GRAINS CONTINUE STRENGTH

Overview

An up and down trading day results in grains closing higher following the late week rally on Friday.

The main headlines surrounding the markets are Russia & Ukraine war, South American weather (planting & harvest delays), and Chinese relations and tension.

If you missed this weekend's newsletter, New All-Time Highs? - Click Here

We are offering 50% OFF Monthly & Yearly subscriptions, and offering 30 day trials for just $1

Today's Main Takeaways

Corn

Corn fairly strong here again today, flirting with resistance on the charts. Closing up +4 cents at $6.85. Can bulls get $7?

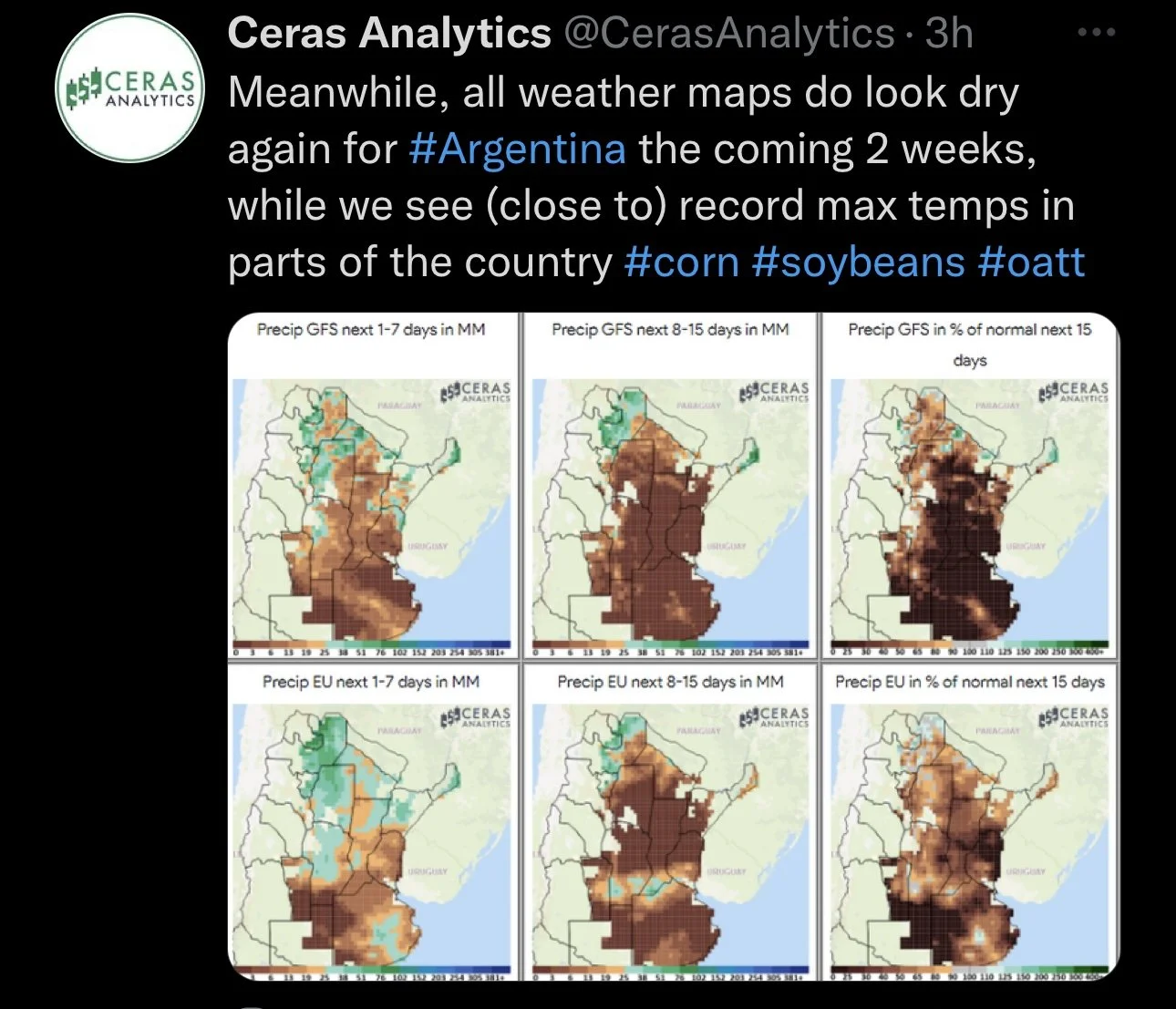

One thing bulls are keeping a close eye on going forward is of course South American weather. With the on going weather problems Argentina has been facing, harvest delays over in Brazil, and we can’t forget about war headlines.

