WEEKLY NEWSLETTER

This is Jeremey Frost with some not so fearless comments and tidbits for www.dailymarketminute.com

Grain Markets That are Hot?

The white proso millet market is what’s hot. Many bids a month ago where low teens per cwt. Now some have approached 18-20 per cwt with others surpassing 20 per cwt depending on the area. Last year it was SD leading the bounce up this year it is CO leading the price action.

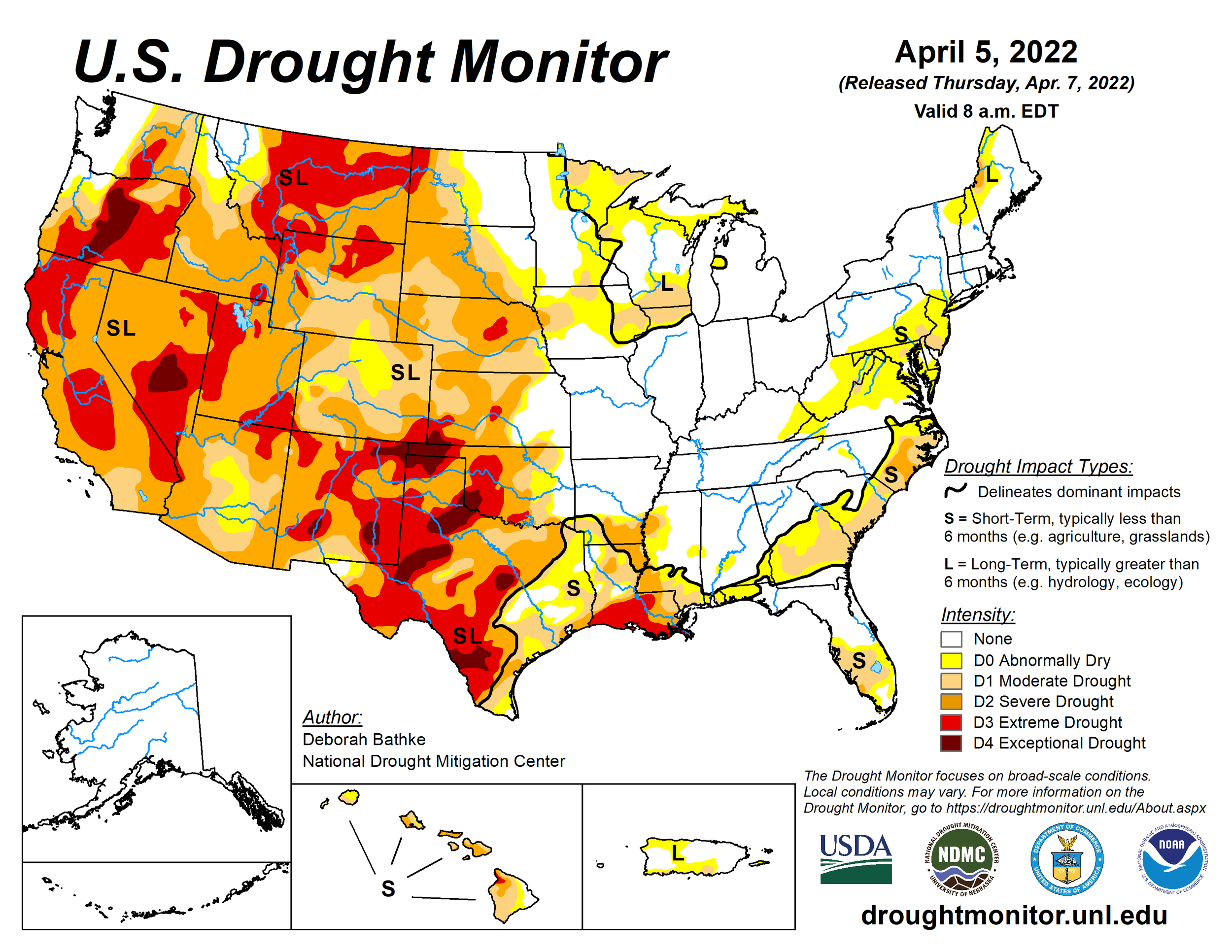

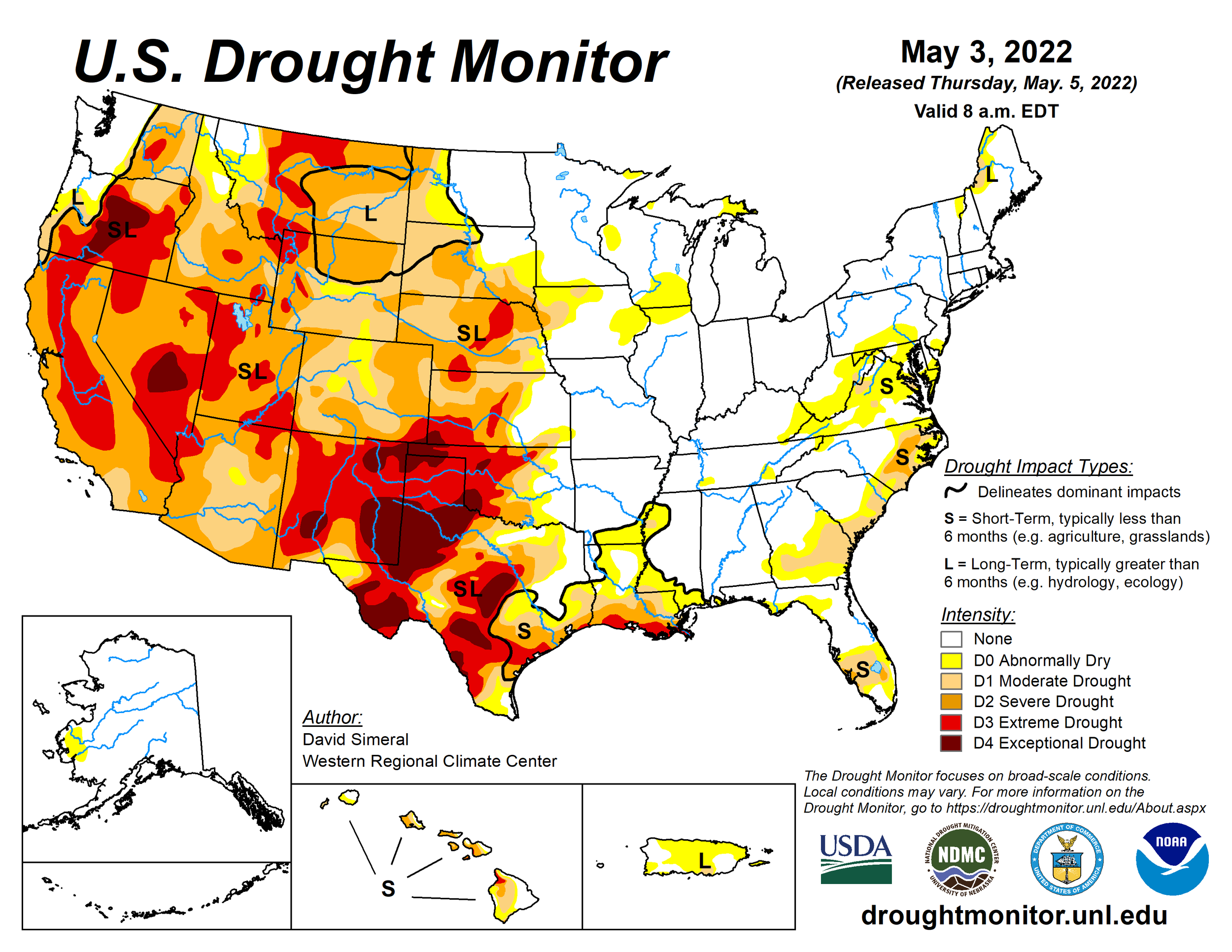

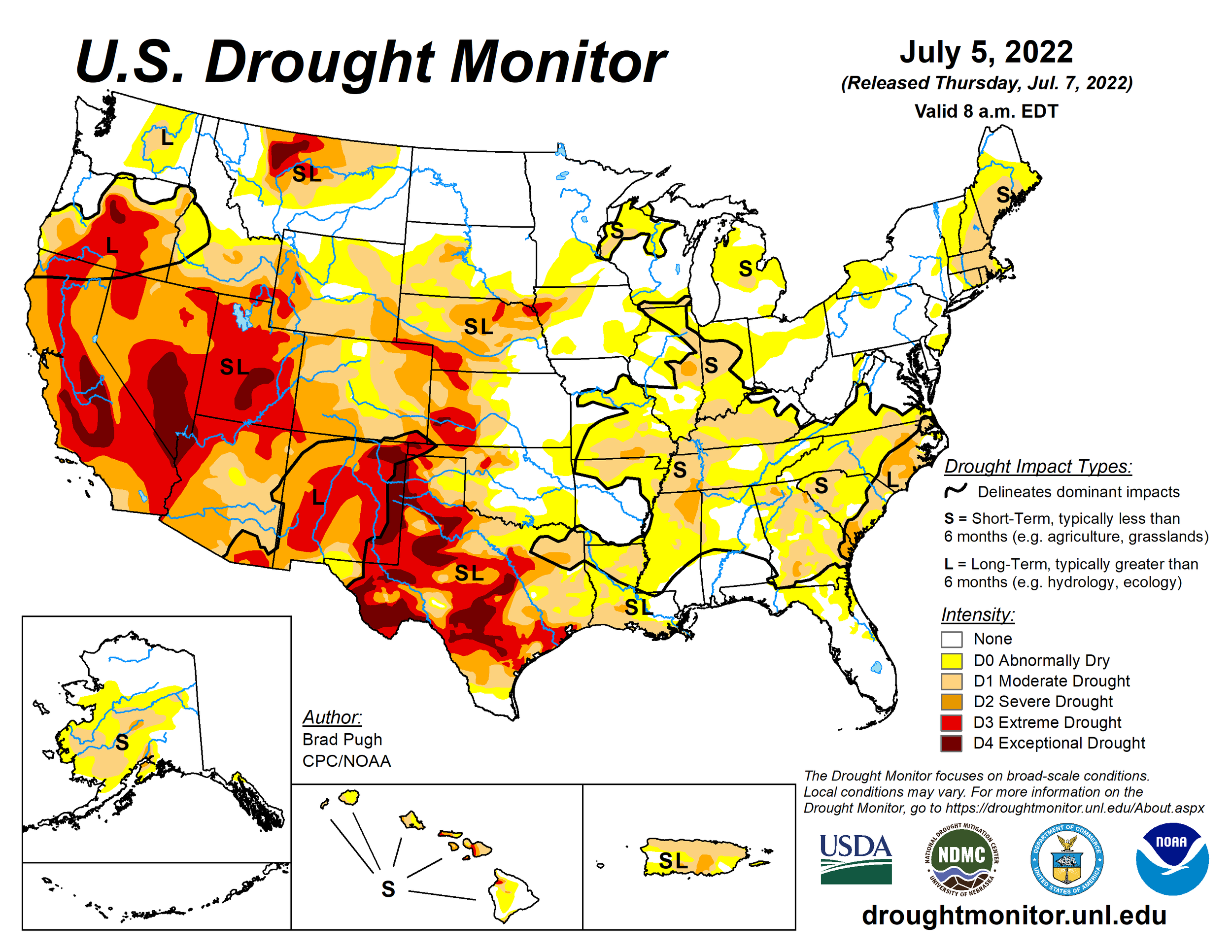

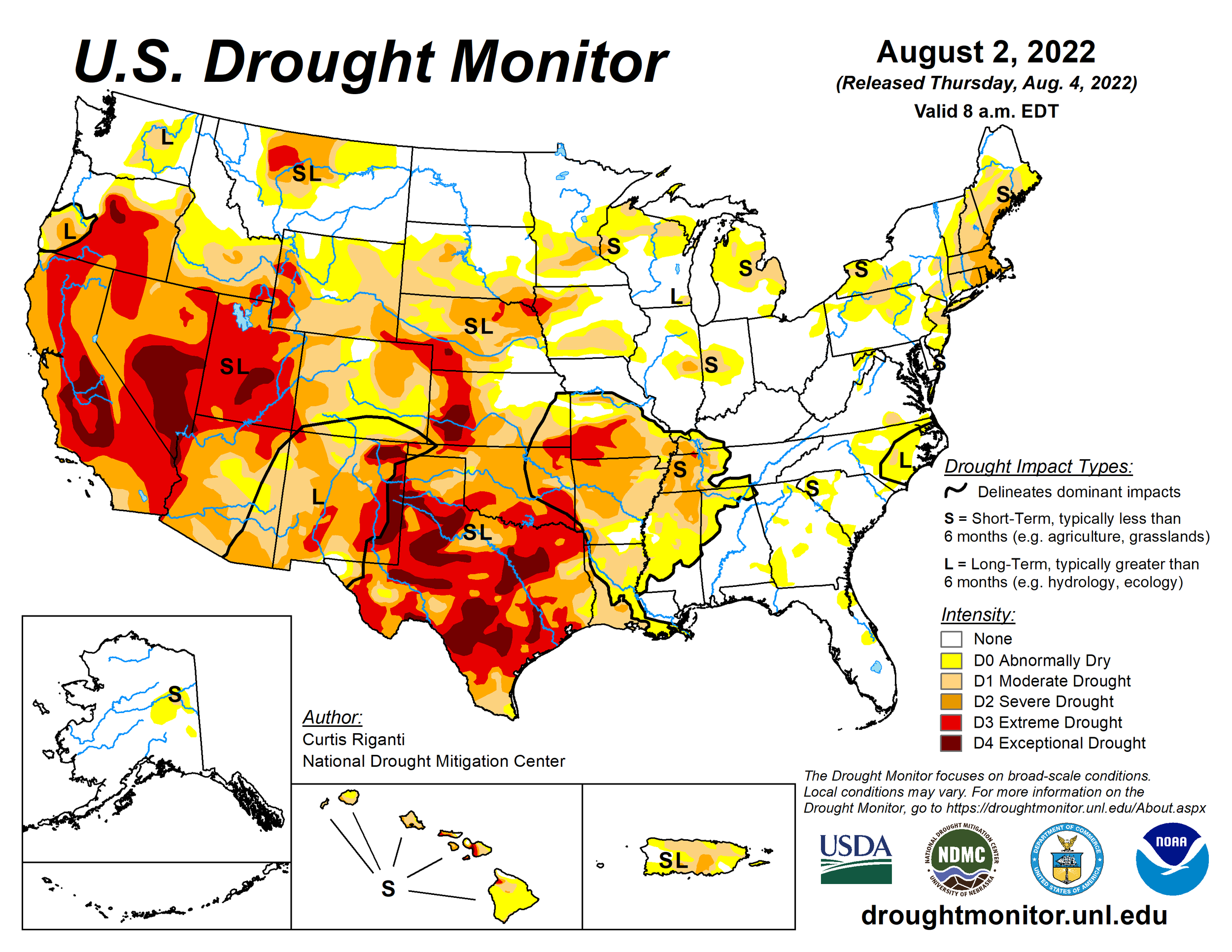

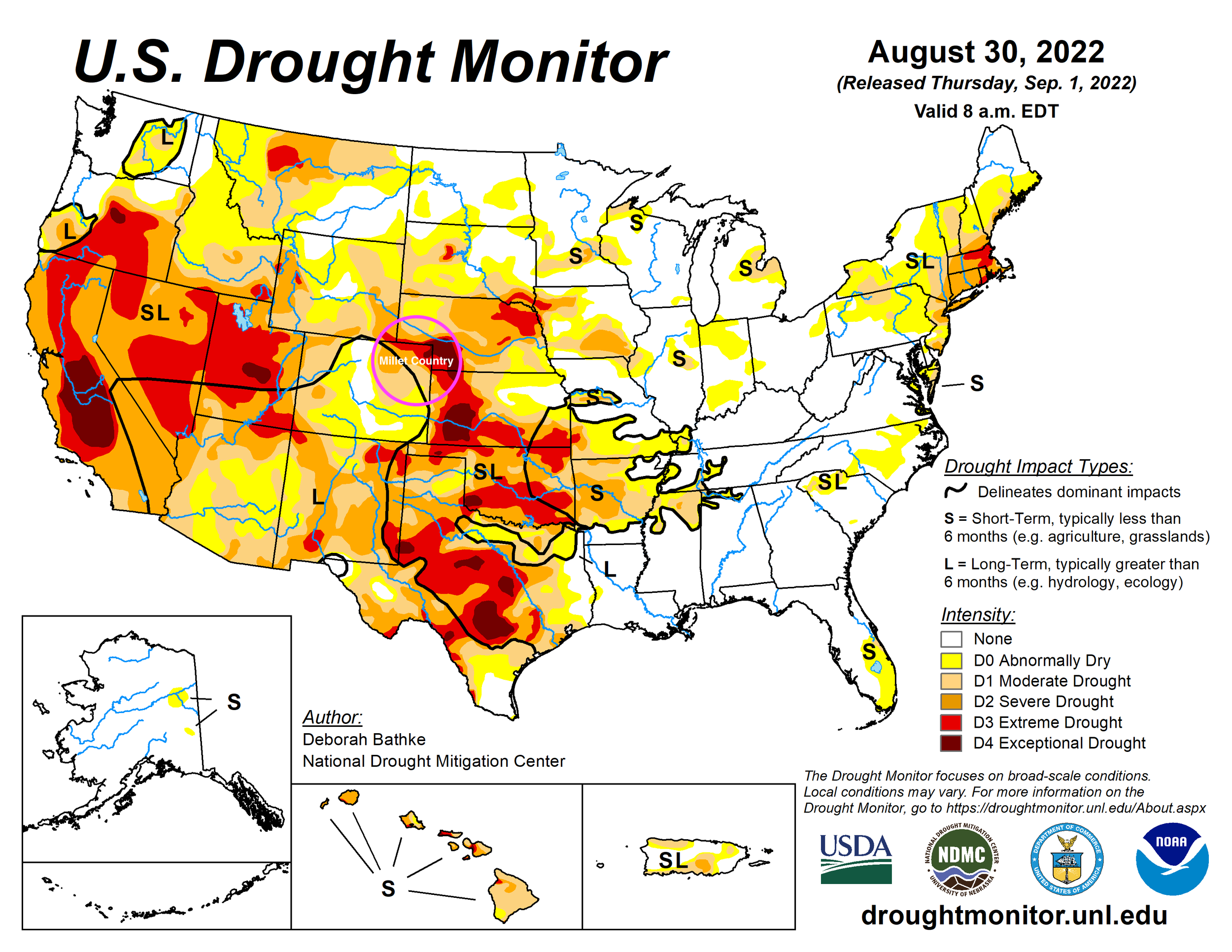

Why is millet price on fire? Basically acres are sus as my daughter would call it and the crop has burnt up. Look at the drought monitor over the past several months— in the weather section of this newsletter.

