WHY WE THINK WE’LL GO HIGHER

AUDIO COMMENTARY

Highlights

Why we think grains will continue to go higher come spring & summer

Why is meal making contract highs despite record crop from Brazil?

Where is the world going to get corn if delays continue?

What's next for grains if war continues

When should you be making sales?

Bullish wild cards

Listen to today’s audio commentary below

Enjoy our stuff? We are offering 50% OFF

Overview

Grains slipping slightly lower with a lack of fresh bullish news. Not too surprising given the recent rally. Outside markets also getting hit hard weighing on the grains. With prices at these levels, bulls will look for more bullish news to continue to support prices.

The trade continues to digest war headlines, South American weather, and Chinese relations.

If you missed this weekend's newsletter

New All-Time Highs? - Click Here

Today's Main Takeaways

Corn

Yesterday we saw corn quietly make its highest close since November. Today prices slipping with a lack of fresh news to keep pushing us higher.

Overnight corn saw some strength as we pushed up to our previous highs. There are a few things adding support to the corn market. First off, Russia says extending the grain deal would be inappropriate unless sanctions against Russia were lifted. We also had Mexico say that they would not ban GMO corn imports if the corn is used for feed or industrial use. These aren't necessarilycessarily game changers but nonetheless supportive.

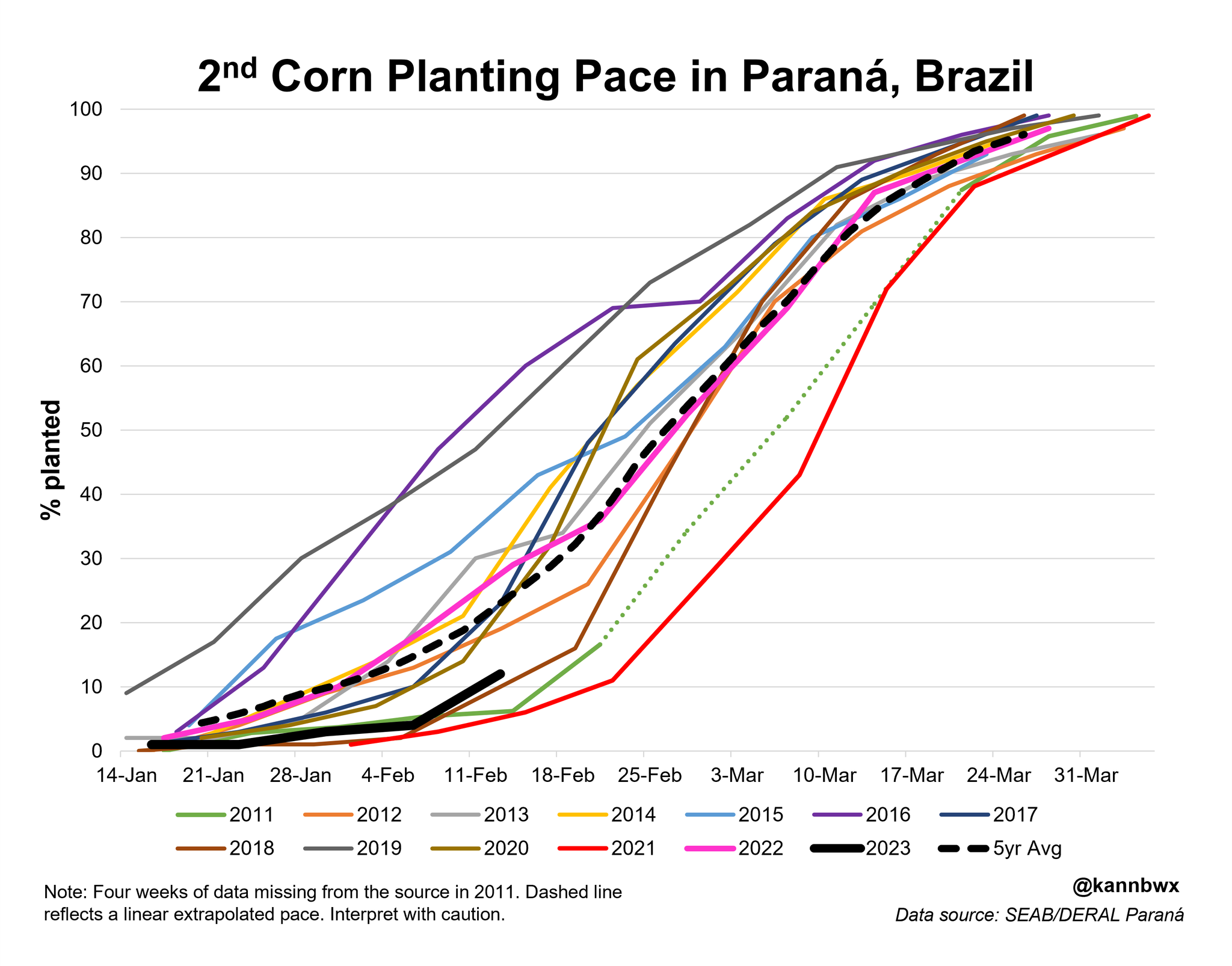

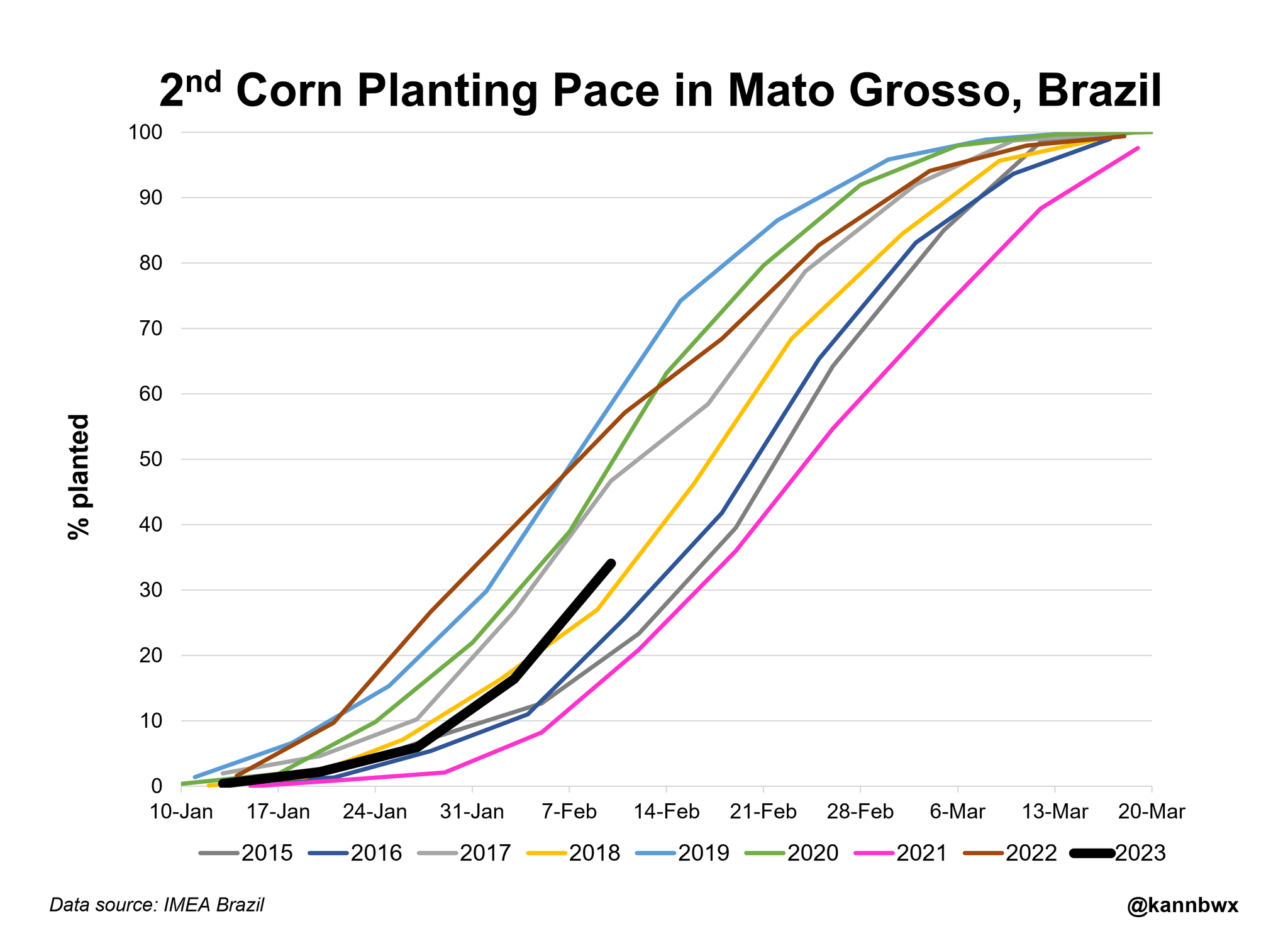

