GRAINS GIVE BACK EARLY GAINS

Overview

Kind of a disappointing day, as all of the grains started off the morning soaring higher, but cooled off as the day went on giving up most of their gains aside from soybeans who wound up still closing up nearly 20 cents.

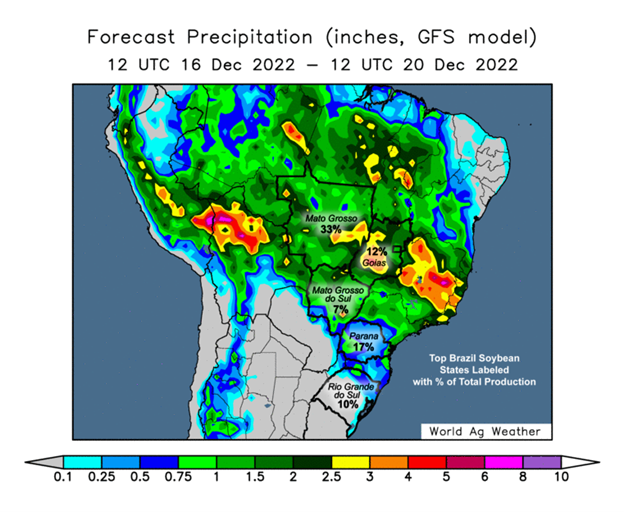

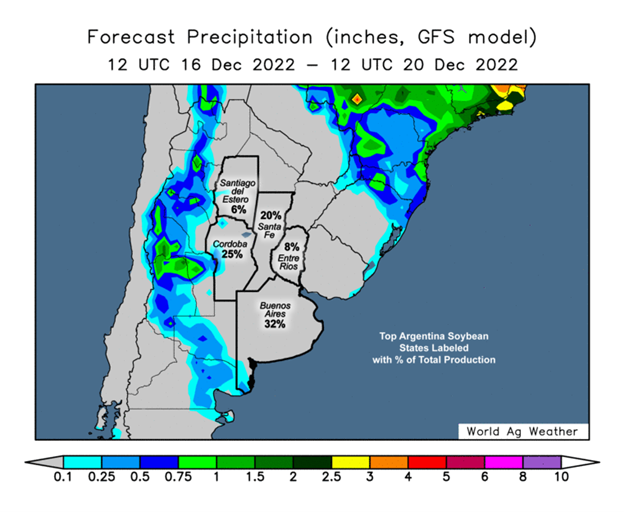

Taking a look at Argentina, they are expecting cooler temps but the forecast for rain the next few days evaporated so the dryness is one of the main factors that added support to soybeans and the market.

We also saw the CPI released this morning. It came in at 7.1% which was below expectations of 7.3% so this is leading to a great rally in the stock market with the easing inflation concerns. Also supporting most of the other world markets with equities higher and the dollar lower. Tomorrow we will see the Fed interest rate announcement where they are looking for a 0.5% interest rate hike.

Today's Main Takeaways

Corn

Corn closed slightly lower here after initially seeing higher prices this morning. As we saw March corn touch a high of $6.60 before ultimately closing 1/2 a cent lower at $6.53 1/2. But on the bright side, even with these minor losses today, futures are still up nearly +20 cents from our lows we saw just last week.

The strength in crude oil added support today but just wasn’t enough to drive prices higher, as crude oil was up over +$2 along with the other markets as the CPI came in lower than expected.

The funds weren’t quite as long as most thought they were. As we thought they were long 170 vs the 120 they actually were. This is actually a little friendly given they have less to get out of when the markets take a turn downwards.

Yesterday the weekly inspections for corn were slightly disappointing, coming in below the weeks prior. We are roughly 30% behind that of last years pace. This is a big reason why some think we may need to see further export cuts in the future.

One of the biggest concerns with seeing higher corn futures here short term is the lack of bullish headlines, as it’s been pretty quiet. Of course, we have the war headlines, but these don't seem to have as large of an effect as they used to and this more directly effects the wheat market rather than that of corn.

We also have demand still being in question, as there is plenty of uncertainty regarding China and if they want to start buying U.S. corn not. We may need to see China step in here with a bigger role if we want higher prices.

Argentina's corn crop estimate was lowered, and the future outlook is neutral to lower. But overall the South American story is a mixed bag. Argentina is expecting to potentially see lower numbers, while Brazil isn’t facing any issues as of right now. We also have to keep in mind, it is still very early for South America headlines. So we will likely see plenty of changes to these stories looking ahead. If the South American headlines remain cooperative we could see corn go back and test our recent lows, but I'm still on the sidelines with a possible slight bullish tilt on corn here. But as always there is nothing wrong with taking some risk off the table on these rallies, especially if one is undersold.

March-22 (6 Month)

Soybeans

Soybeans seeing a bit of a turnaround Tuesday here following the sharp losses yesterday as soybeans followed soy meal lower. All soy complexes seeing gains here today.

