WHEAT HITS NEW YEARLY LOWS

MARKET UPDATE

Prefer to listen instead? Listen to our audio version below

Futures Prices Close

Overview

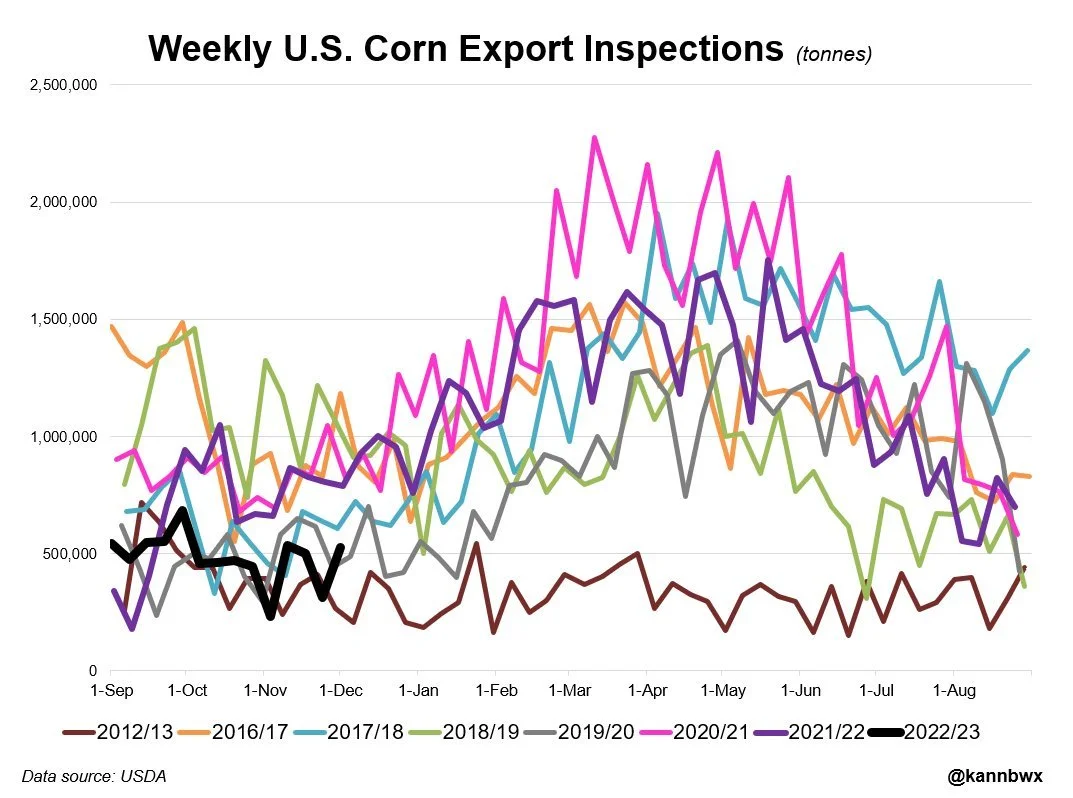

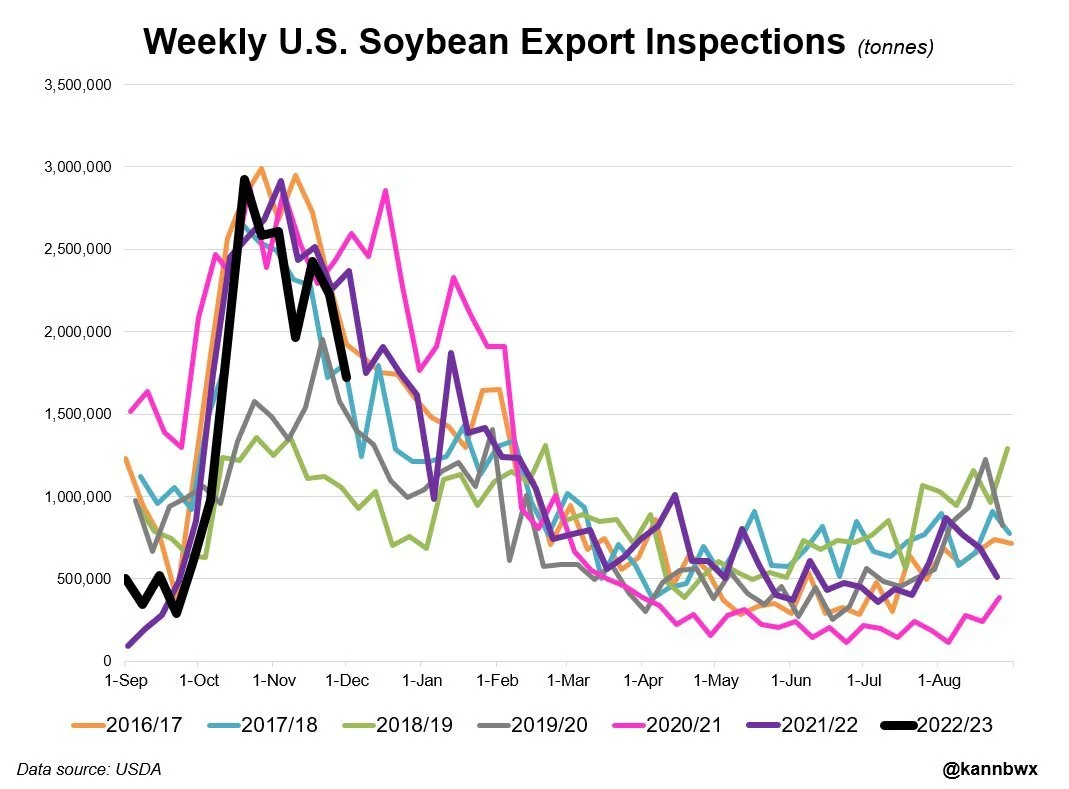

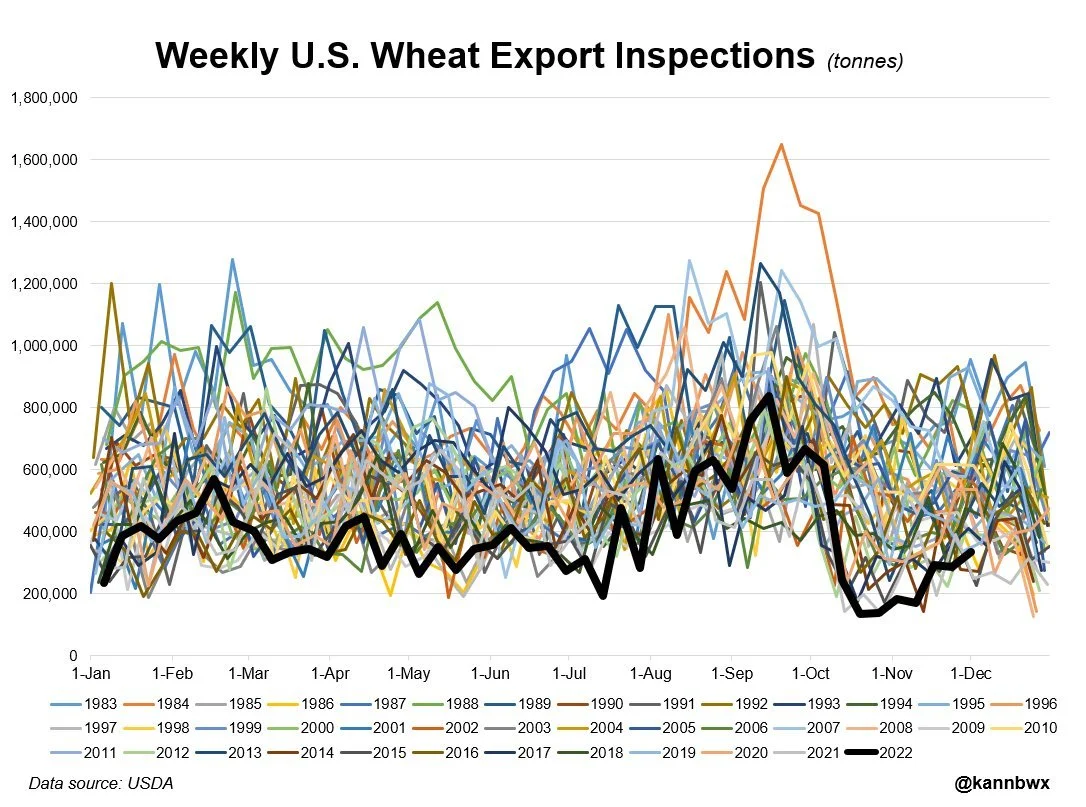

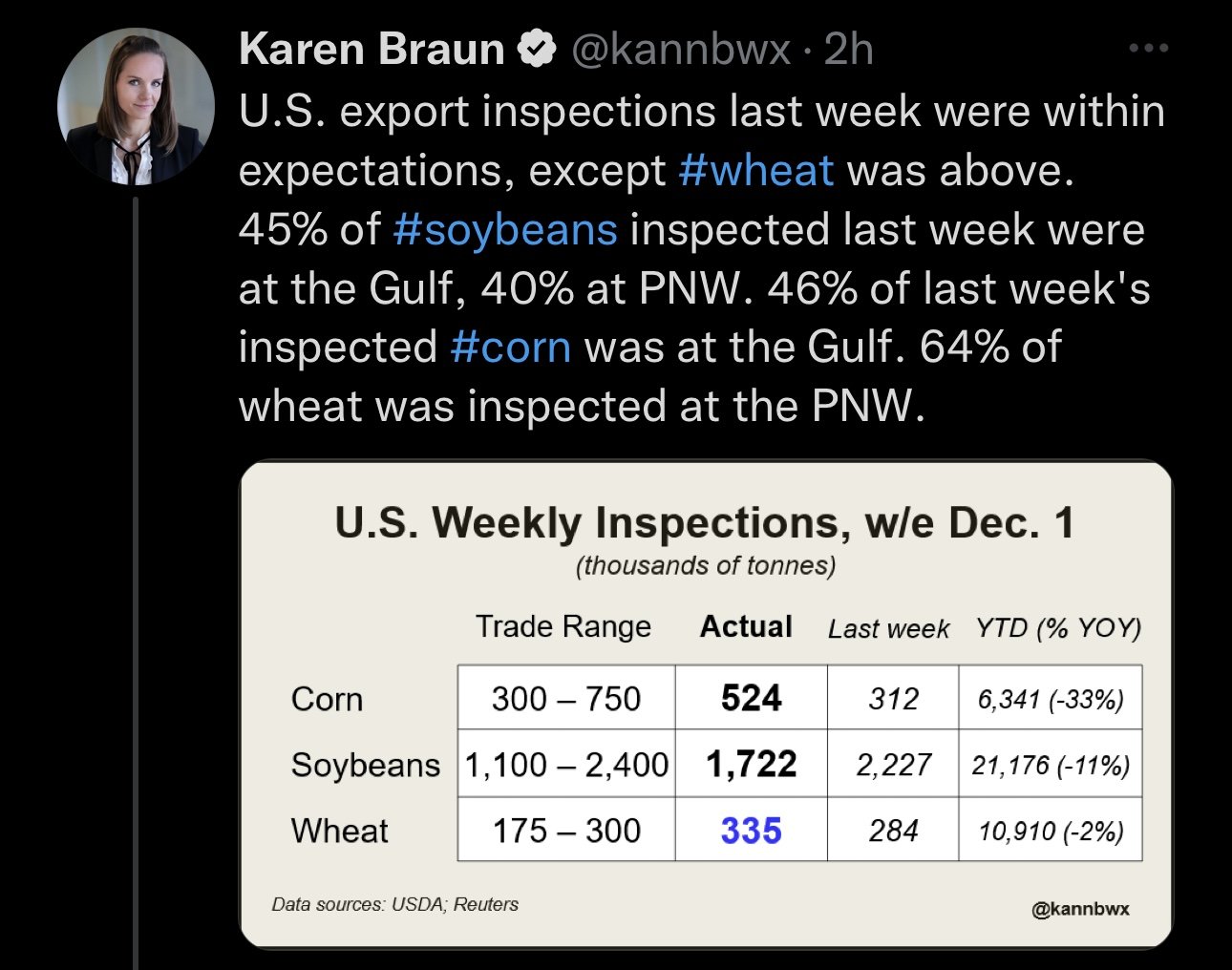

Grains start the week off lower as wheat continues to trade sharply lower and as corn continues to see weakness. Export inspections came in around expectations for both corn and soybeans, but actually came in somewhat strong for wheat, coming in above estimates, but this didn’t stop wheat from bleeding over 20 cents as global competition continues to pressure prices.

We also have pressure coming from the entire stock market, Dow Jones, and crude oil all trading sharply lower today. As the S&P 500 trades over -2% lower, Dow Jones down -1.5%, and crude oil down almost $3 a barrel (-3.5%).

Friday we will see the USDA Supply & Demand report. Thoughts are we won't see any too major changes made in this report, as the more anticipated report comes on January 12th as the year end report.

