MORNING MARKET UPDATE

Futures Prices 7:30am CT

Overview

All eyes have been on the Pro Farmer crop tours, as yields continue to come in lower and remain disappointing. The results from the crop tours are offering an immense amount of support to the markets. With corn hitting a two-month high in yesterday's overnight session. It appears that China is now back looking to purchase U.S. commodities. With their recent purchase of U.S. soybeans. Funds are also now back showing more interest.

Crop Tours

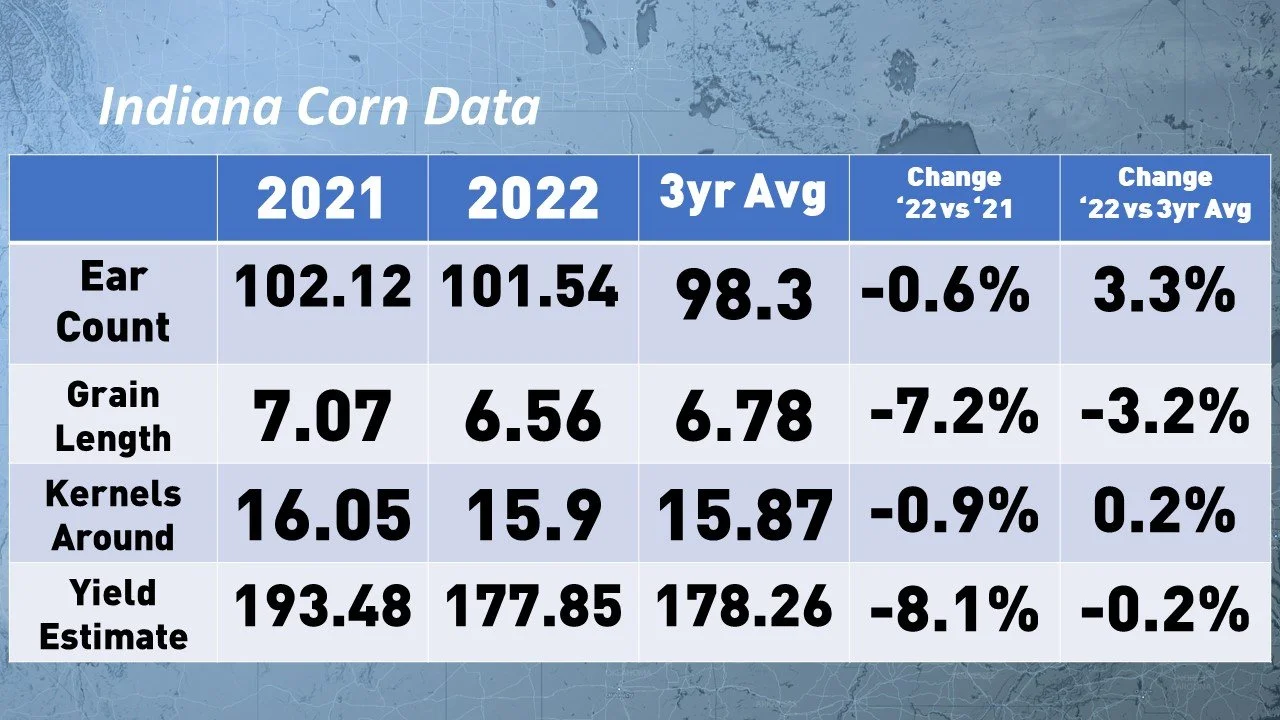

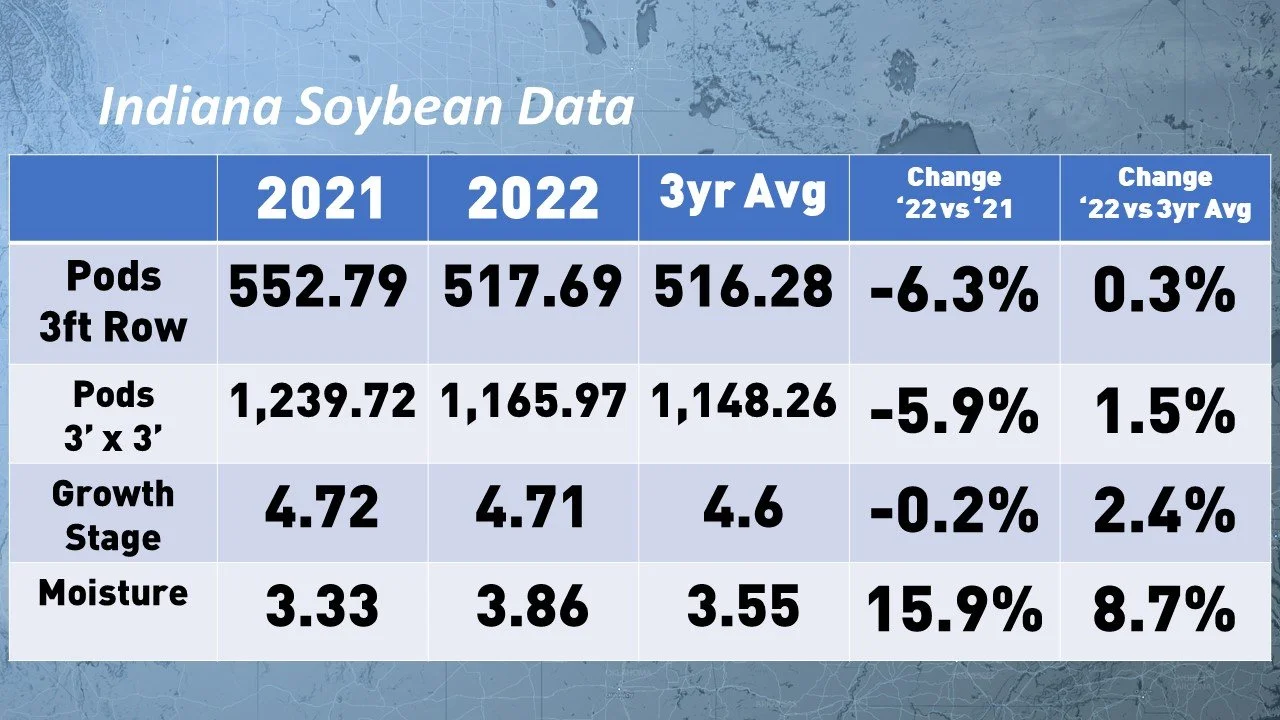

Indiana

The corn yield in Indiana was forecasted at 177.85 bushels an acre, last year was 193.48 and the three year average is 178.26 bushels per acre. The USDA is forecasting a 189 bushel average yield for Indiana.

(Click here for full Indiana results)

