GRAINS RALLY & ERASE EARLY LOSSES

Overview

Grains initially started off the shortened week sharply lower this morning, but picked up steam and rallied well off our lows. As soybeans notch their highest close since June of 2022.

Some slight rains over the weekend in Argentina caused some pressure in beans in the overnight session hence beans were trading a dime lower. But over the next week or so it looks like below normal rains. If they do get rain, the question now remains, will it be enough to save the crop? Or is it too little too late?

In case you missed it, read yesterday's Weekly Grain Newsletter. Read Here

Today's Main Takeaways

Corn

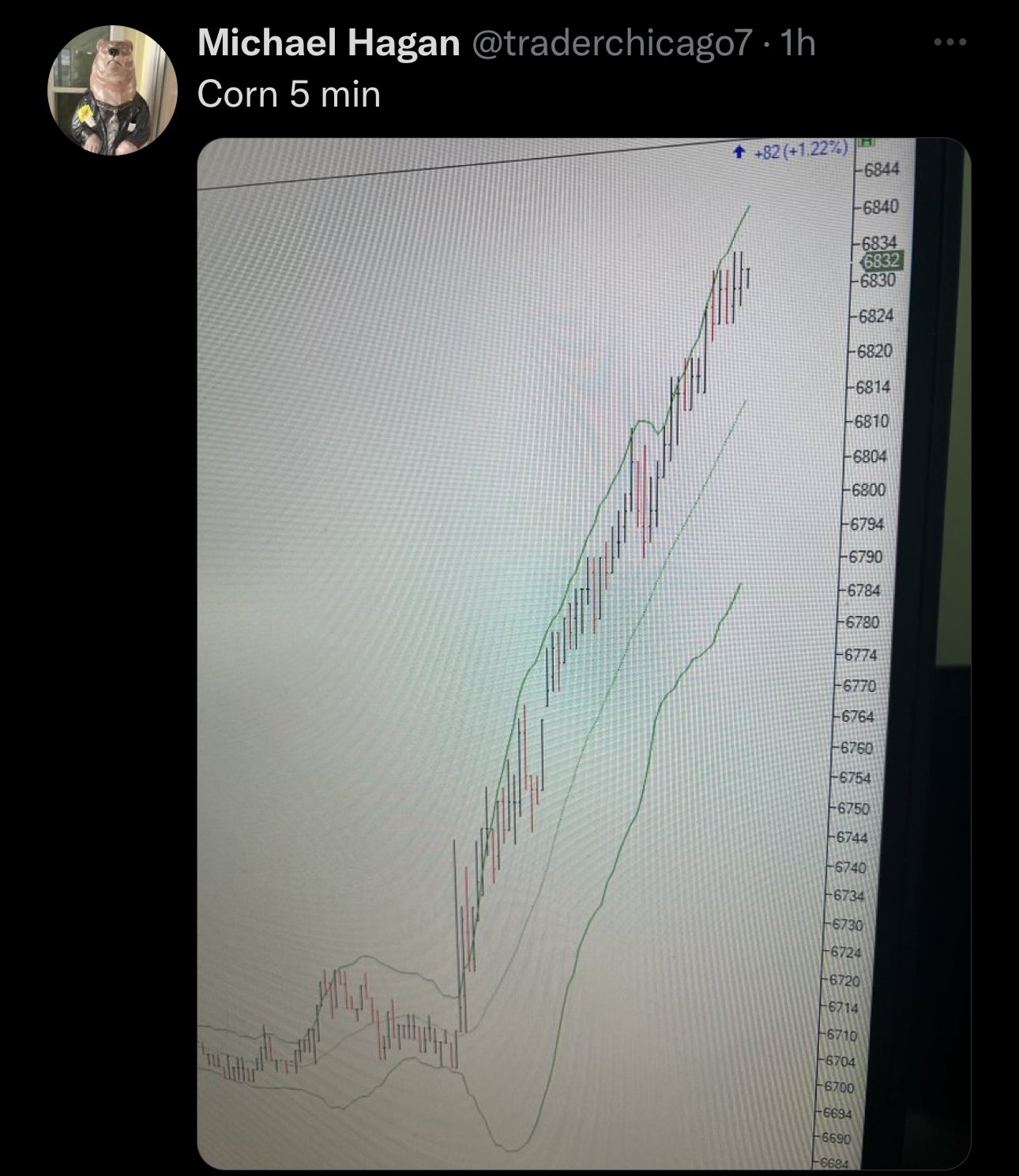

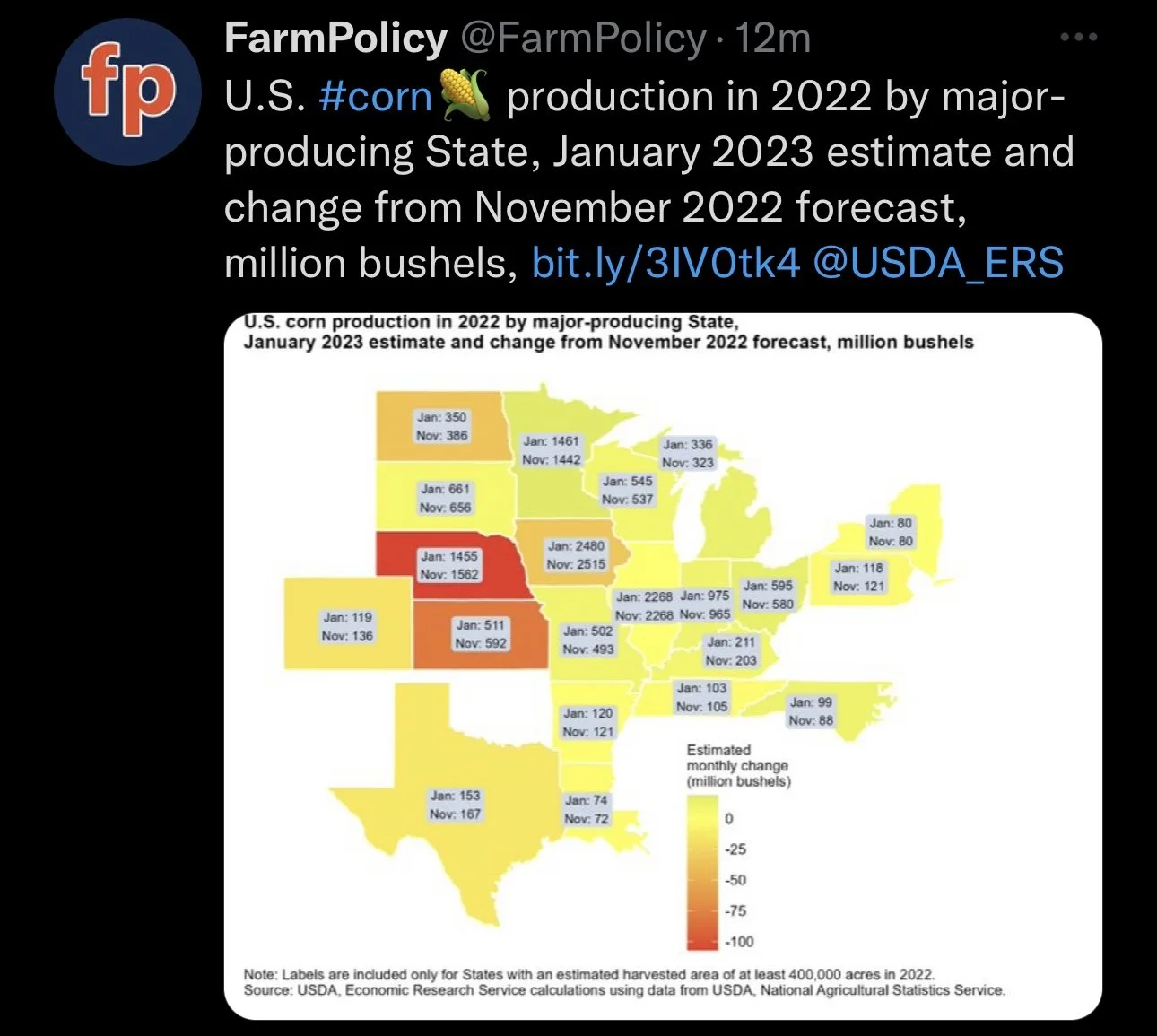

Corn futures strong again here today, adding onto an already impressive +20 cent rally last week with the bullish USDA report.

