GRAINS SEE STRENGTH TO END BRUTAL WEEK

Overview

Grains see a little bit of strength following our week-long lower prices. With Soybeans rallying after being sharply lower all week, and wheat trading slightly lower.

Fundamentally there hasn’t been any major changes that have led to the sell off this week. A majority of the weakness has come from macro headlines such as Argentina rain and the possibility of a recession in China. Another thing that has been adding pressure to the markets that not many people are discussing is the fact that producers have been selling a lot of grain with the higher interest rates, taking some risk off the table.

Overall, I think there is a good chance we see prices find a floor here and bounce back from these low levels going into the USDA Report. But the report will be big one and will likely be a market mover either which way.

Today's Main Takeaways

Corn

Corn ended the week up a penny today closing at $6.54 after trading nearly $6.60 earlier in the session. Corn lost -23 cents on the sell off this week, and we ended the week roughly 6 cents off our weekly low from last week.

Biden will discuss the U.S. GMO corn dispute with Mexico's President next week. Mexico wants to phase out GMO corn imports by 2024. This would significantly reduce U.S. corn exports to its biggest buyer.

Export sales this morning came in very disappointing for corn. Coming in below expectations. Coming in at 0.319 million tons. Trade estimates were 0.4 to 1.0 million. Corn far trails the USDA pace by nearly 285 million bushels (14%).

Ethanol production fell to an 11-week low. As production was down -13% for the last week of the year and nearly -20% from the year before.

Gasoline demand was down -19% to its lowest level in nearly 2 years.

One thing adding some support to the U.S. corn market is the strong corn prices over in China. As they have seen over a week of consecutive gains. Their price equivalent to U.S. is $10.62 per bushel.

Fundamentally not a whole lot has really changed since last week where we saw prices higher across the board. I think there is a good chance we see prices recover and bounce from these levels as we head into next week.

Week High

$6.81 1/4

Week Low

$6.48 1/4

Week Close

$6.54

Weekly Change

March-23: -23 cents

Taking a look at the chart below. Yesterday corn found support on our uptrend from July, and we still hold an uptrend. Short term I think we easily retest the upper range of resistance and test $6.70-80 or possibly higher. But of course, we need to be aware of the USDA report next week as that could shake things up either way.

Corn March-23

Soybeans

Soybeans cap off there wild week of a near 60 cent trade range with a 22 cent rally to end the week. Despite today’s rally it was still a very ugly week for soybeans following our pre new year rally, losing over 30 cents. Today we did almost retest $15, hitting a high of $14.98 1/4.

