RUSSIA SUSPENDS GRAIN EXPORT DEAL

WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless grain market comments for www.dailymarketminute.com

Last week I mentioned that I was going to be talking about emotional, technical, or fundamental factors triggering price moves. Most market advisors say that we have two forms of analysis, technical and fundamental. Which one drives the other usually ends up as a chicken and egg type of debate.

I like to add emotional analysis to the mix. What I mean by that is a hyper over sensitive reaction. Everyone, especially my wife and family, know that when one gets emotional they can do or say things that maybe they shouldn’t say or mean. When emotions get involved in a trade or in a grain marketing plan one can stick with their emotional thoughts on the markets with little consideration of changing technical or fundamental factors.

What are fundamental factors? Supply and demand, carryout, basis, yield, acres, future spreads, local supply, etc. The list goes on and on, but the head of the list for commodities like corn, wheat, and soybeans is simply projected carryout. Some prefer to look at carry out in terms of days of carryout left. Others look at magical numbers in raw terms, for corn a billion bushels is something that has rarely been printed.

I will make the statement that the biggest fundamental factor for any investment is simply money flow, do we have more buyers or more sellers? More overall money looking to buy or looking to sell?

Technical analysis is one of the biggest self-fulfilling prophecies in existence. It involves looking at charts and adding various measurements of price moves to get various points of support and resistance. If one is unfamiliar with technical analysis go to barchart.com and pull up any commodity or stock. Then click on the technical chart. You will notice that one has everything from trend lines, to Fibonacci, to Gann, to moving averages, RSI, STOCH, etc.

You then have technical analysis for various time periods for charts. I have seen charts that have ranged from 5 seconds to 5 years for every little bar or candle. You then have various types of charts, such as a bar chart, a line chart, a candlestick chart, etc.

As I hinted to, so many traders use various technical trading analyses that they tend to work. On days when one reads commentary as to why the market did what it did, when no fundamental highlights happen usually the answer is technical buying or technical selling, along with fund buying and selling.

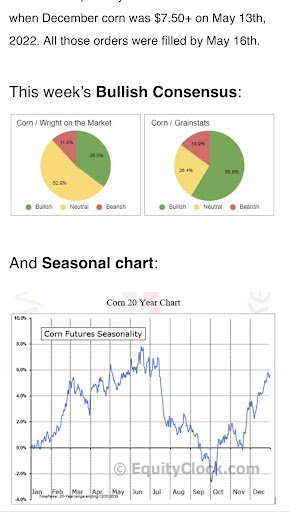

A couple other big factors when trying to decide what a commodity will do and why include seasonal tendencies and money flow. Seasonality is where price action tends to do the same thing year after year at the same time.

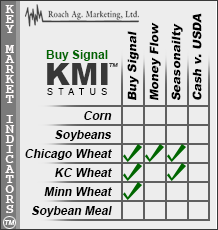

Let’s look at some of the most popular grain advisor’s out there. Take Roach Ag, they issue buy and sell signals based on RSI and STOCH, basically when the market goes up too much or down too much it becomes overdone and that causes them to issue buy or sell signals. A few years ago they added boxes for making the buy or sell signals stronger or weaker. Here is a screen shot I saw the other day from Roach Ag. You will notice that CBOT wheat has buy signals with 3 boxes checked, the first being RSI/STOCH, the next being money flow meaning that the funds are short wheat, and the other checkmark being seasonality. Meaning wheat typically goes higher this time of the year.

Here is what Google had listed as the DTN Six Factors

Here is what Wright on the Market had for his recommendations.

My point in all of these is that these advisors as well as nearly every other one out there is going to talk about and mention factors such as seasonal trends, fundamentals, technicals, and money flow/funds.

So as farmers and as grain market advisors we all probably realize most of these factors that dictate price. But where one tends to drop the ball so to speak is the emotional side of marketing. What I mean by that is emotions tend to get involved and make one try to stick with a trade or grain marketing plan even though perhaps technicals and fundamentals have changed. The other thing emotions do is they lead to one selling too soon, plus they lead to markets overdoing price movements.

Take the Roach Ag method of selling, it's great when a market goes up and down, but when a market keeps going down or keeps going up, they tend to be way too early in making sales. Now on average and historically they are still doing great. But they are always going to start buying too soon in down markets, and selling too early in up markets. For some guys that is ok, for others it is leaving millions and millions of dollars on the table.

