POST USDA REPORT

Overview

Grains mostly lower here following the USDA report. Overall was it was uneventful. Corn hit pretty hard with the somewhat bearish numbers. Wheat's report was fairly neutral but they sold off as well. Beans actually had a pretty bullish report, at one point they were up almost +19 cents, but eventually came down and closed just 2 cents higher.

Grains were also pressured by the outside markets, as the U.S. dollar surged to 3-month highs.

None of the USDA numbers change our thoughts or long term perspective. The price action the day after the report is sometimes more important than that on the day of the report so we will see what tomorrow has in store.

Sunday's Weekly Grain Newsletter

What To Do If You Panic Sold Last Week - Read Here

Enjoy Our Stuff?

Get 50% OFF or Try 30 Days for $1. Receive all updates and audio via text message & email.

Today's Main Takeaways

Corn

Corn has the most bearish report amongst the grains. Closing at its lowest levels since August 19th of last year.

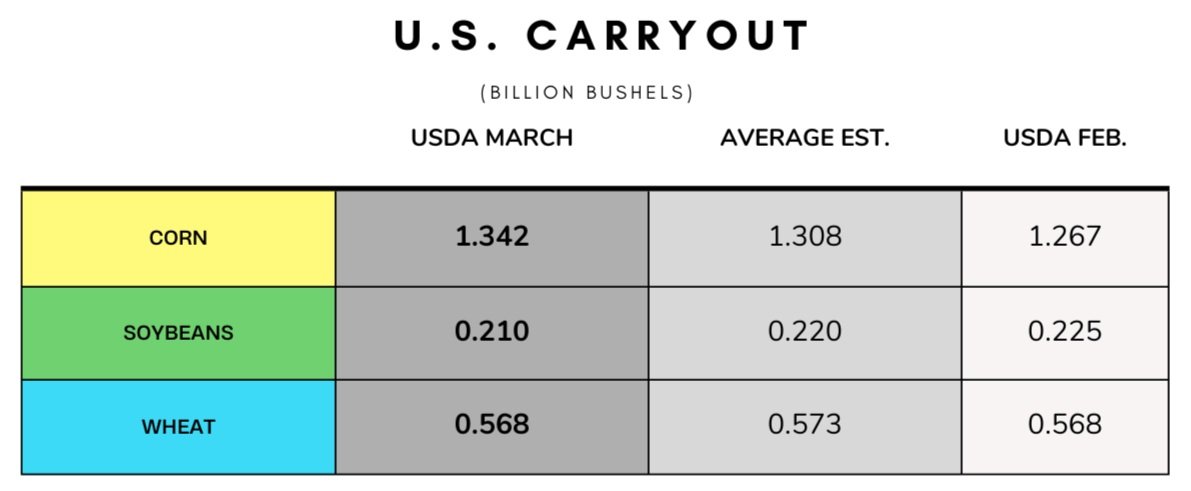

Like we mentioned yesterday, we did see U.S. corn exports were cut by 75 million bushels from February which was the premature reduction we were expecting. Which resulted in a bigger than expected increase to ending stocks. I think this was a little too aggressive. April crop report we could see an increase in feed usage which could offset exporting less corn.

