WILL SVB LEAD TO FUND BUYING IN GRAINS

AUDIO COMMENTARY

Why the Silicone Valley Bank situation will benefit grains

What will the Feds do now?

Will we see the funds step in with lower interest rates

Our long term outlook for the grains

Listen to today’s audio below

Enjoy Our Stuff?

Subscribe to receive all of our updates & audio via text message and email

We are offering 50% OFF yearly & monthly

or try 30 days for $1

Overview

Grains stronger across the board with wheat leading the way, up double digits. While beans and corn both close nicely of their lows. Crude oil sells off heavy, dropping over $3.

Argentina estimates continue to be lowered. U.S. wheat crop conditions also come in poor once again, further adding support to wheat.

The Black Sea agreement extension deadline is this Saturday, March 18th.

We believe the Silicone Valley Bank situation will be beneficial to grains, and it could actually help stop the recent bleeding we've seen. If the Feds decide to print more money it will be bullish for the grains. We go deeper into this topic in today’s audio and Sunday's write up.

If you missed it, read Sunday's Weekly Newsletter

Will SVB Push Grains to New Highs - Read Here

Today's Main Takeaways

Corn

Corn posts some solid gains today as bulls look to stop the recent bleeding. As corn closed today 14 cents off our lows of $6.06 made Friday, closing a hair under $6.21.

Brazil's second crop corn made some improvements the past week. Seeing planting jump 11% up to 81%. Despite the recent improvement, there is still a big concern here. As over 1/3 of their crop is still going to be planted outside its ideal planting window.

Argentina corn crop condition concerns still remain, as we again saw Dr. Cordonnier lower his estimates by 3 million metric tons. The past two weeks have been extremely damaging to the already poor crop. Its not looking like we will see any improvements through this week either, as corn pollination will be mostly complete by next week.

The factors to watch the rest of the week and going forward include; the Black Sea agreement, continuation of declining Argentina crop, Chinese demand, U.S. weather, and the U.S. new crop acres situation.

Taking a look the charts we've made a nice reversal and potential bottom. Short term I could see us possibly looking to test our recent lows again, or even possibly test the heavy psychological support level around $6. But long term we still hold a bullish outlook going into spring and summer.

Corn May-23

Soybeans

Beans manage to close in the green along with the rest of the grains, as they close nearly 10 cents off their lows. Comparatively speaking, beans have actually held up well considering the sell offs in both corn and wheat.

Ag Rural reported that Brazil's bean crop is only 53% harvested. This compares to 64% last year and is still behind the average pace of 57%. Less than half the crop in Mato Grosso do Sul and Parana have been harvested. The bears main argument point is still the continued discussion around Brazil's massive crop.

CONAB lowered Brazil's bean production down to 151.41 million, which is slightly lower than the USDA's current estimate of 153 million.

As for Argentina, Dr. Cordonnier again lowered both his bean and corn estimates by an additional 3 million metric tons. Argentina bean crop predictions started the year at 50 million metric tons. This number is already down to 30 million. The USDA just lowered theirs from 41 to 33 million. I wouldn’t be too surprised to a final number below 30. So we all know the crop is terrible. The questions are just how much of this is currently baked into the market already, and how many bushels will Argentina crushers be able to get a hold of. As Argentina farmers are already pretty hesitate to give away their crop with the issues their inflation and currency are facing.

Argentina's crop conditions still sit at a dismal 2% rated good to excellent. Many people are saying this is the worst drought Argentina has ever faced.

Acres here in the U.S. will continue to become more and more of a topic of discussion. Other questions are how much of the export business will Brazil see and how much will the U.S. get with the losses in Argentina.

Going forward, short term I wouldn’t be surprised to see some of these rallies sold especially when we crawl into the $15.20 to $15.40 range. But looking long term, we have to respect the obvious damage in Argentina, and there are plenty of possible weather concerns here in the U.S. going forward.

Taking a look at the charts, we found support right where we needed to. In Sunday's write up I said I could see us correcting to the $14.90 range before going higher and that's what we did in yesterday's sell-off. Now, will we have to see if this support holds or if we make another leg lower. Next level of support is a dime lower at the $14.79 area. We currently sit right above our uptrend line and support level of $14.90.

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

Wheat finds strength again today, as we are now 35 cents off our recent lows following the beating that bulls took since mid February. Wheat futures all trade up double digits, with Chicago closing up 12, KC up 17, and Minneapolis up 12 1/2.

