GRAINS BOUNCE. WEATHER REMAINS BULLISH

Overview

Grains rally across the board today, as beans are now 70 cents off their lows from just a week and a half ago, the wheat market finally makes a higher high for the first time in 9 trading days as Chiago was up 4% on the day, while corn is now nearly 20 cents off of its lows from 2 days ago.

Why the bounce?

Weather & war. We saw news that Ukraine attacked Moscow with drones. For quiet some time now the markets have mostly ignored the war and headline animosity and given back all of the war premium we receive. We will have to see if the market can hold on to those gains and that premium, or sell the rally as has been the case recently.

The main catalyst is the weather. It's very hot, to go along with almost no rain. Weather was the reason we sold off to close out July, and it's the reason for this bounce.

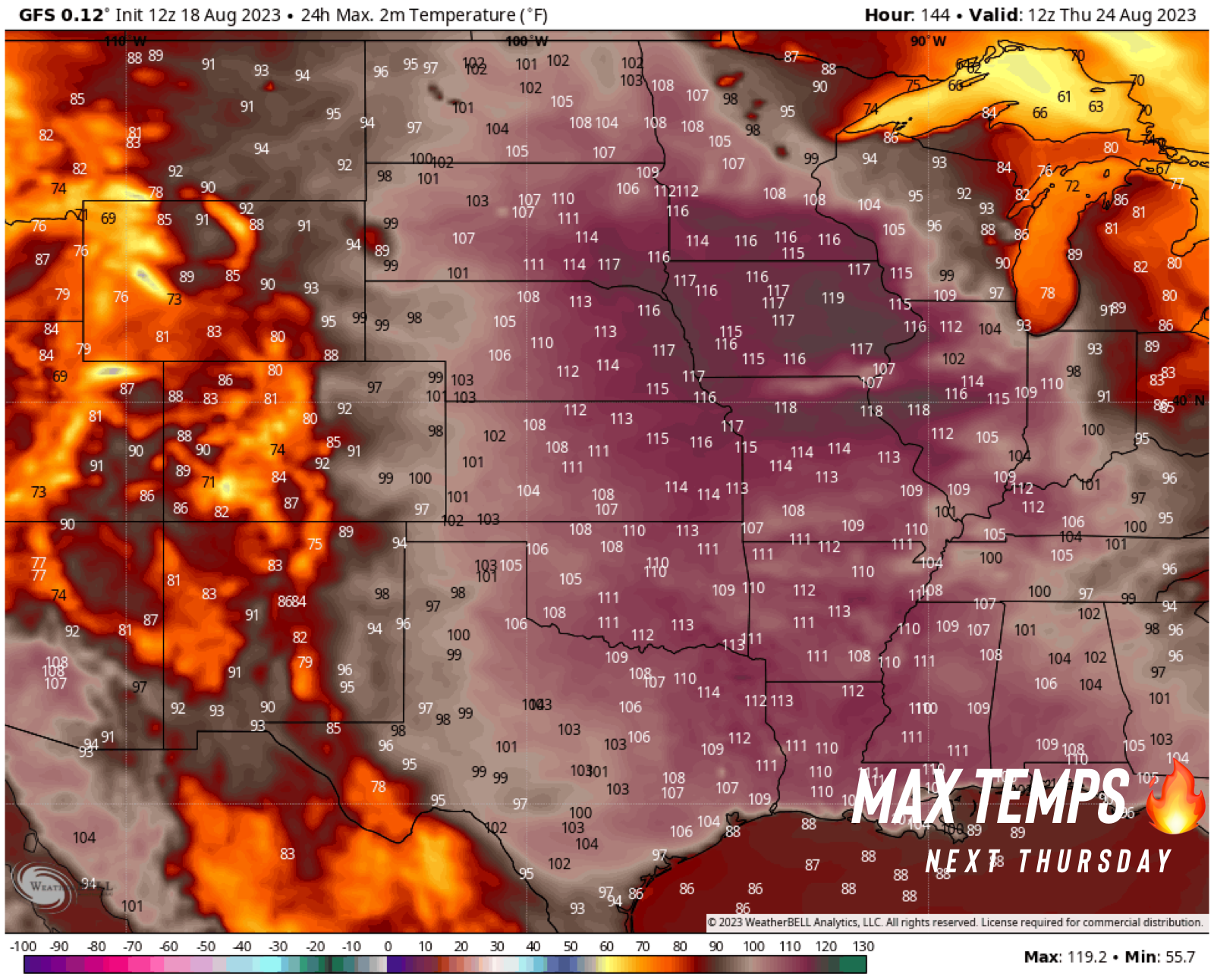

Here is the forecasts. The first one is the GFS model that shows the max temperatures for next Thursday. Now one thing to keep in mind is that often times this model can be off by 5 to 10 degrees. None the less, it’s extremely hot.