So what is the emotional factor that goes into price movement? Sometimes it is the whipsaw price action that happens to markets that go sideways. A market starts going up, and then one feels they missed the rally, so they buy the market in some shape or manner. Then before you know it the market reverses and goes back down, causing them to puke out of the long that they had established. Or they jump on the bear camp that the sky is falling and that the investment tool is going to go to zero, so they sell or get to the short side. Only to realize that it’s old news that has driven the market down and they were the last to sell and we have run out of sellers, at least until some sort of technical or fundamental news comes out to create additional sellers.

The most powerful markets, the ones that get super explosive tend to have all three pricing factors going in the right direction.

Wheat could be that market that will have all three big factors moving in the same direction.

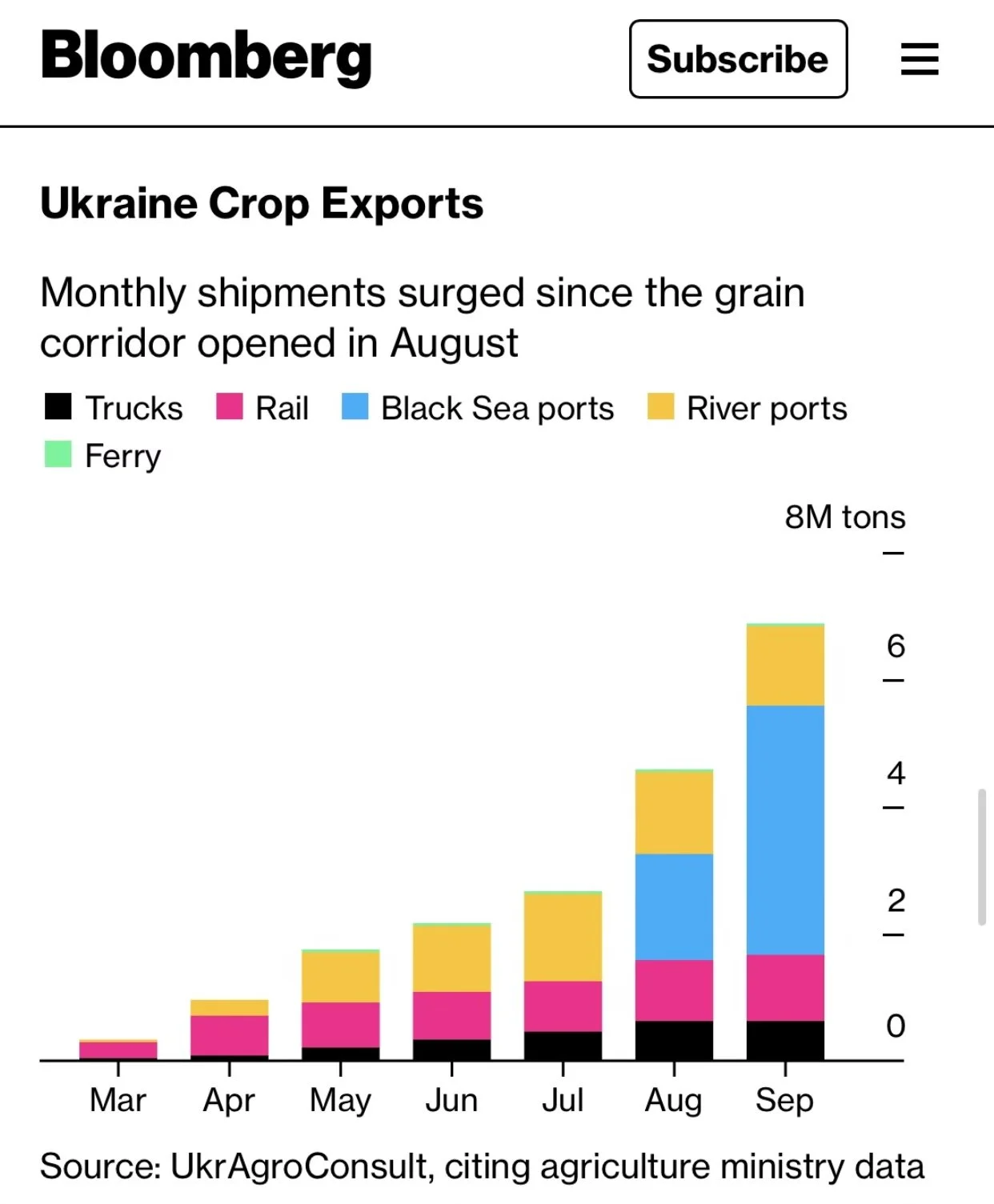

Let’s look at some news that hit yesterday regarding something that could very well be an emotional type of news, that was Russia suspending the Ukraine export deal indefinitely. So this advisor looks for the markets to be rocking and rolling when they open Sunday night. This news could very well lead to a limit-up type of move in wheat. Fundamentally nothing has changed yet, but this obviously could lead to more business for the US and lead to a longer term fundamental change via more demand for US wheat leading to a smaller US wheat carryout. Plus depending on what happens with the 170 vessels that are still trying to leave the Black Sea, it could have a major impact.

