QUIET DAY FOR GRAINS / FEDS RAISE INTEREST RATES

Overview

Grains all started off lower overnight, we have seen a slight rebound here during the day but overall a fairly quiet day for the grains with not much price action aside from KC wheat trading lower by double digits.

Grains were also pressured from news that the Odessa elevators will be getting back into operation. They aren’t at full capacity but power is up and ships are going out.

We saw Biden send patriot missiles to Ukraine. This might change the complexity of the entire war situation. We will have to see what Putin does here now and if he escalates tensions further.

Feds rose interest rates by 50 bps (0.5%). Interest rates now highest since 2007. The main of topic was that they will be extending interest rates even higher going into next year. They are talking about a 1% increase.

Today's Main Takeaways

Corn

Corn trading a few cents lower here today after giving up yesterday's early gains. We have seen some strength in the crude oil market and a weakened dollar but really nothing out of corn, as corn continues to trade in a choppy range.

Due to a delayed harvest, we saw Ukraine production estimates lowered to 2.7 million metric tons, but to go along with that. We saw export estimates also raised to 20.2 million due to the export corridor extension. USDA's current estimate for Ukraine exports is 17.5 million.

With the rains across the U.S. we are seeing the Mississippi river water levels in better shape, which has allowed for more barge traffic. We will have to wait and see how much improvement we see here.

Yes we have problems in Argentina, but that alone hasn’t been enough to support prices as of now. Especially given Brazil outlook is cooperative. Keep in mind it is still a little early for South American headlines as everything could change.

For corn prices to be sustained at these levels we will need either some strength in Chinese demand or a South American weather story to get prices pushing higher. As outside of these two factors there isn't a whole lot there to support the market. We also have the possibility for this Ukraine and Russia war to escalate and benefit prices as well. If we don't get any of these beneficial factors we might just see corn continue to chop around.

March-22 (6 Month)

Soybeans

Soybeans were pretty strong most of the day after initially opening up lower. As soybeans rallied 15 cents off its lows, closing up +2 1/2 cents, seeing some strength from increased dry forecasts over in Argentina.

The short term forecast for Argentina remains hot and dry which has been adding support to the market. And most think we will see the USDA lower their Argentina estimates further. But if Brazil continues to remain in good shape, this may not have as big of an effect as one would like. As the record crop expected in Brazil could create a lot of competition.

Bulls would like to make the argument that we are only one major weather scare over in South America for higher prices. Which isn’t a terrible argument. Perhaps demand is strong enough and stocks are tight enough that the only missing puzzle piece to higher prices is weather scare in Brazil.

Overall South America remains a mixed bag, with plenty of uncertainty ahead. Argeninta has problems, Brazil doesn't. And that been the story as of late. If we don't get that weather scare, we might see Brazil have a record crop.

Covid is spreading very strongly all across China as China is still battling trying to ease off their lockdowns. Its looking like their problems won't be slowing down soon. So this makes everyone question Chinese demand as well as talks about a potential recession going into the new year.

With prices still relatively high, we will likely need to see more bullish catalysts if we want prices to stay elevated at these levels or push past $15. Some solid headlines and we could potentially see +$15 beans. But if we don't get that catalyst we need to break through, we could see prices bounce around and perhaps push lower if South American weather is cooperative along with no other bullish headlines to keep prices elevated.

Soymeal & Soyoil

Soymeal up +6.3 (+1.40%) to 456.2

Soyoil down -0.53 to 62.84

Soybeans Jan-23 (6 Month)

Wheat

Wheat futures started lower overnight and have seen some continued weakness throughout the day, with Chicago bouncing from its lows but still trading a penny and a half lower at close. KC wheat seeing the most weakness, trading -15 cents lower at the close.

Overall, there just isn’t a ton of bullish news surrounding the wheat market as it stands currently. Yes, we have the Odessa situation but the markets just seem to think it’s not that big of a deal. Any additional escalation or damage to Odessa would be bullish for the grains, wheat in imparticular.

With the dollar hitting six months lows, a cooler CPI, some strength in crude, as well as the Russia & Ukraine headlines. One would think we maybe see funds exit some of their short positions as they still hold an incredibly short position.

Russia's Ag Ministry expects 22/23 wheat harvest will be between 80 and 85 million metric tons which is down from their record of 91 million in 2021/22.

USDA's Ag Attache sees Ukraine wheat production at 19.9 million metric tons. This is lower than the USDA's current forecast of 20.5 million and far lower than last year's 33 million.