How far can millet prices go? Well it depends if we have any shorts in the market; which presently it feels may be the case. The other big factor is going to be demand. Which has been weaker for the past year. Can it bounce back?

The birdseed market uses a lot of millet and one would think that we should have seen millet demand higher with millet price in relationship to other birdseed grains that are typically in a mix such as Black Oil Sunflowers.

Banghart Properties has several buyers starting to show some interest in millet and they are actively looking for offers. If you have an offer please call myself Jeremey at 605-295-3100 or give Wade a call at 605-870-0091

Price Action for Grains

I remain in the camp that we will see higher grain prices in the days, weeks, months to come. I believe we have put in our yearly, seasonal lows for corn, beans, and wheat. I believe you could see some local areas where harvest pressure might lead to basis a little wider or cash prices for something such as sunflowers under pressure at gut slot harvest. But much of that is going to depend on the area and what Mother Nature does as far as how quickly or how spread out harvest is.

Naturally a spread out harvest sees less basis pressure or cash price pressure. Whereas a harvest that has no pauses and everything trying to come to town has much more local basis risk.

In central SD; it feels like the crop to the west isn’t nearly as good as it is to the east. But one needs to balance that with the storage and bins that each area has.

Overall I think we see both basis for corn and cash prices for sunflowers start to firm once we get harvest close to 1/2 to 2/3 done. It feels like buyers have some coverage but I know plenty of buyers for sunflowers who like to cost average. So with sunflower prices weaker then they where a few months ago I would look for demand and buying interest to pick up once buyers step back in.

