GRAINS RALLY AHEAD OF HOLIDAY WEEKEND

MARKET UPDATE

Futures Prices Close

For those of you on a free trial, we are offering a

50% OFF Christmas Sale 🎄

Overview

Grains end off the week on a strong note ahead of the long holiday weekend. With both soybean and wheat futures seeing double digit gains.

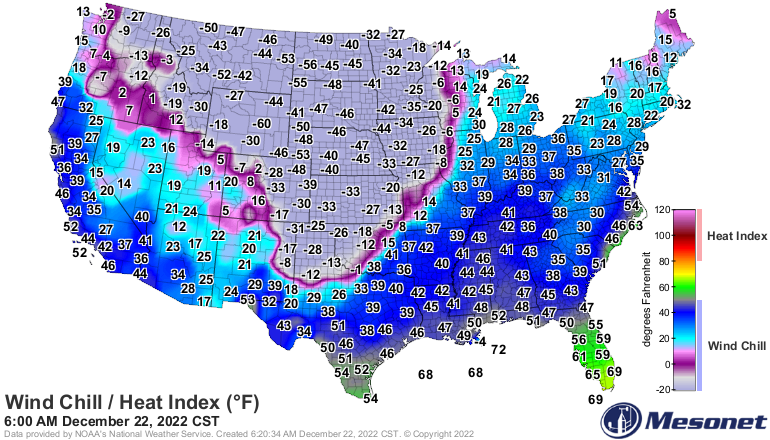

Just a heads up, we will not have a Weekly Grain Newsletter this Sunday, as that is Christmas. We hope you enjoy your holidays, and safe travels as the weather is expected to be brutally cold for most of the midwest. This will be our last update until after Christmas.

Markets will be closed Monday, December 26th.

In case you missed yesterday's audio commentary. The link is below

Can farmers move the corn market by 2.50 a bushel? - Listen Here

Today's Main Takeaways

Corn

Corn finished the day higher along with the rest of the grains, however seeing the least amount of gains. Closing up +5 3/4 cents at $6.66 1/4, which was a very strong close, only 1 1/2 cents off its highs. Overall, corn had a very strong week, ending +13 1/4 cents higher on the week (+2%).

Corn got that $6.65 break we were looking for. With this break I think it potentially opens the door for higher prices. Perhaps we see corn attempt to challenge the $7 level here in the coming weeks as we head into the new year.

The European Commission lowered their 2022 corn production estimate from 53.3 to 52.1 million metric tons yesterday.

One thing adding some pressure to the markets is the continuation of weekly export sales coming in at the bottom of trade expectations. Weekly export commitments are far behind pace. Leading to many thinking we may have to see the USDA made additional cuts to their export forecast.

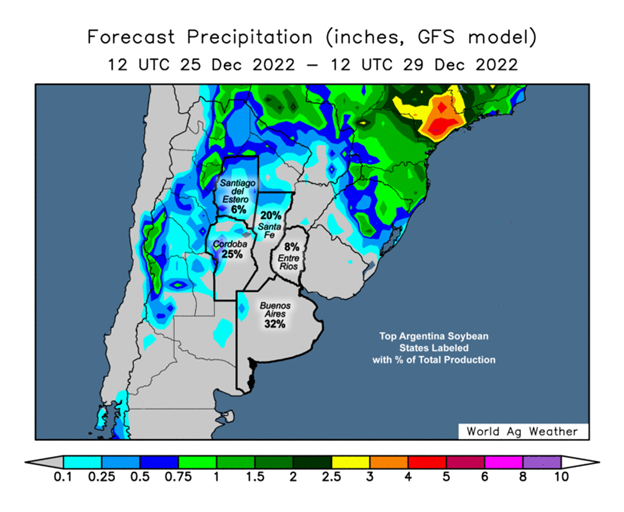

On the flip side, there is talks we may need to see the EU forecast numbers lowered. Argentina for example is one that nearly everyone can agree will likely see their estimate lowered. Depending on how the rest of their weather and rains shale out, most are suggesting we could see a cut of up to -15 million metric tons.