So we have estimates being lowered across the globe in the few that we just mentioned, as well as others such as Argentina. With the possibility to continue seeing these numbers being cut in the future.

One other thing to keep in mind is we have world wheat production being less than that of world consumption for the last 4 years in a row.

Chicago wheat is still holding its head slightly over the trend line. I think we eventually see wheat move higher and break out from these lows as wheat is still pretty cheap, fundamentals are bullish, and the seasonal trend is up. But, the trigger needed to spark prices higher may not happen in days, but rather weeks or maybe even months. As most of these bullish factors are stories for the future that all have the potential to send prices higher. So we very well may see prices break lower here short term before eventually going much higher.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

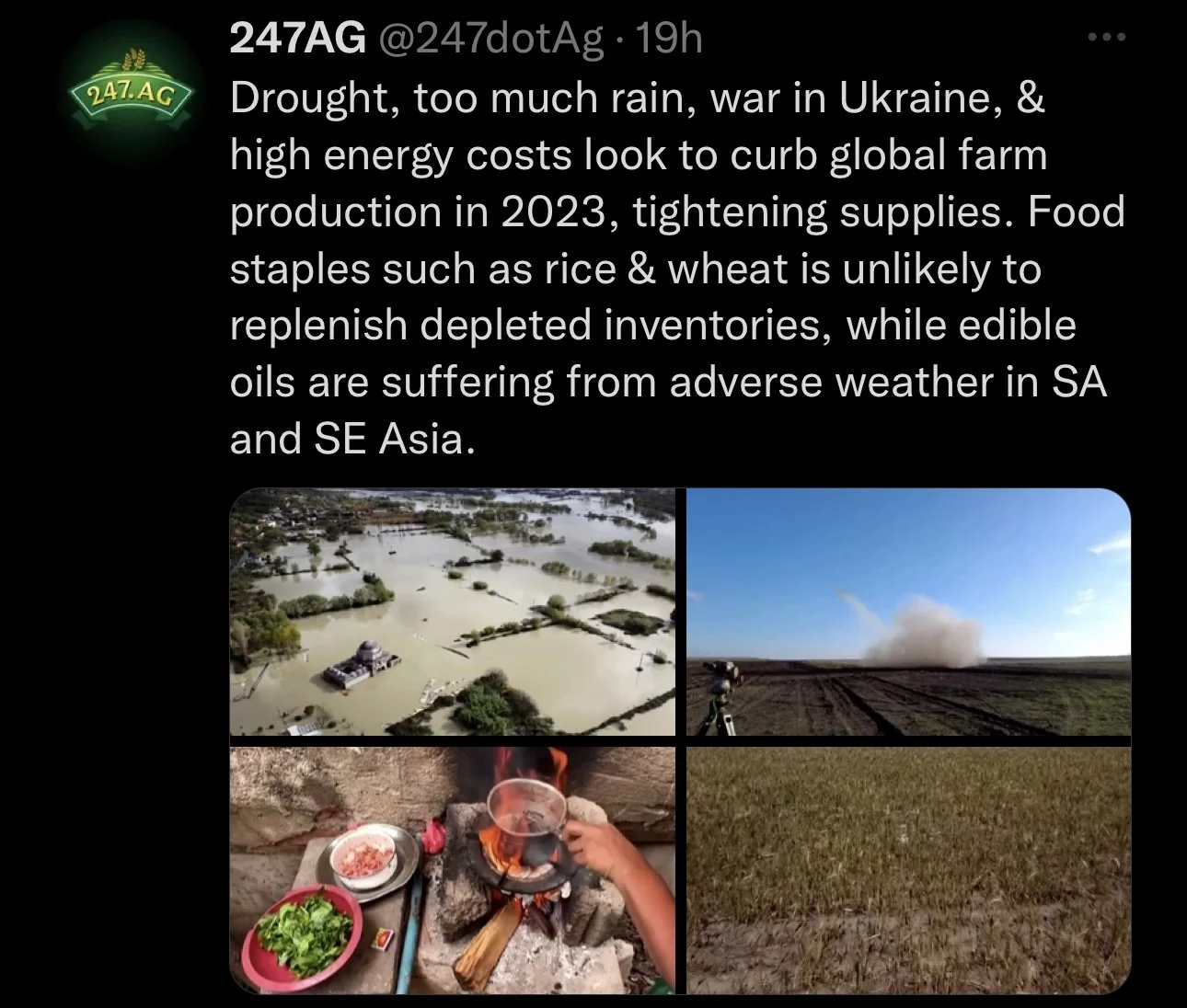

Factors In The Global Ags

via Trend & Hedge Club Presentation

🟢 Bullish

Argentina weather is questionable

Biofuel madate is confusing & erratic

Consumers have very poor coverage after 2023

Prices getting "cheap" again (low end of the ranges)

Ukraine power issues

Pipelines are dry except EU after excess during covid

Drought

🔴 Bearish

Expected large South American crops

Demand - How bad can the recession get?

