CHINA IS BUYING, ARE YOU?

Overview

Grains end the day mixed following yesterday's higher price action. As the wheat market is slightly higher coming off of yesterday's double digit gains, while corn is slightly lower and soybeans test those July lows we mentioned the past few days that we would likely look to do so. However, beans managed to bounce 16 cents off those lows.

Chicago wheat is now 30 cents off the USDA report lows, and only a dime off of where we were before the report. Who would’ve thought that after seeing us drop 40 cents.

Supporting the wheat market, we saw China purchase 220k metric tons of SRW wheat. This is the largest SRW export to China since 2013. Now we know we have the cheapest wheat in the world.

They also bought 265k metric tons of beans. These sales are even more impressive given that China is on a national holiday which continues through the rest of the week.

Today’s price action was overall pretty positive for the grains. We had the dollar make yet another new high. Bonds made new lows, falling to their lowest levels since October of 2007. The stock market fear and greed index fell to it's most fearful it's been all year long.

Yet grains held their own. Beans closed 20 cents of their lows, corn is still nearly at it's highest level in a month, and the wheat market managed to find some life.

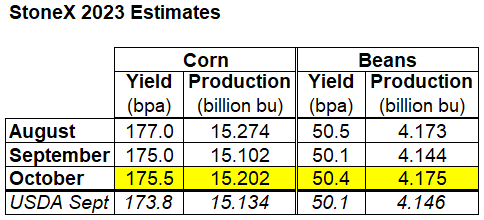

StoneX Yield Survey Estimates

The October StoneX survey showed corn yield at 175.5 up from 175 last month. Their soybean yield was 50.4 bpa.

The USDA's current estimates are 173.8 for corn, and 50.1 for beans.

Dr. Cordonnier has his estimates at 171.5 for corn, and 49 for beans with a lower to neutral bias moving forward.

