POST USDA REPORT

Listen to today’s audio comments and thoughts below.

Overview

Grains sharply lower today post-USDA report. Grains were already lower to start the morning in anticipation of the report. Then after the report, everything started to sell hard. With massive losses across the board especially in soybeans.

USDA Report - Supply & Demand

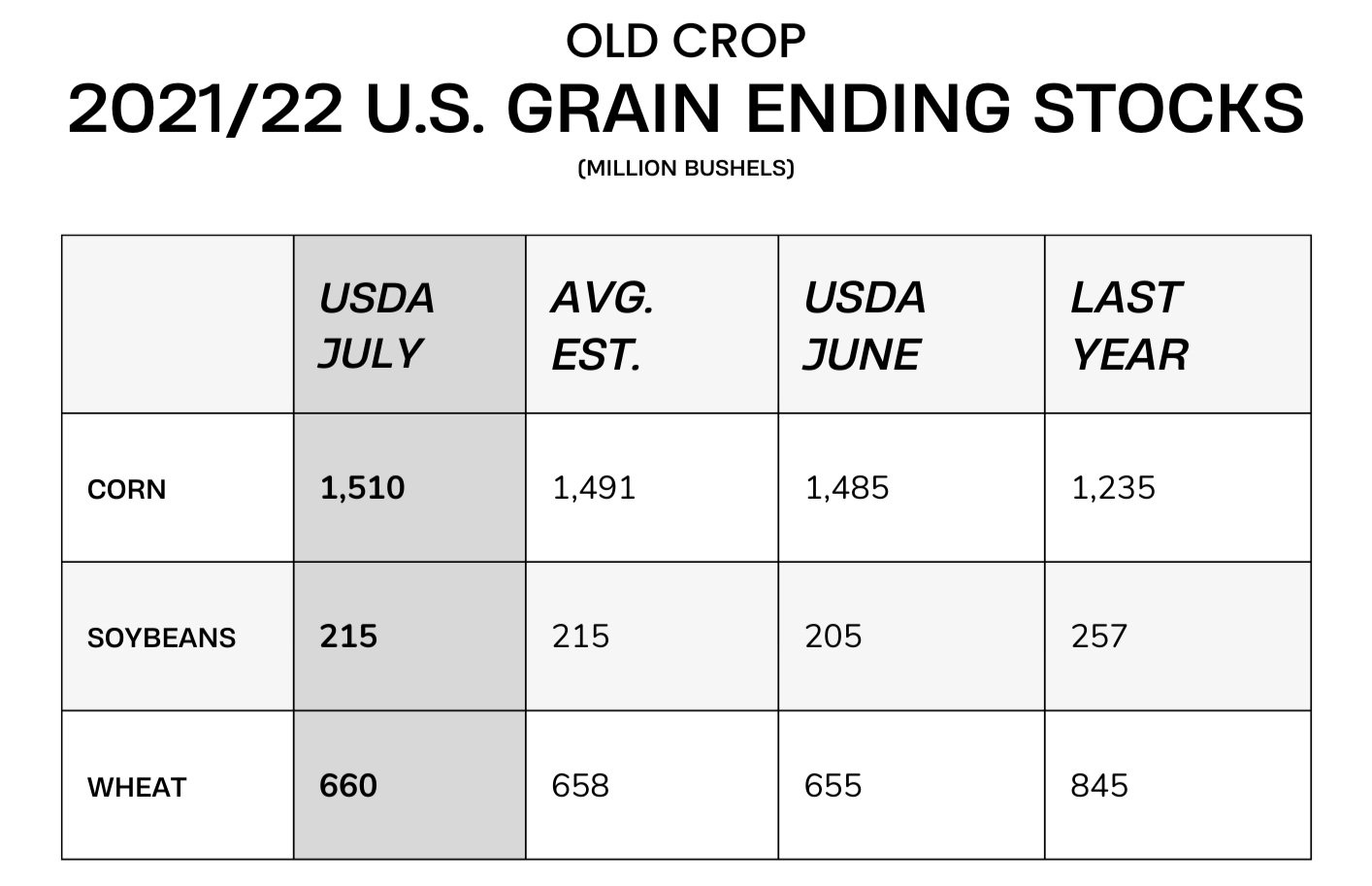

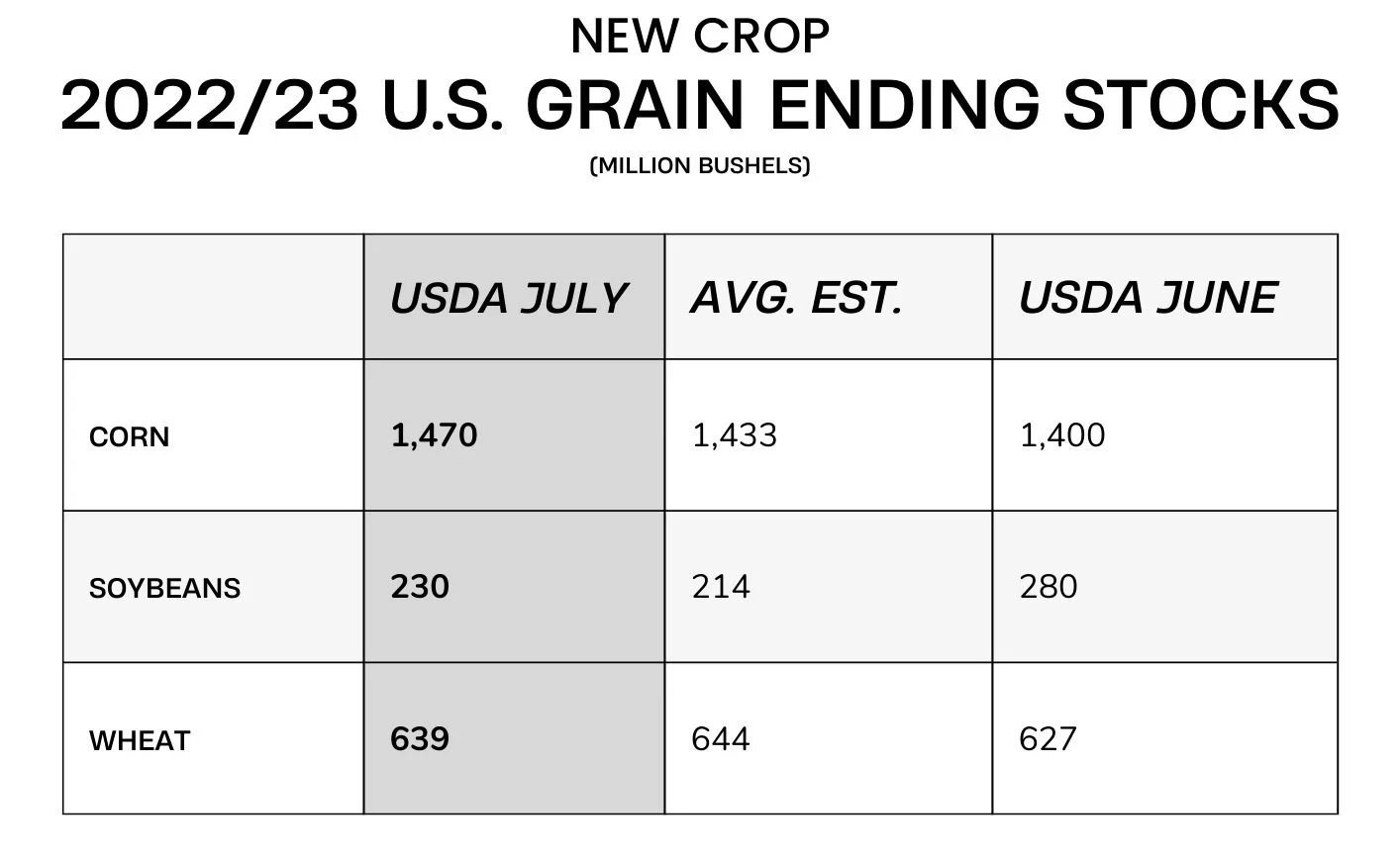

