SOYBEAN RALLY COMES TO AN END

Overview

Grains saw some follow through strength overnight from the recent rally. But ran into some selling in today's session. With soybeans seeing the largest correction to the downside. The bullish USDA report alone wasn’t enough to sustain this rally.

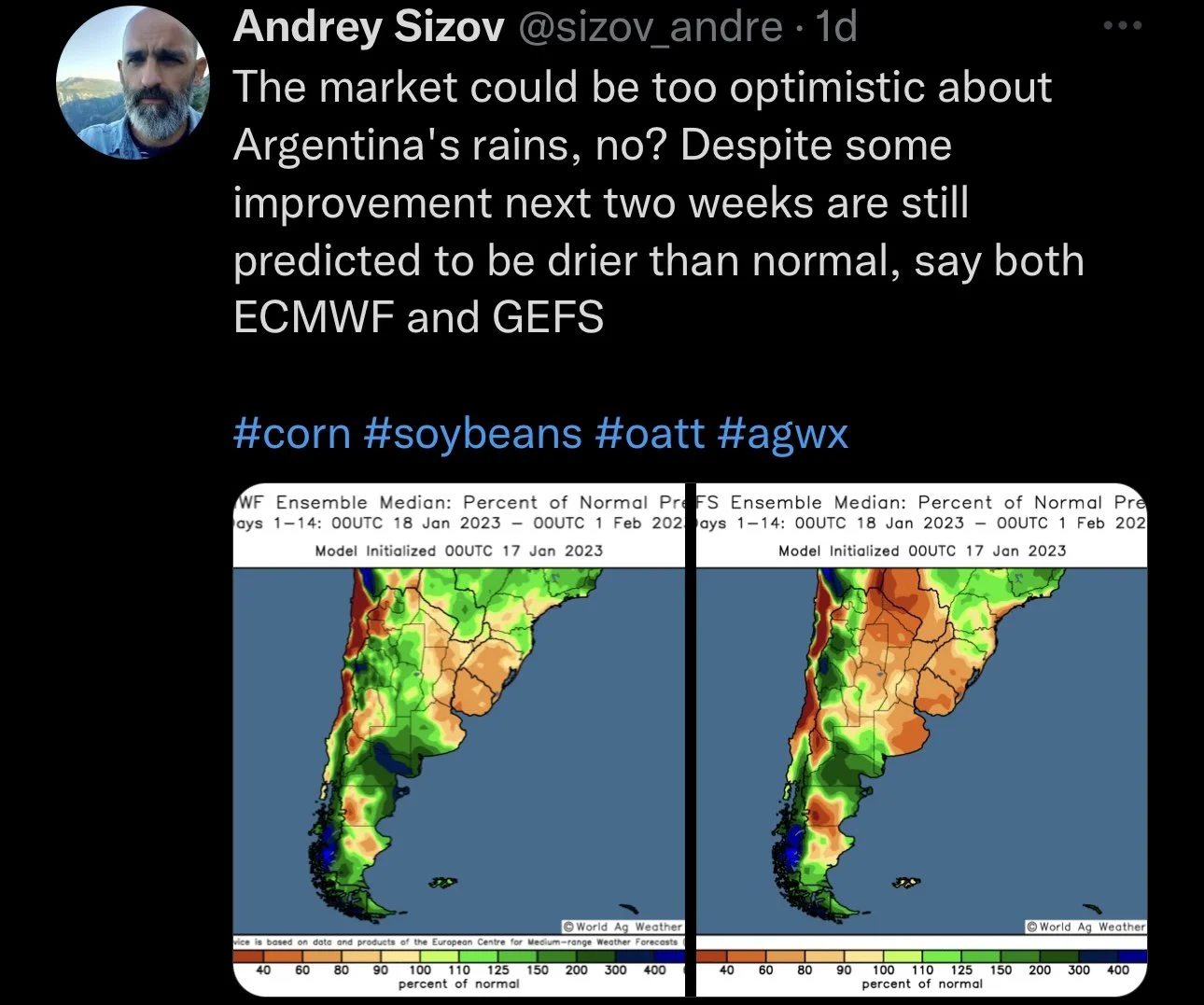

Argentina forecasts call for improved rains with the potential for an overall pattern change, leading to pressure among soybeans.

Yesterday Putin made a statement saying that stable food reserves must be maintained, and that Russia (the worlds leading exporter of wheat) "cannot allow everything to be dragged abroad." Hinting at restricting wheat exports. What Putin decides to do will be a critical factor for global supply & demand short term.

Goldman Sachs reported that they believe commodities will outperform equities in 2023.

In case you missed it, read yesterday's Weekly Grain Newsletter. Read Here

Today's Main Takeaways

Corn

Corn held up the best amongst the grains with soybeans sell off today. As march corn only lost -4 cents, trading in a 10 cent range.

