CONTINUED WEAKNESS IN CORN & WHEAT

MARKET UPDATE

Prefer to listen instead? Listen to an audio version

Futures Prices Close

Overview

Grains started off the week lower yesterday, as the weakness in both the corn and wheat markets continues into today with no demand story to chew on. Bulls were hoping for a turn around Tuesday but instead we got a continuation of lower prices. Soybeans on the other hand have a solid day, finding strength in the belief that China plans to end its zero covid policy.

Dow Jones and crude oil get hit hard again today further pressuring the grains. The Dow Jones now down nearly 1,000 points to start the week, as crude oil loses another $3 a barrel trading below $75.

Today's Main Takeaways

Corn

Corn slightly lower here today, following up on some of its recent weakness we have seen the past few trading days. With the continued weakness, corn is now trading at its lowest levels since August.

Crude oil also down sharply again today further adding pressure to the corn market. Crude was down another -$3 (-4%) as crude closes below $75 a barrel for the first time in a long time. Corn tried to move higher to start the morning, but once crude oil broke lower so did corn.

Export sales and inspection volumes remain sub par which has continued to pressure corn futures. As both are well behind the USDA forecast pace. Will keep an eye out Friday to see if the USDA decides to lower their corn export number or not.

As U.S. harvest comes to end, we haven’t seen good enough demand nor enough bullish headlines such as a South American weather scare to support prices. Going forward, it's obvious that Argentina has seen some struggles. As nearly everyone is lowering their estimates for Argentina production. The USDA currently has them at 55 million metric tons. But some think we actually might see this number lowered to 50 million or possibly even lower. So the consensus belief is that we see this number lowered and this will likely add some support to the corn markets.

Friday we will see the USDA Supply & Demand report. But we need to remember that we won't see the USDA make any adjustments to U.S. production numbers. So the report will mostly focus on the demand side of things. All in all, most aren’t expecting any major changes come Friday, but there is always that chance for a curve ball. One change we might see is higher carry outs all around, which may have weighed on the markets today as well. We are looking at a possible 1.241 billion bushel carry out, up 59 million bushels from last month.

Corn filled a gap down to the $6.38 level from August and broke through that level slightly, closing at $6.37 1/4. Bulls would like to see some support here. Taking a look to the downside, corn has pretty strong support at the $6.00 to $6.20 range but hopefully we see a bounce before that.

Overall, its tough to pick a direction right now until we get a better understanding if we see an increase in demand or not, as that is likely needed to see prices climb higher. Bulls would like to see China step back in here and start buying some corn from the U.S.. We will also be waiting to see if the South America weather story changes and whether we get that scare or not, as there is plenty of uncertainty going forward.

March-22 (6 Month)

This is a technical analysis from Jeff Peterson @jeffpeterson01 on Twitter

His highlights of this analysis were;

We broke out of the recent sideways range we have been in

Initial overhead resistance is at the $6.53 level

Technical indicators are into the oversold area

Soybeans

Soybeans see a nice rally today, closing up +17 1/4 cents to $14.55, but this was nearly 18 cents off its highs of $14.72 1/2. This rally helps make up for last weeks major losses occurred after the poor EPA guidance. Soy oil continues to fall, falling another -1.5% today, but this didn't hold beans back. Soy oil is down over -15% the last five trading days.

Soymeal trading firmly higher adding support to the beans, as they traded at contract highs. Looks like the funds have been selling their long oil positions and buying meal positions against it. Funds are getting pretty long beans and meal.

Overnight we saw two sales of beans, 264 tons of beans to China and 240 tons of beans to unknown which was likely China.

Taking a look at Friday's report, similar to corn, most aren’t expecting any ground shaking changes. There is a chance we possibly see U.S. exports trimmed or see an increase in U.S. crush demand, but there it appears unlikely that we see much if any changes come Friday. Last report we saw the USDA raise their ending stocks by 20 million bushels up to 220 million.

Strength in the soybean market is mainly coming from the optimism surrounding China planning on ending their zero covid policy. It appears that China's economy is in pretty bad shape, and might be worse than most thought it was. Thus giving even more incentive for China to end this policy and get things running back to normal. If this is the case and China does reopen everything and end the policy, this should be pretty friendly for soybean prices. and could likely lead to some higher prices if the announcement is made.

Although yes, soybeans could see some higher prices here if China ends their lockdowns or any other bullish headlines such as a South American weather scare. But prices are still historically high, and with Brazil's expected record crop and no signs of that weather scare, it wouldn’t be a terrible idea to lock in some sales at these levels and take some risk off the table. As there are still plenty of uncertainties in the markets.

