MARKET UPDATE

Futures Prices 11:00am CT

Overview

Grains all in the red to start Thursday morning. Pressure coming from pretty poor export sales this morning across the board. The outside markets also adding some pressure.

Today's Main Takeaways

Corn

Corn down about -8 cents this morning, hopefully we can find support around yesterdays low of $6.75 3/4. The report last week came in the most bullish for corn, and after the report we saw corn trading higher. Despite this, corn is now training around the middle of its trading range which is has traded for around a month now. As corn looks pretty comfy trading around the $6.70 to $7 range.

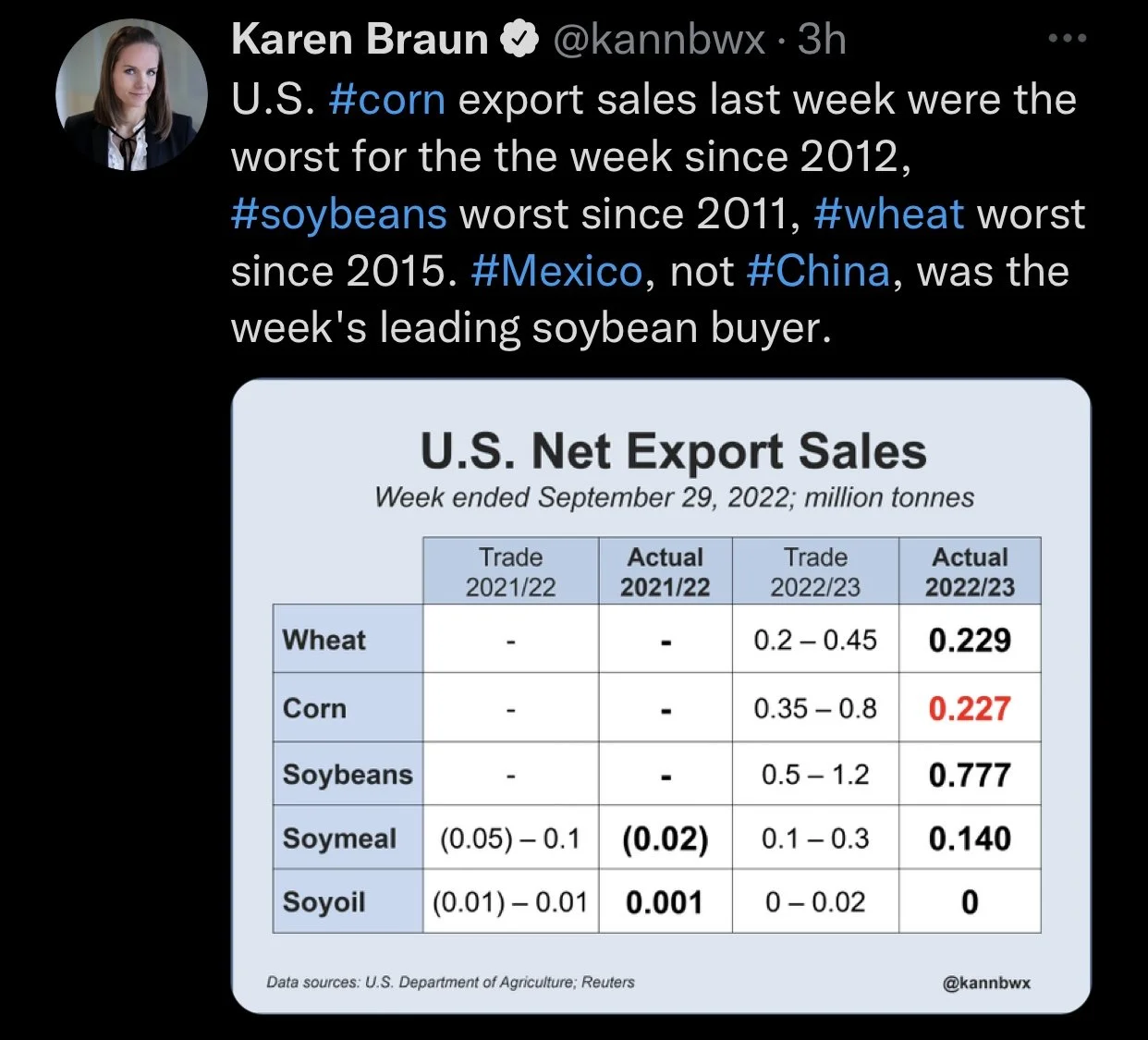

Export sales were pretty poor again, coming in at 227,000 MT. Which was below the range of guesses. As they were looking for 350,000 to 800,000. Exports sales were the worst for the week since 2012.

