MORNING MARKET UPDATE

Futures Prices 10:30am CT

Overview

Despite Dow Jones and the outside markets sharply lower, the grains are holding up relatively well. Crude oil up over +$3 and adding support. The recession fears still appear very in tact, and many believe there is a strong possibility we do still see a recession.

Today's Main Takeaways

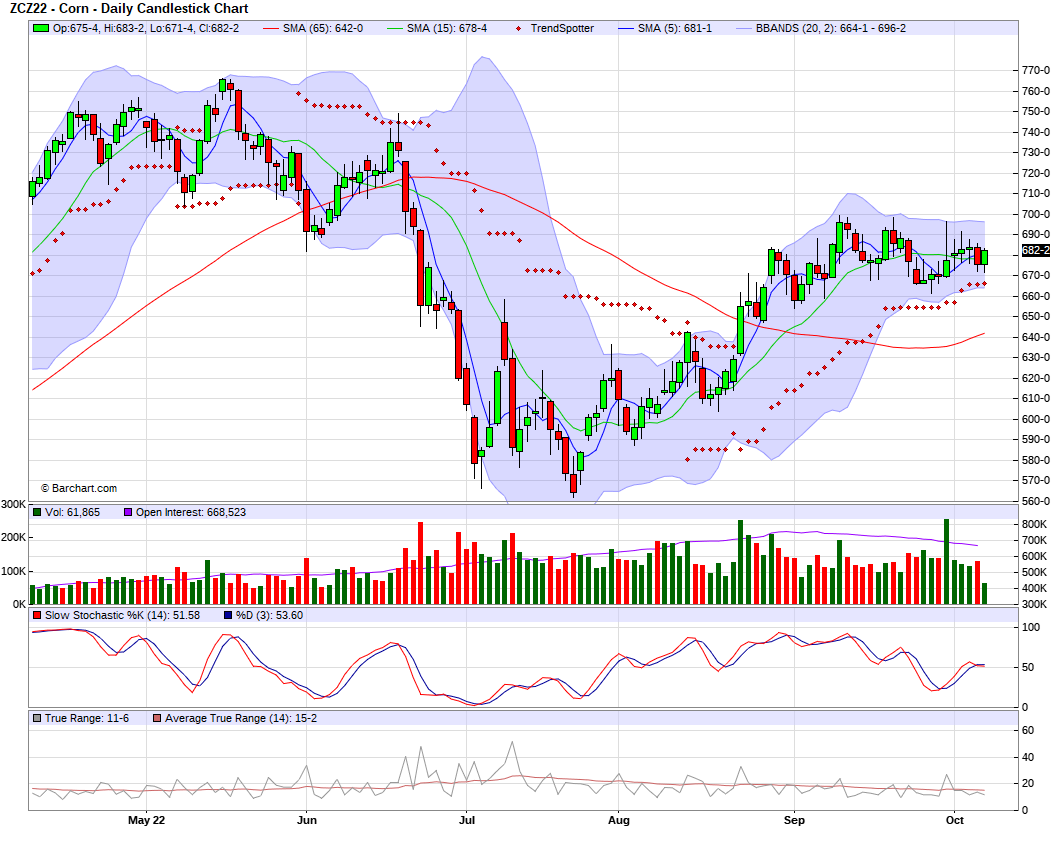

Corn

Corn is higher this morning about a nickel, trading near session highs and about 10 cents off our early lows. Corn has been trading in a pretty wide range since the end of August. As we've seen a range of around 40 cents.

With this wide range, we've traded mostly sideways. With the harvest pressure not helping, and the very weak demand and exports keeping a lid on prices.

Crude oil has been quiet supportive of corn as of lately and is back up over $90. Up nearly +3% today. And is up nearly +$10 the last 5 trading days alone. A lot of this strength is coming from the news that OPEC+ wants to cut their oil production. As they are looking to cut production by 2 million barrels a day.

Private Analyst IHS Markit lowered their 2022 U.S. corn yield estimate to 171.2 bushels per acre. This is a 1.3 bushel per acre decrease from the 172.5 bpa last month. They also lowered their total U.S. corn production estimates from 13.944 billion bushels down to 13.839 billion.