Rising interest rates keep inventories under pressure

Thoughts From This

By Jeremey Frost

A couple of major points, first is risk that if commercials that are short are forced to blow out of hedges like they did in 96 for corn, 2008 for MPLS wheat.....until they find or get banks behind them to stand behind hedging......

that risk exists, and with higher interest rates what's going to happen if everyone that is bearish starts making HTA sales...... then we get a repeat of 2012 weather or some other bullisn black swan event....Elevators could easily go broke........

That in turn causes elevators to lift hedges driving markets up even more

Could the US hedging system be on the verge of a collapse much like the Canadian wheat board was in 08?

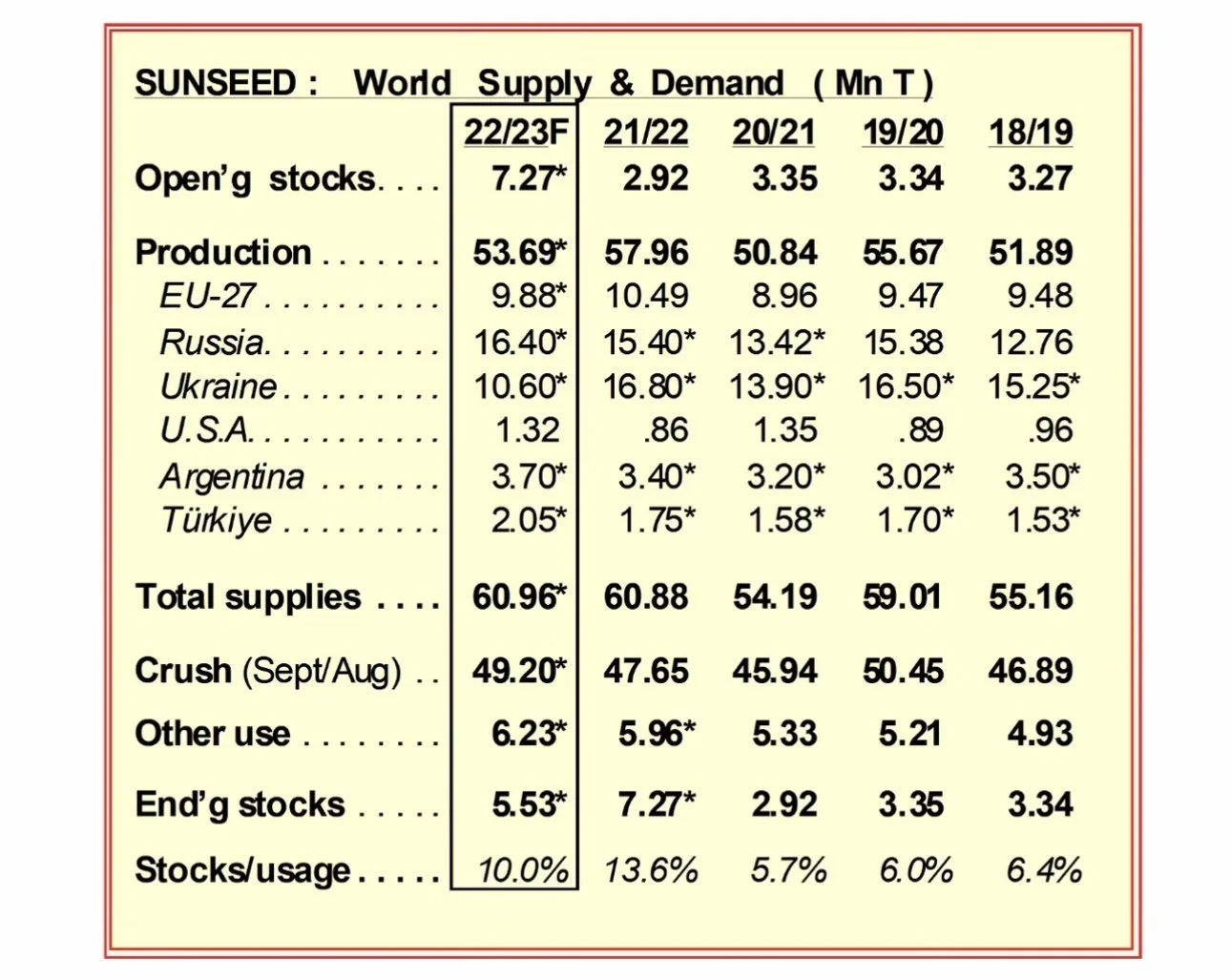

Next is sunflowers....Did you know that Russia has nearly 2 1/2

times the WHOLE US sunflower Crop still in the field....and likely will be in the field until spring....that is rather bullish sunflower prices at some point.

Math Doesn’t Add Up for Renewable Diesel Growth (via DTN)

By CHS Excecutive, Gary Halvorson

"Outsides markets will continue to have an outsized influence in agriculture. It's more about what's going on around the world than it is here at home."

Halvorson said the expansion of soybean crush capacity and the growth of renewable diesel will play a role in perhaps changing farmers' cropping decisions.

If the renewable diesel expansion is to be fully realized, he said, more farmers will need to move corn acres to soybeans.

New construction announcements about soybean crush facilities and renewable diesel plants have been popping up for the past two years, increasing demand for soybean oil and charting a path for change in crop acres in the decades to come.