StoneX recently did a farmer survey, and the results showed slightly higher corn yields than the September survey. Their survey had a yield of 173,9 bushels per acre. Which was an increase of 0.7 bushels per acre from the month prior.

Harvest looks like its going smoothly. The yield stories are really a mixed bag. Some are saying yields are better than expected, some saying they are worse. Of course if yields come in worse we will likely see higher prices. But if we see demand increase I don't think $7+ corn is out of the realm of possibility. Up until today, we where seeing higher highs and lower lows, and corn had closed higher the last six out of seven trading days. Even with today’s losses, we are still higher than we were just a week ago. However, its tough to be super bullish on the demand side of things with China interest not being there, the dollar trading so high, and the recession concerns still looming leading to a lack in consumer demand.

Ethanol

We saw many consecutive weeks of lower ethanol production. However U.S. ethanol production was 4% higher the last week of September. During that week we saw ethanol production average 889k barrels a day. Despite this being higher than previous weeks, it was still far lower than last year. Coming in at -9% lower.

We saw ethanol stocks drop 4.4%, to 21.7 million barrels

Corn used for ethanol came in at 89.4 million bushels. If we want to reach the USDA forecast we'd need about 103 million bushels.

Dec-22 (6 Month)

Soybeans

Soybeans lower again here this morning, down X. With soymeal trading lower as well. Prices broke below the post report lows we saw last week. We took out a new low, going back to August 3rd where we saw a $13.56 low. We do have a gap from all the way back on July 25th, at $13.49 1/4 to $13.58 1/4. So it wouldn’t be too surprising to see us fill that gap back down to the $13.49 level.

Export sales were pretty disappointing for soybeans as well, coming in at 777,100 MT. They were looking for 500,000 to 1.2 million. So at the bottom range of the estimates. Exports were the worst for the week since 2011. Lastly, Mexico, not China was the weeks leading soybean buyer.

Typically around this time of year we'd see a lot larger exports. As South America just started planting and as our harvest gets underway. Usually we'd see something in the 1.5 million to 2 million range. But with China's lockdowns shutting down everything, they have negative crush margins. With the likelihood that they are waiting to see just how big of a crop we see out of South America. Not to mention the recent U.S. and China tensions playing a role in weak demand.

The strong U.S. dollar has been hurting all the markets. But has especially taken a toll on soymeal, leading to added pressure on the soybean market. As soymeal has been trading lower off its highs we saw a few short weeks ago.

If soybeans continue to slip and fall, there is a chance we see prices fall back to the $13 support level. Which acts as a very heavy physiological support. However on the flip side, soybeans still have the chance to rally if we see reports out of the field showing poor yields. Additionally, we do have that chance to see all of the markets gain traction and trade higher if we see demand pickup. But so far the demand just hasn't been there. But there is rumors that China might back off some of their restrictions, if they do so, one would think we would at least see some strength in demand comparatively speaking.

CONAB forecast has soybeans at 152.4 MMT, up from 21% from last years drought damaged crop

Soymeal & Soyoil

Soymeal down -5.1 to 393.4

Soyoil up +0.30 to 65.84

Soybeans Nov-22 (6 Month)

Wheat

Wheat all sharply lower, taking out yesterdays lows and making new lows for the week. After the report last week, we saw wheat initial trading higher, but has since been essentially trading sideways. The report wasn’t crazy bullish either. We haven't been able to see wheat trade at the higher end of their trade ranges this week as Chicago wheat broke below its 20-day moving average.

Traders were hoping to see strong exports this morning. But they came in at 229,400 MT which was at the bottom of the estimate range, and below last weeks of 279,800. As this week they were looking for 200,000 to 400,000 MT. Exports were the worst for the week since 2015.

The Ukraine and Russia war news hasn’t provided any real updates so for the time being its really just a wild card and remains a mixed bag.