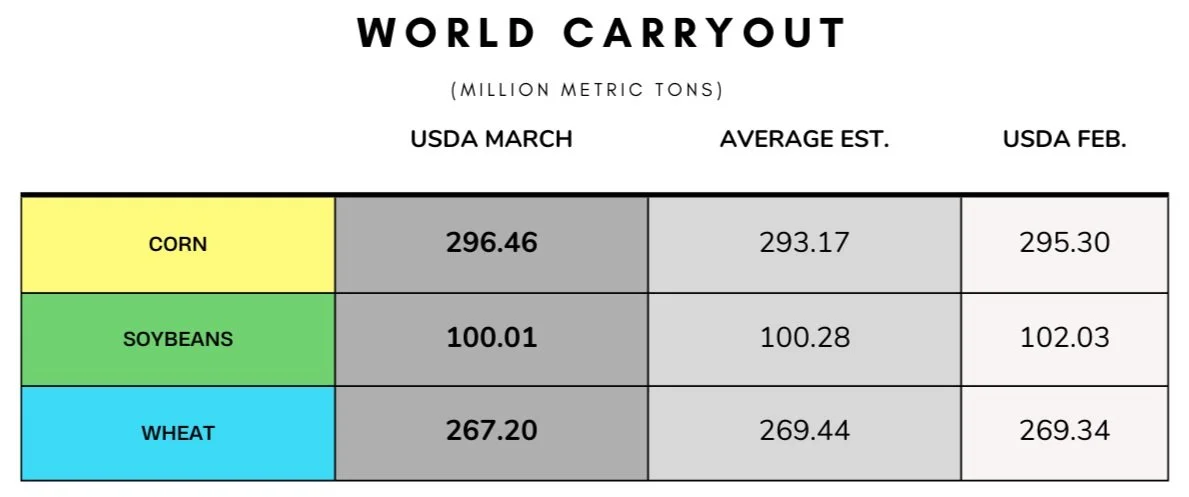

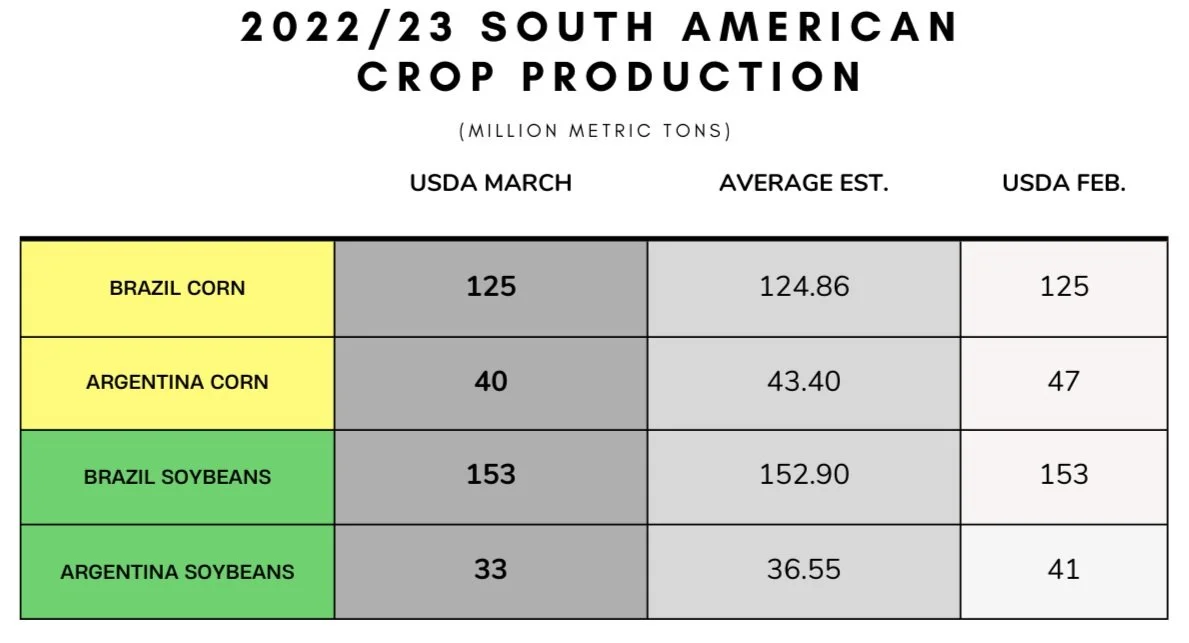

We did however see the USDA cut their Argentina production estimates from 47 million last month down to 40 million today. Which was also below the average trade estimate of 43.40. Brazil estimates were left unchanged as expected. The Argentina cuts weren't enough to combat the increase of stocks and lack of sales.

Despite the USDA leaving Brazil estimates unchanged, this will continue to be a topic of debate going forward. As bulls make the argument that a good amount of their crop has still yet to be planted. with roughly 35% of the crop still left unplanted. Now for Mato Grosso, looks like they only have around 30% of theirs in the ground when they typically have nearly 70% by now.

As we have said in previous updates and audios, it wasn’t surprising to see the USDA report cause some more selling despite the Argentina production cuts. We still have the belief that prices will be much higher come spring and summer.

According to Euronext exchange, funds hold their largest net short position ever in corn. This report is up to date as of last week, while the CTFC is still several weeks behind.

Taking a look at the chart, we again go and test that long term upward trendline for the second time. Nearby resistance remains around the $6.40 range with really stiff resistance when we get up towards $6.85. Taking a look at the downside, bulls would like to see us hold last weeks low

Corn May-23

Soybeans

With the bullish numbers from beans, we saw futures rally initially following the report but we have came back well off those highs (-17 cents). Closing up just over 2 cents, as the weakness in the corn and wheat markets was too just too much for the beans to handle.