Brazil continues to get a ton of rain as their second corn crop continues to see planting delays. The ideal weather for their planting ends at the end of this month, so we will have to wait and see what type of progress is made or if they continue to fall behind. Planting is currently sitting around 15 to 17%. However, the top producing state of Mato Grosso is currently on pace, sitting at 34% planted.

On the other hand, on thing bulls aren’t too excited about is demand. As demand is a big question mark right now. With many questioning USDA estimates for ethanol exports. U.S. average will also start becoming a hotter topic going forward, while some are arguing that we could possibly see more planted acres. So overall, bulls want to see a greater demand story going forward especially when the South America headlines start to fizzle out.

We did see Russia just cut its daily production of ethanol by 500k barrels a day. So perhaps we see crude oil start to gain momentum and help push corn futures higher as well and spark additional interest from the funds.

Factors that will continue to influence the corn market are; South American weather of course. Do we continue to see harvest delays in Brazil. Chinese demand, and war headlines. If war continues to rage, will we see another leg higher.

From a technical standpoint, we are sitting right at resistance to the upside. Can we get a break to the upside or will we reject off this trendline once again as we have the last month or so.

Corn March-23

Soybeans

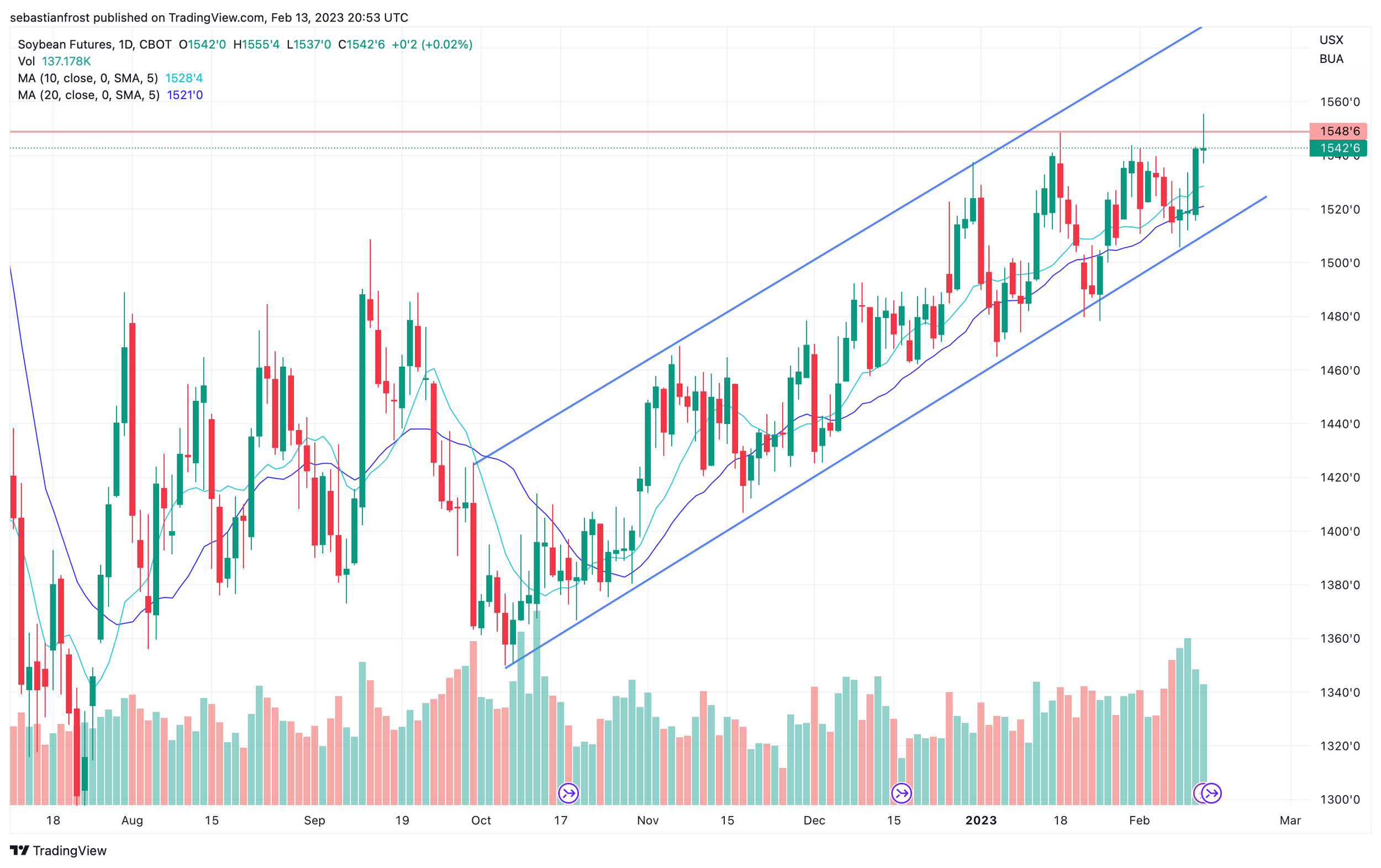

An up and down day ends in soybeans closing a hair in the green. We closed -13 cents off our highs from the overnight session.

Last week beans closed at their highest levels since June of last year, while meal reached new contract highs overnight. All eyes are on the weather in South America going forward. Can weather allow for bulls to continue to push meal and beans higher?

Many still think we see the USDA continue to lower its Argentina estimates going forward. We also need to keep in mind that its Argentina who is the worlds leading exporter in meal. So with Argentina's problems, they are importing beans from Brazil. So the trade is very concerned with global supply going forward hence the strength we’ve seen in meal. We will have to see how much higher Argentina weather and meal can carry the bean market or if this really was our highs. Nonetheless, weather will likely decide this.

Right now it looks like Southern Argentina weather is getting some rain, and are looking to get more this week. Which has added some slight pressure to the bean market to start the week.