We have the chance to see higher prices if demand picks up and the dollar continues to weaken. As most would think this would increase the interest for commodities. Many think that if we do see the dollar cool off, people would look at wheat for a great opportunity. However, its tough to make any guesses as to what will happen with the economy as well as what Putins next move is.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +0.50 to 88.26

Dow Jones down -80

Dollar Index up +0.884

Cotton up +0.32 to 83.55

News

CONAB released their production estimates for Brazil

Corn: 127 million metric tons

Soybeans: 152.35 million metric tons

Jobless claims spike higher. As first time unemployment jumps from 29k to 219k the week ending in Oct.1

US companies cut nearly 30k jobs from payroll during September

Mortgage applications now at 25-year low

Livestock

Live Cattle up +0.275 to 148.200

Feeder Cattle down -0.700 to 176.625

Previous Newsletters

Here is yesterday’s audio in case you missed it

What happens if Barchart corn production numbers are right?

Social Media

Credit: All credit to users of posts

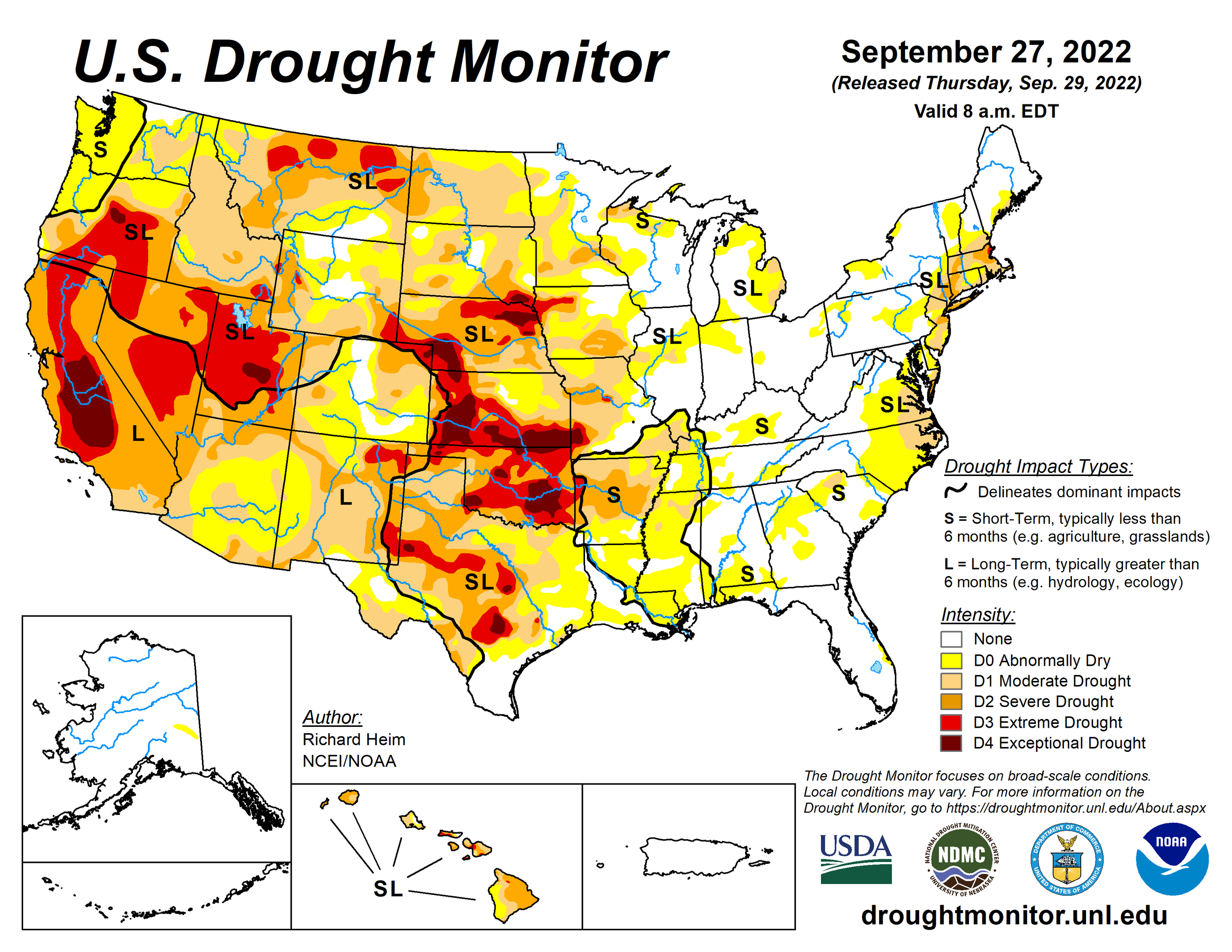

Precipitation Forecast 2-Day

Weather

Source: National Weather Service