With this bounce, soybeans aren’t too far off their recent highs. Prices cooled off a little bit from this morning but we saw Jan-23 beans touch a high of $14.87 3/4. If we get some more bullish headlines, $15 soybeans doesn’t look all that impossible, and could possibly happen sooner rather than later. That is if we get some more bullish catalysts, otherwise we may see prices continue to bounce around in the recent price range, and maybe trickle lower with cooperative South American weather and weakening demand.

We also may have seen soy oil find a bottom here following the recent sharp losses. Seeing a key reversal, as soy oil was trading 3% higher again today following the rally yesterday which has added some support to soybean futures.

We did see the USDA this morning confirm 140,000 tons of U.S. soybeans for unknown delivery for 2023/24. But export inspections have remained pretty lackluster at best, declining for the third week in a row in yesterday's report.

Argentina's weather over the weekend pressured soybean yesterday but is adding a little bit of support today. As over the weekend we saw some rainfall which slightly eased the drought concerns. But the rainfall wasn’t extremely heavy, and the forecasts for rain have disappeared. So overall, it is a bit cooler in Argentina but the outlook still remains pretty dry which will look to add support to both the corn and bean market looking short term here. For them to see any improvements they will need to see some meaningful rain. Most sources are thinking Argentina soybean production is sitting around 45 million metric tons, while the USDA is sitting firm on their 49.5 million. I think there is a good chance we see the USDA walk back their estimate.

On the other hand Brazil’s forecast is still cooperative which isn’t a friendly sign for the grains looking longer term. This has been the story as of late, but South American weather (Brazil imparticular) is the biggest thing that could hold soybean prices back in the future. Unlike Argentina, many have their estimates sitting higher than the USDA's. With a majority having their production estimates around 156 million metric tons or so, while the USDA currently has theirs at 152 million.

In the most recent update, Argentina soybeans were 37% planted vs 57% last year and 61.4% on average. Brazil on the other hand is 95% planted compared to 96% last year according to AgRural.

Soymeal & Soyoil

Soymeal up +1.5 to 449.9

Soyoil up +1.90 to 63.37

Soybeans Jan-23 (6 Month)

Wheat

Wheat futures ended the day mixed with Chicago ending -4 cents lower, KC +3 cents higher, and Minneapolis +6 1/2 cents higher. Wheat started off the day soaring higher and at one point Chicago wheat was trading a penny away from $7.70, but ultimately closed at $7.50 3/4.

Some of the recent support has came from the Russia attacks on Ukraines Odessa which we have mentioned the last few days. If escalations continue this should be beneficial to wheat and corn futures. Overnight we did Ukraine retaliate these attacks by damaging a bridge that Russia uses to transport military equipment. For the time being, it looks like we have a ways to go before the entire war situation is settled.

Outside of the war headlines, there just wasn’t a ton of catalysts to drive prices higher today. Most of the problems going on with the wheat market will likely be bigger problems down the road looking into next year, not so much here short term.

Funds still remain short wheat with the recession woes and worries of record crops in Russia and Australia. Funds hold their shortest position for Chicago wheat since May of 2019.