Second crop corn planting delays in Brazil will continue to be one of the bigger headlines surrounding corn. Brazil's southern state of Parana is just 12% planted vs 28% last year and 23% on average. As you can see from the chart below its one of the slowest years we've seen.

The top planting state of Mato Grosso is also dragging behind. Sitting at 34% planted vs 55% last year and our 42% average. So not too crazy, but definitely something to watch out for going forward.

The slow progress led to Dr. Cordonnier cutting his Brazilian corn production estimate. Lowering his number by 2 million metric tons.

The past few months we’ve seen Argentina drought traded more in soybeans rather than that of corn, when we saw beans take their massive rally. So perhaps the trade has some catching up to do in the corn market.

From a technical standpoint, we closed above the trendline yesterday, but failed to hold as we attempted a rally overnight but ultimately closed back below the trendline. The $6.85 remains stiff resistance.

Corn March-23

Soybeans

Soybeans closing down a nickel today with weaker meal and outside markets following the close yesterday that saw beans close at their highest levels since June.

We saw China purchase some cargos last week, and rumors were they were buyers Sunday night. But we haven't seen any export announcements here yet. So demand is still a bigger question.

Argentina might be seeing some cooler temps here short term to go along with some rains this week. We will have to see just how big of an impact if any that these rains make.

Brazil's crop size continued to be a big debate. Some are saying 151 million metric tons while others are around 154 million with the chance to get higher. They are still expecting a massive crop, so we will have to see just how big and whether we see these numbers grow or get smaller.

Recent news headlines were saying the balloon the U.S. shot down was a spy balloon from China, but China denies this. This situation will continue to be monitored as it has the chance to effect the relationship between China and the U.S., as China is worlds biggest buyer of beans.

As of lately, I'm not extremely bullish when we climb into the mid $15 range. But beans have continued to prove bears wrong time and time again. As a majority of people never thought we’d even see $15, but we did. My biggest uncertainty right now is that the funds are sitting on a record long meal position, and I just wonder if they will continue to add to this or start to shift to sellers. For beans to keep climbing bulls would like to see further South American weather worries and increased demand.

Soybeans March-23

Soymeal

Meal seeing minor losses following its recent contract and 10 plus year high yesterday. Funds are sitting on a record long position which has me slightly nervous here, but meal has had a mind of its own and continued to rally, proving bears wrong along the way. Meal is 40 ticks away from all-time highs. Funds and Argentina weather will decide if continue this bull run.

Soymeal March-23

Wheat

Wheat futures see small losses in Chicago and KC while Minneapolis managed to close slightly higher. Seeing prices take a breather here wasn’t unexpected as today we didn’t see any major bullish headlines. But there is obvious tension between Russia and Ukraine and potential war escalation in the future.

