POST USDA SELL OFF

Overview

Blood bath following yesterdays USDA report that showed massive record yields.

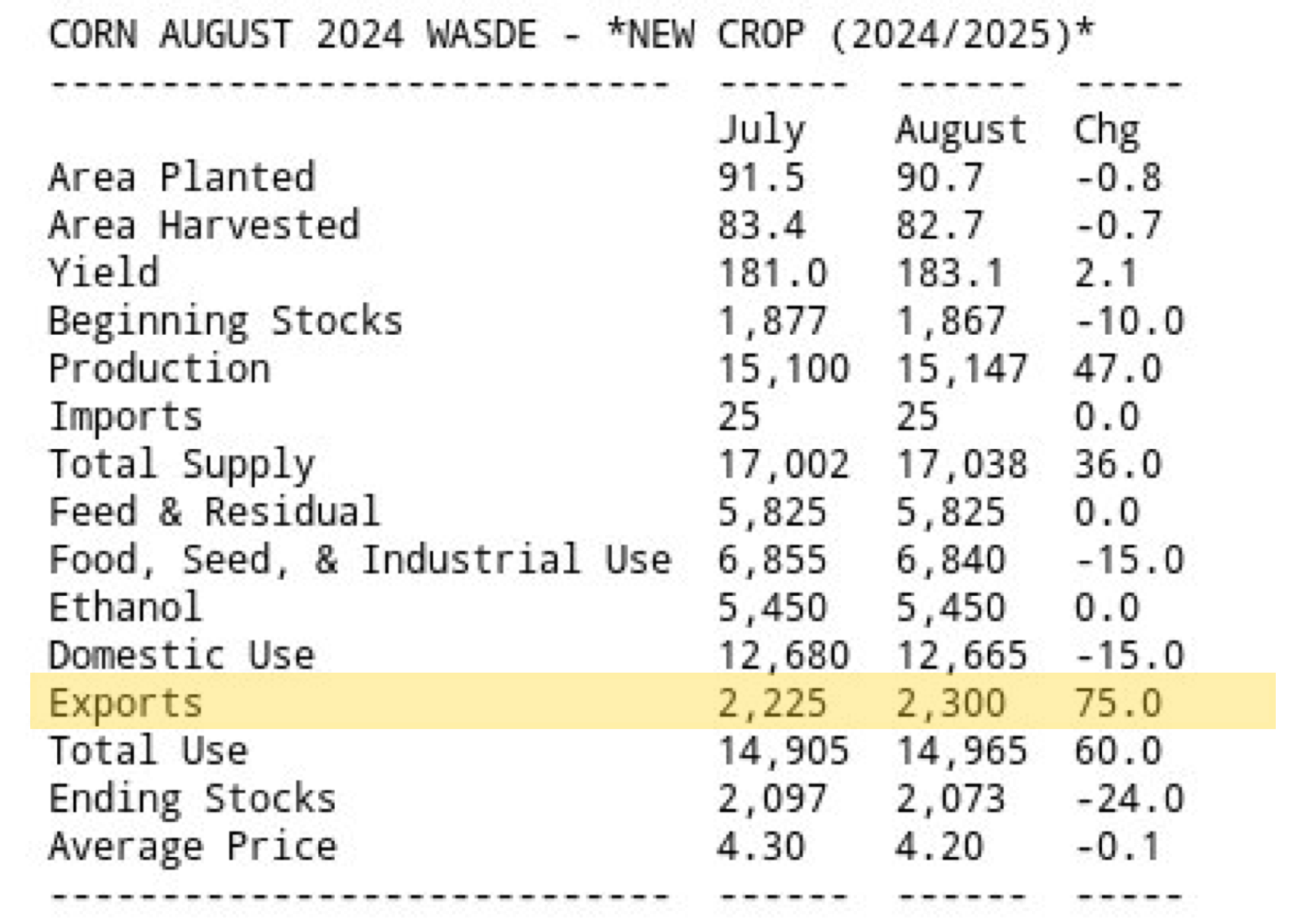

Despite corn yield going from 181 to a record 183, the report wasn’t actually "bearish" corn. The report could have easily been very bearish, but it wasn’t.