Brazils harvest is currently 17% complete vs 24% last year at this time. However, Mato Grasso is 44% harvested which is on pace. So we will have to see if continued rains lead to even more harvest delays. If so this could be a big market mover in the near future.

At the end of last week we saw rumors that China bought a few cargoes of U.S. beans and again bought some more overnight but we haven't had any clear evidence of this just yet.

Overall, yes we can push higher from here. As bears have been left scratching their head as of recent as meal continues to rally. But there is some uncertainties that heavily depend on South American weather and Chinese appetite. So I’m slightly nervous with prices at these levels but Im not counting out the possibility of higher prices here, as many people didn’t even think we would see $15 again when we were at our October lows, while we predicted we'd see $15 again by the end of 2023 which did come to fruition.

Taking a look at the chart, we did make a new recent high before running into resistance. Nonetheless still our highest close since June. If we can crack the $15.50 we have a huge gap to the upside.

Soybeans March-23

Soymeal

We saw meal make yet again another contract high overnight. It will be interesting to see what the funds do here and how long they are. As the latest CFTC data goes through January 24th, when funds were near record long. Meal has rallied 10% since then.

Meal has only traded higher than today in 22 sessions (21 of them were in 2012). Meal is nearing 10 1/2 year highs.

Can Argentina weather carry us even higher? The next major target and resistance on the charts is from our 2012 all-time highs of 541.8

Soymeal March-23

Wheat

Wheat futures adding to last week's war rally. Overnight we saw weakness but managed to bounce 16 cents off our lows in Chicago. Inching closer to the $8 target as we closed at $7.92.

To close out last week we saw wheat rally to levels we haven’t seen since our December rally.

Russia and Ukraine continue to make headlines, as Russia announced that they think it would be "inappropriate" to extend the Black Sea grain deal unless sanctions affecting its agricultural exports are lifted and other issues are resolved. If this doesn't get renewed, we could see prices have a very bullish reaction.

War headlines also continue to impact the markets. The U.S. has told its citizens to leave Russia immediately due to the war in Ukraine. So its looking like things will continue to heat up. Now the question is how high can war push prices, and will we have a similar type rally to that of last year when the war news initially broke out and carried us higher.

Going forward, bulls such as myself think that we will continue to see the war and Ukraines situation get worse, and see limited exports from wheat. With the possibility of Russia's exports being more limited than the estimates suggest.