How High Could Grains Go?

Most anyone reading this may think I am insane but I dont think one can rule out many of the grains taking out previous all time highs.

Why? Here are some reasons. (The actual number one reason is mentioned at the end of my article)

#1 Could Pro Farmer be high in their corn estimate? I have seen zero estimates lower then Pro Farmer. But what would happen if the USDA comes in below Pro Farmer? Just because no one is talking about that doesn’t mean that it isn’t a possibility. The reality is if our corn production comes in below Pro Farmer we will need to Price Ration some Demand.

I think we have a chance that supply is less then Pro Farmer has estimated. If that is the case you can’t rule out new all time high’s and you might not want to rule out Sue Martin’s prediction for the 2023 prices either.

#2 Money Flow. It can be very hard to predict and if the inflation headline wants to take center stage who is going to stop Big Money from buying the grains?

#3 Not all Black Swans are negative. The futures market is called the futures market because it is the price in the future. We dont know what our Government, China, the Funds, Mother Nature, and about a billion other factors that drive our prices will do. If the star’s align all one direction we go down in price, if they align all another direction we go up in price. How cheap or how high prices go tend to depend on emotion. The big unforeseen Black Swan events tend to lead to prices over doing it in either direction. To me it felt like we got a little cheap a couple months ago. Now it feels like we are going to get a little to expensive in the months ahead.