Overnight we did see a lot of pressure across the board. As Argentina rains and weaker than expected data came from China. Corn is also being pressured by lacking interest in U.S. supplies and a favorable shift in U.S. weather.

Despite the overnight losses, corn futures rallied well of their lows by 15 cents or so, as bulls still have their eyes set again on $7.

In the USDA report, we of course saw Argentina production forecasts lowered, as the USDA lowered theirs from 55 to 52 MMT. But, there is still a ton of talk that this number will need to again be lowered. With most agreeing we need at least a sub 50 number, and some even talking about potentially even lower numbers towards the 45 or so range. So overall Argentina is a beneficial factor for corn, we will have to wait and see what type of rains Argentina gets or doesn't get, and if so, how big of an impact it actually makes on an already very poor crop.

We also did see the USDA even lower their Brazil corn estimates slightly. But the overall corn story in Brazil is more about their second corn crop. So there is plenty of time to see changes.

Going forward, Chinese demand will be a large factor in where the corn market goes from here. Will they continue to be buyers from Brazil, Ukraine, etc. or will their appetite for U.S. corn increase?

Is Ukraine's exports being overestimated? From The Van Trump Report - He said "I have to imagine at some point we see a sizeable reduction in Ukraine corn production and total exports. I was personally surprised to see the USDA raise its Ukraine export estimate from 17.5 to 20.5 MMTs in the latest report. I'm not saying its wrong, its just tough for me to get my head around Ukraine's exports getting larger rather than smaller."

From a technical standpoint, corn slightly broke its downward trend line. Is this a bull trap? Or will corn go back and test $7? I think there is a solid chance we do see a test of $7 sometime in the near future.

Corn March-23

Soybeans

Soybeans continue their bull run up over +11 cents today adding onto their impressive +35 cent rally last week. Soybeans now 70 cents off our lows made early into the new year. Soybeans also notched their highest close since June 2022.

Just like corn, soybeans also saw an immense amount of pressure in the overnight session. Pressure of course coming from rain over in Argentina, which has been the main driving force in soybeans for the past month. The somewhat poor Chinese data also added pressure to the bean market. I have a full update from the Chinese data later in this write up.

We already talked about the report, but the bullish highlights were the lower U.S. yield and tighter ending stocks, both of which added support to the strong close last week.

Taking a look at Argeninta which continues to be the largest factor in the bean market. They got some light rains but the forecast now calls for below normal rain so we will have to see how that plays out. Still looks like they have around 10% of their crop to plant, so there is a chance they don’t get a big portion planted.