Now the two major uncertainties in the market remain as two of the topics we have talked about a bunch in the past. Those being the war with Russia & Ukraine, as well as the uncertainties in China as they still battle massive problems with covid, which has created some uncertainty surrounding their economy as well.

Corn has continued to chop around the $6.40-80 range, but bulls would really love a retest of the $7 mark. But for that to happen we will need an increase in demand, some South American problems, or maybe some more war headlines to give prices that spark to go higher. Overall I'm sitting on the sidelines with a slight bullish tilt hoping we see of these factors work out in the bulls favor, as there are plenty of which can do so.

5-Day Change

March-23: +13 1/4 cents

March-22 (6 Month)

Soybeans

Soybeans capped off their up and down week with some pretty solid gains, ending today up +12 1/2 cents. Closing at $14.84 1/2. On the week soybeans saw dismal gains of just 3/4 of a cent.

Soybeans continue to bounce around the $14.60 to $14.90 range. With soybeans again rallying after this correction. The question remains, will we see soybeans push past and break the $15 level, or correct lower once again. As recently, every single time we have seen prices inch up to the $14.80-90 range, prices correct lower. We will have to see if the pattern ensues or if we see a change next week. If we can get prices to break through to the upside, it wouldn’t be a terrible idea to make some more sales from a risk management perspective, as there is always uncertainty in the markets. Roach Ag made this suggestion this morning, "For now, we are content with sales totaling 20% of your expected 2023 production."

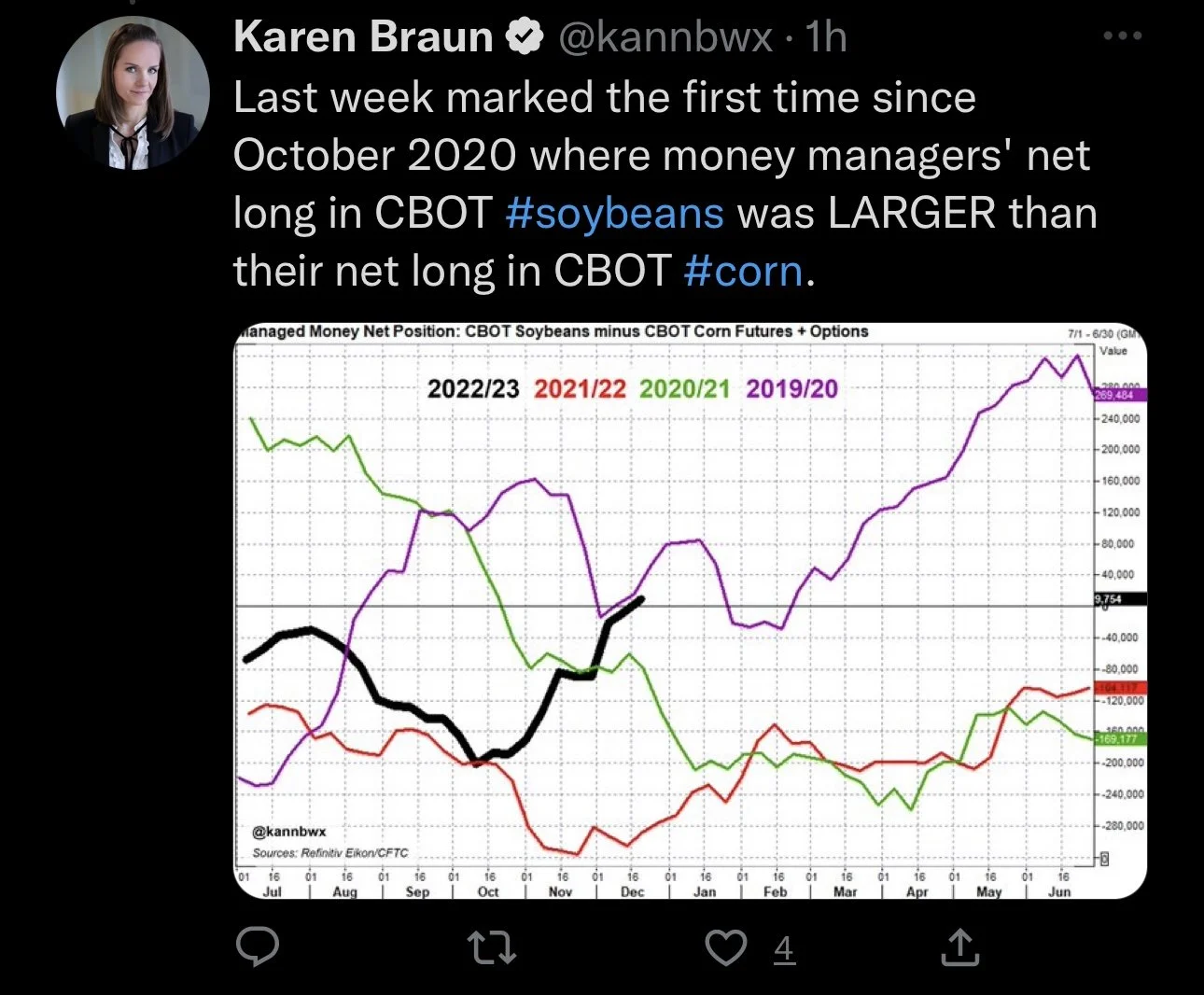

Last week was the first time since October 2020 where money managers net long in CBOT soybeans was larger than their net long in CBOT corn.

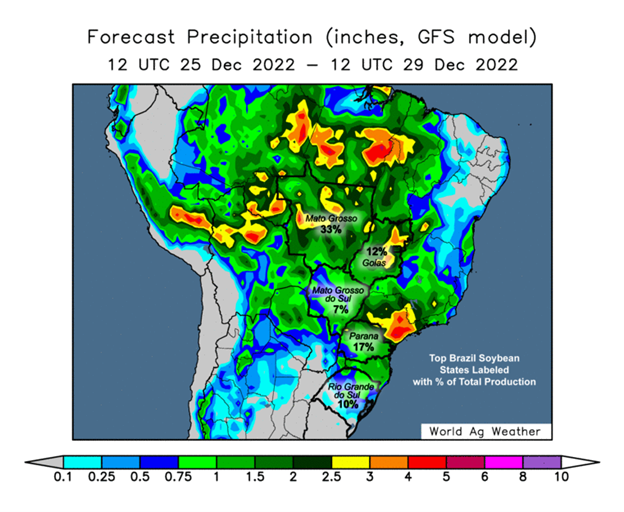

Harvest in Brazil for their 2023 soybeans are officially underway. With the most recent update showing Mato Gasso (Brazil's highest-producing state) was just 1% complete.

I am of course not saying prices can't go higher and break $15, because they certainly can. But there are a ton of uncertainties and factors needed to make that happen. The largest uncertainty is of course South America. With forecasts of Argentina rain, we will have to wait and see if these rains are a hit or miss this weekend. If they miss, this adds concern to the already problematic Argentina crop, which will likely give a small boost to prices. On the other hand, if these rains do hit and are pretty meaningful, one could expect bean prices to see some pressure when markets reopen next week.

Every time we near that $15 range we tend to see demand weaken and prices to break lower. So each time we see prices inch up to these levels it makes it tougher to be super bullish. However, if we can continue to see problems over in Argentina that might be just enough of a supply story to keep prices elevated.

Biggest factors going forward are more of the same. South American weather and Chinese demand/headlines.

Soymeal & Soyoil

Soymeal up +3 to 451.3

Soyoil up +0.64 to 64.65

5-Day Change

March-23: +3/4 cent

Soybeans March-23 (6 Month)

Wheat

Wheat seeing some more strength, with Chicago capping off its 3% weekly gain with an additional +13 3/4 cents today. Moving weekly gains to +22 1/2 cents on the week.

Wheat prices have now finally broke out of their massive downtrend, and have started to form some uptrend now. With wheat prices now back over the 20-day moving average green line.

Wheat has seen a bunch of strength due to the massive winter storms across the U.S. which is adding risk to the crop that has already seen some issues due to drought earlier in the year. Rumors are that nearly 30% of the crop is at risk of winter kill due to the brutally cold temps and wind chills.

The European Commission lowered their estimate production number for soft wheat from 127 to 126.4 million metric tons.

One thing bears might look at is the pretty poor weekly export sales, as they came in over 130,000 less than the week prior. We also have Russia wheat creating plenty of competition for the U.S. wheat market as they sit on a stock pile.

Of course it seems like no one can mention the wheat market without mentioning the war. From the looks of it, there could definitely be some future headlines that add support to the markets. But is still of course a rather large uncertainty as nobody ever knows what Putin will pull out of his hat.

As you all know, I have been pretty bullish wheat here ever since we hit those recent 52-week lows. And going from here, I don't expect a whole lot change. Right now demand and small headlines might not really be enough to hold up the market on their own. But we are now roughly 50 cents off our lows we made in the beginning of the month, and I don’t see much reason to switch up narratives here and take a bearish approach. Sure, maybe we see prices lower in the coming days or possibly weeks. But taking a long term outlook, I think there are far more things that could send the wheat market higher rather than lower.

5-Day Changes

March-23 Chicago: +22 1/2 cents

March-23 KC: +30 3/4 cents

March-23 MPLS: +22 1/4 cents

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Write Up for Wright on the Markets

This morning a good friend of our ours Roger Wright over at Wright on the Markets gave us the privilege to do his write up which was send out to his customers this morning. As you know we typically agree with what Roger has to say and love his insights. You can check out his website here. Below is a copy of this morning's write up we did for him.

Tidbits, Export Sales, Markets & Rain Days Update

Daily Report on December 23, 2022

This is Jeremey Frost with some not so fearless comments from www.dailymarketminute.com for Wright on the Markets. I want to say thanks to Roger for allowing me the opportunity to share some of my thoughts with his customers on the grain markets. But before I do that I want to share with you a little about me and what I do. I am a former CHS Grain buyer for 20 plus years before going out on my own.

I buy and sell cash grain for Banghart Properties, we mainly buy specialty crop grains such as sunflowers, millet, milo, canola, flax, and safflower. But we also help farmers market corn, wheat, and soybeans. We are licensed and bonded in SD, ND, and CO as cash grain buyers/brokers, while also having proper paperwork in other states that don’t require brokers to have licenses. If you are ever looking for bids on any grains and especially grains like sunflowers make sure you give me a call at 605-295-3100 or Wade a call at 605-870-0091.

Me and my son Sebastian also do a grain marketing newsletter advisory service. It is called www.dailymarketminute.com, we do audio commentary on the markets 2-3 times a week, a weekend newsletter that is very unique, and we send out other commentary for the markets. We get our information from various market contacts, but we also subscribe to several other grain market advisors. This allows us to help farmers get the best information out there without having to subscribe to 10-15 different advisors and it is what the name daily market minute comes from trying to give farmers everything they need in less time.

Our big motto this year has been helping farmers become grain price makers instead of grain price takers.

We love the fact that Roger is all about doing what is right for the farmer. That is what we are about as well. We want to tell the farmer when the elevator or buyer is trying to rip off the farmer. We want to be part of the reason farmers are successful so our main goal is to help farmers do what is right for their operation in their given situation with the risk-reward profile that is them.

Highlights

The U of Illinois had a very good article out the other day regarding China. Here is the summary of it.

Summary

Increases in yields have not kept pace with China’s increasing consumption of feed grains and oilseeds, thus necessitating the need for more land.

Based on historical time trends, China now needs roughly 8 million more acres per year to satisfy its growing consumption of feed grains, oilseeds, and food grains.

The World now needs roughly 16 million more acres per year to satisfy its growing consumption of feed grains, oilseeds, and food grains, implying China’s share of needed additional World acres is roughly 50%. China’s share of additional World acres has fluctuated around 50% since the mid-1990s.

The preceding point implies that China is an important but not the only reason for the World’s growing need for more land to produce feed grains, oilseeds, and food grains. The World’s increasing need for additional cropland is more than a “China phenomenon.”

To put the need for additional land in a US perspective, the World needs to roughly add an area equal to the 46.7 million principal crop acres in Illinois and Iowa every three years, with China’s consumption needing half these acres or, roughly, the principal crop acres in either Illinois or Iowa every three years.

____

46.7 million more acres every 3 years is not doable. Roger has told guys the bullish story on soy oil and renewable diesel for some time. But there is another story out there and that remains the China story and the balance between climate control or cutting down more forest and satisfying the big appetite.

When one looks at things like the world demand growing year over year, along with the renewable fuel situation it becomes hard to become bearish when one realizes farmers have much more staying power than years past. Plus you have businesses such as mine and Roger’s that are helping educate farmers and accelerate the grain marketing. We are helping narrow the advantage that the big grain buyers presently have.

This leads to my question: do farmers or can farmers impact grain future prices? I believe that they can impact it tremendously just by changing the way they market grain. I know many advisors that basically spin offs or get sponsored from some major commercial companies or elevators that are always trying to get farmers to panic sell. Year after year they preach how guys need to have grain sold because we could go below cost of production.

Many advisors and elevators try to get farmers to pre-harvest market 50% to 80%, if we raise 15 billion bushels that would be equal to 1,500,000 futures contracts at 50%. That is more than the present open interest for all of the corn contract months.

What happens nearly every year for nearly every commodity? We get a weather scare that causes farmers to stop selling while at the same time buyers panic a little and start buying.

Here is a monthly nearby corn chart, with CFTC long managed money graphed on it.

Based on this and my experience I am going to say that for every 100,000 contracts the markets tend to move something between 50 cents and a dollar a bushel.

So my theory is simple that for every 10% less that farmers pre-sell or pre-harvest market the price would go up 50 cents to a dollar. If farmers sold ½ as many bushels as they typically do ahead of time, I think our price would go up at least 2.50 a bushel, if not as much as $5.00 a bushel.

Keep in mind that buyers either buy, shut down or find a replacement product. Farmers don’t have to sell, they can build more bins.

My recommendation has been for farmers to be patient in making new crop 2023 sales. So has Roger’s, we both believe that there are several reasons why our markets are going to go significantly higher. But we have both preached that farmers not comfortable with our game plan need to adjust a little so that they are comfortable, but without just giving it away to the elevators.

Tidbits

China is seeing massive outbreaks of covid and the Chinese govt is worried about having enough hospital beds again. The covid outbreak is much more than has been reported thus far. Shanghai thinks that half of its 25 million people will get infected by covid by next week.

Weather results and forecasts over the Christmas weekend in South America will be the main driver for corn and soybeans. We are in the early stages of the critical weather time period.

Damage to potential has already been done to Argentina and Southern Brazil

One of my former CHS Colleagues lives in Argentina and he believes that the best case for soybean production in Argy is 44-45 MMT. If the rains that are presently in the forecast don’t happen, he believes we could easily be under 40 MMT in corn production. USDA has this at 49.5 MMT

My local ethanol plant RingNeck Energy in Onida SD, has started offering free delayed price storage until August 31 of 2023. Make sure to check out why it’s not free https://www.wrightonthemarket.com/post/market-commentary-for-12-19-22

Sam Bankman Fried - FTX Scam Leader was released on a $250 million dollar bail.

It is believed that the US sold 2 cargoes of HRW to Iraq, this helped HRW price today despite the risk off attitude.

Quarterly Hogs and Pigs report will be Friday afternoon.

Brazil has little to no corn left to export until they harvest the 2nd crop.

Buenos Aires Grain Exchange decreased soybean G/E ratings by 7% to only 12%

Wheat has nine lives but Mother Nature might have took a handful of them away.

_____

For more info on our services please go to www.dailymarketminute.com

We presently are offering both a 50% off Christmas sale and a $1 trial for a month.

Merry Christmas and thank you Roger for this opportunity. Lastly I want to make sure to communicate that Roger’s style is very solid and his approach is going to help farmers make a lot of money over time. So do yourself a favor and follow what he says instead of letting buyers talk you into Fear Selling.