#4 Farmer staying power. Don’t underestimate the group that feeds the world. The US farmer and the farmers of the world tend to get better at nearly every aspect of their operation every year. They get bigger and better with more holding power; that is a powerful thing up until the point that it curves demand.

#5 Chinese drought and worldwide weather.

#6 Ukraine Wheat acres projected down 20-30%

#7 Demand. The grains started this little rally in 2020 and it was demand lead. Demand hasn’t really slowed tremendously.

#8 Ukraine Russia - Unknown how it shakes out. Nor how much damage will be done in the end.

Things I am reading

From Wright on the Market and Market commentary for Jon Scheve

The best part of the article;

“Be Careful Listening to Someone Talk About Their Position"

"I also find that when I ask farmers how much of their new crop is sold or how much of their old crop is still in storage that it will shape their attitude toward the market. I usually find that a farmer with no new crop sold, and old crop still left in the bin, will view their crop conditions and the national yield differently than farmers who have their new crop sold or are using risk management tools to protect it. Farmers aren’t alone in this bias, most market analysts and end users will often do the same thing as well. It seems to be human nature to have a perspective that suits your hopes and wants.“

Read the full article here

To me as more consolidation happens with grain buyers I think farmers need to keep in mind who they are working with and what the motivation is. Is the motivation to do the best they can to help the farmer thus earning and keeping business? Or is the motivation to buy grain as cheap as possible and scare the farmer into panic or fear selling?

I feel that those that I have associated with over the years are buyers that truly want to earn business. That the motivation and incentive is to do what is right for the farmer. Banghart Properties focus is trying to help the farmer get the best price for their grain. Not to buy it as cheap as possible.

Relationships and adding value to have repeat long term customers is key to success in every business.