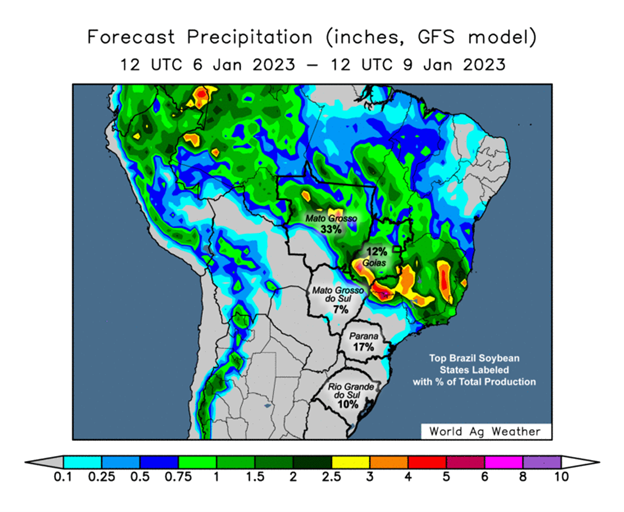

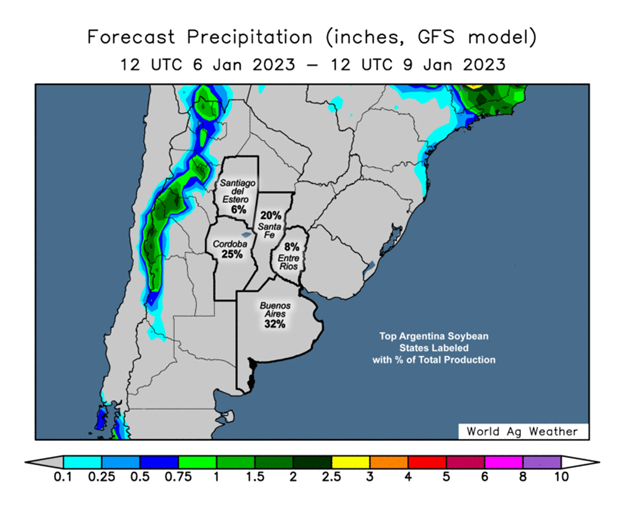

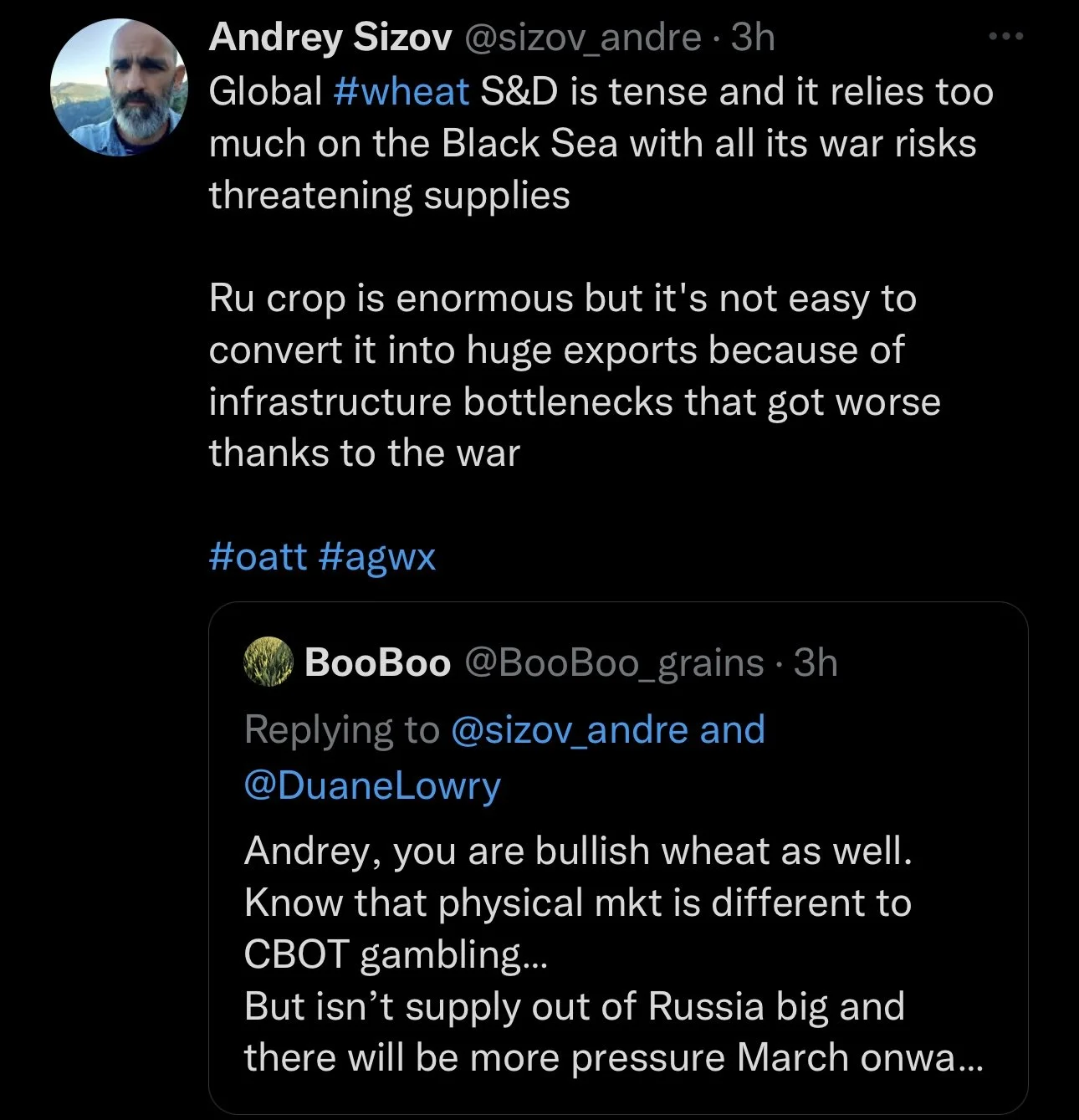

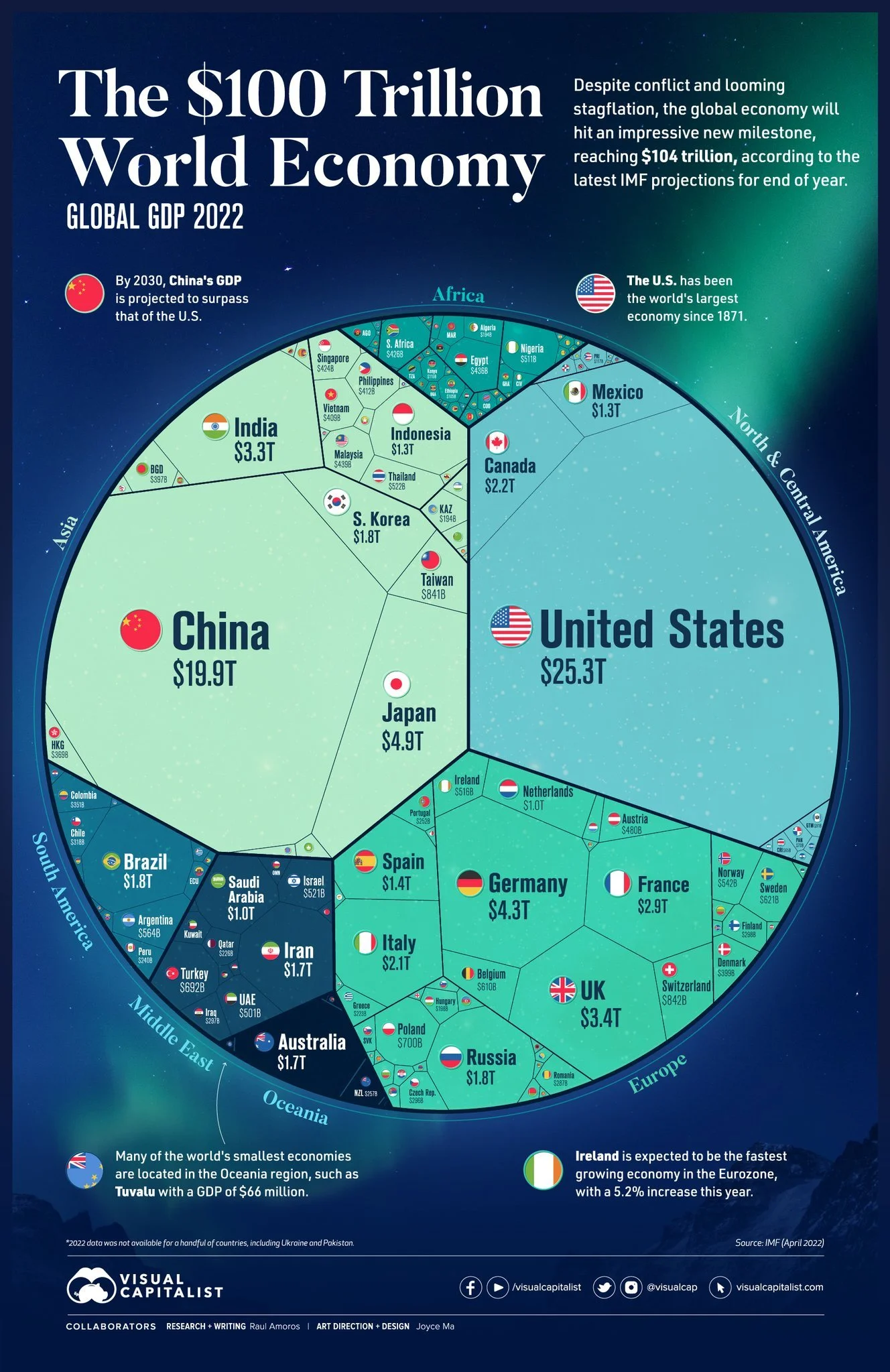

There are two main things that have been pressuring the bean market this week. One of course being Argentina forecasts. Some are saying Argentina might get up to an inch of rain next week. But the other factor that isn't getting as much attention is the situation in China. As China has increased its export corridors in crude oil. This is an indicator that their economy is under pressure as there is plenty of talks that China may be going into a recession or perhaps is already in one.

We will have to see where this China situation goes, so for the time being it's really just a wild card here. If they do go into a recession and there is signs of a weakening economy this will likely lead to additional pressure on the soybean market.

