MORNING MARKET UPDATE

Futures Prices 8:00am CT

Overview

Grains are higher this morning following yesterday’s gains. The markets finding some strength in the surprisingly lower crop condition ratings. The markets were expecting no changes to the condition ratings, however, we saw a decrease in both corn and soybean ratings. So far, the crop tours are also adding support, as the tours have been fairly disappointing, especially for corn.

Crop Condition Highlights

Corn

55% rated good/excellent (Last week 57%) (60% a year ago)

97% silking (99% average)

75% dough (79% average)

31% dented (35% average)

Soybeans

57% rated good/excellent (Last week 58%) (56% a year ago)

98% blooming (98% average)

84% setting pods (86% average)

Spring Wheat

33% harvested (Last week 16%) (21% behind 5-year average)

64% rated good/excellent (Unchanged from last week)

Winter Wheat

95% harvested (Last week 90%)

Crop Tours

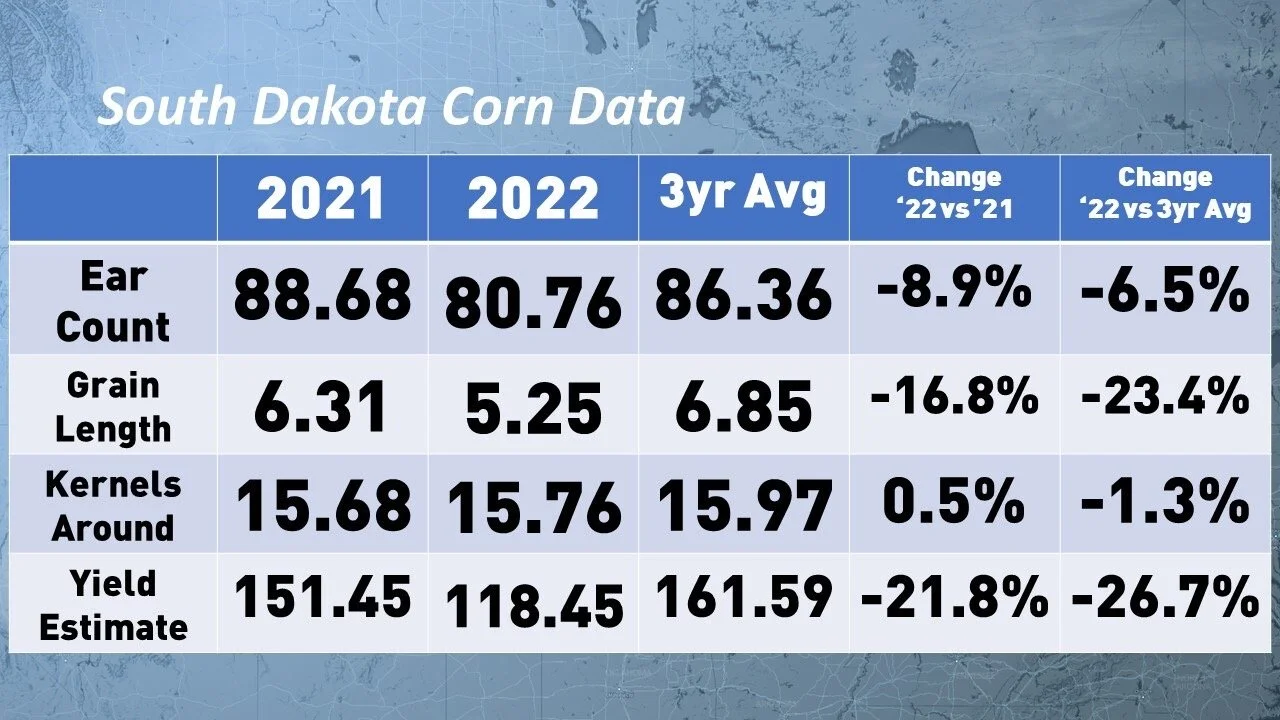

Yesterday we received the day 1 results for the Pro Farmer crop tour. South Dakota and Ohio results came in very disappointing. The tour data showed South Dakota corn yield averaged 118.45 bushels per acre, last year was 151.45 last. The USDA is currently forecasting the South Dakota crop at 147 bushels per acre to put these numbers into perspective.

Click here to review the full results for South Dakota.

Source: Agweb (Jenna Hoffman)

Today's Main Takeaways

Corn

The USDA once again lowered its crop condition ratings for corn, which was somewhat surprising as most expected the numbers to come in unchanged. They lowered the crop condition ratings to 55%, a 2% decrease from last weeks 57%. Majority of people believed we'd see the crops stabilize here after the cooler temperatures and rainfall we've seen lately.