The following tidbit was from Pro Farmer

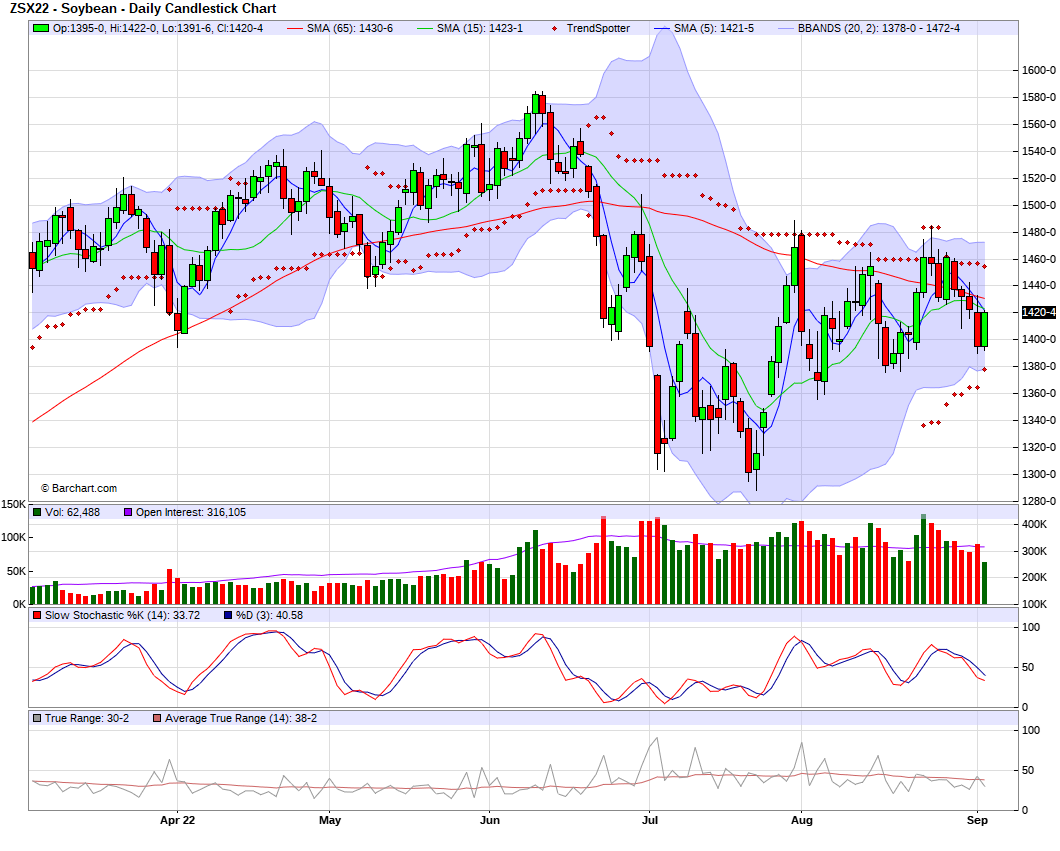

China is aggressively booking soybeans. Chinese firms have booked at least 40 cargoes of soybeans from the U.S., Brazil and Argentina in the past two weeks alone, Bloomberg reports, citing people familiar with the transactions.

Brazilian soybean exports slowed. Brazil exported 6.2 MMT of soybeans in August, according to official data published by the Brazilian government on Thursday, down from 7.5 MMT in July and 6.5 MMT last year.

Soybean crop estimates. StoneX raised its soybean crop estimate to 4.515 billion bu. on a yield of 51.8 bu. per acre, up from 4.490 billion bu. and 51.3 bu. per acre previously. Agricultural commodity brokerage and analysis firm Allendale Inc. forecasts the soybean yield at 50.86 bu. per acre and production at 4.435 billion bushels. Pro Farmer announced our soybean estimates of 51.7bpa and 4.535 billion bushels on Aug. 26th.”

The best thing I read this weekend and most bullish which wasn’t even on my list of why we go to new all time highs in the grains.

Came from Wright on the Markets in his Daily Report on September 5th;

“The number of new soybean crush plants under construction will increase the US soybean crush capacity by 630 million bushels by 2026. That is an average of 7% a year. What will be the market impact? If we crushed 630 million more bushels in the recently completed marketing year, our carryover would be a minus 405 million bushels… We would have run out of beans on the 29th of July!

The market’s job is to make sure we never run out of any foodstuff. How high do you think the price of soybeans would have to go to reduce demand by 405 million bushels just to get the carryover to zero? “

Bottom line is it is still a great time to be in Ag. I remain in the camp that we go much higher.

But to end my comments I want to mention that the most important rule in grain marketing is to be comfortable.

My self or great advisors like Roger Wright, 24/7 Ag…..etc can tell you all we want that things are going up. We can be wrong, or right. But unless we know your operation like the back of our hand our advice might not be correct for your operation. So just keep in mind that you have to be comfortable in where you are at.

If you want some help with it please give myself a call at 605-295-3100 or give Wade a call at 605-870-0091.

Futures Trade of the Week:

