CROP TOUR DAY 3. NOT HUGE MOVEMENT

AUDIO COMMENTARY

Crop tour day 3 (Day 1 & 2 results below)

Crop tour not affecting market

Confirming big crop but holes

So far everything they found built into market

Corn & beans holding recent lows

Wheat makes leg lower

Wheat negates inverse H&S (chart below)

Corn still struggling to reclaim $4.00

Still plenty of risk to the downside

First notice day & basis contracts

Still waiting for confirmation the bottom is in

Insurance pricing coming up

Not much happening on the charts

Dry weather in areas that planted late

Long term we should see more demand

If have to sell off combine have a floor

Dryness in Mississippi could harm basis in some areas

Listen to today’s audio below

WANT FUTURE UPDATES?

Usually we don’t share full updates on social media.

Subscribe to get full access. Comes with our signals & 1 on 1 completely tailored market plans where we walk through every step of your marketing. With the ability to call us 24/7.

Make this the year you beat big ag at their own game.

TRY 30 DAYS FREE

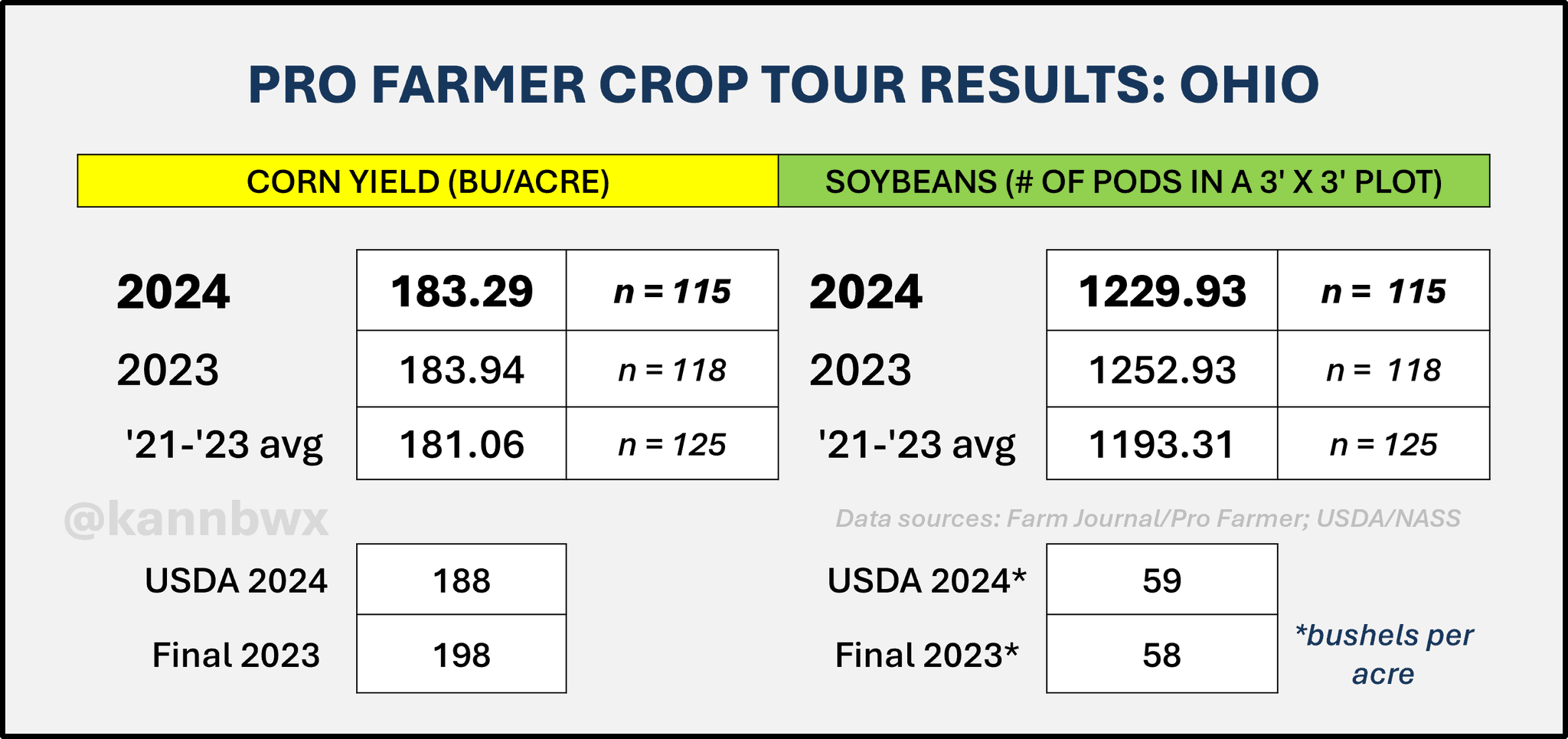

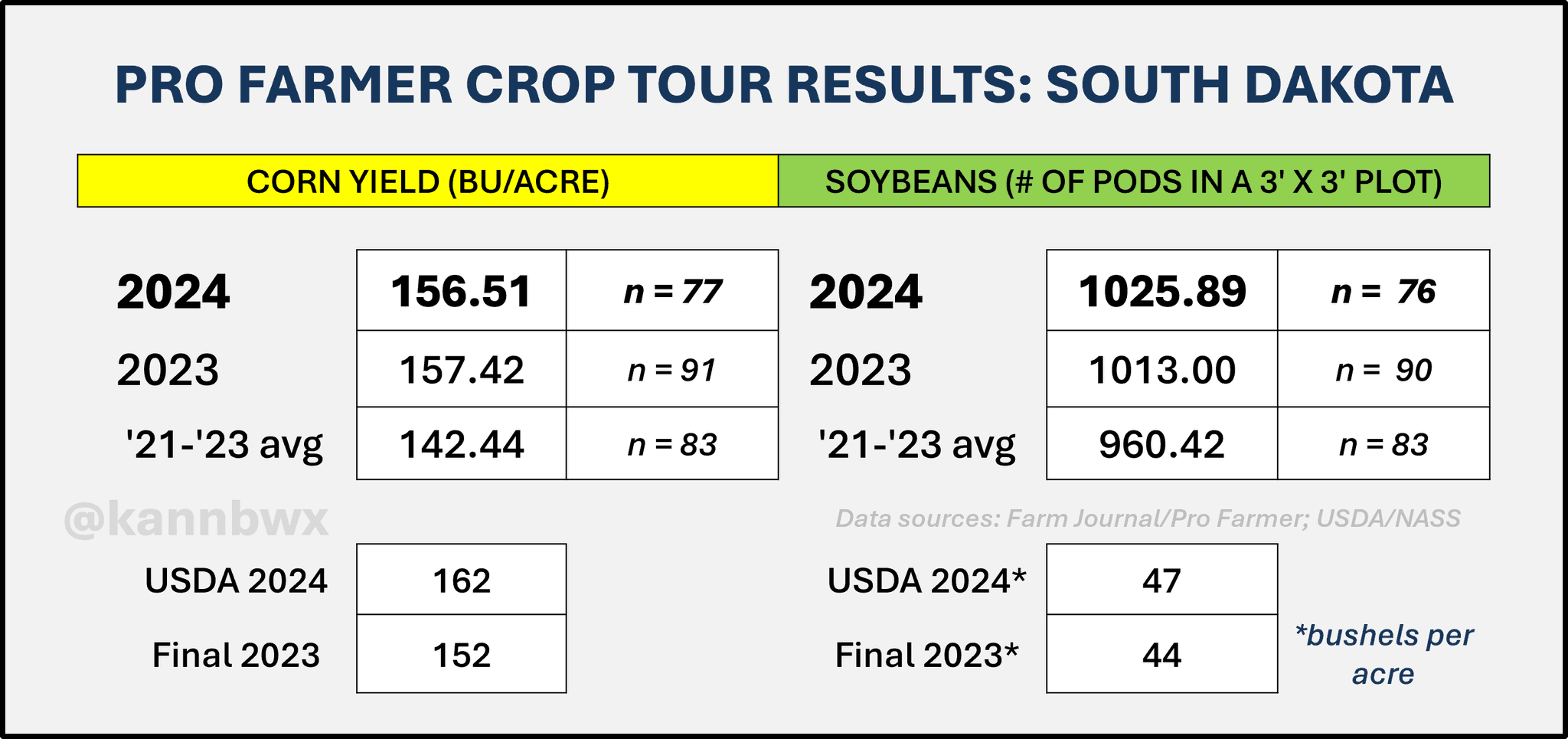

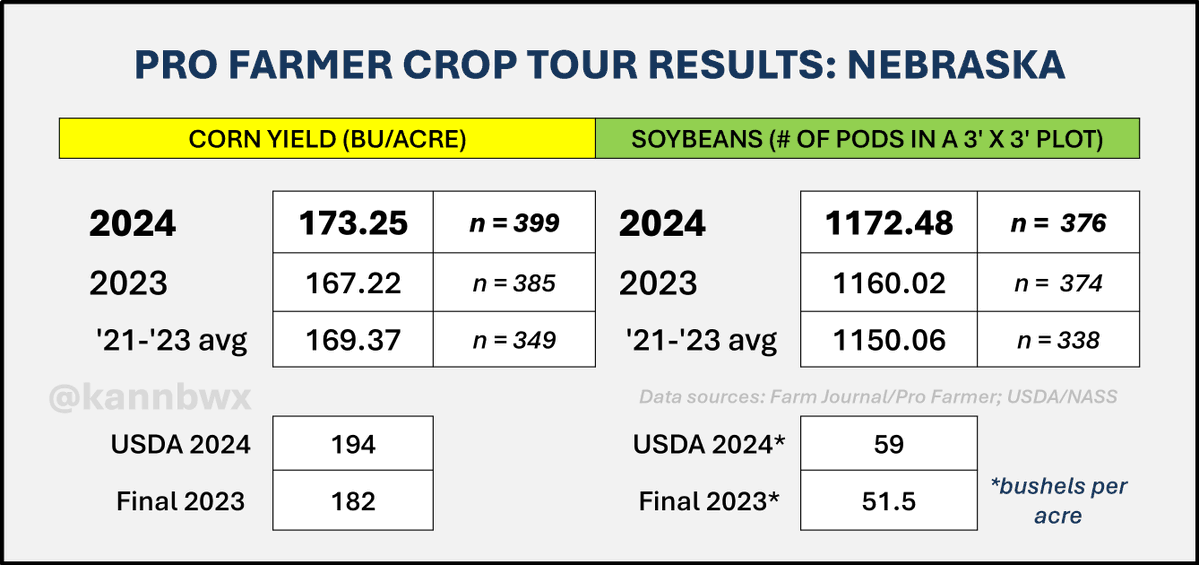

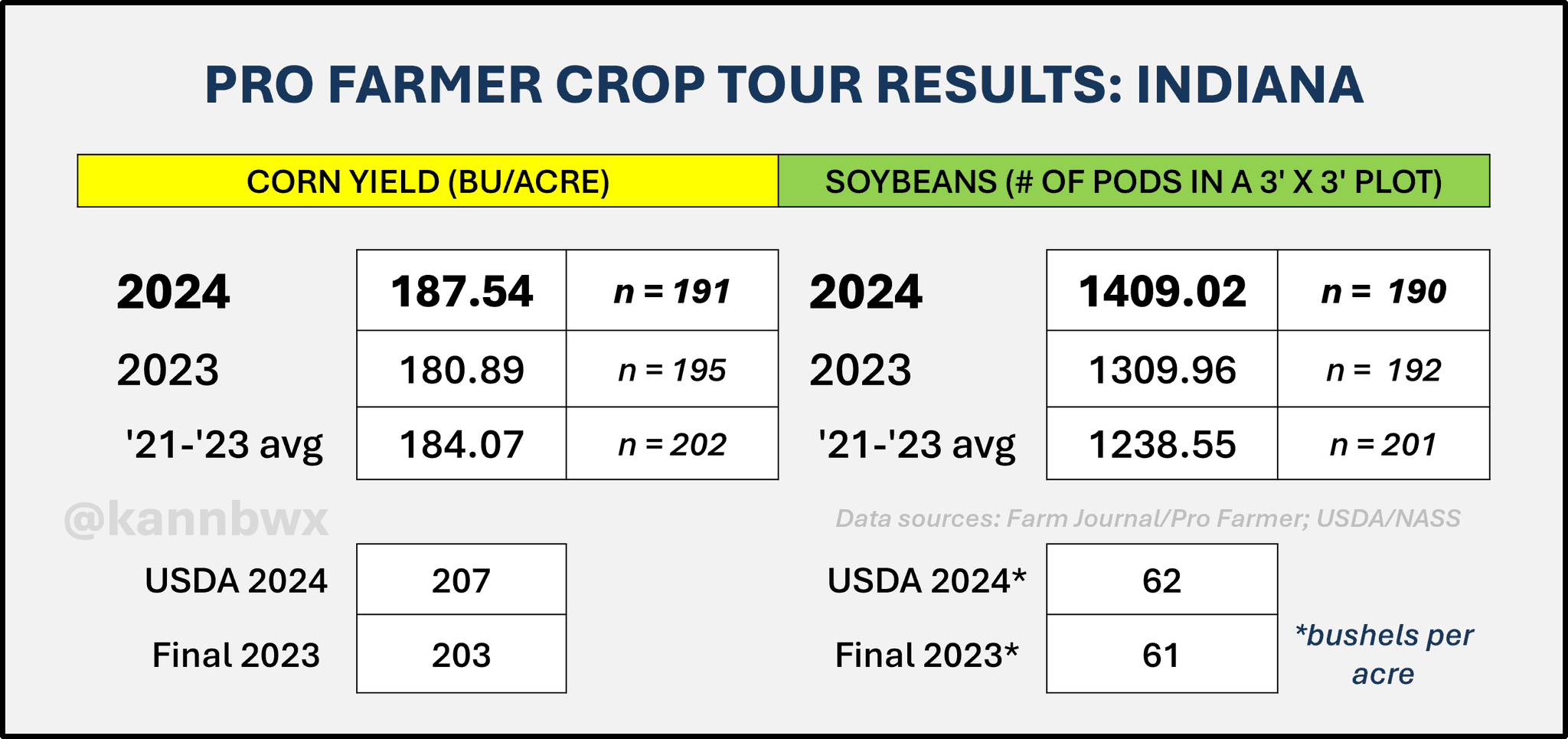

CROP TOUR RESULTS SO FAR

CHARTS

Corn

Still trapped under $4.00. A close above $4.03 would look friendly. Back above $4.09 would look really promising. To completely say we are done going down, still need $4.23-26.