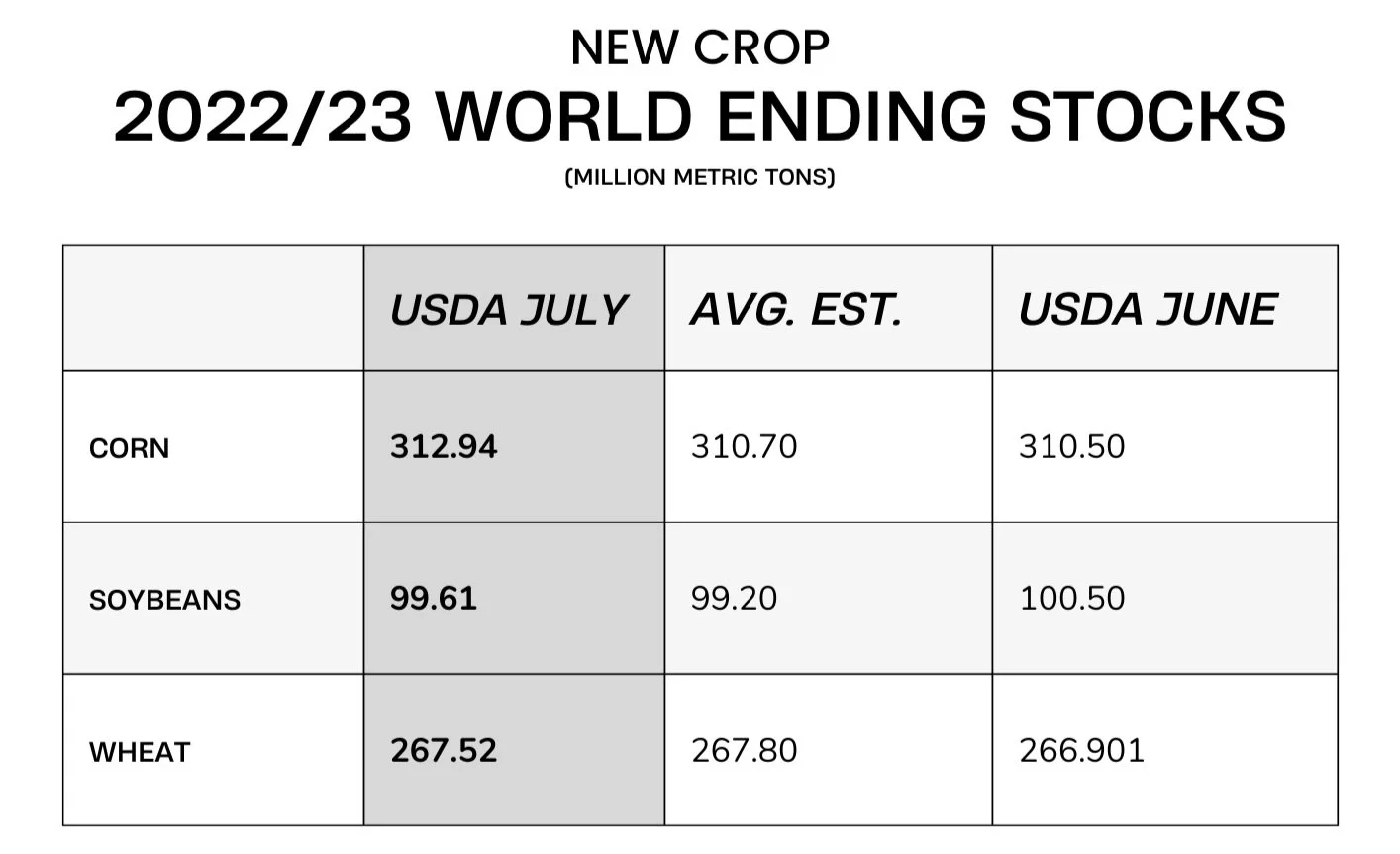

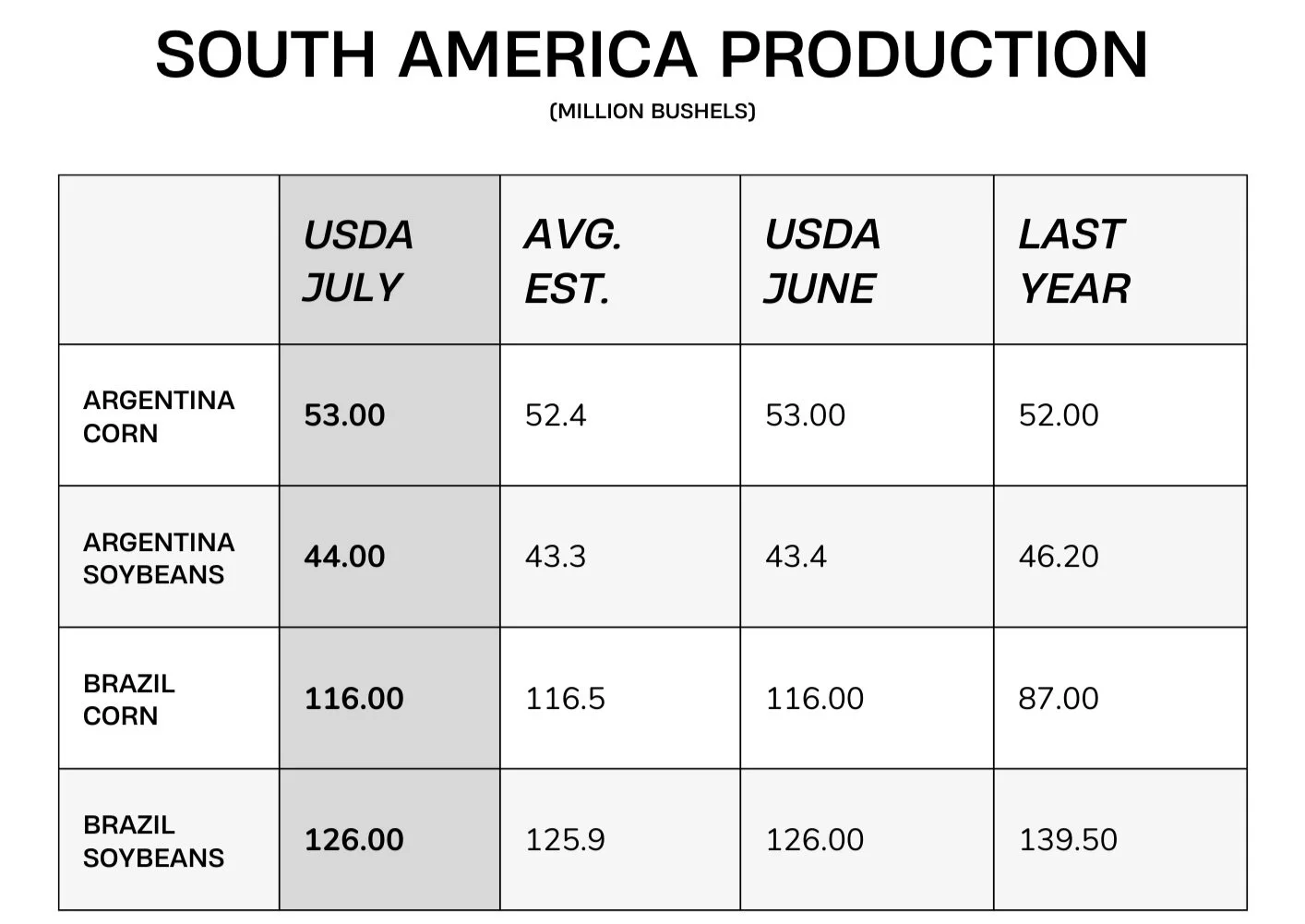

There weren’t any huge surprises in today's report. USDA numbers did come in slightly larger than were expected. But, the majority of the main numbers were somewhat in line with expectations. However, nearly every estimate was larger than what most expected. With the exception of Brazil's corn. Addiojtially, none of these increases were so massive that we'd have to see production cuts.

