MORNING MARKET UPDATE

Overview

Yesterday's USDA was pretty much a snooze, as expected. There weren't any significant changes for the most part, and the changes that did occur, don’t have much of an effect on supply and demand as a whole.

Overnight and into this morning, the markets were actually holding fairly well after our losses following yesterdays report. Until we saw the latest CPI (Consumer Price Index) numbers come out. These came in larger than expected. These numbers continue to raise the expectations for future interest rate hikes.

Outside of the recession fears, the main two factors in the market right now have to be weather and money flow. Recently the markets have been trading the funds rather than trading fundamentals. Spec funds have been big sellers the past few weeks, with the exception of the end of last week's rally to end the week. With no real fundamental news from the report yesterday, prices just continued lower as funds continue to sell. This selling also goes hand in hand with the fears of recession. With losses across the board in equities etc, funds have started to look to liquidate their commodity positions as well.

Inflation Notes

U.S. Labor department announced that U.S. inflation for June 2022 (CPI) reached an increase of 9.1%. This surpassed the previous months 40 year record of 8.6%. This was an increase of 1.3%. As 1.1% was the expectation.

Energy costs rose 41.6%. Most since April 1980

Food prices up 10.4%. Most since February 1981

USDA Report - Supply & Demand

As mentioned yesterday. There weren’t any huge surprises in yesterday’s report. USDA numbers came in slightly larger than were expected. But, the majority of the main numbers were somewhat in line with expectations. However, nearly every estimate was slightly larger than what most expected. With the exception of Brazil's corn.

Overall, there wasn't anything great about this report really at all. No bullish news to spark any buying. Grains still struggling to find their way back to their 20-day moving averages. This report definitely didn't help prices. Could very likely cause some more technical selling, or maybe we see a rebound here today after sharp losses occurred yesterday after the report. Outside of the report, one of the bigger concerns still has to be whether we will continue to see funds liquidate their positions with fear of a global recession. With lower prices in energies and equities. For the grains, essentially the only bullish factors that could help push this market back up to our highs we saw a while ago, would be weather and a spark in demand. Whether this spark comes from China re-opening or an ease in inflation.