Downside risk is still the $3.80 target if $3.90 fails.

Beans

Nice bounce from the lows, but nothing more than a bounce until proven otherwise.

A close above $10.00 would look promising. But to say the bottom is in, we really need to claw all the up past those late July highs.

Once that May downtrend is broken, the chart will look more friendly as well. Until then the risk is lower as we remain in a very clear downtrend.

Chicago Wheat

Yesterday I mentioned a possible inverse head & shoulders forming, which is a bullish pattern. However, today’s action negated that formation.

It is still possible, but we would need a bounce asap tomorrow. A break above that green box would be friendly. If that happens, then we have upside targets of $5.90, $6.00, & $6.25

If we break $5.24 the next logical stop would be $5.00.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

8/20/24

CROP TOUR SO FAR & COMPARISON TO USDA

8/19/24

CROP TOUR BOUNCE

8/16/24

RISK REMAINS LOWER. MANAGE YOUR RISK

8/15/24

DEMAND, BIG US CROPS & BRAZIL DROUGHT

8/14/24

DEAD CAT BOUNCE

8/13/24

POST USDA SELL OFF

8/12/24

USDA REPORT: BEARISH BEANS. SMALLER CORN CARRYOUT & RECORD YIELDS

8/9/24

USDA REPORT MONDAY

8/7/24

HUGE USDA REPORT MONDAY

8/6/24

WHEAT UNDERVALUED? CORN YIELD? WHAT TO DO WITH GRAIN OFF COMBINE

8/5/24

GRAINS STRONG WHILE WORLD PANICS

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24