Overall, I would like to see Chicago break above $8 and still think we definitely have the chance for a lot more upside if we do get that break higher. Sure we have big crops in Australia and Russia, but funds are still short. I think we continue to see them hit the panic button and liquidate these shorts if we continue to see war escalation.

Chicago March-23

KC March-23

MPLS March-23

Calls & Puts?

From Wright on the Market

This is an amazing write up Roger at Wright on the Markets going over calls, puts, and risk management.

Several times a month we receive questions like this from prospective clients:

"I have decided the price of corn will go 60 to 90¢ higher in the coming months. Unfortunately, I already sold 100,000 bushels of my 2022 corn crop. While I still have 50,000 bushels in the bin, I want to make that 60 to 90¢ on the corn I already sold.

I can buy futures to re-own some or all of that 100,000 bushels.

I can buy a call option to re-own that corn, but those calls sure are expensive, but my down side risk would be limited to the cost of the calls.

I can buy futures and buy puts to protect my futures position from losing too much if corn prices go down instead of up.

What do you recommend? Thanks."

None of the above.

You sold that 100,000 bushels of corn for a reason. It may have been because you needed the money, in which case you have no business owning corn in the futures market because of the significant margin requirements and potential financial loss.

The initial margin requirement for a bushel of corn in the futures market presently is 49½¢ per bushel. Do you have $49,500 to put in a futures account? If you do have $49,500 available for futures trading, are you sure you want to risk it? You know nothing is 100% in this business.

Every penny that the price of corn futures decline, you will have to add $1,000 to that futures account. It is impossible to buy anything at the absolute lowest price of the day or week or year. So, at the least, you will have some losses initially. How much are you willing to lose before you decide corn is not going to go up? The daily trading limit for corn is 45¢; that is $45,000 potential loss in one day. How are your nerves?

If you sold the corn because you thought the price would go down, you were wrong. Your track record is not very good. What makes you so confident you are right now?

Even though we expect higher prices as you do, under no circumstances do we recommend you buy futures, because we know we may be wrong. Politicians’ actions are the most unpredictable aspect of marketing grain and we sure have many politicians in positions to make very important decisions that will impact grain prices. Again, you had a good reason to sell 100,000 bushels awhile back. Don't mess it up now due to seller's remorse.

July corn settled Friday at $6.66½. A July $6.50 call will cost 43¢ tonight if the market opens steady. That will make your breakeven on expiration day $6.93 on June 23rd, the day July 2023 options expire.

The $7.00 July call is 23¢. If you bought that option, your breakeven on June 23rd would be $7.23. That will require July corn to go up 57 cents just to breakeven. We do not recommend paying any money for calls. There is a reason 90% of the calls expire worthless. There are much safer and more lucrative investments.

If you buy futures to make money on the way up and buy puts at the same time to protect the downside risk of the futures position, there are several problems with that strategy.

If corn goes down a dollar, depending on the strike price of the put, the put will increase in value 30 to 50 cents less than the loss in the futures. Secondly, even if the put increases in value, which it would if the futures price declines, that additional put value does not meet the margin call for the futures loss because it is tied to the put. To free up the option profit to meet the margin calls, the option must be sold. If one sells the put option to meet the margin call on the futures, the downside futures risk is wide open, which limiting that risk is the reason the puts were bought in the first place.

A July $6.60 put would cost 32¢ this evening. Your breakeven is $6.28 July futures ($6.60 minus 32¢). At $6.28 futures, your futures loss would be 38 cents ($6.66 minus $6.28). No matter how low futures go, you will lose 38 cents if you hold both the option and futures until expiration day. In your case, that would be $38,000 in the futures and you tied up $81,500 doing it ($49,500 for futures initial margin and $32,000 for the puts).

If prices rally after you buy futures and the puts and then sell out the futures at a profit, even at the very top, you will lose 32¢, the cost of the puts, $32,000. If you sell out futures at $8.00, the futures profit would be $134,000. After deducting the put cost, your profit would be $102,000. Pretty good really, but after tying up a minimum of $81,500 (initial margin on futures of 49½¢ plus 32¢ for the puts).

Therefore, we recommend doing nothing now. If futures rally substantially, then we will recommend our clients spend the money to buy puts. The price of corn is much more likely to come down from the $7.50 to $8 range than to go up from $6.66. With the puts, there will be no futures margin and puts will cost then about the same as the calls cost now.