"If we're going to use more renewable diesel fuel, we have to grow disproportionately more soybeans in the U.S. because we need about 9 million more acres to fuel the new soybean crush plants of soybeans," Halvorson said.

"If all the states that are proposing an LCFS (low-carbon fuel standard) like California did or Washington's talking about, there's just no way that the U.S. farmer would grow enough soybeans to fuel that demand to create enough renewable diesel."

For example, if New York and Florida switched from diesel to renewable diesel, he said, "We would consume nearly all the acres that can be farmed; they'd all switch to soybeans in the U.S. So, the math doesn't work."

U.S. farmers in 2022 planted 89.9 million acres of corn and 88.3 million acres of soybeans.

Halvorson said that because it takes a while to build a new crushing plant, the change in crop demand will be gradual.

"We think that there's a scenario that corn acres go all the way down to what they were before the buildup (from ethanol expansion), which means corn (acres) could go to the low 80s, high 70s millions of acres," he said.

"Soybeans take the balance of that, but we have multiple scenarios, and that's probably the most likely -- you take at least 10 to 15 million acres out of corn to replace with soybeans to meet this new crush demand. None of this is going to happen immediately. To build a soy crush facility takes four years. So, year four they'll start contracting more soy acres."

You can read the rest of the article Here

Other Markets

Crude oil up +2.2 (+2.90%) to 77.33

Dow Jones down -300 following Fed decision

Dollar Index down slightly -0.117

Cotton down -0.26 to 81.42

News

Ships are leaving Odessa following the attacks from Russia. This added some pressure to the markets today.

India's December wheat stocks fall to 6 year lows.

The Feds said the declining in rates will begin in November 2023.