Today's Main Takeaways

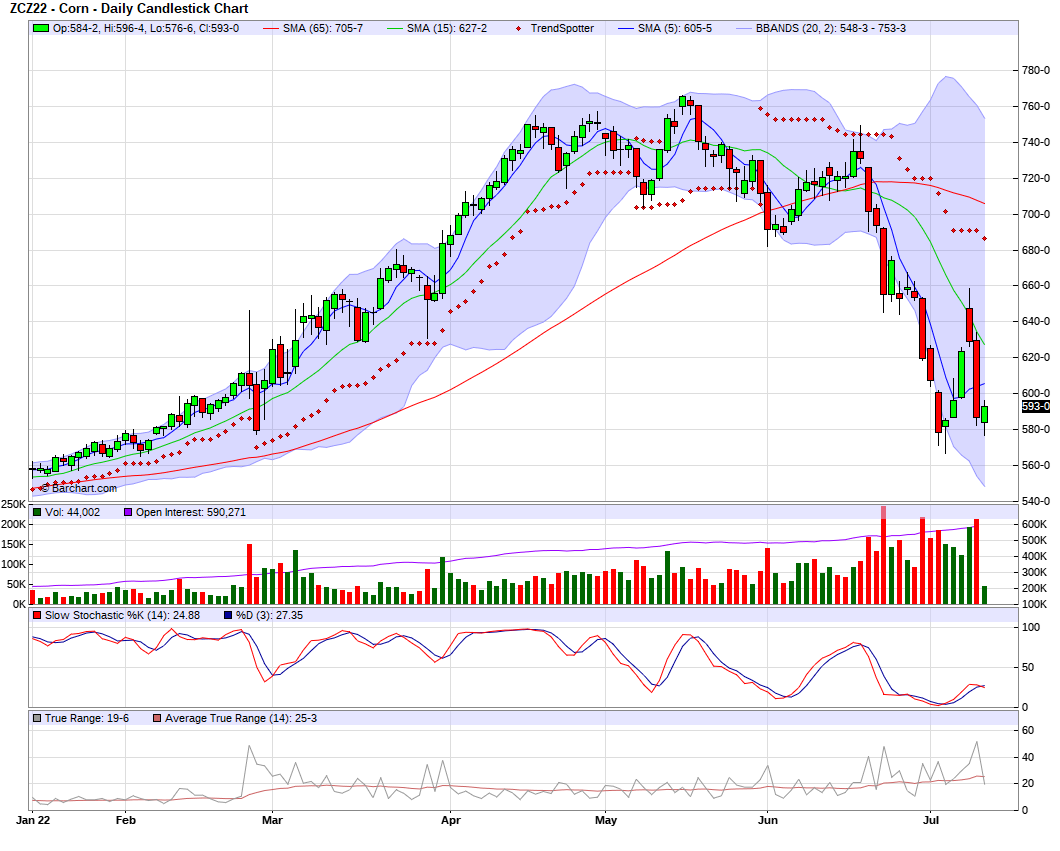

Corn

Yesterdays report wasn't anything crazy. Was slightly disappointing to see the +70 million bushel raise in U.S. new crop ending stocks. With old crop supply being raised +25 million. Yield was left unchanged. Overall, there wasn't anything too surprising here when its all said and done. With the biggest fear coming from the funds and recession scares.

With all thats going on in the world. We have 20 year highs in the U.S. dollar, a huge drop in metal and energy. This all points to a recession and a large slowdown in economic growth. All you have to do for lower grain prices is have a slightly favorable forecast here and there, and toss in some rain.

Recently we've been "trading the weather". With crazy volatility as weather forecasts continue to change. Prices go up when its looking dry, and they go down on any possibility of rain. But now it seems like the funds are a lot more worried about the real possibility of a recession.

If we continue to see demand for everything from ethanol to feed stay weak, it could be a serious problem for prices. Looking to the optimistic side, we could just as easily see demand do a 180 especially if China completely reopens and we see inflation ease.

With the report yesterday, corn was lower. Now looking to test its recent lows made last week. Technically speaking, we'd like to see corn hold above last weeks low of $5.66 1/2. As this is some major nearby support. With the nearby resistance for corn being around the 200 day moving average right around $6.15. If weather stays hot and dry over the last two weeks in July, could easily see prices bounce back.

