CORN & WHEAT HIGHER IN RISK OFF DAY

Overview

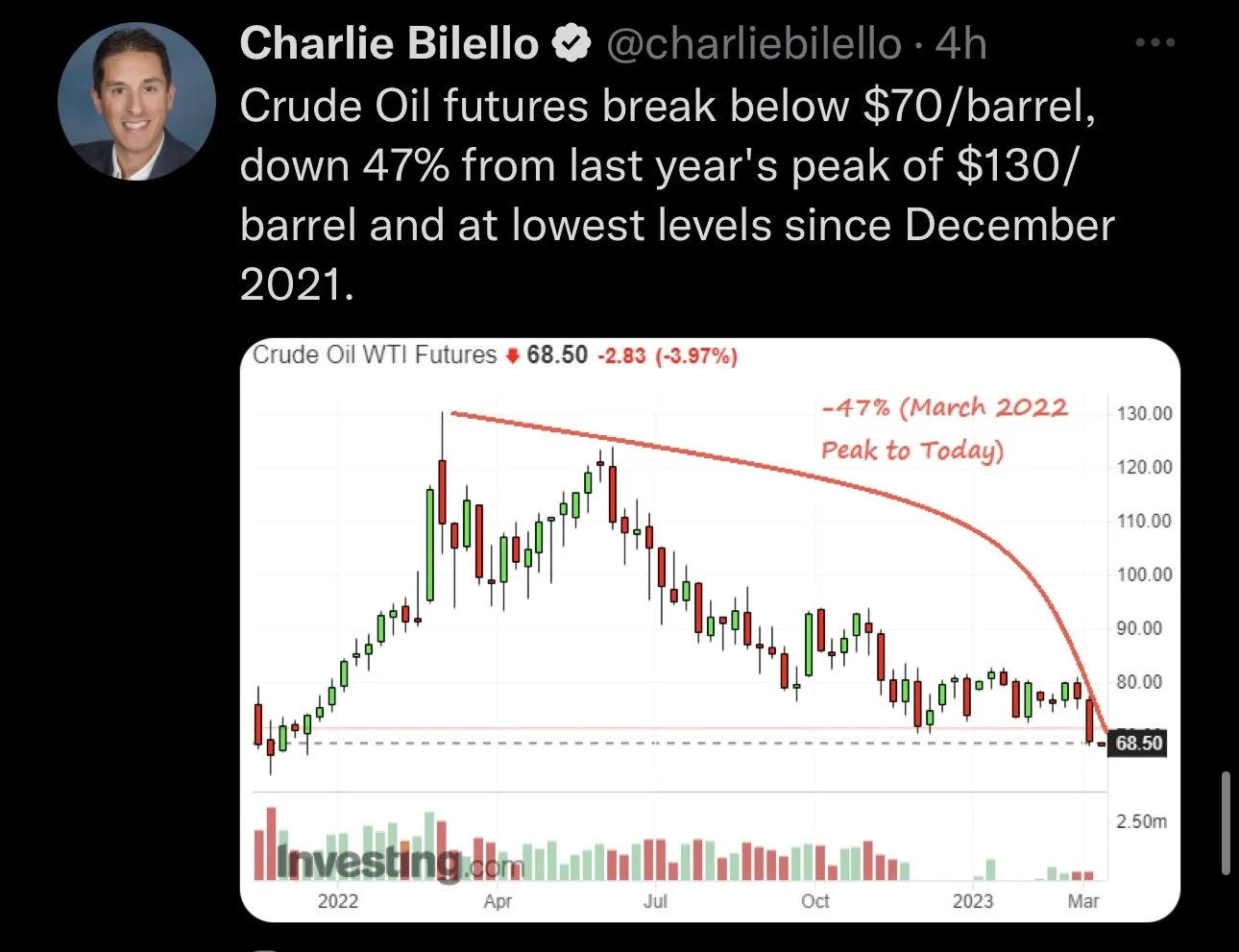

Corn and wheat both post another solid day of gains. The big story today was the outside markets, as they got hit hard in mostly a risk off day. With funds exiting energies and equities in the midst of the concerns surrounding the banking industry. As we get another bank headline, with Switzerland's second largest bank losing 25% of its market value overnight. The news has has global investors concerned. The risk off day leads to crude oil drops over another -$3 a barrel, breaking below $70 and trading at its lowest levels since December of 2021.

The grains held up great despite the sell off in the outside markets. The funds are estimated to be long beans, short wheat, and about even on corn. So on this risk off day, the funds looked to add to wheat and sell some beans which led to the price action today.