It was neutral to maybe even slightly friendly for corn given that fact that despite the 183 yield we actually saw our carryout decrease. This was due to acres falling -800k along with a slight bump in demand on the exports. As they raised export demand by 75 million bu.

So even with a +2 bushel to yield, carryout came down.

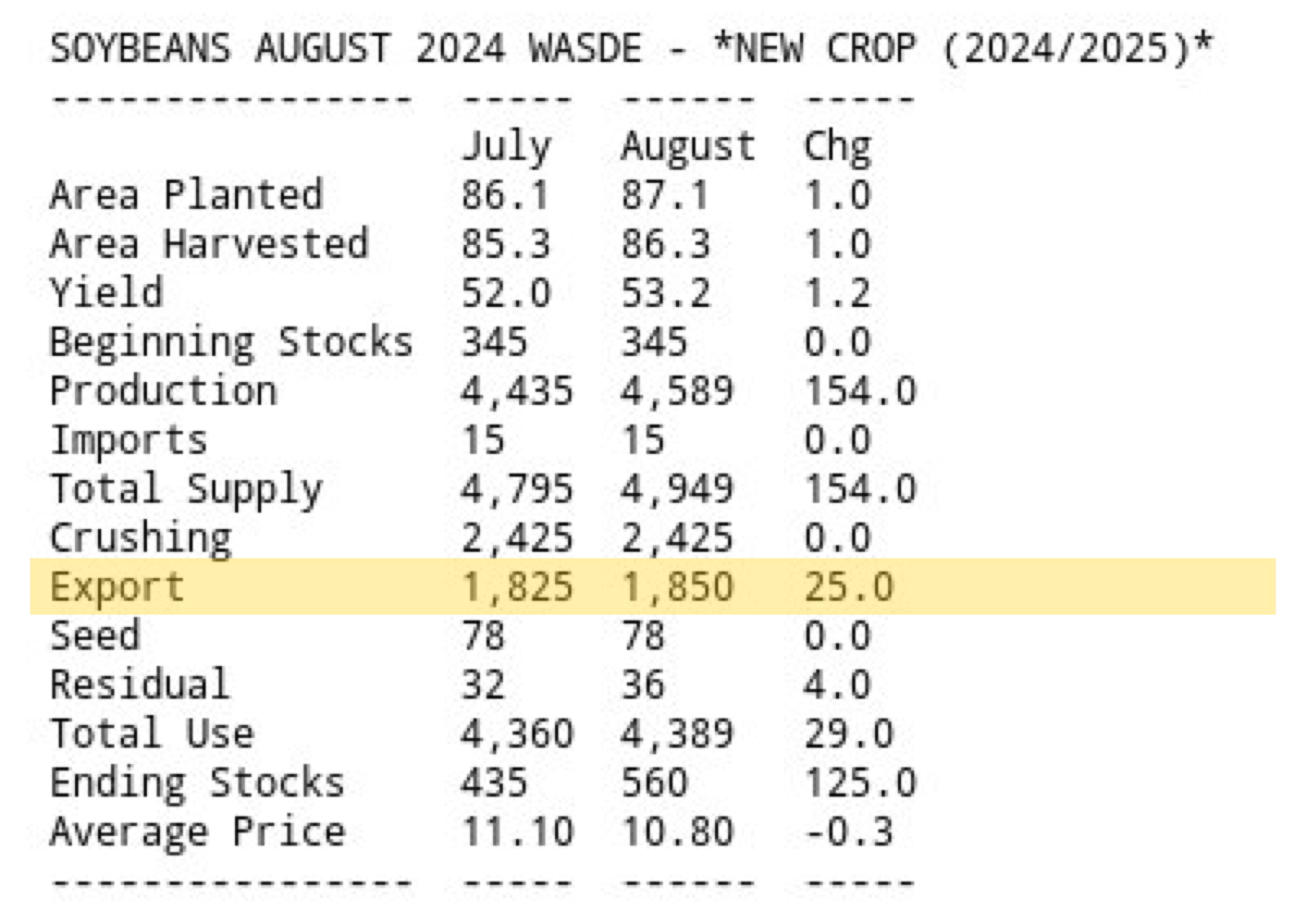

Soybeans on the other hand had about as bearish of report as you'll ever see. Yield was expected to increase, and it