Dec-22 Corn

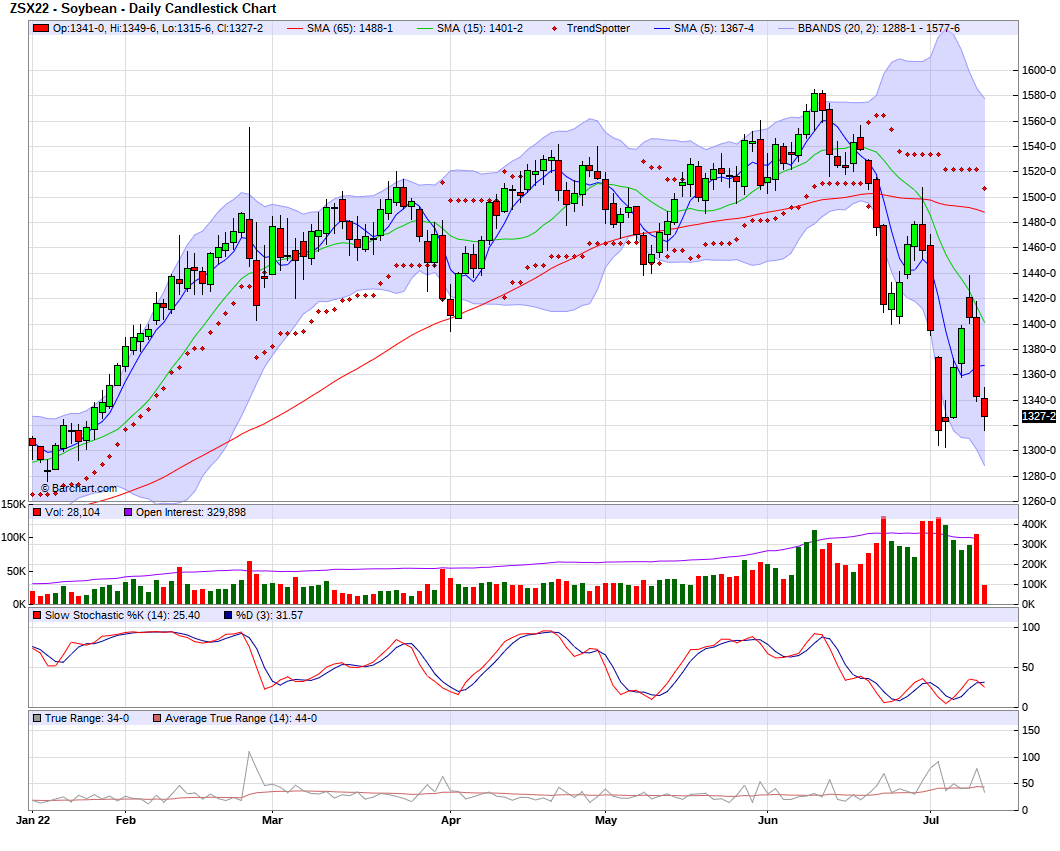

Soybeans

Soybeans sharply lower after the report yesterday. We are now close to testing our recent lows for Nov. beans, with prices continuing to slip in the overnight session. We haven’t seen Nov. beans break below $13 since January. This is a major support level. With nearby resistance around $14.

There were some small changes in the report, but nothing too massive or surprising. Biggest changes were; production declined 135 million bushels. Crush was also lowered by 10 million bushels. Another surprise being the cuts made to the 2022-23 usage estimates. The numbers putting the most pressure on beans would be the 230 carry out (down 50 million from last month due to acreage cut), with estimates at 214. A lot of people thought we'd see a number below 200.

USDA didn't change Brazilian soybeans, but they did however increase Argentina soybeans slightly, by 600,000 tons. Which was the only change made to South America production.

Even with this report, in the end the biggest factor outside of money flow is going to be how the crop actually turns out. With all the weather and drought scares.

If we want to see beans higher, we are going to need to see a flip in demand. Currently its probably best to sit on the sidelines. Unless we see some major weather scares, Chinese demand stories, or a weaken dollar to ignite some more buying. But for the moment being the best decision is to probably sit and wait, see if we bounce back off these lows we saw last week, or reverse and go even higher.

Nov-22 Soybeans

Wheat

Yesterday's report wasn't great for wheat, at all really. Overall, there wasn't any huge changes made. With the USDA making some slight increases to production and beginning stocks.

We've seen sharp losses in wheat even before the report. But following yesterday’s report, we were pulled back down near our recent lows.

Last night we saw Ukraine Government say that they feel like they are nearing agreements with Russia, to allow the closed ports to ship. Even with this news, most people don't actually expect them to come to a full agreement any time soon. But this news is just enough for bears to point to and sell to the downside. Even if this is pretty doubtful, we have to take into consideration the money flow and the global recession fear. Even with all the uncertainty and problems we've seen with Ukraine and India, the slightest news on the possibility for exports ignites selling with the current situation the wheat markets are in.

Other Markets / News

Crude oil been trading in roughly a $4 range, currently down a little over -50 cents to $95.25. Almost $2 off its lows. A lot of pressure coming from European recession and U.S. recession scares.

Soy oil down -1.67 to 56.25

Western corn belt remains hot and dry. Eastern corn belt looking a little more mild.

Dow down -444, this might bring on some more recession talks and isn't a great look for the grains

Brazil upping their exports to China. Mostly corn and beans. This isn't really good news for our export market.

Important Upcoming Dates

Thursday, July 14

Weekly Export Sales

Cotton & Wool Outlook - 2022

Oil Crops Outlook - 2022

Wheat Outlook - 2022

Weather

Source: National Weather Service