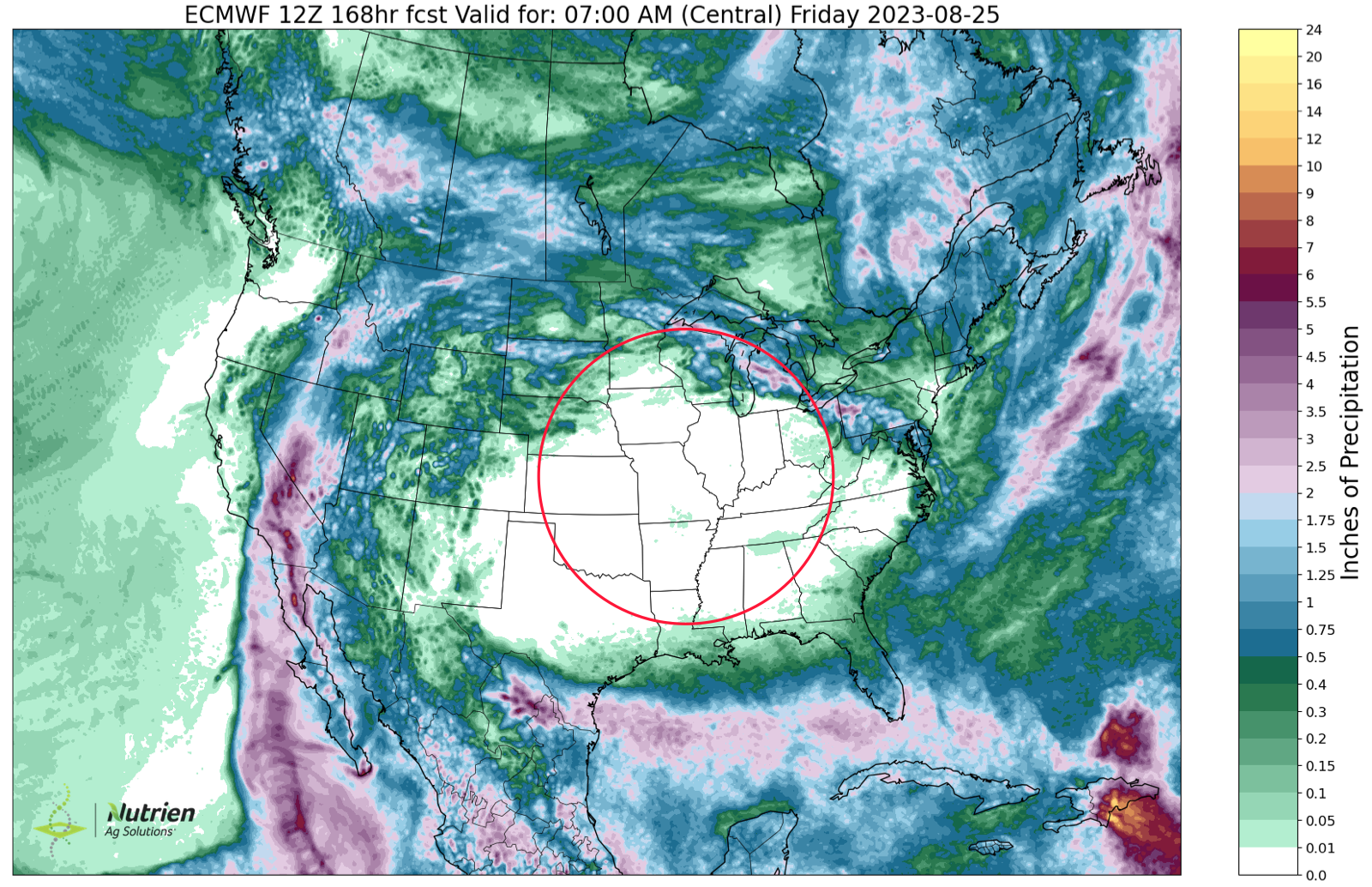

Notice the big pocket missing rain for the next 10 days.

Here is the 6 to 10 day outlook as of Friday afternoon. Showing a little less heat than the models showed the past two days, but still pretty hot with lack of mositure.

So overall, the forecasts look like it is going to be this way until possibly early September. Unless September brings some timely rains, it could very well be a less than favorable finish to the growing season in plenty of areas.

Most key growing regions are expecting temps in the high 90's into the 100's, and nobody is expected to get much if any rain.

Darrin Fessler, a highly respected futures trader said:

Don’t underestimate the impact of high overnight temps (silent killer of yields). Day time temps are one thing, overnight is another. A majority of this crop will not be getting a break starting this Sunday through Monday August 28th.