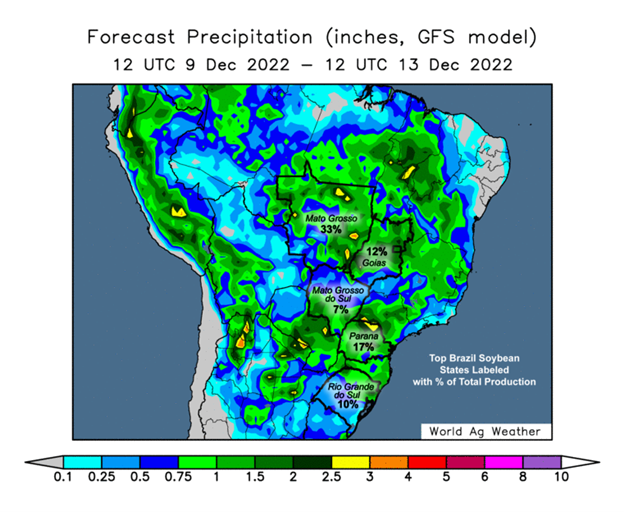

Looking longer term, the biggest factor outside of what China decides to do here will ultimately be how South American (especially Brazil) crop turns out. We have Brazil facing a record crop if all goes well, and outlook is pretty cooperative for weather currently. This is one of the larger concerns for beans going forward, but then again, it seems like every year South America is expected to have a record crop. So this could change, but if weather stays cooperative this would be a bearish factor for beans.

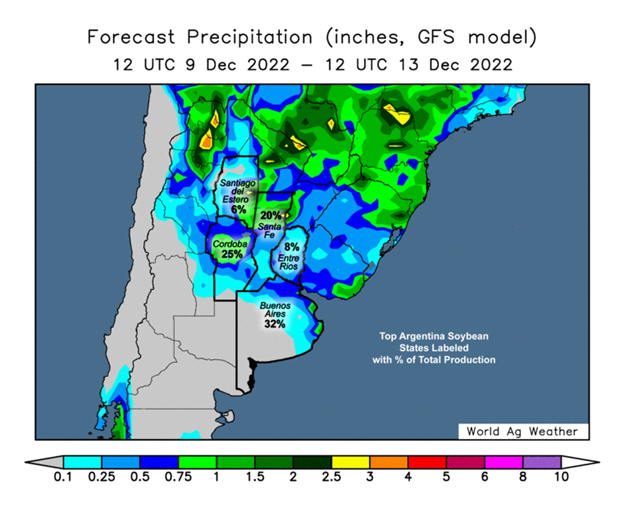

Argentina crops on the other hand are already in pretty poor conditions. With roughly 1/3 of their recently planted crops already being pegged as poor conditions. So perhaps their crop continues to deteriorate, as it still looks like they will continue to suffer from serious drought conditions. Argentina planting is also still running far behind. With these delays, Dr. Cordonnier cut 1 million tons to both his corn and soybean estimates.

Last month we saw the USDA lower their Argentina production estimate to 49.5 million metric tons, down from 51 million. There is a solid chance we may continue to see this number lowered as Argentina planting is still far behind pace.

South America Planting

Currently Argentina only has 29% of their soybeans planted, which is far behind their 50% average.

Southern region is only 15-30% planted

Far Northern region is estimated to be 0-2% planted.

Brazil soybeans are 91% planted, which is slightly behind last year but ahead of the traditional average pace of roughly 88%.

Paraguay soybean planting is complete. The USDA is estimating their production at 10 million tons, which is more than two times that of last years 4.2 million.

Soymeal & Soyoil

Soymeal up +16.5 to 448.6

Soyoil down again -0.95 to 61.62 (-1.5%)

Soybeans Jan-23 (6 Month)

Wheat

Wheat continues to trade lower and drag its feet, leading to bulls scratching their heads wondering when prices will go higher. As Chicago wheat hit its lowest levels this year yesterday and prices down another dime again here today. Wheat has essentially broken through every nearby support level from a technical stance, as wheat futures are down around -11% the last 10 days.

Friday's support is much of the same story, as no major changes are expected. But some are thinking we may see the USDA raise their U.S. ending stocks from 571 million to closer to 581 million.