I think we will continue to hear noise and rumors surrounding the possibility of Russia not renewing the grain deal for the next month. I don't necessarily think they go ahead and not renew it as both parties likely need it. It seems like Putin just sometimes likes to stir the pot. But even the possibility of this happening might be enough for funds to continue to cover their shorts leading us higher.

Even if the deal gets renewed, there is still a ton of tension between Russia and Ukraine, and most including myself don’t see this going away anytime soon as we are now approaching the 1 year anniversary of the beginning of the war. I think we will continue to see escalation. We just saw the U.S. seize thousands of Iranian weapons and send them over to Ukraine to help them prepare for war. Nobody knows what move Putin will pull next, but it wouldn’t surprise anyone to see him cause some havoc and increase tensions.

To add on to the possibility of further escalations and the deal not being renewed, we have to keep in mind Russia is the world's largest wheat exporter. Ukraines marketing is down 29% from just a year ago. This is a lot of grain that has been removed from our world marketplace. So you have to wonder if and how long it will be until we start seeing concerns in world supply.

Something to also note, the news we saw last week was that Russia plans to launch their attack on February 15th, which is tomorrow.

This is what Roger on Wright on the Markets had to say about not selling wheat despite our recent rally; "If you have not yet sold wheat or own wheat futures, now is not the time to sell out, even with the recent rally. Your broker and merchandiser (for March basis contracts) will let you keep March positions until just before the close on the 27th of this month. If wheat gets a really nice bump higher between now and then, we recommend you liquidate the March futures position and buy May on a 10 to 25 cents setback."