Notable Changes by State

Pennsylvania down -10% (at 52%)

Nebraska down -5% (at 42%)

Colorado down -5% (at 31%)

Michigan down -5% (at 62%)

Kansas down -3% (at 26%)

South Dakota down -2% (at 48%)

Texas down -2% (at 17%)

So far the crop tours have also been supportive of prices, as mentioned earlier, the tours have been disappointing thus far. As it appears the soybean crop is holding up better than the corn crop in the western leg. These crop tours will show likely show that the U.S. crop is actually struggling more than the USDA currently has forecasted. The USDA will need to continue to trim their yield estimates.

Dec-22 (6 Month)

Soybeans

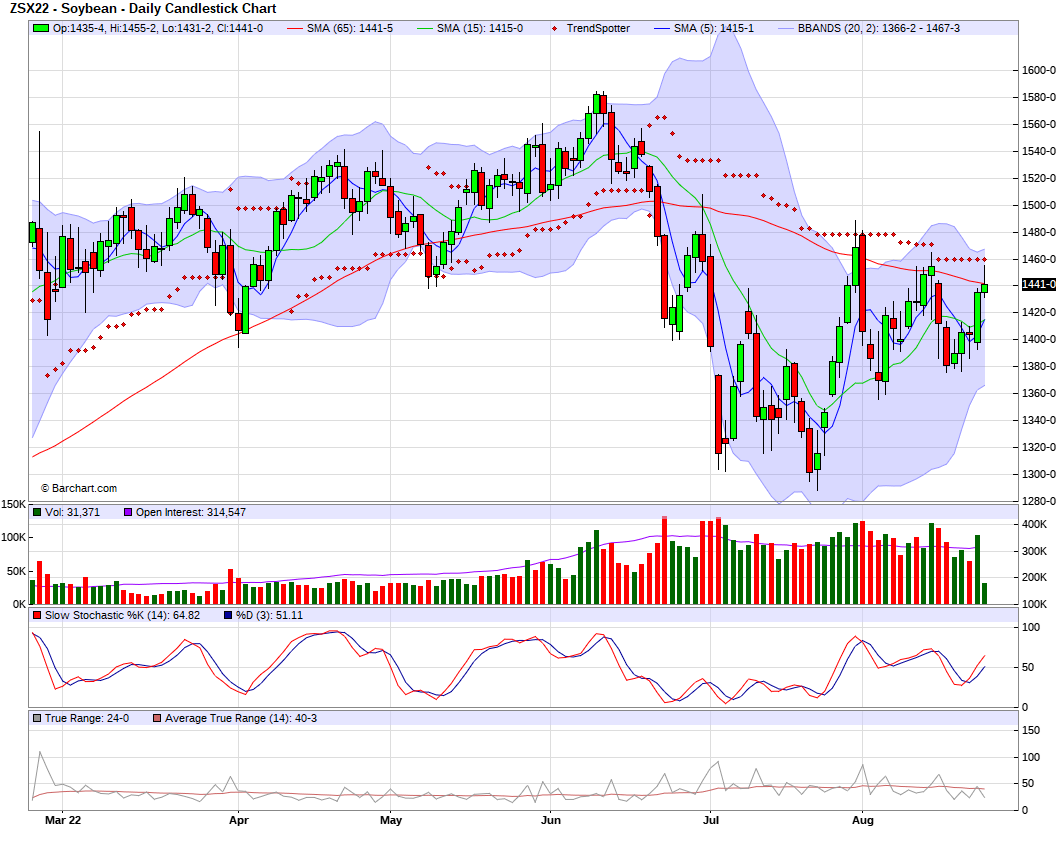

Soybeans slightly higher here this morning. With the crop condition ratings lowered slightly from last week to this week. The USDA lowering the ratings from 58% down to 57% rated good/excellent.

Notable Changes by State

Arkansas down -7% (at 64%)

Kansas down -5% (at 31%)

North Dakota down -5% (at 57%)

Louisiana down -3% (at 63%)

Nebraska down -2% (at 46%)

North Carolina up +7% (at 62%)

Missouri up +5% (at 51%)