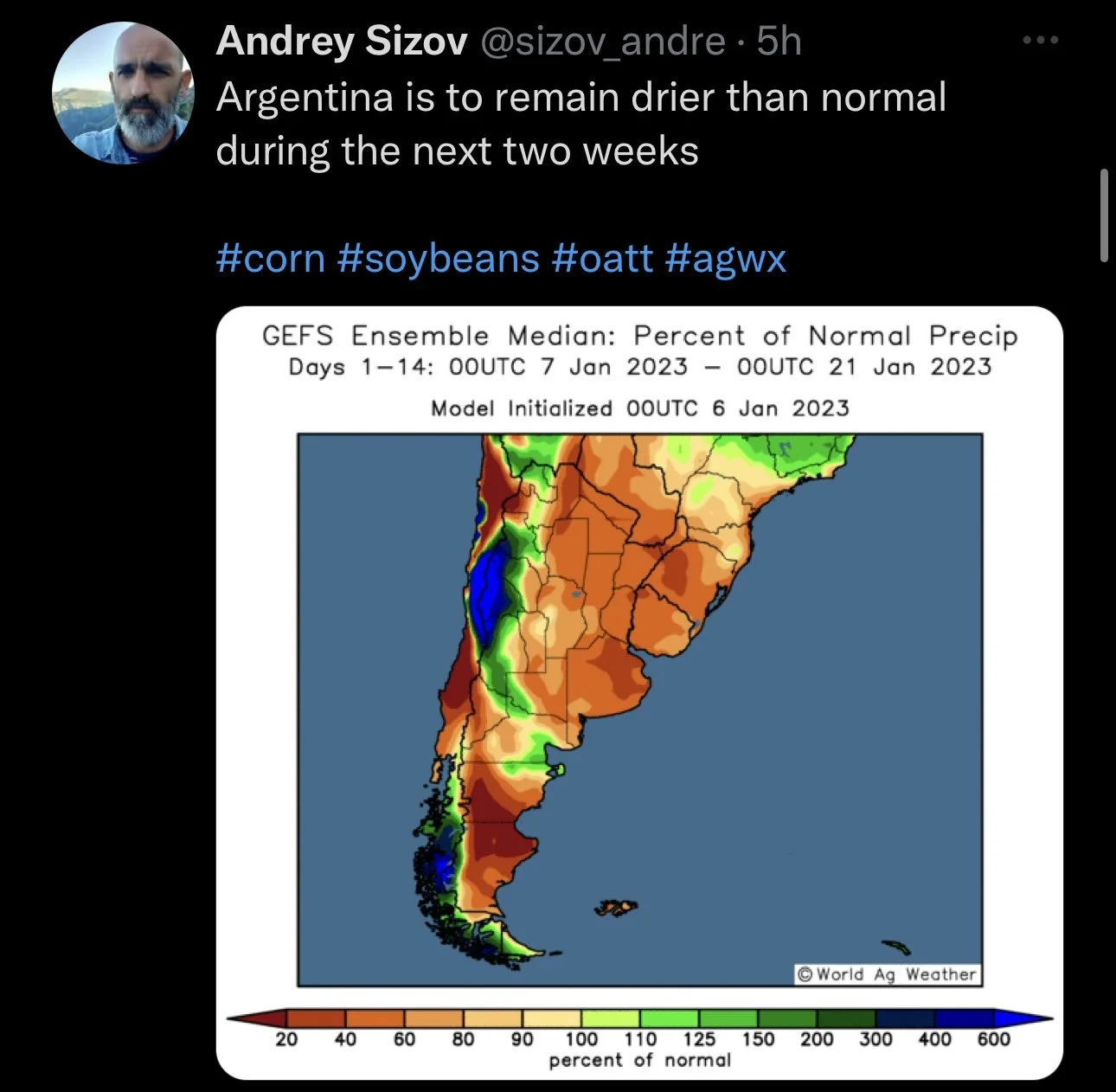

Forecasts for Argentina are dry for the most part. However, next week they are expected to get quiet a bit of rain. So this definitely has the chance to put beans under some more pressure heading into next week if they do get this rain.

Here is a snippet from Wright on the Markets where he shared some insights from Francisco Mariani who is an agronomist in South America. He predicted, "The Brazilian states of Parana and Rio Grande will drop Brazil’s soybean crop to 143-147 million metric tons. Paraguay will be 8 million mt and Argentina might make 38 million mt. Bolivia will also be less than normal." With that being said, the USDA currently has their Brazil forecast at 152 million, 49.5 for Argentina, and 10 for Paraguay. If he is right South America could far under perform what the USDA is expecting. Based on his estimates South America could be looking at over 340 million less bushels of soybeans than the USDA currently has forecasted.

Overall, the soybean market will continue to be dominated by South American weather and China headlines.

With today's rally, beans are again approaching that $15 after trading above $15 for a few days last week. So with the rally, there is of course nothing wrong with making some sales here. Especially if you are nervous and feel like it makes the most sense for your operation. Our number one suggestion is to be conformable with where you are at. You have to ask yourself whether you are conformable with riding out the lows and the volatility of the markets. If you aren't then there is nothing wrong with rewarding these rallies especially when prices are moving at the volatility that they have been.

In yesterday's audio, we talk more about managing risk, you can listen to that Here

Week High

$15.23 1/4

Week Low

$14.65

Week Close

$14.92 1/2

Weekly Change

March-23: -31 3/4 cents

Taking a look at the chart below, soybeans touched support at the trendline and bounced higher off that support today. Soybeans still remain in an uptrend from October.