Takeaway from Wright on the Market

Bullish & Bearish Factors

I want to start off today with a really interesting graphic from Wright on the Market. As he takes a look at bullish and bearish factors in the grain markets going into the end of the year and into next.

"It is time to reassess the factors that will drive corn, wheat, and bean prices into the first part of January and to a large extent, into the spring"

As you can see from the graphic below, there are far more bullish factors rather than that of bearish ones.

He also added;

"Half of Ukraine's 2022 corn crop is still in the field.

Ukraine's 2023 crop will be less than two-thirds of 2022 production.

It will rain enough some time in the next six months to open Mississippi to normal barge traffic.

Barge or no barge, the world has to buy 2.2 to 2.7 billion bushels of US corn or there will be a lot of hungry people.

For 60 years, Brazil's bean and corn crops have been expected to be the biggest ever.

So is their beef, pork and poultry production (eat more every year also).

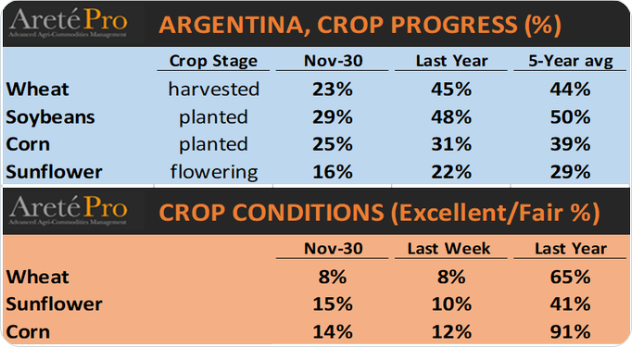

How are crops in Argentina? Note the five averages on the right."

You can visit Wright on the Markets website Here. I highly suggest you give them a visit as they provide valuable information daily.

Today's Main Takeaways

Corn

Corn futures finally broke out of their recent tight trading range, but unfortunately broke out to the downside. Corn now trading below its 100 and 200 day moving averages.

Poor demand continues to pressure corn futures. It looks like most are expecting to see the USDA raise U.S. production numbers rather than lower them. Demand continues to be a large debate, as there is still a ton of questions surrounding ethanol, exports, and China.

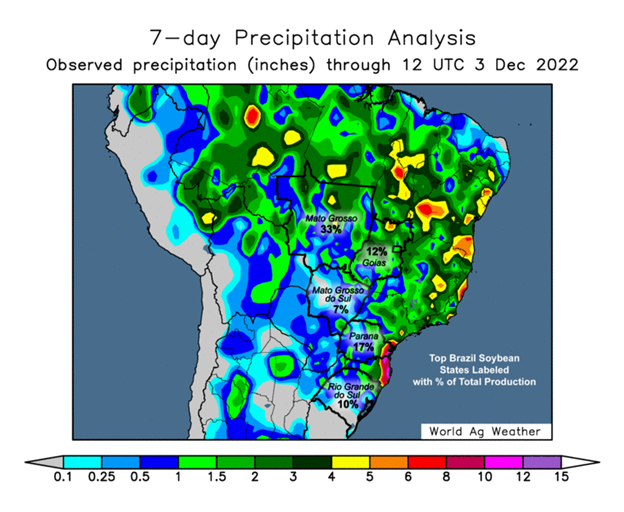

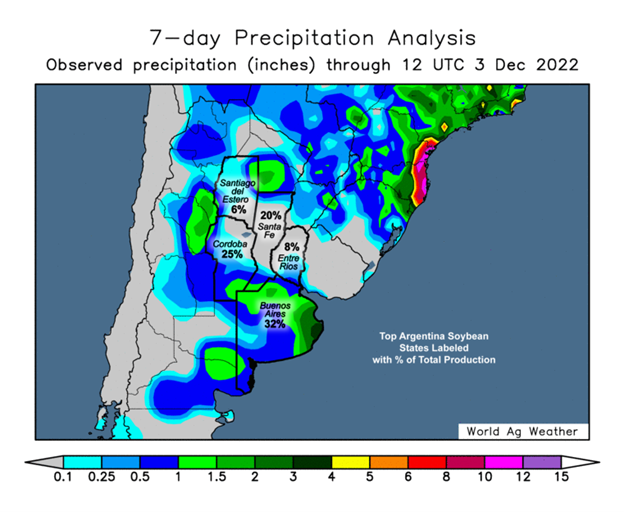

Taking a look at Brazil, its about the same story it has been. Brazil looks pretty good so far so there isn't any concerns there for the time being. While Argentina has struggled but may see some meaningful rain to help their crops out.