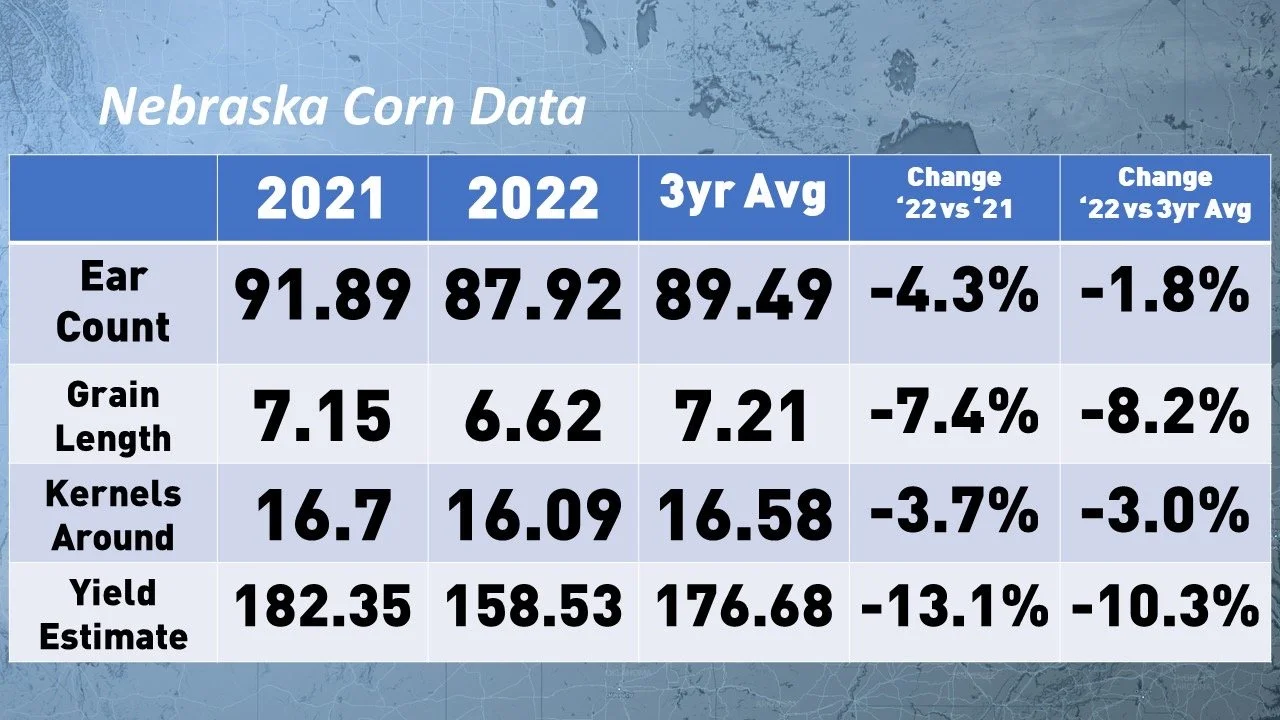

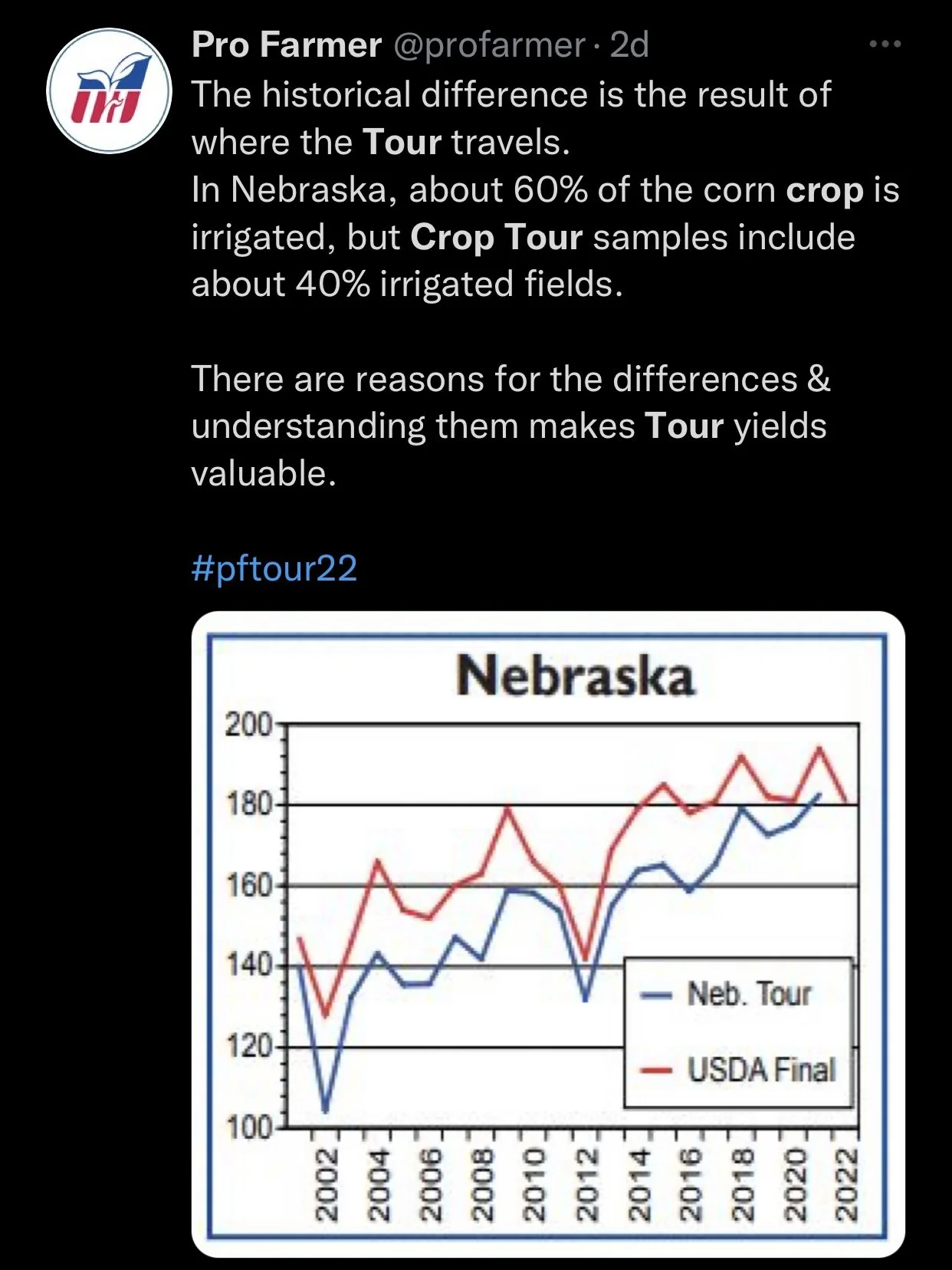

Nebraska

Corn yield in Nebraska was forecasted at 158.53 bushels per acre, with last year being 182.35 and the past three year average being 176.68 bushels an acre. USDA is currently forecasting a 181 average yield for Nebraks, last years final was an average of 194.

