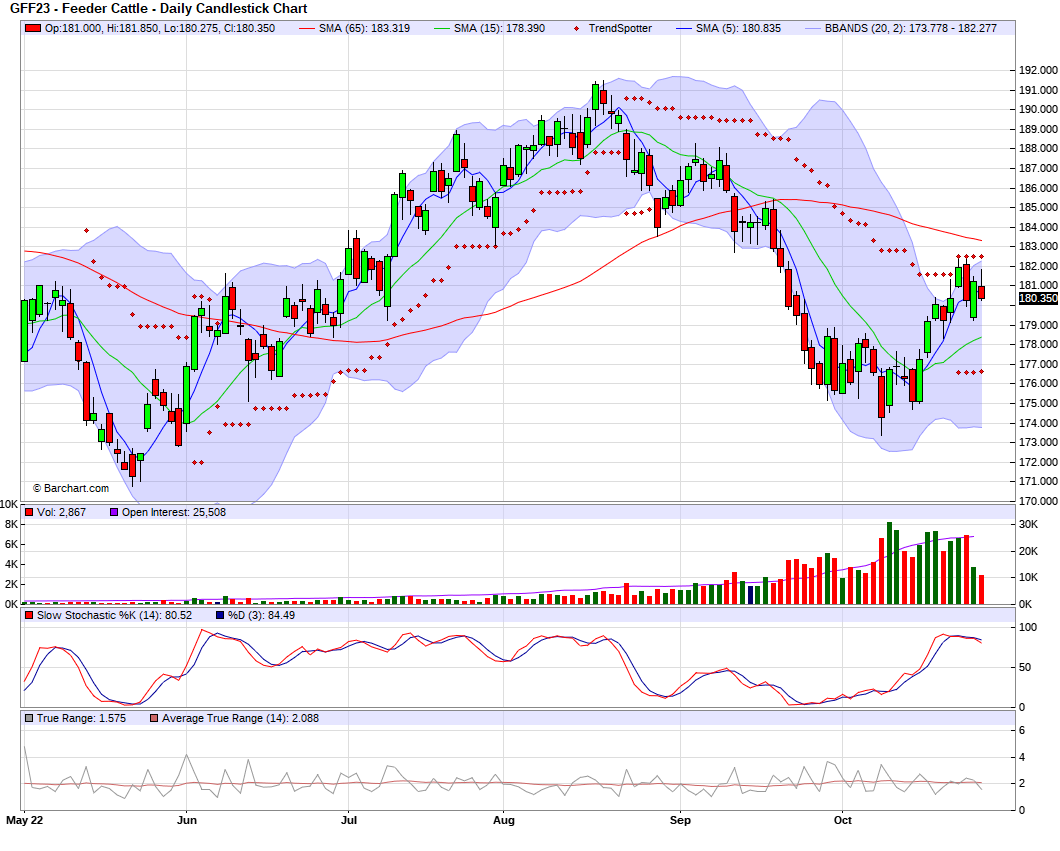

Feeder Cattle down -0.150 to 181.100

Live Cattle (6 Month)

Feeder Cattle (6 month)

Precipitation Forecast 2-Day

Weather

Source: National Weather Service