One thing that has really been supportive of corn futures is the strength in crude oil. As crude oil is trading higher for the 9th consecutive day in a row, and is now $10 off its recent low. One would think that if we continue to see crude oil break out from its lows, the strength would bleed over into the corn market.

Additionally adding support, U.S. export inspections for corn were higher yesterday. Which ended the two week skid. But, the volume yesterday still wasn’t anything incredible and export inspections still far trail that of the USDA forecast pace.

We are seeing some pressure from the increased chances of rain over in Argentina, which impacts soybeans more but is still a big negative for corn. We also have more competitive exports from Ukraine and Brazil which is pressuring corn.

The main things that will continue to decide the direction of corn are; South American weather, Chinese demand and covid headlines, Russia/Ukraine war headlines, and the funds.

Corn retraced back its trendline with the minor losses today. We will have to see if we can break higher or if we see another bull trap. If we can break higher the next stop might be $7.

Corn March-23

Soybeans

Following a 7-month high close yesterday, soybeans run into some selling closing down -15 cents. Trading in a wide 37 cent trade range, while managing to close 13 cents off their lows. This correction wasn’t really unexpected given beans massive bull run the past week. Beans also pressured from Argentina rain forecasts.

Although soymeal did lose roughly -1% today, one thing supporting soybeans is the continued support from soymeal as funds hold a record net long position. If meal prices break lower one could assume we see soybeans follow suite. With prices still over $15, a few advisors such as Roach Ag have advised sell signals.

Tight supply demand numbers and China reopening have been two main supportive factors. But we did see a pretty weak NOPA crush report yesterday, and South America might be getting some rain.

We all know the problems with the Argentina bean crop. But Brazil is also facing some harvest issues due to rain. Which currently has their harvest around sitting 20-25% behind the usual pace.