In case you missed it, listen to yesterday’s audio

Will SVB Lead to Fund Buying? - Listen Here

Enjoy our stuff? We are offering 50% off yearly & monthly or try 30-days for just $1. All updates and audio sent via text message & email.

Today's Main Takeaways

Corn

Corn futures post another solid day of gains. May corn is now +20 cents off its lows made last Friday.

Corn held up amazing considering the absolute sell off we saw in crude oil the post two days. With the near $10 losses over the course of the last few days, it’s probably a good sign that corn has held up as good as it has, posting gains the last two days.

Bulls are also happy to see exports pick up some business this week, as we again saw China purchase another 667,000 metric tons of old crop corn this morning. I think it’s a good sign that we are finally seeing China make some purchases. As plenty of people thought that they might not need much business from the U.S. as they had already bought enough cheap stuff from Brazil. We have to keep in mind that while the rest of the world has mostly put the entire covid situation behind us, China was under lock downs and restrictions for the last few years up until a few months ago. Wright on the Market said, "There is a huge pent-up demand for everything money can buy in China."

Export inspections for corn also came in above expectations for the second week in a row after weeks of poor numbers.

One of the biggest things still being monitored is the progress of planting in Brazil's second crop corn. Their corn is currently 81% planted vs 94% last year. The biggest thing will be what happens over in southern states, as a few such as Parana are only 37% planted vs almost 70% last year at this time.

Brazilian farmers cannot use crop insurance for safrinha corn that’s planted outside the ideal window. One thing to keep in mind is that over 30% of Brazil's crop is going to be planted outside this window, which is going to put the crop at further risk of any weather concerns down the road. The USDA's current 125 million metric ton estimate is probably a little too large, so I think we see this number worked lower.

Here in the U.S. we are looking at possible snow storms across the midwest, which have the potential for fewer corn acres down the road. However, its still too early for the markets to start trading any U.S. based weather stories.

Going forward, we have the South American headlines which are bullish for the most part with Argentina's small crop and Brazil's planting delays. We are starting to see an increase in Chinese appetite. Bulls would like to see both of these factors continue to see higher prices.

Corn May-23

Soybeans

Beans finish the day down -4 1/2 cents in this risk off day. However, we did find support right at that $14.80 support level we talked about yesterday. As beans managed to close 9 cents off their lows.

The reason for the minor losses today was mostly due to the funds, as they looked to exit a portion of their long position.

Argentina is expected to still import a record amount of beans, which could help support our U.S. exports.