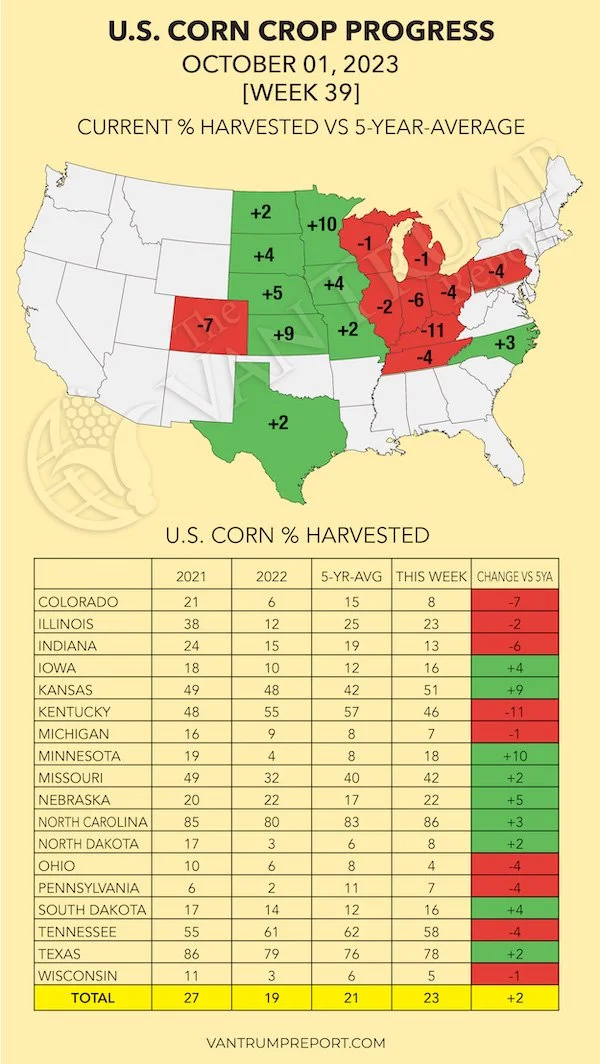

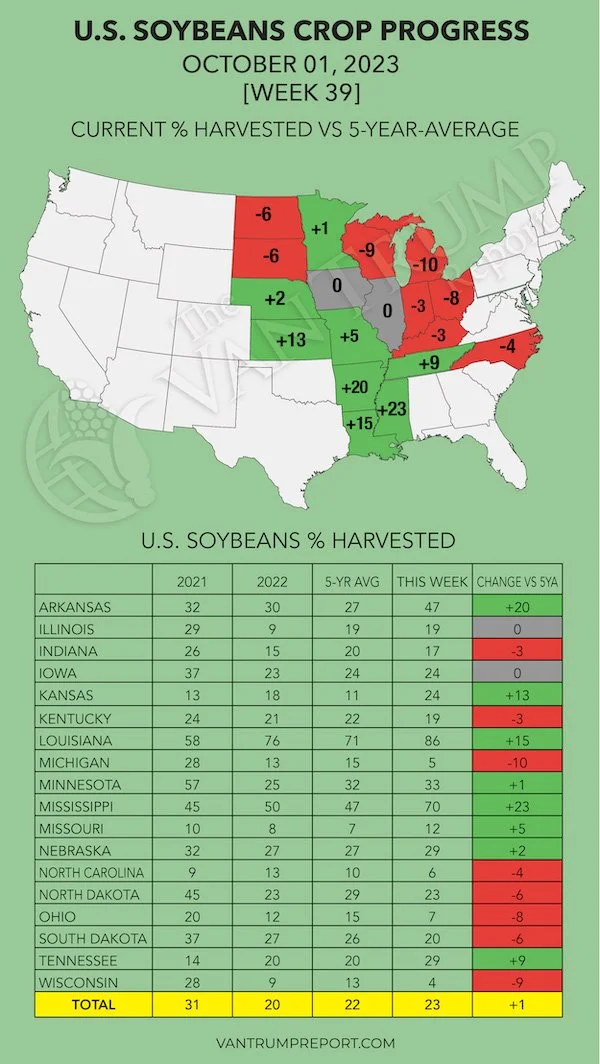

Crop Progress

Harvest is just ahead of our average pace but not as fast as last week or as the trade was expecting.

Here is a state by state breakdown of the current crop progress compared to our 5-year average from the Van Trump Report.

Today's Main Takeaways

Corn

Corn slightly lower in an extremely tight 5 cent trading range day, as we were unable to take out yesterday's highs.

Yesterday we did hit a 1 month high and high settlement.

StoneX Brazil pegged their first crop corn production at 27.5 million metric tons. Down from 28.2 last month. The second corn crop production was also lowered from 109.1 to 108.4 million.

With this, there is a lot of chatter that from multiple sources all saying that there could be less second crop corn acres planted in Brazil.

Typically row crops makes their lows when harvest reaches roughly 50% complete. Currently we are sitting at 23% complete. However, I think corn is already in the process of making these lows. Corn is 20 cents off our mid-September lows.

Funds are still short around 160k contracts of corn, yet we are at the highest levels we have been at in a month. When the funds decide to cover, there is a lot of buying to be made. If we can get a break past $4.92 1/2, I think that will give funds the green light and spark some buying.

Bottom line…..

The rest of this is subscriber-only. Please subscribe to continue reading and get every exclusive update sent via text & email.

Scroll to check out past updates you would have received.

HARVEST SALE

Limited time only.

$299/YR vs $800/YR

NOT SURE? TRY 30 DAYS FREE

Check Out Past Updates

10/2/23

WHY YOU SHOULD BE EXCITED ABOUT TODAY’S RALLY

10/1/23

IF YOU HAVEN’T PANICKED YET, WHY WOULD YOU NOW?

9/29/23

USDA REPORT RECAP

9/28/23

PREPARING FOR USDA REPORT & TAKING A LOOK AT HISTORY

9/27/23

PROTECTING YOUR INSURANCE GUARANTEE

9/26/23