So the news in Russia - Ukraine could lead to improving demand for US wheat and better fundamentals. Technically what could it do? Well if we gap higher like it looks like wheat will when we open Sunday night the charts are going to look like we had a bear trap last week, plus they will look like they bounced off of various technical support such as Fibonacci retracement levels. Take a look at Sebastian’s chart below.

Next is money flow, as Roach Ag mentions in their buy signal we have the funds short wheat. The news could easily move the funds from short to long in a hurry.

What about emotions? If one was short wheat will this news be emotional enough to get on to cover? Will it bring out money that is not invested in the wheat market?

Here is what Wright on the Market had to say over the weekend www.wrightonthemarket.com.

“The Russians just removed 12 to 18 million mt of wheat and 30 to 35 million mt of corn from the world marketplace. That is 16% of the world carryover of wheat (not counting China’s carryover, which will never come to the world market) and 32% of the world corn carryover (minus China).

We recommended canceling all sell orders for wheat several weeks ago and still do, but we do not recommend canceling the order to sell corn when December reaches $7.24. Yes, we think corn futures will eventually exceed last spring’s high next spring, but a lot of things can happen between now and then. If prices do go way up, you can buy puts next spring and make the money on the way down you did not make on the way up.

The Ukrainian grain export “corridor” was closed yesterday by Russia after Ukrainian drones struck the Russian Black Sea military port of Sevastopol in the southeast area of the Crimean Peninsula. Two Russian vessels received minor damage.

The Russian Ministry of Defense reported nine drones and seven autonomous maritime unmanned vehicles were involved in the attack on the Russian Black Sea Fleet with British drone specialists training the Ukrainian military how to execute the attack act against the very ships involved in ensuring the security of the export of agricultural products from Ukraine.

Russian News: The ships of the Black Sea Fleet fought off a drone attack in the Sevastopol Bay on the morning of October 29 for several hours. As a result, all unmanned aerial vehicles were shot down. No one was hurt during the attack, and civilian infrastructure was not damaged.

Russian authorities have repeatedly criticized the implementation of the corridor agreement as grain was not going to the “starving children” of Africa. Only two of the first 80 shiploads went to Africa; the majority went to Turkey and Western Europe. Putin compared the actions of the European states with the colonialists and declared the deception of developing countries. “With this approach, the scale of food problems in the world will only increase,” the president said.

We expected the grain corridor to be closed before the contract ended on the 19th of November. However, all the pro-Ukrainian politicians and media reported everything was going as planned and negotiations to extend the deal were progressing well. Russians were complaining almost from the beginning. Media reports ignored the fact that Russians and Ukrainians are killing each other. When someone is trying to kill you, you are not very agreeable to anything other than to kill your enemy first.

It appears to us the market was very confident the corridor would remain open into the spring of 2023. Funds have been adding to their short wheat positions the past month because, with Ukrainian wheat available to the world market, there is plenty of cheap wheat from the Black Sea area leaving North American wheat producers isolated until all the cheap wheat is gone, which most certainly would not be until March or maybe later because Russia harvested the biggest crop ever by a whopping 14 to 15 million mts (about 16%).

Black Sea wheat guru, Andrey Sizov tweeted last evening: "Not sure why funds were shorting wheat all October... good luck with those 37,000 shorts, you will need it."

Russia has asked for a meeting of the UN Security Council on Monday and said it will donate a half million mts of wheat to hungry people.

Daily Trading Limits for Monday:

Corn $0.50 (expanded $0.75)

Soybeans $1.15 (expanded $1.75)

Minneapolis Wheat $0.60 (expanded $0.90)

KC Wheat $0.70 (expanded $1.05)

Chicago Wheat $0.70 (expanded $1.05)

Effective Tuesday, November 1 Daily Trading Limits:

Corn $0.45 (expanded $0.70)

Soybeans $1.00 (expanded $1.50)

Minneapolis Wheat $0.60 (expanded $0.90)

KC Wheat $0.65 (expanded $1.00)

Chicago Wheat $0.65 (expanded $1.00)

Brazil will (try) elect a president today. The choice is between a conservative incumbent loved by agriculture and business or a hard core socialist loved by everybody else. The result will have a dramatic impact on the exchange rate of their currency, which will have a dramatic impact on the value of Brazil's corn and soybeans exports relative to US commodities.