We saw a 10 million bushel reduction to U.S. crush, but this was more than offset the 25 million bushel increase in exports. Which led to ending stocks falling 15 million bushels (Estimates were just a 5 million reduction).

Similar to corn, we also saw a pretty big cut to the Argentina estimates. With the USDA going from 41 million tons down to 33 million. Which was also below the average estimate of 36.55 million. That 8 MMT reduction is more than the entire U.S. carryout.

Its also looking like Mato Grosso's expected large crop might not be enough to offset the losses in the southern states such as Rio Grand Do Sul. So perhaps we already saw the high print for Brazil's crop. As Brazil's crop is still one of the biggest things bears seem to point when talking about the future of beans.

Current forecasts for Argentina are still looking pretty dry which could look to add support this week. Also, just a reminder that this is still their worst drought in what some say over a century.

A few factors going forward will be, of course South American weather. The funds and what they decide to do, as there is some question as to whether the funds want to keep adding here with uncertainties in China's economy.

China imported a record 26.2 million tons of beans in January and February. A 16% increase from last year. We had strong shipments from the U.S. with the delays in Brazil. There are some rumors are that China will continue to be a big buyer.

From a technical standpoint, we are still in a clear uptrend and we bounced amazingly off last week's lows. Can we go up and retest our recent highs?

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

Wheat futures finish lower along side corn, with the USDA report not providing much of anything at all for wheat. May KC did close 11 cents off its lows so that was a little friendly.

Was overall a quiet report for wheat as many expected. With the U.S. balance sheet being left unchanged. Wheat continues to struggle with cheap world values and enough supplies. Along with countries like Russia and Australia expecting large crops.

We did see world wheat supplies slightly smaller, but most of this was due to the changes made in China's feed and residual use.

On the bearish side of things we saw the world crop upped by roughly 5 MMT.

Traders will still be keeping an eye on the Black Sea agreement, as not too long ago most were calling it a done deal, but we haven’t seen much of any updates recently. The trade is probably expecting the deal to be renewed, but we need to be cautious that if it does get renewed, it will likely be followed by a initial bearish reaction. But this doesn’t change the fact that we expect wheat to go much higher later this year. We do still have the chance to see us make another leg before the selling is completely over. But we look at these lower prices as just creating better buying opportunities.

We haven’t seen any actual CTFC numbers, but the Euronext exchange says the funds hold their third largest short position ever. Now on the surface some may look at this as bearish. But the funds being this short just gives them all the more power to buy when they decide to do so. But then again, unless we get more war headlines or some other bullish catalyst they don’t have a ton of reason to exit these shorts which is a slight concern. But ultimately I think we do eventually get that catalyst bulls are looking for. We might trickle even lower before that happens, either way I think this downward move was a little over done by the bears.

Taking a look at the chart, we are again approaching support, as the previous two levels were broken. Will have to see if we hold or get another leg lower.

Chicago March-23

KC March-23

MPLS March-23

BULLISH FACTORS

The USDA report was sort of uneventful which led to a lack of new topics to write about today. Here is a list of a few of many reasons why we think markets will go much higher in the coming months. (From Sunday's Weekly Grain Newsletter).