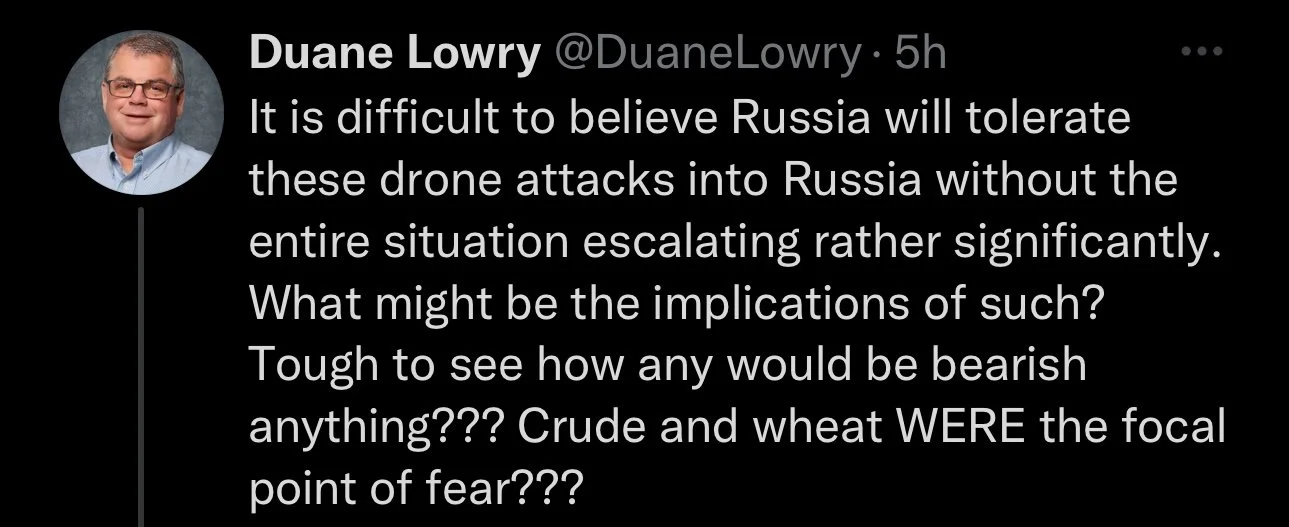

There hasn’t been many updates out of Russia and Ukraine as of recent, but we did see Russia launched a new wave of missle airstrike on Ukrianian cities. So if this escalates this will be a factor to watch out for in the markets wheat especially.

We saw ABARES actually increase their Australia wheat production for 2022-23 despite the flooding they have had, where most expected this to cause some damage to crops. But this must not have been the case, as they raised their estimates to a record 36.6 million metric tons. Which is a 1% increase from their record crop we saw last year. This has added some additional pressure to wheat prices.

Global competition continues to pressure wheat as supply doesn’t look like much of a concern right now. We have Russia sitting on record amount of supply, and its just tough to compete with lower prices globally.

On one hand yes we have problems in Argentina and even here in the U.S. but those problems continue to be offset by the large crops in Russia and Australia. Even with these two expecting large crops, bulls are still optimistic over the fact that U.S. winter wheat is one of the worst on record and we have problems globally negatively effecting wheat crops.

So overall, one would think the bleeding stops eventually, as its difficult to see anyone being bearish here after these losses and with everything going on in the world, but bulls such as myself just continue to smacked in the face as of late. I mentioned this yesterday, but wheats' story isn't necessarily a story for today, but more of a story for the future. As we have a crop that isn't good, but nobody seems to care about that today, it's more about what the crop looks like come April. I have been wrong about wheat finding a bottom the past week or two, but am still optimistic we see prices climb higher from here looking long term as there are plenty of factors that have the potential to support wheat going forward.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Other Markets

Dow Jones down gets hit hard again, down over 400 points (-1.2%)

Dollar Index up 1/4 of a percent again, to 105.6

Cotton up +0.73 to 84.59

Stock market down hard again following the losses yesterday. With S&P 500 down another -1.5%. I personally think there is more downside in the stock market going into next year.