There were 440 beans assigned for delivery Monday. To date is 18 August 2022.

To read Tech Guy Comments and Opening Calls please visit their blog: https://www.wrightonthemarket.com/blog/categories/reports

If you want to receive email notifications when Tech Guy make his posts in our blog, please follow him on our website. You can read instructions how to follow him here:

https://www.wrightonthemarket.com/post/how-to-follow-tech-guy-s-posts

My view is that wheat prices could easily be locked the limit up plus I am sticking with my predictions of $11.00 wheat by the end of the year, along with new all-time highs for soybeans, soybean oil, corn, and wheat in 2023.

Sunflowers

Look for sunflowers to strengthen with the Russia-Ukraine news longer term, but short-term buyers are not yet having to compete. I think we are about two-three weeks away from sunflowers changing back to a sellers market. The yield reports are great in most areas which might keep a lid on prices for the short term, but longer term I look for the US to get some crush oil business that it hasn’t had in years past.

If you need to move some nearby sunflowers because you don’t have enough room give Wade a call at 605-870-0091 or Jeremey at 605-295-3100

Take a look at the following couple of screenshots and notice the headline that 17% of the Global Sunflower oil trade was hit by the terminal that Russia hit nearly two weeks ago.

So growers that don’t have to move sunflowers, please do not do a disservice to the rest of the sunflower growers and sell product to someone like GH that will not probably take it when they indicate they will take it anyways. If it is in the bin be patient and make some of these buyers pay up. Otherwise, wait patiently and let the crush come back in.

Sunflower prices will bounce back from the low bids that are presently being bid. They are going to bounce back a bunch.

Basis

Basis is strong in many areas of the country due to a lack of a crop and the fact that we have yet to use the USDA magical pencil to trim demand for the billion plus bushels for corn that we need to be trimmed, because it is not there to use.

Basis will get stronger in the east as harvest gets done and the grain gets pulled to the west. Once grain is in the bin it should be harder to come out.

Challenge

Last week I challenged farmers to focus on becoming a price maker instead of a price taker. That challenge remains. Next time you think about asking an elevator for a bid, consider giving them an offer before they can even give you a bid.

Once farmers realize that they have the power to become price makers instead of price takers their wealth will go up tremendously. We do not have the type of markets nor the same players we did decades ago, the landscape has changed. In this version of Meta farmers are in control once they WAKE UP AND REALIZE IT.

Don’t forget it and do not let buyers scare you into fear selling, billions of dollars will be lost by farmers this year from selling too early. Don’t be one that sells too early. Wait for the clues in the marketplace, wait for the rally to happen that happens every year on some sort of fear of production shortfall. Then be prepared to take some risk off the table.

If you like what you are reading please go to https://www.dailymarketminute.com/store and subscribe while it is still on sale or click here.

Free Grain Marketing Plans

A couple other updates, please check out our Grain Marketing Plan page. Fill out the questionnaire and I will send you a recommendation for a marketing plan based on your answers. Free.

Check out our all-new Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

To get your business listed in our Ag Directory simply contact me at 605-295-3100.

Commodities Overview by Sebastian Frost

Overview

Friday we saw mixed prices for the grains as corn and wheat closed out the week ending the day lower, with soybeans higher. Wheat was lower with rains putting pressure on prices and ultimately pulling corn down to end the day. This led to wheat seeing its lowest prices in over a month. However, these low prices likely won't last much longer as there was Ukraine and Russia turmoil over the weekend. As Russia suspends its participation in the UN-brokered grain export deal with Ukraine.

Some other key factors to look out for this week are; South American weather, U.S. drought conditions, the Mississippi River, China, and the overall outside markets.

Today's Main Takeaways

Corn

Corn ended the week off just lower by -1 1/2 cents, trading in a tight range Friday. Overall trade for the week was very choppy. As corn ended -3 1/2 cents lower on the week. Corn has continued to trade in a very tight range, and we only traded in a 12 cent range last week. Everyone is anticipating the next USDA report, which is the Supply & Demand report scheduled for November 9th.

With the news of Russias decision to suspend its participation in the UN grain export deal surrounding Ukraine. We will obviously see wheat higher, and corn will likely follow higher as well.