did. Going from 52 to 53.2. But the real whammy was the acres. Both harvested and planted acres jumped a whopping +1 million acres when the trade was expecting harvested acres to decline by -145k.

So while corn carryout decreased, soybean carryout saw a massive +125 million bushel increase from 435 to 560 million. A +22% increase from last month.

Here are the numbers:

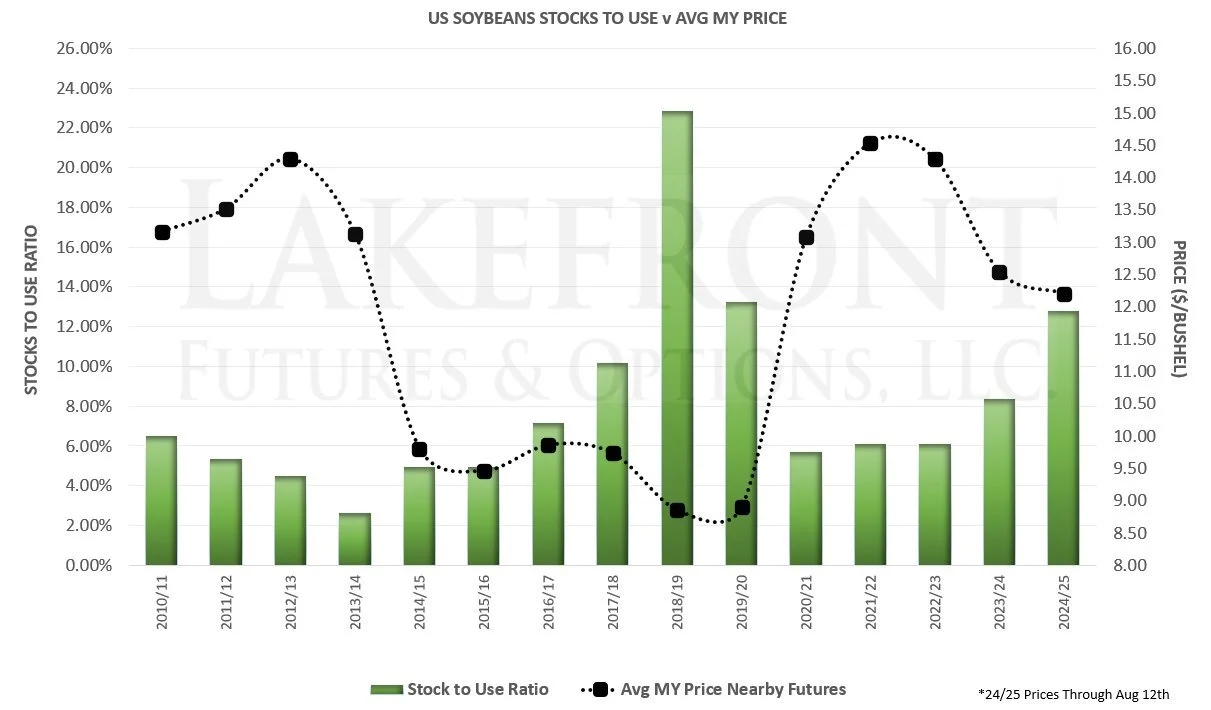

This brought soybean stocks to use ratio all the way to 12.8%. A huge number.