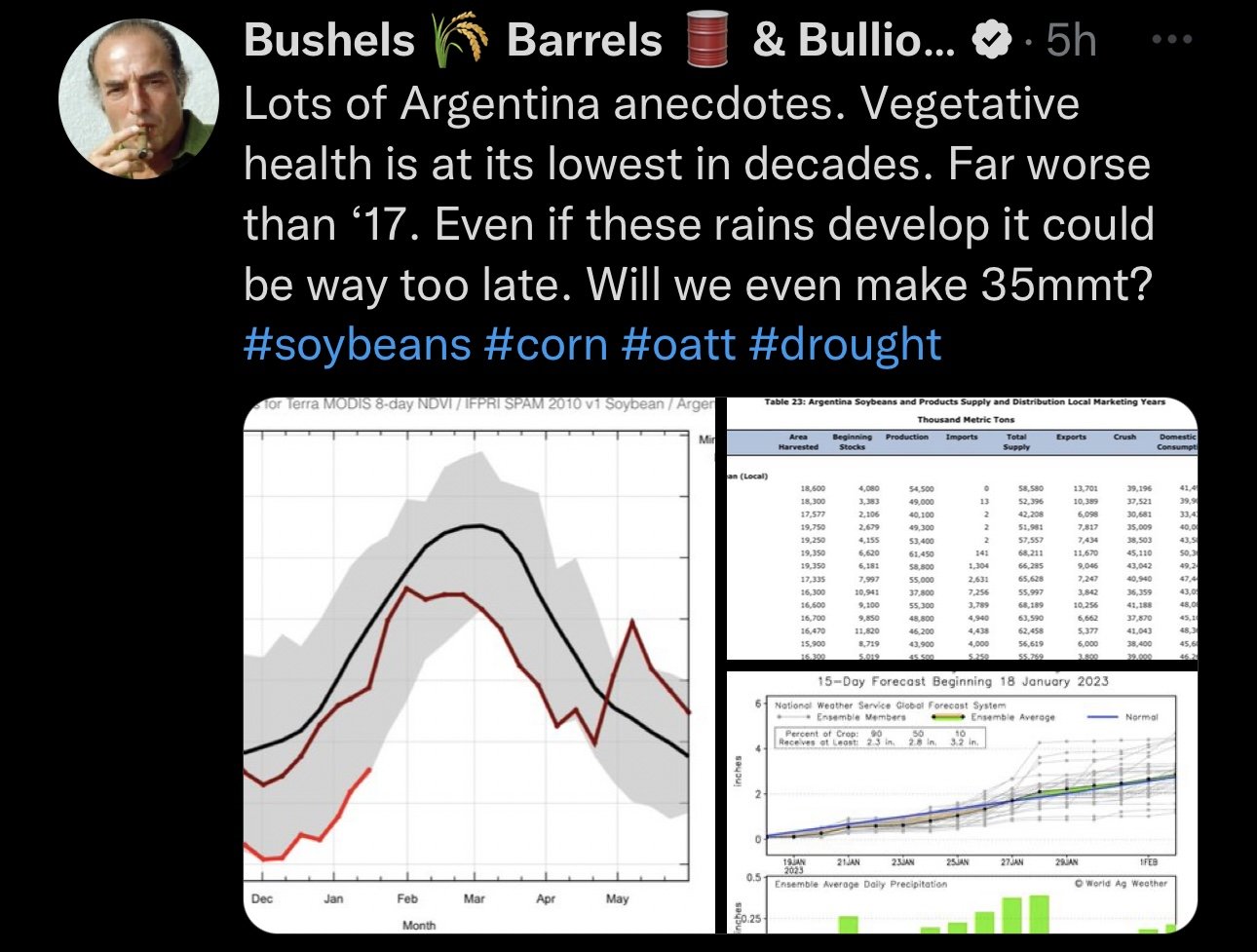

It does look like Argentina might get some rain, so it wouldn’t be surprising to see beans under some more pressure the next few days if they do. But traders continue to debate if this rain will even mean anything, or if its just simply too late. As the most recent update from Argentina showed their crop at a dismal 4% rated good to excellent and a whopping 50% rated poor to very poor.

The Argentina situation is one that won't go away. But outside of that as well as some possible Brazil harvest delays which to this point hasn't affected the trade, fundamentally beans don’t have a ton going for them right now at these high levels. It also appears bean demand from China will begin to start shifting over to South American rather than the US. I'm not saying the bull run is necessarily over for beans, but there is definitely a ton of uncertainties. So from a risk management perspective, it wouldn’t be a bad idea to lock in some sales if that is what your operation needs and feels comfortable with.

It's just kind of tough to hop on the bull train here for the time being with prices still relatively high and with the fundamentals not all that great, with really just a lack of fresh bullish incentive. But there is some hope there with China reopening along with some possible South America weather complications.

NOPA Crush Report

December NOPA crush total came in at 177.5 million bushels. Which was far below the 182.9 million estimate.

This number was also lower than last month and far lower than last December where we saw a record of 186.4 million.

Soyoil stocks increase to 1791 million pounds.

This was far more than estimates.

Domestic bean oil use fell to 3-year lows for the month of December.

Soybean meal production saw a slight increase to 4.218 million tons.

Soybeans continue to trade a wide range and chop around in its channel. We will have to wait and see if we retest the uptrend or fall further to the support line. Nonetheless, we still sit in an uptrend.

Soybeans March-23

Wheat

Wheat futures follow soybeans lower, with wheat losing 9 to 16 cents. As Chicago march traded a 20 cent range, seeing a high of $7.60 before ultimately losing those early gains and finishing near the bottom of the range at $7.42 1/2.

I mentioned this in the overview portion, but yesterday Putin made some statements hinting at restricting wheat exports. This was very beneficial in seeing our higher prices yesterday and caused some fund buying.

However, it doesn’t make a whole lot of sense why he would want to restrict exports given the fact everyone is talking about Russia having this massive crop while already being the worlds leading exporter.

Or possibly, maybe the Russia and the rest of the world actually doesn’t have as much wheat as everyone thinks they do. Keep in mind, the USDA did leave Russia's wheat crop unchanged at 91 MMT. While others raised their estimates to over 100 MMT. Perhaps the USDA too knows that Russia's crop isn't quiet as large as most assume it is. So there is definitely some thoughts floating around that Russia's export estimates might be a tad overly optimistic.

We have the worlds two leading exports still at a war that looks far from over. So there is definitely the chance for some bullish cards being left in the deck.

IGC raised their global wheat output estimate to 796 MMT vs the USDA's 781 MMT.

The biggest concern with wheat is that globally, the world is just cheaper than the U.S. is right now. We also have U.S. weather which has been a slight negative as of late with the warmer temps.

With funds still being net sellers of all three classes of wheat. Once wheat breaks out of its downtrend, I think we see the funds step back in here as buyers and continue to push wheat higher off these lows.

Chicago wheat still sits below its downward trend line. If we can break out of this downtrend one would think we have the chance to see higher prices the next couple of months.