Soybeans March-23

Wheat

Wheat markets finished off the poor week slightly lower again here today. With Chicago losing -3 cents and KC & Minneapolis losing over -7 cents. Wheat futures were actually trading nearly 10 cents higher early in the session but ultimately gave up those gains.

Export sales this morning came in very sub par for wheat, coming in far below expectations at 0.047 million tons. Trade estimates were 0.2 to 0.575 million. Wheat only trails the USDA pace by a small 3%.

One thing that may pressure wheat is the large crop out of Australia who are expecting a record 42 million metric tons. Australia is the world’s 2nd largest exporter of wheat.

We also just simply have really poor demand right now which hasn’t helped push prices out of this slump, to go along with stiff global competition from countries like Russia who have cheaper product.

We will have to see where the funds decide to go from here. We know they are short wheat, and with this recent sell off, there is just less pressure and reasons to exit those short positions.

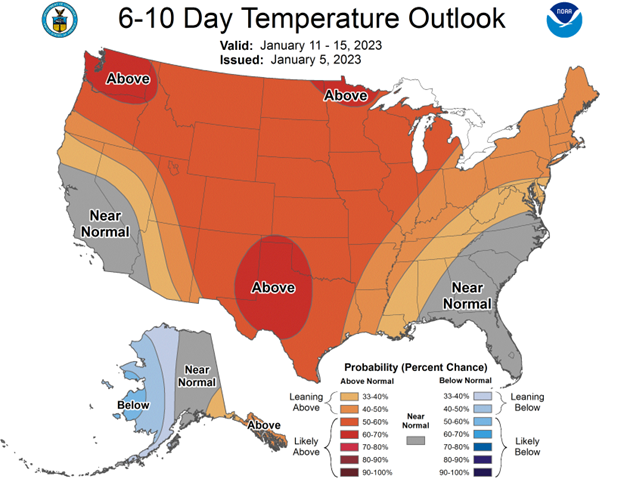

Something thing to look out for in the wheat market next week is the fact that Russia might see some winter kill. As they are going to see brutally cold temps and not a lot of snow cover. Keep in mind, Russia is far and away the worlds leading exporter in wheat and is currently expecting a pretty massive crop.

Despite prices usually falling as spring approaches, SovEcon said they believe wheat prices bottomed out in December and are headed higher. I also think there is a good chance our December lows hold and we see higher prices in the coming months.

Week High

Chicago: $7.94

KC: $8.88

MPLS: $9.38

Week Low

Chicago: $7.36

KC: $8.30 1/2

MPLS: $9.00 1/4

Week Close

Chicago: $7.43 1/2

KC: $8.32

MPLS: $9.01 3/4

Weekly Change

Chicago March-23: -47 1/2 cents

KC March-23: -56 cents

MPLS March-23: -36 1/2 cents

Looking at the chart, Chicago has support just past the $7.40 range so we will have to see if we hold or if we go back to test our early December lows of $7.24. With the recent sell off, I think there is a chance we do see prices a little higher from here as we head into the USDA report on Thursday.

Chicago March-23

KC March-23

MPLS March-23

Factors in the Grains

All week long I've been adding bullish, bearish, and wild card factors for each of the grains. Here is a summarized list of factors that impacts the grains as a whole, and things you should be watching going forward. If you would like to check out more reasons for each separate grain visit yesterday's update here.

Bullish 📈

Possible winter kill in Russia.

Argentina drought and poor crops.

Basis & spreads are stronger than a year ago.

Carry outs are less than they were a year ago.

StoneX lowered Brazil estimates.

War headlines.

Bearish 📉

Possible Chinese recession.

Expected record Brazil crops.

Interest rates lead to more farmer selling after the 1st of the year.

Overall demand.

Wild Cards 🃏

USDA Report, next Thursday.

South American weather.