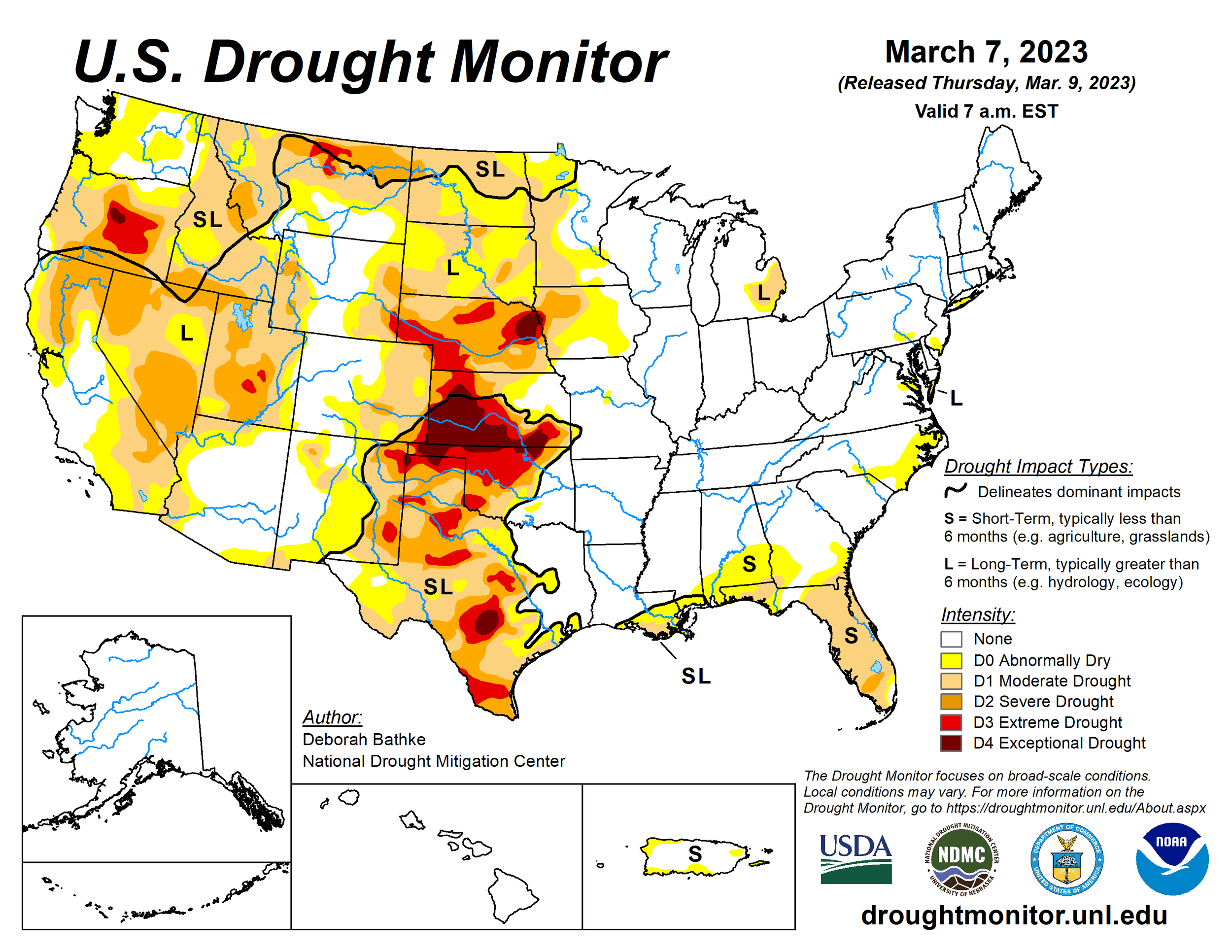

Wheat futures supported by the U.S. wheat crop conditions which came in poor across the board this week. With Oklahoma seeing the worst decline, as their good to excellent ratings dropped -9%, down to just 30%. Kansas and Texas were stable this week but still both sit at just 17% rated good to excellent.

The next week or two in the forecasts show some improvements in rain for the central U.S. and southern plains, so we could see this add some pressure. But we can’t ignore just how poor some of these crop conditions are. So ultimately I think this continues to add support. In the USDA report on March 31st, we will again be reminded of just how bad this drought has been and how poor some of the wheat crops are.

The main headline surrounding wheat continues to be the Black Sea agreement. Russia has now stated that they wouldn’t be opposed to extending the deal by 60-days rather than the long term 120-day extension the other parties such as Ukraine and the UN were looking for. Most still think we do see the agreement renewed. If the UN can only get the 60-day extension they will certainly take it. The deadline to renew the deal is this Saturday.

Even if the Black Sea agreement is renewed, which I believe it will be, the production from the entire Black Sea region is going to likely be far lower in 2023-24.

Going forward the headlines will remain war and weather themed. I still hold a bullish tilt going into spring, as I personally think it's a matter of time before we see the funds shift. And when they do, I think we definitely have the chance to see us go higher in a hurry.

Chicago March-23

KC March-23

MPLS March-23

Crude Oil

Crude sells off heavy today, losing over $3 and breaking back below its nearly year long downtrend. Looking for support at its previous low just above $70.

April-23 Crude Oil WTI

Livestock

Live Cattle down -0.450 to 157.750

Feeder Cattle down -1.325 to 195.750

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service