The last time we saw a +12% ratio soybeans traded below $9. Granted this was during the trade war in 2019/20.

Here is a good chart from Lake Front futures that shows how stocks to use ratio can correlate to prices.

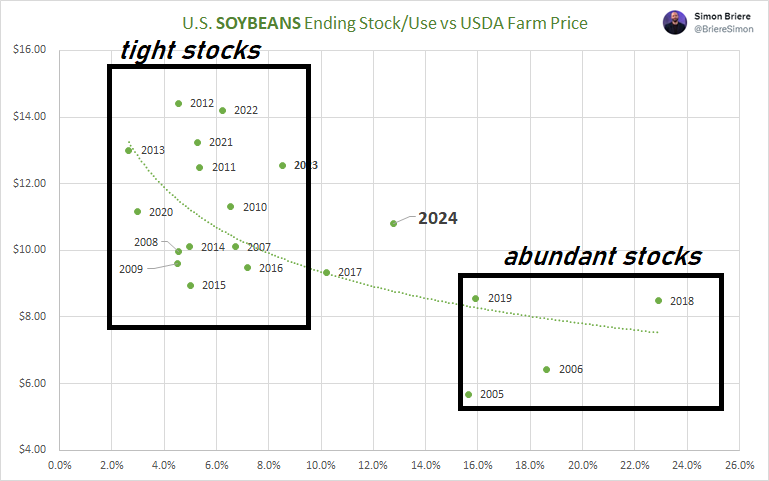

Here is another graph from Simon Briere.

Tight stocks typically correlate to higher prices, abundant stocks to lower prices.

Right now we are roughly in the middle.

So it looks like we are going to have a monster crop of soybeans here in the US.

The even bigger problem?

Demand.

Today we saw yet another round of small exports sales. 132k MT of beans to China. Yesterday we saw 300k MT of beans to unknown.

Now these are good news, but not enough to move the needle at all.

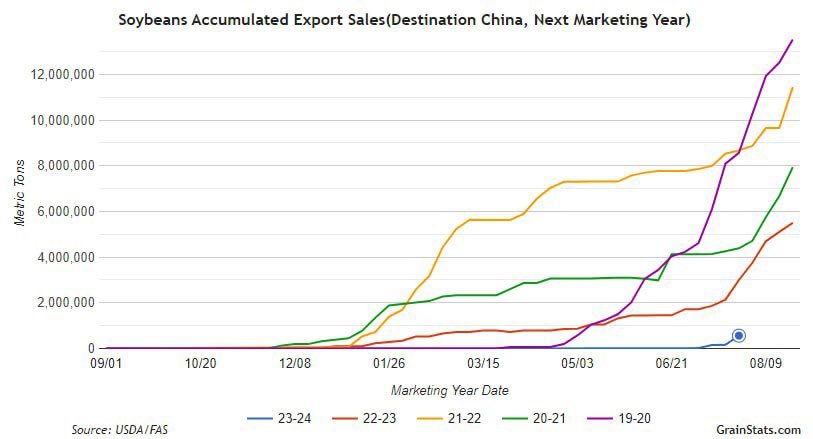

Look at this chart from GrainStats. You can see just how far behind we are in export sales to China.

Eventually low prices will cure low prices.

$15 beans cured $15 beans. The will happen to $8 or $9 beans.

We will need demand to start eating into this now large carryout.

Was this weak market perfect timing for China to step in soon..? Or will they continue to be on the sidelines?

There is no telling as to how low we will have to go to create enough demand to rationalize higher prices.

But what we do know is that at some point, we will find demand. The question is how long and how low do we go before doing so? That is the risk.