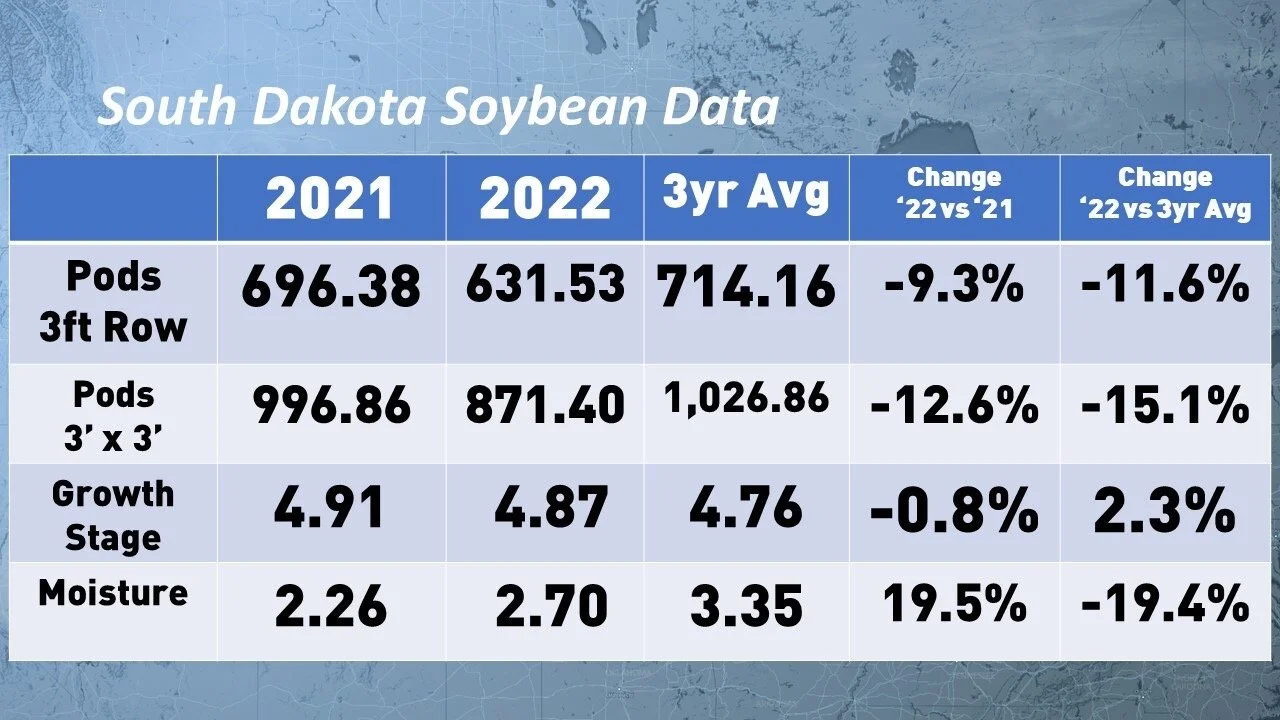

The crop tours have also been supportive for soybeans. With the crop tour showing South Dakota soybean count at 871.40 vs last year's 996.86. The average is 1026.86. The USDA currently forecasts South Dakota's crop at 43 bushels per acre.

Another driving factor in the soybean market would also be the improved demand we've seen from China after our Taiwan situation.

Soymeal & Soyoil

Soymeal up +1.8 to 417.2

Soyoil up +0.15 to 66.50

Nov-22 (6 Month)

Wheat

Wheat firmly higher here this morning. The USDA had spring wheat at 33% harvested which is far behind our traditional pace. We are also seeing the possibility of fewer acres being planted in Russia next planting season. As well as the potential for increased demand out of China as they are currently dealing with some extreme weather. The EU production is also being affected by extreme weather conditions.

The recent news out of Ukraine is also giving support the wheat markets. As there is fear that Russia may launch yet another attack on Ukraine.

U.S. Spring Wheat Harvest

Idaho at 27% (Last year 69%)

Minnesota at 30% (Last year 30%)

Montana at 52% (Last year 67%)

North Dakota at 18% (Last year 69%)

South Dakota at 84% (Last year 93%)

Washington at 40% (Last year 83%)

Other Markets

Crude oil finding strength to start the week, currently up +1.35 to 91.71 this morning. Yesterday it rebounded from $4 losses early.

DOW slightly down

Cotton down -1.39 to 112.75

Dollar Index barely down (-0.03) to 108.950

Export Inspections

Corn

Inspections came in up 8 million bushels to 29.2 million

Did 15% of the goal

YTD corn inspections are are at 94.1% of the 5-year pace

Soybeans

Inspections were down 3 million bushels to 25.2 million

Did 42% of the goal

YTD at 100.7% of the 5-year pace

Wheat

Inspections were up 7 million bushels to 21.8 million

Did 178% of the goal

YTD at 83.7% of the 5-year pace

News

It appears there may be a Russian attack on Ukraine as Russia is gathering missiles. Following the death of the daughter of Alexander Dugin (pro-Putin intellectual).

Ukraine's 2022 combined grain and oilseed forecast was cut from 69.4 MMT down to 64.5 MMT

Brazils weather will delay their second corn crop, however harvest is still ahead of last year.

U.S. government urges its citizens to leave Ukraine as there is fears of attacks.

Unplanted acres rise sharply. As these acres have tripled from this time last year. With prevented plantings at 6.4 million according to USDA Farm Service.

China’s currency drops to weakest level vs the U.S. dollar is 2 years.

Weather

Source: National Weather Service