Chinese demand also remains a big question mark. As to justify higher prices we'd almost certainly need to see demand increase from these poor levels. China has been a buyer of Brazil and Ukraine rather than the U.S. recently which hasn’t helped U.S. exports.

To see higher prices we will either need a major increase in demand, some South America weather scares, or possibly more war headlines. As there aren’t a ton of other bullish cards in the deck here looking short term. Corn is now trading at its lowest levels since August.

Basis

From Barry Morris at Morris Ag:

"I’ve never seen basis this flat across such a large area before. Farmer bid at Sublette, KS is +150CH . Farmer bid in Plainview, TX is also +150CH. I use to haul corn from SW KS into the Tx feedlot market but I doubt anyone is making that work today. Takes about 70cents a bu on truck to get it from Sublette to Plainview. Rail market keeping the south supplied for now."

For those of you that don't know, Barry Morris and Morris Ag have started working along side us at Market Minute. If you need help brokering some of your grain in the Texas, Oklahoma, Kansas areas don't hesitate to give him a call at (214)250-3888

March-22 (6 Month)

via Karen Braun @kannbwx on Twitter

Soybeans

Soybeans slightly lower today holding up the best amongst the grains, as soy oil continues to get hit lower following the EPA forecast last week. Soy oil is down over -4% again today. Soy oil is down nearly -14% the last 5 trading sessions. Traders will have to see if soy oil can regain some of these massive losses

To go along with the poor EPA guidance last week, we also have funds continuing to sell soy oil adding additional pressure to the bean oil market.

Despite the losses late last week, prices are still relatively high. As soybean prices actually hardly lost any ground when you look at the week as a whole. We are over $1.30 off our lows of $13 we saw back in late July. Looking at support, bulls would like to see beans hold over $14 as a break below could trigger more selling.

We have plenty of factors continuing to be at play here for the soybean market, and I might sound like a broken record here, but the biggest of these two have to be South America and China.

We still have Brazil expected to see a record crop, so unless this changes this could call for some problems for soybean futures. While Argentina on the other hand has faced a ton of issues with their drought but there is some rumors they might see some improvements in their crop, as they are expected to see some more rains. But we have to keep in mind that 1/3 of their soybean crop is already in poor conditions. So there is a little bit of uncertainty there, as overall South American weather remains a slightly bearish factor unless we see some weather scares.

Current estimates for Brazil's crop is 152 million metric tons or more, vs last years 127 million metric tons.

Another fact to note; 93% of the planted soybeans in Cordoba, which is one of Argentina's top producing provinces, is under drought major conditions. With 47% in exceptional drought. That is the worst since 2009.

We also have the China situation. As they continue to face difficulties with COVID and whether they should keep their country locked down or not. If they continue to enforce lockdowns this would be bearish news, but any signs of them reopening would be bullish for demand and grain prices. Overnight news was that they are going to begin easing their lockdowns but we will have to see what they actually do.

Soymeal & Soyoil

Soymeal up +8 to 432.1

Soyoil down another -4% to 62.57

Soybeans Jan-23 (6 Month)

via Karen Braun @kannbwx on Twitter

Wheat

Wheat futures continue to trade sharply lower despite a recovery in U.S. export inspections where wheat came in above trade estimates. Wheat continues to be pressured by strong exports and cheap prices in the Black Sea region creating competition as the funds continue to aggressively sell. March Chicago is now 60 cents off its high from last weeks small rally.

We also broke through some key support, breaking our August 18th low at the $7.61 level. We also took out our $7.48 3/4 lows from back in January. Wheat prices are now at the lowest they have been since last year.

The market seems to believe there is plenty of supply around the globe despite the problems we've seen in U.S. and International crops. We have Russia and Ukraine sitting on a lot of supplies at lower prices than us which has created a lot of competition for us leading to lower prices.

U.S. wheat inspections remain historically low, but we have seen numbers rebound off their lows back at the end of October where we saw the 3rd and 4th lightest weeks ever. As mentioned, wheat inspections this morning came in above expectations but that didn’t help the wheat market out today with prices sharply lower again.

Additionally adding pressure, we have forecasts showing a record wheat crop in Australia despite their floods they have experienced. Their forecasted to have production numbers of 36.6 million metric tons in the 12 months running to the end of June next year. Which is a 1% increase over their previous record crop they set last year.