Funds

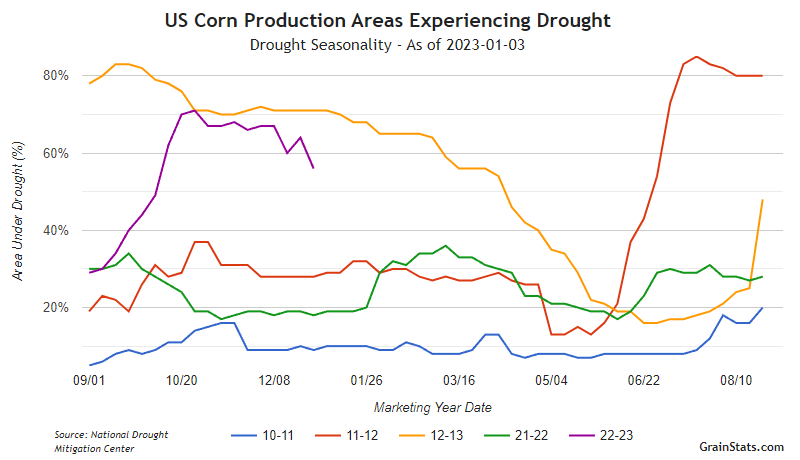

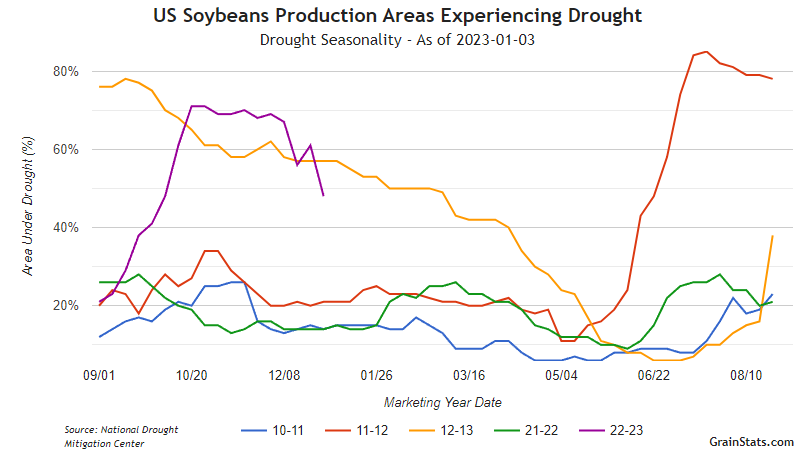

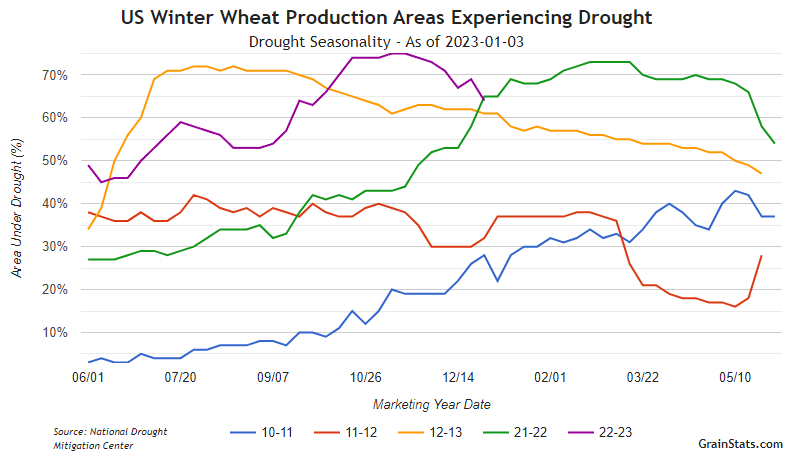

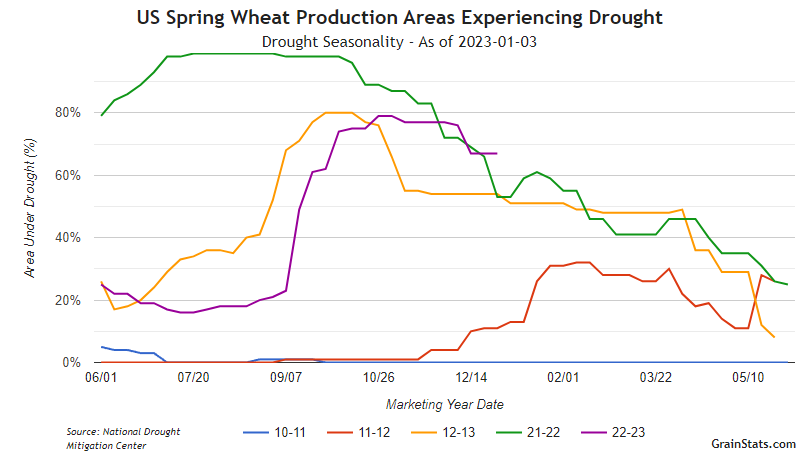

U.S. Drought

How does the 2022-23 growing areas experiencing drought stack up against previous years?

As you can see from the charts, this drought has been one of the greater ones, stacking up relatively similar to those we saw a decade ago.

There is talk about the drought from 2012 possibly resurfacing and being similar in 2023. So this is definitely something to be cautious about.