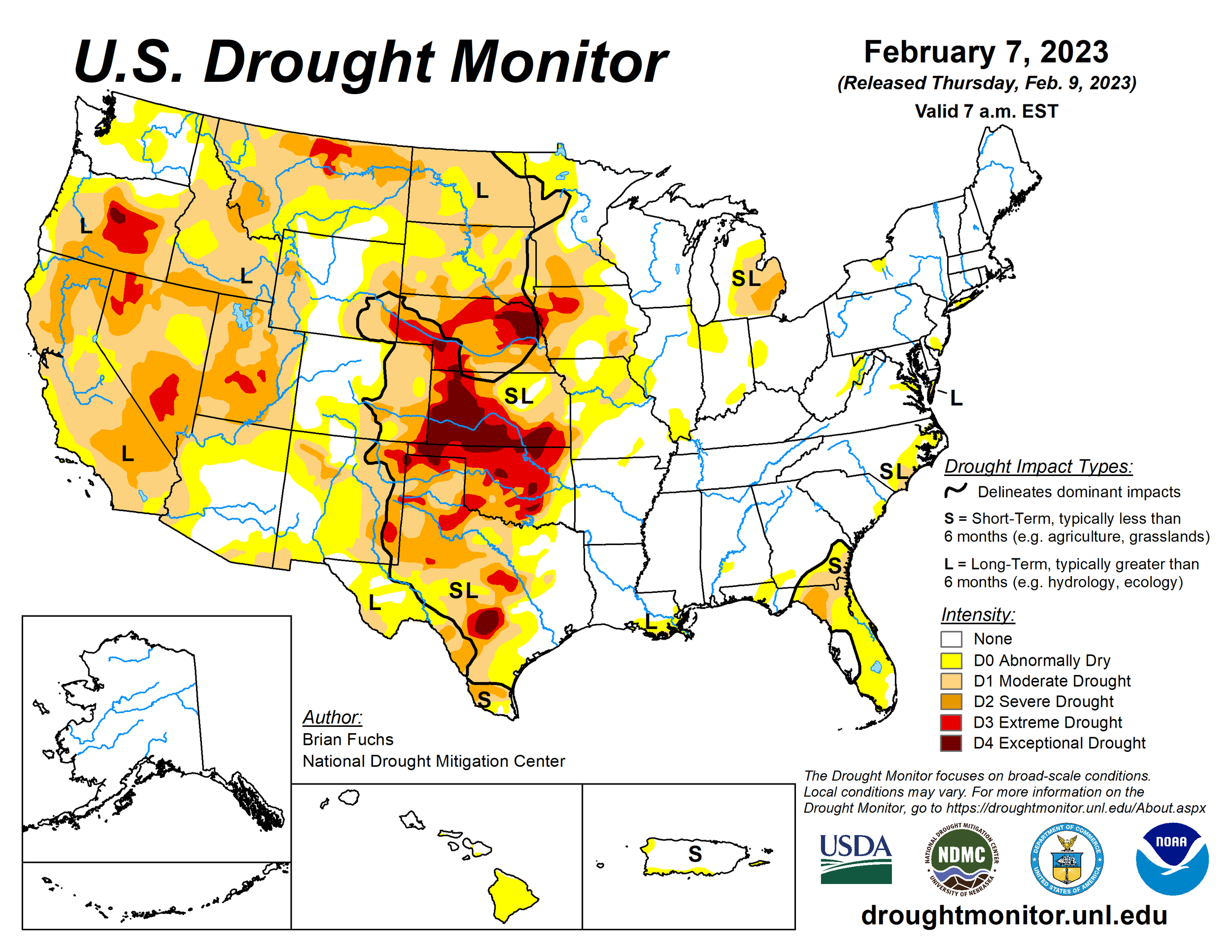

Outside of war, we have Australia suffering from floods, who yes, do have a large crop. But this could continue to be a problem. We also still have some of the poorest conditions we’ve ever seen here in the U.S.

We have rallied almost a dollar off our early 2023 low. Is the rally over? Personally, I'd say no. I think this is just the beginning of much more upside. I'm still bullish wheat as long as war is still making headlines. If we can get that break above $8 I think the floor is wide open to the upside. I also think the continuation of war headlines, and even just the thought and potential of war will be enough to cause funds to cover their short position even further.

Chicago March-23

KC March-23

MPLS March-23

Funds

Yesterday the funds were buyers across the board aside from soy oil.

The Funds Bought

4,000 corn

2,000 beans

3,000 wheat

Sold 1,000 oil

New Estimated Positions

+212,000 corn

+170,500 beans

+158,000 meal

+39,000 oil

-47,000 wheat

South America Update

Crop Conditions

Argentina Corn

Came in at 34% poor to very poor.

With 20% rated good to excellent.

Argentina Beans

Were rated a massive 48% poor to very poor.

With just 13% being rated good to excellent.

Progress

Brazil Beans

17% harvested vs 24% last year.

Mato Grosso is the furthest along at 44% complete. Strong yields in Mato Grosso are expected to offset some of the losses in southern Brazil but we will have to see.

Brazil First Corn Crop

14% harvested vs 23% last year.

Brazil's Second Corn Crop

25% planted vs 42% last year

Delays are a big factor here, as the later this crop gets in the ground, the greater chance we have to see reductions in yield due to the crop potentially missing summer rains.

Highlights & News

Ukrainian farmers may face a shortage of fertizliers for 2023 spring-sown crops. Which could lead to sharp cuts in yield.

Thousands of Iranian weapons were seized by the U.S Navy and are looking like they will be sent to Ukraine to help their battle against Russia.

Agro Consult lowers Brazil's soybean production by 400,000 metric tons. Down to 153 million.

Dr. Cordonnier again cut his Argentina bean estimate. This time by 2 million metric tons.

U.S. inflation came in higher thane expected, coming in at 6.4% vs estimates of 6.2%. This was however slightly lower than the previous months 6.5%.

Ukraine’s Agarian Council Chairman says it will take 2 to 3 years for its agriculture sector to return to its pre-war form.

In Case You Missed It..

You can click here to check out our past updates

Livestock

Live Cattle down -0.425 to 164.675

Feeder Cattle down -0.550 to 186.650

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service