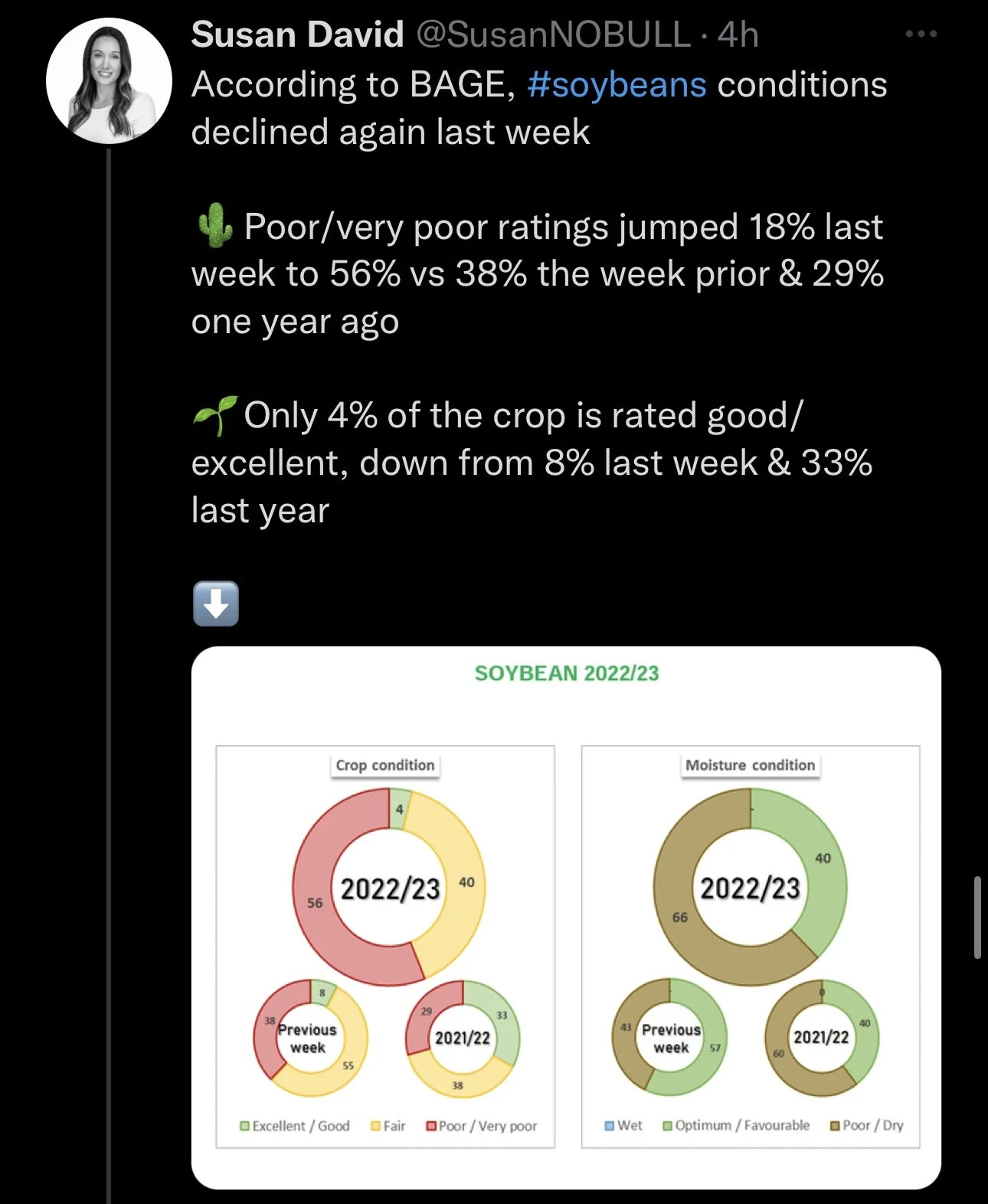

We also have many saying that the crop conditions for Argentina soybeans might be sitting at nearly 50% rated poor to very poor. Which is a huge number. Last week the USDA did lower their production estimate from 49.5 to 45.5 MMT. But there is rumors that this number might be closer to 40 or so. So there is definitely the chance we continue to see these estimates lowered. Perhaps the crop is even smaller than the USDA and trade think, whom already realize its a small crop.

We also have to keep in mind that Argeninta is the worlds leading exporter for bean meal.

Last week funds increased their record net long position in meal.

With China reopening, the question now with Argentina's problems, do we continue this bull run? Or will focus begin to shift away from the poor Argentina crop and start to shift more towards the massive crop in Brazil?

There might be some more upside, but if you are nervous there is nothing wrong with rewarding these rallies. As there is still plenty of uncertainty in the bean market.

Long term concern for beans, by Benson Quinn Commodities - "The longer term issue for U.S. soybeans is a general lack of export demand as Brazil secures business. The potential that Brazil's exports and storage capacity will be tested like never before is a concern. However, modern trade flows are such that if destination has a need the organization with supply finds a way to satisfy that need. SA weather has shifted favorable with North Brazil drying out. Their harvest will start to advance at a faster clip. South Brazil and the bulk of Argentina have favorable 2 week forecasts for the first time this growing season." Read their full write up here

From a technical standpoint, beans continue to bounce around in its channel but remain in a very solid uptrend. Beans also broke their recent high. So there isn’t a ton of resistance to the upside so there is plenty of room to run. But we will have to wait and see if prices correct to the lower end of the range where the bottom trend line lays. Otherwise we do have a chance to see $15.50 or even higher.

Soybeans March-23

Wheat

Wheat follows the rest of the markets on the rally today. Just like corn and beans, wheat started off the day sharply lower but was able to erase those gains and post solid gains. As Chicago wheat rallied 23 cents off its lows, closing up +8 cents on the day.

We touched on the report last week, but out of all the grains wheat had the worst report. Wasn’t necessarily bearish, but it definitely wasn’t super bullish.

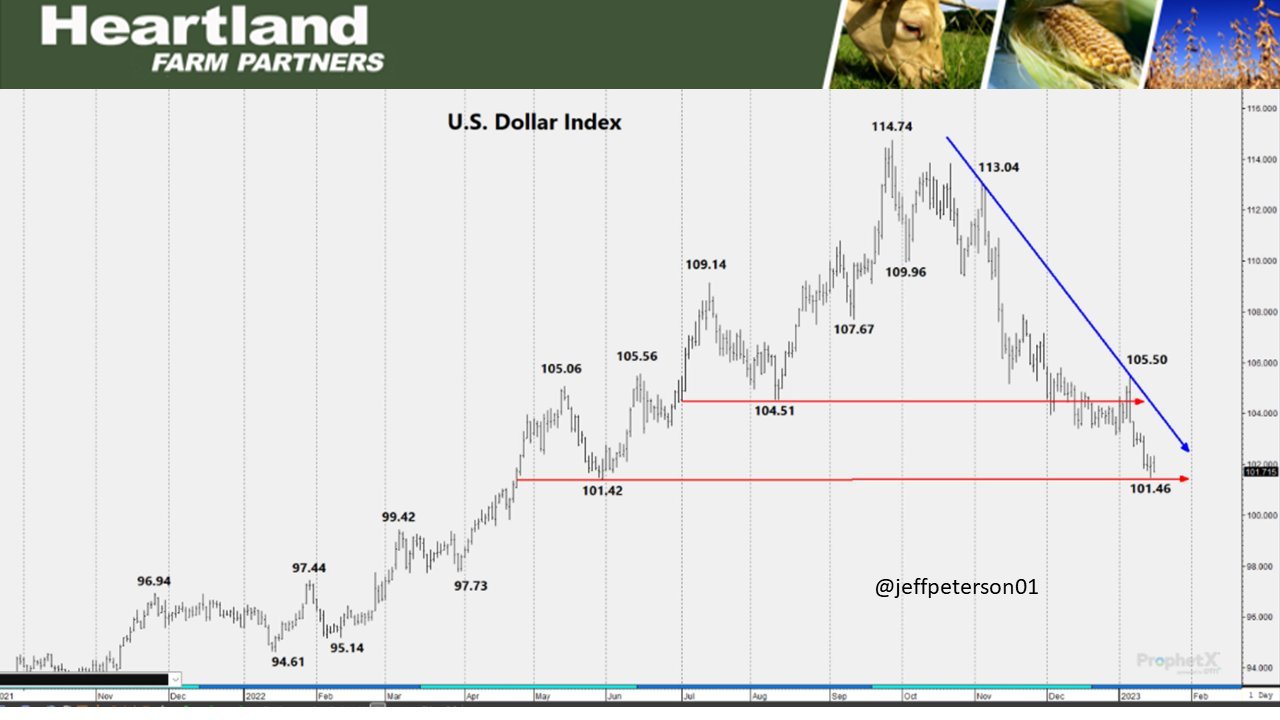

The main thing keeping a lid on wheat is still the cheap global competition. As countries across the world are able to offer their supply at a discount. The weakening dollar is supportive of helping the U.S. be more of a competitor with those cheap global prices. Hopefully we continue to see the dollar weaken and see U.S. exports gain more interest from buyers.

Aside from global competition, countries like Russia just have plenty of supply. As Russia's crop is estimated to be a record one at 91 MMT. This is compared to last years 75 MMT. Australia also has a rather large crop. Along with the USDA slightly raising Ukraine exports.

On the other side of things, we have the war and U.S. weather that both have the potential to get prices moving higher.

Going forward, yes there is a chance we see some more pressure here short term. As wheat lacks that bullish catalyst to get prices moving higher for the time being. But looking long term I still hold my bullish opinion and expect prices to climb the next few months.

Bulls would like to see March Chicago break the $8 mark, which would strongly indicate a shift out of our downward trend. But there is still some ground to cover before we get there.