Livestock

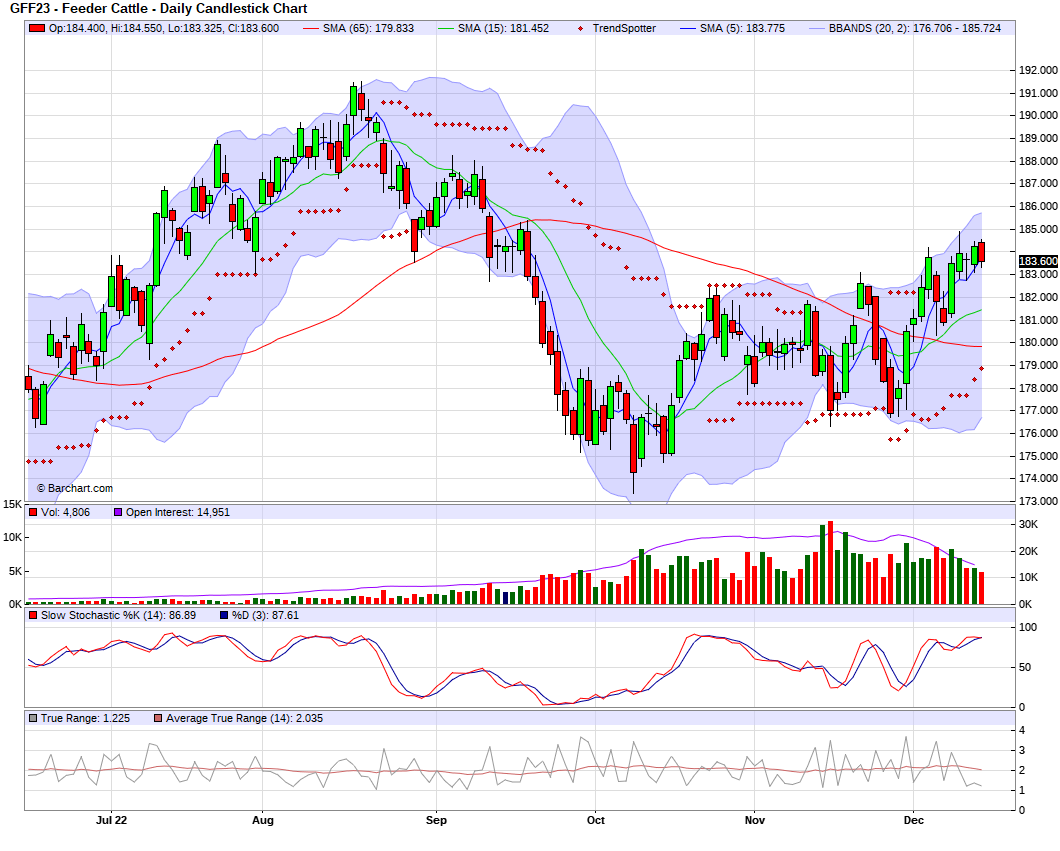

Live Cattle down -0.650 to 155.700

Feeder Cattle down -0.625 to 183.600

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Sunday's Weekly Newsletter - Full Version

Yesterday's Market Update - Technical Analysis from GrainStats

Yesterday's Audio Commentary - Will U.S. Dollar Lead to All Time High Grains?

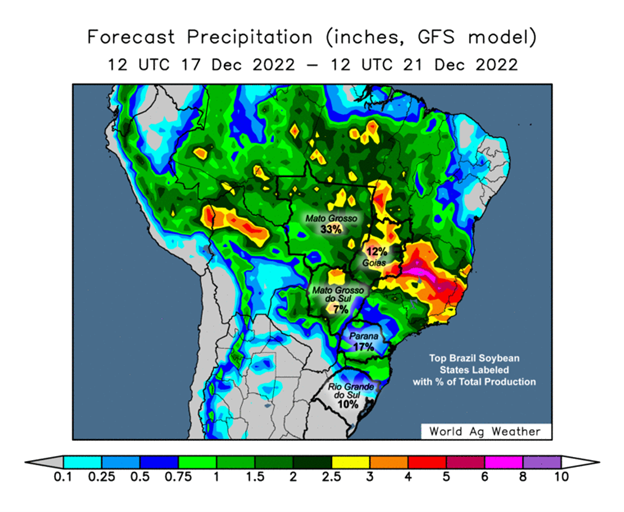

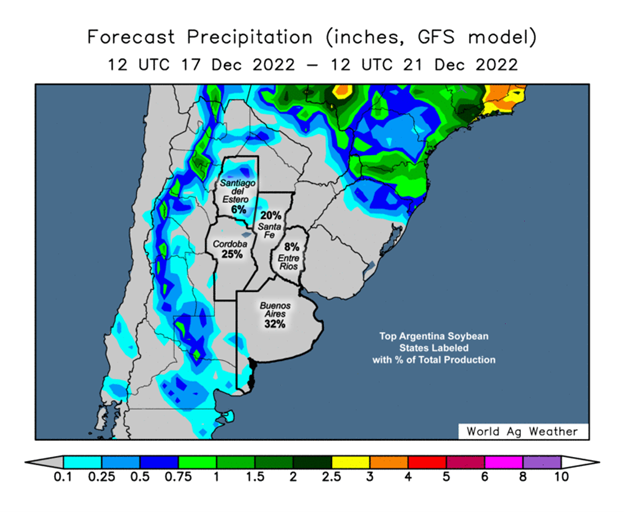

South America Weather

Brazil is expected to see above average rainfall the next week or two. While Argentina is expected to remain fairly dry for the same time frame with chances of rain past that. Overall outlook remains about the same as it has been. Argentina is looking hot and dry which is bullish for the most part as of right now while Brazil remains cooperative which is on the bearish side of things.

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service