Chicago March-23

KC March-23

MPLS March-23

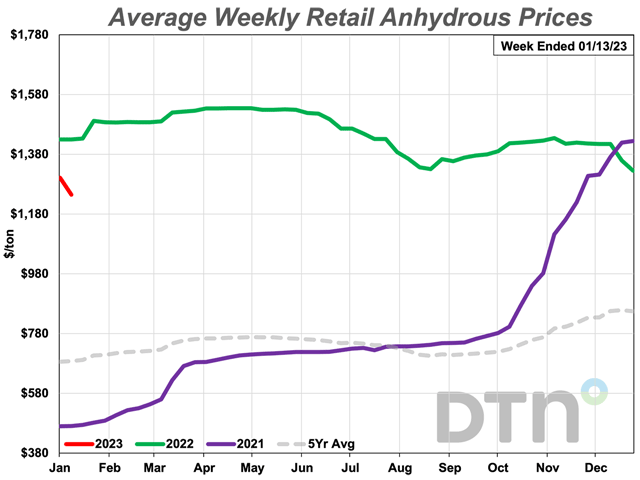

Fertilizer Price Update

This info comes from DTN. Read the full article here

Most fertilizer prices continue to decline. As through the second week of January, 7 of the 8 main fertilizers are lower compared to last month.

Of these seven, five of them saw significant changes from last month (5% move or more).

Significant Changes from Last Month

Anhydrous

12% cheaper

Average price - $1,245 a ton

First time prices have dropped below $1,300 since Nov. 2021

Potash

8% cheaper

Average price - $742 a ton

MAP

7% cheaper

Average price - $875 a ton

Urea

6% cheaper

Average price - $732 a ton

UAN32

5% cheaper

Average price - $650 a ton

Slight Changes from Last Month

DAP

This is the only fertilizer that isn’t cheaper compared to a year ago. As it is 1% more expensive.

Average price - $868 a ton

UAN28

Average price - $563 a ton

10-34-0

This was the only fertilizer that didn’t see a decrease in price from last month

Average price - $754 a ton

Fundamentals vs Technicals

This is a snippet of some audio from Benson Quinn Commodities. You can listen to the full thing here.

"The dollar is trading at its lowest levels since May. I'm just not sure we couldn’t still get a pretty significant amount of institutional money to come into these markets. That may push these markets to respond to the upside in a manner that just completely disconnects from what we are seeing from a fundamental standpoint."

"Ultimately where I'm stuck right now, is do we focus on the fundamental pieces which would tend to lean a bit negative. or do these technicals continue to take hold and allow for higher price action? I believe at the end of the day, there comes a point where the fundamentals just have more of a say."

He then goes on to say that fundamentally there isn’t a whole lot there for the grains, but the technicals look good, so he is torn in the decision whether to believe in the fundamentals or the technicals.

"If the markets continue to rally despite negative news, I'm going to have to put some more belief in the technical side of things. My message to the producer is that most of the globe has a product they can sell cheaper than the US can at this point. The odd one out is corn, as corn is in a competitive position."

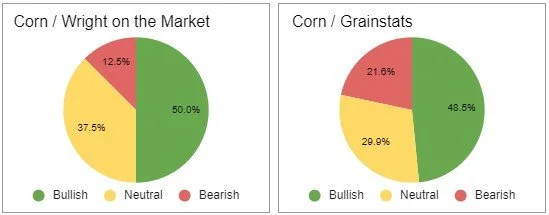

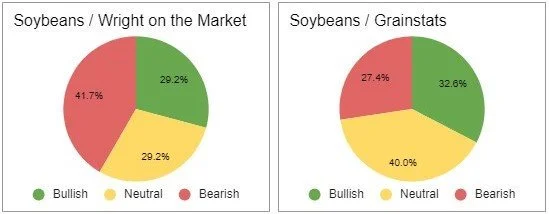

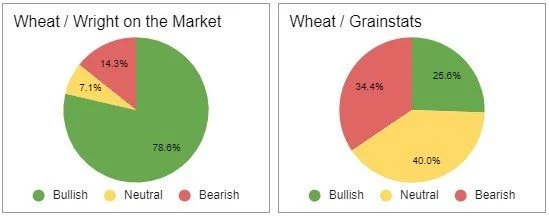

Bullish vs Bearish Consensus

The following pie charts were voted on by Wright on the Market & GrainStats audiences showcasing what their followers' opinions are.

Highlights & News

Consumer Price Index (CPI) came in lower than expected. Dropping 0.5%.

The International Energy Agency increased its global oil demand forecast for this year by 1.9 million barrels per day to a record 101.7 million.

U.S. mortgage applications surged 27.9% last week. The largest increase since March 2020. With interest rates dropping to lowest levels since September.

China has booked 15% more new crop U.S. beans than a year ago.

China's pork output hits 8-year highs. Up 2.1% from 2021 to 2022.

Brazil's summer grain crop is expected to outgrow their storage capacity for the first time in 20 years.

Other Markets

Crude oil down -0.70 to 79.79

Dow Jones gets hammered, down -450

Dollar Index up slightly +0.014 to 102.145

Cotton up nicely, +2.00 to 84.74

Livestock

Live Cattle rebounds slightly, up +0.125 to 160.225

Feeder Cattle up +0.425 to 181.725

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 8-15 Max Temp

Brazil 4-7 Precipitation

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service