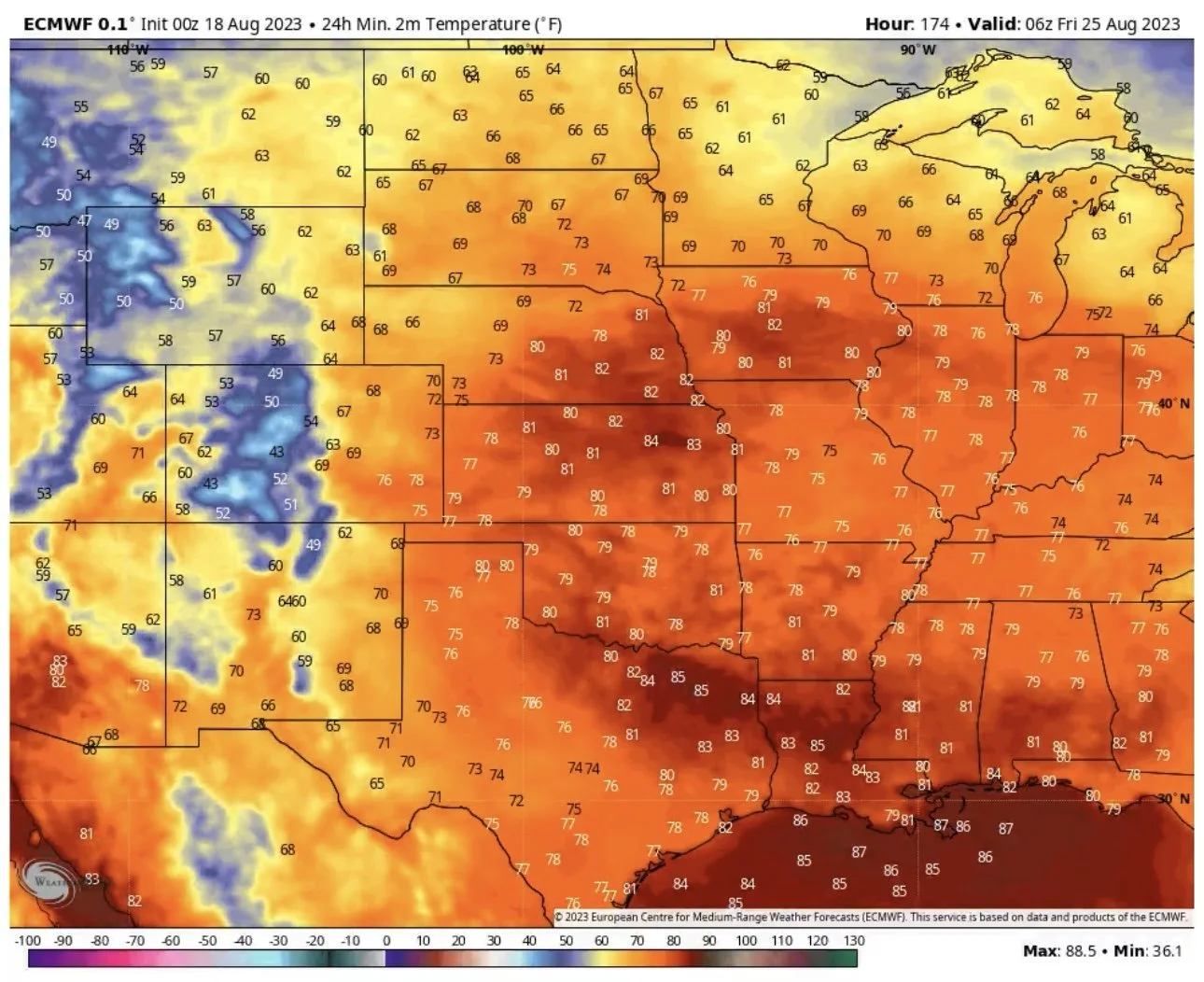

Here is the minimum temperature for next Friday.

India says they are having their driest August in over 100 years.

We saw a flash sale of corn this morning to Mexico.

Mark Gold of Top Third said:

We haven't seen this before, in my 50 years in the business, finishing out an August this hot and dry. It is going to effect hurt the soybeans, corn will have some effect as well. I think with everything happening in the world I wouldn't want to be short here. I think we could see a sizeable rally, particularly in the soybean market. Of course, all of this could change very quickly if we get any change in the forecasts or a break in the heat. I think this heat will do a lot of damage out here.

The funds remains short corn and wheat, so we could be looking as some possible short covering. Although, I do think soybeans will continue to lead the grains as long as the forecasts stay like they are.

The Pro Farmer crop tours start next, so will be keeping a close eye on those.

Today's Main Takeaways

Corn

Corn follows the bean and wheat markets higher here today, closing 7 cents higher. On the week, corn managed to close nearly 6 cents higher and was 20 cents off it's lows made 2 days ago

It was a nice surprise and good indicator when yesterday we get the drought update and it shows that drought improved by a major 7% over the past week, yet corn was able to trade higher the past two sessions. Coming in at 42% experiencing drought vs 49% last week.

Bears continue to point at……

The rest of this is subscriber-only content. Please subscribe to continue reading and receive all of our updates via text & email.

TRY OUR FREE 30 DAY TRIAL

Start receiving all of our exclusive daily updates via text & email.

Scroll to check out past updates you missed.

Check Out Past Updates

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio