SOYBEANS LEAD GRAINS LOWER

MARKET UPDATE

For those of you on a free trial, we are offering a

50% OFF Christmas Sale

Prefer to listen instead? Click here for an audio version

Futures Prices Close

Overview

Grains mostly lower as soybeans run into resistance and trade lower by double digits, pulling the rest of the grains slightly lower as well. Dow Jones and stock market get hit very hard. With Dow down over -700 points, so that likely added some pressure here as well.

Export sales were pretty light across the board.

I don’t expect anything too crazy tomorrow, but we will have to wait and see what positions the funds want to hold over the long weekend.

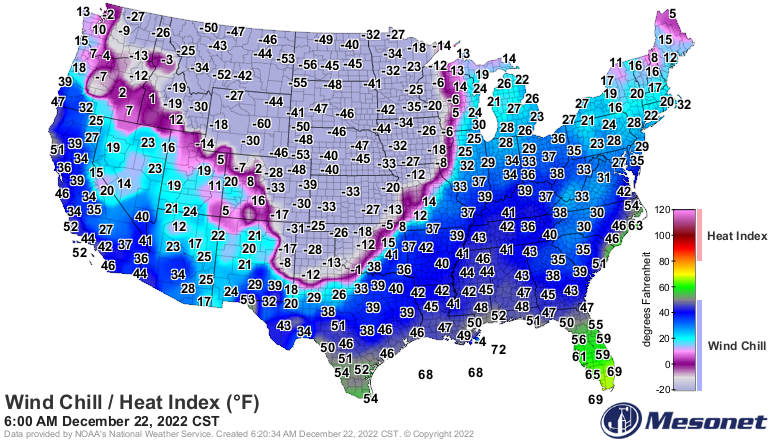

Just a heads up, we will not have a Weekly Grain Newsletter this Sunday, as that is Christmas. We hope you enjoy your holidays, and safe travels as the weather is expected to be brutally cold for most of the midwest.

Markets will be closed next Monday, December 26th.

You should have received an additional email, but here is the link to today’s audio commentary.

Can farmers move the corn market by 2.50 a bushel? - Listen Here

Today's Main Takeaways

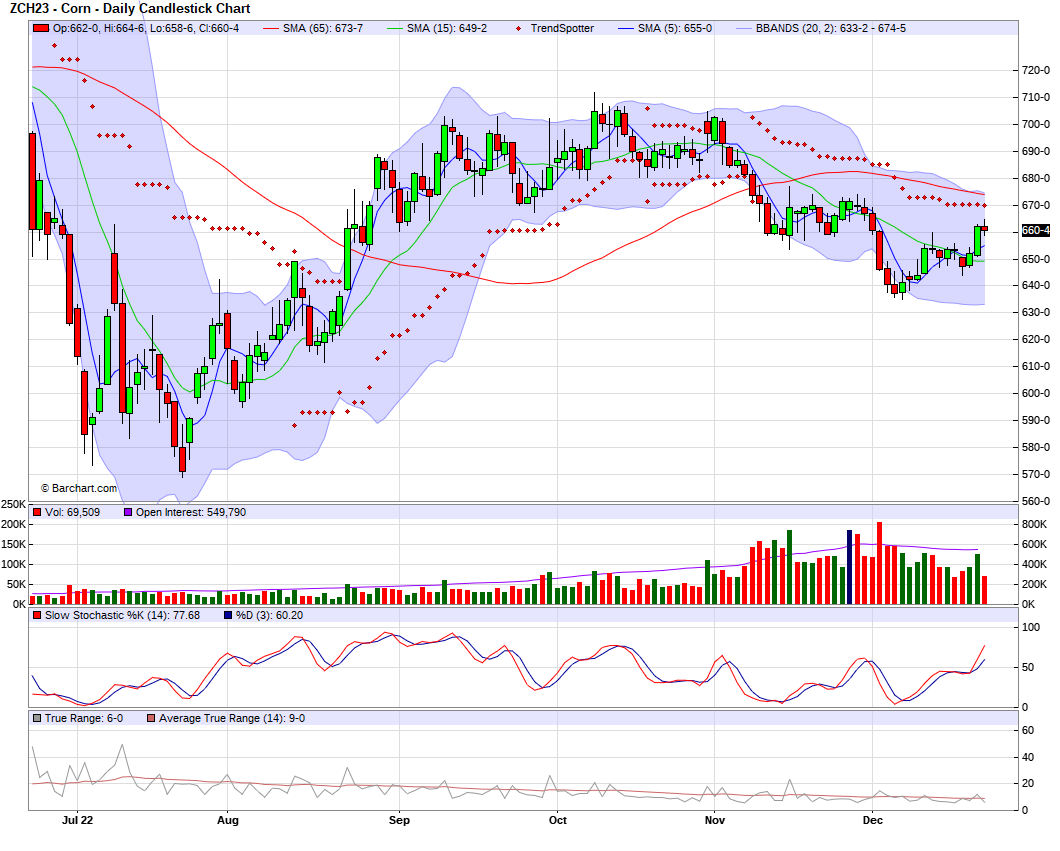

Corn

Corn just lower here today, trading in a very tight range. With a high of $6.64 3/4 and a low of $6.58 3/4. Ultimately closing at $6.60 1/2. Corn has rallied nicely from its lows we saw early in the month.

Yesterday we saw corn break through some still resistance of $6.60, if we can break through $6.65 now we do have the chance to see prices again challenge $7 like they did back in October if some bullish factors work out in the markets favor.

Ukraine's Ag Ministry said only 70% of their crop has been harvested. With estimates now between 22-23 million metric tons, down from the previous estimates of 25-27 million. They also expect less corn to be planted in 2023 due to the unharvested amount. These harvest challenges have added some support to the corn market.

Export sales this morning weren’t great. Coming in below last week and at the bottom of trade expectations.

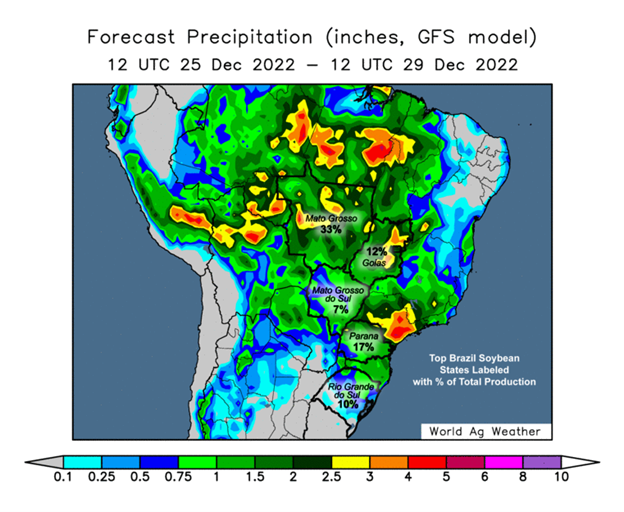

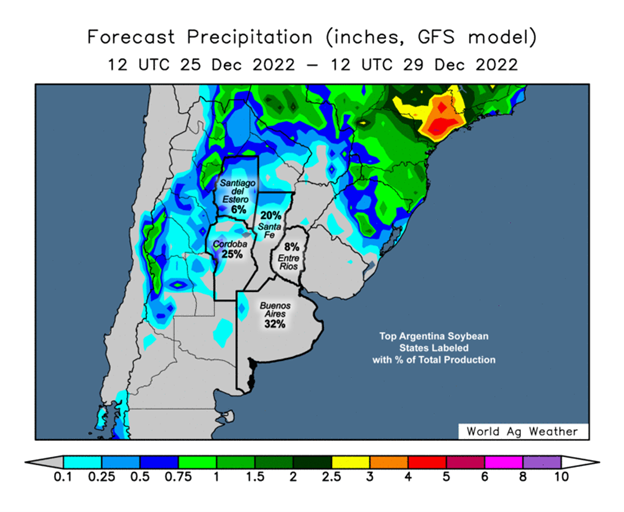

Eyes are still on Argentina and South American weather. There is some forecasted for rain in Argentina, which if hits will likely pressure prices. But if rainfall is dismal or completely misses, we could prices higher off these headlines.

Overall demand especially Chinese demand is still a rather large uncertainty for the corn market. For starters they have their whole covid fiasco which isn’t helping, but they have also been buying from other countries such as Brazil rather than the U.S.

Some are suggesting we see the USDA lower U.S. export estimates by another additional 75 million bushels after we already saw them lower estimates by 75 million.

Going forward the largest factors are more of the same. South American weather, Chinese demand, and war headlines remain the largest potential market movers.

Overall, if we can break this nearby resistance I don’t see a ton of reason for prices not to continue a little higher from here. A break above $6.65 to $6.70 and we have the chance for bulls to gain some steam and test the $7 level again. But for prices to go higher, one would like an increase in Chinese appetite as well as some additional problems in South America.

March-22 (6 Month)

Soybeans

Soybeans close down double digits, seeing the biggest losses of the grains today. March soybeans saw a high of $14.87 3/4 and a low of $14.68 while ultimately closing the day down -12 1/2 cents at $14.72.

As expected, everytime soybeans climb into the $14.80 to $14.90 range we see stiff resistance. In the chart below I have a nearby support line of $14.65 which is where soybeans have bounced the last few sell offs since the beginning of the month. So we will have to see if they bounce or take a leg lower. As a break below could open the door for lower prices. So I wouldn’t be surprised to see soybeans fall down maybe an additional 7-10 cents or so before either bouncing or breaking lower.

Bulls are talking about the obvious problems we have seen in Argentina and fairly good demand. The Argentina rain forecast situation is similar to what I said in the corn section. We will have to see if these rains hit, and how meaningful they are if they do. But if Argentina gets a lot of rain this could lead to beans seeing some pressure tomorrow and as we open up next week.

On the other side of things, we of course have the record crop in Brazil that doesn’t appear to have much threat to it as of now. We also have some thinking that we may have seen soy meal peak. Which if it has, the pullback will negatively effect bean futures.

So overall South America weather will be the deciding factor in the coming weeks for the soybean market. Do we get weather worries or does the weather cooperate. Nobody really knows.

This is what Van Trump said about managing risk, "All I can say is risk the bushels you are willing to risk.. I have a floor under all unsold 2022 bushels and have 25% of estimated new crop priced. Would like to have between 30-40% priced by April-May. If we catch a rally I will be shooting more of my bullets." You can visit Van Trump's website here

Soymeal & Soyoil

Soymeal down -4.4 to 448.3

Soyoil down -0.82 to 64.01

Soybeans March-23 (6 Month)

Wheat

Wheat market sees minor losses in both Chicago and MPLS following the rest of the markets lower today, while KC sees some strength. March Chicago closed roughly 15 cents off its high of $7.77

One of the bigger stories surrounding wheat is the severe winter storms across the midwest. With extremely cold temps and a lack of snow coverage putting nearly 30% of the U.S. wheat crop at risk. This added a lot of support to the wheat market yesterday and will be something that could continue to support wheat if temps remain brutally cold.

Funds are still short wheat, so we will have to see if they want to carry those short positions over the long weekend with the winter storm situations in the midwest.

Wheat prices in India have soared to the highest prices they have seen in ages, so this helps make us a little more competitive.

The Russia & Ukraine headlines will look to continue to add support, as its pretty obvious they won't be signing a peace treaty anytime soon. So any escalations should add support to the markets.

Even though prices have moved pretty nicely off our recent lows, we are still far below our levels before the massive sell off we’ve seen since October. One would like these war headlines to add more support than they have. Because the war headlines just haven’t been as much as a marker mover as bulls would like.

Short term we may see some people start to take profit here. But overall looking long term I still have a bullish tilt going into the new year and beginning of spring. We have a U.S. crop that could continue to struggle into next year, and there is still a chance people are underestimating the impacts of the war in Russia and Ukraine. For prices to stay elevated at these levels short term one would like some more weather worries and war headlines to support the market.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

China & Covid Update

It’s looking like China is still facing some serious problems. We saw them ease their covid lockdowns following protests across the country. Now that they have eased the restrictions, China is being over run by cases of covid.

In hospitals they have nearly 6 million hospitals bed occupied mostly due to covid related illness. So its clear they still have a long way to go combating their battle with covid.

Shanghai hospital stated that they think half of their cities population of 25 million people will be infected by the end of next week.