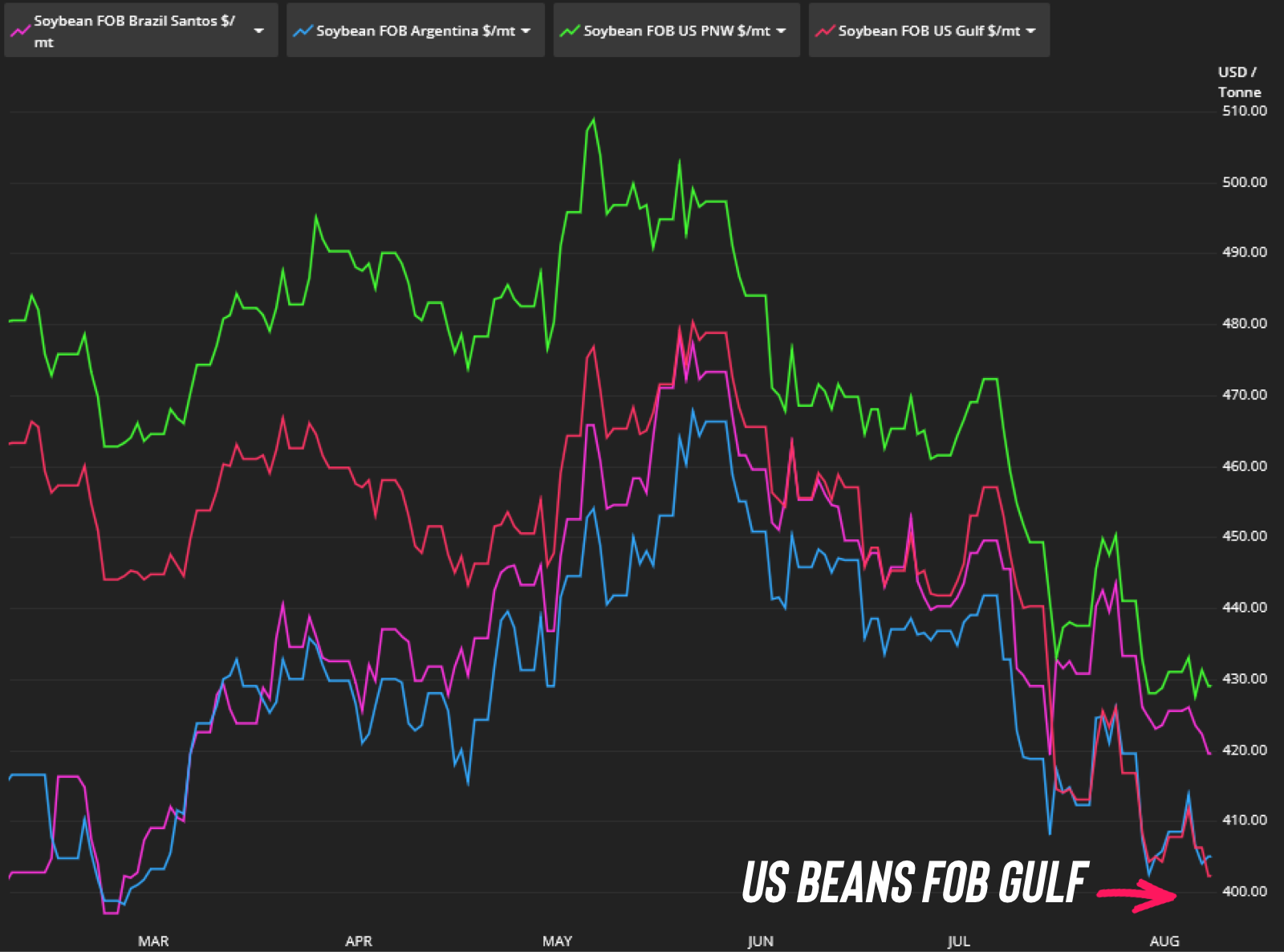

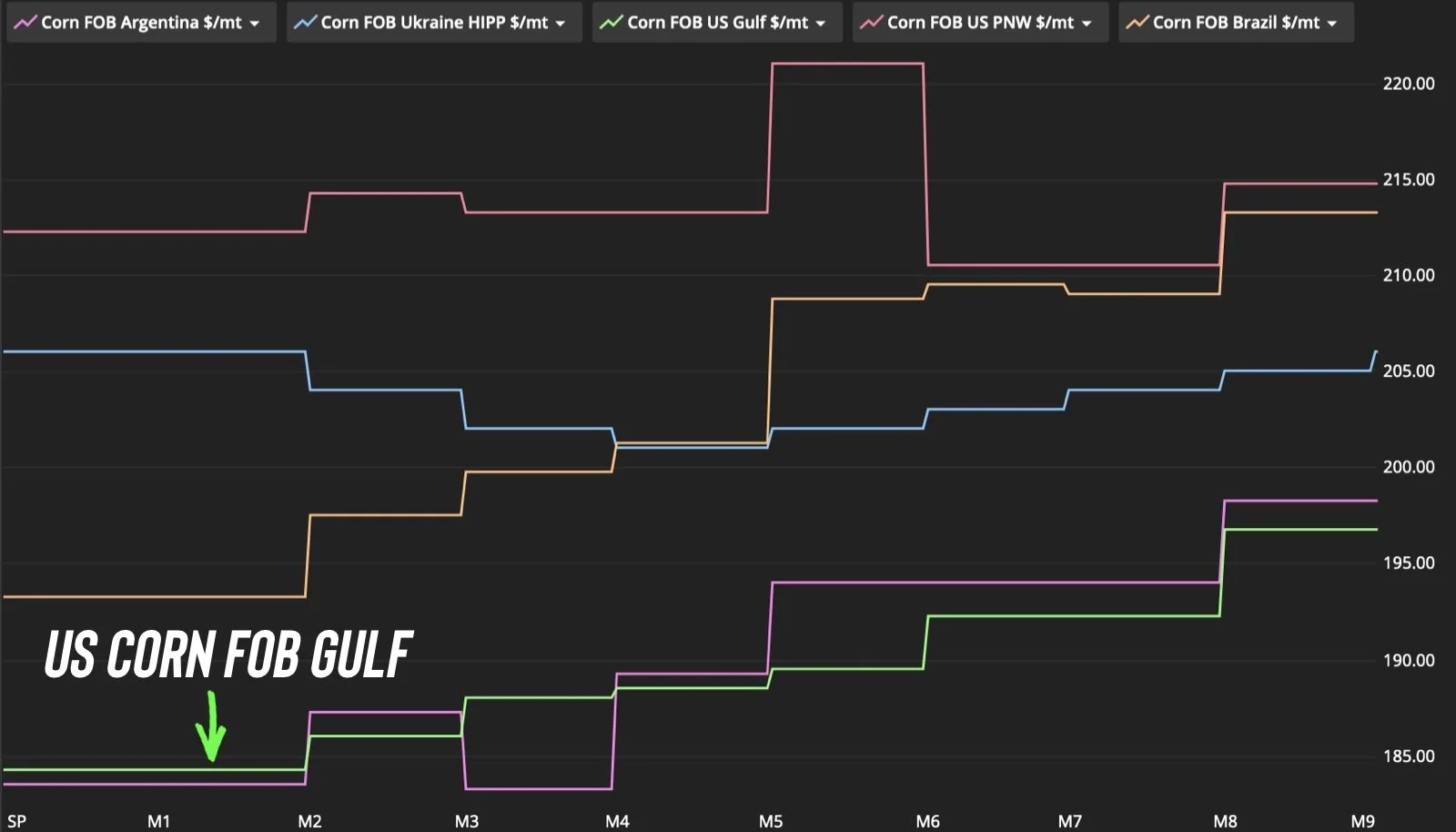

I included these images last week. But here they are again. US Gulf soybeans & corn are the cheapest in the entire world.