Outside of the export agreement situation, corn is still facing some other problems. We continue to see a lack in demand and very sub par exports. As last week we saw some of the worst exports in nearly a decade. So the demand story isn't great currently but this could certainly change. But bottom line is, prices will almost certainly open higher here this week, and we will have to see how the rest of the week plays out after the initial shock of the news dies down.

We also globally have the possibility to see less corn acres being planted due to how expensive everything is. So we could see more growers look to plant less expensive crops. Which would lead to less corn supply.

As for weather, here in the U.S. most arent expecting any problems as harvest continues to move along fairly fast. Focus will start to shift more to South American weather headlines.

5-Day Change

Dec-22 Corn: -3 1/2 cents

Dec-22 Corn (6 Month)

Soybeans

Soybeans ended the week off higher on Friday, and closed roughly 18 cents off its early lows. Which was a very great way for soybean to close out the week. Overall, the trade was fairly sideways similarly to corn. As soybeans ended -7 3/4 cents lower on the week.

One concern we are seeing a lot of surrounding the soybean market is overall Chinese demand. As there was rumors that China might not have enough cargoes to carry soybeans for Nov-Dec. So this is causing some doubt with soybean purchases from China in the coming weeks.

Outside of demand, another thing people will be keeping their eye out on is South American weather. If we get weather scares we will see prices higher. But then again, there is the possibility we don't get a weather scare. If we don't it might be tough to find another major bullish catalyst to push prices higher. Especially given the record crop expected out of South America. The current outlook for South American weather is looking okay, and Argentina has seen an improvement over their drought they recently experienced.

Lastly, one last thing to look out for is the China/Covid situation. As they recently locked down one of their biggest cities. Following the announcement that they will revamp their zero covid policy.

5-Day Change

Nov-22 Beans: -7 3/4 cents

Nov-22 Soybeans (6 Month)

Wheat

Wheat ended the week off lower, hitting their lowest prices in over a month. All wheat trading much lower on the week. However, Russia announced it would not be renewing its export deal. So things may get interesting, and prices we very much likely not stay at these low levels when markets open. If headlines hold true there is a good possibility we see wheat trade limit up tomorrow.

Regardless of the other factors that would typically effect the wheat market, we obviously have the Russia and Ukraine situation which will be the main focus surrounding the wheat markets tomorrow. As it was announced Russia will suspend its participation in the UN grain deal with Ukraine. This came after the drone attacks on Sevastopol. The Russian foreign ministry said the country has suspended its participation for an "indefinite period of time". The markets must have been pretty optimistic on the deal being renewed and corridors remaining open until spring, with funds continuing to add to their short positions. So the consensus thought here is that wheat massively rallies at open with this news. As this headline has been a highly anticipated factor. Additionally, last week on Wednesday, Oct. 26th we sent out a wheat buy signal. Things have certainly changed since then but if you would like to take a listen you can do so here.

Outside of the Russia/Ukraine headlines. We still have a few other factors in the markets, most of which will likely be ignored tomorrow. But weather will be the other big story in dictating the direction of wheat after this news cools off. We have the drought concerns still looming in the U.S. as nearly 75% of U.S. growing area are experiencing drought.

We also have the recession concerns and strong dollar which will continue to be a factor in the markets.

5-Day Changes

Dec-22 Chicago: -21 1/2 cents

Dec-22 KC: -23 1/4 cents

Dec-22 MPLS: -16 1/2 cents

Dec-22 Chicago Wheat (6 month)

Dec-22 KC Wheat (6 month)

Dec-22 MPLS Wheat (6 month)

Cattle

Dec live cattle futures ended Friday down -$0.425, down to $153.000. Finishing +$0.575 higher for the week.

Jan feeder cattle ended the week lower -$0.075 to $180.375 and was unchanged on the week.

Dec Live Cattle (6 month)

Nov Feeder Cattle (6 month)

Crude Oil

Was -1.18 lower Friday to 87.90

Up +2.85 (3.35%) higher on the week

U.S. Dollar

Was +0.153 higher Friday to 110.606

Down -1.374 (1.23%) on the week

News

EU cuts corn crop forecast again, now at a 15-year low

The US economy grew again in Q3 after falling in the first half of the year

Elon Musk, the worlds richest man and founder of Tesla purchases the popular social media platform Twitter.

Mortgage rates hit 20-year highs. Topping 7%

The 20 richest people in the world have collectively seen their networths drop $480 billion this year. Mark Zucekrberg founder of Facebook saw his networth drop $11.2 billion alone when Meta missed its earnings last week.

Social Media

Precipitation Forecasts

2-Day

Weather

Source: National Weather Service