Some keynotes

USDA left corn and bean yield estimates unchanged

The only change in South America estimates was Argentina soybeans. They saw a slight increase.

New crop soybean ending stocks fell 50 million bushels, bringing them to 230 million bushels. Despite this decrease, it was still over the trade expectations.

Overall, there wasn't anything great about this report really at all. Grains still struggling to find their way back to their 20-day moving averages. This report definitely didn't help prices. Could very likely cause some more technical selling. Outside of the report, one of the bigger concerns still has to be whether we will continue to see funds liquidate their positions with fear of a global recession. Metals, crude, and energy are all down lower again today. For the grains, essentially the only bullish factors that could help push this market back up to our highs we saw a while ago, would be weather and war.

Today's Main Takeaways

Corn

Even though the increases were slight, it was still enough to give bears the edge in corn. We had a pre-report sell-off, that only continued to bleed more post-report. Report was overall slightly bearish for corn.

The report always causes an initial movement in the markets. But looking long term. Weather will always be the bigger factor. As the weather is about the only thing corn currently has to go for it. With the dry weather scares and the potential for a drought. The weather alone, if it continues to be extremely dry/hot, should be enough to support corn futures. If the weather changes, as we wind up seeing far more rain than anticipated, we could definitely trend lower.

Again, for the report, there weren’t any crazy surprises. It was however disappointing to see the +70 million bushel raise in U.S. new crop ending stocks. With old crop supply being raised +25 million.

2022/23 corn production is estimated at +45 million bushels with better planted acres as well as harvested acres from the June 30th report.

Ending stocks up +70 million bushels with no new crop demand changes.

Yield was left unchanged.

Soybeans

Soybeans are down the hardest after the report, after their 4-day rally. The soybean situation was pretty similar to the corn. With stocks and South America production numbers coming in slightly larger than expected. The report overall wasn't that terrible for soybeans. The lower prices don't really justify the extremely lower prices. Overall, the report was actually pretty friendly to soybeans.

Taking today's report out of the equation. Similar to corn, the main supporting factor for soybeans will be the weather forecasts and how the weather actually pans out. With forecasts still looking hot and dry for July.

We saw new crop soybean ending stocks fall 50 million bushels, bringing them to 230 million bushels. However, the bulls were hoping for a larger cut, as this was still above the pre-report trade estimates.

USDA is expecting U.S. new crop bean production at 4.5 billion bushels. A decrease of -135 from last month with the lower acres we saw in the June 30th acreage report.

Likewise to corn, the yield was unchanged for beans.

Wheat

Wheat is down hard again today, with the report not showing any remorse for wheat prices. All wheat numbers came in slightly above trade estimates. Which is pretty bearish.

Before the report, wheat held up the best with the pre-report sell-off. The report wasn’t good at all for wheat, but to go along with the news reports surrounding Russia and Turkey, its added a ton of additional pressure.

Wheat production forecast is at 1.20 billion bushels. Up 2% from June 1st. But down -6% from 2021. U.S. yield is forecast at 48.0 bushels per acre. Down -0.2 bushels from month, and down -2.2 bushels from last years average of 50.2.

Other Markets / News

Russia & Ukraine to hold another round of talks on grain exports

France is expecting a 7% decrease in their wheat production

Crude breaks below $100 again

Crude down -$8.50 to $95.53

Money Flow

Over the past several months, hedge funds have bought commodities as a hedge against inflation. But the past few weeks we've entered into a massive liquidation phase. This is partially tied to fears of the recession and the Fed's rate hikes. A lot of the time, the grains and commodities were actually driven more by money flow rather than fundamentals. This has to make us ask two questions; will the grains and commodities go back to trading the fundamentals after the funds wash out, and have we really made the highs in the grains? One would like to think we made our lows last week. And even as of yesterday it looked very likely that that was the case. But today's price action was just brutal across the board. I think this pullback will likely be short-lived, and we should see the market recover in the following few weeks.

Important Upcoming Dates

Thursday, July 14

Weekly Export Sales

Cotton & Wool Outlook - 2022

Oil Crops Outlook - 2022

Wheat Outlook - 2022

Weather

Source: National Weather Service