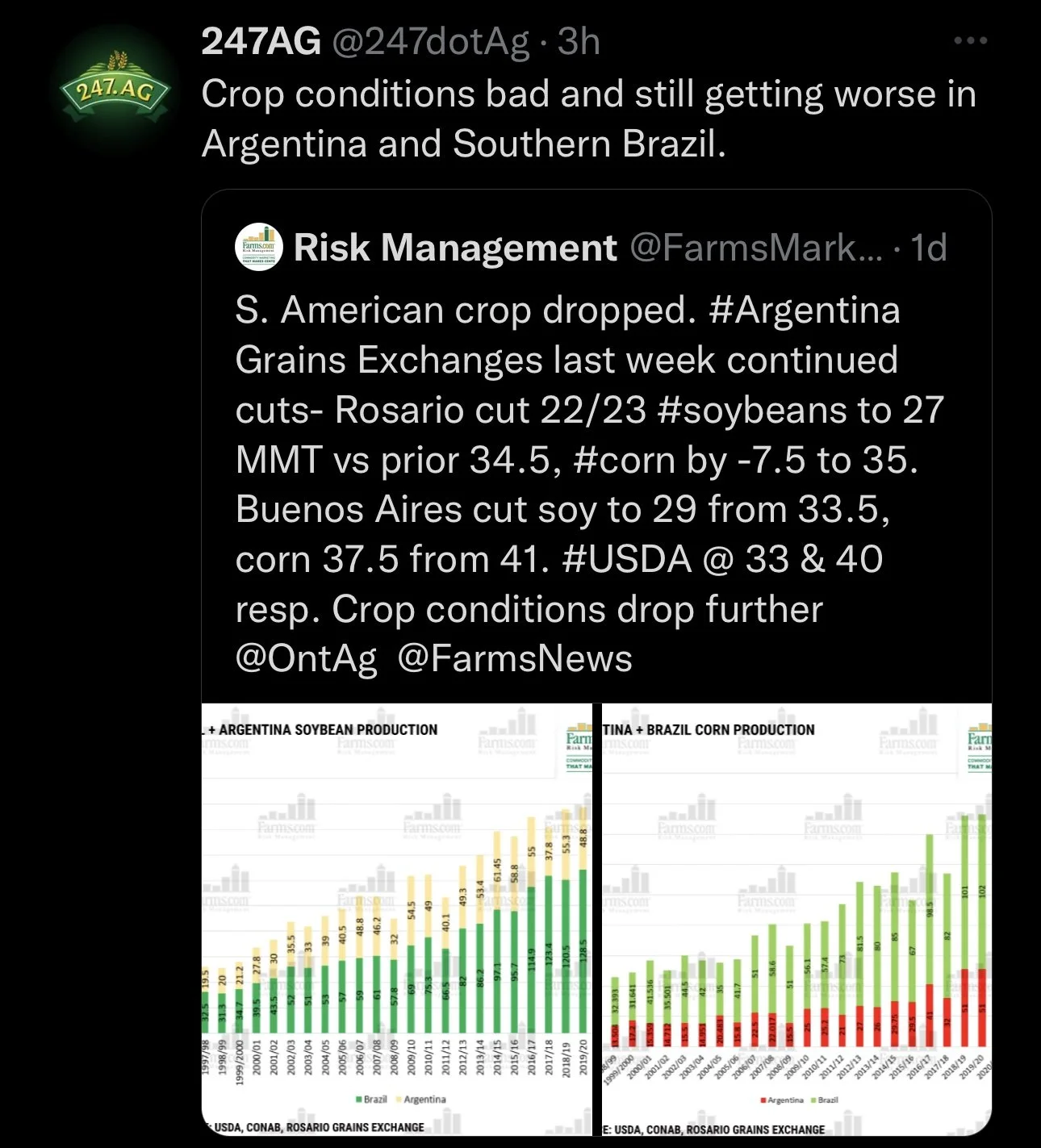

It seems like we go in waves of where bean rallies get sold, then we get more news that Argentina's crop is even worse than we thought, and the cycle has continued since the beginning of the year. The USDA lowered their Argentina bean estimate down to 33 million metric tons, but there are plenty of sources throwing out numbers below 25 million. So if the USDA really is 8 to 10 million too high, will we again get a rally due to the continuation of a deteriorating crop.

Now taking a look at Brazil, the USDA has their number at 153 million. But some are saying that number is also too high. With some estimating a number closer to 150 or 148 range. Sure, this crop is bigger than last years. But right now it is continuing to look like this crop is getting smaller, not larger.

Short term, I could see the funds possibly look to liquidate a few of their longs further adding some pressure. Perhaps we again go and test the $14.79 level which is a dime lower. But the last few times we've traded down to these levels, we have shot right back up into the $15.20 to $15.40 range off the back of Argentina concerns. Nonetheless, the long-term outlook is a complete different story with all of the uncertainties in South America.

Soybeans May-23

Wheat

Wheat futures all end the day green, with Chicago leading the way closing up +6 1/2 cents, while KC and Minneapolis both closed up around +2 cents. Chicago is finally back above $7, closing +40 cents off our lows last Friday.

The movement today was again likely a result of the funds. They are long beans and short wheat. So while they exited some of their bean position they bought back some of their short wheat position.

Some reports are saying that Russia has agreed to extend the Black Sea agreement, but only by 60 days rather than that of the 120 days the UN and Ukraine were looking for. So it looks like Ukraine is going to be forced to sign whatever Russia wants, but there are no official reports of the deal being extended.

Everyone including myself fully believes we do see the extension happen, but I'd have to imagine this is already priced in. So I don’t think the deal being renewed will cause a ton of selling if any in wheat. The only real question left is what length of an extension do they agree on.

We can’t forget that there is still a war going on with two of the worlds leading wheat exporters. I'm not saying this will necessarily happen, but we are one war headline away from the funds scattering to cover their short positions. Even yesterday we again saw a small headline of Russia shooting down a U.S. drone.

Even without the war, we still can’t ignore the poor the wheat conditions here in the U.S. either. I mentioned this yesterday but states like Texas and Kansas are sitting at just 17% rated good to excellent, while Oklahoma is currently at 30% which is down 9% from last week. Sure, we have seen some improvements in areas experiencing drought. But I think this will become a bigger headline and concern down the line when the market is again reminded of the poor conditions.

Going forward, wheat is going to be influenced by the three W's:

War, Weather, and Wealth. All of which have the possibility to drive us higher.

Chicago March-23

KC March-23

MPLS March-23

Crude Oil

The downfall in crude continues, as crude breaks below $70 and is trading at its lowest levels since December of 2021. Down -$12 in the last week. How low can this thing go? Taking a look at the chart, the next major support might be around the $62 range.