Last year, July corn peaked at $8.24 on April 29. December corn peaked at $7.66 on May 16th. When December corn was in the $7.60 area, a $7.00 put was 25¢; the breakeven for that put was $6.75 on December futures. On July 22nd, December corn traded to $5.52 and the $7.00 put was worth $1.48 intrinsic (in-the-money) value plus about 10¢ of time (out-of-the-money) value. That would be $1.33 of put profit (put sold for $1.58 minus 25¢ cost). Maximum money tied up would have been $25,000 with no chance for a margin call and $133,000 net profit on the puts.

Puts allow one to make the money on the way down which was not made on the way up. Market prices go down a lot faster than they go up most years and they spend months near the bottom, making it easy to maximize the put profit.

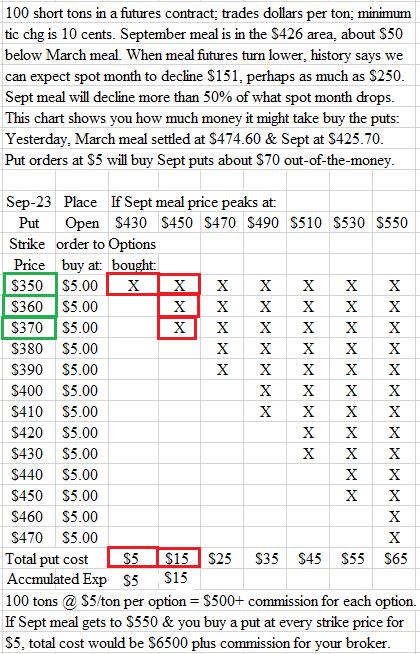

Speaking of puts, those of you participating in the soybean meal put investment, have bought the $350, $360, and the $370 September 2023 soybean meal puts at $5 per ton, a total of $1500 of expense plus commission. You also have placed open orders to buy the $380 September soybean meal put at the same price as the other three. Here is the score board:

Visit Wright on the Markets Here

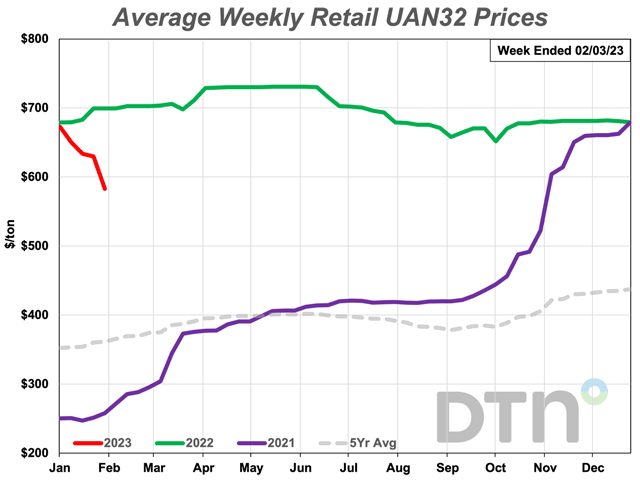

Fertilizer Prices Decline Again

Once again, seven of the eight major fertilizers are less expensive compared to last month. Of these seven, five were significantly lower compared to last month (5% or greater change).

This info comes from DTN. Read the full article here

Leading the way lower are UAN32 and UAN28.

UAN32 was 13% lower in price compared to last month and had an average price of $583 per ton.

UAN28 was 10% less expensive looking back a month and had an average price of $518/ton.

UAN32 is below the $600/ton level for the first time since the fourth week of October 2021. That week the average price was $522/ton.

A trio of fertilizers are 6% less expensive compared to last month.

Potash had an average price of $704/ton,

Urea $698/ton and

Anhydrous $1,223/ton.

Urea is below the $700/ton level for the first time since the first week of October 2021. That week urea's price was $653/ton.

DAP and MAP were just slightly lower in price looking back a month.

DAP had an average price of $847/ton

MAP was at $862/ton.

One fertilizer was just slightly higher in price compared to a month earlier.

10-34-0 had an average price of $754/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.76/lb.N, anhydrous $0.75/lb.N, UAN28 $0.93/lb.N and UAN32 $0.91/lb.N.