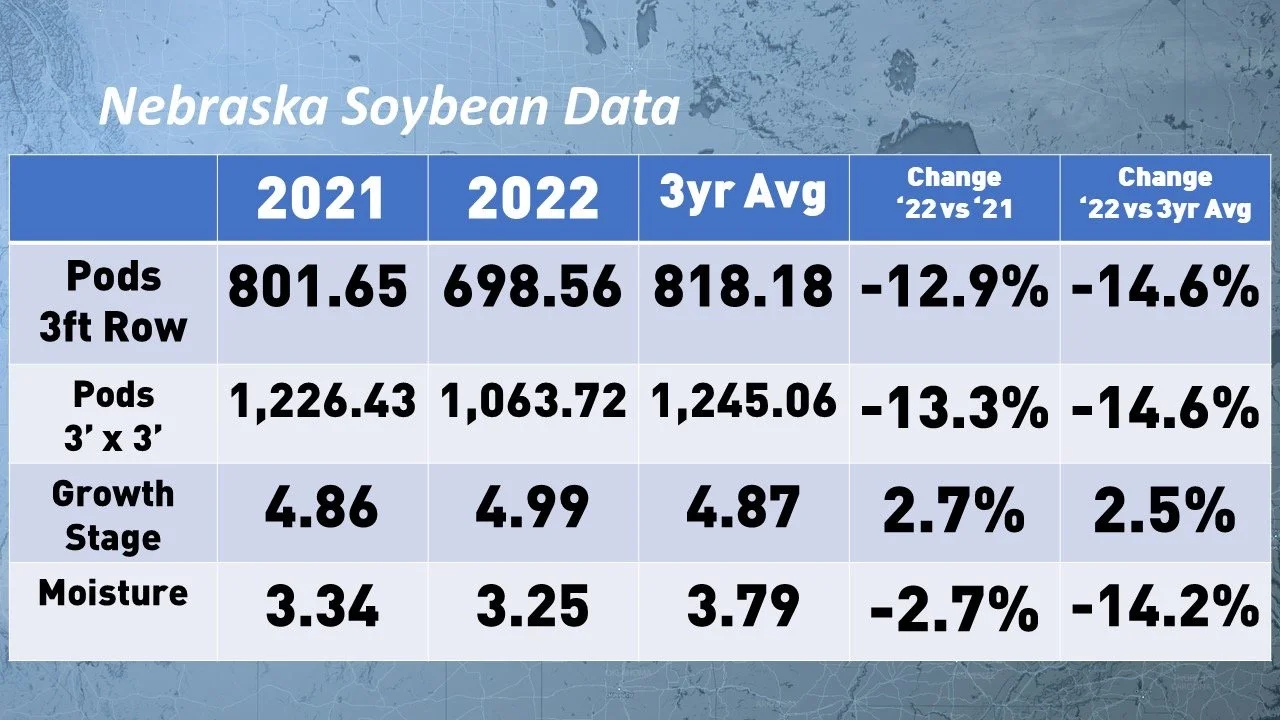

Pods came in higher than last year, but still below the three year average. With pods coming in at 1,226.43 compared to last years 1,063.72 and the three year average being 1,245.06

(Click here for full Nebraska results)