Thanks to GrainStats for the charts. Visit them Here

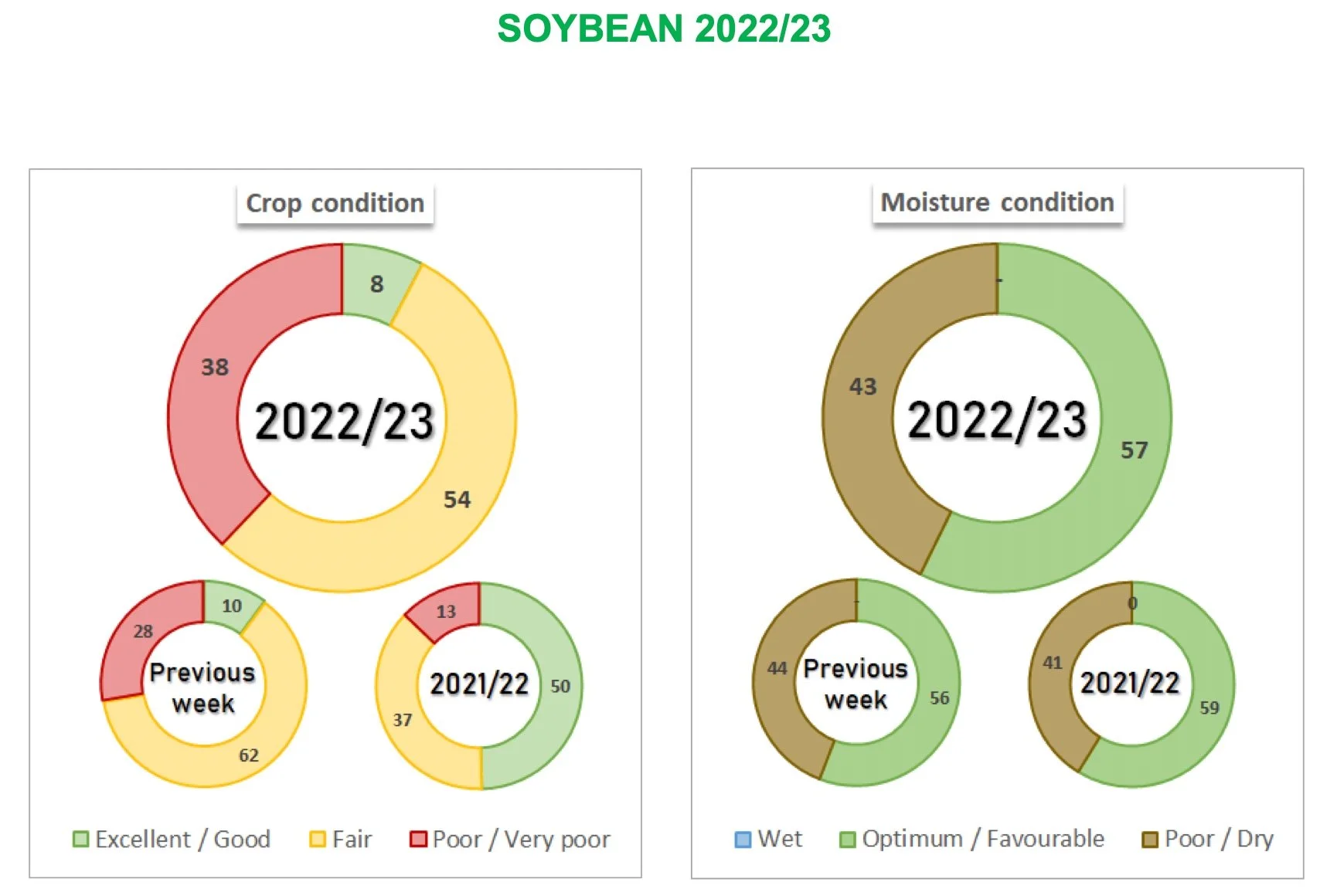

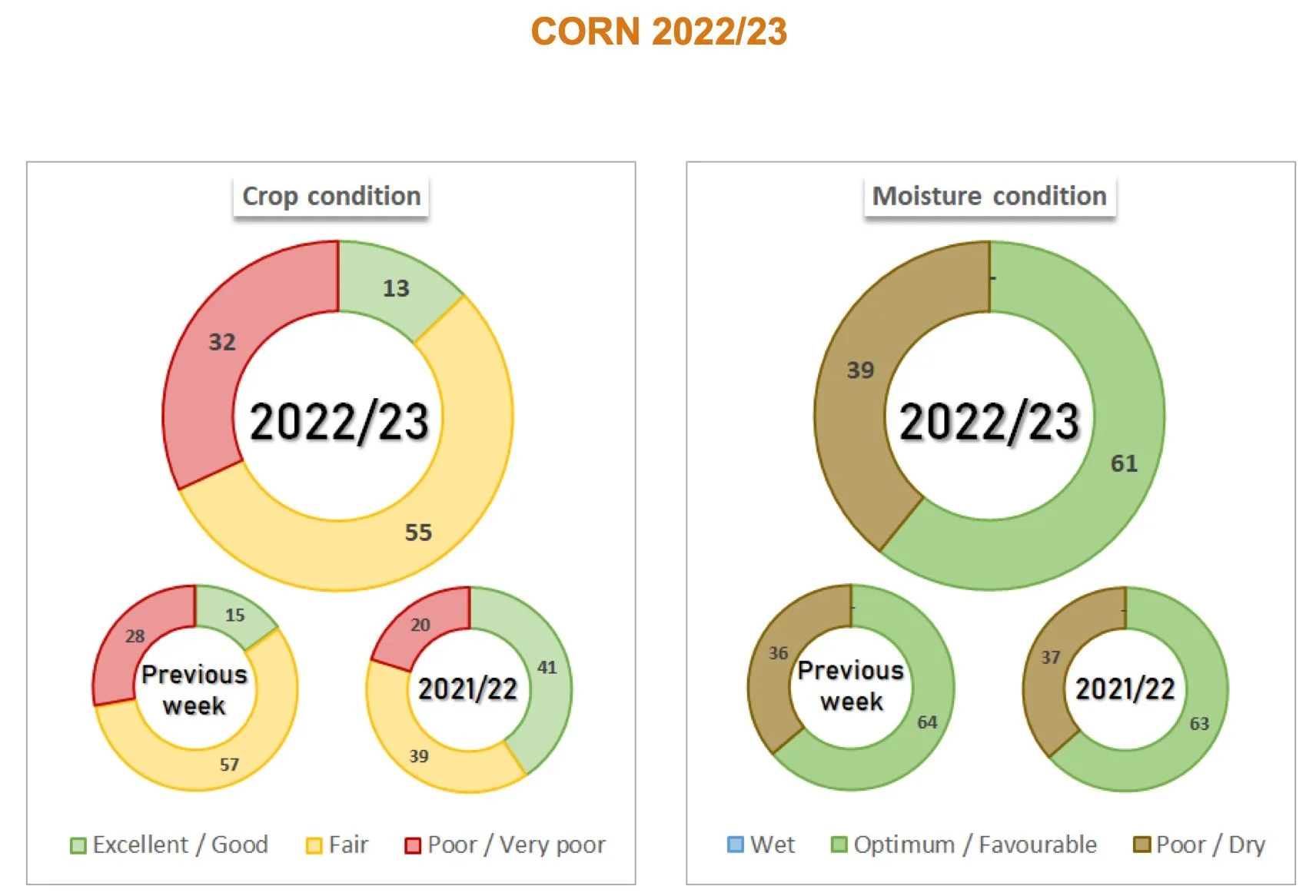

Argentina Crop Ratings

Crop conditions from Buenos Aires Grain Exchange came out and we saw ratings lower this week compared to last which has added some support to both the bean and corn market today. However, the recent rains did allow Argentina to make some progress in their planting. Despite the progress, planting is still roughly 2 weeks behind.

Corn

Good/Excellent down -2% to 13%

Planting at 70% complete vs 85% average

Soybeans

Good/Excellent down -2% to 8%

Planting at 82% complete vs 93% average (up +10% from last week)

In Case You Missed It..

Yesterday's Audio Comments - Will Grains Bounce?

Why are grains lower?

Managing risk

Things to look out for

Yesterday's Market Update

Argy Rains

Is the corn sell off done?

Wednesday's Market Update

Fertilizer Price Update & Recommendations

Wheat loses 30 cents

Bullish & Bearish Consensus

Highlights & News

Argentina crop ratings lowered again.

USDA Report next Thursday.

China is targeting a 667k hectare increase in oilseed acreage in 2023.

Putin said Ukraine will have to surrender territories before a peace agreement can be discussed.

Other Markets

Crude oil essentially unchanged

Dow Jones down up a massive +700 points

Dollar Index down -1.17 to 103.66

Cotton up +3.10

Livestock

Live Cattle down -0.575 to 156.775

5-Day Change: -2.075 (-1.31%)

Feeder Cattle down -0.900 to 185.650

5-Day Change: -1.125 (-0.60%)

The USDA approved $9.6 million in grants and loans to small meat packers, citing industry concentration with +85% of cattle slaughtered by just 4 companies in 2018.

Beef exports for November down -6% from October and -8% year over year.

Live Cattle

Feeder Cattle

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service