So we have the cheapest grain in the world off the Gulf. China is severely underbought soybeans.

One could expect us to start finding demand here at these levels. But yes, we can still go a lot lower before doing so.

The point is, we need demand. Especially for soybeans. If we cannot find demand, we can still go a lot lower from here. Demand aka China is about the only thing that can save this soybean market.

Once China comes in heavy (I'm talking about 1 million MT at a time) that would be an indication that the bean market is done going down. However, until that happens, this monster crop in the US could very well continue to push us lower until after harvest when the trade starts to pay attention to South America etc. Then it might take some South America issues to save the market, but right now expectations are for a monster 169 bu crop out of Brazil.

There are some questions surrounding the increase on the demand side of the corn balance sheet. As some question if exports will really be higher than this past year. But I think we are at low enough prices where this should translate to demand, but we haven’t quiet seen the demand yet. Business is starting to pick up in corn & wheat, but nothing dramatic yet.

The USDA also increased their export projections for beans. Many are already skeptical of the current demand sheet on beans given we have a tiny new crop book of sales to China right now.

The USDA is also assuming that these lower prices will lead to more demand.

Below are charts from GrainStats where you can see the increases they made to export demand:

Today's Main Takeaways

Corn

Corn lower despite a neutral to somewhat friendly report. Corn was simply drug lower by soybeans today.

On the charts, we did not take out yesterday's lows which was a good sign.

On the bright side, we got a report that showed a huge 183 yield, yet our carryout decreased.

I am NOT saying there couldn’t be more downside from here.

Yes, there is a lot of supply that will be entering the market. Which may make a rally until post harvest hard.

But, what else is left to sell this market on?

We already know that……….

The rest of this is subscriber-only.. Subscribe to keep reading & get every future update. Comes with 1 on 1 market plans where we walk you through every single step of your marketing. Ensuring you make the best possible decisions everytime.

TRY 30 DAYS FREE: CLICK HERE

WHAT YOU MISSED

What is left to pressure corn?

The funds & commercials

What could save the bean market?

How big is our bean carryout?

Longer-term bull arguments

Biggest risks we face

PREVIEW OF WHAT YOU MISSED

Could we see another -40 cents of downside? It is possible. It's not very likely in my opinion, but $3.50 Dec corn is not out of the cards. As we found support there many times in other bear market years.

That probably only happens IF this crop gets even bigger and demand disappears. I don’t see either of these happening, as corn growing season is over and we should start finding demand. But both are possible.

From GrainStats:

"I feel the USDA jumped the gun a bit early (talking about bean export projections). So from a trader point of view, we all want to see some more exports on the books before traders get bullish again. That happens when we have new and increasing demand for exports, OR we have problems in competing countries of Brazil or Argentina."

So basically to say we are done going down we need exports or problems in SA.

From Chris Robinson:

"Do the Chinese see this price box? They do not seem to be in a hurry to put their buying shoes on. If you were a buyer, would you want to call the low or just keep going hand to mouth?"

We are officially in bear market territory. If we break $9.60 we enter trade market territory. During other bear markets we didn’t find support until low $9’s to even sub-$9 sometimes.

Right now our stocks to use ratio & ending stocks indicates a scenario like that is possible IF China doesn’t step up.

KEEP READING..

Subscribe to get the full update & future ones. Comes with 1 on 1 market plans where we walk you through every step of your marketing.

Try 30 Days Completely Free

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

8/12/24

USDA REPORT: BEARISH BEANS. SMALLER CORN CARRYOUT & RECORD YIELDS

8/9/24

USDA REPORT MONDAY

8/7/24

HUGE USDA REPORT MONDAY

8/6/24

WHEAT UNDERVALUED? CORN YIELD? WHAT TO DO WITH GRAIN OFF COMBINE

8/5/24

GRAINS STRONG WHILE WORLD PANICS

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24

MARKET EXPECTS A PERFECT CROP?

7/31/24

CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL-OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24