Next week we will see another USDA report. This choppy trade action will likely continue until everyone sees more data come the day of the report. According to Bloomberg, the trade for the USDA report next Wednesday is looking for the USDA to trim their corn yield by 0.4 bpa down to 172.1 bpa. Its doubtful we see anything crazy towards the 170 or lower range, but definitely wouldn’t be a surprise to see the USDA continue to lower its estimates. For production estimates, they are looking at 13.903 billion bushels, and carryout is expected to drop 93 million bushels. It appears that most are going into the report pretty optimistically looking for slightly bullish numbers.

Dec-22 (6 Month)

Soybeans

Soybeans started the morning off lower, but then picked up steam and was trading 10 cents higher at one point. But has since gave back all of its gains trading slightly higher on the day and roughly 10 cents off its highs.

The soybean market continues to be pressured by overall weak demand and exports. Yesterday we saw prices lower with the U.S. harvest progressing nicely, and the low water levels in the Mississippi River causing some problems ultimately pressuring the grains

Private Analyst IHS Markit lowered their 2022 U.S. soybean yield estimate down to 49.9 bushels per acre. A decrease from last months 50.5 bushels per acre. Also lowering their soybean production estimate from 4.378 billion bushels to 4.327 billion.

CONAB's Brazil 2022-23 soybean production estimates came in at 152.4 million metric tons. An increase of 21% from last year.

Traders are excited to get a look at next week's report on Wednesday. One of the biggest question marks surrounding the report currently is where the USDA will set its yield estimate. Currently, they are forecasting 50.5 bushels per acre. Some think this is too high, while some think we will see this number rise in the near future. With a possibility of the USDA just leaving this estimate unchanged from last. It also is looking like most think we will see a slight increase in last year's production. There is a solid chance that exports are left unchanged but it's not unreasonable to think we see a small cut.

Yesterday we talked about filling gap we had back from July 25th at $13.49 1/4. And we got pretty close to filling that gap. But hopefully, we can find support here, otherwise, if we break below that level we could see even more downside.

Soymeal & Soyoil

Soymeal up +3.0 to 396.4

Soyoil down -0.39 to 65.63

Soybeans Nov-22 (6 Month)

Wheat

Wheat prices were all sharply higher early this morning following yesterday’s sharp losses. However, as of 10:30am have gave back a majority of their early gains. All trading near the bottom of their trade range. Chicago wheat is currently almost 16 cents lower off its highs.

There isn't much news surrounding the wheat market for the time being. The U.S. dollar continues to be a negative factor as it surges higher. The Ukraine and Russia news is still a big unknown factor that no one knows how it will play out. One could argue that the very dry conditions in key growing regions has been a supportive factor in prices. Overall, I think there is still some upside potential in wheat, but I'm not overly optimistic.

As for next weeks report, it looks like most are expecting to see a somewhat slightly tighter balance sheet for the U.S. come next Wednesday. Everyone already knows we will see U.S. production trimmed at least a little bit. However one of the bigger questions is how much exports will be lowered. Its looking like most are thinking we see U.S. wheat ending stocks to be lowered to 600 million bushels or lower.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +3.20 to 92.13 (+3.60%)

Dow Jones down -467.61 (-1.56%)

Dollar Index up +0.134 (+0.12%)

Cotton down -0.03 to 82.87

News

Brazil is expecting a record soybean crop, this is despite the La Niña

China soybean imports are forecasted at 2-year lows

Saudi Arabia has lowered its oil prices for Europe but raised them for the U.S., per BI

President Biden announces executive order pardoning Americans convicted of simple marijuana possession under federal law

Goldman Sachs predicts that home prices in the worlds most expensive housing market could fall 30%

Livestock

Live Cattle up +0.625 to 148.500

Feeder Cattle down -0.100 to 176.325

Previous Newsletters

Here is Wednesday's audio in case you missed it

What happens if Barchart corn production numbers are right?

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service