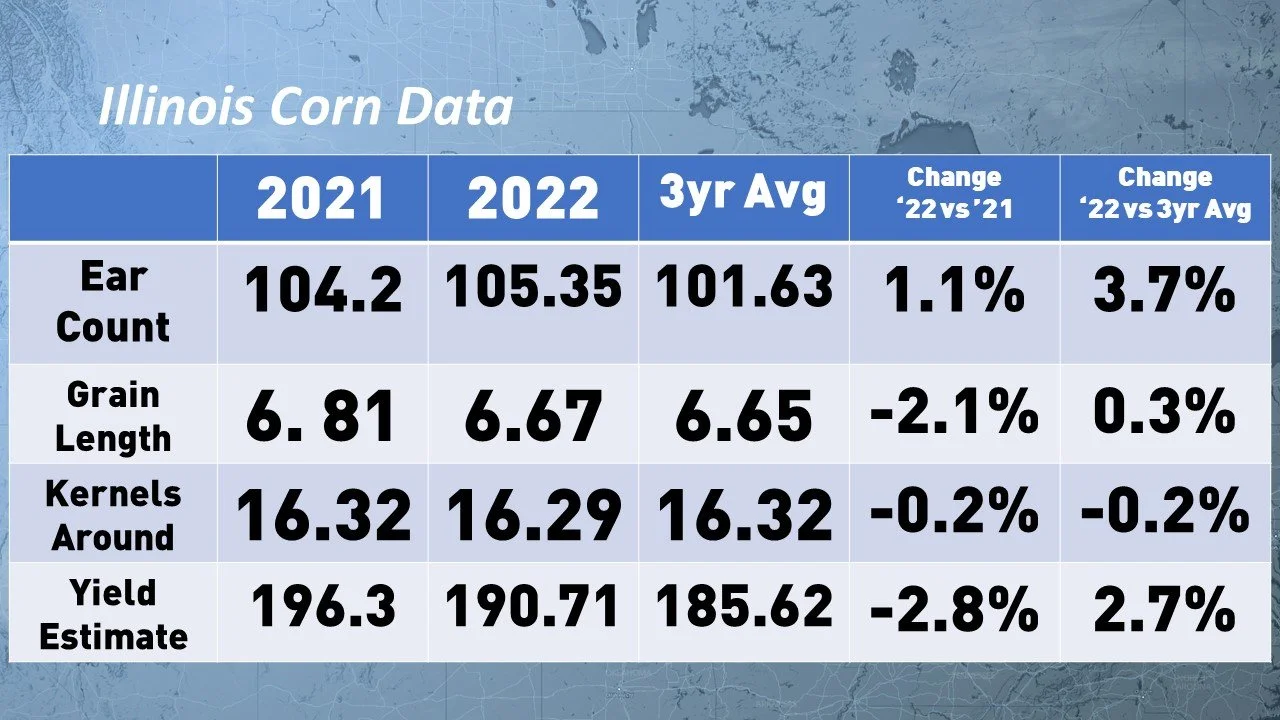

Illinois

Corn production at 190.71 bushels an acre, last year was 196.3 with the three year average being 185.62.

USDA forecasting corn yield at 203 bushels an acre compared to last years 202.

Soybean pod production was estimated at 1249.7 pods vs 1279.79 last year and a 1174.95 year average.

(Click here for full Illinois results)

Western Iowa

Three districts all reported well below last year as well as the three year average.

Northwest was 181.12 bushels an acre compared to last years 183.96 bushels an acre with the three year average being 183.37

Southwest was estimated at 173.7 bushels an acre compared to last years 192.47 with 187.83 being the three year average.

West Central came in at 180.8 bushels an acre compared to last years 201.1 and the three year average of 188.74

(Click here for full Western Iowa Results)