_____

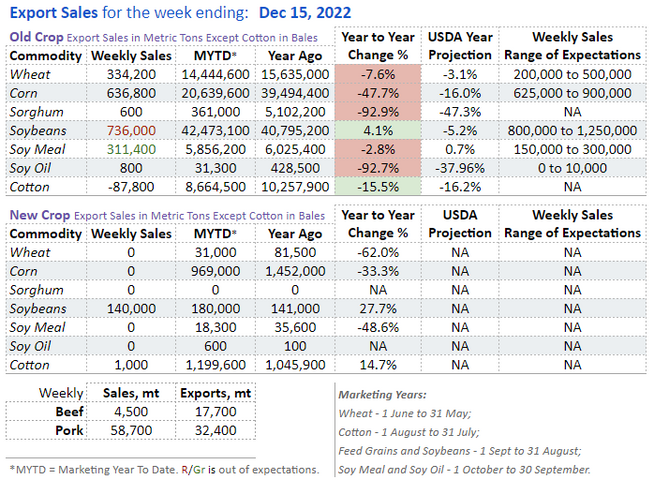

Export Sales Tracker

_____

Market Data

This morning:

Crude oil is at $78.57, up 1.08

The dollar index is at 104.34, down 0.09

July palm oil is at 3,800 MYR, down 48. The contract high was made September, 1st at 4,365 MYR. Palm oil owns 36% and soybean oil owns 28% world market share.

July cotton is at $84.29, up $0.78 per cwt. The contract high was made September, 1st at $101.64 per cwt. Cotton competes with soybeans and corn for acres.

July natural gas is at $4.396, down 0.022. The contract high was made September, 6th at $5.938. Natural gas is the primary cost to manufacture nitrogen fertilizer.

July ULSD is at $2.7745 per gallon, down 0.0433. The contract high was made November, 4th at $3.1450. ULSD stands for Ultra Low Sulfur Diesel.

March Dow Futures is at 33,245, up 37. The lifetime high is 36,832 on January 5th, 2022.

_____

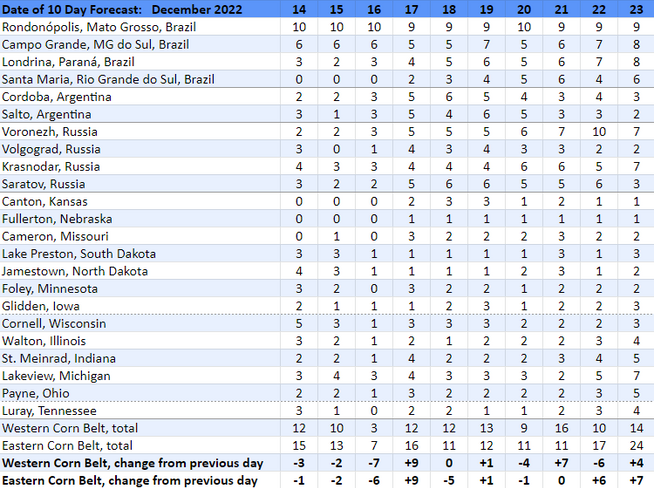

Rain Days Update

The 6 to 10 day forecast updated every day at:

Again, I highly recommend checking out Wright on the Markets. They provide incredible insights nearly every single day. You can visit their website here

Other Markets

Crude oil adds onto its recent rally, adding an additional $2 today. Ending at 79.56

Dow Jones up roughly +170

Dollar Index down -0.117 to 104.01

Cotton sees rebound from recent lows, up roughly +0.90 to 85.21

News

Recent winter storms and brutally cold temps across the U.S. are threating both the U.S. wheat crop and cattle. Due to the massive storms, Tyson foods said it had suspended operations at some meat facilities.

The Senate cleared a spending bill of $1.7 trillion, which includes Ag Disaster Aid and USDA Carbon Program.

Argentina is expected to see some meaningful rain.

Farmers begin harvest in Brazil.

Elon Musk, the richest person in the U.S. says we are "overdue" for a recession.

Livestock

Live Cattle up +0.450 to 157.750

Weekly Change: +1.975 (+1.27%)

Feeder Cattle up +0.300 to 186.750

Weekly Change: +2.050 (+1.11%)

NASS reported 11.673 million head of cattle were in 1,000+ head feedlots on December 1st. Which was a 2.6% decrease from December of 2021. But, the trade was looking for a 2.8% decline.

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Last Sunday's Weekly Newsletter - Full Version

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service