Grain Trading Crash Course - GrainStats

This is a great post from GrainStats. Its part of their series that covers the grain futures contracts, how to translate them, and an introduction to contract terms. It’s great info and completely free. Read Here or click the button below

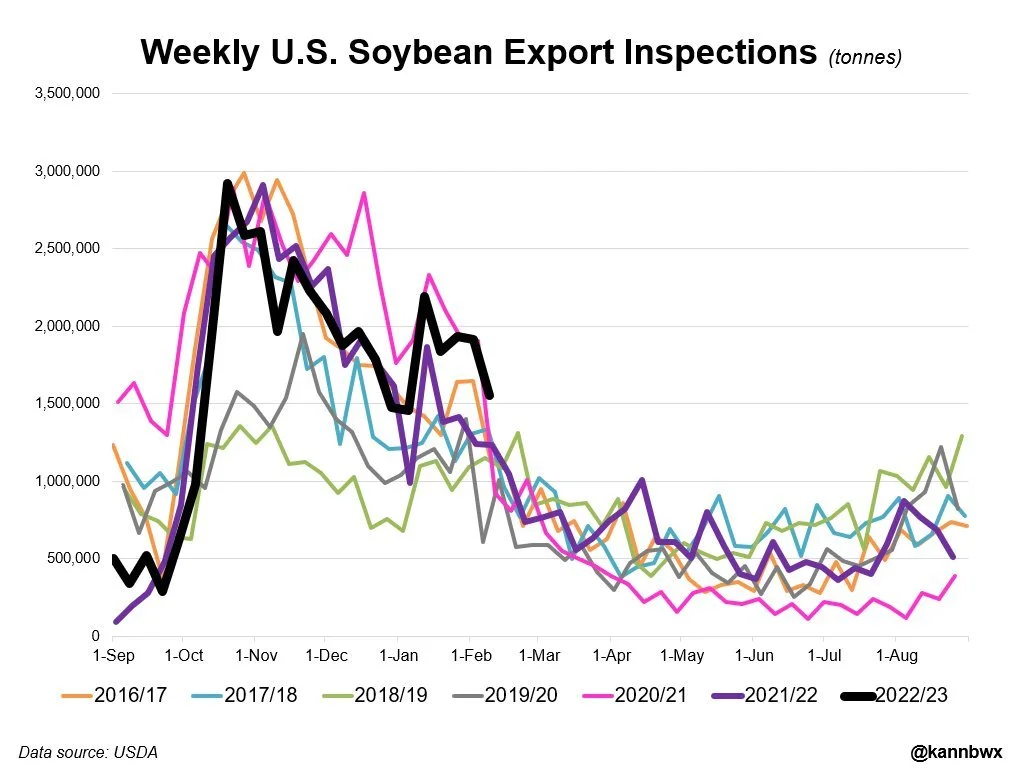

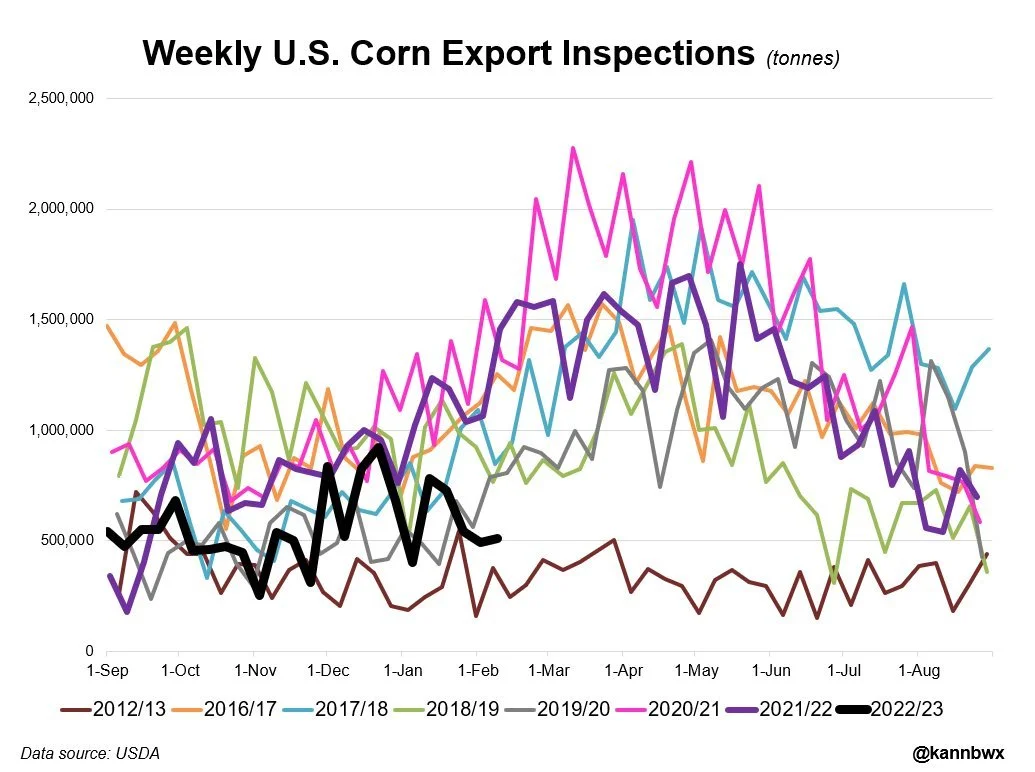

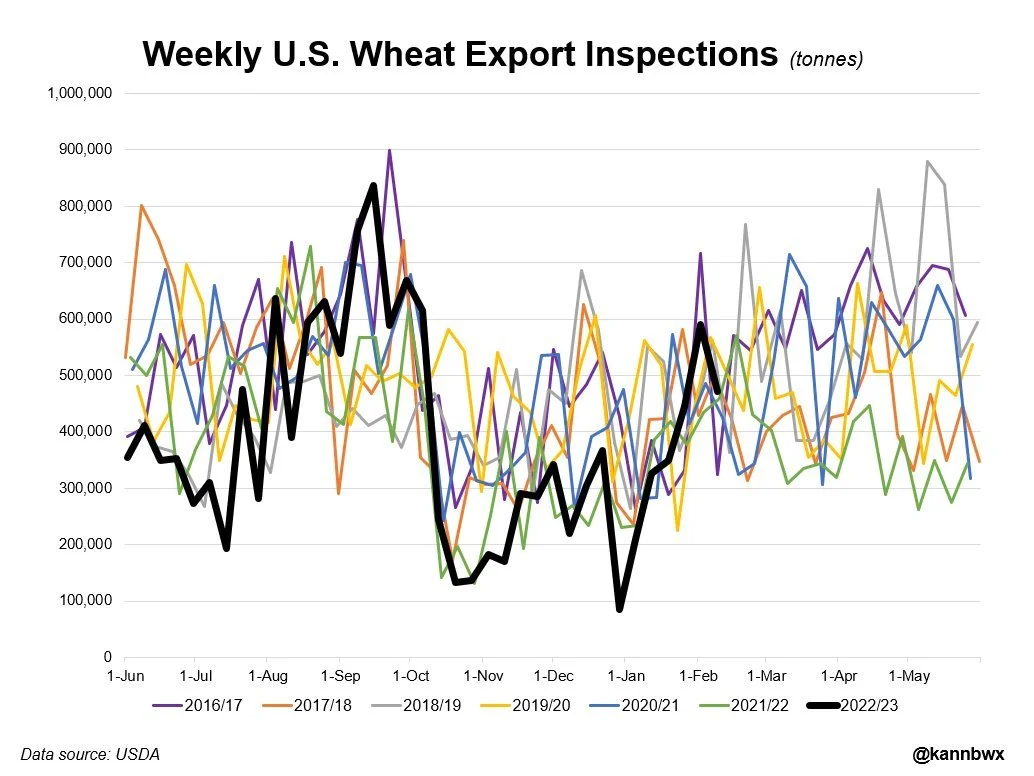

Export Inspections

Last week's export inspections fall within trade ranges for the most part. Soybeans coming in at their lowest levels in over a month but still far above usual average for the week. Corn still pretty low with none to China this week. Wheat was pretty average.

Numbers (thousands of tons)

Corn

Actual: 512

Estimate: 360 to 800

Last Week: 494

Soybeans

Actual: 1,555

Estimate: 605 to 1,920

Last Week: 1,915

Wheat

Actual: 472

Estimate: 250 to 600

Last Week: 591

Highlights & News

Soybean fields in Argentina and Brazil's Rio Grande do Sul are expected to see some very hot temps with a small amount of rainfall. Temps were 104 degrees over the weekend.