Source: profarmer.com

Today's Main Takeaways

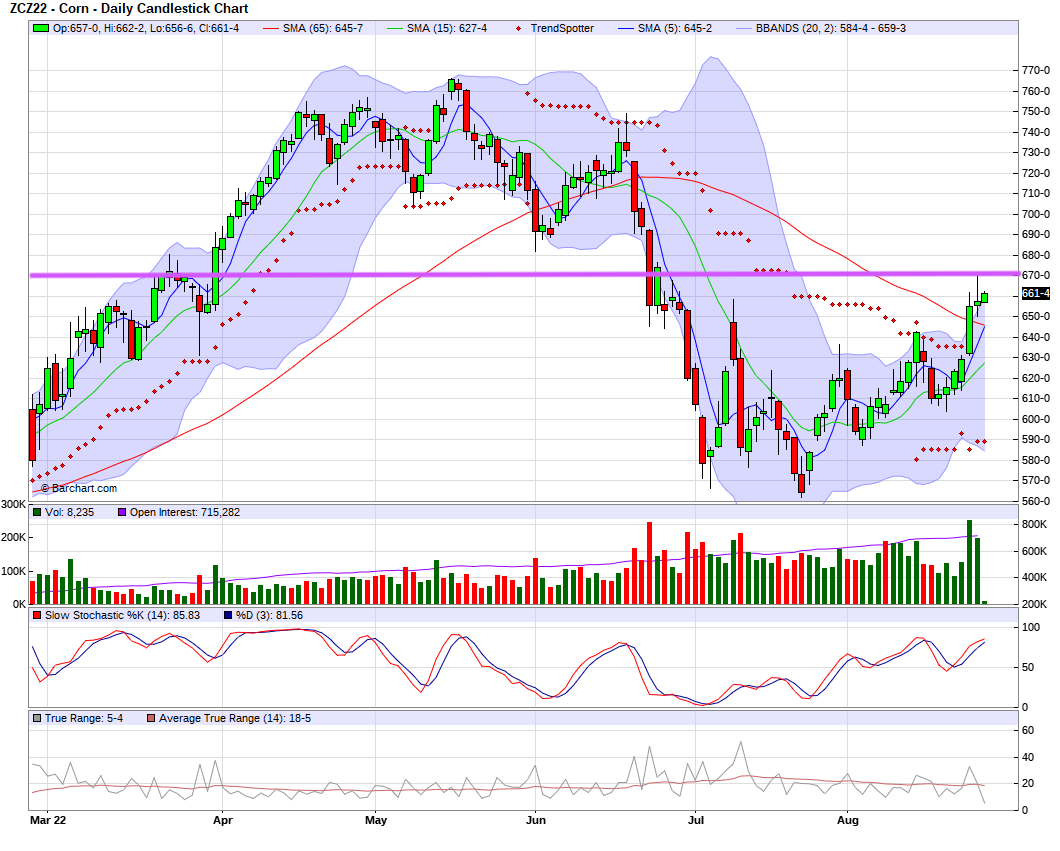

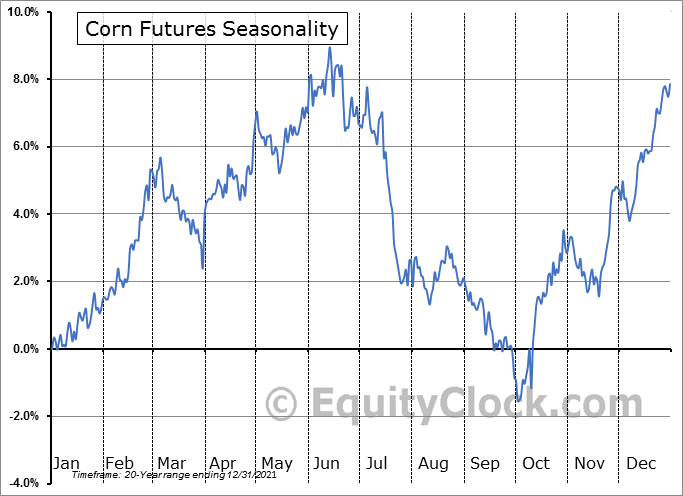

Corn

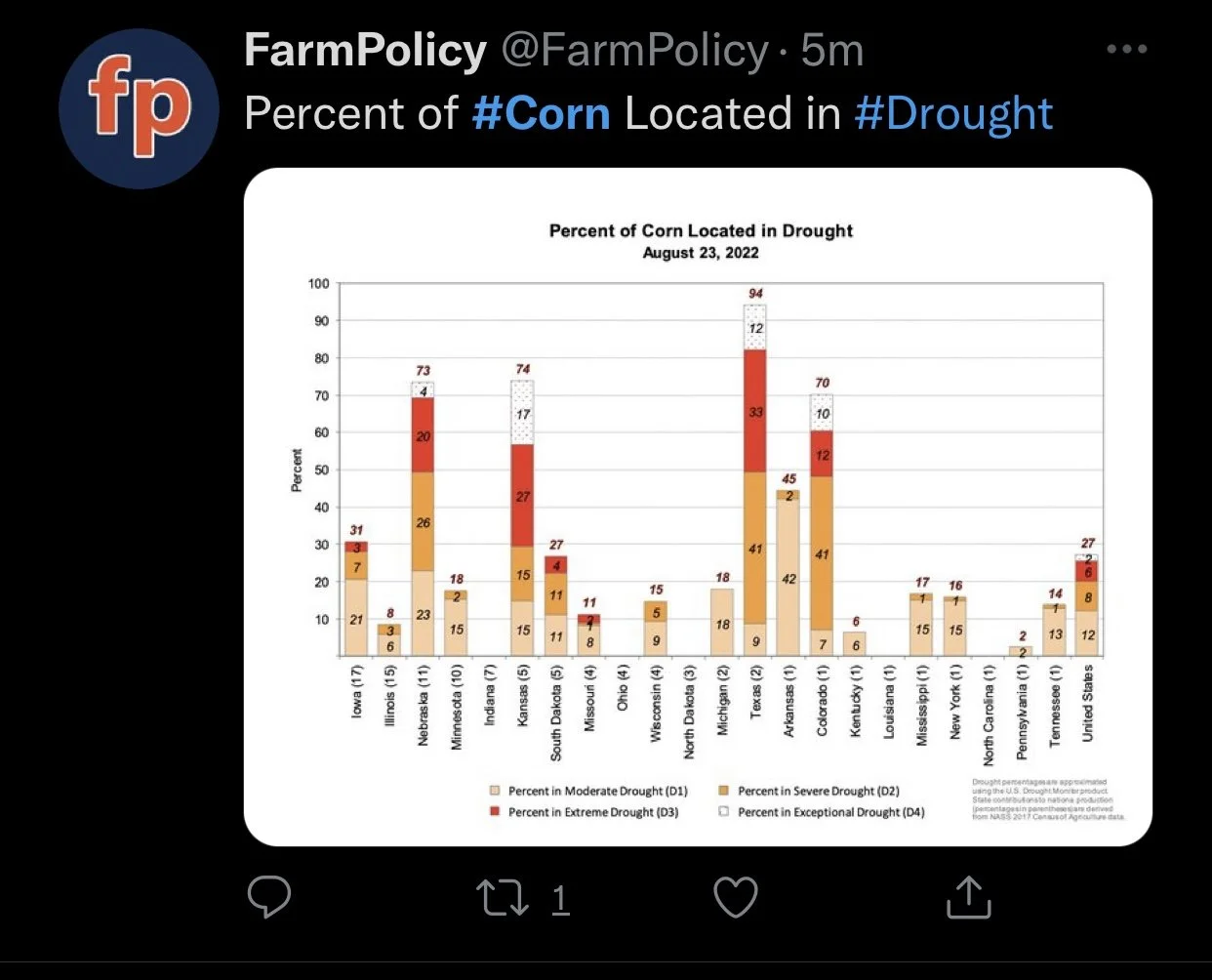

Corn futures now higher for the seventh straight session with prices higher overnight again. We now remain at a two month high. All the talk surrounding corn is about the lower U.S. average yield, with the possibility of fewer harvested acres. In Tuesday's overnight session we saw corn surge to a two-month high. With corn above the 200-day moving average now. There could be some potential pressure over demand concerns for ethanol as well as exports. But if crop tours keep showing lower yields, one would think that would outweigh demand concerns looking short term.

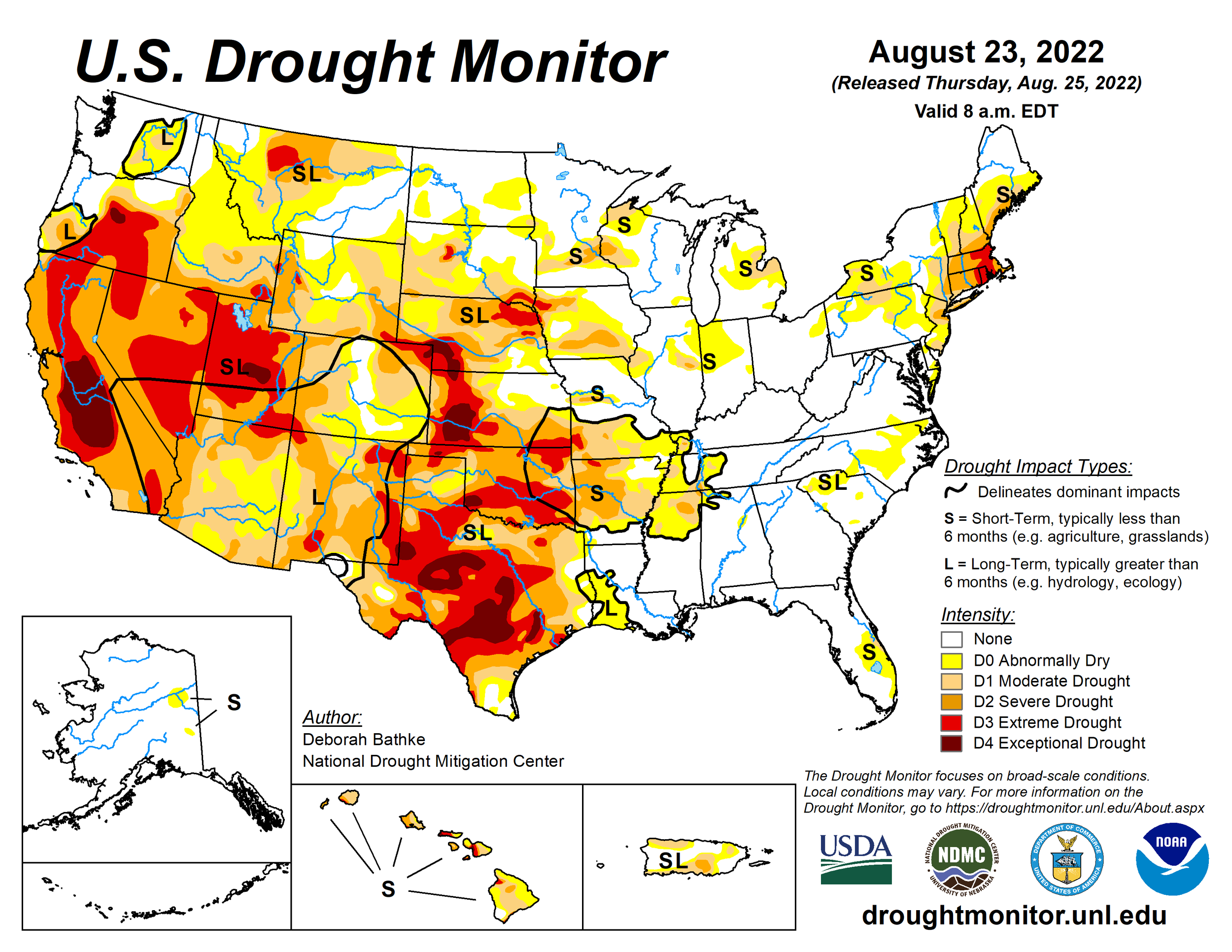

We are seeing lower yields in states where it wasn't necessarily surprising given their dry weather conditions, but it's pretty surprising seeing yields in areas that didn't see a ton of weather scare, such as Ohio. It wouldn’t be a shocker if we continue to see yield estimates coming in lower and supporting prices. With that being said, it wouldn't be unreasonable to think that corn could keep pushing higher, as it appears we may have broken our recent downtrend.

We also have EU production being a lot lower than was originally estimated. Which could also help support prices.

If we can continue to push up through resistance, and break through $6.70 we could see corn break up and see a test to the $6.80 to $6.90 range. The Dec. contract is now over a dollar off its lows we saw at the end of July.

Given the crop conditions and crop tours, I've got a bullish tilt on corn for now. However, demand could be one of the things that has the potential to cap our rally.

Dec-22 Corn (6-Month)

Seasonal Chart

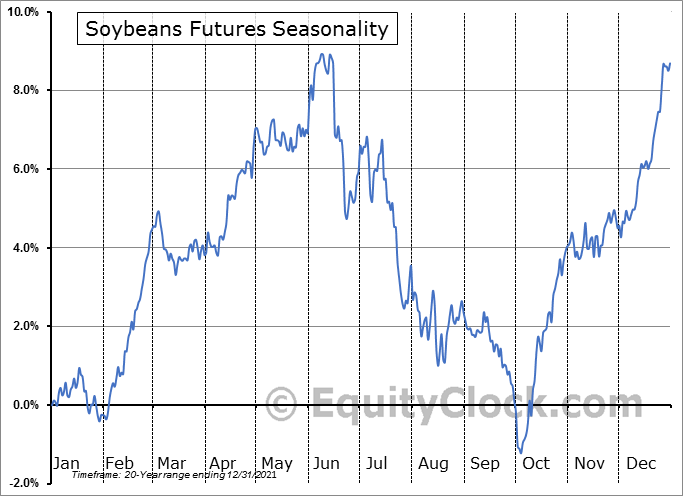

Soybeans

Soybeans lower here this morning. But we have seen some strength in demand as we saw a purchase from China. As it was announced yesterday morning that 517,000 metric tons of new crop soybeans were sold to China. We've now seen soybeans rally roughly 80 cents since the start of the week at their highest, now roughly 28 cents or so off their highs.

The massive strength in the soymeal and soyoil market has been one of the main driving factors pushing soybeans higher. As Dec. soymeal has rallied over 25 ticks this week. With Oct. making a contract high yesterday. Soyoil has recovered nearly half of its massive sell-off we saw in June and July.

If we want to continue to see higher soybeans we will need to continue to see Chinese demand pick up. As the crop tours aren't faring as poorly as they have been for corn, there is news that Brazil is looking to grow 20% more soybeans next year. CONAB also stated that Brazil is looking for a record soybean crop in 2023. With a projection of 150.36 million metric tons. we do have September contracts expiring tomorrow, which usually results in lower prices. However, if these crop tours continue to come in below expectations, they may change that typical scenario.

I’m somewhat nervous, but still slightly bullish on soybeans. With concerns over Chinese demand and U.S. relations. However, if we continue to see demand pick up and crop tours keep playing out the way they have so far, there is no reason to not think prices won't be higher in the near future. However, demand could also just as easily be a factor that puts a cap on this recent rally.

Soymeal & Soyoil

Soymeal down -5 to 424.3

Soyoil up up +0.05 to 66.03

Nov-22 Soybeans (6 Month)

Seasonal Chart

Wheat

It’s mostly a red start for wheat to start Thursday morning. With spring wheat trading higher, and both KC and Chicago trading slightly lower. However, the wheat market held its ground yesterday afternoon posting solid gains, as both corn and soybeans saw much of their gains fade.

Weather scares in China, the EU, and in India are providing strength to the wheat market. There is also some rumors that we may see some problems with new crop planting in Russia and Ukraine. As well as some strength on the demand side, with China purchasing French wheat. However, U.S. wheat demand still remains on the weak side.

Another factor we can look at that has the potential to spark some buying, is the fact that the exports out of Ukraine could very likely be overestimated. There is a solid chance we may see those numbers pushed lower.

With global weather adding support, and a ton of countries seeing drought. Weather has been a pretty mixed bag in the U.S. looking international, China is in the middle of a historic drought. Which is causing blackouts and factories to be shut down. Global wheat inventories outside of China are forecast to drop to their lowest levels in 14 years for 2022-23. Making it the thrid consecutive annual decline in wheat ending stocks excluding China. This could cause some global supply concerns.

Other Markets

Crude oil up +0.20 to 95.09

DOW up +74

Cotton up +0.63 to 114.70

Dollar Index down -0.18 to 108.43

News

Russian missile strike kills around 25 people in Ukraine. This attack was on a train station.

China's central bank announced a yuan stimulus plan for one trillion equivalent to $146 billion USD.

It was announced that California was be banning all gas powered cars in 2035.

Ukraine's 2022 crop could see another decrease. Down to 52.5 and 55.4 million metric tons from a record 86 million. Which Russian invasions reducing harvested areas.

Social Media (Crop Tour)

Credit: All credit to users of posts

Weather

Source: National Weather Service