The reason for the sell off in crude is the global recession concerns and banking worries which I mentioned earlier.

April-23 Crude Oil WTI

Bulgarian Farmers Protest Grain Imports from Ukraine

🤔 Bulgarian farmers with 50 tractors blocked the route Ruse - Pleven, protesting against the import of agricultural products from Ukraine. They believe that duty-free imports of Ukrainian wheat and sunflowers will bankrupt farmers, as low prices for grain from Ukraine reduce the competitiveness of Bulgarian products. The participants of the action sent a note of protest to the Minister of Agriculture with complaints about overcrowded granaries and the impossibility of settling accounts with counterparties.

🔎 We will remind that the Polish authorities have decided to compensate their farmers for the losses caused by the significant volume of Ukrainian grain exports, so they will pay them subsidies for the sold grain - wheat and corn.

🔎 According to the report of the Global Agricultural Information Network of the Foreign Agricultural Service (FAS) of the US Ministry of Agriculture, despite the increase in the area of oilseed crops in Bulgaria by 8% compared to last year, their production will remain at the level of 2.4 million tons due to a decrease in productivity due to the summer heat and droughts. It is expected that in 2022/23 MR, the rape crop will decrease by 20% compared to the previous season to 299.25 thousand tons, and the sunflower crop will increase by 4% to 2.077 million tons.

📊 Bulgaria became the largest importer of price-competitive sunflower seeds from Ukraine to the EU with a share of 40% in total European imports. In addition, it has increased its sales volume and is currently the leader in the export of sunflower meal to the EU (provides 66% of the total volume) and sunflower oil (47% of European exports).

🤔 However, local farmers are concerned that sunflower imports are depressing domestic prices. According to the preliminary forecast of FAS Post Sofia, in 2023/24 MR, the country will increase the production of oil crops, provided that the weather is favorable and soil moisture reserves are restored.

📣 "Overall, rainfall in 2022/23 MR was significantly lower than in the previous season," FAS said. - "So far, rapeseed crops have developed well, but in the spring, when the need for moisture will increase, development risks may arise. There are also risks for spring sowing of sunflowers, if the amount of precipitation in March-April will not be sufficient to restore moisture reserves in the soil, which remain very low."

📻 Source: https://lnkd.in/ej8eQzj9

Best regards.

Sunflower oil trader,

Oleg Shklovtsov.

-

This info comes from Oleg Shklovtsov over on LinkedIn

You can visit his LinkedIn post here:

https://www.linkedin.com/.../oleg-shk_bulgarian-farmers...

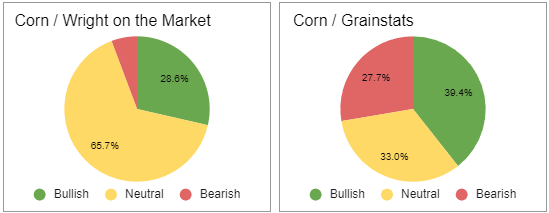

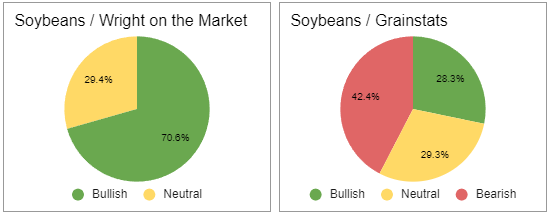

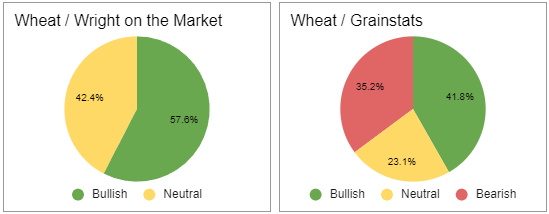

Bullish vs Bearish

The following charts are voted on by Wright on the Market & GrainStats respective audiences.

Livestock

Live Cattle down -1.175 to 156.575

Feeder Cattle down -2.500 to 198.800

The cattle market continues to take it on the chin this week. With live cattle trading lower for nearly seven consecutive days.

Below is a good article from DTN titled:

"Don't let your inner chicken little rob you of a good cattle market"

Read Here

Feeder Cattle

Live Cattle

Past Updates

In case you missed them, here are a few past updates & audio

3/14/23 - Audio & Market Update

Will SVB Lead to Fund Buying in Grains

Read More

3/12/23 - Weekly Grain Newsletter

Will SVB Drive Grains to New Highs

3/10/23 - Market Update

Wheat Finally Sees Strength

3/9/23 - Audio Commentary

Soybean Fundamentals Continue to Be Bullish

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service