S&P 500 Chart

Crude Oil

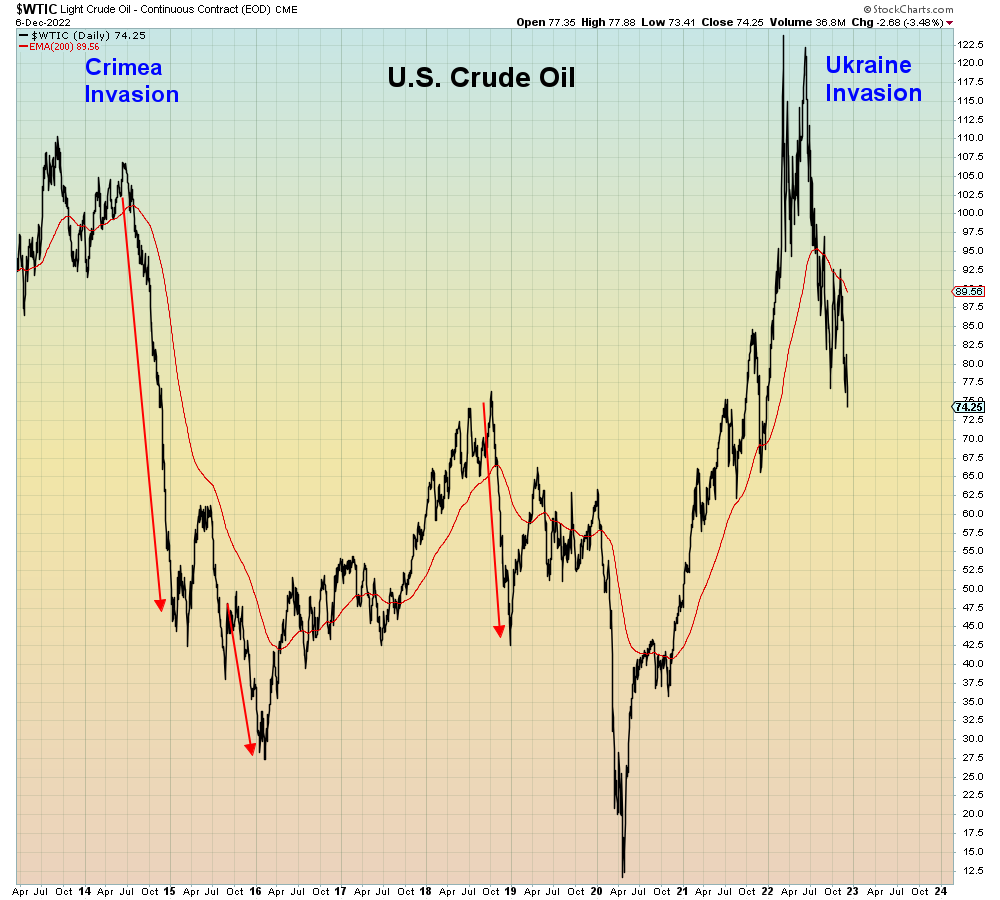

Crude oil has given up all of its 2022 gains. Falling to 10-month lows. As it continues to fall, falling below $75. Down nearly -$3 (-4%)

Chart Credit: @SuburbanDrone on Twitter

News

Dr. Cordonnier cut 1 million tons from both his corn and soybean estimates in Argentina. Poor weather continues to delay planting.

Australia is forecasting a record wheat crop despite the floods they have faced

Home prices drop for the 3rd month in a row

Livestock

Cattle sharply lower today. Cattle futures being pressured by both the lower cattle prices and firmer tone in old crop corn.

Live Cattle down -2.2 to 153.625

Feeder Cattle down -1.975 to 181.8

Live Cattle (6 Month)

Feeder Cattle (6 month)

Bullish & Bearish Factors

I added this in yesterday's update, but here is a great graphic that Wright on the Markets put together where they show case the bullish and bearish factors for the grains.

You can visit Wright on the Markets website Here. I highly suggest you give them a visit as they provide valuable information daily.

In Case You Missed It

Yesterday's Update - Wheat Hits New Yearly Lows

Sunday's Weekly Newsletter - Why You Shouldn’t Be Fear Selling

South America Weather

Chart Source: Roach Ag

Social Media

All credit to respectful owners

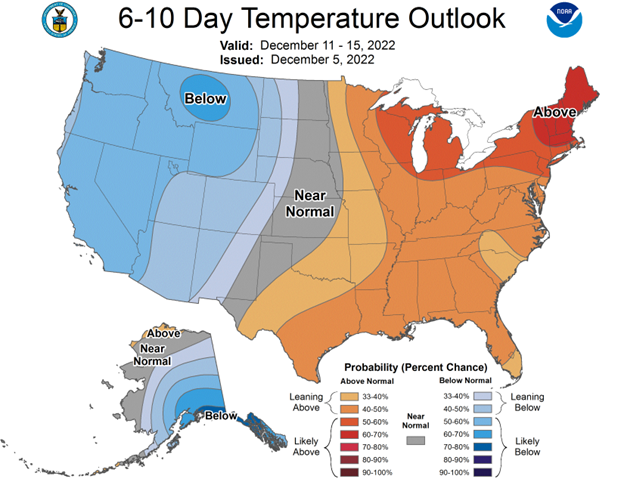

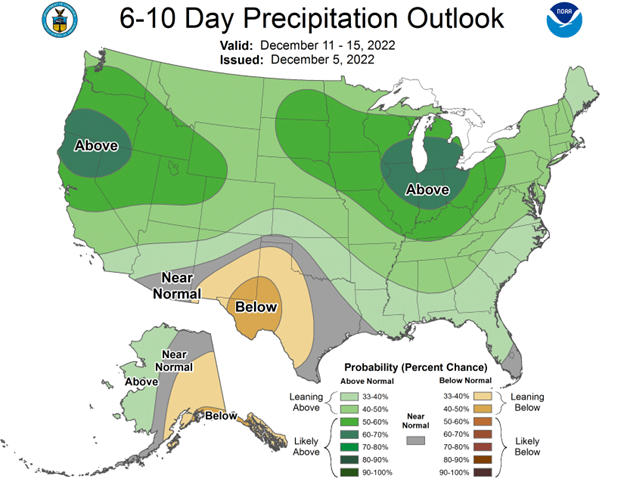

U.S. Weather

Source: National Weather Service