With all of this, China's government said they will not be reinstating their lockdowns at least until February if they do decide to do so. So this is hopefully good news for grains that their won't be lockdowns, as that would have been harmful to demand and slightly caused some bleeding in the soybean market. But even so, the entire covid situation isn't great for the grains or Chinese demand. But at least we won't be seeing anymore lockdowns.

Other Markets

Crude oil slightly down -0.16 to 78.14. But has seen an impressive near $8 rally from its lows not too long ago.

Dow Jones down nearly -500

Dollar Index up +0.233 to 104.080

Cotton gets hit hard,down -4.00 (-4.5%) to 84.30

News

Yesterday was the winter solstice. Which is the darkest day of the year. Meaning we will now start to see more and more sunlight into the summer.

Wells Fargo was fined $6.7 billion since 2020 for consumer abuses and fraud.

Sam Bankman Fried, the man behind the billion dollar scam of FTX has been released on a $250 million bail.

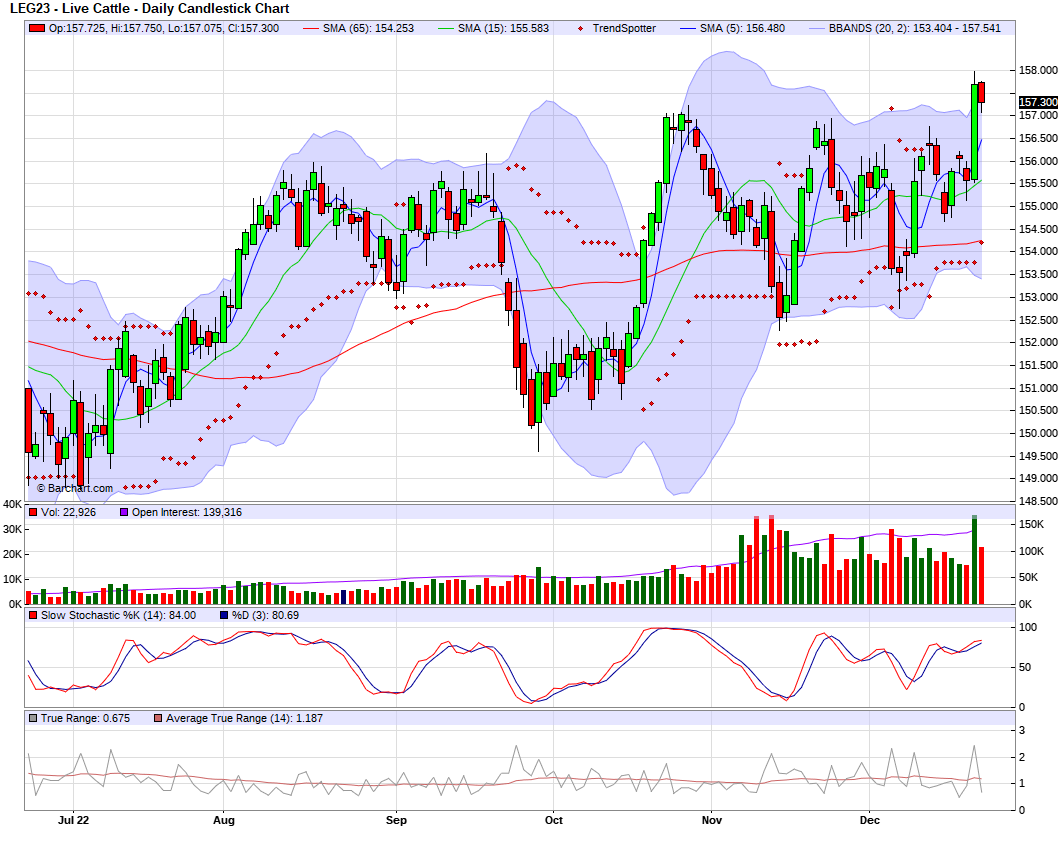

Livestock

Live Cattle rally comes to an end, closing down -0.400 to 157.300

Feeder Cattle up +0.725 to 186.450

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Sunday's Weekly Newsletter - Full Version

Tuesday's Audio - What if farmers didn’t pre-harvest market?

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service