Why the funds being short wheat might not be as bearish as you think

Funds as we all know are incredibly short wheat. I think we will ultimately see a short covering rally sometime, but there isn’t really a massive catalyst here right now to give them any major reasons to exit their large short positions. But nonetheless, the funds being incredibly short might not be as bad of a situation as you think.

Below is a fantastic write up from Roger at Wright on the Market

"Roger, please explain why the funds being so heavily short is bullish soft red winter wheat. They all think the market will go lower. How is that bullish?"

Yes, the funds are heavily net short so many contracts because they expect wheat futures price to decline.

In the case of soft red winter, the big spec funds are short more contracts than any time the past three years. A client said it appears the funds had a larger net short in 2016-17. While there is no absolute limit to how many contracts the market, as a whole, can be short, but there is a practical limit.

For example, my brothers will never sell wheat futures. My grandchildren will not be selling wheat for at least another 15 years. All of us know many, many people who will never sell wheat futures no matter how many newspapers print a headline reporting that selling wheat futures will make a person rich.

Recall the Joe Kennedy story. When Kennedy learned that an 8 year old boy and his grandmother were buying stocks, he realized that meant "everyone" between their ages had already bought stocks as well. Who is left to buy enough stocks to make the market go higher? The boy's little sister and his great grandmother?

You can read how an 8 year old boy saved the Kennedy fortune before the crash of 1929 here

The funds are presently short (sold) so many soft red wheat contracts now, historically, there are not many potential new sellers available to push the market lower.

On the other hand, every one of those short contracts must be offset with a buy to avoid the delivery requirement or they will have to buy the bushels of physical wheat to deliver on those short (sold) contracts. Either of those two actions will rally wheat prices remarkably. The only questions are:

How many new sellers can the wheat market attract?

When will the short position holders start to buy wheat futures to offset their short positions?

Nobody knows the answer to those questions, but one thing for certain: The potential buyer pool is much, much larger than the potential seller pool. That is a very good reason not to be selling soft red winter wheat, but nothing is 100% in this business.

Visit Wright on the Market here

From a technical standpoint, wheat still sits below its downward trend line. If we can break out this downtrend I think we can easily see $8. After $8 there is plenty of running room.

Chicago March-23

KC March-23

MPLS March-23

China Update

Chinese headlines as well as the condition of their economy has been a major talking point for some time when it comes to demand for the grains especially beans and corn.

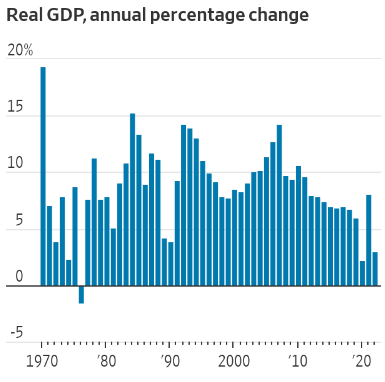

The Chinese GDP was reported to increased by 3% for 2022. Aside from the covid year in 2020, this was China's slowest growth they’ve seen since since 1976. Last year was 8.1% compared to this years 3%, a 5% swing.

China also had their first year in 60 years where their total population took a dip and did not increase.

Despite the rough year last year, most seem to think the outlook for 2023 is strong economic growth. As China is now essentially fully reopened following their decision to get rid of their zero covid policy some time ago.

If this is the case, and China's economy will only go up from here, this would be a big positive for the U.S. grains and help create more demand.

China's GDP Annual Change

Highlights & News

Credit card interest hits record high.

China December soybean imports raise but annual volume falls.

Indonesia, the worlds leading exported in palm oil, is set to restrict shipments and boost domestic biodiesel consumption is set to squeeze global veg oil supplies.

Ukraines grain harvest sits at 94% complete.

China reported its first population decline in 60 years.

Argentina's soybean crop sits at just 4% rated good/excellent.

Other Markets

Crude oil up +1.24 to 81.10

Dow Jones down nearly -400

Dollar Index up +0.204 to 102.150

Cotton up +0.53 to 82.82

Will the dollar continue its decline? Below is a chart from Jeff Peterson.

Another chart from Jeff Peterson. Looks like crude might be getting ready to break out of its down trend.

Livestock

Live Cattle -0.800 to 160.100

Feeder Cattle down -1.575 to 181.300

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 8-15 Max Temp

Brazil 4-7 Precipitation

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service