We also have Statistics Canada reporting that total Canada wheat production rose by nearly 52% in 2022, up to 33.8 million metric tons. This number would be their largest wheat production since 2020 and the 3rd largest on record.

Here in the U.S. it looks like the crop may be seeing some improvement but we can’t ignore that this crop is one of the worst on record. We also have Argentina seeing their crop get smaller rather than larger. So overall, there are factors both bearish and bullish, with weather and war being the two biggest bullish cards left in the deck.

I mean eventually one would think we find a bottom here sometime, markets can sometimes be irrational longer than a person can stay solvent. Wheats' story isn't necessarily a story for today, but a story for the future. As we have a crop that isn't good, but nobody seems to care about that today, it's more about what the crop looks like come April.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

via Karen Braun @kannbwx on Twitter

Other Markets

Crude oil down nearly -$3 (-3.5%)

Dow Jones down over 500 points (-1.5%)

Dollar Index up nearly +1%

Cotton up +0.66 to 83.86

Stock market sees a major correction. With S&P 500 down over -2%

Stock Market Heat Map

News

India wheat planting rises +6% from last year

Ukraine exports down -30% so far in 2022/23

Ukraine has lost at least $1 billion of wheat harvested in areas controlled by Russia

Tesla stock down -7% today, as every other major company sees massive correction in the stock market.

Livestock

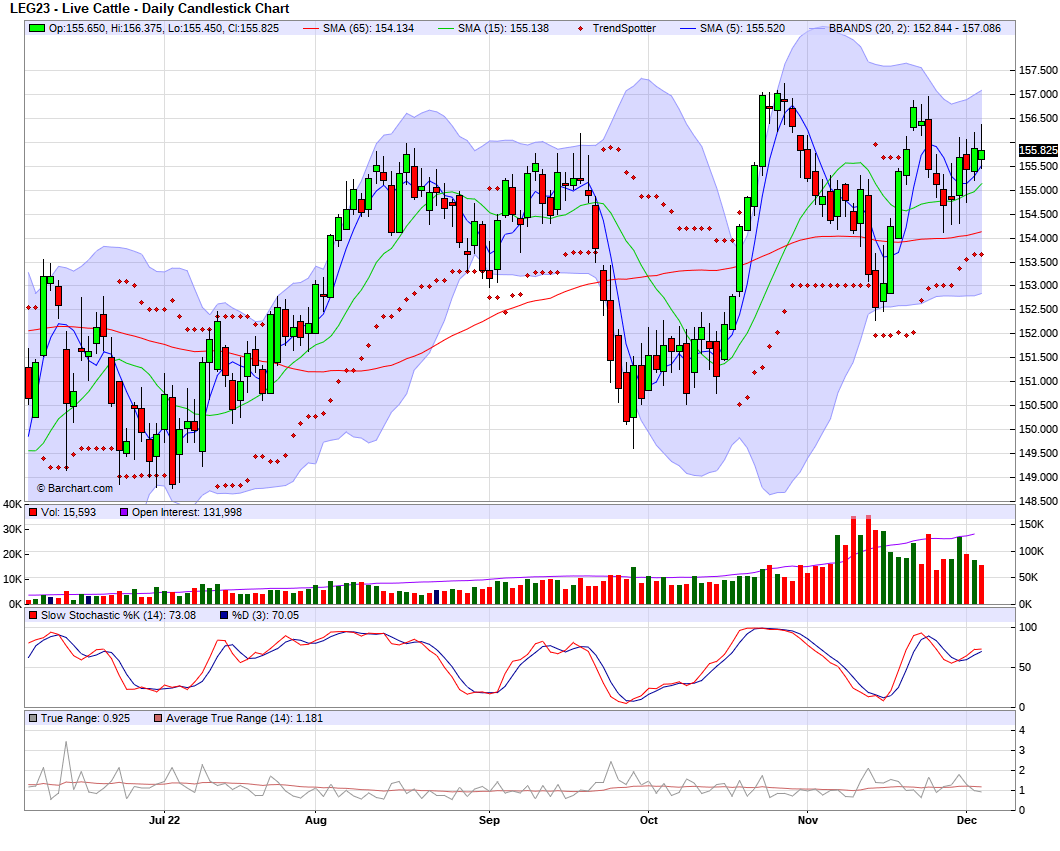

Live Cattle down -0.050 to 155.825

Feeder Cattle up +1.325 to 183.775

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

Chart Source: Roach Ag

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service