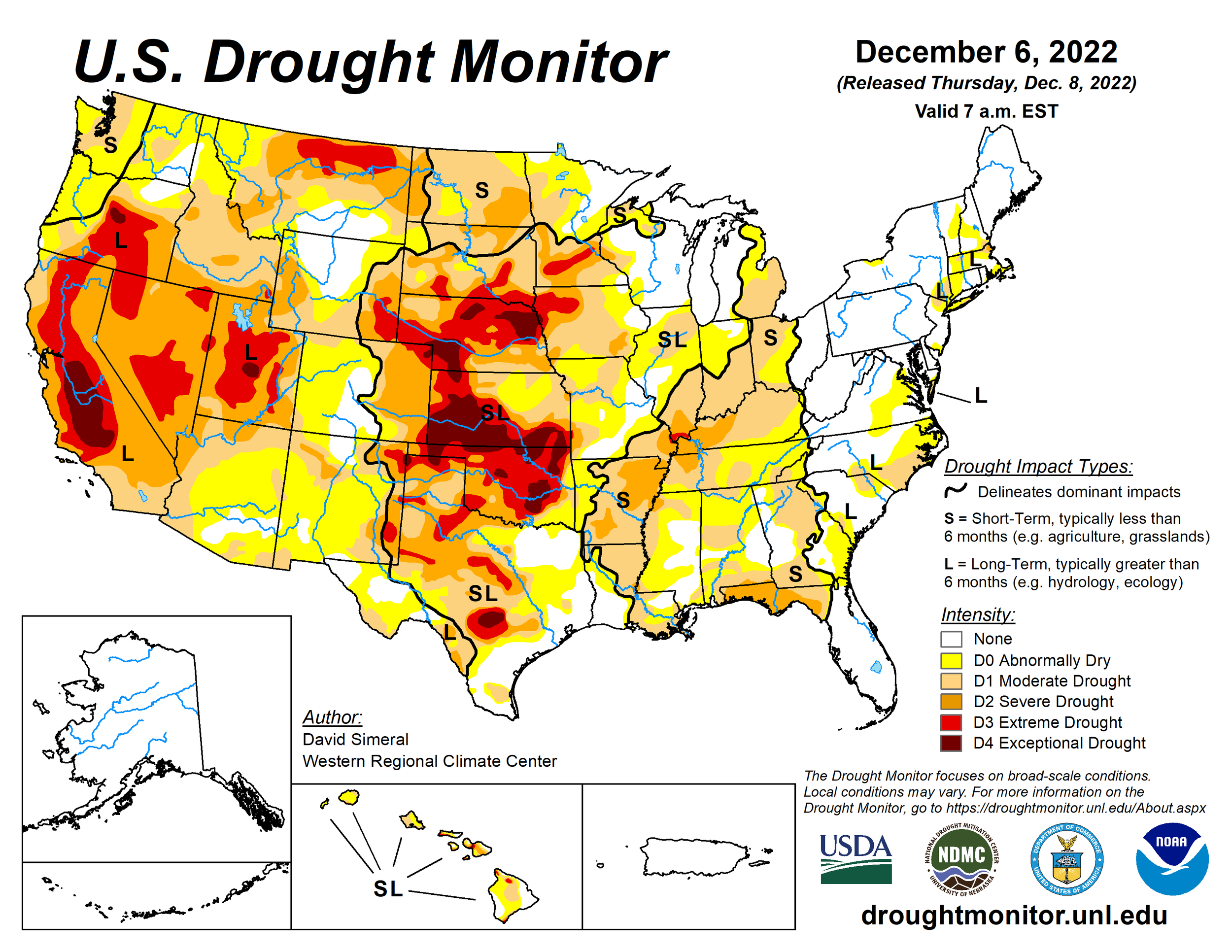

The U.S. wheat crop is experiencing the worst drought conditions since records began in 200. Argentina has a ton of problems and estimates are already being lowered. Ukraine has planted 36% less acres compared to last year. On the other hand we are potentially looking at a record crop from Australia and a fairly large crop from Canada as well. So all in all, I think we have more bullish cards left in the deck than that of bearish ones looking long term. I can't imagine anyone getting too bearish at these levels to begin with.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Technical Analysis from GrainStats

Here are a few great technical analysis’ from GrainStats.com 🌾

I highly suggest checking out some of their stuff as they provide great info daily

You can visit their website here or GrainStats.com

Corn Analysis 🌽

This is what they had to say about their corn analysis;

"Corn appears to be trading sideways with defined support levels. A major downtrend line for 2022 seems to burden every market rally. Be watchful if we break above the near term downtrend line."

🟢 Current upside target is 6.74

🔴 Current downside target is 6.35

⚠️ Mind the gap below 5.95

Wheat Analysis 🌾

Here is what they had to say on wheat;

"Wheat is back from purgatory after breaking the 7.33 support line.

Did longs puke at the bottom?

Did new shorts get trapped at the bottom?It's hard to be a bear if either is the case. I would expect wheat to continue to punish both bulls and bears for the moment trying to get above the head and shoulders neckline that broke last week."

🟢 Current upside target is 8.00

🔴 Current downside target is 7.23

Soybean Analysis 🌱

Here is what they said;

"Soybeans have been supported by South American weather and Soybean Meal strength. A big decision will have to be made soon in the market as we're in between two trendlines. Expect volatility."

🟢 Current upside target is 14.92

🔴 Current downside target is 14.58 and 14.25

⚠️ Mind the gap above 15.36

Soy Oil Analysis ⛽️ 🌱

Here is what they had to day;

"Soybean oil has been in liquidation mode for the past two weeks shredding over 15% of its value. The bear case seems to have paused with funds reporting the largest weekly liquidation in futures contracts since 2017. We believe the low of 59 was panic selling and the market is now neutral to bullish."🟢 Current upside target is 67.33

🔴 Current downside target is 60

⚠️ Mind the gap at 67

Soymeal Analysis 🐮 🌱

They said';

"Soybean meal has taken its share back in the crush and helping hold the grains complex together. The move after the EPA decision feels over done, but still bullish overall. We would watch for potential long liquidations below the recent lows @ 447-448. Watch for rains in Argentina to determine if this rally continues to have legs."🟢 Current upside target is 462

🔴 Current downside target is 447-448

Again you can check out the rest of their stuff at GrainStats.com

Other Markets

Crude oil up +2.25 to 75.43

Dow Jones up +100 after trading much higher at open

Dollar Index down -1.12 following the CPI cooler than expected

Cotton down -up +2.24 to 81.63

News

CPI comes in at 7.1% vs 7.3% leading to a rally in the stock market, further easing inflation concerns

Sam Bankman-Fried, the former CEO of FTX. The company that stole billions and went bankrupt. Has finally been arrested in the Bahamas.

Rumors are circulating that nearly 60% of China residents could be infected by COVID-19. Which equates to 840 million people.

Brazil hopes to be worlds largest cotton exporter by 2023

Livestock

Live Cattle up +0.250 to 156.350

Feeder Cattle up +0.575 to 184.225

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Yesterday's Weekly Newsletter - Full Version

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service