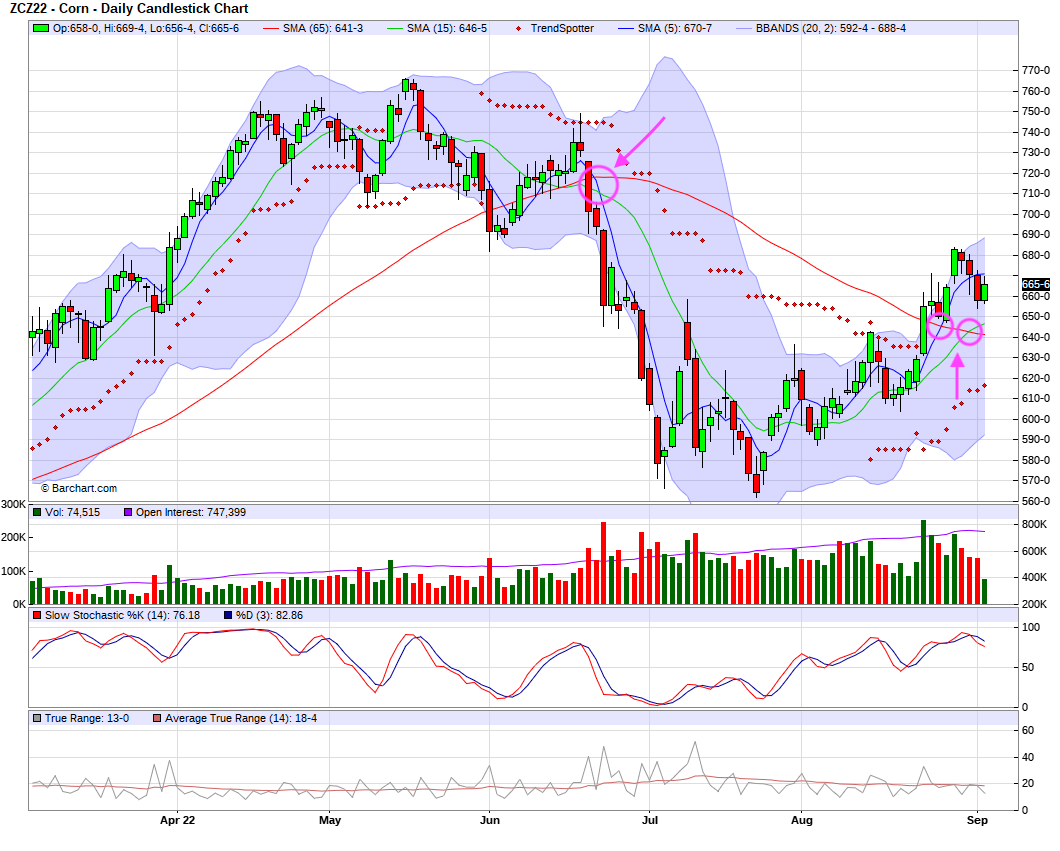

Moving average cross over, buy Dec Corn with a stop at the 15-day moving average.

Tidbits

Source: AgTalk

KSU Weekly Market Review

I highly recommend reading Kansas State University’s Weekly Grain Market Review. Which you can view here

www.banghartproperties.com

Commodities Overview by Sebastian Frost

Overview

Markets had a rough week overall, but managed to see a pretty strong close Friday to end the rocky week. I think it'd be fair to expect the markets to open higher tonight with the strength in crude oil, up nearly $2 this afternoon as I'm writing this.

Today's Main Takeaways

Corn

A very volatile week for corn as well as every other commodity. We did manage to close the week just higher. Comparatively, corn held up fairly well, given the extreme sell off in crude last week, as well as sharply lower soybeans through out the majority of the week. Now with crude finding some strength this afternoon, we should likely see markets open tonight higher.

The outside markets have been the main story behind lower prices. With crude oil, the 20 year high we just saw from the dollar, and China lockdowns all putting pressure on the markets. Crude oil is down around -20% the last three months, with the dollar up around +8% in the same time frame.

On the other hand, we have to look at the obvious need for the USDA to lower its yield estimate. Although, there isn't much a weather risk could do now for prices.

(Dec-22) 5-Day Change: +1 1/2 cents

Dec-22 Corn (6 Month)

Soybeans

Given how rough of a week overall it was for soybeans, it wasn’t all the bad. We managed to close well off the lows, with Nov-22 closing up almost +26 cents on Friday.

Similar to corn, the outside markets have been putting immense pressure on all the markets. We also have yields not expected to be as bad compared to corn. With the chance for some late weather to help soybeans, unlike corn. Stone X also had a survey, and their results were fairly similar to that of the Pro Farmers crop tours. With a pretty good soybean crop, and lower corn yield.

Another main concern has to Chinese demand. Yes we saw some sales last week. But for soybeans to find any sort of momentum we will likely need to see demand stay strong. China's covid lockdown of one of their largest cities (Chengdu) isn't helping the cause. With this news, as well as the U.S. expected to see close to record production, it makes it tough to be extremely bullish. As we also aren't really seeing any sort of crop scare either.

(Nov-22) 5-Day Change: -40 3/4 cents

Nov-22 Soybeans (6 Month)

Soymeal (6 Month)

Wheat

Wheat continues to struggle for the most part. We did close Friday higher along with the rest of the market. However, demand is still pretty weak and recession fears and 20-year highs in the dollar are all putting a lid on prices.

We also have Russia expected to have a record crop. As well as the continuation of Ukraine grain shipments. However, there is a chance that everyone could be totally wrong and far too optimistic with these two headlines.

News

We won't see USDA export numbers until September 15th

There were 315,000 new jobs added in August. Better than was expected, but far below July's 528,000

Brazil sees soy output rising 20%

12 vessels with food and grain left Ukraine ports Sunday

Russia suspended natural gas flow through the Nord Stream gas Pipeline to Europe.

Below is a 6 month chart of the U.S. dollar index. The dollar index closed the week up +0.93%

Dollar Index (6 Month)

Crude Oil WTI (6 Month)

Month to Month Drought Monitor History

(April to Now)

Precipitation Forecasts

Sep. 6

Sep. 7

Weather

Source: National Weather Service