MORNING MARKET UPDATE

Why we don't want to panic despite grains lower yesterday

Grains across the board as well as crude oil started off the month of September sharply lower. With corn closing 12 1/2 to 15 1/2 cents lower and soybeans 27 1/2 to 34 3/4 cents lower. With wheat all dropping around 40 cents. Crude oil fell nearly another $3, closing below $87. Hitting a new two-week low. In the last two days alone crude oil is down around $10. Down -20% from its highs in the past three months.

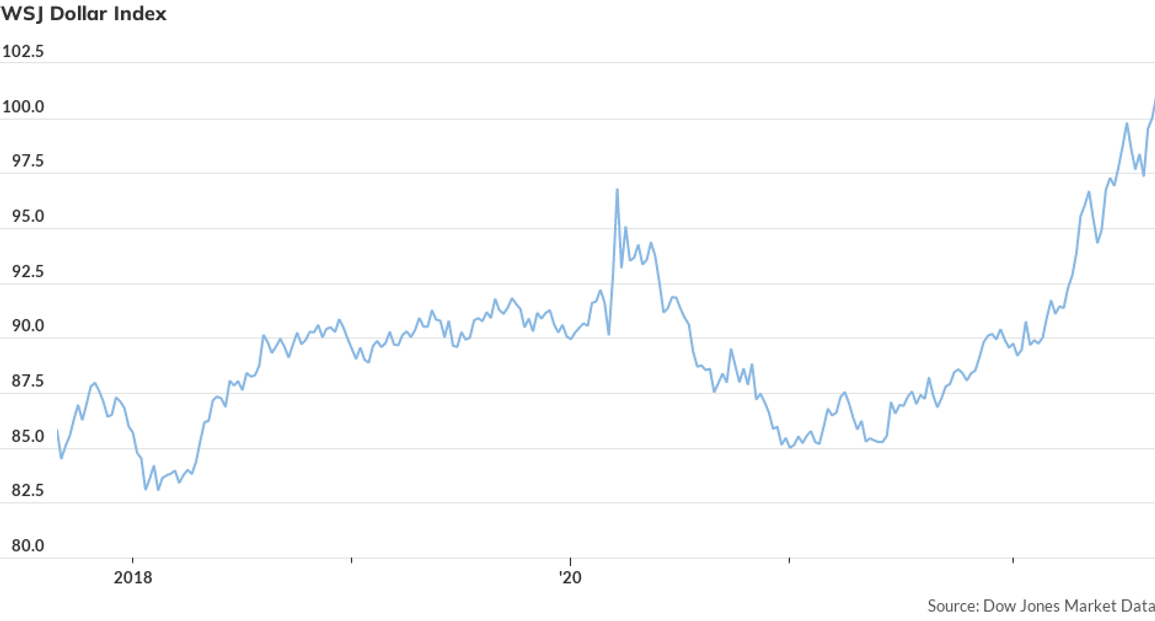

The grain markets are continuing to be pressured by the outside markets and weaker crude oil, weakened demand, and we are seeing more Chinese lockdowns. The U.S. dollar also hit new highs, as we continue to face recession fears.

The dollar index surged by .967 points to 109.667. With the dollar indexing hitting a 20-year high. With gains of +8% over the past three months.

China's lockdown was over the city of Chengdu, which has a population of 21 million citizens, resulting in weaker demand for gasoline and everything else. As well as the recent news of California looking to only allow electric cars by the year of 2035.

Naturally, when we see crude oil lower. Especially this much lower. We will almost always see an effect on the corn and bean markets. As these biofuels become less valuable, with declining crude and gasoline prices.

Some Highlights

It was announced that the USDA will not have any export data until September 15th

China purchased 6.1 million bushels of soybeans

Russia bombed a smaller-sized Black Sea port

Ukraine’s 2023 wheat crop is expected to sharply decline. As Ukrainian Ag Minister expects the 2023 crop to be 60% of normal

The cheap prices out of Ukraine and Russia are hurting U.S. exports

Taiwan shot down a Chinese drone. This is the first time this has occurred

We saw talks about putting a cap on Russian crude oil

Historically, Pro Farmer's corn yield estimate from their crop tours have typically landed between 2 to 6 bushels lower than the final USDA estimate. This year's Pro Farmer estimate came in a little over 7 bushels per acre lower than the current estimate. With a Pro Farmer estimate of 168.1 bushels per acre. If the final USDA estimates come close to the Pro Farmer estimates, prices will need to trade significantly higher. With the possibility of new highs given they do come in that low.

Why we shouldn’t panic

Technically we didn't do much damage to the charts, nothing has really changed from a week ago. We are just volatile. With crude oil down $10 the last two days, we are bound to see grains lower. Relatively speaking, then grains' performance hasn't been all that bad. We continue to see purchases of soybeans. WW plantings could be down 30-40% in Ukraine. The last time we saw lockdowns initially everything came crashing down, now on the surface, this is bearish. However, after the lockdowns, we saw everything come back stronger. Will we see that same kind of reaction when the lockdowns are over.

As we continue to see purchases of U.S. soybeans. China can not go extremely long without having to purchase U.S. soybeans. Otherwise, they put their country at risk for over a billion to go hungry. So their government won't let this happen. China is currently aggressively booking soybeans. With Chinese firms having booked at least 40 cargoes of soybeans from the U.S., Brazil, and Argentina the past two weeks alone.

Despite markets getting beat up the last few days, corn is currently a few cents away from closing the week higher, depending on today’s action.

Bottom line, we recommend being patient on making grain sales unless you absolutely have to.

-

Banghart Properties is still looking for millet, as that market remains very firm.

Contact them at Jeremey (605) 295-3100 or Wade (605) 870-0091