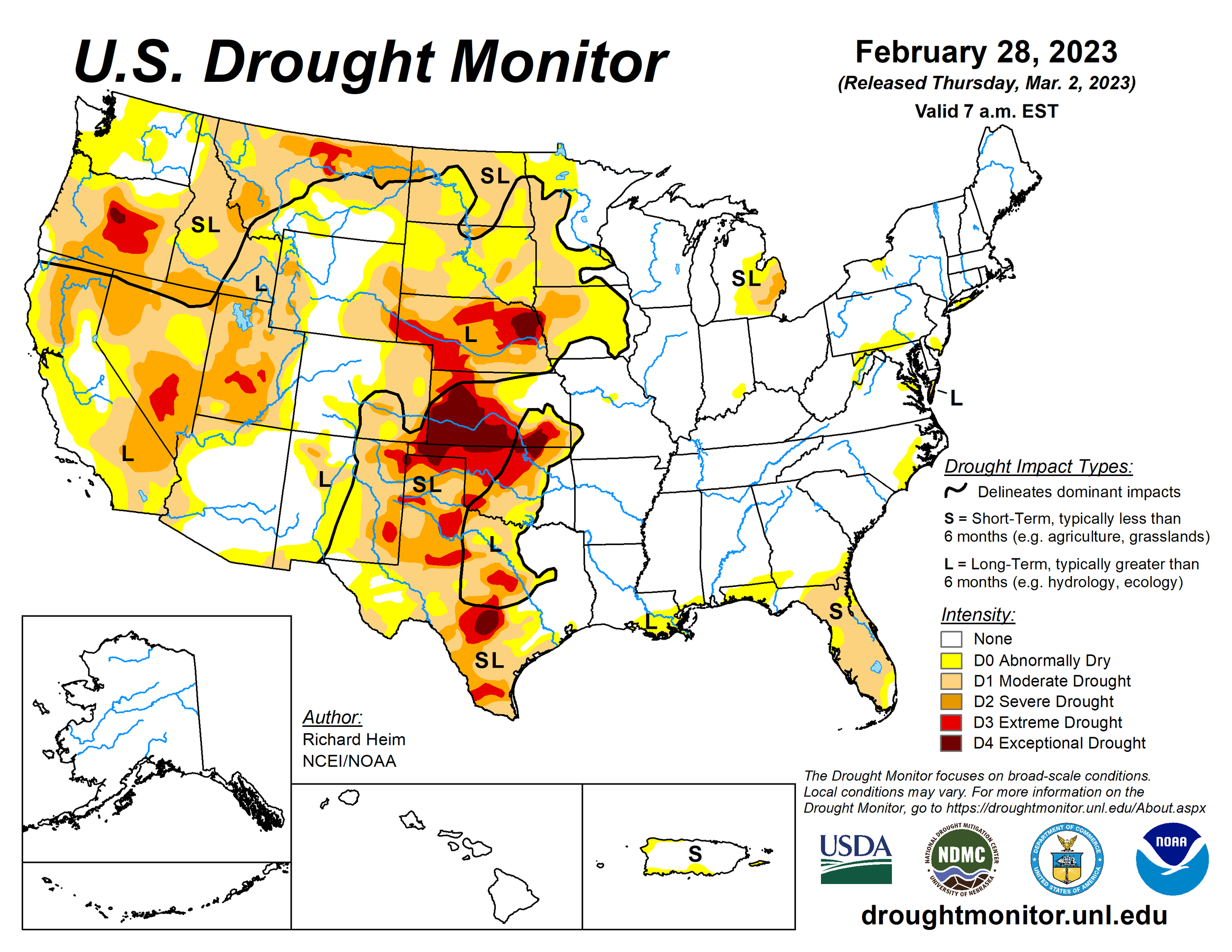

Mother Nature.

She continues to be very moody to say the least. Almost daily we hear of some place in the world that has a major disaster or weather event that takes away yield in a hurry.

A couple examples the past couple of weeks are, the record heat in India.

The freeze in Argentina, which comes on the heels on the worst drought they have had in decades

The extremes that the US is seeing

Mother Nature is going to throw a curveball one of these years, (I think this year) to the corn belt. We will see yields drop well below the trend line. With the demand we have built up we can not ration it fast enough. When or if a 2012 like drought hits the corn belt we will see prices go so stupid as emotions get out of control as the world and the funds wonder who will all go hungry

Demand

Margins are very strong for most of the major grain buyers. Look at soybean crush margins and tell me they will not try to buy all the beans that they can find.

Money

There is so much more money to be made if grains go skyrocketing higher, that why would a fund manager want to try to short grains. We will never have grains go to zero, or stay at zero for an extended period of time. But we have and always will continue to see grains go 1.5-5x previous highs.

Any of you remember in 2001 when millet went from 4.00 per cwt to 20.00 per cwt in a matter of a few weeks.

Any of you remember 25.00 MPLS wheat in 2008

Technical trading

Many of you know that we follow the tech guy from Wright on the market. Have many of you noticed some of the possible targets he has had out for months for corn and soybeans. These targets are not numbers he magically made up, they come from self fulfilling systems that many traders use which helps them work. These targets blow out the old all time highs. Keep this in mind that as our markets take out resistance more and more buyers will jump on board.

I am also a member of the commodity technical trading group on Facebook. Vince I, puts out some great info on there and I noticed today that he mentioned a 6.60 target for December corn, he has been in front of this recent price break calling it correctly and even he has a price target nearly a dollar above the present new crop price.

Livestock

Live Cattle down -0.525 to 165.450

Feeder Cattle up +1.400 to 200.075

Cattle is another commodity that we think has the chance to keep climbing this year and work its way to potentially new highs. Bull inflationary hedge type markets cant out produce demand.

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service