China's oil demand continues to rise as they reopen after 3 years of covid. Experts are saying China will account for half of the worlds oil demand growth.

Another "UFO" was shot down, making it the fourth one.

Tomorrow's CPI data will be the first to be calculated using a new methodology.

In Case You Missed It..

You can click here to check out our past updates

Livestock

Live Cattle up +1.150 to 165.100

Feeder Cattle up +0.800 to 187.200

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

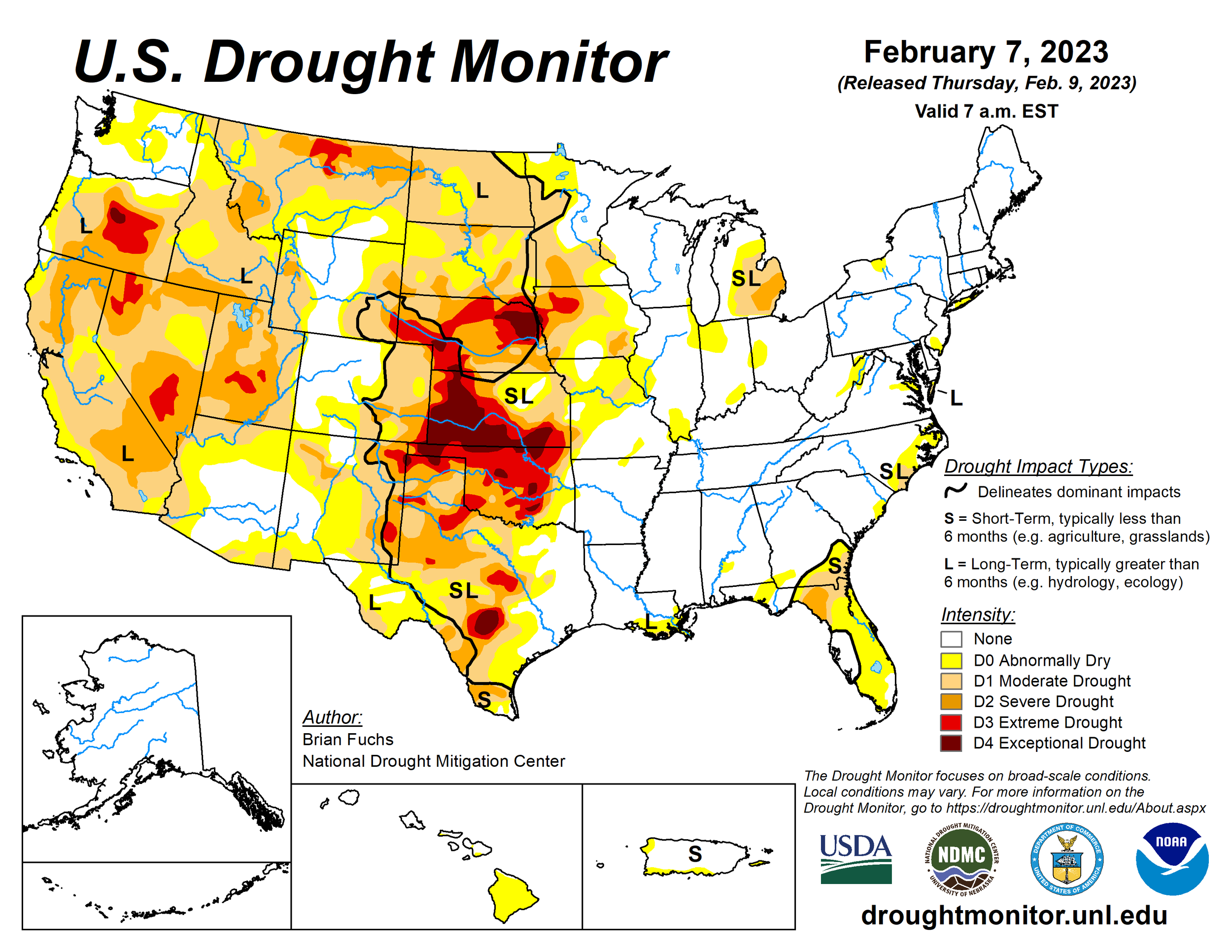

U.S. Weather

Source: National Weather Service